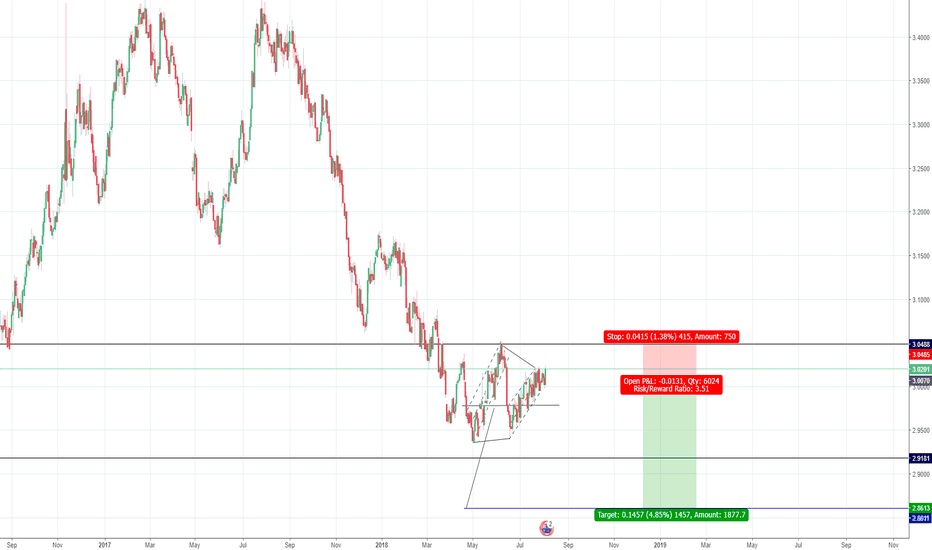

Bitcoin to reach target of $3010A few months ago, I estimated BTC to reach a range of about $3700 when it was trading around the $6k region (check my earlier posts).

With it dropping, I still don't yet see this as a time to call bottoms and buy as it is never safe to do so. Forming a solid triangle pattern, I have three targets set with the main one being at the $3007 levels.

Alpha Sniper Capital group enjoyed and made money on the way down for the $6k levels. Don't be a blind Hodler. Follower a well strategic strategy and make money on the downside !

Enter short: $3560

Stop Loss: $3772

Target: $3010

Hvf

BCHSVUSDT Upside HVF Early Entry RRR 1:9 potentialBINANCE:BCHSVUSDT

another Hard Fork, another pump ?

BCHSVUSDT perform a HVF setup in H1 Timeframe. i got an early entry near trend line and put my stop under RL2.

Disclaimer : As a friendly reminder, nothing written below is a recommendation to trade or invest in anything. You are responsible for your own financial decisions and due diligence.

EFAV Short PlayEFAV looks like it topped out. It capitulated downside after the first topping and staggered back up to the upside (which took some time to form, with eventually a quicker capitulation back down to the downside. Over time you will notice that the time frames of rising and the falling become quicker (with rises legs taking longer to form than the down legs which are quicker in respect).

On top of the time volatility being compressed, you will notice price behavior becoming compressed and less volatile. Most may see this pattern as a Descending Triangle. Due to the flat bottoms and decreasing lower highs, this gives it another strong bearish sign.

There are smaller patterns within my bigger (HVF) pattern like rising wedges and grind lines against rising prices, and strong Key Levels of Significance like certain "Gap Zones" (highlighted in red) which play a strong factor between certain support and resistant zones.

On Balance Volume also helped me get a feel for the strength of purchasing power. The OBV seems to have hit a double top and broke down out of the Ascending Wedge for weaker volume.

I have 3 targets set for the downside (pink lines) with the last one being your main target. 2nd interim target would not be a bad spot to take a percentage of your profit at.

Hope this helps in some way. Feel free to follow and comment with any questions or concerns!

XBTUSD Short Triggered.. BITMEX:XBTUSD

after FUD about tethered, and look like no follow through.. xbtusd create an inverted HVF and have a primer in it.. potential RRR 1:19 if you get the primer..

Let see how it plays..

Disclaimer : As a friendly reminder, nothing written below is a recommendation to trade or invest in anything. You are responsible for your own financial decisions and due diligence.

XMRUSD - INV HVF - BEARXMRUSD - INV HVF - BEAR

- Set up orders this morning, back to check on it and target almost met

- Closed trade 80/90% at target, mainly due to second big dip on only small volume (15min time frame)

- Will watch to see if target is made

Looking for indicators/methods/strategies for better predicting breakouts, want to increase the quality of the setups i trade, if anybody has any suggestions please leave a comment =P