Indexes

Nasdaq and Indexes Week 22 BiasWhile the Indexes maitain a Bullish perspective on Weekly right now, I would not dare to anticipate next week "Flavour" but rather wait for The New Week Opening and if necessary till FOMC Minutes on Wednesday.

I would like to see immediate rejection from where price it's right now (allowing it to reach the IFVG starting at 20,690.00) to maintain a bullish bias rather then a deeper retrace, otherwise Bias may change on a Daily basis and pause that Weekly View for a later time .

DOW JONES INDEX (US30): Your Plan to Buy Explained

There is a high chance that US30 will resume growth soon.

The index is currently testing a wide daily support cluster.

My signal to buy will be a bullish violation and a candle close above

41920 minor horizontal resistance.

A bullish movement will be anticipated at least to 42200 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Indexes Daily "Slow" Trend anticipationExpecting a Daily slowliness a.k.a. HRLR (ICT Concepts) due to the Bonds decorrelation which is bearish. Once Bonds has reached Sell Side Liquidity Target, acceleration will be seen on Indexes higher. Meanwhile "give and take" is expected on a Daily and 4h basis.

DOLLAR INDEX (DXY): Bullish Reversal Confirmed?!

Dollar Index formed an inverted head and shoulders pattern on a daily.

Its neckline breakout is a strong bullish reversal signal.

The broken neckline of the pattern turns into a significant support now.

We can expect a growth from that at least to 101.25 resistance.

❤️Please, support my work with like, thank you!❤️

DOW JONES INDEX (US30): Another Gap to Watch

US30 is on its way to fill the gap up that was formed 2 days ago.

It looks like the market will reach a gap opening level soon.

I expect a bearish movement at least to 39285

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AAPL About to CRACK!Without Question, AAPL is the best company in the world and the most valuable. However, it means little in this economic landscape.

AAPL is about to start cracking here. I usually do not post them ahead like this, but in this situation, I will break my own rules.

Take your money and RUN!!!

WARNING!! GTFO!

Global Market Overview. Part 2 — U.S. Stock Indices Start of the series here:

Indices? What about the indices?

When the market isn’t an economy, but a chessboard riddled with landmines.

As much as we’d like to see rationality reflected in index charts, indices are not the economy.

They are derivative instruments that track the capital flow into the largest publicly traded companies. In our case — they serve as a mirror of the U.S. stock market. But here’s the thing:

There’s one core principle that most analysts love to forget:

Once interest rates are cut — the game flips bullish.

Cheap money doesn’t lie idle. It flows straight into corporate balance sheets. And one of the first strategies that gets deployed? Buybacks.

Share repurchases are the fastest way to inflate stock prices — without changing the product, the market, or even the strategy. It’s an old Wall Street tune. And it’ll play again the moment Jerome Powell gives the signal to cut. Even if he says, “It’s temporary,” the market won’t care — it’ll act automatically.

But what if the cut doesn’t come?

What if the Fed drags its feet, and U.S.–China relations fully descend into trade war?

What if instead of cheap money, we get a recession?

That scenario benefits neither the U.S. nor China. Despite political theatrics, the two economies are deeply intertwined. Much more so than their leaders admit.

The unspoken threat from China

If Beijing wanted, it could cripple the U.S. economy overnight —

Nationalizing all American-owned assets on Chinese soil, from Apple’s factories to Nike’s logistics chains.

If that happens, dozens of U.S. corporate stocks would be worth less than toilet paper.

But China doesn’t make that move. Because blackmail is not the tool of strategists.

Beijing thinks long-term. Unlike Washington, it counts consequences.

And it knows: with Trump — you can negotiate. You just have to place your pieces right.

Want to understand China? Don’t read a report — read a stratagem.

If you truly want to grasp how Beijing thinks, forget Bloomberg or the Wall Street Journal for a minute.

Open “The 36 Stratagems” — an ancient Chinese treatise that teaches how rulers think.

Not in terms of strong vs. weak — but when, through whom, and against what.

You’ll see why no one’s pressing the red button right now: the game isn’t about quarterly wins — it’s about future control.

The economy is built for growth. That’s not ideology — that’s axiomatic.

Argue all you want about bubbles, fairness, or who started what.

One thing never changes: the global economic model is based on growth.

No ministry or central statistical agency can stand before a microphone and say, “We want things to fall.”

Markets reflect future expectations. And expectations are, by definition, based on belief in growth.

Even crashes are seen as temporary corrections, paving the way for recovery.

That’s why people always buy the dip.

Not retail. Smart money.

Because no panic lasts forever — especially when the whole system is backed by cash.

The U.S. controls the market through headlines

This logic fuels Washington’s strategy.

Today, Powell “waits.”

Tomorrow, the White House stirs panic with tariff threats.

The day after — surprise! “Constructive dialogue.”

And just like that:

Markets rally, dollar corrects, headlines flip from “crisis” to “hope.”

It’s not coincidence. It’s perception management.

Markets crash fast — but they rebound just as fast, once a positive signal drops. Especially when that signal touches the U.S.–China trade front.

One line — “talks are progressing” — and by nightfall, S&P 500 is back in the green.

Why? Because everyone knows:

If there’s de-escalation — it’s not a bounce. It’s a new cycle.

The recovery scenario

Here’s what happens if negotiations progress:

The dollar weakens — capital exits safe havens

S&P 500 and Nasdaq spike — driven by tech and buybacks

Money flows back into risk assets — especially industrials and retail, exposed to international trade

Gold and bonds correct — as fear fades

We don’t live in an era of stability. We live in an era of narrative control.

This isn’t an economic crisis.

This is a crisis of faith in market logic.

But the foundation remains: capital seeks growth.

And if growth is painted via headlines, buybacks, or a surprise rate cut — the market will believe.

Because it has no other choice.

In the markets, it’s not about who’s right —

It’s about who anticipates the shift in narrative first.

SPX Fractal Expansion: New Highs Ahead Despite FearAs of April 14, 2025, the CBOE:SPX is exhibiting a clear fractal expansion, suggesting the beginning of a new bullish leg. The recent correction, which caused widespread panic, appears to have completed a fractal cycle reset, with price respecting historical support near 4704 and forming a new fractal edge around 5300.

Despite the fear-driven selloff, momentum indicators like RSI and MACD show signs of bottoming, and volume surged on rebound days, confirming strong institutional buying. The price is now testing temporary resistance at 5878, with a path open to reclaim all-time highs (6100+).

Global & Technical Tailwinds

Technical momentum is recovering across timeframes, with positive divergence on stochastic oscillators.

Breadth is improving: More stocks are participating in the rally, reflecting internal strength.

Sentiment has flipped: The VIX has cooled from panic levels (above 45), and investor fear is easing.

Macro support: Inflation is declining, and central banks are signaling potential rate cuts by late 2025.

Earnings outlook remains solid, and analysts forecast SPX to end 2025 around 6500–7100.

🔍Conclusion

The SPX is carving out a fractal mirror of past bullish reversals, reinforced by strong macro and technical context. Barring unexpected shocks, the index is likely to break above resistance and push toward new highs, even as residual fear lingers. The setup favors buying dips within this emerging structure.

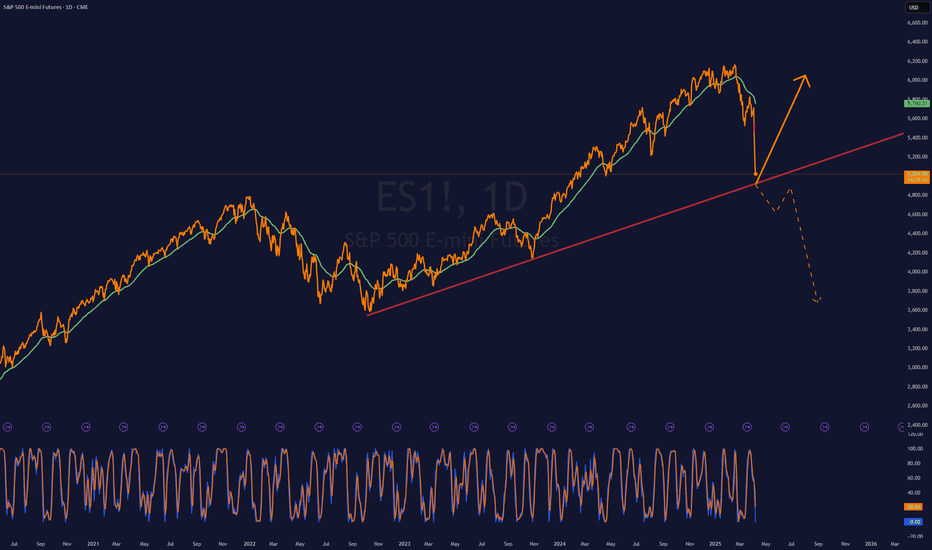

ES where?📉 ES1! - S&P 500 E-mini Futures (Daily)

We’re approaching a critical point on the long-term trendline.

🟠 Price has bounced sharply after a steep pullback, reacting right at the dynamic support that’s held since the 2022 lows.

🟢 Two possible scenarios:

Bullish Continuation: support holds, the index regains momentum and pushes back toward the highs.

Bearish Breakdown: trendline breaks, signaling a potential structural shift with downside targets possibly below 4000.

📊 Momentum indicator is in extreme territory → wait for confirmation, don’t anticipate.

DOW JONES INDEX (US30): Detailed Support & Resistance Analysis

Here is my latest structure analysis for US30 Index.

Resistance 1: 40650 - 40850 area

Resistance 2: 41150 - 41300 area

Resistance 3: 42550 - 42850 area

Support 1: 40000 - 40250 area

Support 2: 39470 - 39650 area

Support 3: 38400 - 38650 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DOLLAR INDEX (DXY): Long-Awaited Recover

It looks like Dollar Index is going to pullback

after a test of a significant support cluster on a daily.

A strong bullish imbalance candle that was formed on an hourly

time frame shows a strong buying interest from that zone.

I expect a bullish movement at least to 102.35

❤️Please, support my work with like, thank you!❤️

NASDAQ INDEX (US100): Bullish Reversal Confirmed?!

I see 2 very strong bullish reversal confirmation on US100 on a daily.

First the market violated a resistance line of a falling channel.

Then, a neckline of a cup & handle pattern was broken.

Both breakouts indicate the strength of the buyers.

We can expect a growth at least to 20300 resistance.

❤️Please, support my work with like, thank you!❤️

DOLLAR INDEX (DXY): Strong Bullish Sentiment

As I predicted yesterday, Dollar Index continued growing.

Analyzing the intraday price action today,

we can see that the market established a nice rising channel on a 4H.

I think that the Index will keep rising within a channel and will reach 105.0 level soon.

❤️Please, support my work with like, thank you!❤️

$GBIRYY -U.K Inflation Rate (February/2025)ECONOMICS:GBIRYY

February/2025

source: Office for National Statistics

- The annual inflation rate in the UK fell to 2.8% in February 2025 from 3% in January, below market expectations of 2.9%, though in line with the Bank of England's forecast.

The largest downward contribution came from prices of clothing which declined for the first time since October 2021 (-0.6% vs 1.8%), led by garments for women and children's clothing.

Inflation also eased in recreation and culture (3.4% vs. 3.8%), particularly in live music admission and recording media, as well as in housing and utilities (1.9% vs. 2.1%), including actual rents for housing (7.4% vs. 7.8%).

In contrast, food inflation was unchanged at 3.3% and prices rose faster for transport (1.8% vs 1.7%) and restaurants and hotels (3.4% vs 3.3%).

Meanwhile, services inflation held steady at 5%.

The annual core inflation rate declined to 3.5% from 3.7%.

Compared to the previous month, the CPI increased 0.4%, rebounding from a 0.1% decline but falling short of the expected 0.5% increase.

DOLLAR INDEX (DXY): Time to Recover

I see a confirmed bullish reversal on Dollar Index

initiated after a test of a key daily horizontal support.

A formation of a double bottom pattern on that and a consequent

violation of its neckline provides a strong bullish signal.

I think that the index will reach at least 105.0 level soon.

❤️Please, support my work with like, thank you!❤️

DOLLAR INDEX (DXY): Bearish Outlook Explained

Dollar Index is currently consolidating within a range on intraday time frames.

Testing its upper boundary, the market formed a double top pattern.

With a strong bearish mood after the opening, the market is going

to drop lower.

Goal - 103.8

❤️Please, support my work with like, thank you!❤️

$USINTR - U.S Interest Rates (March/2025)ECONOMICS:USINTR

March/2025

source: Federal Reserve

- The Fed keep the funds rate unchanged at 4.25%-4.5%,

but signaled expectations of slower economic growth and rising inflation.

The statement also noted that uncertainty around the economic outlook has increased, but officials still anticipate only two quarter-point rate reductions in 2025.

DOW JONES INDEX (US30): Pullback From Resistance

Dow Jones Index looks bearish after a test of a key daily/intraday resistance.

An inverted cup & handle pattern on that on an hourly and a strong

intraday bearish momentum this morning leaves clear bearish clues.

I think that the market can retrace at least to 41580 support.

❤️Please, support my work with like, thank you!❤️

Dollar Index (DXY): Bullish Reversal is Coming?!

Dollar Index is stuck on a key daily horizontal support.

Analyzing the intraday time frames, I spotted an inverted head & shoulders

pattern on a 4H.

Its neckline breakout will be an important event that will signify a bullish reversal.

The index will continue recovering then.

Alternatively, a bearish breakout of the underlined blue support

will push the prices lower.

❤️Please, support my work with like, thank you!❤️

S&P500 INDEX (US500): More Down

With a confirmed bearish breakout of a key daily horizontal support,

US500 index opens a potential for more drop.

Next key support is 5425.

It looks like the market is going to reach that soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.