Hellena | GOLD (4H): LONG to max of wave “3” 5593.I think that wave “3” is complete, since excessive stretching is also unacceptable, so it would be more rational to assume that the price is now in a correction of wave “4” of a higher order.

This means that we will still see new highs, but the correction in wave “4” should end before wave “5” begins.

In our case, wave “4” has either ended or will soon end in the area of 38.2% - 50% Fibonacci levels at 5016.

Then I expect the upward movement to continue at least to the area of the wave “3” high at 5593.

The forecast may take quite a long time to play out, so I will immediately indicate that I will consider closing positions at the level of 5450 if the price reaches that level after a good correction.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena

Hellena | EUR/USD (4H): LONG to MAX wave 3 (1.20813).I think that the price confirmed the extension of wave “3” and, as a result, the continuation of the upward movement.

This means that we will see new highs, but the correction in wave “4” should end before wave “5” begins.

In our case, wave “4” has either ended or will soon end in the area of 38.2% - 50% Fibonacci levels (1.18594).

Then I expect the upward movement to continue at least to the area of wave “3” high at 1.20813.

The forecast may take quite a long time to play out, so I will immediately indicate that I will consider closing positions at the level of 1.20000 if the price reaches that level after a good correction.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | GOLD (4H): LONG to resistance 5200.Since the movement continues and clearly shows no signs of reversing, I had to slightly revise the wave count, and it looks as if the impulse has been extended.

This means that the higher-order wave “3” has just ended or will end soon.

This means that wave “5” is not over yet and we should expect another update of the maximum.

I expect the gap at 4984.97 to be closed, after which I expect the rather important and strong level of 5200 to be reached.

Alternatively, wave “3” has not yet ended and should be expected at the same level of 5200.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | Oil (4H): SHORT to support area 62.295.Colleagues, earlier I described the upward movement as a full-fledged ABC correction, and the price justified expectations and completed the planned upward movement, but at the moment I think it is worth considering that wave A has been extended.

This fits well with both the old and new scenarios.

I expect wave “B” to begin its movement soon.

I will not set distant goals and will wait for the price to reach the first support area — the maximum of wave “3” of the middle order at 62.295.

I admit the possibility of updating the maximum of wave “A” approximately in the resistance area of 65.199.

In general, if correction “B” continues too far down, I will return to the old scenario.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | EUR/USD (4H): LONG to resistance area 1.19348.Colleagues, the price has actively updated the maximum of wave “1” of the higher order, which means that wave “3” of the middle order continues to develop.

At the moment, we are seeing a gap in the 1.18373 area, which means that wave “4” will close this gap, after which I expect the upward movement to continue to the resistance area of 1.19348, which is about 100 pips.

It is quite possible that wave “3” will renew its maximum, and we will see wave “4” a little later.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | Oil (4H): LONG to resistance area 62.545.Colleagues, after a strong upward movement, I decided to observe the price and understand what is happening.

Now I believe that this movement resembles the beginning of an “ABC” correction, which means that the higher-order wave “A” ended at 54.956.

This means that we can expect the upward movement to continue at least to the resistance area of 62.545.

A correction to the support area of 58.890 is possible.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | EUR/USD (4H): LONG to resistance area 1.17666.Dear colleagues, The upward movement is confirmed, the red wave “3” is just beginning to develop, and I think that the medium-term wave ‘2’ is completing its correction and we will soon see a continuation of the upward movement in the medium wave “3”.

I think it is worth paying attention to the maximum of wave “1” at 1.17666, as this is the first area of resistance that is worth paying attention to and should be overcome in the near future.

For greater confidence and to reduce risks, you can look for an entry into a long position in the support area at 1.16595.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

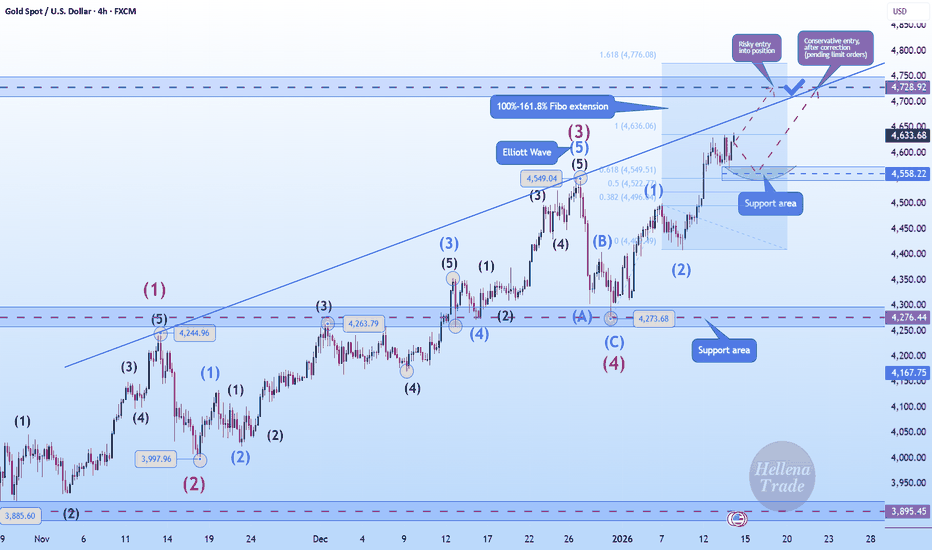

Hellena | GOLD (4H): LONG to 161.8% Fibo 4728 .Colleagues, the price is updating its maximum, and I think we shouldn't stop there.

After re-marking the waves, I realized that it would be more correct to place wave “3” at the 4549 level, since 5 waves fit well into it.

This means that the price is now in wave “5,” which can be quite unpredictable, but if we look at the blue waves, we can assume that there is now a medium-term impulse wave “3,” which means we can apply Fibonacci extension levels and see the 161.8% level as the target.

But I don't want to take such a risk and will set a slightly lower target - in the 4728 area. At the moment, we need to be very careful.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | EUR/USD (4H): LONG to resistance area 1.17420.Colleagues, the price has either completed or is completing a corrective movement in wave “2,” and I expect an upward movement to begin, which has either already started or will start soon.

I believe there is a possibility of the local minimum of 1.16180 being updated to the 1.16036 area, but the main target is the 1.17420 area, which is the maximum area of the average corrective wave “B” and confirmation of the start of the upward wave “3”.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | SPX500 (4H): LONG to resistance area of 7010.Colleagues, I expect the upward movement in the medium-term wave “1” to continue.

The minor wave “3” should still be developing, and I expect a repeat update of the high of the higher-order wave “3” (6929.4).

I consider the 7010 area to be the nearest target. If we calculate using Fibonacci expansion, the target is higher, but I always play it safe and take the nearest targets.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | GOLD (4H): LONG to max wave "1" 4564.Wave “2” appears to be complete, as waves “abc” are clearly visible, and at the moment I expect a correction in wave ‘2’ of the middle order 4397 to continue the upward momentum of the large wave “3”. The plan is to update the maximum of wave “1” and reach at least 4564.

Next, we will look for an opportunity to continue the upward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

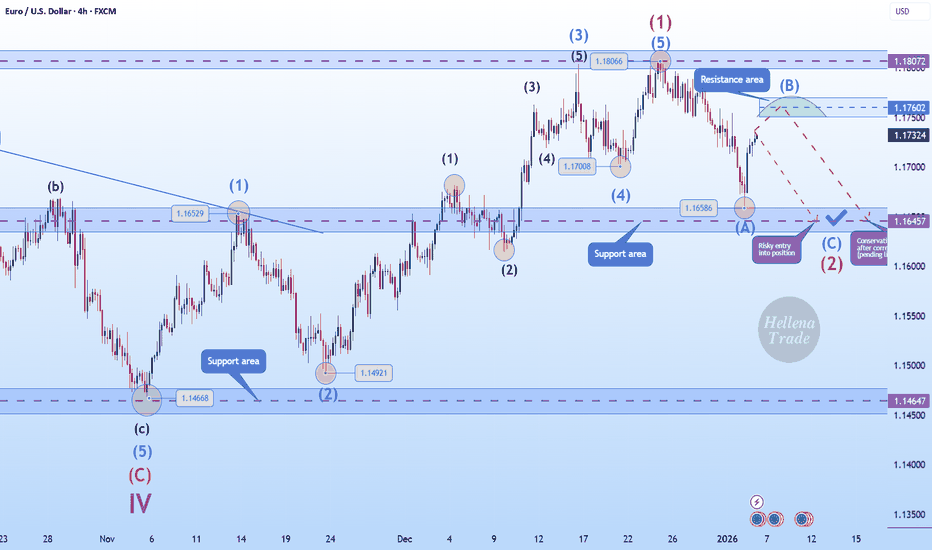

Hellena | EUR/USD (4H): SHORT to support area 1.16457 (ABC).Colleagues, judging by the nature of wave “2” movement, I assume that the correction is not yet complete. This movement is slightly stretched, and we can clearly see waves “A” and ‘B’, which means we can expect an update of wave “A” minimum and reaching at least the support level of 1.16457.

Somewhere below, I expect the completion of wave “C” and wave “2”, but that will be a slightly different forecast.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | Oil (4H): SHORT to support area of 54.53 (Wave 5).Colleagues, the price is still forming a downward impulse of five waves, and given the geopolitical situation and rather loud news, we need to be cautious.

Therefore, I believe that wave “5” will update the minimum of wave ‘3’, but I will not set a distant goal - I want to see the price in the support area of 54.53. This will be enough to confirm the structure of the momentum and think about the continuation of the large “ABC” correction.

It is quite possible that we may see a small correction to the 57.00 area before the start of the downward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | Oil (4H): SHORT to support area of 55.74 (Wave 5).Colleagues, wave “4” of the minor order is ending or has already ended. As part of a major downward movement in wave ‘5’ of the major movement, I expect a downward movement in wave “5” of the minor order.

This wave should update the low of wave “3”, but I believe it is worth looking at the nearest target in the support area of 55.746.

I also allow for the possibility of reaching the 59.00 area before the price begins a downward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | EUR/USD (4H): SHORT to support area 1.16780 (Wave 2).Colleagues, I believe that the price is completing an upward movement in wave “1” of the middle order, and we will soon see a correction in wave “2.”

First of all, I think we should expect the completion of the small wave “5” in the 1.18300 area and then expect the price to fall to the support area of 1.16780.

There are two possible ways to reach the target:

1) the price will immediately start moving towards the target, and then we will need to slightly revise the wave marking.

2) from the resistance area.

In any case, the target is the same.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | GOLD (4H): SHORT to support area of 4360 (Correction).Colleagues, the price has shown fairly steady growth, reaching a new historic high, and I believe that a correction is not far off.

So, at the moment, wave “1” of the higher order is coming to an end, and I expect this to happen around the 4545 level, followed by the start of corrective movement “2” towards the 4360 level — this is the minimum target. Of course, I expect a deeper correction, but I prefer to take more likely targets.

I would also like to point out that the price may already begin its correction, which would mean that wave “1” is already complete.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | SPX500 (4H): LONG to the area of 6956.Hello, colleagues!

I previously published a forecast for an upward movement, and I believe it is time to update the plan slightly. The direction of movement remains the same, but wave “1” has lengthened, which means that the correction in wave “2” may occur slightly higher than previously.

I expect a corrective movement to the support area of 6764, followed by a continuation of the upward movement and an update of the peak level of wave “3” of the higher order 6929 and reaching the area of 6956 at a minimum.

An extension of wave “1” is also possible, but then it will be necessary to slightly revise the wave markings again.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | EUR/USD (4H): LONG to resistance area of 1.18000.Colleagues, the price is successfully moving in an upward impulse “12345” in a medium-term wave “3”.

I believe that this week we will see a continuation of the upward movement.

A slight correction to the support area of 1.17049 is possible to complete wave “4”, followed by an update of the local maximum of the lower-order wave “3” and reaching the resistance area of 1.18000.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | Oil (4H): LONG to 50% Fibo lvl (58.00).The structure has broken down. Wave “2” of the middle order should not have updated the minimum of 56,420 of wave “B” of the higher order, but this has happened.

This means that the wave structure will have to be revised.

It seems that the major correction is not yet complete, and in order for the scenario to be completed, impulse “12345” must be completed.

At the moment, I think that the price will begin to form wave “4”.

I expect movement towards the 50% Fibonacci level from wave “3” at 58.00.

The target is not far off, but at the moment we need confirmation of the impulse.

This would mean that the price will update the local minimum, but more on that later.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | GOLD (4H): LONG to resistance area of 4417.This week, I expect the upward movement to continue and the medium-term “12345” impulse to complete.

I expect to see a small correction, after which I expect to see at least the 4417 area reached at the end of wave “5” or in the extension of wave “3”.

This week, after the completion of this movement, I plan to figure out our next steps.

It may be that a major correction awaits us in the near future, but we will talk about that later.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | GBP/USD (4H): LONG to resistance area of 1.34683.Colleagues, the upward movement is actively developing, and I see a medium-term upward impulse (12345) developing in the higher wave “1” (red).

At this stage, I see:

1) the possibility of a correction in wave “4” in the area of 1.32440, then reaching the resistance area of 1.34683.

2) the extension of wave “3” directly to the area of 1.34683. Such scenarios often occur in impulses.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | GOLD (4H): LONG to resistance area of 4298.I suggest to consider the lower timeframe (1H), which has some peculiarities.

I see here an upward impulse in the red wave “3”, which is not over yet.

I believe that we should expect the price in the resistance area of 4298.33.

A small correction in the form of continuation of wave "4" to the area of 4174.78 is also possible. But in general, I am set for long positions.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | EUR/USD (4H): LONG to resistance area of 1.17561.Colleagues, I assume that wave “C” ended at 1.14668 and at the moment we see an upward movement in the mid-order impulse “12345”.

I think that the wave “1” of lower order will either extend to the area of 1.17561, or we will see a correction to the area of 50% Fibonacci level 1.15967, and then the movement in the wave “3” to the area of 1.17561.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!