HOOD S&P 500 Inclusion = Gamma Squeeze Incoming?

# 🚀 HOOD Weekly Setup (Sep 5, 2025) 🚀

**Catalyst:** 🔥 S\&P 500 inclusion → forced buying

**Options Flow:** 📊 C/P = **3.15** (extreme bullish)

**Volatility:** 😴 Low VIX → cheap calls

**Technical:** RSI mixed but catalyst > chart

---

### 📈 Trade Idea

* 🎯 **Buy \$106C** (Sep 12 Exp.)

* 💵 Entry ≈ 2.44

* 🎯 Target: 4.00 (+64%)

* 🛑 Stop: 0.98 (-40%)

* 📅 Exit: by Thu, Sep 11

* 🔥 Confidence: 75%

---

### ⚡ Bonus YOLO Play

* 🎯 \$114C (0.81) → cheap lottery ticket

* ⚠️ High risk / lower win rate

---

📌 **Consensus:** ALL models bullish (flow + catalyst)

📊 Heavy OI at 105 → dealer gamma squeeze setup

---

\#️⃣ NASDAQ:HOOD AMEX:SPY NASDAQ:QQQ AMEX:IWM #SP500#NASDAQ #OptionsTrading #UnusualWhales#GammaSqueeze#OptionsFlow#FlowTrading#WeeklyOptions#CallOptions#StockMarket#TradingView #Bullish#SP500Inclusion#StocksToWatch#MarketMoves#EarningsSeason#MomentumTrading#RiskReward

Hoodweeklytradesetup

Robinhood - This is still not the end!🏹Robinhood ( NASDAQ:HOOD ) is not done yet:

🔎Analysis summary:

After creating a quadruple bottom formation back in 2023, Robinhood managed to rally an incredible +1.400%. It seems to be obvious that Robinhood has to correct soon, but that's not how markets work. Momentum tends to continue for much longer so Robinhood will just rally more.

📝Levels to watch:

$150

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

$HOOD Crash Alert? Put 94C Traders Loading Up

# 🔻 HOOD Weekly Outlook: Neutral → Bearish Tilt? (Sep 2, 2025) 🔻

### 📊 Multi-Model Consensus

* **Momentum**: Daily RSI 37.1 → bearish 📉 | Weekly RSI 65.5 falling 🟡

* **Volume**: 0.6x prior week → weak liquidity ⚠️

* **Options Flow**: C/P ratio = 2.17 → strong **bullish skew** 🐂

* **Volatility**: VIX 18 → favorable environment

👉 **Net View**: **Neutral w/ Bearish Tilt**

* Price momentum & weak volume = downside risk 📉

* Heavy bullish call flow = potential contrarian fade 👀

---

### 🧠 Model Breakdown

* **Gemini / Grok / Llama / DeepSeek** → 🚫 No Trade (low conviction)

* **Claude** → ✅ Tactical Bearish PUT (contrarian call vs. flow)

---

### 🎯 Trade Setup (Tactical Play)

* **Instrument**: \ NASDAQ:HOOD

* **Direction**: PUT 🟥

* **Strike**: 94.00

* **Expiry**: 2025-09-05 (3DTE)

* **Entry**: \$0.97 (market/open)

* **Profit Target**: \$1.45 (+50%) 💰

* **Stop Loss**: \$0.48 (–50%) 🛑

* **Size**: 1 contract (small / tactical)

* **Confidence**: 60% ⚖️

⏰ Exit by **Thursday close** to avoid Friday gamma risk.

---

### ⚠️ Key Risks

* Heavy call flow → possible squeeze 💥

* Weak volume → illiquid / erratic moves

* Time decay (theta burn) accelerating 🕒

---

🔥 **Summary**:

\ NASDAQ:HOOD sits in a **neutral-to-bearish zone**. Most models = "NO TRADE", but one high-conviction model spots a contrarian PUT setup. Risk small, manage tight stops, and exit early if momentum stalls.

HOOD Momentum Setup — Buy $122 Calls

# 🚀 HOOD Weekly Options Trade Idea (2025-08-18)

📊 **TRADE DETAILS** 📊

* 🎯 **Instrument:** HOOD

* 🔀 **Direction:** CALL (LONG)

* 🎯 **Strike:** 122.00

* 💵 **Entry Price:** 0.67

* 🎯 **Profit Target:** 1.00 → 1.34 (+50% to +100%)

* 🛑 **Stop Loss:** 0.36 (\~46% premium)

* 📅 **Expiry:** 2025-08-22

* 📏 **Size:** 1 contract

* 📈 **Confidence:** 65%

* ⏰ **Entry Timing:** Market open

* 🕒 **Signal Time:** 2025-08-18 09:43:26 EDT

---

### 🔎 Quick Summary

* **Momentum:** Daily RSI 62 → bullish, but weekly RSI 82 → potential pullback risk

* **Options Flow:** Call/Put ratio 2.28 → strong institutional bullish positioning

* **Volume:** Weak weekly volume → trade with caution

* **Volatility:** VIX < 20 → favorable for options trading

* **Market Bias:** Moderate bullish overall

Get Ready: HOOD’s Bullish Wave Is Here — Ride It to Profit! 🚀 HOOD Weekly Options Play (08/11/2025) — Bullish Momentum Incoming! 🚀

**🔥 Key Signals:**

* **RSI:** Daily 70.6 / Weekly 80.1 — Strong bullish momentum

* **Options Flow:** Call/Put ratio at 2.41 — Heavy institutional call buying

* **Volatility:** VIX low at 15.54 — Perfect calm for upward moves

* **Volume Warning:** Weekly volume down 0.8x last week — Caution advised

---

**📈 Trade Setup:**

* **Trade:** Long Call

* **Strike:** \$125

* **Entry:** \$0.84 (market open)

* **Stop Loss:** \$0.42 (50%)

* **Profit Target:** \$1.68 (100%)

* **Expiry:** August 15, 2025

* **Risk:** Up to 3% of portfolio

---

**⚠️ Watch Out:**

Volume dip could challenge the move — stay alert & respect your stop!

Low volatility environment favors smooth upside moves.

---

**Summary:**

Strong bullish bias driven by institutional calls + momentum RSI — expect upside next week! Perfect time to ride the wave, but keep volume risk in check.

---

🔥 **Trade Smart, Trade HOOD!** 🔥

HOOD Lifetime Setup--Will You Miss It Again?### 🟢 **HOOD Options Flow Explodes: 2.05 Call/Put Ratio Sparks Bullish Firestorm 🔥**

**Will \$114 Be Breached This Week? Smart Money Thinks So.**

📈 **HOOD Weekly Options Breakdown – Aug 5, 2025**

---

#### 🔍 Market Snapshot:

* **Total Calls**: 178,756

* **Total Puts**: 87,243

* **C/P Ratio**: 2.05 → **BULLISH**

* **RSI**: Daily – 60.2, Weekly – 77.3 → **Uptrend Confirmed**

* **Volume**: 1.5x Previous Week → **Institutional Flow Detected**

* **Gamma Risk**: 🟡 Moderate

* **VIX**: 17.5 → Ideal for Weekly Plays

* **Time Decay**: 🔥 Accelerating

---

### 🧠 Consensus:

✅ All models confirm **strong bullish momentum**

⚠️ Some debate: Is rising volume accumulation or distribution?

---

### 🎯 Recommended Trade Setup:

> **Naked Call – HOOD \$114C (Exp: 2025-08-08)**

* **Entry**: \$0.79

* **Stop Loss**: \$0.40

* **Profit Target**:

* 🥇 Base: \$1.03 (+30%)

* 🥈 Stretch: \$1.58 (+100%)

* **Confidence Level**: 80%

* **Timing**: Enter @ market open

---

### 🔖 Tags (Hashtags for TradingView & Socials):

`#HOOD #OptionsFlow #CallOptions #BullishSentiment #WeeklyOptions #TradingStrategy #VolumeBreakout #RSI #Gamma #Robinhood #SmartMoneyMoves #HOODTradeIdea #TechnicalAnalysis #StockOptions #ViralTradeSetup`

Hood Targeting The Hights

📈 **HOOD BULLISH SETUP - WEEKLY TRADE IDEA (08/03)** 📈

**Ticker:** \ NASDAQ:HOOD | **Bias:** 🟢 *Moderate Bullish*

🔁 **Call/Put Ratio:** 2.13 = **Strong Bullish Flow**

💼 **Volume:** 166K Calls vs. 78K Puts = Institutional Interest

📉 **Gamma Risk:** LOW | ⏳ **Time Decay:** Moderate

🔥 **TRADE SETUP** 🔥

• 💥 **Buy CALL @ \$109**

• 💰 *Entry:* \$0.85

• 🎯 *Target:* \$1.70 (100% ROI)

• 🛑 *Stop Loss:* \$0.43

• ⏰ *Expiry:* 08/08/25 (5DTE)

• 🧠 *Confidence:* 65%

• 📈 *Size:* 5 contracts

• 🕒 *Entry Timing:* Market Open

💡 **Why it matters:**

Despite mixed RSI and conflicting trend models, **massive call volume + low gamma risk** supports a short-term breakout play.

📌 **Watch for confirmation at open. Tight risk/reward. High upside if momentum holds.**

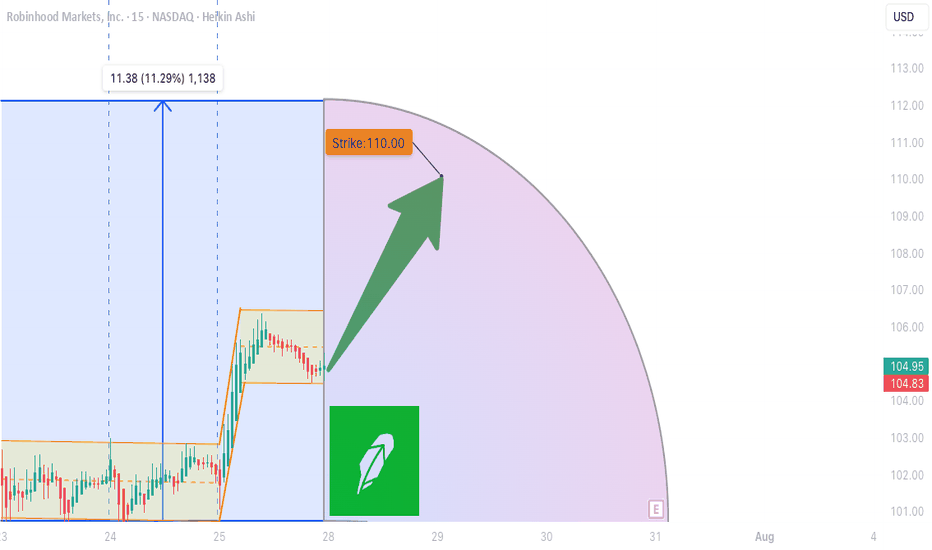

HOOD WEEKLY OPTIONS TRADE (7/31/25)

### ⚡️HOOD WEEKLY OPTIONS TRADE (7/31/25)

📈 **Setup Summary**

→ Weekly RSI: ✅ Rising

→ Daily RSI: ❌ Falling (⚠️ Short-term pullback risk)

→ Call/Put Ratio: 🔥 **1.89** (Bullish flow)

→ Volume: 📉 Weak — fading conviction

→ Gamma Risk: 🔥 High (1DTE)

---

💥 **TRADE IDEA**

🟢 Direction: **CALL**

🎯 Strike: **\$110.00**

💰 Entry: **\$0.82**

🚀 Target: **\$1.62** (+100%)

🛑 Stop: **\$0.41**

📆 Expiry: **Aug 1 (1DTE)**

🎯 Entry: Market Open

📊 Confidence: **65%**

---

🧠 **Quick Insight:**

Mixed signals = *Scalper’s Playground*

✅ Weekly trend favors upside

⚠️ Weak volume & daily RSI divergence = TRADE LIGHT

---

📌 Posted: 2025-07-31 @ 11:53 AM ET

\#HOOD #OptionsTrading #WeeklyPlay #GammaScalp #TradingViewViral #HighRiskHighReward

HOOD WEEKLY TRADE IDEA (07/27/2025)

**🚨 HOOD WEEKLY TRADE IDEA (07/27/2025) 🚨**

**BULLISH OPTIONS FLOW MEETS EVENT RISK CAUTION**

📊 **Options Flow Snapshot:**

📈 **Call Volume > Put Volume**

🧮 **Call/Put Ratio: 2.30** → **Institutional Bullish Flow**

📈 **Momentum Readings:**

* 🟢 **Daily RSI: Bullish**

* 🟡 **Weekly RSI: Mixed to Weak**

➡️ *Momentum is short-term positive, but not confirmed long-term*

📉 **Volume Insight:**

* **Only 0.7x** last week’s volume

➡️ *Lack of participation = ⚠️ caution*

🌪️ **Volatility Environment:**

* ✅ **Low VIX = Great Entry Timing**

* ❗ Fed Meeting ahead = Binary Event Risk

---

🔍 **Model Consensus:**

All 5 models (Grok, Claude, Gemini, Meta, DeepSeek) say:

🟢 **Moderately Bullish Bias**

✅ Bullish options flow

✅ Daily RSI uptrend

⚠️ Weak volume + Fed caution

---

💥 **TRADE SETUP (Confidence: 65%)**

🎯 **Play:** Long Call

* **Strike**: \$110

* **Expiry**: Aug 1, 2025

* **Entry**: ≤ \$2.90

* **Profit Target**: \$5.80 (🟢 100%)

* **Stop Loss**: \$1.47 (🔻50%)

📆 Entry: **Market Open Monday**

📦 Size: 1 Contract

📈 Risk-Reward Ratio: \~1:2

---

🧠 **Key Risks:**

* 📉 Volume Weakness = No confirmation

* ⚠️ **FED Event Risk** = Watch for Wednesday volatility

* ⏳ Theta decay as expiry nears

---

📌 **JSON TRADE DETAILS (for bots/scripts):**

```json

{

"instrument": "HOOD",

"direction": "call",

"strike": 110.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 5.80,

"stop_loss": 1.47,

"size": 1,

"entry_price": 2.90,

"entry_timing": "open",

"signal_publish_time": "2025-07-27 15:09:35 EDT"

}

```

---

🔥 Stay sharp. Ride the flow, respect the risk.

👀 Watch volume + Fed headlines!

💬 Tag your team: \ NASDAQ:HOOD Bulls loading?

\#HOOD #OptionsTrading #UnusualOptions #FedWeek #WeeklyTradeSetup #TradingView #StockMarket