S&P 500 Daily Chart Analysis For Week of Feb 6, 2026Technical Analysis and Outlook:

The Index exhibited notable volatility during the trading session this week, reflecting one of the most robust rebounds observed to date. It has stabilized above the Mean Support level of 6,892 and below the Key Resistance level of 6,993.

It is anticipated that the Index will continue its upward trajectory toward the target of the Outer Index Rally at 7,026, while helming through the newly established Key Resistance level at 6,993.

However, it is imperative to acknowledge that, given the prevailing market conditions, there is a substantial likelihood of a retracement that may lead to revisiting the Mean Support at 6,892, prior to the Index regaining its bullish momentum and progressing toward the projected outcome of the Outer Index Rally at 7,026. At this stage, an In Force retracement is expected to be initiated from that completed target.

Inflationhedge

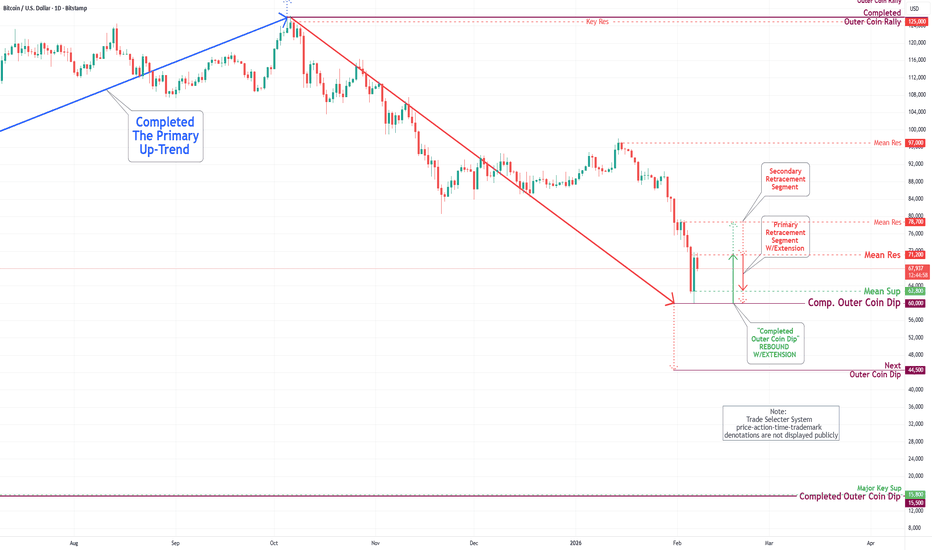

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 6, 2026Technical Analysis and Outlook:

Bitcoin has experienced a substantial decline this trading week. As outlined in the Bitcoin Daily Chart Analysis for the week of January 30, the cryptocurrency adhered closely to our projections by surpassing the critical Mean Support level at 82,000, ultimately achieving the Outer Coin Dip target at 78,500. Additionally, it fulfilled our long-term objective by reaching the subsequent Outer Coin Dip at 64,000. Following this significant milestone, the digital asset experienced a robust rebound, as anticipated.

Current market analysis indicates a potential downward move to revisit the Main Support level at 62,800 and to reach the Outer Coin Dip at 60,000 before reviving upward momentum.

It is essential to highlight that there may be gradual fluctuations between the Mean Support level of 62,800 and the Mean Resistance level of 71,200 before a breakout in either direction. The target for upward movement is a Mean Resistance of 78,700, while the target for downward movement is an Outer Coin Dip at 44,500.

EUR/USD Daily Chart Analysis For Week of Feb 6, 2026Technical Analysis and Outlook:

In the past week’s trading session, the Euro has exhibited a limited trading range, having fallen below the Mean Support level of 1.185 and currently trading closely below the Mean Resistance level of 1.183.

It is anticipated that, following the achievement of the letter target, a retracement towards the Mean Support at 1.177 will commence. This retracement is expected to precipitate a renewed downtrend, with the primary target set at the Outer Currency Dip of 1.166, supported by Mean Support levels at 1.177 and 1.168, which will present consequential hurdles. The rebounds are expected to be initiated from the aforementioned support levels and ultimate reached target the Outer Currency Dip 1.166.

Furthermore, market participants should remain vigilant regarding the potential for the currency to experience a gradual intermediate oscillation between the Mean Support at 1.177 and the Mean Resistance at 1.183 before resuming the downward movement.

S&P 500 Daily Chart Analysis For Week of Jan 30, 2026Technical Analysis and Outlook:

The Index exhibited considerable volatility during the trading session this week, ultimately finding support at the Mean Support level of 6,897. Following this decline, the Index demonstrated a robust rebound and has stabilized just below the Key Resistance level of 6,977.

It is anticipated that the Index will maintain an upward trajectory towards the outstanding target of the Outer Index Rally at 7,026, and contrive the route through the newly established Key Resistance level at 7,000.

Nonetheless, it is crucial to recognize that, given the current market conditions, there is a significant probability of a retracement that may revisit the Mean Support at 6,897 before the Index regains bullish momentum and progresses towards the foretold outcome of the Outer Index Rally at 7,026 in the previous Daily Chart Analysis. At this juncture, a renewed In Force retracement is expected to be initiated from that level.

EUR/USD Daily Chart Analysis For Week of Jan 30, 2026Technical Analysis and Outlook:

Over the past week, the Euro trading session has demonstrated a substantial upward trajectory, surpassing the Interim Inner Currency Rally target of 1.186 and successfully retesting the completed Outer Currency Rally level at 1.191. Upon reaching this target, the Euro achieved the outstanding Outer Currency Rally level of 1.208, thereby activating a retracement towards the current Mean Support at 1.185.

It is anticipated that this retracement will continue toward the Mean Support at 1.178, with the potential extension to the Mean Support at 1.173. At this juncture, a renewed Inner Rebound is expected to initiate from the forenamed support levels.

Furthermore, market participants should be cognizant of the likelihood that the currency will exhibit a gradual intermediate gyration between the Mean Support at 1.185 and the Mean Resistance at 1.191 before resuming the retracement.

S&P 500 Daily Chart Analysis For Week of Jan 23, 2026Technical Analysis and Outlook:

The S&P 500 Index declined substantially during this week's trading session, eliminating both Mean Support levels at 6,902 and 6,850. Following this decline, the Index has demonstrated a striking rebound, stabilizing above the newly established Mean Support level at 6,897. It is projected that the Index will continue its upward trajectory towards the subsequent target of the Outer Index Rally at 7,026, via Key Resistance at 6,977.

However, it is essential to recognize that, given prevailing market conditions, there is a significant likelihood of a study to lower pullbacks that may retest the Mean Support at 6,897 before the Index returns to bullish sentiment and achieves the Outer Index Rally target of 7,026. At this stage, a renewed In Force retracement is anticipated to initiate from that level.

EUR/USD Daily Chart Analysis For Week of Jan 23, 2026Technical Analysis and Outlook:

Over the past week, the Euro trading session has shown a notable upward rally, surpassing the Mean Resistance level at 1.164. This ascent continued toward the completed Interim Inner Currency Rally target of 1.180 and subsequently extended to a new level identified at 1.186.

Upon reaching this target, an In Force retracement is anticipated toward the Mean Support level at 1.178. Nevertheless, market participants should be aware that the currency may continue its trajectory to retest the completed Outer Currency Rally at 1.191, via the Key Resistance level at 1.187. At this juncture, a renewed In Force retracement is expected to be initiated from the Outer Currency Rally at 1.191.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Jan 23, 2026Technical Analysis and Outlook:

Bitcoin dropped dramatically in this week's trading session and continued falling sharply after successfully reaching a target price of Interim Inner Coin Rally 98,000, eliminating both the Mean Support levels at 94,200 and 90,500 in the process.

Current market analysis suggests progressive Intermediate Retest gyration between the Mean Resistance 91,300 and Mean Support 88,300, with a prominent drawdown sentiment currently exerting downward pressure, should the initial support level of Mean Support 88,300 be breached, with an immediate downside targets are identified as Mean Support 85,300, with additional targets such as Mean Support 82,000 and the ultimate outcome of Outer Coin Dip 78,500 underlying below.

On the upside, the coin's rebound, breaching Mean Resistance at 91,300, may drive prices higher before resuming its downward trajectory.

S&P 500 Daily Chart Analysis For Week of Jan 16, 2026Technical Analysis and Outlook:

The S&P 500 Index showed eye-catching bearish sentiment in this week's trading session. The Index has successfully breached and has remained buoyed above the critical Mean Support level at 6,922. It is anticipated that the Index will continue its upward trajectory toward the subsequent target of Outer Index Rally 7,026 via Key Resistance 6,977.

Nonetheless, it is crucial to acknowledge that, given prevailing market conditions, there is a significant probability of steady to lower pullbacks to retest Mean Support at 6,902 before the Index successfully achieves the Key Resistance 6,977 and eventually conquers the Outer Index Rally target of 7,026.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Jan 16, 2026Technical Analysis and Outlook:

This week’s trading activity has concentrated on completing the Interim Inner Coin Rally, successfully reaching a target price of 98,000. Following this completion, the market experienced an immediate pivot.

The principal downside target is identified at Mean Support, positioned at 94,200, which has been partially attained. Given the prevailing dynamics in the Bitcoin market, traders need to monitor price movements diligently.

A prominent drawdown sentiment is currently exerting downward pressure, and should the initial support level be breached, a further decline to the Mean Support level of 90,500 will be the primary target.

On the upside, there is a conceivable intermediate rebound scenario from the previously mentioned support levels, with the primary objective being a retest of the completed Interim Inner Coin Rally at 98,000.

S&P 500 Daily Chart Analysis For Week of Jan 9, 2026Technical Analysis and Outlook:

During the inaugural trading session of the New Year, the S&P 500 Index is demonstrating a pronounced bullish sentiment. The Index has successfully breached the critical Key Resistance level at 6,932 and has also retested the completed Outer Index Rally at 6,945. It is anticipated that the Index will continue its upward trajectory toward the subsequent target of Outer Index Rally 7,026.

Nonetheless, it is crucial to acknowledge that, given prevailing market conditions, there is a significant likelihood of steady to lower pullbacks before the Index successfully achieves the Outer Index Rally target of 7,026. However, the market participants need to be aware that this event will trigger a price action in Force Retracement to the attainable Mean Support level of 6,922.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Jan 9, 2026Technical Analysis and Outlook:

This week's trading activity in the Bitcoin market has focused on completing the Interim Inner Coin Rally at a target price of 98,000. However, the market pivoted from the Mean Resistance level at 93,500, validating its strength by establishing a new Mean Resistance level at 94,000. Conversely, the primary downside target for strong support is identified at 87,000, which may be attained should the Mean Support at 89,500 be breached.

Given the prevailing dynamics in the cryptocurrency market, it is essential for traders to monitor price movements closely. A significant bearish sentiment is exerting downward pressure on prices, with the possibility for an Outer Coin Dip to be reached at 78,500. Additional support levels are indicated at 84,500 and 81,500, further underscoring the need for vigilance in trading strategies.

S&P 500 Daily Chart Analysis For Week of Jan 2, 2026Technical Analysis and Outlook:

During this abbreviated New Year's trading session, the S&P 500 Index is currently continuing to demonstrate an In Force Retracement sentiment. The Index has established a new Mean Support level at 6,833, and it is anticipated that it will persist in its downward trajectory towards the subsequent Mean Support level at 6,877.

It is imperative to recognize that, given the conditions of the market, there exists a considerable probability of a Dead-Cat rebound. This rebound may prompt a retest of the completed Outer Index Rally at 6,945, via the Key Resistance identified at 6,932.

Additionally, it is expected that the prevailing downward sentiment will remain or may even deepen, and intermediate bearish momentum is likely to persist, particularly as the above-named target levels realign with the anticipated market trajectory.

EUR/USD Daily Chart Analysis For Week of Jan 2, 2026Technical Analysis and Outlook:

In the New Year trading week, the Euro market exhibited a notable downward trend, followed by a brief upward trading momentum at the Mean Support level of 1.175.

Given the prevailing conditions in the currency market, a "dead cat" rebound is anticipated from the Mean Support level of 1.171, with a target price identified as the Mean Resistance level of 1.175.

Moreover, it is expected that steady to lower declining intermediate downward momentum will continue once the Mean Resistance level of 1.175 realigns with the anticipated market trajectory.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Jan 2, 2026Technical Analysis and Outlook:

In this New Year's trading week, the Bitcoin market has climbed towards the upper end of our Active Inner Trading Zone (See Daily Chart Analysis For Week of Dec 26, 2025). This breakout from his progressive zone will be met by Mean Resistance at 93,500.

Given the prevailing dynamics in the cryptocurrency market, it is recommended that traders diligently monitor this price movement, as significant momentum is pushing prices toward the Interim Inner Coin Rally at 98,000 and the possibility of advancing to a subsequent Interim Coin Rally at 102,500.

On the downside, the principal target, identified for some time, is the Outer Coin Dip at 78,500, which might be realized once the Mean Resistance 93,500 is hit, along with the Interim Coin Rally at 102,500.

S&P 500 Daily Chart Analysis For Week of Dec 26, 2025Technical Analysis and Outlook:

During this shortened holiday trading session, the S&P 500 Index achieved a significant milestone by completing the highly anticipated Outer Index Rally target of 6,945, surpassing the Key Resistance level of 6,905, which had been forecasted over a considerable period.

At this time, upon the above-mentioned target completion, the index market experienced an admirable pullback; the downside target is currently set at Mean Support 6.877.

It is, however, essential to acknowledge that, given the market's recent gains, there is a substantial likelihood that prices may exhibit an upward fluctuation near this completed target. Additionally, there remains the potential for further upward movement before the anticipated alignment with the projected downward trajectory.

EUR/USD Daily Chart Analysis For Week of Dec 26, 2025Technical Analysis and Outlook:

In the trading session of this holiday week, the Euro market experienced an upward breakout, subsequently retesting the target of the Interim Inner Currency Rally at 1.180 and bypassing the Mean Resistance level at 1.175.

Following this retest, the euro experienced a rapid downward retreat, with the primary objective aiming at the Mean Support level at 1.175. It is important to note that this price point is the inverse of the preceding resistance level. At this juncture, we anticipate a substantial “dead cat” rebound from this support level, targeting a price objective at the Key Resistance level of 1.179.

Furthermore, some intermediate upward momentum may materialize within this downward trend before price levels realign with the anticipated trajectory.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Dec 26, 2025Technical Analysis and Outlook:

The Bitcoin market has traded within a narrow range in the Active Inner Trading Zone during the current holiday season. This progressive zone is characterized by a Mean Resistance level of 90,500 and a Mean Support level of 84,500.

Given the prevailing dynamics in the cryptocurrency market, it is recommended that traders diligently monitor price movements in this Active Trading Zone. A breakout on the upside from this range may lead to vital targets, including an Interim Inner Coin Rally at 98,000, and a subsequent Interim Coin Rally at 102,500. However, it is important to acknowledge that these targets will encounter resistance at the Mean Resistance level of 93,500 before being attained.

On the downside, the principal target, identified for some time, is the Outer Coin Dip at 78,500. This target will be supported by significant backing from the Mean Support level of 82,500, which is situated below the Active Trading Zone’s Mean Support level of 84,500.

S&P 500 Daily Chart Analysis For Week of Dec 19, 2025Technical Analysis and Outlook:

In the most recent weekly trading session, the S&P 500 Index demonstrated significant downward movement followed by a notable recovery, bringing it closer to our primary target for the Outer Index Rally at 6,945.

At this time, the current market positioning indicates robust potential for continued upward momentum, with the principal objective being to reach the Key Resistance level of 6,905. This milestone is expected to contribute towards achieving the anticipated target of the Outer Index Rally at 6,945.

Nonetheless, it is essential to recognize that, given prevailing market dynamics, there is a considerable probability that prices will experience a pullback before realigning with the projected upward trajectory.

EUR/USD Daily Chart Analysis For Week of Dec 19, 2025Technical Analysis and Outlook:

In this week’s trading session, the Euro market experienced an upside breakout, reaching the Interim Inner Currency Rally target at 1.178, having crossed the Mean Resistance level at 1.175. With this completion, current market conditions demonstrate a downward trend, with the primary objective being the Mean Support level at 1.163.

On the upside, we anticipate a healthy dead-cat rebound from the Mean Support at 1.163, aiming for the price zone around 1.169. It’s important to note that some intermediate upward momentum may occur within this downward trend before prices realign with the expected trajectory.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Dec 19, 2025Technical Analysis and Outlook:

The Bitcoin market in this week's trading session continued to trade within an Active Inner Trading Zone defined by the Mean Resistance level at 93,500 and the Mean Support level at 89,300.

Given the current dynamics of the cryptocurrency market, it is advisable for traders to monitor price action in this Active Trading Zone closely. A breakout may lead to additional targets, including an Interim Inner Coin Rally at 98,000 and a subsequent Interim Coin Rally at 102,500. Conversely, on the downside, the established Mean Support levels are situated at 84,700 and 82,500, with the prospect of an Outer Coin Dip occurring at 78,500.

S&P 500 Daily Chart Analysis For Week of Dec 12, 2025Technical Analysis and Outlook:

In the course of the recent weekly trading session, the S&P 500 Index exhibited significant gyrational volatility, reaching a Key Resistance level at 6,895 before retracting to the Major Mean Support level delineated at 6,816.

At present, this market positioning indicates strong potential for continued downward movement, with the primary objective focused on targeting the Mean Support level at 6,755 via heavily traded Mean Support at 6,816.

Nevertheless, it is crucial to recognize that, given current market dynamics, there is a substantial probability of a robust price surge to retest the critical Key Resistance at 6,900, which may be accompanied by a strong rebound to the Outer Index Rally target at 6,945.

EUR/USD Daily Chart Analysis For Week of Dec 12, 2025Technical Analysis and Outlook:

During the most recent trading session, the Eurodollar currency rose sharply, reaching the Mean Resistance level at 1.175, via the Mean Resistance level of 1.167. Current market conditions indicate that the price may pull back to the critical Mean Support level at 1.169.

However, it is also crucial to monitor the breakout level for this currency to the upside by a rise to the Interim Inner Currency Rally 1.178 via Mean Resistance 1.175.

Conversely, on the downside, a major re-ignited retracement may occur from the completed Interim Inner Currency Rally 1.178, with the possibility of extending to the Mean Support 1.163.