Can GOOGL Sustain Its Bullish Run Before 320 Resistance Hits?🎯 GOOGL HEIST: Operation Alphabet Escape Plan 💰

Alphabet Inc. (NASDAQ) - Swing Trade | Multi-Layer Entry Strategy

📊 THE SETUP

Sentiment: 🟢 BULLISH | Timeframe: Swing Trade | Risk Level: Medium

🎲 ENTRY STRATEGY: "THIEF LAYERING"

Strategic multi-level buy accumulation using limit orders

Layer-by-Layer Approach:

🔵 Layer 1: $270.00 (Initial entry - 30% position)

🔵 Layer 2: $275.00 (Support zone - 35% position)

🔵 Layer 3: $280.00 (Strength builder - 35% position)

Why This Works? Multiple entries reduce average cost basis and allow maximum capital efficiency. If price rejects higher, you've got fills at lower zones. If it pumps, you're already in! 💡

🛑 STOP LOSS PROTECTION

Hard Stop: 🚨 $265.00 (Below support structure)

This represents a 1.9% risk from Layer 1 entry — disciplined risk management at its finest.

⚠️ Risk Acknowledgment: Your stop loss, your rules. We're traders, not financial advisors. Adjust based on YOUR risk tolerance and account size. This is educational strategy sharing, not personalized financial advice.

🎖️ PROFIT TARGETS & ESCAPE ROUTES

Primary Target: 📈 $310.00

Strong resistance zone forming

Overbought conditions developing

Action: Take 50-60% profits here

Secondary Target: 🏆 $320.00

Police barricade zone (extreme resistance)

High trap probability at this level

Action: Scale out remaining 40-50% OR tighten stops to breakeven

Exit Philosophy: Greed kills traders. Take profits systematically. The best trade is one where you sleep well at night. 😴

⚠️ Profit Note: Your targets, your timing. Scale exits based on market conditions, volume confirmation, and YOUR comfort level.

🔗 RELATED PAIRS TO MONITOR (Correlation Watch)

🔵 NASDAQ:MSFT 📱 — High Correlation (Tech Sector) | If MSFT breaks down, GOOGL faces sector headwinds. Watch for divergence signals here first.

🔵 NASDAQ:QQQ 🔺 — 0.85+ Correlation (Nasdaq-100) | QQQ weakness = potential GOOGL pullback signal. This is your sector health check before entry.

🔵 AMEX:IWM 📊 — Inverse Correlation (Rotation Risk) | Russell 2000 strength = growth money leaving mega-caps. If small-caps pump, tech might cool off.

🔵 NASDAQ:TLT 💳 — Interest Rate Proxy | Rising bonds = tech pressure; falling bonds = tech friendly. Fed policy flows directly through here.

🔵 TVC:VIX 😰 — Volatility Index | VIX spike = risk-off, potential GOOGL liquidation. Above 20 = reduce position exposure.

Key Insight: Watch QQQ and MSFT first. They're your canary in the coal mine. If sector is weak, reconsider your entry conviction. 🚨

💎 STRATEGY SUMMARY

✅ Bullish bias with disciplined multi-entry accumulation

✅ Defined risk with hard stop at $265

✅ Staged profit-taking to lock gains systematically

✅ Correlation awareness prevents surprise sector rotations

🎬 FINAL THOUGHTS

Remember: This is the Thief Strategy™ — a fun, educational framework for swing trading, NOT financial advice. Trade at your own risk. Position sizing, stop losses, and profit targets should reflect YOUR unique situation, risk tolerance, and account size.

The heist only works if you ESCAPE with profits. Don't get caught holding the bag! 💼🚪

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#GOOGL #AlphabetInc #SwingTrade #TechAnalysis #TradingStrategy #NASDAQ #TradingIdeas #MultiLayers #RiskManagement #Bullish #ThiefStrategy #TradingCommunity #TradingView #Technical #StockMarket

Googletrading

GOOG Bulls Loading Calls ($243.5) – Ride or Fade?

## 🔥🚀 GOOG Weekly Options Alert 🚀🔥

📊 **Cheap Weekly Call Setup – Big Risk / Big Reward!** 💎💰

### ✅ Key Takeaways

* 📈 **Flow & Volume:** Institutional call flow 🔥 (C/P ratio **295:1**) with 1.3x volume → Bullish bias.

* ⚡ **Volatility:** VIX \~17 → Favorable for short-term calls.

* 🛑 **Caution:** Daily RSI 70.6, Weekly RSI 77 → Momentum divergence 📉.

* ⏰ **Risk:** Only 2 days to expiry → Theta & Gamma risk sky high ⚡.

### 🎯 Trade Setup (High-Risk, Small Size)

* 🏦 **Instrument:** GOOG

* 🚀 **Strike:** \$243.00

* 💵 **Entry Price:** \$0.11

* 🛑 **Stop Loss:** \$0.06 (50%)

* 🎯 **Target:** \$0.22 (100% gain)

* 📅 **Exit Plan:** By **Thursday EOD** (don’t hold into Friday gamma risk)

* 📊 **Confidence:** 65%

### ⚠️ Key Risks

* 🕒 Time decay (theta) → Premium melts fast.

* 📉 Momentum exhaustion → RSI overbought, possible pullback.

* 📊 Liquidity → Tight spreads, use limit orders.

---

## 📌 Viral Tags (TradingView + SEO)

\#GOOG #OptionsTrading #WeeklyOptions #CallOptions #SwingTrade #Breakout #StockMarket #GOOGAnalysis #TechStocks #RiskReward #TradingSetup #GammaRisk #ThetaDecay #MomentumTrading

Alphabet Stock Price Soars By Around 8% After Court RulingAlphabet (GOOGL) Stock Price Soars By Around 8% After Court Ruling

At the end of August, we reported that Alphabet (GOOGL) stock price had reached a historic high, closing above $210. But today, the price is likely to climb to a new, significantly higher level. Yesterday, in after-hours trading, it surged by roughly 8%.

Why did Alphabet (GOOGL) shares rise?

The jump is explained by a court ruling in a case concerning alleged monopoly practices related to the Chrome browser. According to Investopedia, a federal judge ruled that the tech giant does not need to sell Chrome. This dispelled fears that Alphabet might have been forced to part with a core part of its business.

Interestingly, one of the factors behind the judge’s decision was the spread of AI solutions (such as ChatGPT and Perplexity), which offer competition to Chrome’s search and browsing functions.

Technical analysis of GOOGL shares

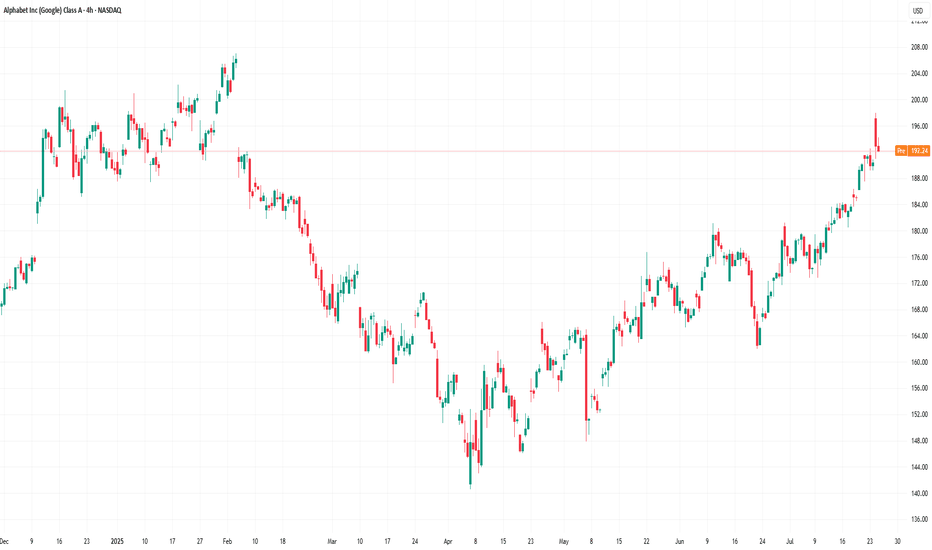

In our earlier review, we identified:

→ an upward channel (shown in blue), formed by long-term price movements;

→ an intermediate channel (in place since late spring).

If today’s trading in GOOGL opens around where the price settled in yesterday’s after-hours session (close to $226), this would mean:

→ the growth target at the upper boundary of the blue channel has been reached;

→ in the context of the summer’s price swings, Alphabet (GOOGL) shares will be in an extremely overbought zone.

Once the initial excitement following the news subsides, this could pave the way for a correction, which seems reasonable after a rise of more than 55% in the past five months.

In this case, the $215 level may serve as an indicative target for the correction to end:

→ it marks the lower boundary of a bullish gap that is highly likely to form today;

→ the market could then return within the aforementioned channels, giving the bulls renewed confidence to buy, as Alphabet (GOOGL) would no longer appear overbought, while the strong fundamental backdrop (as can reasonably be expected) would remain intact.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Alphabet (GOOGL) Shares Set an All-Time HighAlphabet (GOOGL) Shares Set an All-Time High

As the chart of Alphabet (GOOGL) shares shows, the price in August exceeded the February high. For the first time in history, the close price moved above $210.

The positive market sentiment is being driven by the development of AI technologies, as well as Alphabet’s (GOOGL) ambition to maintain a leading position in this field. Among the latest news, it is worth noting that Meta Platforms (META) has signed an agreement to use Google Cloud’s infrastructure for its AI projects, which is expected to bring Alphabet around $10 billion in revenue.

Technical Analysis of GOOGL Shares

In the long-term context, price fluctuations are forming an ascending channel (shown in blue). After falling to the lower boundary in early April (when Trump first announced his tariffs), the balance of sentiment shifted, and the price has since been moving within a new medium-term ascending channel (shown in purple), approaching the upper boundary of the blue channel.

At the same time, we can make the following observations, which generally point to a bullish market:

→ the price has confidently broken above the median line of the long-term channel;

→ the price has consolidated above the psychological level of $200, which acted as resistance at the start of the year;

→ this summer, the price has been trading near the upper boundary of the medium-term channel, highlighting strong demand – short-term declines towards the median line of the medium-term channel have quickly attracted buyers;

→ in August, the $205.75 level switched its role from resistance to support.

From a bearish perspective, the RSI indicator is showing signs of divergence, suggesting that the rally may be running out of steam. However, it seems that more significant drivers would be needed to shift the current positive sentiment:

→ Technically, Alphabet’s (GOOGL) share price reaching the upper boundary (which looks realistic given the bullish factors listed) could motivate buyers to take profits.

→ Major economic news, such as a change in the Federal Reserve’s interest rate policy.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GOOG 2026 LEAPs: $205 Calls for the Next Big Tech Wave!## 🚀 GOOG LEAP Setup (2025-08-08) 🚀

**Bias:** 📈 **Moderate Bullish** (short-term momentum + low volatility)

**Strategy:** Buy Call LEAP – Target upside with managed risk.

**🎯 Trade Plan**

* **Instrument:** \ NASDAQ:GOOG

* **Type:** CALL (LONG)

* **Strike:** \$205 (0.6-0.7 delta sweet spot)

* **Entry:** \$27.40

* **Profit Target:** \$54.80 (+100%)

* **Stop Loss:** \$18.22 (-30%)

* **Expiry:** 2026-09-18

* **Size:** 1 contract

* **Confidence:** 72%

**📊 Key Notes:**

* RSI (Weekly): 70.1 → strong momentum

* VIX: 15.4 → favorable for LEAP entries

* High valuation (90% of 52-week range) = pullback risk ⚠️

* OI = 0 → possible liquidity challenges

Big Money is Buying GOOGL Calls — Are You In?

## 🚨 GOOGL WEEKLY TRADE IDEA (Aug 4–8)

**Institutional CALL Buying Surges — \$197.50 CALL Setup Triggered**

---

### 📊 Model Consensus Breakdown:

* **🔁 Call/Put Ratio**: **3.33** — strong bullish options bias

* **📉 RSI**: Weak Daily & Weekly = ⚠️ caution zone

* **💰 Volume**: Institutional call flow ✅ but light overall volume ❌

* **🧠 AI Model Split**:

* ✅ **Grok, Gemini**: Bullish lean

* ⚠️ **Claude, DeepSeek**: No trade – weak conviction

* ⚖️ **Meta**: Wait-and-see bias

🧭 **Net Sentiment: MODERATE BULLISH** (With structural caution)

---

### 🎯 Trade Setup:

| 🔧 Strike | 💵 Entry | 🎯 Target | 🛑 Stop | 📅 Expiry | 🔒 Confidence |

| ------------- | -------- | --------- | ------- | --------- | ------------- |

| \$197.50 CALL | \$0.69 | \$1.05+ | \$0.34 | Aug 8 | 65% ✅ |

🕰 **Entry Timing:** Market open

🔍 **Volume Note:** Trade ONLY if opening volume aligns with premarket flow

📉 **Momentum Flag:** Falling RSI = quick exits if invalidated

---

### 🔥 WHY IT MATTERS:

* **Whales Are Loading Calls** despite momentum weakness

* **VIX Low = Options Cheap** = better R\:R on call spreads or singles

* **Target Return**: \~52% upside on premium w/ tight risk guardrails

---

### 🚨 RISKS:

* RSI trend down → invalidates quickly

* Weak market breadth = easy rejection on fakeouts

* Earnings hangover & macro drag = overhang risk

---

### 🏷️ Hashtags / Tags:

`#GOOGL #Alphabet #OptionsTrade #CallOption #AITrading #BullishFlow #TradingView #WeeklySetup #StockSignal #RiskReward`

Alphabet (GOOGL) Stock Chart Analysis Following Earnings ReleaseAlphabet (GOOGL) Stock Chart Analysis Following Earnings Release

Earlier this week, we highlighted the prevailing bullish sentiment in the market ahead of Alphabet’s (GOOGL) earnings report, noting that:

→ an ascending channel had formed;

→ the psychological resistance level at $200 was of particular importance.

The earnings release confirmed the market’s optimism, as the company reported better-than-expected profits, driven by strong performance in both its advertising and cloud segments.

In his statement, CEO Sundar Pichai noted that AI is positively impacting all areas of the business, delivering strong momentum.

The company is expected to allocate $75 billion this year to expand its AI capabilities.

As a result, Alphabet (GOOGL) opened yesterday’s trading session with a bullish gap (as indicated by the arrow). However, as the session progressed, the price declined significantly, fully closing the gap.

This suggests that:

→ the bulls failed to consolidate their gains, allowing the bears to seize the initiative;

→ the ascending channel remains valid, with yesterday’s peak testing its upper boundary;

→ such price action near the $200 level reinforces expectations that this psychological mark will continue to act as resistance.

It is possible that the positive sentiment following the earnings report may weaken in the near term. Accordingly, traders may consider a scenario in which Alphabet’s (GOOGL) share price retraces deeper into the existing ascending channel. In this case, the former resistance levels at $180 and $184 may serve as a support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

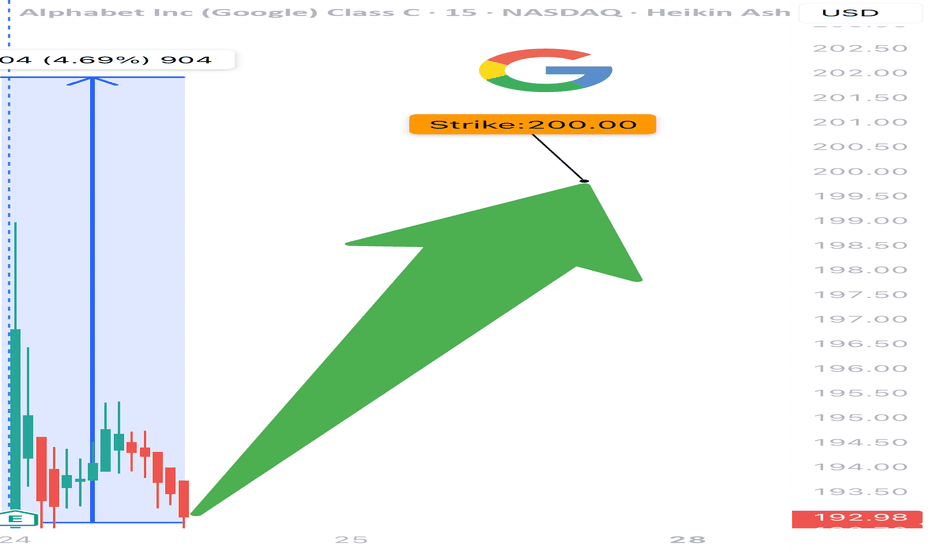

GOOGL TRADE IDEA (07/24)

🚨 GOOGL TRADE IDEA (07/24) 🚨

💥 Big institutional flow. 1 DTE. High gamma = high reward (⚠️ high risk too)

🧠 Quick Breakdown:

• Call/Put Ratio: 2.44 → ultra bullish

• Weekly RSI climbing (67.3) 📈

• Daily RSI falling from 77.5 → 🔻 short-term pullback risk

• Reports split: trade or wait? We’re in.

💥 TRADE SETUP

🟢 Buy GOOGL $200 Call exp 7/25

💰 Entry: $2.09

🎯 Target: $3.14–$4.18 (50–100%)

🛑 Stop: $1.25

📈 Confidence: 70%

⚠️ Expiry in 1 day = tight execution needed. Gamma can cut both ways. Watch it like a hawk. 👀

#GOOGL #OptionsFlow #CallOption #GammaSqueeze #TechStocks #UnusualOptionsActivity #TradingView #StockAlerts #BigMoneyMoves #DayTrading #OptionsTrading

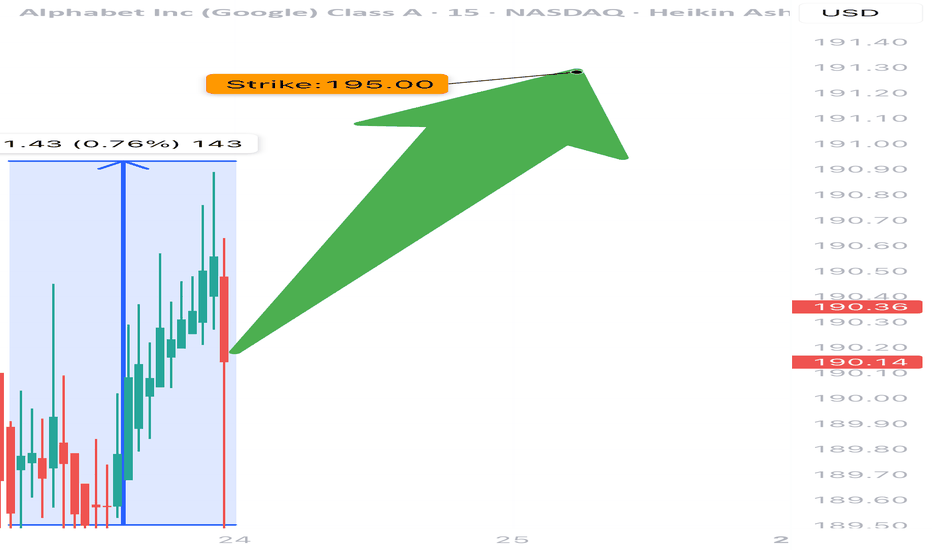

GOOG Earnings Setup (2025-07-23)

📈 GOOG Earnings Setup (2025-07-23) 🚀

🔥 STRONG BULLISH BIAS – 85% Confidence

Alphabet (GOOG) is set to report after market close. Here’s why this setup is 🔥:

⸻

📊 Fundamental Highlights:

• 💸 TTM Revenue Growth: +12.0%

• 🧾 Profit Margin: 30.9%

• 💯 Earnings Beat Rate: 8/8 last quarters

• 📈 EPS Est: $8.95

• 🎯 Forward P/E: Attractive in the AI-dominant market

👉 Score: 9/10

⸻

🔍 Options Market Flow:

• 🚀 Heavy Call buying at $195 strike

• 💰 Implied Move: ±5.12%

• 🛡️ Light Put hedging at $190 shows cautious optimism

• 📉 IV Rank: 0.75 (Elevated but tradable)

👉 Score: 8/10

⸻

🧭 Technicals:

• 🔺 RSI: 73.32 (strong momentum)

• 🔼 Above 50/200 MA

• 🔵 Support: $190.00

• 🔴 Resistance: $200.00

👉 Score: 8/10

⸻

🌍 Macro/Sector Tailwinds:

• 🌐 AI & Ads tailwind still fueling growth

• 📡 Sector leadership + resilient biz model

👉 Score: 9/10

⸻

🛠️ Trade Idea (High Conviction)

🔹 Ticker: NASDAQ:GOOG

🔹 Direction: CALL

🔹 Strike: $195.00

🔹 Expiry: 07/25/2025

💵 Entry Premium: $3.95

🎯 Target Premium: $11.85 (200%)

🛑 Stop: $1.98 (50%)

📅 Entry: Before 07/23 Close (Pre-Earnings)

⸻

📌 Risk-Reward

• Max Loss: $395 per contract

• Target Gain: $1,190 per contract

• Break-even: $198.95

• ⏳ Time-sensitive: Close post-earnings if flat (avoid IV crush)

⸻

🚨 Summary

💥 GOOG looks primed for an upside breakout. Strong fundamentals + bullish technicals + aggressive options flow make this a top-tier earnings play.

🔔 Watch $195–$200 zone post-earnings.

💬 Drop your thoughts 👇 — are you playing GOOG this earnings?

Alphabet (GOOGL) Stock Approaches $200 Ahead of Earnings ReleaseAlphabet (GOOGL) Stock Approaches $200 Ahead of Earnings Release

According to the Alphabet (GOOGL) stock chart, the share price rose by more than 2.5% yesterday. Notably:

→ the price reached its highest level since early February 2025;

→ the stock ranked among the top 10 performers in the S&P 500 by the end of the day.

The positive sentiment is driven by expectations surrounding the upcoming quarterly earnings report, scheduled for release tomorrow, 23 July.

What to Know Ahead of Alphabet’s (GOOGL) Earnings Release

According to media reports, Wall Street analysts forecast Alphabet’s Q2 revenue to grow by approximately 11% year-on-year, with expected earnings per share (EPS) of around $2.17 — up from $1.89 a year earlier. Notably, the company has consistently outperformed estimates for nine consecutive quarters, setting a positive tone ahead of the announcement.

Despite the optimism, investors are closely monitoring two key areas:

→ Cloud computing competition , where Google Cloud contends with Microsoft Azure and Amazon AWS;

→ Growing competition in the search sector , linked to the rise of AI-based platforms such as ChatGPT.

In response, Alphabet is significantly increasing its capital expenditure on AI infrastructure, planning to spend around $75 billion in 2025. These investments are aimed at both defending its core search business and advancing the Gemini AI model, while also strengthening Google Cloud’s market position.

Technical Analysis of Alphabet (GOOGL) Stock

Since April, GOOGL price fluctuations have formed an ascending channel (marked in blue).

From a bullish perspective:

→ the June resistance level at $180 has been breached and may soon act as support;

→ previous bearish reversals (marked with red arrows) failed to gain momentum, suggesting sustained demand is pushing the price higher.

From a bearish standpoint, the price is approaching:

→ the psychological level of $200, which has acted as a major resistance since late 2024;

→ this barrier may be reinforced by a bearish gap formed in early February.

Strong results from the previous quarter, combined with optimistic forward guidance from Alphabet’s management, could provide bulls with the confidence needed to challenge the $200 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Alphabet - The textbook break and retest!📧Alphabet ( NASDAQ:GOOGL ) will head much higher:

🔎Analysis summary:

If we look at the chart of Alphabet we can basically only see green lines. And despite the recent correction of about -30%, Alphabet remains in a very bullish market. Looking at the recent all time high break and retest, there is a chance that we will see new all time highs soon.

📝Levels to watch:

$200

🙏🏻#LONGTERMVISION

Philip - Swing Trader

$GOOGL primed for a BIG MOVE!NASDAQ:GOOGL primed for a BIG MOVE! 🚀

Heading into earnings, this stock’s valuation has been overlooked—but strong results could flip the narrative fast! 💨

✅ Bounced off 2021 highs

✅ RSI at its lowest since COVID

✅ Major indicators curling upward

✅ Volume shelf launch incoming

✅ Wr% pendulum swinging

Momentum is building—are you ready? 👀

Not financial advice

Alphabet (GOOGL) Shares Hover Near Psychological LevelAlphabet (GOOGL) Shares Hover Near Psychological Level Ahead of Earnings Report

On 31 March, we noted that bearish sentiment could push Alphabet’s (GOOGL) share price towards the psychological level of $150. As the current price chart suggests, GOOGL is now trading close to that very level.

Moreover, the price is approximately equidistant from the recent highs and lows (marked A and B), which may be interpreted as a sign of balanced supply and demand — and a wait-and-see stance from market participants ahead of Alphabet’s Q1 earnings release (scheduled for tomorrow, 24 April).

Awaiting the GOOGL Earnings Report

With the Nasdaq 100 index (US Tech 100 mini on FXOpen) having fallen by around 13.5% since the beginning of the year, investors are approaching tech earnings with caution. According to Barron’s, three key themes are expected to dominate the narrative:

→ management forecasts amid continued uncertainty around the White House’s tariff policy;

→ plans for major capital investment in AI-related infrastructure;

→ signs of softening consumer demand.

Given the current climate of uncertainty, Alphabet’s earnings report could prove particularly influential — serving as a benchmark for shaping market expectations ahead of other major tech company reports.

Technical Analysis of Alphabet (GOOGL)

The $150 level has served as key support throughout 2024, and over the coming days it may act as a springboard for a new price movement, potentially driven by the earnings results.

From a bearish perspective, the market remains in a downward trend (indicated in red) following a breakout below the lower boundary of a previously active rising channel (marked in purple) that had held since last autumn. However, if Alphabet’s management maintains an upbeat outlook for 2025, this could give the bulls the confidence to challenge the upper limit of the red channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GOOGLE Long PlanSo here is our plan for entering a Google long position. And you know what the old saying is "plan your trade, and trade your plan".

We will be looking long and hard at the volume profile when we reach that area.

Our last Google trade that we posted it all the Take Profit points, and was great.

So mark this on your chart and set alerts.

GOOGLE: Patiently wait for this level to buy.Google is marginally bullish on its 1D technical outlook (RSI = 57.689, MACD = 5.220, ADX = 40.687) as it has been practically consolidating for the past 2 weeks, having formed a HH (Dec 17th) at the top of the Channel Up. The 1D RSI bearish divergence suggests that this is a top like Nov 7th was. The trend didn't turn into a buy again before hitting the 1D MA50 after a 0.5 Fibonacci pullback and this would be the most optimal level for buying again. Beyond that, since both bullish waves so far have been approximately +23.90%, we expect another such rise to take place. Our target is the 1.5 Fibonacci extension (TP = 225.00).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Google I Potential positive growth in the ascending channel Welcome back! Let me know your thoughts in the comments!

** Google Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

THE STOCK GAUNTLET HAS BEGUN! GOOGLE 1/17⚔️🛡️ THE STOCK GAUNTLET HAS BEGUN! ⚔️🛡️

STOCK/TRADE UPDATE: 1/17

1⃣ NASDAQ:GOOG NASDAQ:GOOGL

Show some love: ❤️

LIKE | FOLLOW | SHARE | BOOKMARK IT

🔔 Hit the bell to be notified when each video drops!

NFA #tradingstrategy #HIGHFIVESETUP

NASDAQ:GOOG NASDAQ:GOOGL

$GOOG $GOOGL IS A GIFT RIGHT NOW. YOU WILL SEE! NASDAQ:GOOG NASDAQ:GOOGL

IS A GIFT. YOU WILL SEE!👀

1.) High Five Setup

2.) Inverse H&S Breakout/will retest and fill earnings GAP then head to the Measure Move (MM) of $193.

3.) They just demolished earnings and everyone was bullish until the market decided to pull back. Everyone just forgot about the ones who reported first out the MAG7.

What do you think? Is this the easiest trade you've ever seen? IMO it's definitely one of them haha

"BE GREEDY WHEN OTHERS ARE FEARFUL"-WB

NFA

GOOGLE Rockets! 15-Min Surge Hits All Targets – What's Fueling?ALPHABET (GOOGLE) Analysis:

Alphabet Inc. (GOOGL) experienced a powerful upward movement in the 15-minute timeframe, achieving all set profit targets with ease using the Risological Swing Trader.

The momentum from a strong earnings report has aligned with a positive risk sentiment across US equity indexes, sparking increased buying interest in tech giants like Alphabet.

Here’s a breakdown of the trade and supporting market context:

Entry : $164.75

Targets Achieved:

TP1: $167.07

TP2: $170.81

TP3: $174.56

TP4: $176.88

Stop Loss (SL): $162.87

Market Sentiment:

Recent quarterly earnings reports have fortified investor confidence, with broader equity indexes advancing. Alphabet's strong fundamentals and growth projections contributed to the bullish sentiment, encouraging traders to follow through on this aggressive buying trend.

With all targets hit in a single session, this upward momentum for Alphabet highlights robust institutional interest and solid fundamentals. Keep an eye on further tech earnings, which may continue to impact Alphabet's trajectory in the upcoming sessions.

GOOGLE (GOOGL) Breaks Out? Bullish Surge on 15m TimeframeGoogle (GOOGL) has shown a bullish breakout following the entry at 163.31, pushing through the first target (TP1) at 165.51 with significant momentum.

Key Levels

Entry: 163.31 – The entry point aligns with a breakout from a period of consolidation, supported by upward movement across key technical indicators.

Stop-Loss (SL) : 161.52 – Positioned below recent support to minimize downside risk and protect against potential pullbacks.

Take Profit 1 (TP1): 165.51 – Already achieved, confirming the initial bullish momentum.

Take Profit 2 (TP2): 169.07 – Represents the next resistance level where profit-taking may occur as the uptrend continues.

Take Profit 3 (TP3): 172.64 – Should the bullish momentum persist, this is the next key resistance level to watch.

Take Profit 4 (TP4): 174.84 – The ultimate target, signaling a strong upward movement.

Trend Analysis

GOOGL is well above the Risological dotted trendline and shorter-term moving averages, indicating a healthy uptrend.

The breakout suggests continued bullish momentum, with TP2 and TP3 likely in focus if the uptrend sustains.

The bullish momentum in GOOGL is evident, with the price moving swiftly past TP1. With solid support from moving averages and strong buying pressure, the next targets at 169.07 and 172.64 are in sight.