GOLD 1H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 5085 and a gap below at 4954, as support. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

5085

EMA5 CROSS AND LOCK ABOVE 5085 WILL OPEN THE FOLLOWING BULLISH TARGETS

5208

EMA5 CROSS AND LOCK ABOVE 5208 WILL OPEN THE FOLLOWING BULLISH TARGETS

5334

EMA5 CROSS AND LOCK ABOVE 5334 WILL OPEN THE FOLLOWING BULLISH TARGETS

5446

EMA5 CROSS AND LOCK ABOVE 5446 WILL OPEN THE FOLLOWING BULLISH TARGETS

5550

BEARISH TARGETS

4954

EMA5 CROSS AND LOCK BELOW 4954 WILL OPEN THE SWING RANGE

4842

4715

EMA5 CROSS AND LOCK BELOW 4715 WILL OPEN THE SECONDARY SWING RANGE

4600

4493

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Goldtrading

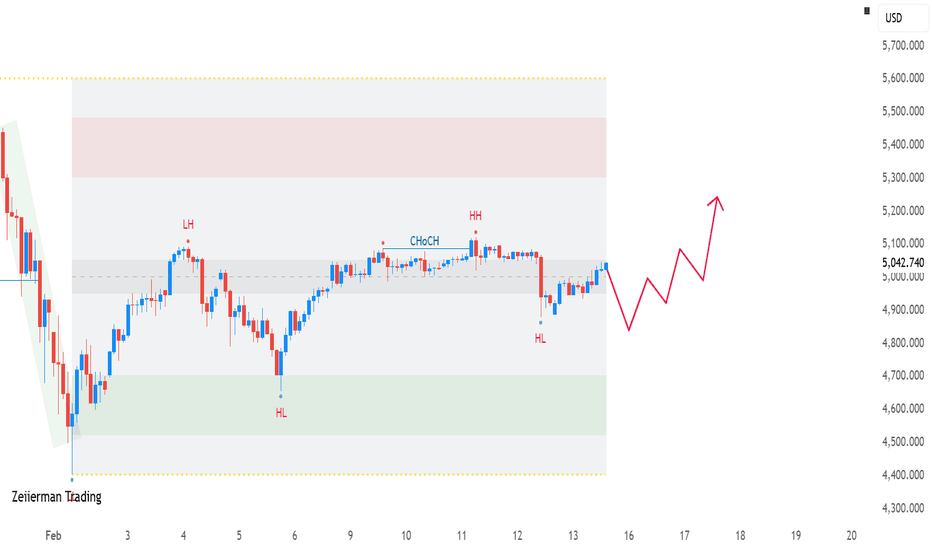

XAUUSD Bullish Break: Higher Low Confirms Gold UpsideGold (XAUUSD) is currently trading around the 5,040 – 5,050 zone, holding above a key internal support area after printing a clear Change of Character (ChoCH) followed by a Higher Low (HL).

The structure shows:

Previous Lower High (LH) formation

Break in structure → ChoCH

Formation of Higher High (HH)

Recent pullback into demand → New Higher Low (HL)

This sequence confirms a bullish market structure shift on the short-term timeframe.

🔎 Key Technical Observations

1️⃣ Change of Character (ChoCH)

Price broke the prior lower high, signaling the first shift from bearish to bullish order flow. This was the early indication that sellers were losing control.

2️⃣ Higher High (HH)

After the ChoCH, price expanded and printed a new higher high, confirming bullish intent and continuation potential.

3️⃣ Higher Low (HL) Retest

The current pullback respected the internal demand zone (green area) and formed another higher low — maintaining bullish structure integrity.

As long as price holds above the 4,900–4,950 support zone, upside pressure remains valid.

📈 Bullish Scenario

If buyers maintain control:

Short-term pullbacks remain buy opportunities

Liquidity above 5,100–5,200 becomes the next target

Expansion toward 5,300+ is possible if momentum increases

The projected path suggests consolidation followed by impulsive continuation toward previous supply liquidity.

📉 Bearish Invalidation

Bullish bias fails if:

Price closes strongly below 4,900

Structure shifts back into lower highs and lower lows

Demand zone gets decisively broken

Until then, the market structure favors buyers.

🧠 Trading Insight

This setup reflects classic Smart Money Concepts (SMC):

Liquidity sweep

Structure break (ChoCH)

Internal demand mitigation

Higher low continuation

Patience during pullbacks is key. Chasing breakouts without structure confirmation increases risk.

🔑 Key Levels to Watch

Support: 4,900 – 4,950

Intraday Resistance: 5,100

Liquidity Target: 5,200 – 5,300

Invalidation: Below 4,900

📌 Conclusion

Gold has transitioned from corrective behavior into a structured bullish phase. The formation of higher highs and higher lows suggests accumulation rather than distribution.

If demand continues to hold, XAUUSD could expand toward new short-term highs in the coming sessions.

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our 4h chart route map and trading plan for the week ahead.

We are now seeing price play between two weighted levels with a gap above at 5075 and a gap below at 4925. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

5075

EMA5 CROSS AND LOCK ABOVE 5075 WILL OPEN THE FOLLOWING BULLISH TARGET

5214

EMA5 CROSS AND LOCK ABOVE 5214 WILL OPEN THE FOLLOWING BULLISH TARGET

5375

EMA5 CROSS AND LOCK ABOVE 5375 WILL OPEN THE FOLLOWING BULLISH TARGET

5482

BEARISH TARGET

4925

EMA5 CROSS AND LOCK BELOW 4925 WILL OPEN THE FOLLOWING BEARISH TARGET

4823

EMA5 CROSS AND LOCK BELOW 4823 WILL OPEN THE SWING RANGE

4701

4592

EMA5 CROSS AND LOCK BELOW 4592 WILL OPEN THE SECONDARY SWING RANGE

4435

4297

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

XAUUSD – 15M Intraday StructureMarket Context

Price is moving inside a rising channel (short-term bullish structure).

Price is approaching PDH / PWH zone near 5,080–5,100.

Clear M15 Order Block (OB) marked in red.

Below price sits an M15 FVG + discount imbalance zone (4,950–4,940 area).

External liquidity rests at PDL / PWL (4,888–4,878).

This suggests price is currently in premium of the intraday range.

🧠 Liquidity & SMC Perspective

1️⃣ Buy-Side Liquidity

Equal highs forming just under PDH → liquidity likely resting above 5,080.

2️⃣ Channel Exhaustion

Price respecting ascending channel.

If upper boundary + OB rejects → possible internal BOS to downside.

3️⃣ Imbalance Magnet

The clean M15 FVG below acts as a draw on liquidity.

🎯 Conditional Short Idea

📍 Entry Area (Only on Confirmation)

5,075 – 5,095

(Upper channel + M15 OB + liquidity sweep zone)

❌ Invalidation

Strong 15M close above 5,105–5,120 with displacement.

🎯 Targets

TP1 → 5,040 (intraday structure low)

TP2 → 4,950 (M15 FVG)

TP3 → 4,888 (PDL liquidity)

📌 Execution Model (Safer Approach)

Wait for:

Liquidity sweep above equal highs

Bearish CHoCH on 5M

Displacement candle leaving small FVG

Retracement into that FVG for entry

No confirmation → No trade.

🔄 Alternative Scenario

If price:

Breaks channel with strong bullish displacement

Accepts above PDH

Then continuation toward 5,120+ becomes more probable.

📊 Risk Management

Risk ≤ 1% per setup

Avoid selling mid-range

Don’t anticipate — wait for reaction

Let liquidity confirm direction

GOLD (XAUUSD): Updated Support & Resistance Analysis

Here is my support and resistance analysis for Gold.

Support 1: 4878 - 4892 area

Support 2: 4654 - 4762 area

Support 3: 4340 - 4406 area

Resistance 1: 5095 - 5120 area

Resistance 2: 5581 - 5600 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD (Gold) 1H – Support Rejection Toward Range HighMarket Structure

On the 1H timeframe, Gold remains within a broader corrective range after the prior impulsive decline. Price recently swept liquidity below the previous swing low and reacted strongly from the marked support zone (4,880–4,920 area).

The reaction formed a sharp V-shaped recovery, suggesting:

Liquidity grab below support

Strong bullish absorption

Continuation toward range highs

Price is now trading above the short-term ascending trendline and reclaiming minor intraday structure.

Key Technical Levels

Support Zone: 4,880 – 4,920

Immediate Resistance: 5,120 – 5,160

Current Price: ~5,038

Trend Bias (Short-Term): Bullish above 4,920

The resistance zone around 5,150 aligns with:

Prior rejection highs

Descending dynamic resistance

Range upper boundary

Trade Idea (Bullish Scenario)

Entry Zone: Pullbacks toward 4,980 – 5,020

Stop Loss: Below 4,880

Target 1: 5,120

Target 2: 5,150 – 5,170

Rationale:

Higher low formation after liquidity sweep

Momentum shift with strong bullish candles

Risk-to-reward favorable toward range high

Invalidation Scenario

A clean break and close below 4,880 would invalidate the bullish structure and open room for deeper retracement.

Conclusion

Gold shows signs of short-term bullish continuation after defending key support. As long as price holds above 4,920, upside toward 5,150 remains the higher-probability path.

If you want, I can also provide this in German, French, Spanish, Italian, Polish, Turkish, or Russian.

Support-Based Long Toward Major Resistance Overview

This is a 1-hour chart of Gold (XAU/USD) showing price consolidating above a well-defined support zone after rejecting a major resistance area.

🔵 Key Levels Identified

Support Zone:

4,965 – 4,980

Previously acted as resistance

Now flipped into support

Multiple reactions confirm buyer interest

Resistance Zone:

5,080 – 5,100

Strong supply area

Prior highs rejected from this zone

Clear liquidity resting above highs

Current Price: ~4,993

🧠 Market Structure Insight

Strong impulsive move down → sharp recovery

Price now forming higher lows near support

Compression below resistance suggests potential breakout attempt

Liquidity likely resting above 5,090–5,100

This looks like a classic support retest in an overall bullish structure.

📈 Trade Idea (Based on Chart Markup)

Entry: Near 4,970–4,980 (support zone)

Target: 5,090–5,100 (resistance sweep)

Invalidation: Clean break below 4,960

Risk-to-reward looks favorable if entry is taken near support.

⚠️ What to Watch

Strong bullish reaction candle from support

Volume expansion on breakout

Rejection wicks near 5,100

If price breaks below 4,960 with momentum, bullish bias weakens.

🎯 Conclusion

Bias: Short-term bullish toward 5,100 resistance

Structure supports a bounce play as long as support holds.

Gold (XAU/USD) 1H Chart Analysis – Short Setup Below Resistance

On the 1-hour chart, Gold (XAU/USD) is showing signs of short-term weakness after a strong rally. Price recently rejected a key resistance zone and is now consolidating below it, suggesting potential downside continuation.

🔴 Key Resistance Zone (Stop Loss Area)

Zone: ~5,020 – 5,040

Price failed to break and hold above this level.

Multiple upper wicks indicate selling pressure.

This zone aligns with prior structure resistance.

This area is marked as the invalidating level for short positions.

🟢 Supply / Rejection Area (Entry Zone)

Zone: ~4,965 – 5,000

Price is currently trading inside this range.

Structure shows lower highs forming.

Momentum appears to be fading after the recent bounce.

This is the probable sell zone, assuming bearish confirmation.

🔵 Target Zone (Support / Previous Resistance)

Target: ~4,900 – 4,920

Previous resistance turned potential support.

Liquidity resting below recent lows (marked circles).

Clean downside path if sellers gain control.

📊 Trade Idea Summary

Bias: Bearish (short-term)

Entry: Rejection inside 4,965–5,000 zone

Stop Loss: Above 5,040

Target: 4,900–4,920

Risk-to-Reward: Favorable if entry is near upper supply

⚠️ What Would Invalidate the Setup?

Strong 1H close above 5,040

Break and hold above recent highs

Increasing bullish volume

🧠 Overall Outlook

Gold is currently ranging below resistance. If price continues forming lower highs and fails to reclaim 5,020–5,040, a move toward the 4,900 area is likely. However, if buyers regain control above resistance, this bearish scenario becomes invalid.

If you'd like, I can also break this down using pure price action concepts (SMC/ICT style) or traditional support-resistance structure.

Chart Analysis – Bullish Reversal Toward Resistance

The 1-hour chart of Gold vs US Dollar (XAU/USD) shows a strong bullish recovery after a sharp sell-off. Price has reclaimed a key demand zone and is now pushing toward a major resistance level.

🟢 1. Demand Zone Holding (Bullish Structure Intact)

Price sharply dropped into the 4,880–4,920 support area

Strong rejection from the lows (highlighted reaction zone)

Higher low formed after the bounce

Momentum shifted bullish with consecutive higher highs and higher lows

This confirms buyers stepped in aggressively at discount levels.

🔴 2. Stop Loss Zone

The marked 4,930–4,950 region acts as invalidation.

A break below this zone would:

Disrupt bullish structure

Indicate potential continuation downside

Suggest failed breakout attempt

As long as price remains above this level, bullish bias remains valid.

🟩 3. Current Resistance Zone

Price is now testing 5,020–5,060 supply area

This zone previously acted as consolidation and breakdown area

Reclaiming and holding above it turns it into support

A clean breakout and close above 5,060 increases probability of continuation.

🎯 4. Upside Target

If breakout confirms:

Next major resistance: 5,120–5,150

Strong momentum could extend toward the psychological 5,200 region

📊 Technical Structure Summary

Level Type Price Zone Meaning

Major Support 4,880–4,920 Strong demand reaction

Invalidation 4,930–4,950 Stop loss area

Breakout Level 5,020–5,060 Key resistance flip

Target Zone 5,120–5,150+ Upside objective

📌 Bias: Bullish Above 4,950

Holding above support → continuation likely

Break and close above 5,060 → acceleration expected

Failure below 4,930 → bearish pressure returns

If you'd like, I can also provide:

A short trading plan version

Risk-to-reward breakdown

Intraday scalp vs swing perspective

Or convert this into a caption for social media 🚀

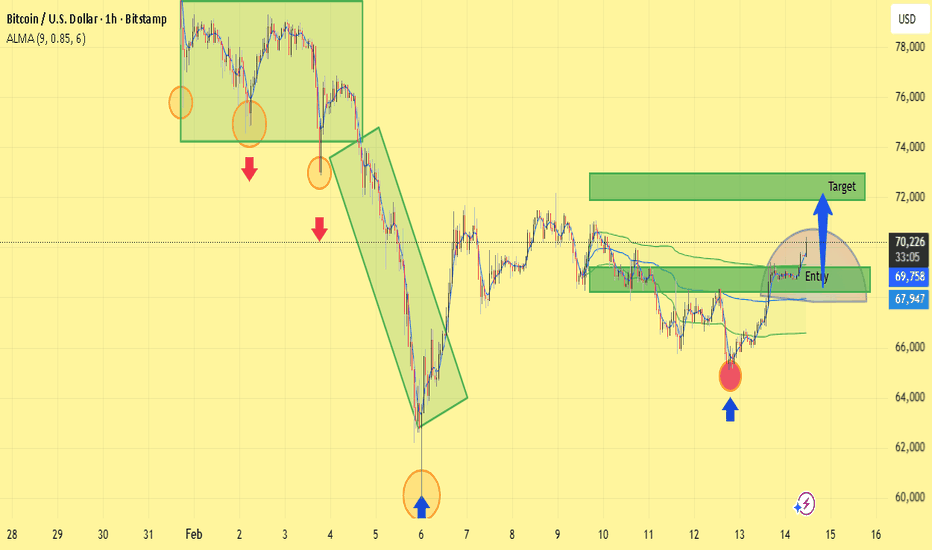

Range Accumulation After Sell-Off, Bullish Breakout in ProgressMarket Overview

On the 1H timeframe, BTCUSD shows a clear transition from a strong bearish impulse into a structured accumulation phase, followed by an early-stage bullish breakout attempt.

Phase 1: Distribution & Breakdown

Price formed a distribution range near the 76,000–78,000 zone.

Multiple rejection wicks at the range highs indicated supply absorption.

Breakdown below range support triggered a strong impulsive sell-off.

The descending channel structure confirms aggressive bearish momentum.

Phase 2: Capitulation & V-Shape Recovery

Sharp sell-off into the 60,000–62,000 demand zone.

A strong bullish reaction suggests liquidity sweep and institutional accumulation.

The recovery rally broke minor structure, signaling short-term trend exhaustion.

Phase 3: Consolidation Range (Accumulation)

Price entered a tight sideways structure between 67,000–71,000.

ALMA (9) flattening indicates volatility compression.

Repeated higher lows inside the range suggest buyers gradually gaining control.

Current Structure

Price is breaking above range resistance around 69,700–70,000.

Momentum shows bullish expansion after reclaiming moving average support.

Structure is shifting from range-bound to bullish continuation.

Trade Idea

Entry Zone: 69,500–70,000 (break and hold above range high)

Target Zone: 72,000–73,000 (previous supply area)

Invalidation: Clean rejection back inside the range below 68,500

Technical Confluence

Range breakout pattern

Higher low formation

Moving average support reclaim

Volatility expansion after compression

Conclusion

BTCUSD is transitioning from post-selloff consolidation into potential bullish continuation. Sustained acceptance above 70,000 increases probability of a move toward 72,000–73,000. Failure to hold above breakout level would likely return price to mid-range consolidation.

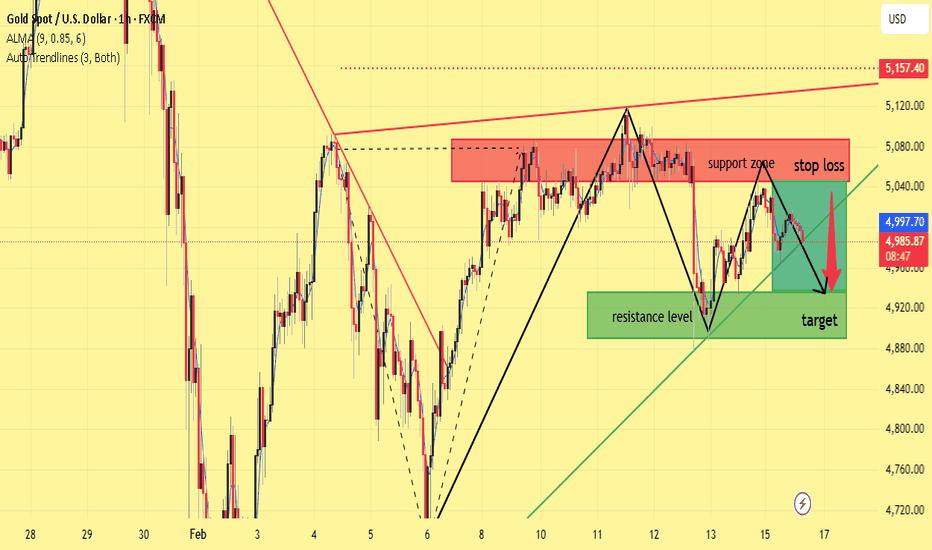

Bearish Rejection from Supply Zone, Downside Target in FocusOn the 1-hour timeframe, Gold (XAUUSD) shows a clear rejection from a well-defined supply/resistance zone around 5,070–5,120. Price previously formed a corrective structure after a strong recovery from the 4,720 lows, but bullish momentum weakened as price approached the upper resistance band.

Technical Structure

Supply / Resistance Zone:

The red highlighted area marks a strong distribution zone where sellers previously entered aggressively. Multiple rejections confirm institutional selling interest.

Trendline Confluence:

Price respected the ascending green trendline from the recent swing low near 4,880. However, the recent breakdown below short-term structure suggests weakening bullish control.

Lower High Formation:

The latest push upward failed to break the previous swing high, creating a lower high within the resistance zone — a classic bearish continuation signal.

Support to Resistance Flip:

The marked resistance level (around 4,880–4,920) previously acted as support. After the breakdown, it now serves as a downside magnet (target area).

Trade Idea

Entry Zone: Rejection within 5,040–5,080 supply region

Stop Loss: Above 5,120 (above supply and structure high)

Target: 4,900–4,880 support zone

Bias

Short-term bearish while price remains below the 5,120 resistance. A confirmed breakdown below 4,980 strengthens the probability of continuation toward the green target zone.

Invalidation

A strong 1H close above 5,120 would invalidate the bearish setup and open the path toward 5,150+.

XAUUSD 1H – Bearish Rejection from Supply Zone, Downside TargetOn the 1-hour timeframe, Gold (XAUUSD) shows a clear rejection from a well-defined supply/resistance zone around 5,070–5,120. Price previously formed a corrective structure after a strong recovery from the 4,720 lows, but bullish momentum weakened as price approached the upper resistance band.

Technical Structure

Supply / Resistance Zone:

The red highlighted area marks a strong distribution zone where sellers previously entered aggressively. Multiple rejections confirm institutional selling interest.

Trendline Confluence:

Price respected the ascending green trendline from the recent swing low near 4,880. However, the recent breakdown below short-term structure suggests weakening bullish control.

Lower High Formation:

The latest push upward failed to break the previous swing high, creating a lower high within the resistance zone — a classic bearish continuation signal.

Support to Resistance Flip:

The marked resistance level (around 4,880–4,920) previously acted as support. After the breakdown, it now serves as a downside magnet (target area).

Trade Idea

Entry Zone: Rejection within 5,040–5,080 supply region

Stop Loss: Above 5,120 (above supply and structure high)

Target: 4,900–4,880 support zone

Bias

Short-term bearish while price remains below the 5,120 resistance. A confirmed breakdown below 4,980 strengthens the probability of continuation toward the green target zone.

Invalidation

A strong 1H close above 5,120 would invalidate the bearish setup and open the path toward 5,150+.

Bearish Rejection at Resistance Overview

This is a 45-minute chart of Gold (XAUUSD) showing price reacting strongly to a marked resistance zone around 5,000. The chart highlights a potential short setup with a projected move toward a lower support/target zone near 4,880–4,900.

🧱 Key Technical Levels

🔵 Resistance Zone (~4,995–5,010)

Multiple rejections from this area.

Price tapped into resistance and failed to break higher.

Liquidity likely resting above the highs.

⚪ Entry Area (~4,990–5,000)

Suggested short entry after rejection confirmation.

Ideally triggered after bearish confirmation (rejection wick / bearish candle close).

🩶 Support / Target Zone (~4,880–4,900)

Previous demand zone.

Logical downside target.

Aligns with prior consolidation base.

📊 Market Structure Analysis

Overall short-term structure shows a lower high forming at resistance.

Strong rejection from highs after a rally.

Momentum slowing near the 5,000 psychological level.

Clear range between resistance (5,000) and support (4,880).

This suggests a range rejection trade with downside potential.

🎯 Trade Idea (Based on Chart)

Bias: Bearish (short-term)

Entry: Near 4,995–5,000 after rejection

Stop Loss: Above 5,020–5,030 (above resistance sweep)

Target: 4,890 area

Risk-to-Reward: Approx. 1:2 or better

⚠️ What Invalidates the Setup?

Strong bullish close above 5,020–5,030.

Break and hold above resistance (turning it into support).

High momentum breakout with volume.

🧠 Conclusion

Gold is currently reacting at a well-defined resistance zone. Unless buyers break and hold above 5,000 decisively, the probability favors a short-term pullback toward the lower support zone.

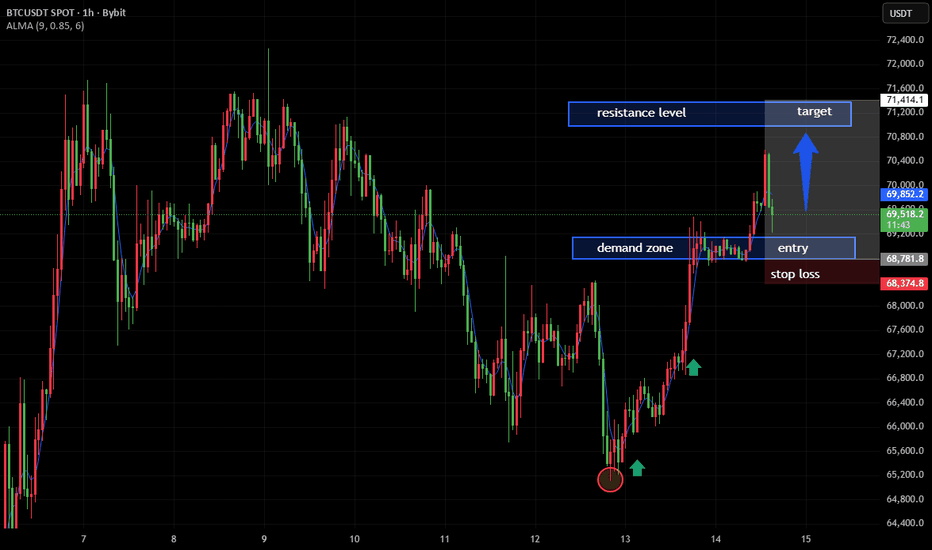

Analysis – Demand Zone Bounce Toward Key Resistance🔎 Market Overview

On the 1-hour timeframe, BTCUSDT (Bybit) shows a strong bullish reaction after forming a short-term bottom near the 65,000 area. Price has broken structure to the upside and is now consolidating above a marked demand zone, suggesting buyers are in control for the short term.

🟢 Key Technical Observations

1️⃣ Demand Zone Holding (≈ 68,700 – 69,000)

Price impulsively moved up from this area.

Current consolidation above it confirms it as short-term support.

This zone aligns with the proposed entry region.

2️⃣ Stop Loss Placement (≈ 68,374)

Positioned below the demand zone.

Logical invalidation level — if price breaks below, bullish structure weakens.

3️⃣ Resistance Level (≈ 71,200)

Previous rejection zone.

Likely liquidity area where sellers may step in.

4️⃣ Upside Target (≈ 71,200+)

First major take-profit aligns with resistance.

Break above could open continuation toward 72,000+.

📊 Trade Idea Summary (Bullish Setup)

Bias: Short-term bullish

Entry: Retest/hold above 68,800–69,000

Stop Loss: Below 68,374

Target: 71,200 resistance

Risk-to-Reward: Favorable if targeting full resistance move

⚠️ What Would Invalidate This Setup?

A strong 1H close below the demand zone.

Failure to hold 68,700 with increasing selling volume.

📌 Conclusion

BTC is showing bullish momentum after reclaiming structure and holding a demand zone. As long as price remains above 68.7K, probability favors a push toward the 71.2K resistance area. A clean breakout above resistance could accelerate upside momentum.

If you'd like, I can also provide:

A bearish alternative scenario

Lower timeframe confirmation plan

Risk management sizing example

Volume/liquidity breakdown analysis

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD H1 – Resistance Rejection and Pullback Toward Key SupportMarket Overview:

On the H1 timeframe, Gold faced strong rejection near the 5,090–5,100 resistance zone after completing a sharp impulsive move from the 4,680 swing low. The failure to sustain above resistance triggered a bearish retracement toward the 4,900 region.

Technical Structure:

A clear bullish impulse leg formed from 4,680 to approximately 5,120.

Price entered consolidation beneath the 5,100 resistance and failed to break decisively.

A lower high structure developed, followed by strong bearish momentum.

The ALMA (9) has turned downward, confirming short-term bearish pressure.

Key Levels:

Resistance Zone: 5,080–5,100

Immediate Support: 4,900–4,880

Major Support Zone: 4,850 area

Invalidation for Bears: Sustained move back above 5,100

Trade Scenario:

The current structure favors a corrective move toward the marked support zone around 4,880–4,850. If buyers defend this area and bullish confirmation appears, a potential rebound toward the 5,050–5,100 region could follow.

However, a clean H1 close below 4,850 would weaken the broader bullish structure and expose 4,800 as the next downside objective.

Conclusion:

Gold is undergoing a technical pullback after rejection at resistance. The 4,880–4,850 support zone is critical for determining whether this move is a healthy retracement within an uptrend or the beginning of a deeper bearish correction.

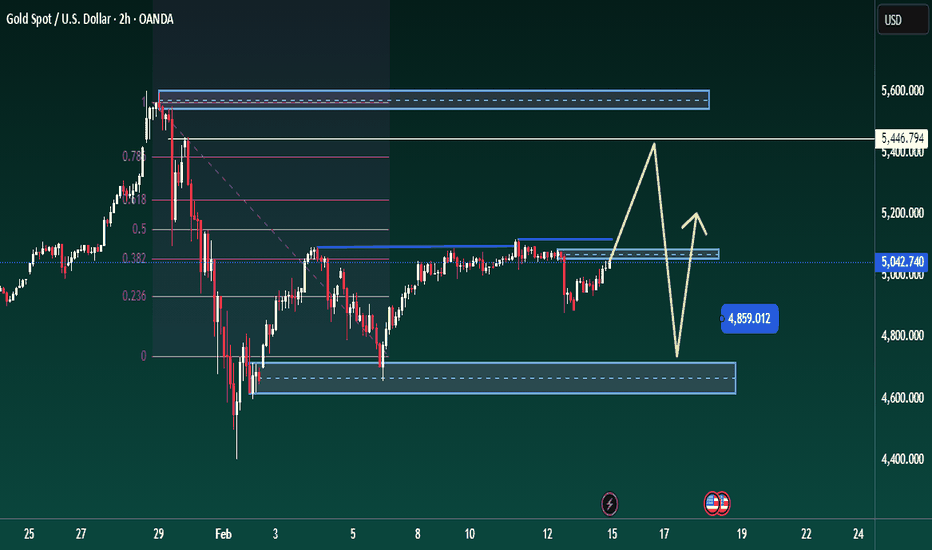

XAUUSD – Brian | Weekly OutlookXAUUSD – Brian | Weekly Outlook: Compression Before Expansion

Gold closed the week holding above mid-range structure after rejecting the recent short-term low. On the H2 timeframe, price remains inside a broader bullish framework, but momentum is clearly compressing beneath upper liquidity.

The market is not breaking — it is building pressure.

🔎 Technical Structure Overview

Strong rejection from previous swing high (near 1.0 Fibonacci)

Pullback respected the deeper retracement zone and formed higher lows

Current price consolidating around the 0.382–0.5 Fibonacci region

Major resistance liquidity remains untouched near the upper range

This structure suggests accumulation rather than distribution.

📌 Key Levels For Next Week

Resistance / Liquidity:

5,440 – 5,460 zone (untapped sell-side liquidity)

Mid-Structure Decision Zone:

Around 5,040 – 5,060 (current balance area)

Strong Demand / Reaccumulation Zone:

4,800 – 4,860 area (major liquidity base)

📊 Probable Scenarios

🔵 Primary Scenario (Higher Probability)

Early-week pullback toward the 4,850–4,900 demand zone to sweep liquidity → followed by bullish continuation toward 5,400+.

This would create a healthy reset before expansion.

🟡 Alternative Scenario

If price holds above 5,000 and absorbs selling pressure, breakout toward upper liquidity may occur without deep retracement.

📈 Market Logic

After a strong impulsive leg earlier in the month, gold is transitioning into a compression phase.

Compression near highs often precedes expansion — direction depends on liquidity sweep.

Next week is likely about liquidity engineering before directional commitment.

🎯 Trading Focus For The Week

Do not chase highs inside compression

Watch liquidity reactions near 4,850 and 5,440

Trade confirmations at Fibonacci confluence zones

Prioritize structure over emotion

Gold is still structurally constructive on higher timeframes — but patience will define precision.

Follow Brian for structured XAUUSD breakdowns, liquidity mapping and disciplined execution planning each week.

XAUUSD Stop Hunt Completed – Liquidity Sweep Before Major Move? The recent XAUUSD price action suggests a classic stop hunt and liquidity sweep scenario. Price briefly broke below a key support zone, triggering sell-side liquidity and stop-loss orders from retail traders, before sharply reversing back into the previous range.

This move appears less like a true bearish breakdown and more like a liquidity grab engineered to fuel a larger directional expansion.

📌 What Happened?

Equal Lows Formed – Price created a visible support area where retail traders placed buy entries and tight stop losses.

Liquidity Sweep – Smart money pushed price below those lows, triggering stops.

Aggressive Rejection – Strong buying pressure immediately absorbed the sell orders.

Reclaim of Structure – Price moved back above the broken support, signaling potential bullish intent.

This pattern often signals accumulation rather than continuation.

🧠 Why This Matters for Gold Traders

In the forex market, liquidity drives momentum. A stop hunt provides the fuel required for institutions to build positions before a significant move.

For Gold (XAUUSD), this setup typically leads to:

🔹 Short squeeze potential

🔹 Strong impulsive expansion

🔹 Market structure shift on lower timeframes

🔹 Break of short-term resistance

If price continues to hold above the reclaimed level, the probability increases for a bullish continuation toward higher resistance zones.

📊 Technical Confluence

Key confirmations to watch:

Higher low formation on 1H / 4H timeframe

Break of minor lower high (structure shift)

Increasing bullish volume

Rejection wicks below swept liquidity

Failure to hold above the reclaimed support would invalidate the bullish scenario and could lead to deeper downside continuation.

🎯 Trading Perspective

Instead of chasing the initial breakout, patient traders wait for:

Pullback into imbalance / fair value gap

Confirmation candle (bullish engulfing or strong momentum close)

Clear risk-to-reward structure

Risk management remains critical — liquidity sweeps can occur in both directions.

📈 Conclusion

The recent XAUUSD move shows characteristics of a stop hunt completion, suggesting smart money may have accumulated positions before a larger expansion.

If bullish structure confirms, Gold could be preparing for a significant upside move. However, traders should monitor key levels closely for confirmation rather than anticipating direction prematurely.

GOLD 1H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 4982 and a gap below at 4863, as support. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

4982

EMA5 CROSS AND LOCK ABOVE 4982 WILL OPEN THE FOLLOWING BULLISH TARGETS

5077

EMA5 CROSS AND LOCK ABOVE 5077 WILL OPEN THE FOLLOWING BULLISH TARGETS

5200

EMA5 CROSS AND LOCK ABOVE 5200 WILL OPEN THE FOLLOWING BULLISH TARGETS

5334

EMA5 CROSS AND LOCK ABOVE 5334 WILL OPEN THE FOLLOWING BULLISH TARGETS

5446

EMA5 CROSS AND LOCK ABOVE 5446 WILL OPEN THE FOLLOWING BULLISH TARGETS

5550

BEARISH TARGETS

4863

EMA5 CROSS AND LOCK BELOW 4863 WILL OPEN THE FOLLOWING BEARISH TARGET

4734

EMA5 CROSS AND LOCK BELOW 4734 WILL OPEN THE SWING RANGE

4600

4493

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

XAUUSD H1 – Triangle Breakdown Confirmed | Sideway Range ResolvAfter several sessions of compression inside a symmetrical triangle, Gold has finally resolved the range with a decisive downside expansion.

The prolonged sideway structure between 5,070 and 5,020 has now transitioned into a momentum-driven breakdown, confirming liquidity sweep and structural shift on H1.

🧠 Market Structure Update

Multi-day sideway compression inside triangle

Liquidity resting above 5,070 and below 5,020

Strong impulsive candle broke below 5,043 and 5,020

Clean expansion through 5,000 psychological level

This is no longer accumulation — this is distribution confirmed.

Short-term structure has shifted bearish.

📌 Key Zones From Current Chart

🔴 Broken Support Zone – 5,043

Former triangle support

Now acting as intraday supply on pullback

Rejection here favors continuation lower

🔴 Major Supply – 5,000 – 5,005

Psychological level

Previous consolidation base

Now resistance if retested

🔵 Immediate Reaction Level – 4,956

Intraday retracement zone

Potential lower high formation area

🔵 Primary Demand / Liquidity Target – 4,882 – 4,885

Major liquidity pocket

Projected downside expansion objective

🎯 Trading Scenarios

🔽 Bearish Continuation Scenario (Primary Bias)

Condition:

Price holds below 5,000

Rejection at 5,000 or 5,043 supply

Entry:

On bearish rejection after pullback

Targets:

TP1: 4,956

TP2: 4,920

TP3: 4,882 liquidity zone

Structure favors continuation unless 5,000 is reclaimed with strength.

🔼 Counter-Trend Recovery Scenario

Condition:

Strong M30 close back above 5,000

Acceptance above 5,043

Targets:

5,070 prior range boundary

Without reclaiming 5,000, upside remains corrective only.

📊 Tactical Summary

Sideway compression has completed.

Liquidity sweep below range triggered momentum expansion.

Bias: Bearish while below 5,000.

Pullbacks into broken structure are opportunities, not reversals — unless reclaimed decisively.

From compression → expansion → continuation phase.

Gold H1: Trendline Retest Before the Next Impulse?Gold is pulling back into a key confluence zone while macro volatility remains elevated.

Is this a breakdown… or just a liquidity reload before continuation?

📊 Technical Overview (H1)

Overall structure: Higher highs & higher lows intact

Price broke below short-term support → now retesting ascending trendline

Current pullback approaching major H1 FVG demand

This is a classic trendline retest + imbalance reaction area.

🟢 Key Support Zone

Major FVG Demand:

4,800 – 4,820

This zone aligns with:

Ascending trendline

Prior bullish impulse origin

Liquidity resting below recent lows

If price sweeps liquidity into 4,805 and shows strong H1 rejection → bullish continuation probability increases.

🔴 Resistance & Upside Targets

Near-Term Resistance:

4,983 – 5,000

Expansion Target:

5,080 – 5,120

If bullish continuation confirms:

TP1: 4,983

TP2: 5,080

TP3: 5,120

❌ Invalidation

Sustained H1 close below 4,780

→ Trendline failure

→ Structure shifts to deeper correction

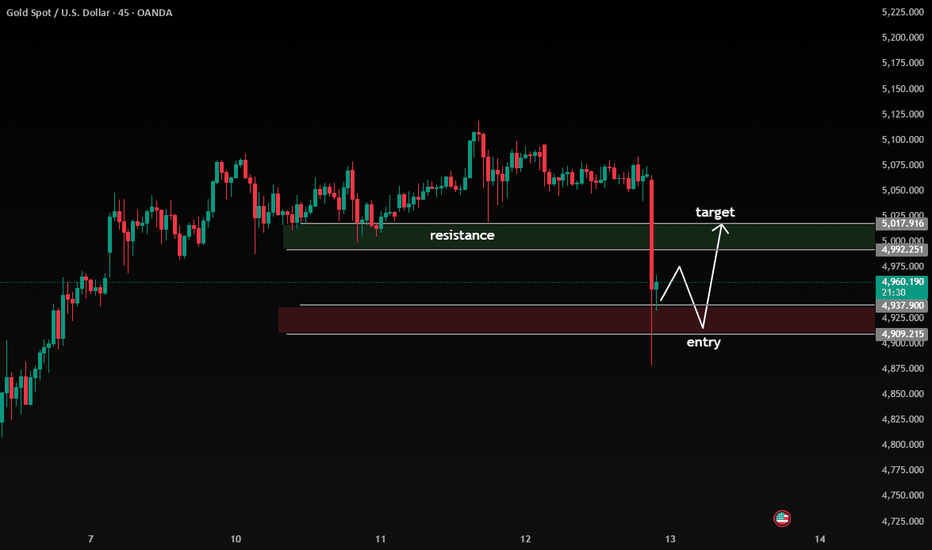

Bearish Breakout Below Range, Pullback Into Resistance

Current Structure:

Price was ranging under a clear resistance zone (≈ 4,992 – 5,018) before printing a strong bearish impulse candle that decisively broke structure to the downside. This move invalidated short-term bullish momentum and shifted bias intraday to bearish.

🔎 Key Observations

1. Market Structure Shift

The large bearish candle confirms a break of minor support and signals momentum expansion.

This looks like a liquidity sweep + displacement move, often followed by a corrective pullback.

2. Entry Zone (Demand) – 4,909 – 4,937

Price tapped into a marked demand/support area.

Reaction here suggests potential for a short-term retracement rather than immediate continuation.

This zone is likely where buyers attempt a bounce.

3. Resistance / Target Zone – 4,992 – 5,018

Previous consolidation + supply area.

If price retraces, this zone becomes:

A sell-on-rally area

A potential lower high formation zone

📈 Probable Scenario (Based on Structure)

Most likely flow:

Short-term bounce from demand

Retracement toward ~4,975–5,000

Rejection at resistance

Continuation lower if bearish structure holds

This would form a lower high, confirming bearish continuation.

⚠️ Alternative Scenario

If price:

Reclaims and closes strongly above 5,018

Holds above resistance

Then the bearish impulse becomes a fake breakdown and buyers regain control.

📊 Bias Summary

Intraday Bias: Bearish

Short-term Expectation: Pullback → rejection → continuation lower

Invalidation: Sustained move above resistance zone

XAU/USD (Gold) – 1H Chart Technical Analysis

🟢 Market Structure

The chart shows bullish recovery after a strong downtrend.

Price formed higher lows and higher highs, indicating buyers are gaining control.

Currently, price is moving in a consolidation range just above a demand zone.

🔵 Key Zones

✅ Demand Zone / Buy Entry

Around 5000 – 5030

Price has reacted multiple times here → strong buyer interest.

This area is marked as a potential BUY entry.

🔴 Stop Loss Zone

Around 4970 – 4990

If price breaks and closes below this zone, bullish setup becomes weak.

🟩 Resistance / Target Zone

Around 5140 – 5170

Previous rejection area.

Likely profit-taking zone if price continues upward.

📍 Current Price Behavior

Price is consolidating above demand → bullish sign.

ALMA moving average is supporting price → trend strength confirmation.

The circled region suggests a pullback and continuation pattern.

📈 Trade Idea (Based on Chart)

Buy Entry: Demand zone (≈ 5000 – 5030)

Stop Loss: Below 4970

Target: 5140 – 5170 resistance zone

⚠️ Risk Notes

If price breaks below demand zone → possible bearish continuation.

Watch for false breakouts near resistance