Goodluckcapital

"Nifty Hits a Red Light After a Four-Week Sprint — What’s Next?"Indian markets finally took a breather after a four-week winning streak, ending the week marginally lower at 25,722.

The week began on an upbeat note, with the index advancing through the first three sessions. However, back-to-back declines in the last two days wiped out those early gains.

Even with this mild correction, October stood out as the best month in seven months, marking the strongest performance since March.

Technically, the index appears to be losing some steam after hitting a strong resistance near 26,000. This weakness could drag it toward the 25,400–25,500 support zone, and if the weakness deepens, a slide toward 25,000 cannot be ruled out.

On the fundamental side, one key factor to watch is India’s ongoing bilateral trade negotiations with the US, which are now in their final stages — a development that could sway market sentiment in the near term.

For traders, the strategy remains clear: stay stock-specific and adopt a buy-on-dips approach, as the broader market undertone remains constructive.

Bullish Setups Emerging: Usha Martin and Alicon in Focus🔹 Usha Martin NSE:USHAMART

After months of sideways movement, the stock has formed a rounding bottom pattern.

It recently broke out and retested its support zone. If momentum continues, the stock could move higher from here. 📈

🔹 Alicon Castalloy NSE:ALICON

The stock bounced back strongly from ₹600 after a big correction from ₹1,530.

It now trades near the key resistance zone of ₹1,000–₹1,050.

Yesterday’s 13% jump with high volume shows strong buying interest. A breakout above this zone could take it closer to previous highs. 🔥

👉 Keep an eye on both — they’re showing promising setups for the next move!

Nifty Hits the 26K Wall—Market Awaits the Spark for a Big LeapAfter six consecutive gains, the Indian benchmark Nifty paused on Friday and slipped slightly from its recent highs, mainly due to profit booking.

Despite the mild correction, the index still ended the week in green, registering modest gains — a sign that the broader market sentiment remains upbeat.

Meanwhile, The India VIX declined 0.30% to 11.59, pointing to subdued market volatility.

Technical View:

On the charts, Nifty attempted a breakout above the 26,000 mark but couldn’t sustain above it.

According to Open Interest (OI) data:

● Resistance: 26,000 remains the strong resistance zone, with heavy call writing indicating a supply wall.

● Support: The 25,500–25,400 zone holds firm as crucial support, backed by significant put writing activity.

Key Triggers for the Week Ahead:

1. US Fed Meeting (Oct 28–29)

Markets will watch closely as the Federal Reserve meets this week. Experts widely expect a rate cut to support growth and ease borrowing costs.

2. Q2 FY26 Earnings Season

The ongoing earnings season will continue to drive stock-specific moves as major Indian corporates announce their quarterly results.

3. US–China Presidential Meeting

Investors will keep an eye on global cues from the upcoming U.S.–China talks, which could influence global sentiment and trade outlook.

4. India–US Trade Deal Progress

Reports suggest India is close to finalising a trade pact with the U.S. — a move that could further boost investor confidence if concluded smoothly.

Looking Ahead

Nifty seems to be catching its breath within a tight range of 25,400–26,000. The bias remains positive, but a decisive breakout above 26,000 is needed to confirm fresh upside momentum.

Until then, traders should focus on stock-specific opportunities, manage risk tightly and stay agile — the next breakout could set the tone for November’s trend.

Pre-Diwali Cheer on Dalal Street! Nifty Hits Fresh Yearly HighIndian markets extended their rally for a third straight session on Friday, October 17, with the Nifty hitting fresh one-year highs, spreading early Diwali cheer across Dalal Street.

With this surge, the Nifty 50 is now just 2.16% away from its all-time high of 26,277, reached in September 2024. October has been particularly strong, with the index closing most sessions in the green and posting month-to-date gains of 4.46%, its best performance since March 2025.

Key Drivers of the Rally

● Consumption Stocks Lead the Charge – FMCG and other consumption-oriented stocks gained as investors anticipate improved volume growth.

● Banking Sector Strength – A strong start to the earnings season, led by Axis Bank, boosted confidence with better-than-expected margins and improving asset quality. Nifty Bank NSE:BANKNIFTY even hit a fresh all-time high in the last session.

● Foreign Investor Support – FPIs turned net buyers, helping fuel the rally.

● Positive Macroeconomic Signals – Hopes of an India-U.S. trade deal and falling crude oil prices added to market optimism.

● Geopolitical Stability – Easing tensions in the Middle East reduced risk sentiment, supporting equities.

● Earnings Recovery Expectations – Investors expect H2 FY26 to see stronger earnings, aided by GST rate cuts and the RBI’s cumulative 100-basis-point repo rate reduction, boosting domestic consumption.

Technical Observations

Nifty has broken past the trendline resistance near its previous high of 25,670, signaling continued bullish momentum.

● Immediate support: 25,400–25,500

● Strong support: 25,000

● Resistance zone: 25,850–26,000

Outlook

Next week may stay muted as market holidays on October 21 and 22 could limit major moves. Nifty is likely to remain sideways with a slight bullish bias. Muhurat trading on Tuesday, October 21 (1:45 PM–2:45 PM) will serve as an early indicator of market momentum post-Diwali.

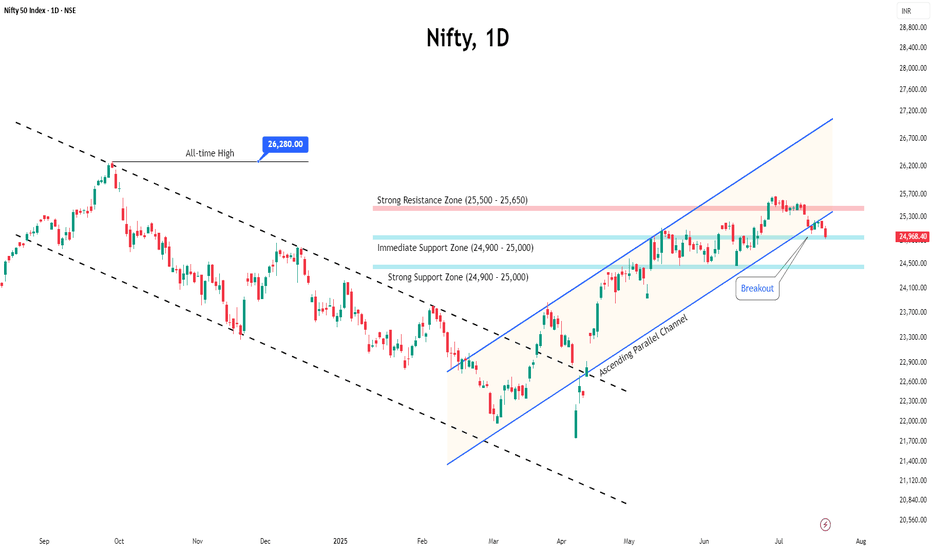

Nifty Pauses Below Resistance, Eyes Earnings-Driven MoveIndian markets closed on a strong note last week, with the Nifty rising over 1.5% to 25,285. The rally was led by IT sector (up nearly 5%) and PSU banks (up around 1.5%), reflecting sectoral strength during the earnings season.

The India VIX inched up 0.42% to 10.10, still near multi-month lows, though volatility may rise as corporate results roll in.

Technically, the Nifty is now testing a crucial resistance zone at 25,400–25,500, aligning with the apex of a large symmetrical triangle pattern. Open interest data shows heavy call writing at this zone, while strong put writing around 25,100–25,200 indicates immediate support. A decisive breakout on either side may set the tone for the next directional move.

Looking ahead, some consolidation or range-bound movement is likely as the market digests earnings and global developments. US–China trade tensions and semiconductor supply chain concerns may weigh on sentiment if risks intensify.

Given the current setup, traders are advised to adopt a cautious, stock-specific approach. While the broader bias remains positive, protecting profits and avoiding aggressive long positions until a clear breakout is confirmed would be prudent.

Positive Sentiment Drives Nifty Higher, Resistance in SightThe Nifty 50 closed the week on a positive note, rising nearly 1%, supported by strong macro cues and sectoral gains.

RBI Policy Boost:

The Reserve Bank of India kept the repo rate unchanged at 5.50% for the second straight meeting while raising FY26 GDP growth to 6.8% and lowering the inflation forecast — a move that lifted overall market sentiment.

Sector Highlights:

Banking stocks led the rally, with Bank Nifty up over 2% as private lenders like Kotak Mahindra Bank and Axis Bank posted solid gains.

Metals also shined, with Nifty Metal up 1.85%, driven by optimism over potential Fed rate cuts and a weaker dollar.

Key Levels to Watch:

Resistance: 25,000–25,100 remains a tough barrier. A breakout above 25,100 could spark a rally toward 25,400.

Support: 24,400–24,500 is the key zone to hold. A dip below this may trigger renewed selling pressure

Outlook:

The market is expected to consolidate within the current range, with sector rotation likely to drive short-term moves. Overall sentiment remains constructive as long as Nifty holds above key support levels.

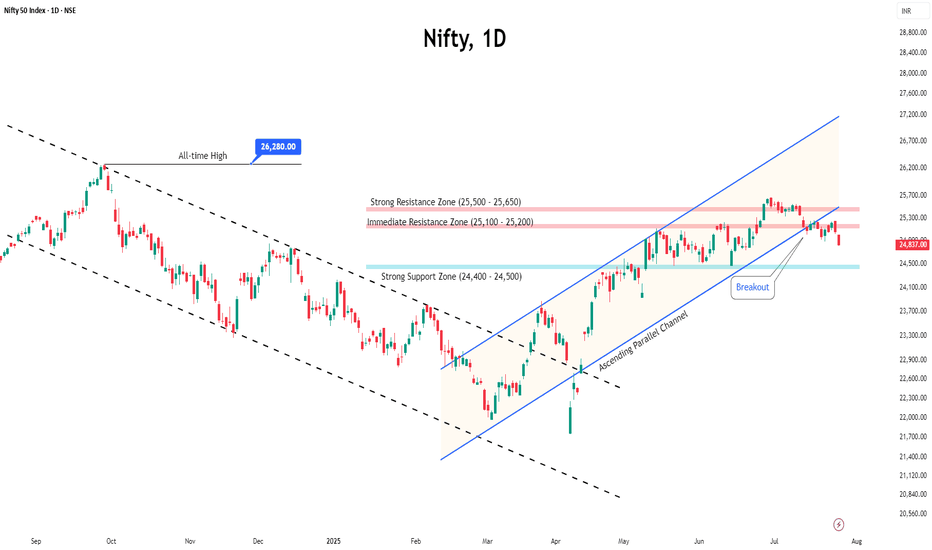

Market Mood Turns Sour as Nifty Slips Below 25KThe Nifty 50 ended its three-week winning streak with a sharp fall of ~2.6% , slipping below the crucial 25,000 psychological mark .

What Triggered the Decline?

● Global headwinds weighed on sentiment as trade tensions resurfaced, hurting risk appetite across equity markets.

● Domestic pressures coupled with persistent selling by foreign investors added to the weakness.

● Foreign Institutional Investors (FIIs) offloaded equities worth over ₹5,500 crore during the week.

● Concerns around a potential change in U.S. H-1B visa norms spooked the IT sector, a key driver of Indian exports.

Technical Backdrop

● The index has now fallen for 7 straight sessions , showing clear downward momentum.

● Immediate support: 24,400–24,500 zone. A break below this could drag the index toward the 23,900–24,000 strong support zone.

● Resistance levels: After slipping below the 25,000 mark, this level will now act as an immediate resistance. Strong resistance is placed at 25,400–25,500.

Market Outlook

With global uncertainties and foreign outflows, cautiousness and volatility are likely to dominate sentiment heading into October.

Strategy for Traders & Investors

● Maintain strict stop-loss discipline and manage position sizing carefully in this environment.

● For short-term traders: watch the 24,400–24,500 support zone for signs of reversal or breakdown.

● For investors: remain selective, focus on quality stocks, and avoid chasing momentum until stability returns.

Netweb Technologies: The Backbone of India’s AI RevolutionWhile everyone's talking about AI, Netweb is actually BUILDING India's AI backbone - and the results are spectacular! 📈

What's Happening:

● Stock soared 116% in 6 months (₹1,638 → ₹3,535) 📊

● Just secured ₹450 Cr fresh order (Sep 22) + earlier ₹1,734 Cr NVIDIA deal

● Q1 results were phenomenal - Revenue & PAT both DOUBLED! 💰

Why This Matters:

Netweb is powering India's ambitious AI Mission with high-performance servers and GPU systems. They're not just riding the AI wave - they're the infrastructure making it possible.

The Numbers Speak:

✅ Revenue: ₹301 Cr (+102% YoY)

✅ Profit: ₹30.5 Cr (+101% YoY)

✅ AI Segment: +300% growth

✅ Order book: Strong visibility till FY27

Technical View:

● Fresh breakout confirmed from a rounding bottom, with robust volume support.

● Setup looks primed for another strong rally ahead. 🚀

⚠️ Disclaimer: This is an educational post meant for learning purposes only. Not a stock recommendation.

Nifty Rides 3-Week Rally, Faces Tough Resistance AheadThe Indian benchmark indices extended their rally for the third week in a row, reinforcing the ongoing bullish sentiment.

From a technical perspective, Nifty is trading just below its long-term trendline resistance, where it recently lost some steam. Immediate support lies in the 25,200–25,300 zone, while resistance is expected around 25,400–25,500, due to heavy call writing.

On the global front, markets were briefly unsettled after Donald Trump announced a sharp H-1B visa fee hike, triggering concerns for Indian IT companies. However, clarity came soon after — the White House confirmed that the $100,000 fee would apply only to new petitions, not to renewals or existing holders. This eased fears, ensuring minimal impact on ongoing IT operations.

Outlook: Nifty may witness short-term swings amid global uncertainties, but the broader setup still points to an underlying bullish trend.

Nifty Holds Above 25K, Market Drivers Signal More UpsideNifty’s winning streak hit eight sessions, closing above psychological 25,000 mark as global optimism and strong domestic cues kept the rally alive.

Technical View

● The index has registered a fresh breakout above the trendline resistance, pointing toward renewed bullish momentum.

Key Levels to Watch

● Immediate resistance is seen around 25,200–25,300, while a stronger hurdle lies at 25,500–25,600.

● Support has shifted higher to 25,000–24,900, keeping the short-term outlook positive.

Market Drivers

● Global cues: Hopes of a US Fed rate cut and progress on the India–US trade deal have lifted market sentiment.

● Domestic macros: India’s economy looks strong with solid financial stability, steady GDP growth, and easing inflation.

● Consumer demand: Spending is expected to rise sharply after September 22, especially in automobiles and consumer durables, which could boost markets in the near term.

● Policy & earnings: Market mood is supported by GST reforms, easier monetary policy, and positive earnings expectations for the second half of FY26.

Strategic View

● The overall market trend is expected to stay positive. Traders should follow a buy-on-dips strategy with strict stop-losses. As long as Nifty holds above support, it can gradually move higher in the coming sessions.

Nifty Wraps Week Positive: Sustainability in QuestionIndian equity markets closed the week with strong gains, with the Nifty rising 1.29% supported by solid domestic economic data and policy reforms.

Key economic indicators like Q1 GDP growth at 7.8%, steady FDI inflows, and a smaller current account deficit have boosted investor confidence.

Despite these positives, global challenges and heavy FII selling over the last two months (₹94,600 crore) still pose risks.

Sector-wise, the picture is mixed. While the overall market outlook is positive, weakness in banking and IT is restraining gains. A rebound in these sectors is crucial for the uptrend to sustain.

Technically, the index faces immediate resistance at the 24,950–25,000 zone, with support positioned at 24,500–24,400.

A decisive breakout from this range is needed to establish the next directional trend; otherwise, the market is poised for a period of consolidation.

Nifty Ends August in Pain: Can September Spark a Turnaround?Nifty slipped nearly 1.8% in the last week of August as global headwinds and US-India tariff concerns weighed on sentiment.

Selling was broad-based, with Banking and Financials dragging the index down the most.

The index currently trades just above 24,400, a crucial support level. Open interest data indicates that the 24,400–24,300 zone may provide short-term support, while the 25,500–25,600 zone remains significant resistance due to heavy call writing. A decisive break below 24,300 could quickly push the index toward 24,000.

Amid the weakness, a silver lining emerges — India’s strong 7.8% GDP growth, the highest in five quarters and well above expectations, may help cushion further downside.

Looking ahead, Monday’s open will set the tone for September—a gap-up above 25,500 could spark a rebound, while staying below may keep Nifty under pressure.

Nifty Hits Resistance; Volatility Looms Ahead of Monthly ExpiryReason Behind the Fall

The Indian market snapped its six-session winning streak on Friday as investors turned cautious ahead of US Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole symposium.

Concerns over the upcoming 25% US tariffs, set to take effect on August 27, further added to market volatility.

Importantly, Powell signalled in his remarks on Friday that the Federal Reserve is likely to cut interest rates in September.

Technical Setup

The Nifty faced rejection from the key resistance zone of 25,000–25,100, which may trigger further downside towards 24,500–24,400.

OI Data Analysis

Open interest data shows significant call writing at 25,000, reinforcing it as a strong resistance for the upcoming monthly expiry.

On the downside, 24,800 is emerging as immediate support with notable put writing. If this level fails to hold, the next support is likely near 24,500.

Suggested Strategy

With the additional tariff deadline approaching alongside monthly expiry, heightened volatility is expected.

Traders are advised to stay cautious and adopt a wait-and-watch approach until the index provides clear directional cues.

Nifty Rebounds After Six-Week Fall, Consolidation Continues● Nifty finally ended its six-week losing run, closing the week with a 1.10% gain despite trading in a narrow range.

● Volatility inched higher, with India VIX rising 2.68% to 12.35, reflecting a slightly elevated risk perception, though it remains comfortably low.

● On the technical front, the 24,300–24,400 zone is likely to act as immediate support, while resistance is seen at 24,700–24,800.

● Heading into nest expiry, the index is expected to remain in a neutral phase as it continues to consolidate below key resistance levels. Without a decisive breakout, aggressive buying should be avoided.

● Traders are advised to closely monitor price action around these key levels and manage risk carefully while planning trades.

Nifty Extends Losing Streak: Is a Dead Cat Bounce Coming?The Nifty 50 dropped for the fifth week in a row, losing around 1.5%. Sectors like banks, IT, and consumer stocks are under pressure, and there are no big positive news to lift the market right now.

◉ Why is the Market Falling?

● Poor Q1 Results

Many big companies, especially in banking and IT, reported weaker-than-expected earnings. This disappointed investors and led to selling.

● U.S.–India Trade Trouble

The U.S. has added a 25% tax on Indian exports starting August 1. The two countries couldn’t agree on some trade issues, especially related to agriculture and dairy. This is bad news for export-focused companies.

● Weak Rupee

The rupee is near record lows against the U.S. dollar. This is because foreign investors are pulling money out of India. A weak rupee hurts sectors like IT and pharma, which earn in dollars.

◉ What the Charts Say?

The market has had a tough 5 weeks, but now it’s near a strong support level. This means a short-term bounce (dead cat bounce) is possible — a small recovery before another fall.

● Support at 24,500

There’s a large number of put option writers at this level. This means many traders are confident that Nifty won’t fall below 24,500 — so they’re willing to take that risk. This builds a strong support zone.

● Resistance at 24,700–24,800

There’s heavy call writing in this range. That means traders are betting Nifty won’t go above these levels. As a result, this area acts like a short-term ceiling or resistance.

Expect the Nifty to stay between these levels coming week unless some major news changes the game.

◉ Suggested Strategy

● For Traders: Stay cautious. Avoid aggressive long positions unless Nifty reclaims 25,000 decisively. Look for shorting opportunities near resistance zones with strict stop losses.

● For Investors: Stick to quality. Defensive pockets like FMCG, utilities, and select pharma may offer stability amid broader volatility.

Pressure Builds on Nifty Before ExpiryThe Nifty traded in a tight range for most of the week but eventually slipped below the 25,000 mark, ending on a weak note.

With the monthly expiry approaching, the index is likely to remain under pressure, and volatility may pick up in the coming sessions.

Key resistance levels are seen at 25,200 and 25,500. A decisive move above 25,500 could trigger an upside breakout. On the downside, support is expected around 24,500 and 24,400.

Given the current structure, traders are advised to stay cautious, focus on selective opportunities, and avoid aggressive positions until a clearer trend emerges.

Nifty Closes Below 25,000 — What Lies Ahead?The Indian market's recent uptrend appears to be losing momentum, as the benchmark Nifty index extended its decline for the third consecutive week, ending just below the important 25,000 mark.

This pullback has been largely driven by weakness in the Financial and IT sectors, with major players like NSE:TCS , NSE:HCLTECH , and NSE:AXISBANK posting disappointing earnings.

From a technical perspective, the index is now approaching a key support zone near 24,900. A decisive break below this level could open the door for a further slide towards 24,500.

Open Interest (OI) data reinforces this view, with the 25,000–24,900 zone seeing the highest put writing, marking it as an immediate support area. On the upside, strong call writing at 25,100 and 25,200 on Friday suggests these levels will act as immediate resistance.

Given the current structure, the outlook for the coming week remains neutral to bearish.

Traders are advised to stay cautious, manage risk effectively, and keep a close watch on these crucial levels.

Nifty Dips, Suggests Range-Bound Movement AheadIndian markets ended the week with a decline of nearly one percent, driven by lingering concerns over global tariffs and a weak start to the earnings season.

The 25,500 level has now turned into a strong resistance zone, marked by heavy call writing, while 25,000 continues to act as a solid support level backed by significant put writing.

Given these dynamics, the index is likely to enter a consolidation phase, with upcoming earnings announcements expected to keep sectoral volatility elevated.