Ichimoku Cloud

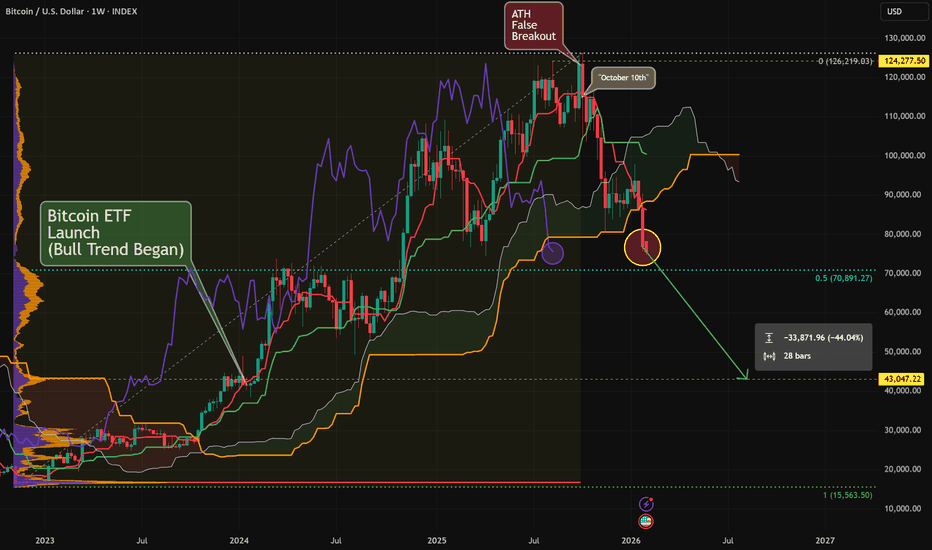

Bitcoin: Weekly Ichimoku Bear Trend ConfirmedThe Bitcoin INDEX:BTCUSD Weekly Bullish trend has officially ended per Ichimoku with both price and Chikou closing outside the cloud on the bearish side.

This is the complete inversion of the trend's start around the same time as the Blackrock Bitcoin ETF NASDAQ:IBIT launch.

Why is this signal important? I have studied and written about the high efficacy of Bitcoin's Daily Ichimoku trend strategy for over a decade. The weekly signal is naturally more infrequent (only 3 cases before) but every single time has been the precursor to bearish trend continuations -43% to -55%:

From the closing weekly price that fired the signal the ETF launch price ~$43k is -44% below. This will be a reasonable place to look for a bottom based on historic signals.

This is also in line with my long standing expectation that the bear cycle will be a -65% Retracement from the All Time High.

AMAZON - EMA 200: Where Institutions Step InAMZN - CURRENT PRICE : 237.70

📈 AMZN — Institutional Support Holds, Momentum Breakout

AMZN continues to trade in a primary uptrend, with EMA 200 acting as a strong institutional accumulation zone. Multiple pullbacks toward the EMA 200 (highlighted in green) were met with immediate buying interest, confirming long-term demand.

Momentum is now turning bullish:

🔥Price has broken back above the Ichimoku Cloud, signaling trend resumption.

🔥RSI is crossing above the 60 level, a classic sign of bullish momentum acceleration.

This setup favors momentum traders looking to enter as the uptrend resumes.

ENTRY PRICE : 235.00 - 237.80

TARGET : 258.00 (All Time High level)

SUPPORT / INVALIDATION : EMA 200

📌 As long as price holds above EMA 200, the bullish structure remains intact.

ETHUSD finds support at Weekly Ichimoku CloudIt appears that ETHUSD, after quite a consolidative year in 2025, has found some support at the weekly Ichimoku Cloud. The Leading (Senkou) Span A appears to be crossing the Leading (Senkou) Span B in the first week of January 2026. That is a more bullish type of cloud support.

So it appears that the sideways chop for the last few weeks might be prices finally stabilizing after a significant -47.13% decline over the past few months. Note that ETH also declined about -66% in the first part of 2025.

It could be that ETH has another correction later in 2026, and its volatility isn't atypical at all.

For now, ETH looks poised to move higher into Q1, either into the bullish Ichimoku Cloud or perhaps even above it towards $3700 - $4000.

Finally, the Lagging Span also found support over the past few weeks at the price candles in July 2025. The Lagging Span tracks current price closes but moves them backward in time 26 periods, and offers some insights about support and resistance levels.

Happy New Year, and as always, trade with a plan and do your own research!

TVTX - Breaks a 10-Year High – A New Chapter BeginsTVTX - CURRENT PRICE : 38.21

TVTX has made a major technical breakout by moving above its 10-year high at $37.04, a level last seen in August 2015. This move places the stock firmly into price discovery, meaning there is no nearby historical resistance overhead. Importantly, the breakout is holding, with the previous resistance now acting as strong support, a key sign of a healthy and sustainable uptrend.

Looking back, the 24 December breakout can be viewed as an ascending triangle breakout, where price consistently made higher lows before finally pushing above resistance. This pattern often signals strong accumulation and continuation rather than a short-term spike. Trend indicators remain supportive, with price trading above the EMA 50 and above the Ichimoku Cloud, both pointing to a well-established bullish trend.

From a price action perspective, the latest candlestick structure has formed a Bullish Harami based on Japanese candlestick analysis , suggesting selling pressure is fading and buyers may be preparing for the next move higher. As long as TVTX continues to hold above the former resistance zone and the EMA 50 on a daily closing basis, pullbacks are considered buy-on-dip opportunities. The next upside targets are $42 followed by $45, while a daily close below the EMA 50 would invalidate the bullish setup and serves as a cut-loss level.

ENTRY PRICE : 38.21

FIRST TARGET : 42.00

SECOND TARGET : 45.00

SUPPORT : EMA 50 (Cutloss if price closed below EMA 50)

Bitcoin Price History RhymesAs I look at the chart for CRYPTO:BTCUSD on the Weekly timeframe with Ichimoku overlayed the similarities to the 2021-2022 cycle top are eerie. Let's break down what I mean:

The key indicator of Ichimoku is price relative to the Kumo Cloud. A trend on the respective timeframe begins when price is above the cloud. I also use Chickou as momentum for confirmation. This means that the current Bull trend of Bitcoin began officially on the Weekly in November 2023.

The inverse to this rule is when price and momentum are on the opposite side of the cloud. The last Bear trend of Bitcoin began officially on the Weekly in May 2022.

So we can see how close Bitcoin is to true Bearish territory; getting below 80k and staying there for a prolonged time.

The other eerie similarity is the double false breakouts or "Spikes." If you learn ONE price action indicator remember the false breakout! There is no more reliable signal of reversal than when price makes a new high/low and then CLOSES back inside the prior range.

Once again this year as in 2021 there were two such signals weeks apart. It means that the market stopped buying at critical moments where breakouts should have occurred if price were to continue. These false breakouts are past being tradeable now but everyone should take note of just how frequent and reliable these instances are.

CRDO: Cloud + EMAs Aligning for Upside ContinuationCRDO - CURRENT PRICE : 162.95

CRDO is showing a bullish reversal setup as price rebounds and closes back above the EMA50 while holding firmly above the Ichimoku Cloud , signaling the major trend remains intact. Momentum is improving with RSI rising above 50 and not yet overbought, supported by increasing volume on the recent bullish white candlestick.

Today’s move above the 20-day SMA adds a positive layer to the short-term trend structure. Short term targets are 175.00 and 185.00 while support is 148.00.

ENTRY PRICE : 160.00 - 162.95

FIRST TARGET : 175.00

SECOND TARGET : 1.85

SUPPORT : 148.00

XAUUSD Daily AnalysisBased on ichimoku's data XAUUSD long-term trend is still bulish.

Xauusd is in the short-term downward trend.

if it cannot break through the support level (3962) with ichimoku elements, it will change its direction to resistence levels, but if it can, it will continue to highlighted support levels which are very important for gold and you can consider it as long-term support zones.

Long Term Bitcoin ForecastAlways early, never in doubt

I have already exited my Bitcoin related ( NASDAQ:IBIT Puts) shorts and NASDAQ:MSTR Puts. I felt confident I would be early as that that is my habit. There will undoubtably be a relief rally at some point that I may re-enter. My long term forecast is that the bull phase of the Halvening price cycle has ended and the bear phase has begun. Let's break down each price action component I am watching...

First let's take a step back to learn why we got here.

The false breakout or "Spike" as I call them are one of the most trustworthy signals that I trade. If you study one single element of price action it should be this. When price fails to close above a prior ATH (or below a major low) this is the highest probability of a reversal. Market psychology is on display that traders refused to continue the rally and now many are "trapped". This was the reason for the mass liquidations in October that started this bear trend. Many thought a breakout was in order but the confirmation failed.

One day after the "Trump tweet" the Daily Ichimoku Cloud trend confirmed bearish. This is another indicator of Bitcoin's trend that has been useful for all of Bitcoin's history. It is also what we will evaluate later on the Weekly.

At this point the most important level to watch is the 50% Retracement for the entire bull phase going back to November 2022 low. There are Volume Profile levels to watch but we assume that price will retest the 50% and evaluate what will happen in the Ichimoku Cloud trend context there.

Back in April 2025, when price on the Weekly made a move to the Weekly Ichimoku Cloud, price never hit or got inside the cloud nor did Momentum have a reasonable chance of crossing into bearish. "This time it's different" because if price does test the 50% Retracement it will signal full bearish trend confirmation on the Weekly timeframe.

During the last cycle, the bearish trend ended when the timing element of the Monthly Ichomoku cloud turned upwards. There is a similar timing element on the Monthly now in November 2026.

My fundamental, market psychology based speculation is that the ETF buyers from January 2023 must have their patience tested. That price is around 43k.

TL:DR;

Price will trend bearish down to 43k with the bear phase ending around November 2026.

APP - UPTREND STILL INTACT!APP - CURRENT PRICE : 670.00 - 674.00

APP is showing strong bullish momentum as the price trades above the 50-day EMA and ICHIMOKU CLOUD , indicating a sustained uptrend. The RSI is in bullish territory but not yet overbought, indicating room for further upside. With the current setup, the stock has potential to retest its all-time high area if momentum continues.

ENTRY PRICE : 670.00 - 674.00

FIRST TARGET : 727.00

SECOND TARGET : 770.00

SUPPORT : 50-day EMA

Bitcoin (BTC), End of Cycle Season Based on Cycle DurationBINANCE:BTCUSDT

Bitcoin appears to have already formed its peak within the current bullish cycle and may now be preparing for a correction.

Alternatively, if BTC makes another attempt to reach a new all-time high within October, that period could mark the final peak of this cycle.

Looking at historical data, Bitcoin has shown a repeating pattern —

an uptrend lasting approximately 3 years and 11 months (1,065 days) from the bottom,

followed by a downtrend of about 1 year (365 days) from the peak.

During down cycles, the cycle low has typically formed between the EMA 50 and EMA 100.

Backtesting monthly charts shows that Bitcoin often breaks below the EMA 50, finds support above the EMA 100, and then breaks through the Ichimoku Cloud, signaling the start of a new bullish cycle.

Become an early follower and be part of the journey.🚀

I am Korean and I used Google Translate.

ETH Elliott Wave - WXY Correction Complete soon!This chart analyzes Ethereum (ETHUSD) at the conclusion phase of a major WXY corrective structure, highlighting the technical environment for a new impulsive wave sequence. Price action is assessed using multiple technical indicators:

Elliott Wave Structure: The chart maps a completed 1-2-3-4-5 impulse, followed by W–X–Y corrective waves. The final Y leg approaches the critical Point 4 support, maintaining overall cycle validity and setting the stage for significant trend reversal once completed.

Ichimoku Cloud: ETH price is currently testing the lower bounds of the Ichimoku cloud, reinforcing a major support zone. A close above the cloud would further validate trend reversal; a breakdown would signal extended bearish pressure.

Volume Profile: Recent sessions show a spike in trading volume as price approaches historical support levels, indicating potential capitulation and increased probability of trend exhaustion.

Fibonacci Retracement: Key supports are identified at the 38.2%, 50%, and 61.8% levels, with the 38.2% zone (around $3,600) as a strong candidate for final Y wave completion based on confluence with cloud and momentum indicators.

RSI and Stochastic RSI: Both relative strength oscillators are in oversold territory, consistent with the final stages of a corrective structure. A bullish crossover or RSI divergence would strengthen the reversal thesis.

CVO/OBV: Volume-based momentum indicators confirm heavy participation during the latter stages of the sell-off, validating the probability of a strong bounce once buyers re-enter.

Scenario Outlook:

The analysis anticipates that, upon completion of the WXY correction—ideally above the Point 4 support (roughly $3,350)—Ethereum is set for a new impulsive uptrend as part of the final bull market rally. The setup favors strategic accumulation in the defined support zones, with projected upside targets ranging from previous all-time highs (~$4,950) to extended Fibonacci projections should the market move through a classical 1-2-3-4-5 impulsive wave.

Bitcoin range: 110k defended, 111.9–114k caps the upside__________________________________________________________________________________

Market Overview

__________________________________________________________________________________

BTC is consolidating above 108.7–109.0k after the pullback from ATH, capped under 111.9–114.0k. Short-term momentum is improving while 6H/12H remain corrective.

Momentum: 📈 Neutral-to-slightly bullish above 110k, but capped by 111.9–113.5k; 6H/12H still in a corrective trend.

Key levels:

- Resistances (HTF/MTF) : 111.9–113.5k (W/720 pivots), 114.0k (240 PL→R), 120.0k (W PH).

- Supports (HTF/MTF) : 110.0–110.2k (recent shelf), 108.7–109.0k (720 PL cluster), 107.3k (240 PL).

Volumes: Very high on 2H/1H/30m/15m; normal on 1D → credible rebound, not yet HTF-validated.

Multi-timeframe signals: 1D in NEUTRAL BUY above 108.7k; 12H/6H/4H trending down (sell-the-rips below 111.9–113.5k); STTF (2H/1H) improving on volume.

Risk On / Risk Off Indicator context: SELL (moderate risk-off) → contradicts the intraday bounce, so be cautious until 114.0k is reclaimed.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

Compressed range: favor opportunistic executions at the edges; wait for confirmed breaks.

Global bias: Neutral-to-slightly long above 110k while 108.7k holds; swing invalidation on 1D close below 108.7k.

Opportunities:

- Defensive buy on 110.0–110.2k retest; target 111.9k then 113.5k if break confirms.

- Tactical sell on rejection at 111.9–113.5k; target 110.0k then 108.8k.

- Breakout buy if 12H/1D close >114.0k; target 117.4k.

Risk zones / invalidations:

- Loss of 108.7k on HTF close invalidates longs, opens 107.3k then 95.3k if weakness extends.

- Acceptance >114.0k invalidates most shorts, exposing 117.4k.

Macro catalysts (Twitter/News):

- Fed leaning to a 25bp cut (Sep 17 FOMC) with a bull steepener → supports dip buys if ISM/Jobs confirm.

- Gold at record (>3,500$/oz), softer USD, Asian equities broadly positive → mild tailwind for risk.

- Policy divergence (ECB dovish, BOJ cautious) + geopolitics → potential capping below 113.5–114.0k.

Action plan:

- Long Plan: Entry 110.0–110.2k / Stop 109.6k / TP1 111.4k, TP2 111.9k, TP3 113.5k (≈1.8–2.5R).

- Short Plan: Entry 112.0–113.0k on rejection / Stop 113.7k / TP1 110.0k, TP2 108.8k, TP3 107.3k (≈1.6–2.2R).

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Overall, timeframes are compressing: HTF resilient, MTF corrective, STTF recovering on strong volumes.

1D: Holding above 108.7–109.0k; acceptance >114.0k would open 117.4k then 120.0k.

12H/6H/4H: Lower highs/lows, favor sell-the-rips below 111.9–113.5k; rejection there likely retests 110.0k then 108.8k.

2H/1H/30m/15m: Strong-volume rebound; as long as 110k holds, a squeeze toward 111.9k then 113.5k is possible; losing 110k points back to 108.8k.

Key confluences: Multi-TF support 108.7–109.0k; ceiling 111.9–113.5k with 114.0k as decision level → compressed structure favors an imminent move.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro modestly supports dip-buys while background risk-off tempers upside; on-chain is neutral-to-cautious, aligned with the technical range.

Macro events: Markets price Fed cuts with a bull steepener; gold at record (>3,500$/oz), softer USD, Asia broadly green; ECB leaning dovish, BOJ cautious; upcoming US CPI/PMI/ISM and Jobs in focus.

Bitcoin analysis: Ichimoku Tenkan/Kumo as overhead resistance; key pivot 110.4–110.7k; some watch 103–100k on downside; ETFs saw net inflows in August despite -6.5% spot → ongoing institutional demand.

On-chain data: Large transfers (e.g., 7,860 BTC, 6,002 BTC) → potential liquidity/volatility; 6m/CTH cost basis near 107–108.9k as support; STH stress near 113.6k; no broad capitulation (SOPR ~1).

Expected impact: Confluence for a 108.7–113.6/114.0 range; easing bias may help a topside break if volumes persist, otherwise rallies cap below 114.0k.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

BTC sits between 110k support and 111.9–114.0k resistance, with strong intraday volumes but a risk-off backdrop.

- Trend: neutral-to-slightly bullish above 110k, yet MTF remains corrective.

- Best setup: defensive long at 110.0–110.2k with <109.6k invalidation, or rejection short at 111.9–113.5k.

- Macro: Fed cut path and softer USD support dips, but caution below 114.0k.

Stay nimble: trade the edges and wait for a close >114.0k or <108.7k for direction. ⚠️

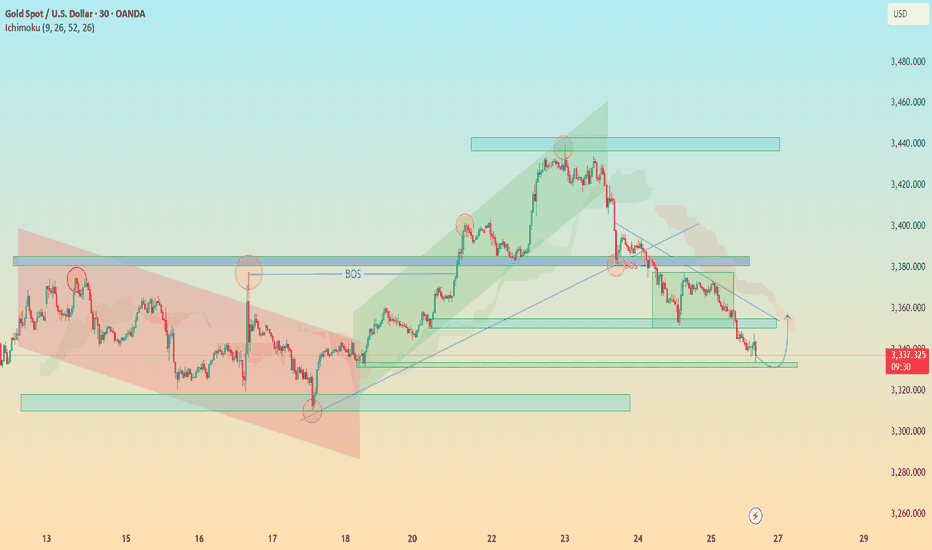

"XAU/USD Hits Major Demand – Is a Relief Rally Brewing?"🟡 XAU/USD (Gold) – Demand Zone Rejection in Play | Bullish Correction Ahead?

Timeframe: 30-Minute | Date: July 25, 2025

Created by: AllyPipsExpert

Indicators: Ichimoku Cloud, BOS (Break of Structure), Dynamic S/R, Trendlines

---

🔍 Technical Analysis & Key Insights:

🔸 1. Market Recap – Distribution & Downtrend Confirmation:

After the Break of Structure (BOS) near 3385, gold confirmed a bearish reversal following the distribution phase at the top resistance zone around 3445–3460.

Bearish momentum was sustained by a descending trendline, paired with a bearish Kumo (Ichimoku cloud) crossover.

🔸 2. Major Zone Tagged – Key Demand Area Tested:

Price has now reached the critical demand block at 3320–3340, a zone that previously initiated bullish impulse on July 18–19.

The current bullish projection (in blue) reflects potential short-term recovery or correction phase, following oversold conditions and historical support strength.

🔸 3. Bullish Reversal Potential – Short-Term Retracement?

The blue arrow reflects a likely bullish retracement toward 3360–3380, aligning with trendline retest and potential Kumo rejection.

Expect sellers to re-enter if price retests former BOS/imbalance zone, creating scalp or swing sell setups on confirmation.

---

🔧 Confluences & Technical Highlights:

Confluence Point Description

Demand Zone Strong previous accumulation at 3320–3340

BOS Retest Area Key liquidity level now acting as resistance

Ichimoku Cloud Price below cloud = bearish bias maintained

Descending Trendline Reinforces bearish structure unless broken

Price Action Rejection wick at demand + potential short squeeze

---

🎯 Trade Outlook:

🧭 Bias: Short-Term Bullish Rebound → Long-Term Bearish Continuation

🟩 Support: 3320 – 3340

🟥 Resistance: 3360 – 3385 (BOS & Trendline zone)

🔁 Scenario: Bounce → Retest → Continuation lower (unless breakout confirmed)

---

📘 Why This Chart Could Be Featured:

✅ Multi-layered Analysis: BOS, zones, cloud, price action, and psychological zones used together.

✅ Forward-Looking: Projects the next logical market reaction instead of just explaining the past.

✅ Clean, Structured, Educational: Layout and visuals guide the viewer through logical trade steps.

✅ Value-Packed: Provides actionable levels and flexible scenarios — helpful to traders of all levels.

BTC 4H analysisIn the previous analysis, the zone of 70 was determining level for us, whether it was a correction or a downward trend.

BTC continued it's upward movement from near that area.

Now Bitcoin is near it's historical resistance area, this time the zone of 110 to 114 plays this role for us.

According to ICHIMOKU and according to previous analysis, Bitcoin tends to move to higher levels marked on the chart.