Trading Liquidity – Quick Guide in 5 StepsWelcome back everyone to another guide, today we will speed run "Trading Liquidity" in a quick 5 step guide. Be sure to like, follow and join the community!

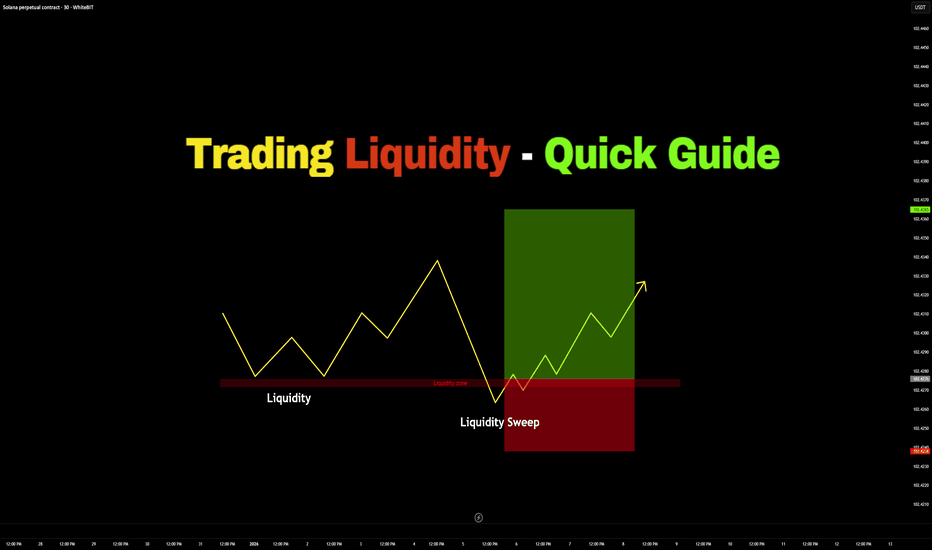

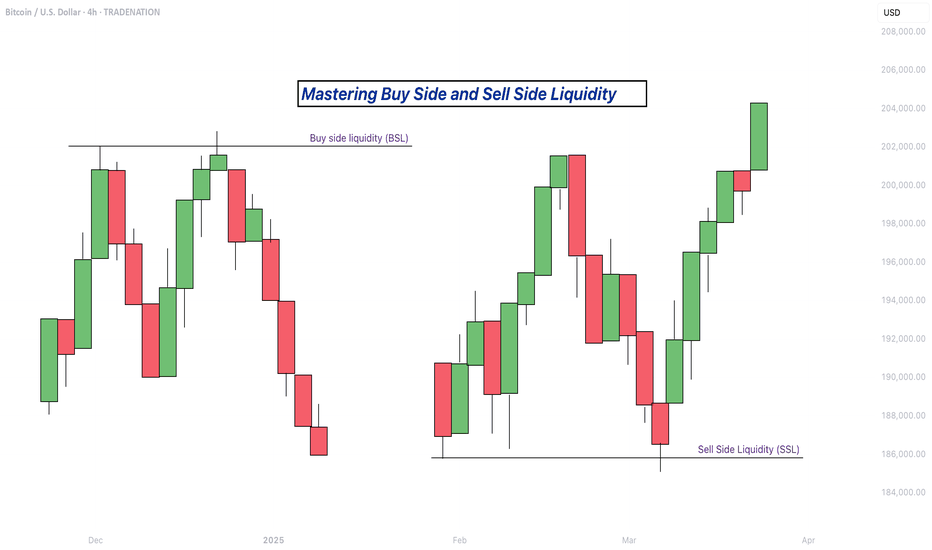

1) Identify Liquidity:

- Equal highs or cluster of highs (Buy-side Liquidity)

- Equal lows or cluster of lows (Sell-side Liquidity)

- Obvious highs & lows

2) Identify Liquidity Direction (Price moves towards liquidity first):

- Equal highs > Price is likely to sweep above

- Equal lows > Price is likely to sweep below

3) Wait for Liquidity Sweeps

- Price takes out lows

- Stops get triggered

- Look for rejection or close back inside

Do NOT enter before the sweep or before the confirmation.

4) Enter Trade:

Enter after confirmation, away from liquidity

- Stop loss: Longs > Below Swept Lows

- Stop loss: Shorts > Above Swept Highs

5) Take Profits:

- Take Profit: Nearest opposing liquidity

- Take Profit: Previous high/low

- Take Profit: Range boundaries

RESULTS:

Liquidity sweep > confirmation > clean move

Thank you all so much for reading! Hopefully this is a useful guide in the future or present! If you would like me to make any simplified guides, articles or tutorials, let me know in the comment section down below - or even contact me through trading view.

Thank you!

Guide

How Overconfidence Destroys Profitable TradersHow Overconfidence Destroys Profitable Traders

Understanding Overconfidence in Trading

Welcome everyone to another article.

One of the most dangerous stages a trader can walk into is not fear… but overconfidence. (EGO)

Overconfidence in trading is essentially ego.

However, there is still an important difference:

- Confidence is a real belief built on proof, statistics, and discipline.

- Overconfidence is an inflated belief in your ability beyond the proof. This is driven by ego.

Many traders do not fail because they do not know enough.

They fail because at some point, they believe they know enough or know “everything.”

What Overconfidence appears as in Trading:

A trader builds a system. ( yay! )

They go on a clean winning streak maybe 10, 12, even 15 profitable trades in a row.

At this point, the trader begins to think and assume:

“ I’ve cracked the code. ”

- Risk gets increased .

- Position sizes get bigger .

- Rules start to bend .

Confidence continues grow until it crosses a dangerous path where belief is no longer supported by data, statistics and proof.

Reality eventually steps in.

You will never again feel as confident as you did during your first major winning streak when it looked like the market finally made sense and success was “ figured out. ”

That feeling is exactly what traps traders.

Overconfidence WILL break Risk Management

Overconfidence destroys a trader by slowly dismantling their risk management, their system, their discipline, their psychology and their consistency.

It rarely happens all at once.

First:

- “ I’ll just risk a little more this time. ”

- “ This setup looks perfect. ”

- “ I’m on a winning streak. ”

Over time, the trader begins to:

• Ignore position sizing rules ( Too many LOTS or contracts )

• Move stop losses (Increases risk)

• Add to losing trades ( Does not accept the original loss )

• Trade larger to “maximize opportunity” (Stick to what you can afford to lose )

The trader thinks and believes the system will continue to work, because it worked before.

But markets do not reward belief, they reward discipline. (I have mentioned this many times in my previous posts.)

Once risk management breaks, even a profitable system becomes dangerous and can lead to zero profits, or even down to negatives.

Overconfidence Blocks Positive criticism and continuous Learning

There is no such thing and there will never be a 100% perfecto trading system/strategy.

Losses are part of the game.

Overconfident traders struggle when reality does not meet their expectations.

Instead of adapting to the market by adjusting their strategy they:

- Resist feedback (Or consider any feedback as hate/negative criticism)

- Ignore changing market conditions (Consolidation, flat lining, barcoding etc)

- Refuse to admit the system is underperforming (Bad performance & results)

- Believe the problem can’t be them (“It’s not the system, it’s the computer!”)

But Why…?

Well because… their mind keeps rewinding the dopamine high from when everything worked perfectly and the win rate was 99%

They only remember the wins, and “ GREEN ” $$$ %%% not the probability.

The exact moment a trader believes they “can’t be wrong,” learning comes to a halt.

And in trading, when learning stops, losses accelerate, revenge trading increase, risk management collapses, and consistency becomes scrambled.

Overconfidence changes Traders into > Gamblers

Overconfidence does not just cause losses it can also change behavior.

Frustration from unexpected losses turns into:

- Anger

- Impatience

- Forced trades

- Revenge trading

Rules get ignored.

Emotions take control.

The trader may still look like a trader, but they are acting like a gambler.

The most dangerous part?

They still believe they are right…

Example: How Overconfidence Destroyed a Profitable Trader

Let’s look at Bobby.

Bobby was a profitable trader. A very successful one in his 4th year of trading.

He discovered what he believed was a 99% win-rate system.

The first month was incredible.

The second month was just as good. Cash flowing in, heaps of green.

By the third month, losses started to appear.

Instead of falling back, taking a breather and reassessing , Bobby doubled down.

Continuing to trade the same system despite clear signs of underperformance.

He was no longer focusing on perfect executions and setups, he was chasing the high.

Losses turned into frustration .

Frustration turned into anger .

Anger turned into impatience .

Soon Bobby was:

• Forcing trades

• Revenge trading

• Ignoring risk management

Bobby refused to take responsibility.

“It was my internet.”

“My computer lagged.”

“My family distraccted me.”

The excuses piled up, but the account kept shrinking.

Bobby did not fail because of the system.

Bobby failed because ego stopped him from adapting to the market and adjusting his system.

Markets Will Always Humble Ego

Markets will humble traders in ways they never expect.

No matter how experienced you are, there is always something else to learn.

Trading is not a destination, it is a constant process of adaptation towards the market. Traders who believe they “know everything” will always be reminded by the market that They. Do. Not.

Overconfidence doesn’t end trading careers immediately.

But it slowly erodes them trade by trade turning it into mental torture.

Final Thoughts

Confidence is necessary to trade.. But Ego is fatal!

The very moment a trader believes they have cracked the code is often the moment their decline begins.

Stay humble.

Respect risk.

Let statistics, not emotion, guide your decisions.

Because in trading, the market doesn’t punish ignorance it punishes ego.

The Boredom Stage of Trading - Why Most Traders Quit HereGood morning, all, thank you all for coming today.

Today we will be looking into the “ Boredom ” Phase of trading, and why most new traders quit because of it. Lets begin.

What Is the Boredom stage during Trading?

Boredom in trading is the stage where the excitement goes away, but the results have not arrived yet.

You are no longer a beginner filled with hype, joy and excitement.

You are aware of, and understand the basics, you have a strategy, and you know what you should be doing.

Yet progress feels slow , repetitive , and unrewarding .

There are less trades, fewer emotional highs, and long stages of patiently waiting.

This is where trading begins to feel boring , and for many traders, boredom feels like failure, it feels like they are failing since they are not “ doing anything. ”

This phase is not a sign you are doing something wrong it is a sign you are doing something right .

How the Boredom stage Affects Traders

Boredom secretly ruins traders because it does not feel dangerous.

During this period, traders will often:

• Start forcing trades just to feel active or “ alive ” like they are doing something.

• Break rules out of impatience ( breaking their own system )

• Abandon strategies that are working ( same as above )

• Chase excitement instead of probability ( they seek the 100x return )

• Confuse “ no trades ” with “ no progress ” ( If you follow your system and wait, you are making progress )

The market rewards patience, but boredom pushes traders toward action.

This creates losses, frustration, and eventually self-doubt. ( Which no one wants )

Many traders do not fail because they lack knowledge or skill. They fail because they cannot tolerate stillness. ( They psychology weakens when they face boredom. )

Why the stage Phase Occurs

The boredom phase takes place when trading becomes process-driven instead of emotion-driven. ( It becomes mechanical )

Early trading is exciting because:

• Everything feels new

• Wins feel euphoric

• Losses feel catastrophic

• The market feels fast and you feel uncertain

• You are eager to learn more

As you improve, your trading becomes:

• More selective and tight

• More rule-based and systematic like

• Slower and quieter ( calm )

• Less emotionally stimulating

This shift removes chaos, but it also removes excitement.

The market hasn’t changed.

You have.

And most people mistake this emotional flatline as a sign that something is missing.

( This is where “ The market rewards patience ” comes in. The market rewards those who wait. )

How to Overcome the Boredom stage

The key to overcoming boredom is understanding that trading is not meant to entertain you. ( It is just like a 9-5, you must follow rules, a system. Just in your own routine. )

Practical ways to handle this phase:

• Reduce screen time once your plan is complete. ( Do not over trade )

• Focus on execution quality, not trade quantity. ( Quality over quantity )

• Track rule-following instead of PnL. ( Did you follow your system? )

• Journal boredom-triggered decisions. ( Losses from impatience? )

• Accept that waiting is part of the job. ( Strengthen your mind by waiting. )

Professionals do not trade more and when they are bored, they trade less.

The goal is not to feel engaged and hyped up.

The goal is to remain consistent and disciplined.

Why the Boredom stage Is a Filter, not a Problem

The boredom stage exists to separate traders who want excitement from traders who want results. ( Splits Gamblers from Real Traders )

Most people quit and give up here because:

• There is no longer any dopamine .

• Progress feels slow, painful or invisible.

• Social media makes others look “ active ” when it is actually not.

• Patience feels unproductive since the mind is sitting “ idle .”

But this stage is where real traders are built.

If you can:

• Follow rules without excitement. ( Follow your system )

• Sit through days with no trades. ( Accept the process of waiting )

• Trust your edge without constant validation. ( Ensure to backtest to prove this. )

• Stay disciplined when nothing happens. ( Do not give in to FOMO. )

You have already passed a major psychological barrier.

The boredom phase is not a dead end it is a gateway that sits at the end of a long run.

Those who quit here were never meant to last.

Those who stay quietly move closer to consistency and mental freedom.

Final Thoughts

Every profitable trader has survived the boredom phase.

Most failed traders quit during it because of weak psychology.

If trading feels boring, repetitive, and uneventful, that is good.

That means emotions are leaving and structure is taking its place.

The market does not reward excitement.

It rewards endurance, patience, discipline, consistency and proper risk management.

Mastering Divergence in Technical AnalysisIn technical analysis, a divergence (also called a “momentum divergence” or “price/indicator disagreement”) is one of the most powerful early warning signals available to traders. In simple terms, divergence occurs when price and a momentum indicator (such as RSI, MACD, or Awesome Oscillator etc.) move in opposite directions.

This disagreement often signals that the current trend is losing strength and that a pause, pullback, or full reversal may be approaching.

1. What Is Divergence?

Normally, in a healthy trend:

In an uptrend, price makes higher highs and momentum indicators also make higher highs.

In a downtrend, price makes lower lows and momentum indicators also make lower lows.

A divergence appears when this alignment breaks.

Typical example with RSI or MACD:

Price makes a higher high,

But the indicator makes a lower high.

This tells us that, although price has pushed to a new extreme, the underlying momentum is weaker. Smart money may be taking profits, and the late participants are driving the final leg of the move.

2. Types of Divergence

There are two main families of divergence:

Regular (classic) divergence – often associated with potential trend reversals.

Hidden divergence – often associated with trend continuation after a correction.

Within each family, we have bullish and bearish versions.

2.1 Regular Bullish Divergence – Potential Trend Reversal Up

This suggests that sellers are still pushing price to new lows, but momentum is no longer confirming the strength of this selling pressure. The downtrend is weakening and a bullish reversal may develop.

Context where it’s most powerful:

After a prolonged downtrend.

At or near a higher-timeframe support level (daily/weekly support, major demand zone, trendline, or Fibonacci confluence).

2.2 Regular Bearish Divergence – Potential Trend Reversal Down

This signals that buyers are still able to push price higher, but each new high is supported by less momentum. The uptrend is aging, and a bearish reversal or deeper correction becomes more likely.

Context where it’s most powerful:

After a strong, extended uptrend.

Around major resistance levels, supply zones, or upper trendlines.

2.3 Hidden Bullish Divergence – Trend Continuation Up

Here, price structure still shows an uptrend (higher lows), but the indicator has overshot to the downside. This often appears during pullbacks within an uptrend, suggesting that the correction is driven more by short-term emotion than by real structural weakness.

Interpretation:

Hidden bullish divergence indicates trend continuation. Bulls remain in control, and the pullback may provide an opportunity to join the uptrend at a better price.

2.4 Hidden Bearish Divergence – Trend Continuation Down

Price structure still favors the bears (lower highs), but the indicator has spiked higher, often due to a sharp counter-trend rally. This suggests that the bounce is corrective rather than the start of a new uptrend.

Interpretation:

Hidden bearish divergence favors continuation of the downtrend and often appears before the next impulsive bearish leg.

3. Which Indicators to Use?

Divergence can be spotted on many oscillators, but the most commonly used are:

RSI (Relative Strength Index) – very popular for spotting overbought/oversold zones and divergences.

MACD (and its histogram) – useful for trend and momentum, especially on higher timeframes.

Stochastic Oscillator – often used in range-bound environments.

Awesome Oscillator, CCI, etc. – alternative momentum tools, depending on your preference.

The concept is the same: price and indicator should generally confirm each other. If not, you have a divergence.

4. Timeframes and Reliability

Divergences can be found on all timeframes, but their reliability increases with higher timeframes:

On M5–M15, divergences are frequent but often short-lived. Better for scalpers.

On H1–H4, signals have more weight and can lead to multi-session moves.

On Daily/Weekly, divergences can mark major tops and bottoms, but they may take longer to play out.

A good practice is to:

Identify major divergences on higher timeframes (H4, Daily).

Refine entries on lower timeframes (M15, M30, H1) using structure and price action.

5. How to Trade Divergences (Practical Framework)

Divergence by itself is not a complete trading system. It is a signal of potential imbalance, which should be combined with:

Key levels (support, resistance, supply/demand zones).

Trend structure (higher highs/lows or lower highs/lows).

Price action confirmations (reversal candles, break of structure, etc.).

Risk management (position sizing, stop loss, invalidation level).

6. Common Mistakes When Using Divergences

- Trading every divergence blindly.

Not every divergence leads to a big reversal. Many will result in only minor pullbacks.

- Ignoring the trend.

Regular divergences against a strong trend can fail multiple times before a real top or bottom forms. Hidden divergences are often more reliable in trending markets.

- Forcing divergences where they don’t exist.

Only connect clear, obvious swing highs and lows on both price and indicator. If you have to “stretch” the lines, the signal is probably weak.

- No risk management.

A divergence is just a probability edge, not a guarantee. Always define invalidation and manage position size accordingly.

7. Best Practices

Combine divergence with market structure (trendlines, channels, higher highs/lows).

Use higher-timeframe context and drop to lower timeframes for refined entries.

Pay attention to confluence:

Divergence + key level + candlestick signal is stronger than any single factor.

Keep a trading journal of divergence setups, including screenshots from your charts. Over time, you will see which conditions work best for your style.

Divergences are not magic, but they are one of the cleanest ways to see when price and momentum disagree. Used correctly, they can:

Help you avoid entering late in a trend,

Alert you to potential reversals before they are obvious to the crowd, and

Provide high-probability continuation entries via hidden divergences within strong trends.

5 Key Trading Tips for BeginnersWelcome back everyone to another post! In this article we will be explaining 5 key pointers (tips) for new individuals entering the trading space.

When it comes to trading first there is “ understanding ” before we begin the 5 keys steps. Let me assist you in understanding what will happen when you take on trading.

Trading is a challenge. Not a video game challenge, not a math test challenge – a * Challenge * One that will break you. Trading will break you mentally, physically, spiritually and financially. It is an eye-opening journey.

Trading will teach you a lot about yourself, and it will teach you a lot about discipline, patience and how you can analyze markets.

I saw a quote somewhere, it said trading: “ Trading is the hardest way, to make easy money ” and they are right.

You will be learning how to manage risk, control your emotions, understand your own decision-making patterns. These are all invaluable lessons for life, as well as trading.

Sounds great! But then there are the losses, what you lose to gain all this. Trading isn’t something that you can learn overnight – all those posts you see about a young 17-year-old “ cracking the code ” is rubbish. Why? Because they haven’t learnt life lessons.

You can make money fast, but you will lose it faster if you don’t know how to manage it.

Trading will drain every bit of energy out of you. You will feel like you’re falling behind, you will eventually collapse at every loss and become frustrated. The market will test you; the market doesn’t give a damn about you – you accept the risk when you take on trading and since you’re the one making the trades, it’s you VS you.

You’re testing yourself. You agree to test your patience, your confidence, your mindset. Doing so will make progress feel nonexistent or slow.

Every day, and every trade you will question yourself, wondering if “trading” is even for you. Sometimes it will feel like you’re going in circles. You will continue to make mistakes repeatedly. It will become exhausting but remember – only experience and your own strengths will allow you to succeed. Only those who can endure the grind without giving up will make it.

So, let’s start off the 5 key pointers that will prepare you.

1) Prioritize Risk Management Over Profits:

Most newbies focus first on “ making money ” rather than safeguarding capital. The reality is that surviving in the market is way more important than winning every trade you see or come across.

Key Points:

Determine risk per trade: A common rule is risking no more than 1-2% of your trading account on a single trade. This way even a string of losses will not wipe you out.

Always use stoploss: A defined maximum loss per trade enforces discipline and emotions to stay in check.

Position sizing: Your sizing should be proportional to what you’re willing to lose on each trade. Bigger trades amplify the losses, but they also amplify the profits.

Why it matters:

Without strong risk management, even a high win-rate strategy can fail. Protecting capital ensures you’re still in the game when opportunities arise.

2) Develop a trading plan and stick to it .

Random reactive trading is the best way to lose money. Build your plan overtime.

Key points:

Define your strategy: Building your strategy is the longest part, constant back testing and forward testing, refining and rebuilding. You’re not “switching” your strategy if you’re adding something small to it, you’re changing it if you eliminate the whole thing.

Identify your form of trades, short, mid, long term or swing trades.

Set clear rules: Don’t leave anything to chance, for example “I only enter trades if price closes above the 50ema and RSI is above 50”

Journalling trades: Ensure to journal all your trades, “How do I journal” Easy. Record the time, date, symbol, pair, what model/system you used, images, your entry, tp and exit, why and for how long you’ll have it open.

Why it matters:

Consistency is a key, it pairs with discipline, psychology and lingers with risk management. Traders who follow a disciplined system perform better than those to trade off an impulsive feeling. Other words “Gamble”

3) Master one market and one system first:

Beginners usually spread themselves too thin, trying forex, crypto, stocks and commodities all at once – Unfortunately for me I made this mistake at the start which made it very difficult! – Don’t do this. Stick to one market.

Key points:

Pick one market: Each market has its own rhythm, volatility, and liquidity. Teaching one thoroughly allows you to understand everything about it.

Focus on one system: Instead of trying every new system from you tubes or forums, master one approach and refine it onwards e.g. – you trade FVGs, Win rate is 50% once you add Fibonacci it might be e.g. 65%

Avoid information overload: Social media and trading forums are filled with conflicting advice, stick to your chosen approach and refine it. People say you need to have 12-hour trading days. If you do this, you will FAIL. You will grind yourself into the ground and face burnout making it very difficult to get back up again. Limit yourself to how much trading and trading study you do a day. Eg 10 back test trades, 3 real trades, 3 journaled trades, 1 hour of studying and researching the market.

Without strong risk management, even a high win-rate strategy can fail. Protecting capital ensures you’re still in the game when opportunities arise.

Why it matters

Depth beats breadth early on. Mastering a single market and system will allow you to build confidence and improve your edge.

4) Understand the Psychology of trading.

Trading isn’t just numbers: as mentioned in “understanding” it’s a test of emotional control, fear, greed and impatience.

Key points:

Emotions vs logic: ensure you recognize emotional reactions like FOMO (Fear of missing out) or revenge trading. Pause before reacting to a trade that will go against you.

Set realistic expectations : Markets move slowly. Sometimes for months, don’t expect huge gains overnight. Just like DCA focus on compounding. Compound your knowledge and skill set.

Mindset training: Techniques like medication and journaling as well as visualization can help reduce stress and maintain discipline.

Why it matters:

Even a diamond system can still fail if emotions drive your actions. Psychology often determines long term success, more than technical skill.

5) Prioritize learning. Then earning.

Beginners fall into the trap of trading being a “get rich quick” scheme. But the real investment is learning how the market works.

Key points:

Paper and demo trade first: Practice on demo accounts before you use real money – you will be surprised how many times you will fail. It’s better to fail with simulation money than your McDonalds weekly wage.

Review every trade: Analyze your losing trades, but also your winning trades. Find patterns and areas to improve.

Continuously educate yourself: Read books about the mind, about habits, watch market analysis but critically, apply what you learn and don’t just collect information and not use it.

Why it matters:

Earnings are just the byproduct trading. The faster you learn and adapt, the sooner your profits will appear. Treat early losses as tuition. Not failure.

Thank you all so much for reading.

I hope this benefits all those who are starting off their trading journey. If you have any questions, let me know in the comments below!

Understanding Discipline in TradingWelcome back everyone to another post. In today’s article we will dive deeper into the 3 keys of Trading success! As attached below.

Today we will be reviewing the Key “DISCIPLINE”

Just like risk management and Psychology this is also a difficult skill to maintain.

In the modern world it’s considered a skill now, because most of society doesn’t have any discipline in any field.

Let’s get started.

Definition:

When it comes to Trading Discipline. Trading Discipline means one user has the mental ability ( strength ) to follow their system. Their Trading Plan, risk management and maintain their psychology regardless of what events happen.

Trading Discipline separates profitable traders from the gamblers.

(Below I have attached the article Trader or Gambler as it relates to this post, make sure to give it a read!)

Discipline ensures that the user makes the right decisions based on strategy and logic instead of FOMO, ego and greed.

It is not just about following rules though. Discipline relates to the outside world of cultivating habits, mindsets and self-control too.

1) Understanding Trading Discipline

Firstly, you must truly grasp what it actually means. Most individual traders confuse it with stubbornness. They think it’s about holding on to trades or forcing a system. In reality, it’s only about consistency and self-control! Simple right?

Example:

Imagine, you have a system. A trading plan. It has the 1% rule where you don’t risk more than 1% of your account per trade. Understanding discipline means you must know why that rule is in place. It’s too protected your capital! Not breaking it after a few losses just to catch up.

Real Life Analogy:

A professional runner trains every day. They do it even when they are sad, tired, unhappy and unmotivated. This is discipline. Discipline drives long term results. Discipline is continuing it no matter what the current situation is.

2) Implementing Trading Discipline

The process of implementation is nothing complicated. It’s only turning knowledge into action. Knowing about it won’t do anything, you must maintain the effort of consistently applying it to each step in your system.

How to implement it:

- Follow your plan: Before each trading day starts, read out your system and tell yourself you will follow it. Even if no set ups appear, you will still succeed because you followed your plan.

- Set risk rules: Apply proper risk management and lot management so you don’t cave into fear. Apply the 1:3 Rule or 1:4 Rule.

- JOURNAL your TRADES Damn it: Record every trade, your reasoning, and whether you actually followed your rules. Don’t just add a screen shot and nothing else. YOU won’t succeed if you don’t journal your trades properly.

Example:

A novice trader may plan to place an entry when price is at $50 and exit at $55 with a 2% risk per trade. Even if it dips to price $48, they hold to the stop loss accepting the loss instead of moving it and hoping it “recovers”

Real Life analogy:

Think of it as budgeting every day, or for a holiday, or your next maccas run. You set a weekly budget plan and stick to it. Even when tempted by special deals, sticking to your budget allows for long term financial health to take place. Just like risk management but with real life.

3) Maintaining Trading Discipline

Discipline can’t act overnight, it’s the process of small steps working your way up to solid consistency over time. Even when feelings run high – discipline isn’t one time. It’s daily practice.

Some strategies are:

- Reviewing your previous trades daily or at the end of each week during a market close. Assess your wins and losses.

- Build up emotional awareness, be aware of what fear, greed and overconfident emotions take place.

- Reward yourself to the rules of your system, not just profitable outcomes.

If you reward yourself for not trading in one day because not a single set up appeared, you were still successful because you didn’t “force” a set up and take a gamble.

Example:

A trader might experience 3 losses in the first hour of the day, even if they were all A++ set ups. Instead of revenge trading, he sticks to his plan, accepts the L and leaves the charts for the rest of the day to reset mentally and gain a win in another field, eg – Gym.

Real-life analogy:

By maintaining a healthy lifestyle, you must apply the same approach. You don’t stop exercising after a few days off. Discipline keeps you aligned even when your motivation and mental strength fades.

4) Adapting without breaking your Discipline

Long story short, Markets move, Markets change, Markets can and WILL evolve.

Traders must adapt. Not just allows their system to adapt, but their psychological mindset of discipline.

Adapting can be confusing but it can be done by:

- Don’t switch up new strategies, adjust your current system slightly then back test and forward test it on demo accounts. Eg Paper trading.

- Update your trading system based on data and monthly results, not emotions.

- Avoid making sudden changes right after losses.

Example:

Let’s say a forex strat no longer works due to low volume and volatility. A strict trader tests adjustments in their demo accounts, then incorporates them into the plan after they have received positive data from tests.

Real-life analogy:

A chef might change his recipe based on a specific ingredient availability but will not ignore the core cooking principles. It’s about adapting strategically, not impulsively.

5) Reinforcing Discipline Through mindset and daily life.

Discipline in the trading field is just amplified by the discipline process outside of trading. It follows the exact same process. Daily habits and mindset directly impact one’s trading performance.

To reinforce discipline, you can:

- Maintain routines: Wake up at consistent times. Don’t wake up at 3:00am to “grind” if you do that, you’re stupid – you’ll burn yourself out and make the process harder.

Plan your day and review goals. Eg do a brain dump every morning, write down or type out all ideas, thoughts and emotions and sort it out.

- Practice mental training: People suggest doing personal journaling or meditation. Just go for a walk in the morning for 5 minutes. First thing in the morning, feel the fresh breeze, air, sunlight and nature. You simulate the mind and body in a natural way allowing for you to think clearly and train your mind.

- Change your environment: surround yourself with work dogs, people who are strict on routines, self-improvement, self-development, individuals who don’t slack off.

Example:

Traders who can control their time well, exercise, eat healthy can maintain their stress in trading better than one who does not focus on outside habits.

Real-life analogy:

A school student who studies consistently every day and night rather than squishing it all in before exams perform better. Just like a trader who can maintain structured habits inside and outside of the market.

Conclusion:

Trading discipline is more than following rules, it’s a mindset and a lifestyle, it relates to the world outside of trading. Just like psychology, if you can’t master it outside, you won’t master it inside.

It's about understanding your own weaknesses and adjusting the system to hold structured rules that will allow it to be more easily achievable for yourself.

Remember, trading is not sunshine and rainbows.

It’s about building a system and following it. It is the hardest way to make “ easy ” money.

To find out what the other 2 keys are, review the 3 posts below where I explain the 3 keys to trading success, and go deeper into each of them!

How to build Discipline & Structured Trading HabitsDiscipline is not something you rely on in the moment; it is something you build through habits that remove emotional decision-making from your trading process.

1. Define Rules Before You Trade

Traders without predefined rules rely on emotion. Traders with rules rely on structure.

Clearly define your entry criteria, risk per trade, maximum daily loss, and exit strategy.

When these rules exist before the session starts, you eliminate most impulsive behaviors.

2. Limit Your Daily Decisions

Every decision drains mental energy. The more choices you make, the weaker your discipline becomes.

Reduce the number of markets you watch, the number of setups you take, and the amount of chart time you expose yourself to.

Fewer decisions lead to higher-quality decisions.

3. Use a Pre-Session Checklist

A checklist forces you into a disciplined routine. It can include:

• Reviewing your trading plan

• Checking upcoming news releases

• Confirming your bias or market conditions

• Ensuring your risk settings are correct

The act of going through the checklist prepares your mind to follow structure.

4. Implement a Hard Stop for the Day

One of the fastest ways to lose discipline is to trade while emotional.

Set a maximum daily drawdown. Once it is hit, the session ends. No exceptions.

This protects both your capital and your psychology.

5. Track Your Rule Breaks

Most traders only track wins and losses. Disciplined traders also track deviations.

Write down every time you break a rule, why it happened, and how you plan to prevent it next time.

Over time, this builds awareness and accountability.

6. Delay Impulsive Actions

If you feel the urge to jump into a trade that does not fit your plan, delay the action by 30 to 60 seconds.

Impulses lose power quickly. By introducing a pause, you give your rational mind time to regain control.

7. Keep Your Environment Clean

Distractions destroy discipline.

Silence notifications, close irrelevant tabs, and avoid multitasking.

A clean trading environment supports clean decisions.

8. End Each Session With a Routine

A consistent end-of-day routine reinforces discipline. Examples:

• Rating your discipline on a scale from 1 to 10

• Reviewing whether you followed your rules

• Logging emotional triggers

Ending the day with structure makes it easier to begin the next one with structure.

Conclusion

Discipline is not built through motivation but through habits that create consistent behavior. A structured trading routine removes uncertainty, minimizes emotional influence, and helps you operate like a professional rather than a reactive participant.

How to build a Healthy Trading MindsetMany traders underestimate how much psychology shapes their results. This guide outlines the foundations of a strong trading mindset that supports consistent and disciplined decision-making.

1. Understand That Emotional Discipline Is a Skill

Trading naturally triggers emotions such as fear, frustration, greed, and impatience. These reactions are not weaknesses; they are human. What separates consistent traders from inconsistent ones is their ability to recognize emotions without acting on them.

A resilient mindset comes from training, not talent.

2. Create Distance Between Yourself and Your Trades

Do not tie your self-worth to the outcome of a single position. A loss does not mean you failed, and a win does not mean you are skilled. When traders begin to link identity to results, they make impulsive decisions.

Use phrases like “this trade” instead of “my trade” to remove ownership bias.

3. Focus on Process, Not Profit

Most traders sabotage themselves by obsessing over the end result. The market does not reward effort; it rewards alignment with probability.

Instead of thinking “How much can I make?”, think “Did I execute according to my plan?”

Your trading plan should define your entries, exits, risk, and market conditions. Follow it even when it feels uncomfortable.

4. Accept Uncertainty as Part of the Game

No setup is guaranteed. Every trade, no matter how perfect, carries uncertainty. Accepting this prevents you from forcing control where none exists.

When you fully accept uncertainty, you no longer fear it.

5. Build Consistency Through Routine

A stable routine reduces mental noise. Examples include:

• Reviewing your plan before each session

• Limiting how many markets you monitor

• Taking breaks after high-stress situations

• Logging your trades with honest notes

When your routine is consistent, your decisions become consistent.

6. Use Losses as Data, Not Drama

A loss is not a personal attack from the market. It is information.

Ask: “What does this loss teach me about my system or my mindset?”

If you can extract value from losses, they become opportunities instead of obstacles.

7. Master Patience

Most trading errors come from acting too soon, not too late. Patience means waiting for your setup without deviation.

If you need to be in a trade at all times, it is no longer trading; it is compulsion.

8. Protect Your Mental Capital

Mental capital is as important as financial capital. Overtrading, revenge trading, and excessive chart time drain your cognitive energy.

Stop trading when you notice fatigue, frustration, or impulsiveness. A clear mind is an advantage.

9. Develop Long-Term Thinking

Think in terms of series, not individual outcomes. A single win or loss means little. What matters is the overall direction of your equity curve.

Professional traders think in months and years. Amateurs think in minutes.

Conclusion

A powerful trading mindset is built through consistency, self-awareness, and emotional control. By focusing on process and discipline rather than short-term results, you create a stable internal environment that supports longevity in the markets.

Understanding Risk Management in TradingWelcome everyone back to Trading view article by King_BennyBag.

In today’s post we will discuss how one can understand risk management in trading, and action it.

We will start off by defining what risk management is.

Risk management definition:

Risk management is the process of identifying your current capital and assessing what you can afford to invest and lose. Never to see again.

It involves identifying risks, assuming risks and ensuring you have a planned response for before, during and after a trade.

CAPITAL IN RISK MANAGEMENT:

In the past, I have stated that the goal of trading is to “PROTECT” your capital first. Once you know how to protect it, you can then multiply it and risk bit by bit.

To take on proper risk management, you must decide what amount you will allocate to your investments or trades. For example – you risk only 1% of your capital on every trade.

INVEST WHAT YOU CAN AFFORD TO LOSE:

You should only do trading with the funds that you can AFFORD to lose, even then you must be cautious and apply the process above to the same capital. Doing this eliminates the emotional pressure factor and avoids decisions that are driven by Fear of Missing Out. (FOMO)

Before Trading, set a clear number on what you can lose (NEVER to see again) without it affecting your life.

IDENTIFYING RISKS:

Relating to my previous posts, you must have a defined trading plan/edge. This plan must allow you to identify market volatility, news events, psychological mistakes, or technical invalidation points. These are risks that must be identified BEFORE trading.

Knowing these will allow you to apply the right position size correctly.

ASSUMING RISKS:

When it comes to assuming risks, (most people don’t factor this in) it means to accept the potential scenario of you losing, before the trade is actioned.

Your stop loss (always use a stoploss!) must be defined in a way that will not get yourself liquidated. You must calculate the right position size and learn to accept the outcome of the trade, and the mental effects it has on you.

Doing this, the trades & the process becomes mechanical. No longer would it be emotional.

If the loss is too big and you take it anyway. You should not be taking that trade as it will encourage revenge trading.

PLANNING RESPONSES BEFORE, DURING and AFTER RISKS:

With trading & risk management, you must have a pre-defined response for before, during and after trades. Your risks must be set.

Before the trade, you should have an entry, SL & TP set. Along with an invalidation level (if price hits a specific point, you DON’T take the trade) and a maximum risk, eg “I’ll risk max $5,000 on this trade”

During the trade, you must stick to the plan, don’t adjust your SL, or TP if it’s not part of your strategy.

After the trade, if you win, or lose, find out why. Was it a valid trade, did it follow your edge? Or did you take a blind gamble. If you lose, figure out why, if you won, figure out how you could have scaled it upwards.

Applying these 3 factors allows the cycle of discipline to develop and grow. It then removes randomized decision making.

Risk management is a crucial Key in trading. Without it – you have already lost.

I have attached the 3 KEYS to trading success below. Here I go in depth on what an individual must master to be successful in trading.

Backtesting on TradingViewBased on the massive feedback from our previous article about backtesting we decided to make a follow up on how to backtest your strategy.

Every trader talks about strategy.

Few actually test it.

Backtesting is where ideas meet data — and TradingView makes it surprisingly simple.

Whether you code your own system or use built-in tools, backtesting shows you how your logic performs before you risk a single dollar.

1. Open the Strategy Tester

Start by opening the chart of the asset you want to test.

Click “Strategy Tester” at the bottom of the screen.

This activates TradingView’s built-in engine that simulates your system’s historical trades automatically.

You’ll see three tabs appear:

Overview: a summary of your results.

Performance Summary: key stats like profit, drawdown, and win rate.

List of Trades: every single historical trade your strategy executed.

2. Load or Create a Strategy

Go to the Indicators & Strategies tab.

TradingView separates indicators from strategies — only strategies can trigger trades for backtesting!

You have two options:

Use a built-in or public strategy: like “MACD Strategy” or “Moving Average Crossover.”

Paste your own Pine Script strategy: under “Pine Editor,” then click “Add to Chart.”

Once applied, TradingView automatically calculates historical trades based on your logic.

Tip: Indicators are for signals, strategies are for testing execution.

3. Adjust the Test Parameters

To make your test realistic, click the ⚙️ icon next to your strategy name.

In the Properties tab, you can define:

Initial capital (e.g. $10,000)

Position size (fixed or percent-based)

Commission and slippage

Pyramiding (how many positions can stack)

Then set your date range in the Strategy Tester — for example, test from 01-01-2022 to 01-01-2024.

The goal is to simulate what your system would have done under real conditions.

4. Analyze the Results

Once the test runs, TradingView gives you a detailed breakdown:

Net Profit (%) — your total gain or loss.

Max Drawdown — your biggest loss from peak to trough.

Win Rate & Profit Factor — how often you win and how much you win versus lose.

Average Trade — the mean result per trade.

Equity Curve — how your balance evolved over time.

Scroll through the List of Trades to see how each entry and exit behaved.

If you spot clusters of losses, note the pattern — that’s where improvements start.

This is the part where you analyze and think why did a trade fail and how can I avoid it.

TradingView also enables you to export data in excel so its super easy to analyze and look for improvement.

5. Refine and Forward-Test

Once you’ve seen how your system performs historically, make small adjustments.

Change one parameter at a time — like EMA length, RSI threshold, or stop-loss distance — and rerun the test.

When you find consistent results across timeframes or markets, move to paper trading mode.

Forward-testing confirms your backtest logic under real conditions, including live volatility and execution timing.

If your live and backtested results align closely, you’ve built something solid and you are ready to make money.

A big tip here, even a small thing such as a change in stop loss or timeframe change from 15 minutes to 14 minutes can make a huge difference so try out different conditions.

Mastering Trading Psychology; Why Mindset is the toughest skillWelcome all to another post.

In this article we will dive into the process of Mastering Trading Psychology.

1) What is Trading Psychology:

Trading Psychology, it is your mindset. It is what you think, how you feel, what you need to do, what you want to do. It is a mixture of thoughts, future actions, emotions and past, present or future behaviors that influences your present self in making good, or bad decisions in the market.

It can be considered a “strategy” but leans more to a “skill” It’s about what your thought process is when you are under pressure.

Everybody, investor, gambler, trader, swing trader, day trader, scalper and holders, bring their own personalities & habits into the trading space. Whether it’s impatience, or patience, fear or greed, confidence or impulsiveness, or discipline. These mental sets determine how frequently you can follow your edge and how well you can manage wins, losses and uncertainty.

Trading psychology is the framework of the mind. It works for you or goes against you. Both are under your control to choose from. A strong, stable, clear mind keeps you going. A weak, broken, cluttered mind keeps you falling.

Ultimately, to master trading in psychology, you need to master yourself.

2) Pros and Cons of Trading Psychology:

Pros:

The pros/benefits of Trading Psychology, once it is mastered, is simple.

You understand the game. You understand the process. You understand why you lose, why you win, why manipulation takes place and why you trade it.

It is a skill that is developed through patience and perseverance along with constant practice.

Like every other skill, it demands TIME, ENERGY, and constant Trial and Error of failures, wins, adjustments and so on. It isn’t something that can be taught or learned once, except for those who learn to recognize and leverage their mental strengths & weaknesses can truly master it over time.

Cons:

Trying to master Trading Psychology means you need to LOSE. You need to experience loss after loss after loss after loss. You need to fail many times. Every time you fail, you understand how to take control of your emotions, you learn where things went wrong, you learn how to build your edge.

But it’s not always about losses, it’s about gains (wins )too. You need to maintain a stable status of emotions whether you win or lose. You can’t show anger, you can’t show excitement. Because both will come back at you with another loss.

This means you cannot allow yourself to be ruled by any emotion, positive or negative. It can be a long uncomfortable process that can take years to master. Sometimes even decades.

What makes it more challenging is that trading psychology does not exist in isolation.

Psychology outside of trading must be mastered too. How you think, act, live, every single day.

- We will explore this topic further down the article.

3) Why it is important in the trading space:

Psychology is an essential topic that must be taught and considered. Because without it, you will not succeed. Without self-control, or a strong mind, trading will become nothing more than just gambling like a slot machine.

It's a skill that many overlook. With it, you are aware of what works and what fails. It allows you to step back and re-assess the next trade instead of forcing it.

The end goal is to make money, but to even do that you first have to protect your capital. Only take A++ Set ups (High confluence/probability set ups) and avoid any traps involving emotions like: Fear of Missing Out (FOMO) or the “I just need 1 good pump” (One Big Win) Mindset.

With it being in the trading space, it gives users the ability to pause, re-assess and question your decisions on the trade you are about to take.

It helps to mention, “Is this an A++ Setup?” “Does it align with my strat, my edge, my goals?” If it does not and you decide not to take it, you save yourself a loss of capital and have made a win of improved trading psychology.

It assists you in distinguishing the difference between good/bad trades. Not on the result but the process. It keeps you grounded.

4) How to Master Trading Psychology:

Just because it is difficult & challenging, does not mean it is impossible.

First step – building discipline through consistency and structure.

Ensure you have a clear trading plan set up. One that defines your edge or can be adjusted to find your edge. Commit to following it no matter what the market is doing. Pumping, Dumping or consolidating.

Consistency in action will build mental strength.

Secondly, you must work on emotional control. Understand and be focused on how you feel when you experience fear, greed, or overconfidence. These emotions push you off your plan if you let them take over.

Each time this happens, you must log it. That way you can accumulate data and self-awareness.

With that, everyone says this. BackTEST or at least forward test you strategies extensively.

Keep a detailed journal that has a good list of questions that you must answer after each trade. Be brutally honest with yourself. Don’t hide losses because you have already hit 10 in a row. Log them all down. This way you will then be able to recognize emotional triggers and recurring patterns appearing that are holding you back.

Being able to recognise them is the first step to controlling them. OBSERVE YOURSELF.

While this takes place, you must begin to build trust in your system (strategy) and in yourself. You will see how your actions and choices line up with your plan. That way your confidence will shift from emotions to process driven.

Last one is patience. The hardest yet most critical psychological skills. Take ONLY A++ set ups, for example a set up that has 4 confluences or 5 lining up. Doing this trains your mind into avoiding impulsive behavior or falling into FOMO based environments.

To see another deep dive into mastering trading psychology, review the post below to determine which mindset you currently have. Are you a trader? Or are you a gambler.

5) How Psychology in our daily lives affects our ability to trade:

Trading Psychology is an interesting concept, but so is psychology in general.

The human mind is weak and for it to be strengthened, it takes time & self-awareness.

A weak mind won’t get you anywhere.

Psychology is not a simple one sentence definition. It can mean many things, or many situations.

It is a critical role in our life, it shapes our emotions, reactions and choices. It can lead us to self-sabotage or it can lead us to success.

If you cannot control your psychology outside of trading, you won’t be able to control it inside of trading. By this I mean daily emotions.

For example:

Imagine an individual experiences a breakout, they are sad, they are angry, they are emotionally drained and hurt. Then they go off to trade. They will LOSE.

This is because when the mind is in an uncomfortable state, it seeks a dopamine hit, and when they associate a win in trading = dopamine hit, they naturally turn towards trading. They want to feel that dopamine hit, so they can feel good again. But then they are no longer following their edge.

This destroys discipline, objectivity and focus.

This is not just tied to relationship breakups, but everything in our day to day lives. If you experience a bad day at work, failed an exam, argued with family, or facing a stressful time. If you bring unresolved emotions, thoughts and feelings into the trading space, trading just becomes a big emotional outlet.

Psychology appears in every action we do, EVERY day. “I need to drink water” I will get water. I see soda, “I now want soda.”

The mind now as switched completely from the main objective “Water” to soda. If you cannot control your mind to stick to what is right, then you will not master trading psychology.

The better control you have over yourself, & your mind, the more consistent and rational your trading decisions will become.

KEY POINTS:

1) What is Trading Psychology:

- Trading psychology is the foundation of every mental action. You must master yourself before mastering the market.

2) Pros & Cons of Trading Psychology:

- Trading Psychology cannot be mastered without failure, each loss has a lesson, that lesson is based around strengthening your mind with emotional control.

3) Why it is important in the Trading Space:

- Without a strong mind, trading turns into gambling, you must become disciplined and maintain self-control. This splits pros from the gamblers.

4) How to Master Trading Psychology:

- Right to the point: Consistency & discipline, emotional awareness, journaling, and most importantly, being patient. These are core aspects of mastering your mindset and obtaining the right psychological discipline.

5) How daily psychology affects trading:

- The way you manage your everyday emotions outside of trading mirrors the way you will end up reacting to the markets.

Control your life, then control your trades.

Psychology is a great skill, but it’s only part of 3 keys that will lead you to success. Find out the 2 other keys below:

Thank you all so much for reading - I hope this post brings a lesson into everyone's trading journey.

I am aware that this is a big long article, however Trading psychology goes even deeper - I have summarized my knowledge and research that I have obtained over time and summarized it.

Please let me know if any of you would like an a post on a specific topic.

I'd love to provide more for the community!

Fibonacci Retracement - Quick Guide in 5 StepsTrading the Fibonacci Retracement - Quick Guide in 5 Steps.

What is the Fibonacci tool?

The Fib Retracement Tool is a tool used widely across many charts. From crypto to stocks.

It assists in identifying the Golden Pocket, along with any potential Support and Resistance zones based on the sequence in Fibonacci.

Investors & Traders draw it from a previous high/low or low/high.

On a chart, each key level shows where price might pause or reverse during a pull back, before it continues the trend.

In this guide you will learn how to use the Fibonacci tool in 5 steps.

1. Configurations

Open up your Fib Retracement Tool's settings, apply the below configurations.

(You can change the color to your choice)

2. Identify High/Low's

Identify, recent highs and lows of your current chart/pair.

3. Applying Fib Retracement

Select your Fib Retracement tool. Place it on your chart starting from the swing low to the swing high.

4. Once completed

Highlight the Golden Pocket Field in the zone (0.65-0.618)

5. Review Entry

Price will eventually make it's way back down to the Golden Pocket to retest and reverse.

SL Placement would be on a previous low or key level, TP placement would be at a previous high or key level.

Bonus:

See the real time example below:

Please like, comment and follow if this guide was useful to you.

If you have any requests on analysis or tutorial requests, let me know and I'll be happy to make one!

Understanding Psychological LevelsDefinition:

In Trading, Psychological levels are often called round numbers or psy levels.

This is because the price ends in zeros and fives naturally attracting a trader’s attention.

Examples:

• Forex: 1.0000, 1.0500, 1.1000

• Stocks: $50, $100, $150, $200, $250

• Cryptocurrency: $10,000, $15,000, $20,000, $25,000

These levels are crucial as traders instinctively see targets in round numbers. (Or Incremental levels such as 5, 10, 15, 20, 25, 30 and so on...

This causes many buy, sell, and stop orders to cluster around the same price zones, creating self-reinforcing areas of interest in the market. Again, price sits at 113.2k – Psychological level is 115k.

___________________________________________________________________________________

Why Psychological Levels Matter in Trading

1) Human Bias:

Traders and investors often place orders at simple, rounded numbers. This makes their charts and order list “Clean.”

2) Institutional Targeting:

Large groups, whales or organizations use these levels to find liquidity or trigger stops. (Eg, BTC swept 125k before dumping)

3) Market Memory:

When a Psychological level reacts, traders remember it, and it often becomes relevant again in the future. (Turns into a prev liquidity sweep.)

5) Order Clustering:

Stop losses, take profits, and pending orders frequently build up around these areas. (As above, it builds liquidity.)

__________________________________________________________________________________

How to Identify Psychological Levels

Begin with marking clean, round (or quarterly) numbers on your chart. These are often major levels such as 4.0000, 5.0000, or 6.0000.

See the example below:

Then identify the midpoints/quarter points between them, like 4.5, 5.5, 6.5, 7.5, 8.5

See the example below:

For stronger assessments, look for psychological levels that align with other forms & tools of technical confluence—such as previous S & R, Supply/Demand, Highs & Lows, Fibonacci retracements, trendlines, or volume clusters.

See the example below:

When multiple forms of technical evidence converge near a round number, the level tends to have greater impact.

__________________________________________________________________________________

Trading Around Psychological Levels

When price approaches a psychological level, three common behaviors can occur:

1) Rejection:

Price touches the level and reverses quickly, suggesting strong defense by buyers or sellers. (Liquidity Sweep)

2) Break and Retest:

Price breaks through the level, then revisits it to confirm it as new support or resistance.

3) Compression or Grind:

Price consolidates near the level before a breakout as liquidity builds up.

Practical Application:

Enable alerts slightly before major psychological levels to observe reactions in real time (for example, 4.45 instead of 4.5 ). Wait for confirmation using price action such as a clear rejection wick, an engulfing candle, or a BOS (Break of Structure). Combine this analysis with liquidity or other forms of technical tools for a stronger assessment.

__________________________________________________________________________________

Trader Behavior at These Levels

Market reactions at psychological levels are largely directed by emotion and herd (Group) behavior. Fear of missing out can push price through a round number with momentum & speed while profit-taking can trigger short-term reversals & rejections. Stop hunts are also common, where smart money briefly pushes prices beyond a round level to collect liquidity before reversing. (From 4.0 up to 4.25 then down again)

Because many traders watch these same levels, reactions often repeat, reinforcing their significance.

__________________________________________________________________________________

Example: BTC/USD for $125k

When Bitcoin approaches $125k, many retail traders view it as a significant threshold. They might place short orders just below it or stop just above. Institutions recognize this and may intentionally push prices above $125k (sweeping $126k) to trigger those stops and fill large positions.

Once that liquidity is collected, price can reverse, and the $125k area may later serve as a new resistance zone.

This type of liquidity hunt and reversal pattern occurs frequently across all markets.

__________________________________________________________________________________

Practical Tips

1) Never trade purely based on a round number. Always wait for confirmation through structure or price action. (Retests, MSS, BOS, candle patterns etc)

2) Use alerts & alarms rather than fixed lines; prices often wick slightly above or below the exact level.

3) On higher timeframes, psychological levels often act as major turning zones. On lower timeframes, they tend to attract short-term reactions. (Lower the time frame, the more reactions = constant noise)

4) Combine psychological levels with liquidity, order flow, or volume analysis for a more complete view.

__________________________________________________________________________________

Summary

Psychological levels are where human reactions and liquidity meet. They represent areas of emotional and institutional/organizational interest rather than fixed points of reversal.

By understanding how traders behave around these zones and observing how price reacts to them, you can determine key movements with greater confidence.

$BTC Daily chart $130K! or $115k DUMPBTC/USDT – Bearish Harmonic Formation | Key Levels & Scenarios

Technical Overview:

Price is currently forming a bearish harmonic pattern, approaching a key decision zone. The next few daily candles will determine whether BTC continues its bullish trend or initiates a corrective phase.

Key Zones

Demand: 122.2K – 124.7K

Supply: 105.1K – 108.9K

Psychological Levels: 130K · 125K · 120K · 115K

Golden Pocket: Around 115K (0.618–0.65 retracement)

Fair Value Gaps (FVGs):

115K–118K

110K (secondary FVG)

Swing Points:

Previous Swing Low: 108K

Previous Swing High: 126K

High Volume Nodes: 118K and 115K

Market Structure

BTC is respecting a consistent bullish leg with limited pullbacks. Price recently swept the 125K psychological level, aligning with harmonic completion and demand resistance.

Scenario Outlook

🔼 Bullish Continuation:

A daily close above the 124.7K demand zone could invalidate the bearish harmonic and signal continuation toward 130K+ targets.

🔽 Bearish Reversal:

A close below the previous day’s candle low may confirm the start of a bearish correction, targeting 118K → 115K, and potentially 110K.

Bearish Confluences

Bearish Harmonic Pattern completion near key resistance.

Golden Pocket + FVG + Psychological + Volume confluence at 115K.

Extended bullish leg with no significant retracement, followed by 125K liquidity sweep.

LET me know your thoughts below!

Understanding Consolidation & Trading itWhat Consolidation Is

Consolidation is a market phase where price moves sideways within a defined range, showing indecision or balance between buyers (bulls) and sellers (bears).

Characterized by low volatility, overlapping candles, and no clear trend direction.

Often occurs after strong moves (as the market pauses) or before breakouts (accumulation/distribution).

Impact on Bulls & Bears

Bulls: View consolidation near highs as accumulation (buyers building positions before a breakout upward).

Bears: View consolidation near lows as distribution (sellers unloading before a breakdown).

Both sides place stop orders outside the range → creating liquidity pools that smart money hunts.

How Traders Can Take Advantage

Range Trading – Buy near support of the range, sell near resistance, until breakout occurs.

Liquidity Strategy – Wait for fakeouts beyond consolidation, then trade in the opposite direction (stop hunt setup).

Consolidation Across Timeframes

Lower Timeframes (1m–15m):

Looks like noise but is often where scalpers range trade.

Breakouts can give small but quick moves.

Mid Timeframes (1H–4H):

Shows clear accumulation/distribution phases.

Useful for intraday & swing traders.

Higher Timeframes (Daily–Weekly):

Represents major market indecision.

Breakouts from these zones often fuel massive trend moves.

✅ Summary:

Consolidation = sideways range = balance of bulls & bears.

Inside range → fade the extremes.

Outside range → trade support & resistance or liquidity sweep.

On different timeframes → the same consolidation can be noise on 5M, but a critical accumulation on the Daily chart.

Mastering indecision candlestick patterns - How to use it!In this guide I will explain the indecision candlestick patterns. The next subjects will be discussed:

- What are indecision candlestick patterns?

- What is the doji?

- What is the spinning top?

- What is the high wave candle?

What are indecision candlestick patterns?

Indecision candlestick patterns are formations on a price chart that suggest uncertainty in the market. They appear when neither buyers nor sellers have full control, meaning the price moves up and down during the trading period but closes near where it opened. This creates a candle with a small real body and often long wicks on either side, showing that the market explored both higher and lower prices but ended up not committing strongly in either direction. These patterns are often seen during periods when traders are waiting for more information before making bigger moves.

What is the doji?

One of the most well-known indecision candles is the doji. A doji forms when the opening price and the closing price are almost identical, resulting in a very thin body. The wicks, which show the highest and lowest prices of the period, can be long or short depending on market activity. A doji tells us that buying and selling pressure were almost equal, which can happen during pauses in trends or before major reversals.

What is the spinning top?

Another type is the spinning top. A spinning top also has a small body, but unlike the doji, the open and close are not exactly the same. The wicks on both sides are typically of similar length, indicating that the market moved both up and down significantly before settling close to the starting point. This pattern reflects hesitation and a balanced struggle between bulls and bears.

What is the high wave candle?

The high wave candle is a more dramatic version of indecision. It has a small real body like the other patterns but features very long upper and lower shadows. This means the market swung widely in both directions during the period, but ultimately closed without making strong progress either way. The high wave candle signals strong volatility paired with uncertainty, which can often precede sharp moves once the market chooses a direction.

When you see these types of candles, they are essentially the market saying “I’m not sure yet.” They often appear at turning points or before big news events and can warn that the current trend may be losing strength. However, they are not guarantees of reversal or continuation on their own. Traders usually combine them with other technical signals or chart patterns to confirm whether the market will break out in one direction or the other.

-------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like 👍 and leave a comment 💬, I’d love to hear your thoughts!

Mastering bearish candlestick patterns - How to use it!Bearish candlestick patterns are a cornerstone of technical analysis, relied upon by traders across financial markets to assess the likelihood of price reversals or continued downward trends. At their core, these patterns are visual representations of shifts in market sentiment, formed by the open, high, low, and close prices over one or several trading sessions. When recognized accurately and interpreted in context, bearish candlestick setups can alert market participants to the fading strength of buyers and the increasing presence of sellers, which often precedes downward price movements. Expanding on this, a comprehensive understanding of each pattern’s nuances, psychological underpinnings, and optimal trading applications can significantly enhance a trader’s analytical toolkit.

What will be discussed?

- What is a shooting star?

- What is a hanging man?

- What is a gravestone dojo?

- What is an evening star?

- What are the three black crows?

- How to trade the bearish candlestick patterns?

Shooting star

The shooting star pattern stands as a prominent candlestick configuration foreshadowing potential bearish reversals after an uptrend. This single-candle pattern is distinguished by a small real body situated near the lower end of the price range, a long upper shadow that is at least twice the length of the body, and little to no lower shadow. The psychological narrative implied by the shooting star is compelling: buyers initially control the session, pushing prices sharply higher, but by the close, sellers have overwhelmed this optimism, pulling the price back down to near or below the opening point. This abrupt shift in control suggests that the bullish momentum is waning, priming the market for a price correction or reversal.

Hanging man

The hanging man, while visually similar to the hammer pattern of bullish reversals, is distinctly bearish because of its position at the top of an established uptrend. This single-candle pattern features a small body at the upper part of the trading range and a markedly long lower shadow, again with minimal or absent upper shadow. During the session, substantial selling pressure drives prices down, accounting for the extended lower shadow, yet buyers temporarily regain some control, recovering much of the loss by the close. Despite this late-session recovery, the appearance of the hanging man warns traders that sellers are growing more aggressive – especially if the next candle confirms the weakness with a lower close.

Gravestone doji

A classic and somewhat ominous formation, the gravestone doji is a specialized form of doji candlestick that carries even greater weight when it appears after a rising market. Here, the open, close, and low are all clustered near the session’s low, forming a long upper shadow with no lower shadow. This structure vividly illustrates a dramatic shift in sentiment: buyers propel prices higher during the session, only to be met by intense selling which pushes prices back to the opening level by the close. This failed rally, marked by the upper wick, reflects the exhaustion of buying interest and the potential onset of bearish dominance.

Bearish engulfing

Turning to multi-candle setups, the bearish engulfing pattern is a powerful, two-bar reversal pattern. The initial candle is bullish and typically a continuation of the prevailing uptrend, but the second candle is bearish and must open above and close below the body of the first candle, “engulfing” it completely. The transition from a relatively small upward move to a much larger downward move highlights a rapid escalation in sell-side enthusiasm. Importantly, the larger the second candle and the greater the volume accompanying it, the more reliable the signal.

Evening star

The evening star expands the analysis further into a three-candlestick formation, representing a storyline of shifting market dynamics. The pattern commences with a long bullish candle, followed by an indecisive small candle (the star) that gaps above the previous close, and concludes with a large bearish candle that closes deep into the first candle’s body. The evening star is especially meaningful because it narrates a transition from bullish exhaustion to bearish control over three sessions, making it a robust signal of a pending trend reversal. The reliability of the evening star increases if the bearish candle is accompanied by high volume, confirming a surge in selling pressure.

Three black crows

Among the most striking bearish signals is the three black crows pattern. It comprises three consecutive large bearish candles, each opening within the body of the previous candle and closing successively lower. This pattern demonstrates relentless selling over several sessions, erasing prior gains and indicating that bearish sentiment is in full swing. Collectively, the three black crows can shift market psychology significantly when they appear after a lengthy uptrend, especially if accompanied by increased trading volume.

How to trade the bearish candlestick patterns?

Effectively using bearish candlestick patterns in a trading strategy requires more than mere recognition of shapes. The context in which these patterns emerge matters greatly; traders should analyze preceding price action, the scope of the trend, and any converging signals from other technical tools such as momentum oscillators or volume indicators. Confirmation is a best practice, waiting for a subsequent session that continues in the bearish direction can filter out false signals and decrease the chances of whipsaw trades.

In practice, traders may use these patterns to identify short-selling opportunities, define entry and exit points, or adjust stop-loss levels to protect profits as a trend appears to reverse. Risk management is crucial, as no pattern is infallible. Position sizing, stop-loss placement, and ongoing evaluation of the broader market environment all contribute to the prudent use of candlestick analysis. By integrating these patterns into a comprehensive market analysis framework, traders are better positioned to interpret crowd psychology, anticipate significant reversals, and navigate the complexities of price movement with a higher degree of confidence and skill.

-------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like 👍 and leave a comment 💬, I’d love to hear your thoughts!

Trade The Trend – Quick Guide In 5 StepsWhat is Trading the Trend?

Trading the trend means buying when the market is going up, and selling when it’s going down.

You're following the direction of the market, not fighting it.

If the trend is up:

Price makes higher highs and higher lows

You look for chances to buy (go long)

If the trend is down:

Price makes lower highs and lower lows

You look for chances to sell (go short)

Why it works:

You’re going with momentum

Simple rule:

Buy in an uptrend, sell in a downtrend — never trade against the flow

1. Assess the chart. Where is it headed? It's headed up.

2. Place your trend line by connecting the first two points.