GRASSUSDT

Grass price analysisThe market continues its broad consolidation decline, yet $GRASS suddenly shows an abnormal move: +130% in 3 days.

Such behavior rarely occurs without a catalyst — most likely news, liquidity injections, or targeted market activity.

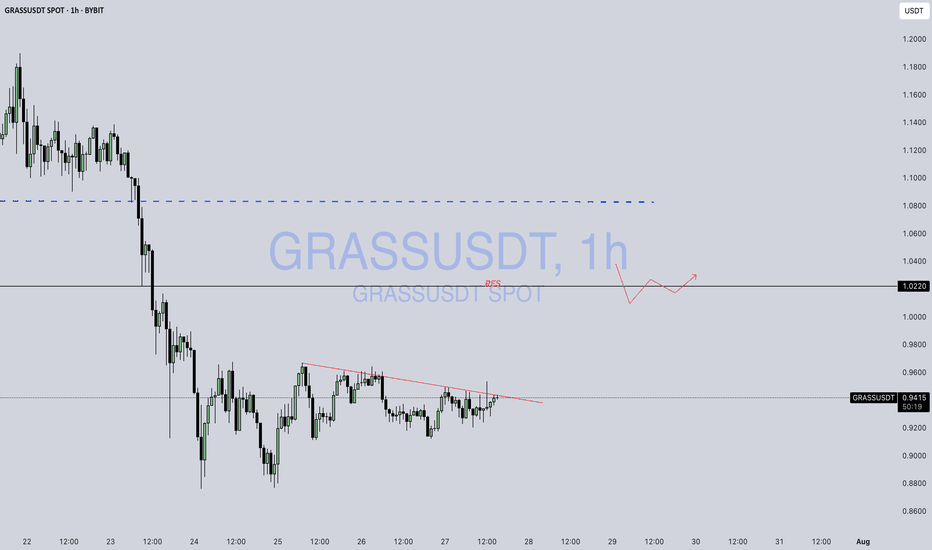

From the current structure, OKX:GRASSUSDT.P may attempt an extension toward $1, although the resistance zone above $0.90 is unlikely to break on the first test.

A corrective pullback could provide another accumulation opportunity near $0.60, with a mid-term target around $1.40.

Key question for traders:

Is this a short-term volatility spike, or the beginning of a structural trend reversal?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

$GRASS — Eyeing 0.50 Next?Over 100M $GRASS is now staked, with many of the tokens released to early investors this month being restaked and locked again. GRASS is redefining the DePIN landscape — turning idle internet bandwidth into an on-chain data asset.

Recent interest stems from rising investor focus on the DePIN sector, with backers such as Polychain Capital, Delphi Ventures, and Hack VC supporting Grass’s mission to decentralize data access.

Technical View:

Currently trading at $0.3846, the token has gained momentum alongside growing demand for decentralized data networks. $GRASS is showing a healthy rebound from the $0.30 support zone.

On the 6-hour timeframe, price is consolidating above $0.34 with rising volume, indicating renewed buying momentum and potential for another leg up.

If price holds the 0.36–0.34 zone, we could see a move toward 0.45–0.47, with the next leg aiming for 0.50–0.52

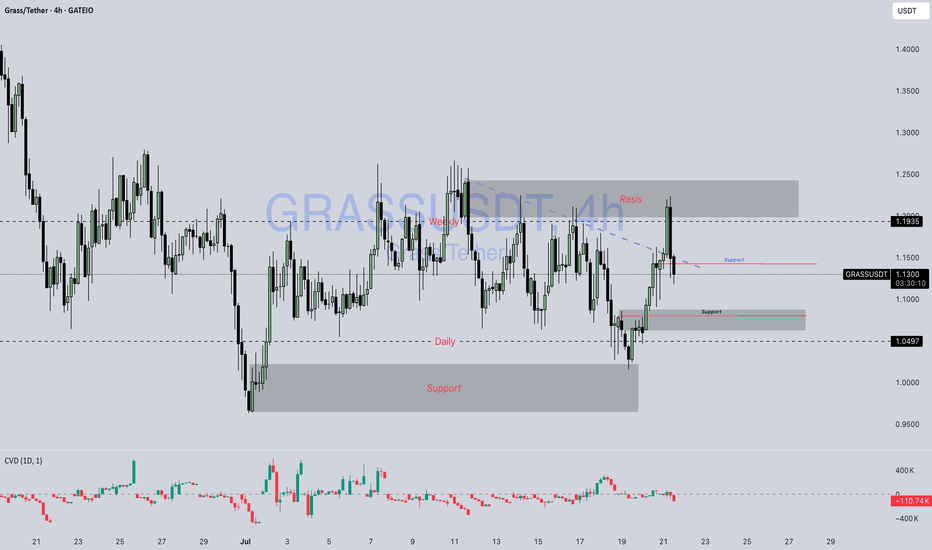

Grass / Usdt GATEIO:GRASSUSDT

📊 **Chart Overview – GRASSUSDT (4H):**

* 💰 **Current Price:** \$1.1362

* 🔻 **Previous Trend:** Downtrend has been challenged; price broke above the **descending trendline (blue dashed)**.

* 🟦 **Key Support Zones:**

* \$1.10 (recent demand area retest)

* \$1.05 (major support below, seen from earlier bounce zone)

* 🟥 **Key Resistance Zone:**

* \$1.19 – \$1.25 (major supply area where price got rejected again)

---

### 🔍 **Technical Breakdown:**

1. **Break and Retest Attempt:**

* Price **broke the descending trendline** and tapped into the \$1.19 resistance.

* Currently pulling back — possibly a **retest of the broken trendline** and the previous support near \$1.10–\$1.13.

2. **Supply Zone Rejection:**

* Strong rejection from **\$1.19–\$1.25**, which aligns with the upper supply zone.

* Sellers are actively defending this area.

3. **Bullish Case:**

* If GRASS holds above **\$1.10**, it may gear up for another push toward **\$1.19–\$1.25**.

* A clean break and hold above \$1.1935 could open room toward \$1.30+.

4. **Bearish Case:**

* Failure to hold \$1.10 or a breakdown below \$1.05 could invalidate bullish bias and revisit the lower demand zone near **\$0.95–\$1.00**.

---

📌 **Market Summary:**

GRASS is at a **critical zone**, attempting to flip trendline resistance into support. The reaction from \$1.10–\$1.13 will be key to deciding whether it can revisit higher supply levels or turn back toward major support.

---

⚠️ **Disclaimer:**

*This is **not financial advice**. All information provided is for **educational and informational purposes only**. Always perform your own analysis and manage your risk properly before trading.*

---

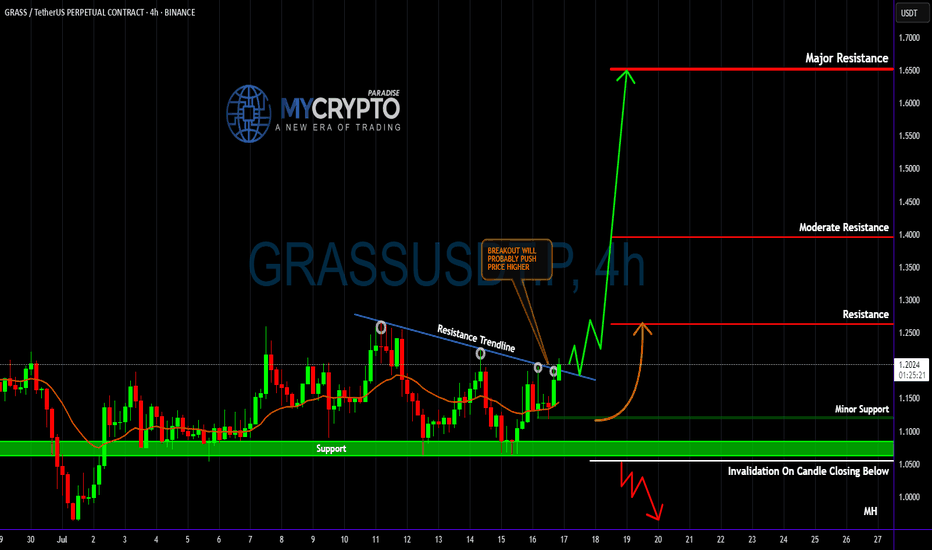

GRASS About to EXPLODE or COLLAPSE? Traders Could Get Trapped inYello, Paradisers! Are you ready for what could be one of the most deceptive breakouts we’ve seen this week? #GRASSUSDT is showing signs of strength, but as always, we need to stay sharp and look beneath the surface to avoid getting trapped like 90% of the herd.

💎#GRASS is knocking on the door of a key descending resistance trendline that has been respected multiple times this month. The current price action is attempting to break above it with momentum, and a confirmed breakout could trigger a strong probable impulsive move toward the next resistance levels at $1.2630, $1.3959, and eventually even $1.6512.

💎But what gives this setup its real probability strength is what most retail traders are overlooking: the confluence between minor support at $1.10–$1.15 and the short-term EMAs on the 4H timeframe. The 50 EMA and 100 EMA are starting to curve upward and align just above this support range, offering a strong dynamic base. This zone isn’t just visual support anymore—it’s turning into a technical launchpad.

💎From a technical standpoint, any clean 4H candle close above the trendline and $1.2630 resistance will increase the probability of continuation toward the mid-range resistance near $1.3959. However, failure to break above this zone convincingly or a rejection back into the previous range could signal that market makers are just pushing price up to trap breakout traders before dumping it again.

💎Support remains firm in the $1.10–$1.15 zone, but invalidation is crystal clear — any 4H candle close below $1.0549 would negate this bullish outlook entirely and suggest a deeper move is coming. That level has held well so far, but remember: one quick breakdown can wipe out many weak hands.

💎This is exactly the kind of setup that separates emotional traders from strategic ones. Many will FOMO in right at the breakout without considering the higher timeframes or waiting for confirmation.

Strive for consistency, not quick profits, Paradisers. Treat the market as a businessman, not as a gambler. Only the patient and prepared will survive and profit from these types of traps. Let’s continue to stay smart, strategic, and wait for the best high-probability opportunities.

MyCryptoParadise

iFeel the success🌴

$GRASS just broke out of a long-term downtrend!$GRASS just broke out of a long-term downtrend!

#GRASS has broken out of a long-term symmetrical triangle and flipped the trend bullish.

Price is currently holding above the breakout zone and also respecting the 0.786 fib level from the recent range.

As long as it stays above the $2.13–$2.14 zone, the move toward $2.60+ looks likely.

This breakout could be the start of a bigger trend shift. Let’s see how it holds up in the coming days.

DYOR, NFA

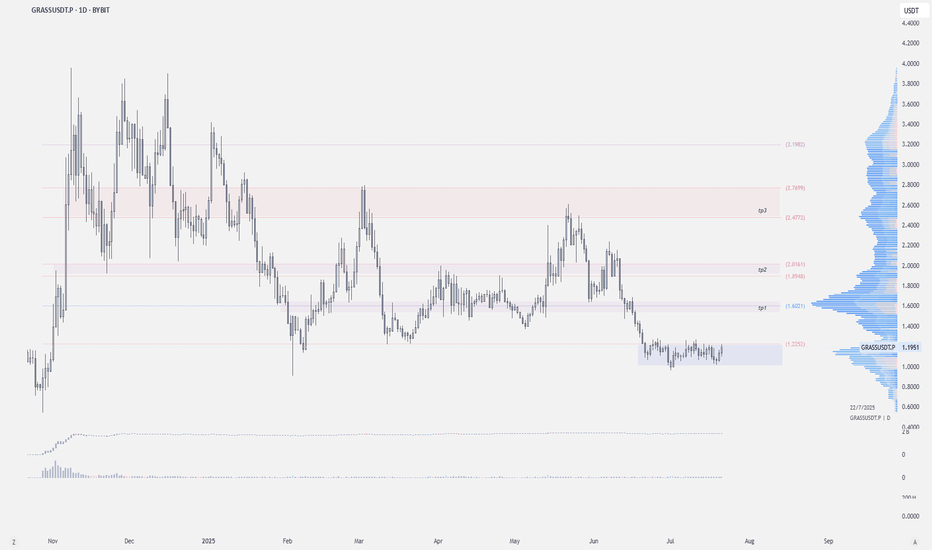

GRASS Looks Bullish (1D)It appears that a triangle has completed and the B-D resistance line has been broken. Buy/long positions can be considered during pullbacks.

We have identified two entry points for potential entries.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

"Scalp Shorting GRASS at CMP Entry Plan Inside!"📉 Scalp Short Setup: #GRASS

⚙️ Leverage: 5x to 6x

🟢 Entry 1: CMP - 1.8650

🟢 Entry 2: 1.9000

🎯 Take Profits:

TP 1: 1.8464

TP 2: 1.8277

TP 3: 1.8091

TP 4: 1.7718

TP 5: 1.7345

TP 6: 1.6972

🔴 Stop Loss: 2hr Close Above 1.9330 (~2.7%)

📌 TP's & SL will be updated as price action develops.

🚨 Not financial advice. DYOR before entering any trade!

$GRASS - Long SetupBYBIT:GRASSUSDT | 12h

We shared a detailed long setup on this one last week, and it's now up 66%

If $1.80 holds as support or flips cleanly, $GRASS could push toward $2.50 or even extend to $3.30

I'll be watching for a re-long opportunity in the $1.90–$1.80 zone

Set stoploss just below $1.60

Targets:

$2.25 to $2.30

$2.50 to $2.60

$3.20 to $3.30

#GRASSUSDT.P - Reversal Signal from the Bottom: Target 1.72! Hey folks! Today I'm here with a trade on #GRASSUSDT.P. There’s not much to say, but to sum it up — a bottom formation has formed, and our LONG target is in the $1.69–$1.72 range.

Good luck and may your days be filled with green candles! 💚

Manage your risk, stay in the game! 🎯🔥

#AlyAnaliz #TradeSmart #CryptoVision #GRASSUSDT #Binanciega

GRASS/USDT –Trend Confirmation & Profit Target StrategyTrading Setup: GRASS/USDT Perpetual Contract

Entry Point: $1.61

Stop Loss: $1.5198

Take Profit Targets:

TP1: $1.7163

TP2: $1.7895

TP3: $1.8853

Strategy Overview

Trend Confirmation: Monitor price action for Break of Structure (BOS) or Change of Character (ChoCH) for entry validation.

Risk Management: Position size adjusted to maintain optimal risk-to-reward ratio..

This setup ensures a structured trade approach while managing risk efficiently. If you need refinements or additional indicators, let me know!