WULF Macro analysis | The bigger picture | Long-term holdersNASDAQ:WULF

🎯 Price appears exhausted at the upper channel boundary. The Elliot wave pattern completes a leading diagonal, which hints at higher to go, but after a deep wave 2 pullback, which could end at the 0.382 Fibonacci retracement, $8, but a more likely target is the 0.5 Fib at $5.84 with downside momentum, also the weekly 200EMA.

Breaking out above the channel would change the count and structure and be very bullish.

📈 Weekly RSI is oversold with no divergence and can remain here for months as price keeps increasing.

👉 Analysis is invalidated if we close back above $18

Safe trading

Hash

RIOT Macro analysis | The bigger picture | Long-term holdersNASDAQ:RIOT

🎯 Riot tested the upper boundary trend-line after its breakout. Expected behaviour. The uptrend is intact with price above the weekly 200EMA and pivot. Price appears to be in a wave 3 with a target of $40, the R£ weekly pivot.

📈 Weekly RSI has hidden bullish divergence at the EQ

👉 Analysis is invalidated if we close below $6.33

Safe trading

IREN Macro analysis | The bigger picture | Long-term holdersNASDAQ:IREN

🎯 Price has overextended in a macro wave 3, the strongest and most powerful move described as a “wonder to behold” by Elliotticians. Initial downside targets for wave (4) have been hit $39, the next is 0.382, $26. In the long term, we have higher to go in wave (5) with a target of the R2 weekly pivot, $111.

📈 Weekly RSI hit overbought with no divergence

👉 Analysis is invalidated if we continue into price discovery

Safe trading

HUT Macro analysis | The bigger picture | Long-term holdersNASDAQ:HUT

🎯 A large bearish engulfing candle at major resistance saw the price drop back into the range, but the price wasted no time continuing its wave III uptrend. The next target is the $82 all-time High Volume node.

📈 Weekly RSI hit overbought and is now showing unconfirmed bearish divergence, which can take weeks to play or be negated

👉 Analysis is invalidated if we close back below the weekly pivot, $30

Safe Trading

CLSK Macro analysis | The bigger picture | Long-term holdersNASDAQ:CLSK

🎯 Price attempted to break out of the macro triangle upper boundary but was rejected. Breaking above wave D at $24 is key to trigger the next thrust towards $42, then $80 all-time High Volume Node. Triangles are penultimate patterns found before a final strong move. Price found support at the weekly pivot and 200EMA.

📈 Weekly RSI has printed bullish divergence below the EQ, but with no strong reaction yet. This can take months to play out.

👉 Analysis is invalidated below wave E, $5.97, keeping the wave E alive.

Safe trading

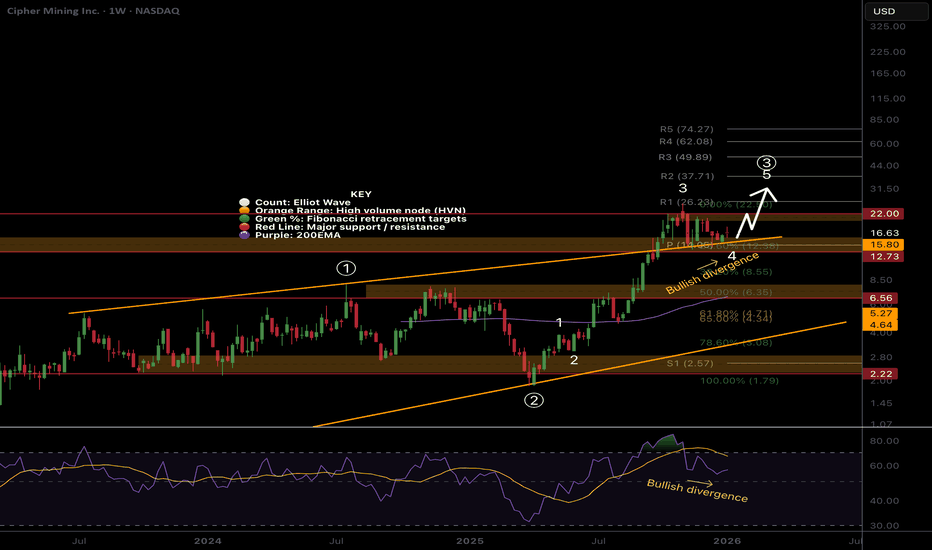

CIFR Macro analysis | The bigger picture | Long-term holdersNASDAQ:CIFR

🎯 CIFR remains in a wave (4) of 3 range, near the all-time high. Wave 4s are expected to be drawn out, often being a triangle or flat correction, where most traders give their money back to the market due to whipsaw and fakeouts.

📈 Weekly RSI has printed bullish divergence above the EQ, but with no strong reaction yet. This can take months to play out sometimes. Falling below the orange trend line will negate this divergence.

👉 Analysis is invalidated if price falls below the 0.5 Fibonacci retracement at $6.35

Safe trading

BTDR Macro analysis | The bigger picture | Long-term holdersNASDAQ:BTDR

🎯 After a 500%+ rally to all-time high, BTDR gave back most of its gain in a single week, alongside Bitcoin, undoing all that hard work. Price is currently finding support just above the weekly 200EMA and low-cap golden pocket, 0.786 Fibonacci retracement. The macro structure is still bullish with a series of higher highs and higher lows. Wave C of (C) appears to be underway with a target of the R3 pivot at $44 once momentum to Bitcoin and AI returns. The weekly pivot is the next resistance, $15.

📈 Weekly RSI is below the EQ with plenty of room to fall until oversold, though historically it never quite reaches this low.

👉 Analysis is invalidated if price falls below wave (B), $6, and the structure will start to look bearish.

Safe trading

WULF Short-term analysis | Trading and expectationsNASDAQ:WULF

🎯 The triangle analysis appears to be playing out, currently printing wave d. Price lost the daily pivot but remains well above the daily 200EMA. Wave V target is the R2 pivot at $18.74. Triangles are a penultimate pattern.

📈 Daily RSI sits at the EQ

👉 Analysis is invalidated if price falls below wave a, $10.40

Safe trading

RIOT Short-term analysis | Trading and expectationsNASDAQ:RIOT

🎯 Price appears to have completed wave II of 3, reclaiming the daily 200EMA, but still has to overcome the daily pivot, its current resistance.

📈 Daily RSI hit oversold with bullish divergence

👉 Continued downside has a target of the High Volume Node, $10

Safe trading

IREN Short-term analysis | Trading and expectationsNASDAQ:IREN

🎯 Iren wave 4 hit the daily 200EMA, just above 0.382 Fibonacci retracement. Price is at High Volume Node resistance, but above the daily pivot and 200EMA, showing the uptrend is intact. Continued downside has a target of the daily 200EMA, $26.75

📈 Daily RSI has not reached oversold

👉 Analysis is invalidated only at all time high for now

Safe trading

HUT Short-term analysis | Trading and expectationsNASDAQ:HUT

🎯 Wave 4 of V was indeed complete at the 0.382 Fibonacci retracement and High Volume Node just above the daily 200EMA. The daily pivot has been reclaimed.

📈 Daily RSI is showing unconfirmed bearish divergence

👉 Analysis is invalidated if we close below wave 4, $30

Safe trading

CLSK Short-term analysis | Trading and expectationsNASDAQ:CLSK

🎯 Price fell a dollar shy of breaking the triangle wave D target, keeping the triangle alive. The 3 white knight pattern was rejected, but the structure is still bullish. Support was found at the orange trend line, and resistance is found at the daily 200EMA.

📈 Daily RSI sits at the Eq with no divergence.

👉 Analysis is invalidated if price falls below wave (2) at $9

Safe trading

CIFR Short-term analysis | Trading and expectationsNASDAQ:CIFR

🎯 Wave d of the triangle may still be underway, wave e is expected to end at the daily pivot where price currently sits, above the daily 200EMA, showing the uptrend is still intact but flattening.

📈 Daily RSI bullish divergence has failed to play out, showing the bears are in control.

👉 Analysis is invalidated if price falls below wave C, $12.50, suggesting a deeper retracement

Safe trading

BTDR Short-term analysis | Trading and expectationsNASDAQ:BTDR

🎯 Price appears to have bottomed at the low-cap golden pocket, 78.6 Fibonacci retracement and major High Volume Node support. However, a triangle could be printing, suggesting one more push lower is on the table. Getting above $14.50 will negate this.

📈 Daily RSI has printed bullish divergence, but we need to see some follow though to be confident the bottom is in.

👉 Analysis is invalidated if price falls below wave (B), $6, and the structure will start to look bearish.

Safe trading

HUT Uptrend intactNASDAQ:HUT A large bearish engulfing candle at major resistance saw the price drop back into the range. It is now attempting break-out once more.

Price remains in a firm uptrend at major resistance with not much to add.

🎯 Terminal target for the business cycle could see prices as high as $135 based on Fibonacci extensions

📈 Weekly RSI hit overbought and reset back to the EQ.

👉 Analysis is invalidated if we close back below the weekly 200EMA

Safe trading

IREN Well overextended.... deeper pullback before upsideNASDAQ:IREN Price has overextended in a macro wave 3, the strongest and most powerful move described as a “wonder to behold” by Elliotticians. Novice investors are likely to get over-confident in these conditions, enter without risk management and keep chasing the price upwards only to be underwater when it turns around.

Profit taking appears to be taking place. I have closed my positions and am waiting for re-entry. The weekly pivots have been run.

Initial downside targets for wave (4) have been hit $39, the next is 0.382, $26.43. Expect shorts to pile in, adding to any downside momentum.

In the long term, we have higher to go in wave (5).

🎯 Terminal target for the business cycle could see prices as high as $124 based on daily pivots

📈 Weekly RSI hit overbought with no divergence

👉 Analysis is invalidated if we continue into price discovery

Safe trading

MARA cant catch a break, macro outlook still strongNASDAQ:MARA found support at the golden pocket and channel lower boundary just above the S1 pivot.

Price appears to be in an Elliot wave B, restricting upside targets to the 1:1 Fibonacci extensions at $106. Price is below the weekly 200EMA and pivot.

🎯 Terminal target for the business cycle could see prices as high as $106 based on Fibonacci extensions

📈 Weekly RSI is nearing oversold with room to fall

👉 Analysis is invalidated if we close back below wave (II)

Safe trading

RIOT Macro outlook, weekly bullish divergenceNASDAQ:RIOT tested the upper boundary trend-line after its breakout. Expected behaviour.

A large weekly candle formed after hitting the weekly 200EMA and support suggesting the bottom is in.

Price remains above the downtrend and showed strength by poking above the wave 1 high.

🎯 Terminal target for the business cycle could see prices as high as $112 based on Fibonacci extensions

📈 Weekly RSI has bullish divergence

👉 Analysis is invalidated if we close below $6.33

Safe trading

WULF LocalPrice caught a bid above the daily 200EMA on bullish divergence. It’s possible a triangle is forming for wave IV.

Price is stuck between the breakout upper-boundary and mean support, its hard to decipher the next direction as it stands. A breakout above the line could see it rally to $25 while back below wave IV would test the 200EMA.

📈 Daily RSI had confirmed bullish divergence but not from oversold

👉 Continued upside will invalidate this analysis.

Safe trading

WULF Macro looks exhausted... pullback before higherNASDAQ:WULF Price appears exhausted at the upper channel boundary, and I have exited completely for now. The Elliot wave pattern completes a leading diagonal, which hints at higher to go after a deep wave 2 pullback, which could end at the 0.382 Fibonacci retracement, $8, but a more likely target is the 0.5 Fib at $5.84 with downside momentum. Also the weekly 200EMA.

Breaking out above the channel would change the count and structure and be very bullish. RSI has been overbought for a while. For now, I watch and wait.

🎯 Terminal target for the business cycle could see prices as high as $25 based on weekly pivots

📈 Weekly RSI is oversold with no divergence and can remain here for months as price keeps increasing.

👉 Analysis is invalidated if we close back above $20

Fair value sits at $11.

Safe trading

RIOT holding up stronger than the others..NASDAQ:RIOT Price remains in its uptrend and wave II of 3 appears complete with a 3 white knight bullish candle pattern.

Price recovered the daily 200EMA and looks rady for higher.

📈 Daily RSI hit oversold with bullish divergence

👉 Continued downside has a target of the High Volume Node, $10

Safe trading

MARA struggling...NASDAQ:MARA Price dropped hard, changing the Elliott wave count completely, stopping at the golden pocket.

Wave (z) of B appears complete, but we need to see a structure change to add confirmation, so the probability is to the downside with a target of the $8 High Volume node.

📈 Daily RSI went deep into oversold

👉 Continued downside has a target of the High Volume Node, $8

Safe trading

IREN, still lower to go...NASDAQ:IREN wave 4 appears to want one more pusher lower towards the daily 200EMA and 0.382 Fibonacci retracement.

Price has broken its uptrend on bearish divergence and is yet to show strong support, suggesting we continue lower next week.

📈 Daily RSI has printed a bullish divergence, but not from oversold

👉 Continued downside has a target of the daily 200EMA, $26.75

Safe trading