Gold Starts 2026 with a Setup — Correction or New Rally Ahead?Wishing you all a Happy New Year 2026 in advance.

First and foremost, I wish you good health — because everything starts from there.

I hope your hearts feel lighter, your minds stay calm, and the new year brings many positive and meaningful moments into your lives.

May most of your trades end in wins, and may the money you earn through trading be used for joy, happiness, and beautiful memories.

I truly wish you a year filled with growth, peace, and reasons to smile.

------------------------------

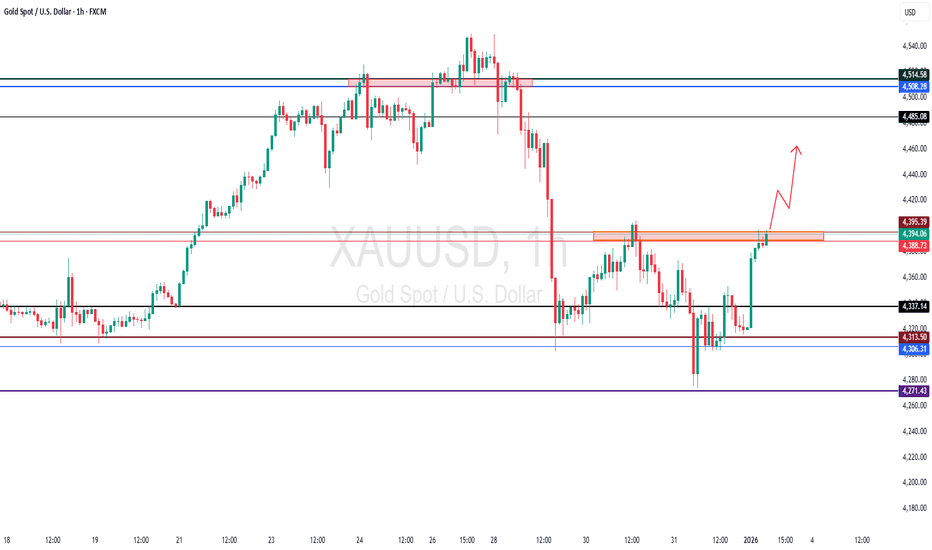

As I previously expected, Gold( OANDA:XAUUSD ) has reached its targets (full target) and has now approached the resistance zone($4,382-$4,341).

From an Elliott Wave perspective, it seems that gold has completed a wave 5 with the help of an expanding ending diagonal pattern.

Additionally, we can observe a positive Regular Divergence (RD+) between two consecutive valleys.

I expect that after a correction, gold will once again test theresistance zone($4,382-$4,341) and could potentially climb at least up to $4,371. If it breaks through that resistance zone($4,382-$4,341), we could see gold rising further to around $4,421.

What do you think? Will gold repeat its bullish trend in 2026, or should we expect a correction? I’d love to hear your thoughts!

First Target: $4,371

Second Target: $4,421

Stop Loss(SL): $4,237(Worst)

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Goldprediction

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHey everyone,

Please see our weekly chart timeframe Route Map and Trading plans for the week ahead.

After seeing the test at 4294, we now have a candle body close above 4294 opening long range target at 4519 and will need ema5 cross and lock above this level to further confirm and strengthen this target.

We will now look for 4294 to provide support and play between this new range to confirm if it was a fake out or confirmed breakout into this new range.

We’ll keep these long range timeframe structures in mind as we continue with our plans to buy dips.

We will keep you all updated as this chart idea unfolds.

Mr Gold

Gold at 4300 Demand vs 4397 Supply — Smart Money Sets the Trap🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (02/01)

📈 Market Context

Gold remains structurally supported on higher timeframes, despite the recent corrective leg triggered by a clear CHoCH from premium. Current price action reflects controlled rebalancing and liquidity engineering, not impulsive continuation.

As the market digests USD yield fluctuations and positioning flows at the start of the new trading year, Gold continues to attract institutional interest on pullbacks. However, intraday volatility suggests Smart Money is prioritizing liquidity capture and re-accumulation rather than directional chasing.

This environment favors engineered sweeps, inducement, and delayed confirmation, not clean breakouts.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

HTF bullish structure with short-term corrective consolidation

Key Idea:

Expect price interaction at HTF demand (4300–4302) or a reaction from internal supply / FVG (4395–4397) before any meaningful displacement.

Structural Notes:

HTF bullish BOS remains intact

Prior CHoCH initiated corrective downside

Sell-side liquidity has been probed and absorbed

Price is stabilizing above demand

Discount zone aligns with institutional accumulation

Buy-side liquidity rests above internal highs

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4300 – 4302 | SL 4290

• 🔴 SELL GOLD 4395 – 4397 | SL 4407

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4300 – 4302 | SL 4290

Rules:

✔ Liquidity sweep into HTF demand

✔ Bullish MSS / CHoCH on M5–M15

✔ Clear upside BOS with impulsive displacement

✔ Entry via bullish FVG fill or refined demand OB

Targets:

4350

4395

4450 – extension if USD weakens and risk-off sentiment expands

🔴 SELL GOLD 4395 – 4397 | SL 4407

Rules:

✔ Reaction into internal supply / FVG

✔ Bearish MSS / CHoCH on LTF

✔ Downside BOS with momentum shift

✔ Entry via bearish FVG refill or supply OB

Targets:

4360

4325

4300 – extension if USD strengthens or yields rise

⚠️ Risk Notes

Compression favors false breakouts

No execution without MSS + BOS confirmation

Expect volatility during U.S. session

Thin liquidity increases stop-hunt probability

Reduce risk around macro headlines and yield spikes

📍 Summary

Gold remains bullish by structure, but today’s edge is patience over prediction.

Smart Money is likely to engineer liquidity before committing:

• A sweep into 4300–4302 may reload longs toward 4395–4450, or

• A reaction near 4395–4397 could fade price back into discount.

Let liquidity move first. Let structure confirm.

Smart Money waits — retail reacts. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

GOLD: Broken Trendline, Retest in ProgressHi!

Gold has clearly broken the rising trendline, signaling weakness in the bullish structure.

Price is now retesting the broken trendline from below, which acts as dynamic resistance.

As long as price stays below this zone, bearish continuation is favored

Rejection here can open the door for a deeper pullback

Bulls need a strong reclaim above the trendline to regain control

Gold (XAU/USD) | Demand Holding, Upside Potential Builds🏆 XAU/USD: GOLD vs U.S. DOLLAR - METALS MARKET OPPORTUNITY 💰

📊 MARKET CONTEXT (JANUARY 2, 2026)

Current Price: $4,310 - $4,381 (Trading in consolidation zone)

Market Structure: Bullish trend intact after +67% YTD rally in 2025

52-Week Range: $2,614 - $4,550

🎯 TRADE SETUP BLUEPRINT

📈 PLAN: BULLISH (Day/Swing Trade)

🔑 ENTRY STRATEGY: "THIEF" LAYERED LIMIT ORDERS

Using multiple buy limit orders at strategic support levels:

Layer 1: $4,300

Layer 2: $4,320

Layer 3: $4,340

Layer 4: $4,360

💡 Note: This layered entry strategy allows you to average in at different price levels. You can add more layers or adjust these levels based on your risk tolerance and account size.

🛑 STOP LOSS: $4,250

⚠️ Risk Disclaimer: This is MY stop loss level. YOU should determine YOUR OWN stop loss based on your risk management rules. Trading is at YOUR OWN RISK. I am not responsible for your trading decisions.

🎯 TARGET: $4,520 (Police Barricade Resistance Zone)

📍 Key Resistance Analysis:

Strong resistance + overbought conditions near $4,520-$4,550 zone

Previous all-time high resistance cluster

Profit-taking area after extended rally

⚠️ Profit-Taking Advisory: This is MY target level. YOU should take profits at YOUR OWN discretion based on your trading plan. Make money, TAKE money at YOUR OWN RISK.

💱 CORRELATED PAIRS TO WATCH

🔄 POSITIVELY CORRELATED (Watch for confirmation):

EUR/USD: Currently trading ~1.05 (Strong EUR = Weaker USD = Higher Gold)

AUD/USD: Currently ~0.62 (Commodity currency, risk sentiment proxy)

🔄 INVERSELY CORRELATED (Watch for divergence):

DXY (U.S. Dollar Index): Currently 98.2 (-9.91% YTD 2025)

USD/JPY: Currently 156.60 (BOJ policy divergence factor)

USD/CHF: Safe-haven flows proxy

KEY CORRELATION INSIGHT:

Gold maintains a strong negative correlation with the U.S. Dollar Index (DXY). The current DXY weakness at 98.2 (down from 110+ in early 2025) is a significant tailwind for gold prices. Every 1% decline in DXY typically supports 1-2% gains in gold.

📰 FUNDAMENTAL & ECONOMIC FACTORS

✅ BULLISH CATALYSTS:

1. Federal Reserve Policy (FOMC January 28, 2026):

Current Fed Funds Rate: 3.50%-3.75%

Market pricing 82.3% probability of holding rates

Two rate cuts expected in 2026 (supportive for gold)

Lower interest rates reduce opportunity cost of holding non-yielding assets

2. U.S. Dollar Weakness:

DXY trading at 98.2, near multi-year lows

-9.91% decline in 2025 (steepest annual drop since 2017)

Policy uncertainty and fiscal deficit concerns weighing on USD

Narrowing yield advantage vs. other currencies

3. Central Bank Gold Buying:

Central banks purchased 220 tonnes in Q3 2025 (634 tonnes YTD)

Expected 755 tonnes of purchases in 2026 (elevated vs. 400-500t pre-2022 average)

China, India, and emerging market diversification continues

De-dollarization trend supporting structural demand

4. Geopolitical Risk Premium:

Ukraine-Russia tensions persist

Middle East conflicts (Gaza ceasefire fragile)

U.S.-Venezuela oil blockade escalation

U.S.-China trade tensions remain elevated

Trump administration tariff policy uncertainty

5. Safe-Haven Demand:

Gold ETF inflows strong (275 tonnes expected in 2026)

Physical bar/coin demand exceeding 1,200 tonnes annually

Record investor positioning in futures markets

Portfolio diversification amid stock/bond correlation concerns

⚠️ UPCOMING ECONOMIC EVENTS:

📅 January 7, 2026: JOLTS Job Openings Report

📅 January 9, 2026: U.S. Employment Report (December)

📅 January 13, 2026: U.S. CPI Inflation Report (December)

📅 January 15, 2026: PMI Manufacturing Data

📅 January 28, 2026: FOMC Rate Decision + Powell Press Conference

🏦 INSTITUTIONAL OUTLOOK (2026):

Goldman Sachs: $4,900 target (Base case)

J.P. Morgan: $5,000+ by Q4 2026

Bank of America: $5,000 forecast

Morgan Stanley: $4,500 by mid-2026

World Gold Council: $4,000-$4,500 consolidation range

ING Commodities: $4,325 average for 2026

⚡ TECHNICAL CONTEXT:

Support Levels:

$4,315 (20-day SMA)

$4,275-$4,300 (Key demand zone)

$4,250 (Critical support)

Resistance Levels:

$4,400-$4,450 (Near-term resistance)

$4,475-$4,500 (Supply zone)

$4,520-$4,550 (Major resistance / ATH zone)

Market Structure:

Bullish trend intact on higher timeframes

Recent pullback from $4,550 ATH = healthy correction

Price consolidating before next potential leg higher

🔥 WHY THIS TRADE MAKES SENSE:

Structural Bull Market: Gold in multi-year bull cycle supported by five key forces (Fed easing, central bank buying, ETF flows, geopolitical risks, debt concerns)

Technical Setup: Buying the dip after pullback from ATH with layered entries near support

Fundamental Backdrop: Weakening USD, dovish Fed, geopolitical tensions, and institutional support align perfectly

Risk/Reward: Favorable 5:1+ ratio with defined stop loss and clear resistance target

Momentum: 5th consecutive month of gains in 2025, continuing into 2026

⚖️ RISK MANAGEMENT RULES:

✅ Never risk more than 1-2% of your account per trade

✅ Use proper position sizing based on stop loss distance

✅ Consider splitting entries across multiple limit orders

✅ Trail stop loss to breakeven after price moves in your favor

✅ Take partial profits at intermediate resistance levels

✅ Don't let winners turn into losers - manage positions actively

🎓 EDUCATIONAL TAKEAWAY:

Gold trading requires understanding of macro fundamentals (Fed policy, USD dynamics, geopolitical events), technical analysis (support/resistance, trend structure), and proper risk management. This layered entry strategy helps average into positions while managing downside risk.

📊 MARKET DATA SOURCES:

Price data verified via multiple sources including Investing.com, FXStreet, and Bloomberg (January 2, 2026)

🔔 Follow for more high-quality trade setups and market analysis!

👍 Like if this analysis helps your trading!

💬 Comment your thoughts on Gold's 2026 outlook!

TheGrove | GOLD BUY | Idea Trading AnalysisGold remains overall bullish, trading within a well-defined ascending structure.

Price is now approaching a high-confluence area, where the demand zone aligns perfectly with the lower red trendline. This intersection is critical, as it represents a classic trend-following buy zone within a healthy uptrend.

As long as this zone holds, we will be looking for bullish reactions and continuation setups, aiming for a move back toward the upper side of the channel and the previous highs.

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great BUY opportunity GOLD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

The price is falling under pressure. Watch for support at 4300.Gold prices edged higher during Friday's early US trading session. Amid escalating tensions between the US and Iran, market demand for safe-haven assets was evident, and intraday price volatility remained high.

However, the market opened high and closed low this week, plummeting after hitting a new historical high, mainly due to the CME Group raising margin requirements for metals to curb irrational speculation. On Friday, the Asian market opened at 4318. After fluctuating and rising in the Asian and European markets, it reached a high of 4402, a gain of 74 dollars. During the US trading session, it fell sharply, reaching a low of around 4330.

Looking at the daily and 4-hour charts for gold, the price of gold has generally shown a pattern of rising and then falling back. Although the magnitude is not particularly exaggerated, it also shows a trend of the bulls gradually weakening. If the important support level of 4300 is breached again, it may directly open up the downside potential.

Currently, the short-term moving average group has started to turn downwards, so we should pay attention to the continued decrease in pressure. The MACD indicator has also moved below the zero axis, so it is recommended to focus on shorting at high levels. The MACD indicator is also running below the 0 axis. It is recommended to focus on shorting at higher levels. Continue to monitor the 4315-4300 support level.

Trading Recommendations:

If the price remains above 4300, a small long position can be attempted, waiting for a rebound from a lower point.

Shorting is recommended again at 4380-4400, with a profit target of 4330-4300.

I will update more trading information in the channel.

XAUUSD Intraday Plan | Key Levels to WatchGold dipped into the HTF support zone, where buyers stepped in, leading to a recovery from the recent sell-off. Price is now making a second attempt at the 4404 resistance, which remains the key level for short-term direction.

A confirmed break above 4404 would signal strengthening bullish momentum and open the path toward 4433. Conversely, failure to hold above this area may result in a retracement back into lower support zones.

Immediate support sits at 4378, followed by 4347. Price reaction at these levels will be important in determining whether the recovery can extend or if selling pressure resumes.

Let price confirm direction at key levels. Patience and risk management remain essential.

📌Key levels to watch:

Resistance:

4404

4433

Support:

4378(minor level)

4347

4317

4280

Prices rebounded again. Short at the 4400 resistance level.Let's analyze the current market situation on the first trading day of 2026.

Gold prices fell nearly $250 on Monday, briefly approaching the $4,300 mark; on Tuesday, prices surged to $4,400 before retreating; on Wednesday, influenced by the Chicago Mercantile Exchange's increase in margin requirements, prices briefly fell below $4,300 to $4,275 before quickly rebounding, and then fluctuated repeatedly above $4,300.

After the sharp drop in gold prices, it is expected to fluctuate for some time. The key level to watch remains the $4,400 mark. A move above $4,400 would indicate that the decline since $4,550 is nearing its end. The $4,300 level remains crucial, and its importance has been repeatedly emphasized. Tuesday's drop was merely a false break, and the bulls remain bullish as long as the $4,300 level holds.

In terms of trading strategy, in the short term, we should still pay attention to the resistance at the 4400 level. If it breaks above 4400, short positions should be avoided; if it holds below 4300, long positions can still be considered. If the price falls below 4300 again, try shorting following the market trend, and then go long after it touches the trend support. Set a strict stop-loss order if the price breaks below this level.

After the Asian session opens with a gap down, focus on finding opportunities to short after the European session rebounds. Note that there will be an opportunity to go long on a pullback. It's crucial to manage the trading rhythm well.

Bullish or bearish? How to trade gold in the new year?#XAUUSD OANDA:XAUUSD FOREXCOM:XAUUSD

The trading strategy given yesterday did not provide suitable trading opportunities in the evening. After the market opened this morning, it rebounded from around 4328, only $3 away from our entry point of 4325. However, as everyone knows, I was sleeping during the Asian session and hardly participated in any trading, so I unfortunately missed this trading opportunity.

Currently, gold prices have rebounded after testing the 4285-4275 level.It's not advisable to get involved in rapidly fluctuating markets, as it's too easy to trigger stop-loss orders. Don't envy those who make huge profits in one wave or another, whether it's real or not is still unknown. Just focus on doing your own thing and remember that what we need is to achieve steady and consistent gains.

Based on the current trend, the upside resistance level to watch is 4335-4355, the short-term support level is 4260-4250, and the key defense level is 4210-4200. Observe first. If the rebound continues and reaches the resistance level around 4335-4355, then consider shorting with a small position. Wait for my subsequent trading signals

Waiting for a pullback to the support level. Follow 4305.Based on the current gold technical chart analysis, the area around 4305 constitutes a key support zone. The 4-hour chart shows that the price has rebounded after repeatedly testing this level, indicating a concentration of buying interest. Although the short-term moving average system on the daily chart has flattened slightly, it still maintains an overall bullish arrangement, and the 4300-4290 range corresponds to the previous breakout platform, possessing strong technical support significance.

The RSI indicator has stabilized near the 50 neutral zone, and the MACD green histogram is showing a contraction, indicating that the short-term downward momentum has weakened. If the price can find effective support in this area, it is expected to return to the upward channel.

The primary resistance level above is around the previous high of 4380. This level is not only the upper boundary of the recent trading range but also roughly coincides with the upper Bollinger Band on the weekly chart.

If the price successfully breaks through the intermediate resistance at 4350, it will open the path to this target. Overall, placing long orders in key support areas aligns with trend-following trading logic, but close attention needs to be paid to whether the price can form a clear stabilization signal above 4305. If it breaks below 4290, the short-term technical structure will turn into a volatile and bearish trend.

Trade recommendation: Buy gold on a pullback to around 4305, stop-loss at 4290, target around 4380.I will be sharing more real-time strategies on the channel.

GOLD Long Term BUYING Trading IdeaHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Gold/Silver Ratio AnalysisSince 2007, the Gold/Silver ratio has been moving in certain patterns. Although the ratio generally tends to rise, we can see significant volatile deviations from time to time. These deviations present us with good opportunities. We are currently experiencing one of these opportunities.

The overall uptrend in the chart means that gold has generally outperformed silver. The sharp increases in 2008 and 2020 also point to periods when gold significantly outperformed silver.

In 2010, the second half of 2020 and the period we are currently experiencing, silver has significantly outperformed gold, causing the chart to fall.

But there is a common point in both periods. After every period of extreme volatility, the Gold/Silver ratio tends to converge towards the average. This will likely be no different now. So what does this indicate?

As we all know, silver has gained significant momentum, pushing the Gold/Silver ratio up to 60. While there's a possibility the ratio could fall back to 50 in the coming months with continued momentum, a Hodrick Prescott filter shows a significant negative deviation from the normal average. This means that the time for convergence with the average is slowly approaching. So how will this convergence scenario unfold? In two ways:

1. Either silver won't experience a decline, but gold will rise significantly with buying pressure and momentum.

2. Or, while gold remains stable or continues its uptrend slightly, silver will fall significantly.

I particularly think the scenario where silver falls due to profit-taking (and it's pretty overbought) more likely. During this period, gold may continue its gradual rise, which could bring the Gold/Silver ratio back into an overall trend free from volatility.

Gold remains in a bearish trend in the short term.

news:

Gold prices surged in Asian markets on Friday, driven by market expectations of a Federal Reserve rate cut this year and the potential for geopolitical risks to push up prices.

Gold ended 2025 with a significant gain, rising approximately 65% for the year, marking its largest annual increase since 1979. The rise in precious metal prices was primarily driven by market expectations of further US interest rate cuts in 2026 and the inflow of safe-haven funds.

The Federal Reserve decided to cut interest rates by 25 basis points at its December policy meeting, lowering the target range for the federal funds rate to 3.50% to 3.75%. Supporters of the rate cut argued that it would alleviate downside risks to employment and inflationary pressures.

The minutes of the December 9-10 Federal Open Market Committee (FOMC) meeting showed that most Fed officials believed further rate cuts were appropriate as long as inflation continued to decline, but they remained divided on when and by how much.

Technical aspects:

From a daily chart perspective, gold prices are generally in a weak downtrend. Prices continue to trade below major moving averages, with short-term and medium-term moving averages arranged in a bearish pattern, indicating a still-firm trend structure.

Regarding momentum indicators, the RSI remains relatively low, reflecting ample bearish momentum, but also suggesting a short-term need for technical consolidation.

Currently, the key support level is located in the $4350 area, around the previous pullback low and the 5-day and 10-day moving averages, while the upside faces both psychological and technical resistance near historical highs.

If gold prices cannot effectively break through and hold above these highs, the short-term trend may be dominated by a bearish bias at higher levels.

Strategy Signals:

Buy : 4420-4425, stop loss :4435, target:4360,4330

Gold price analysis on January 2nd📈 GOLD – Uptrend Returns at the Beginning of the Year

The gold market is showing signs of restarting an uptrend as the new year begins. After a false break below the trendline, the price quickly regained momentum and returned to trading above the 4400 mark, indicating that buying pressure is still in control of the market.

Given the typical defensive capital flow at the beginning of the year, along with expectations ahead of interest rate meetings, a strong recovery in gold is entirely possible. The current strategy prioritizes looking for BUY opportunities following the main trend.

📌 Trading Strategy

🔹 BUY around 4350 on price correction

🔹 BUY breakout at 4375 when price confirms upward momentum

🎯 Target: 4470

⚠️ Risks to note

If the price closes below the trendline, a deep correction scenario may occur, with a key support zone around 4250 – where you can wait for new signals to establish a safer BUY position.

➡️ Prioritize trading with the trend, patiently waiting for price reactions at key technical zones.

Gold - The -50% correction is starting!🎯Gold ( OANDA:XAUUSD ) is starting a -50% correction:

🔎Analysis summary:

For the past 10 years, we have been witnessing an underlying bullrun on Gold. Just like we saw back in 2011, the 10 year bullrun was followed by a correction of -50%. Together with the retest of the ultimate resistance trendline, Gold is now clearly shifting bearish.

📝Levels to watch:

$4,500

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Gold - This metal is collpasing very soon!😱Gold ( OANDA:XAUUSD ) is preparing a major dump:

🔎Analysis summary:

Gold has been rallying an incredible +175% over the course of the past couple of months. But at this exact moment, Gold is retesting the ultimate resistance trendline. Considering that Gold is totally overextended, we will see a harsh drop in the very near future on Gold.

📝Levels to watch:

$4,500

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Is Smart Money Reloading Gold After the Latest Liquidity Sweep?🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (30/12)

📈 Market Context

Gold remains structurally supported on higher timeframes, but current price action reflects controlled volatility and liquidity engineering rather than trend continuation.

With markets reacting to fresh U.S. data expectations, USD yield fluctuations, and ongoing geopolitical uncertainty, Gold continues to attract safe-haven interest — yet extended intraday ranges suggest Smart Money is actively positioning rather than chasing price.

Recent headlines around Fed rate path uncertainty and mixed U.S. macro signals keep Gold bid on pullbacks, while thinning liquidity into the year-end session increases the likelihood of stop hunts and engineered traps on both sides of the range.

Smart Money behavior favors drawing liquidity first, confirming structure later — not clean breakouts.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

HTF bullish structure with short-term corrective compression

Key Idea:

Expect liquidity interaction at discount (4320–4318) or reaction from internal supply (4465–4467) before any sustained displacement.

Structural Notes:

HTF bullish BOS remains valid

Prior CHoCH triggered a corrective leg

Price is compressing under bearish trendline

Discount zone aligns with potential accumulation

Buy-side liquidity rests above internal highs

Sell-side liquidity recently probed and absorbed

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4320 – 4318 | SL 4310

• 🔴 SELL GOLD 4465 – 4467 | SL 4475

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4320 – 4318 | SL 4310

Rules:

✔ Liquidity grab into discount zone

✔ Bullish MSS / CHoCH on M5–M15

✔ Clear upside BOS with impulsive displacement

✔ Entry via bullish FVG fill or refined demand OB

Targets:

4360

4400

4465 – extension if USD weakens and risk sentiment deteriorates

🔴 SELL GOLD 4465 – 4467 | SL 4475

Rules:

✔ Reaction into internal supply / premium imbalance

✔ Bearish MSS / CHoCH on LTF

✔ Downside BOS with momentum shift

✔ Entry via bearish FVG refill or supply OB

Targets:

4430

4385

4320 – extension if USD strengthens or yields rise

⚠️ Risk Notes

Compression favors false breakouts

No execution without MSS + BOS confirmation

Expect volatility during U.S. session

Reduce risk around USD yield spikes or Fed-related headlines

Thin liquidity amplifies stop hunts

📍 Summary

Gold remains bullish by structure, but today’s edge lies in patience, not prediction.

Smart Money is likely to engineer liquidity before committing:

• A sweep into 4320–4318 may reload longs toward 4400–4465, or

• A reaction near 4465–4467 could fade price back into discount.

Let liquidity move first. Let structure confirm.

Smart Money waits — retail reacts. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

GOLD in Red Zone? What's next??#GOLD... Perfect move in yesterday and now again market just reached at current resistance region.

That is around 4370-80

That 10 points region can make or break the market.

Keep close.

NOTE: we will go for cut n reverse above 4380 on confirmation ...

Good luck

Trade wisley

Gold (XAUUSD) EMA Resistance Sell Setup | Trade with StructureWhenever the market is below the 50 EMA, the EMA line acts as a strong resistance.

In the same way, if price approaches the 200 EMA, it is expected to behave as a resistance, so we are planning a sell setup on Gold (XAUUSD) based on market structure and EMA confluence.

📍 Selling Area: 4365 – 4382

📍 2nd Selling Area: 4396 – 4405

🛑 Stop Loss: Above 4408

🎯 Target 1: 4337

🎯 Final Target: 4275

Trade with proper risk management and wait for confirmation.

Prices are weak. Wait for a rebound to short.Gold has been stumbling and uncertain throughout its journey, adept at concealing its strength while also displaying resilience. After a significant drop on Tuesday, it rebounded, reaching a high of around 4404 before halting its decline, consistent with our strategy of shorting near 4400. It then encountered resistance at 4360, a reasonable level for a rebound after the fall, and subsequently touched a low of around 4328 during the US session before rebounding again.

In the short term, the strategy should still focus on shorting. After Tuesday's correction, the short-term downtrend has been basically confirmed. The only thing to consider is the magnitude of the rebound. The current resistance level is around the psychological level of 4400, which will be a key watershed in the near term. The support level is around 4300-4310, which will be a strong support line for the downtrend in the later period. Once broken, the speed and magnitude of the decline may double.

In the current market, it is relatively safer to wait for a rebound before shorting. The highest rebound in the Asian session was around 4373. Combined with Tuesday's rebound to around 4382, if the price rebounds to around 4390-4400 in the short term, we can short, with a target of around 4330. If the price drops directly during the European session, you can still short during the rebound before the US session. If the European session is stronger, you will need to adjust your shorting position during the US session.I will be sharing more real-time strategies on the channel.