Northrop Grumman: Architecting the Future of AI Warfare

Northrop Grumman (NOC) is redefining the defense sector by fusing lethal hardware with digital intelligence. While the delivery of the 1,500th F-35 center fuselage cements its manufacturing legacy, the company’s valuation thesis is shifting. Investors must now analyze Northrop as a master architect of space militarization, autonomous systems, and AI-driven command structures.

Geopolitics and Geostrategy

Global conflicts now demand seamless integration across land, sea, air, and space. Northrop’s Integrated Battle Command System (IBCS) serves as the central nervous system for this new reality. It connects disparate sensors and shooters, creating a unified shield against hypersonic threats. As the space militarization market expands, nations require robust ground systems to command orbital assets. Northrop dominates this geostrategic niche, securing critical infrastructure that nations cannot afford to lose.

Technology and Innovation

The company’s "BattleOne" initiative represents a quantum leap in military logic. This digital ecosystem accelerates decision-making by fusing data from satellites and terrestrial sensors. It utilizes advanced artificial intelligence to predict enemy movements and optimize response times. Northrop is not merely selling weapons; it is selling decision dominance. This move toward software-defined warfare creates a high competitive moat against legacy hardware manufacturers.

Industry Trends: The Rise of Autonomous Mass

The U.S. Air Force currently prioritizes "Collaborative Combat Aircraft" (CCA) to fly alongside manned fighters. Northrop is aggressively targeting this sector with platforms like the "Lumberjack." This one-way attack drone delivers kinetic capabilities at an affordable price point. Furthermore, their ANCILLARY vertical take-off drone eliminates the need for traditional runways. These innovations align perfectly with the industry trend toward "affordable mass" and distributed lethality.

Electronic Warfare and Cyber Security

Nations fight modern warfare in the electromagnetic spectrum. Northrop’s electronic warfare (EW) solutions actively jam enemy communications while shielding friendly networks. These systems integrate cyber resilience directly into the hardware architecture. As adversaries develop sophisticated jamming techniques, Northrop’s multispectral capabilities become non-negotiable for the Pentagon. This ensures recurring revenue streams for constant software and hardware upgrades.

Business Models and Economics

Management is adapting its business model to match tightening fiscal environments. The shift toward platforms like Lumberjack signals a pivot from low-volume, high-cost units to high-volume, lower-cost attrition assets. This diversification protects the balance sheet against potential budget cuts to expensive flagship programs. By balancing the massive F-35 supply chain with agile drone production, the company optimizes its revenue mix.

Management and Leadership

Executive leadership demonstrates strategic agility by embracing digital engineering. They are successfully navigating the transition from a hardware-first mindset to an AI-centric strategy. Their ability to deliver on legacy contracts while funding speculative high-tech ventures instills confidence. Leadership is effectively positioning the firm to capture the lion's share of the Joint All-Domain Command and Control (JADC2) budget.

Conclusion

Northrop Grumman has evolved beyond the definition of a traditional defense contractor. It stands as a technology powerhouse integrating space, AI, and autonomous systems. The company effectively monetizes the complexity of modern warfare. For investors, NOC represents a strategic play on the convergence of silicon and steel in the 21st century.

Innovation

Kiniksa Pharmaceuticals Strategic Dominance Kiniksa Pharmaceuticals (KNSA): Strategic Dominance in Inflammation Therapy

Kiniksa Pharmaceuticals (KNSA) has executed a decisive pivot from clinical speculation to commercial profitability. Driven by the aggressive expansion of its flagship asset, ARCALYST (rilonacept), the company has fundamentally altered the treatment landscape for recurrent pericarditis. The company’s ability to "flip the script" from a net loss to an $18.4 million profit in Q3 2025 signals a maturation of its business model that warrants serious investor attention.

Industry Trends: The Shift in Standard of Care

The cardiovascular landscape is moving away from broad-spectrum anti-inflammatories toward precision biologics. Historically, recurrent pericarditis—a debilitating inflammation of the heart's sac was treated with NSAIDs or corticosteroids, often with poor long-term outcomes.

Kiniksa has capitalized on this unmet need by establishing ARCALYST as the first and only FDA-approved therapy specifically for this indication. The trend is clear: physicians are abandoning "watch and wait" approaches in favor of targeted Interleukin-1 (IL-1) blockers. The data support this shift, with over 3,825 physicians now prescribing the drug, including 350 new prescribers in the third quarter alone.

Financial Performance: A Profitability Inflection

Kiniksa’s Q3 2025 financials reveal a company hitting its stride.

* Revenue Surge: Quarterly revenue hit $ 180.9 million , a $69 million jump year-over-year.

* Guidance Raise: Management increased full-year revenue guidance to $670–$675 million .

* Bottom Line: The company reported $18.4 million in net income, reversing a $12.7 million loss from the prior year.

This financial discipline suggests Kiniksa is no longer reliant on dilutive capital raises to fund operations, a rare stability marker in the volatile mid-cap biotech sector.

Innovation & Science: The Next-Gen Pipeline

While ARCALYST drives current cash flow, Kiniksa’s long-term value lies in KPL-387 . This investigational therapy targets the same IL-1 alpha and beta pathways but offers a significant upgrade in delivery: a monthly injection.

Currently, ARCALYST requires weekly dosing. A monthly alternative would drastically improve patient compliance and "stickiness," fortifying Kiniksa's moat against future competitors. With Phase 2 results expected in the second half of 2026, this asset represents a potent call option on the company’s future growth.

Business Model: Patient Retention

Kiniksa’s commercial strategy focuses on the duration of therapy. The average patient now remains on ARCALYST for 32 months , up from 30 months previously. This increase in "lifetime value" per patient is a direct result of aggressive prescriber education and patient support programs. Furthermore, 20% of prescriptions are now written after a first recurrence, indicating the drug is moving earlier in the treatment line, a critical expander of the total addressable market (TAM).

Market Sentiment & Valuation

Despite the bullish fundamentals, KNSA stock trades at a discount to analyst expectations.

* Current Price: ~$42

* Average Price Target: $54

* Analyst Consensus: 7 "Strong Buy" / 1 "Moderate Buy."

The market appears to be discounting the durability of the ARCALYST franchise, perhaps fearing a growth plateau. However, with only 15% market penetration among eligible patients, the data suggests the growth runway remains substantial.

Summary

Kiniksa Pharmaceuticals has successfully transitioned from a "burn" story to an "earn" story. With a profitable quarter, a growing monopoly in pericarditis, and a de-risked pipeline asset in KPL-387, the company presents a compelling risk/reward profile. The divergence between the stock price ($42) and the average target ($54) offers a clear tactical entry point for investors seeking exposure to high-growth, profitable biotech.

Mobileye 2026: Reclaiming the ADAS Throne with EyeQ6HMobileye (MBLY) kicked off 2026 with a decisive victory, securing a massive production deal with a top-10 U.S. automaker. This agreement integrates Mobileye’s "Surround ADAS" into millions of vehicles as standard equipment. The market responded immediately, sending shares up 7% in early January trading. This win signals a strategic pivot for the industry, prioritizing scalable safety over elusive fully autonomous dreams.

Geostrategy: Balancing the US-China Tech Divide

Global regulatory pressures are accelerating the adoption of Advanced Driver Assistance Systems (ADAS). Europe’s latest mandates for automatic braking and driver monitoring have forced automakers to seek rapid, reliable solutions. While Chinese OEMs lead in urban "Navigation on Autopilot," Western manufacturers are now fighting back. By securing a major U.S. player, Mobileye reinforces its position as the preferred partner for "Eyes-on, Hands-off" highway technology across North America and Europe.

Technology: The Efficiency of Heterogeneous Computing

The EyeQ6H chip is the crown jewel of this new partnership. Unlike competitors who focus solely on raw "TOPS" (Tera Operations Per Second), Mobileye emphasizes power efficiency and hardware-software co-design. The EyeQ6H utilizes a specialized architecture, including Vector Microcode Processors (VMP) and Deep Learning Accelerators (XNN). This design allows a single chip to process data from up to 11 sensors, enabling highway speeds of 81 mph (130 kph) with minimal power draw.

Business Model: ECU Consolidation and Cost Leadership

Automakers are currently struggling with the rising complexity of vehicle electronics. Mobileye’s "Surround ADAS" offers a way to simplify this architecture. By consolidating multiple driving and safety functions onto a single Electronic Control Unit (ECU), manufacturers can significantly reduce production costs. This business model appeals directly to mass-market brands needing to offer premium features without premium price tags. The current deal targets 9 million units, proving that Mobileye’s "democratization of safety" is finally scaling.

Macroeconomics: Navigating the Post-Shutdown Recovery

The 43-day U.S. government shutdown in late 2025 created a vacuum in regulatory approvals and economic data. As federal agencies resume operations, the automotive sector is bracing for a wave of new safety certifications. Mobileye’s proven track record—with over 200 million vehicles already using its technology—gives it an edge in this "bottleneck" environment. Investors view this new contract as a high-visibility revenue bridge that offsets previous concerns about slower robotaxi deployments.

Innovation and Patent Moats: The REM Advantage

Mobileye’s true competitive moat lies in its Road Experience Management (REM) data. Over 8 million vehicles currently harvest anonymized, crowdsourced mapping data globally. This patented approach allows Mobileye-equipped cars to "see" the road with centimeter-level precision without expensive LiDAR. This scientific advantage in localization and mapping makes their systems easier to deploy at scale than "vision-only" or "LiDAR-heavy" alternatives.

Can One Fund Bridge the $13 Trillion Private Market Gap?The ERShares Private-Public Crossover ETF (XOVR) represents a groundbreaking financial innovation that democratizes access to private equity investments, which have traditionally been reserved for institutional players and accredited investors. Following a strategic relaunch in August 2024, the fund has experienced remarkable growth, with assets under management reaching $481.5 million and attracting over $120 million in inflows since its initial SpaceX Investment. Built on Dr. Joel Shulman's proprietary "Entrepreneur Factor" methodology, XOVR combines the proven ER30TR Index (which accounts for over 85% of its portfolio) with carefully selected private equity holdings, creating a unique structure that offers daily liquidity and transparency while capturing pre-IPO value creation.

The fund's investment thesis centers on identifying companies at the convergence of technology, national security, and global strategy. Its marquee private holdings - SpaceX and Anduril Industries - exemplify this approach, representing critical players in a privatized defense industrial base. SpaceX has evolved beyond a commercial space company into a geostrategic asset through Starlink, which serves as essential communication infrastructure in modern conflicts, such as Ukraine. Anduril's AI-powered Lattice platform and its recent $159 million contract with the U.S. Army for mixed reality systems illustrate the military's shift towards agile, software-focused defense solutions. Both companies have constructed formidable competitive moats through technological innovation and robust intellectual property portfolios.

XOVR's performance validates its high-conviction strategy, delivering a 33.46% total return over the past year compared to its benchmark's 26.48%, with three-year annualized returns of 28.11%. The fund's concentrated approach - with top ten holdings comprising over 50% of the portfolio - is a deliberate design choice that enables outsized returns by taking conviction positions in category-defining innovators. Rather than following market trends, XOVR positions investors at the source of innovation, leveraging its unique structure to identify and access the next generation of disruptive companies with the potential to become tomorrow's market leaders.

The fund represents more than an investment vehicle; it embodies a fundamental shift in capital allocation that recognizes the blurring lines between public and private enterprise. By combining the accessibility and liquidity of public markets with the growth potential of private investments, XOVR offers retail investors unprecedented access to value creation opportunities that were once the exclusive domain of institutional players, positioning them to participate in the technological and strategic innovations that will define the next decade.

IonQ (IONQ) — Quantum Leader Targeting 8,000 Logical QubitsCompany Overview:

IonQ, Inc. NYSE:IONQ is a quantum computing pioneer using trapped-ion technology to solve problems beyond the reach of classical systems, offering investors exposure to the fast-growing quantum sector.

Key Catalysts:

Quantum communications expansion: Strategic acquisitions (e.g., Capella Space) and investments in quantum networking aim to build a future quantum internet.

Talent & execution strength: High-profile hires like Dr. Marco Pistoia (ex-JPMorgan) and Dr. Rick Muller (ex-IARPA) enhance R&D capabilities.

Long-term roadmap: Goal of 8,000 logical qubits by 2030, a milestone that could cement its competitive edge and drive adoption of practical quantum applications.

Investment Outlook:

Bullish above: $35.00–$36.00

Upside target: $80.00–$82.00, supported by tech milestones, strategic expansion, and top-tier talent.

#IONQ #QuantumComputing #Innovation #AI #QuantumInternet #Investing #TechGrowth

How Does a Silent Giant Dominate Critical Technologies?Teledyne Technologies has quietly established itself as a formidable force across defense, aerospace, marine, and space markets through a disciplined strategy of strategic positioning and technological integration. The company recently reported record Q2 2025 results with net sales of $1.51 billion (10.2% increase) and demonstrated exceptional organic growth across all business segments. This performance reflects not market timing but the culmination of deliberate long-term positioning at the intersection of mission-critical, high-barrier-to-entry markets where geopolitical factors create natural competitive advantages.

The company's strategic acumen is exemplified by products like the Black Hornet Nano micro-UAV, which has proven its tactical value in conflicts from Afghanistan to Ukraine, and the emerging Black Recon autonomous drone system for armored vehicles. Teledyne has strengthened its market position through geopolitically aligned partnerships, such as its collaboration with Japan's ACSL for NDAA-compliant drone solutions, effectively turning regulatory compliance into a competitive moat against non-allied competitors. The 2021 acquisition of FLIR Systems for $8.2 billion demonstrated horizontal integration mastery, with thermal imaging technology now deployed across multiple product lines and market segments.

Teledyne's competitive advantage extends beyond products to intellectual property dominance, holding 5,131 patents globally with an exceptional 85.6% USPTO grant rate. These patents span imaging and photonics (38%), defense and aerospace electronics (33%), and scientific instrumentation (29%), with frequent citations by industry giants like Boeing and Samsung indicating their foundational nature. The company's $474 million annual R&D investment, supported by 4,700 engineers with advanced degrees, ensures continuous innovation while building legal barriers against competitors.

The company has proactively positioned itself to meet emerging regulatory requirements, particularly the Department of Defense's new Cybersecurity Maturity Model Certification (CMMC) mandate, which takes effect in October 2025. Teledyne's existing cybersecurity infrastructure and certifications provide a crucial advantage in meeting these standards, creating an additional "compliance moat" that will likely enable the company to capture increased defense contract opportunities as competitors struggle with new requirements.

Can One Company Turn Global Tensions Into Battery Gold?LG Energy Solution has emerged as a dominant force in the battery sector in 2025, capitalizing on geopolitical shifts and market disruptions to secure its position as a global leader. The company's stock has surged 11.49% year-to-date to 388,000 KRW by August 12, driven by strategic partnerships and a pivotal $4.3 billion deal with Tesla for LFP battery supply from its Michigan facility. This partnership not only reduces Tesla's dependence on Chinese suppliers but also strengthens LG's foothold in the critical US market amid escalating trade tensions.

The company's strategic expansion in US manufacturing represents a calculated response to changing geopolitical dynamics and economic incentives. LG is aggressively scaling its Michigan factory capacity from 17GWh to 30GWh by 2026, while repurposing EV production lines for energy storage systems (ESS) to meet surging demand from renewable energy projects and AI data centers. Despite a global slowdown in EV demand, LG has successfully pivoted to capitalize on the booming ESS market, with Q2 2025 operating profits rising 31.4% to KRW 492.2 billion, largely attributed to US production incentives and strategic positioning.

LG's technological leadership and intellectual property portfolio serve as key differentiators in an increasingly competitive landscape. The company is pioneering advanced LMR battery technology, promising 30% higher energy density than LFP batteries by 2028, while maintaining over 200 LMR patents and aggressively enforcing its IP rights through successful court injunctions. Beyond technology, LG's commitment to sustainability through its RE100 initiative and integration of high-tech solutions for smart grids and AI-enabled energy systems positions the company at the forefront of the clean energy transition, making it a compelling investment opportunity in the rapidly evolving battery and energy storage sector.

Can Global Chaos Fuel Pharmaceutical Giants?Merck's remarkable growth trajectory demonstrates how a pharmaceutical leader can transform global uncertainties into strategic advantages. The company has masterfully navigated geopolitical tensions, including US-China trade disputes, by diversifying supply chains and establishing regionalized manufacturing networks. Simultaneously, Merck has capitalized on macroeconomic trends such as aging populations and rising chronic disease prevalence, which create sustained demand for pharmaceutical products regardless of economic fluctuations. This strategic positioning allows the company to thrive amid global instability while securing revenue streams through demographic tailwinds.

The foundation of Merck's success lies in its innovation engine, powered by cutting-edge scientific breakthroughs and comprehensive digital transformation. The company's partnership with Moderna for mRNA technology and its continued expansion of Keytruda's indications exemplify its ability to leverage both external collaborations and internal R&D prowess. Merck has strategically integrated artificial intelligence, big data analytics, and advanced manufacturing techniques across its operations, creating a holistic competitive advantage that accelerates drug development, reduces costs, and improves time-to-market efficiency.

Protecting future growth requires fortress-like defenses of intellectual property and cybersecurity assets. Merck employs sophisticated patent lifecycle management strategies, including aggressive biosimilar defense and continuous indication expansions, to extend the commercial life of blockbuster drugs beyond their primary patent expiry. The company's substantial cybersecurity investments safeguard its valuable R&D data and intellectual property from increasingly sophisticated threats, including state-sponsored espionage, thereby ensuring operational continuity and a competitive advantage.

Looking forward, Merck's sustained momentum depends on its ability to maintain this multifaceted approach while adapting to evolving market dynamics. The company's commitment to ESG principles and corporate social responsibility not only attracts socially conscious investors but also helps retain top talent in a competitive landscape. By combining organic innovation with strategic acquisitions, robust IP protection, and proactive risk management, Merck has positioned itself as a resilient leader capable of converting global complexity into sustained pharmaceutical dominance.

Is Nissan's Future Fading or Forging Ahead?Nissan Motor Company, once a titan of the global automotive industry, navigates a complex landscape. Recent events highlight the immediate vulnerabilities. A powerful 8.8-magnitude earthquake off Russia's Kamchatka Peninsula on July 30, 2025, triggered Pacific-wide tsunami alerts. This seismic event prompted Nissan to **suspend operations at certain domestic factories in Japan**, prioritizing employee safety. While a necessary precaution, such disruptions underscore the fragility of global supply chains and manufacturing, potentially impacting production targets and delivery schedules. This immediate response follows a period of significant operational adjustments as Nissan grapples with broader economic, geopolitical, and technological headwinds.

Beyond natural disasters, Nissan faces substantial financial and market share challenges. Although Fiscal Year 2023 saw operating profit and net income increases, global sales volume remained largely stagnant at 3.44 million units, signaling intensified market competition. Projections for Fiscal Year 2024 indicate a **forecasted revenue decline**, and recent U.S. sales figures show an 8% year-on-year drop in Q1 2025. Macroeconomic pressures, including inflation, volatile currency fluctuations, and a significant hit from **billions of dollars in lease losses** due to plummeting used car values, have directly impacted profitability. Geopolitical tensions, particularly the threat of a 24% U.S. tariff on Japanese auto exports, further threaten Nissan's crucial North American market.

Nissan's struggles extend into the technological arena and its innovation strategy. Despite holding a **remarkable patent portfolio** with over 10,000 active families, the company faces criticism for **lagging in electric vehicle (EV) adoption** and perceived technological stagnation. The slow rollout and underwhelming market impact of new EV models, coupled with a notable absence in the booming hybrid market, have allowed competitors to gain significant ground. Moreover, the brand has contended with **multiple cybersecurity breaches**, compromising customer and employee data, which damages trust and incurs remediation costs. Internal factors, including the lingering effects of the **Carlos Ghosn scandal**, management instability, and costly product recalls—like the recent July 2025 recall of over 480,000 vehicles due to engine defects—have further eroded investor confidence and brand reputation. Nissan's journey ahead remains uncertain as it strives to regain its competitive edge amidst these multifaceted pressures.

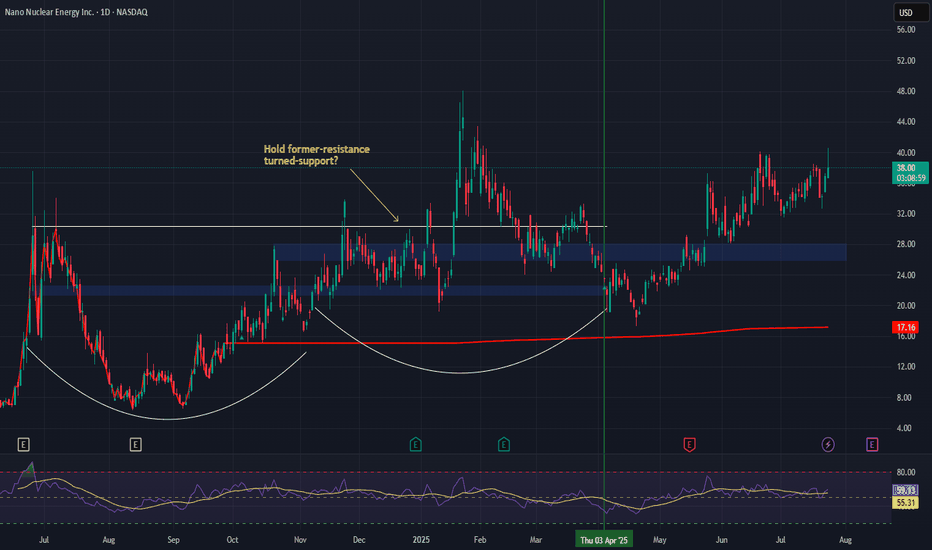

Nano Nuclear (NNE) –Powering the Future of Clean U.S. Energy 🇺sCompany Snapshot:

Nano Nuclear Energy NASDAQ:NNE is a pioneering U.S.-based microreactor company developing compact, modular nuclear power solutions for defense, medical, and national grid applications.

Key Catalysts:

Nuclear Innovation Meets Energy Independence 🔌

NNE is at the forefront of advanced nuclear tech, supporting America’s push toward energy resilience and decarbonization.

Its microreactors are designed for fast deployment, critical for defense bases, hospitals, and remote power needs.

Strong Market Momentum 📈

Since our initial entry on April 3rd, NNE has surged 74%, reflecting rising investor interest in nuclear solutions.

After printing a higher high, the stock is pulling back toward a key support zone.

Policy & Investor Tailwinds 📊

U.S. energy policy is increasingly focused on nuclear as a clean base-load source, giving NNE a strategic edge.

Growing institutional attention on microreactors as scalable, next-gen energy infrastructure.

Investment Outlook:

Bullish Entry Zone: $26.00–$27.00

Upside Target: $58.00–$60.00, supported by innovation, policy alignment, and long-term energy demand.

🔆 NNE is shaping up as a high-conviction play on America’s nuclear energy future.

#NNE #NuclearEnergy #Microreactor #CleanEnergy #EnergySecurity #DefenseTech #GridStability #Innovation #GreenEnergy #NextGenPower #EnergyIndependence

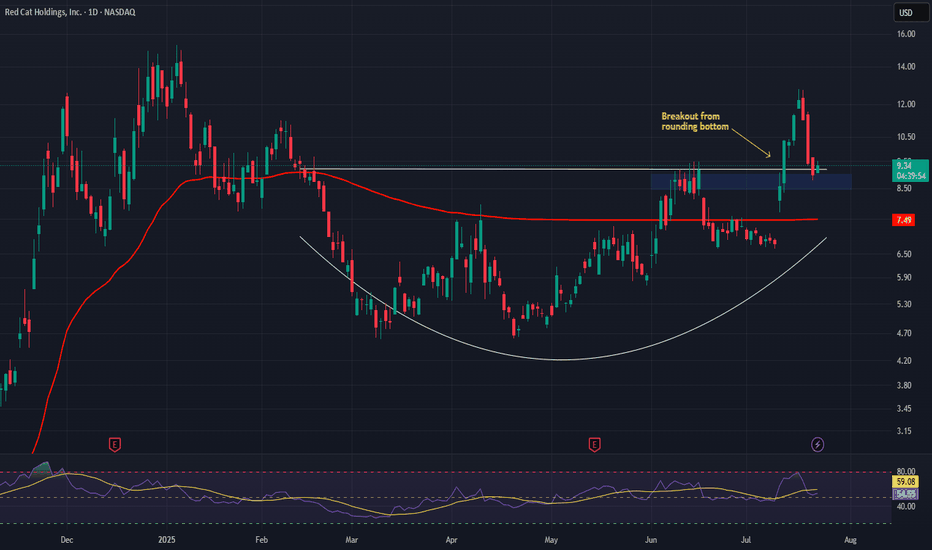

Red Cat Holdings (RCAT) – Soaring with Defense & Global DemandCompany Snapshot:

Red Cat NASDAQ:RCAT is an emerging UAV (drone) technology leader, rapidly scaling through defense-grade contracts, global expansion, and vertical integration.

Key Catalysts:

Defense Sector Traction 🎯

Recent U.S. DoD contract wins underscore RCAT’s credibility as a mission-critical UAV supplier.

Sequential revenue growth in earnings signals accelerating adoption in defense and commercial markets.

Global Expansion Strategy 🌐

RCAT is diversifying via allied procurement programs, reducing dependence on U.S. defense budgets and broadening international exposure.

Tech Stack Integration ⚙️

Strategic acquisitions are bolstering RCAT’s in-house capabilities—driving vertical integration, improving margins, and fueling innovation velocity.

Investment Outlook:

Bullish Entry Zone: Above $8.50–$9.00

Upside Target: $15.00–$16.00, supported by defense contract momentum, global reach, and a strengthened tech edge.

🛡️ RCAT is becoming a high-leverage play on modern defense tech with scalable, global upside.

#RCAT #DefenseStocks #UAV #DroneTechnology #MilitaryContracts #Innovation #DoD #Aerospace #Geopolitics #GrowthStocks #VerticalIntegration

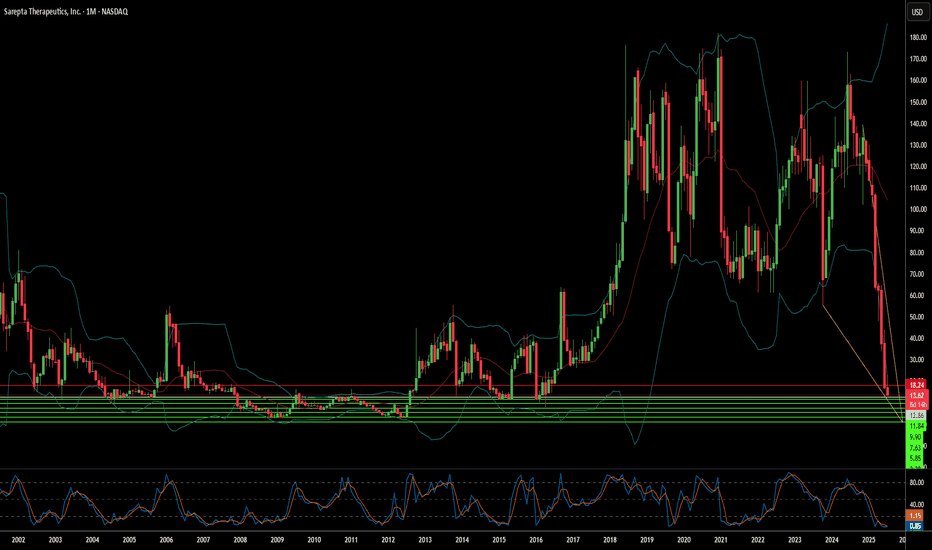

Sarepta's Plunge: A Confluence of Challenges?Sarepta Therapeutics (SRPT) faces significant market headwinds. The company's stock has seen a notable decline. This stems from multiple, interconnected factors. Its flagship gene therapy, ELEVIDYS, is central to these challenges. Recent patient deaths linked to similar gene technology raised safety concerns. The FDA requested a voluntary pause in Elevidys shipments. This followed a "black box warning" for liver injury. The confirmatory EMBARK trial for Elevidys also missed its primary endpoint. These clinical and regulatory setbacks significantly impacted investor confidence.

Beyond specific drug issues, broader industry dynamics affect Sarepta. Macroeconomic pressures, like rising interest rates, reduce biotech valuations. Geopolitical tensions disrupt global supply chains. They also hinder international scientific collaboration. The intellectual property landscape is increasingly complex. Patent challenges and expirations threaten revenue streams. Cybersecurity risks also loom large for pharmaceutical companies. Data breaches could compromise sensitive R&D and patient information.

The regulatory environment is evolving. The FDA demands more robust confirmatory data for gene therapies. This creates prolonged uncertainty for accelerated approvals. Government initiatives, like the Inflation Reduction Act, aim to control drug costs. These policies could reduce future revenue projections. Sarepta's reliance on AAV technology also presents inherent risks. Next-generation gene editing technologies could disrupt its current pipeline. All these factors combine to amplify each negative impact.

Sarepta's recovery depends on strategic navigation. Securing full FDA approval for Elevidys is crucial. Expanding its label and maximizing commercial potential are key. Diversifying its pipeline beyond a single asset could de-risk the company. Disciplined cost management is essential in this challenging economic climate. Collaborations could provide financial support and expertise. Sarepta's journey offers insights into the broader gene therapy sector's maturity.

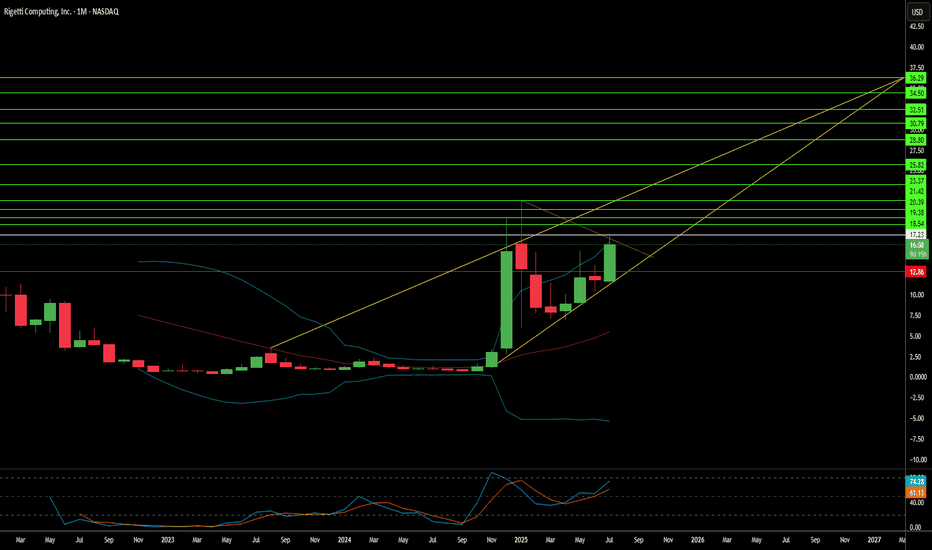

Rigetti: Quantum Mirage or Computing's Next Frontier?Rigetti Computing, a pioneer in quantum computing, recently commanded market attention with a significant 41% surge in its stock. This jump followed a critical technological breakthrough: achieving 99.5% median 2-qubit gate fidelity on its modular 36-qubit system. This represents a twofold reduction in error rates from previous benchmarks, a vital step toward practical quantum applications. Rigetti's superconducting qubits offer gate speeds over 1,000 times faster than competing modalities like ion traps, leveraging semiconductor industry techniques for scalability. The company plans to launch its 36-qubit system by mid-2025 and aims for a 100+ qubit system by year-end, underscoring its rapid technological roadmap.

Beyond technical achievements, strategic partnerships and government contracts bolster Rigetti's position. A substantial $100 million manufacturing deal and a $35 million equity investment from server giant Quanta validate Rigetti's modular architecture. Government backing also provides a stable revenue stream, including a $1 million DARPA award for developing "utility-scale quantum computing" and a $5.48 million Air Force consortium award for advanced chip fabrication. The company further secured three UK Innovate awards for quantum error correction. These collaborations signal confidence from both private industry and national defense initiatives, crucial for a sector still in its nascent stages of commercialization.

Despite these positives, Rigetti's financial metrics reflect the high-risk, high-reward nature of quantum investment. While its market capitalization stands at a robust $5.5 billion, Q1 2025 revenue declined over 50% year-over-year to $1.5 million. Operating expenses remain substantial, with the company operating at a loss. Rigetti's valuation hinges on future potential rather than current profitability, trading at a high price-to-sales ratio. This places immense pressure on the company to meet ambitious technological milestones and rapidly scale revenue in the coming years, transforming speculative bets into tangible commercial success.

The broader quantum computing landscape is marked by intense competition and geopolitical implications. Giants like IBM and Google, also leveraging superconducting qubits, race alongside Rigetti. The sector's projected market size varies wildly, reflecting ongoing uncertainty about widespread commercial adoption. From a geostrategic perspective, quantum computing poses both a national security threat to current encryption and an opportunity for military advancement, driving a global race in post-quantum cryptography. Rigetti's extensive patent portfolio, comprising 37 quantum computing patents, underscores its intellectual property differentiation. However, macroeconomic factors, including rising interest rates, could tighten venture capital funding for speculative high-tech ventures, adding another layer of complexity to Rigetti's path forward.

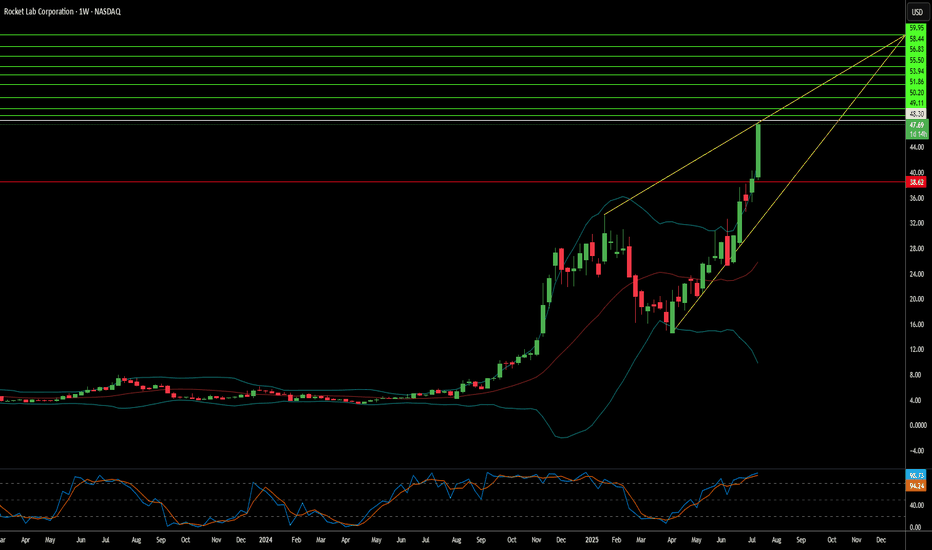

Is Rocket Lab the Future of Space Commerce?Rocket Lab (RKLB) is rapidly ascending as a pivotal force in the burgeoning commercial space industry. The company's vertically integrated model, spanning launch services, spacecraft manufacturing, and component production, distinguishes it as a comprehensive solutions provider. With key operations and launch sites in both the U.S. and New Zealand, Rocket Lab leverages a strategic geographic presence, particularly its strong U.S. footprint. This dual-nation capability is crucial for securing sensitive U.S. government and national security contracts, aligning perfectly with the U.S. imperative for resilient, domestic space supply chains in an era of heightened geopolitical competition. This positions Rocket Lab as a trusted partner for Western allies, mitigating supply chain risks for critical missions and bolstering its competitive edge.

The company's growth is inextricably linked to significant global shifts. The space economy is projected to surge from $630 billion in 2023 to $1.8 trillion by 2035, driven by decreasing launch costs and increasing demand for satellite data. Space is now a critical domain for national security, compelling governments to rely on commercial entities for responsive and reliable access to orbit. Rocket Lab's Electron rocket, with over 40 launches and a 91% success rate, is ideally suited for the burgeoning small satellite market, vital for Earth observation and global communications. Its ongoing development of Neutron, a reusable medium-lift rocket, promises to further reduce costs and increase launch cadence, targeting the expansive market for mega-constellations and human spaceflight.

Rocket Lab's strategic acquisitions, such as SolAero and Sinclair Interplanetary, enhance its in-house manufacturing capabilities, allowing greater control over the entire space value chain. This vertical integration not only streamlines operations and reduces lead times but also establishes a significant barrier to entry for competitors. While facing stiff competition from industry giants like SpaceX and emerging players, Rocket Lab's diversified approach into higher-margin space systems and its proven reliability position it strongly. Its strategic partnerships further validate its technological prowess and operational excellence, ensuring a robust position in an increasingly competitive landscape. As the company explores new frontiers like on-orbit servicing and in-space manufacturing, Rocket Lab continues to demonstrate the strategic foresight necessary to thrive in the dynamic new space race.

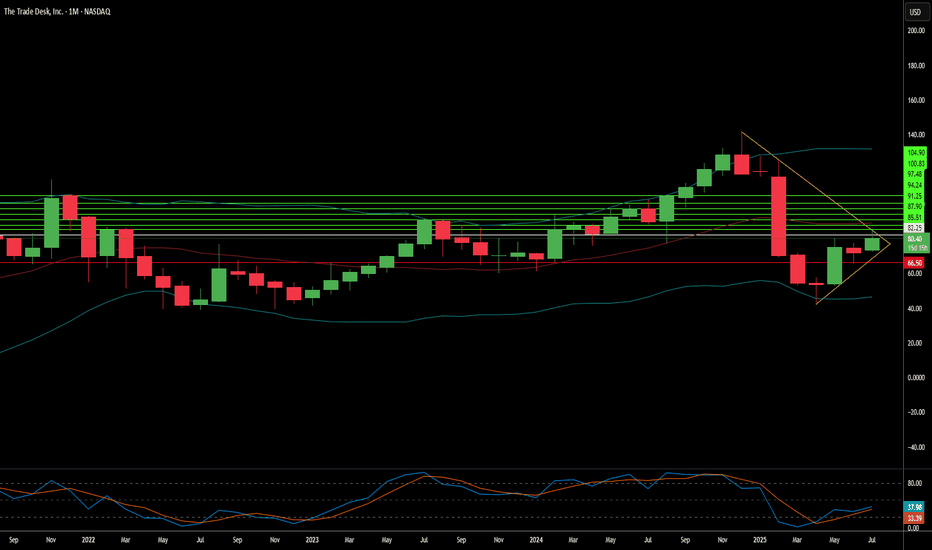

The Trade Desk: Why the Sudden Surge?The Trade Desk (TTD) recently experienced a significant stock surge. This rise stems from both immediate market catalysts and robust underlying business fundamentals. A primary driver was its inclusion in the prestigious S&P 500 index, replacing Ansys Inc. This move, effective July 18, immediately triggered mandated buying from index funds and ETFs. Such inclusion validates TTD's market importance and enhances its visibility and liquidity. This artificial demand floor, coupled with TTD's $37 billion market capitalization, underscores its growing influence within the financial landscape.

Beyond index inclusion, TTD benefits from a significant structural shift in advertising. Programmatic advertising is rapidly replacing traditional media buying, expected to account for nearly 90% of digital display ad spending by 2025. This growth is driven by advertisers' need for transparent ROI, publishers avoiding "walled gardens" through platforms like TTD's OpenPath, and AI-driven innovation. TTD's AI platform, Kokai, greatly lowers acquisition costs and enhances reach, resulting in over 95% client retention. Strategic partnerships in high-growth areas like Connected TV (CTV) further reinforce TTD's leadership.

Financially, The Trade Desk demonstrates remarkable resilience and growth. Its Q2 2025 revenue growth of 17% outpaces the broader programmatic market. Adjusted EBITDA margins hit 38%, reflecting strong operational efficiency. While TTD trades at a premium valuation - over 13x 2025 sales targets-its high profitability, substantial cash flow, and historical investor returns support this. Despite intense competition and regulatory scrutiny, TTD's consistent market share gains and strategic positioning in an expanding digital ad market make it a compelling long-term investment.

Soaring High: What Fuels GE Aerospace's Ascent?GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture and proprietary platforms. This market leadership, coupled with formidable barriers to entry and significant switching costs in the aircraft engine industry, secures a robust competitive advantage. Furthermore, a highly profitable aftermarket business, driven by long-term maintenance contracts and an expanding installed engine base, provides a resilient, recurring revenue stream. This lucrative segment buffers the company against cyclicality and ensures consistent earnings visibility.

Macroeconomic tailwinds also play a crucial role in GE Aerospace's sustained growth. Global air travel is steadily increasing, driving higher aircraft utilization rates. This directly translates to greater demand for new engines and, more importantly, consistent aftermarket servicing, which is a core profit driver for GE Aerospace. Management, under CEO Larry Culp, has also strategically navigated external challenges. They localized supply chains, secured alternate component sources, and optimized logistics costs. These actions proved critical in mitigating the impact of new tariff regimes and broader trade war tensions.

Geopolitical developments have significantly shaped GE Aerospace's trajectory. Notably, the U.S. government's decision to lift restrictions on exporting aircraft engines, including LEAP-1C and GE CF34 engines, to China's Commercial Aircraft Corporation of China (COMAC) reopened a vital market channel. This move, occurring amidst a complex U.S.-China trade environment, underscores the strategic importance of GE Aerospace's technology on the global stage. The company's robust financial performance further solidifies its position, with strong earnings beats, a healthy return on equity, and positive outlooks from a majority of Wall Street analysts. Institutional investors are actively increasing their stakes, signaling strong market confidence in GE Aerospace's continued growth potential.

Can Ondas Holdings Redefine Defense Tech Investment?Ondas Holdings (NASDAQ: ONDS) is carving a distinct path in the evolving defense technology landscape, strategically positioning itself amid escalating global tensions and the modernization of warfare. The company’s rise stems from a synergistic approach, combining innovative autonomous drone and private wireless network solutions with shrewd financial maneuvers. A pivotal partnership with Klear, a financial technology firm, provides Ondas and its growing ecosystem with non-dilutive working capital. This off-balance-sheet financing mechanism is crucial, enabling rapid expansion and strategic acquisitions within the capital-intensive defense, homeland security, and critical infrastructure sectors without shareholder dilution.

Furthermore, Ondas's American Robotics subsidiary, a leader in FAA Type Certified autonomous drones, recently cemented a strategic manufacturing and supply chain partnership with Detroit Manufacturing Systems (DMS). This collaboration leverages U.S.-based production to enhance scalability, efficiency, and resilience in delivering American Robotics' advanced drone platforms. This domestic manufacturing focus aligns seamlessly with initiatives like the "Unleashing American Drone Dominance" executive order, which aims to bolster the U.S. drone industry, fostering innovation while safeguarding national security against foreign competition.

The company's offerings directly address the paradigm shift in modern warfare. Ondas's private industrial wireless networks (FullMAX) provide critical secure communication for C4ISR and battlefield operations, while its autonomous drone solutions (like the Optimus System and Iron Drone Raider for counter-UAS) are integral to evolving surveillance, reconnaissance, and combat strategies. As geopolitical instabilities intensify, driving unprecedented demand for advanced defense capabilities, Ondas’s integrated operational and financial platform is primed for significant growth, attracting considerable investor interest with its innovative approach to capital deployment and technological advancement.

Is Decentralization the Future of Cell Therapy?Orgenesis Inc. (OTCQX: ORGS) champions a revolutionary approach to cell and gene therapy (CGT) manufacturing. The company focuses on decentralizing production, moving away from traditional, centralized facilities. This strategy, centered on their POCare Platform, aims to drastically improve accessibility and affordability of life-saving advanced therapies. Their platform integrates proprietary therapies, advanced processing technology, and a network of clinical partners. By enabling onsite therapy production at the point of care, Orgenesis directly addresses critical industry hurdles like high costs and complex logistics, which currently limit patient access.

Orgenesis's innovative model is already yielding promising results. Their lead CAR-T therapy candidate, ORG-101, targeting B-cell Acute Lymphoblastic Leukemia (ALL), showed compelling real-world data. A study demonstrated an 82% complete response rate in adults and an impressive 93% in pediatric patients. Crucially, ORG-101 also exhibited a low incidence of severe Cytokine Release Syndrome, a common safety concern with CAR-T therapies. These positive clinical outcomes, coupled with a cost-effective, decentralized production method, position ORG-101 as a potentially transformative treatment option.

The broader pharmaceutical industry stands at a pivotal juncture, with cell and gene therapies driving unprecedented innovation. The global CAR T-cell therapy market alone anticipates substantial growth, projected to reach \$128.8 billion by 2035. This expansion is fueled by increasing chronic disease prevalence, significant investment, and advancements in gene-editing technologies. However, the industry grapples with high treatment costs, manufacturing complexities, and logistical challenges. Orgenesis's decentralized GMP-validated platform, along with their recent acquisition of Neurocords LLC assets for spinal cord injury therapies and the MIDA Technology for AI-based stem cell generation, directly confronts these barriers. Their approach promises to accelerate development, enhance production efficiency, and reduce costs, potentially democratizing access to advanced medicine.

Howmet Aerospace: Navigating Geopolitics to New Heights?Howmet Aerospace (HWM) has emerged as a formidable player in the aerospace sector, demonstrating exceptional resilience and growth amidst global uncertainties. The company's robust performance, marked by record revenues and significant earnings per share increases, stems from dual tailwinds: surging demand in commercial aerospace and heightened global defense spending. Howmet's diversified portfolio, which includes advanced engine components, fasteners, and forged wheels, positions it uniquely to capitalize on these trends. Its strategic focus on lightweight, high-performance parts for fuel-efficient aircraft like the Boeing 787 and Airbus A320neo, alongside critical components for defense programs such as the F-35 fighter jet, underpins its premium market valuation and investor confidence.

The company's trajectory is deeply intertwined with the prevailing geopolitical landscape. Escalating international rivalries, particularly between the U.S. and China, coupled with regional conflicts, are driving an unprecedented surge in global military expenditures. European defense budgets are expanding significantly, fueled by the conflict in Ukraine and broader security concerns, leading to increased demand for advanced military hardware incorporating Howmet’s specialized components. Simultaneously, while commercial aviation navigates challenges like airspace restrictions and volatile fuel costs, the imperative for fuel-efficient aircraft, driven by both environmental regulations and economic realities, solidifies Howmet’s role in the industry’s strategic evolution.

Howmet's success also reflects its adept navigation of complex geostrategic challenges, including trade protectionism. The company has proactively addressed potential tariff impacts, demonstrating a capacity to mitigate risks through strategic clauses and renegotiation, thereby protecting its supply chain and operational efficiency. Despite its premium valuation, Howmet’s strong fundamentals, disciplined capital allocation, and commitment to shareholder returns highlight its financial health. The company's innovative solutions, crucial for enhancing the performance and cost-effectiveness of next-generation aircraft, solidify its integral position within the global aerospace and defense ecosystem, making it a compelling consideration for discerning investors.

Is BigBear.ai the Next Titan of Defense AI?BigBear.ai (NYSE: BBAI) is emerging as a significant player in the artificial intelligence landscape, particularly within the critical national security and defense sectors. While often compared to industry giant Palantir, BigBear.ai carves its niche by intensely focusing on modern warfare applications, including guiding unmanned vehicles and optimizing missions. The company has recently garnered considerable investor attention, evidenced by its impressive 287% rally over the past year and a notable surge in public interest. This enthusiasm stems from several key factors, including a substantial 2.5x increase in backlog orders to $385 million by March 2025 and a significant ramp-up in research and development spending, signaling robust foundational growth.

BigBear.ai's technological prowess underpins its rising profile. The company develops sophisticated AI and machine learning models for diverse applications, from facial recognition systems deployed at major international airports like JFK and LAX to AI-augmented shipbuilding software for the U.S. Navy. Its Pangiam® Threat Detection and Decision Support Platform enhances airport security by integrating with advanced CT scanner technology, while its ConductorOS platform facilitates secure communication and coordination for drone swarm operations under the U.S. Army's Project Linchpin. These cutting-edge solutions position BigBear.ai at the forefront of AI-driven advancements crucial for evolving geopolitical landscapes and increasing defense AI investments.

Strategic collaborations and a favorable market environment further fuel BigBear.ai's ascent. The company recently formed a significant partnership in the UAE with Easy Lease and Vigilix Technology Investment to accelerate AI adoption across key industries like mobility and logistics, marking a major step in its international expansion. Additionally, multiple contracts with the U.S. Department of Defense, including those for J-35 fleet management and geopolitical risk assessment, underscore its vital role in government initiatives. While BigBear.ai faces challenges, including revenue stagnation, escalating losses, and stock volatility, its strategic market position, growing backlog, and continuous innovation in mission-critical AI solutions present a compelling high-risk, high-reward investment opportunity in the burgeoning defense AI sector.

Is AMD Poised to Redefine the Future of AI and Computing?Advanced Micro Devices (AMD) is rapidly transforming its market position, recently converting a Wall Street skeptic, Melius Research, into a bullish advocate. Analyst Ben Reitzes upgraded AMD stock to "buy" from "hold," significantly raising the price target to \$175 from \$110, citing the company's substantial progress in artificial intelligence (AI) chips and computing systems. This optimistic outlook is fueled by a confluence of factors, including surging demand from hyperscale cloud providers and sovereign entities, alongside colossal revenue opportunities in AI inferencing workloads. Another upgrade from CFRA to "strong buy" further underscores this shifting perception, highlighting AMD's new product launches and an expanding customer base, including key players like Oracle and OpenAI, for its accelerator technology and the maturing ROCm software stack.

AMD's advancements in the AI accelerator market are particularly noteworthy. The company's MI300 series, including the MI300X with its industry-leading 192GB HBM3 memory, and the newly unveiled MI350 series, are designed to deliver significant price and performance advantages over rivals like Nvidia's H100. At its "Advancing AI 2025" event on June 12, AMD not only showcased the MI350's potential for up to 38x improvement in energy efficiency for AI training but also previewed "Helios" full-rack AI systems. These comprehensive, plug-and-play solutions, leveraging future MI400 series GPUs and Zen 6-based EPYC "Venice" CPUs, position AMD to directly compete for the lucrative business of hyperscale operators. As AI inference workloads are projected to consume 58% of AI budgets, AMD's focus on efficient, scalable AI platforms puts it in a prime position to capture a growing share of the rapidly expanding AI data center market.

Beyond AI, AMD is pushing the boundaries of traditional computing with its upcoming Zen 6 Ryzen CPUs, reportedly targeting "insane" clock speeds, well above 6 GHz, with some leaks suggesting peaks of 6.4-6.5 GHz. Built on TSMC's advanced 2nm lithography node, the Zen 6 architecture, developed by the same team behind the successful Zen 4, promises significant architectural improvements and a substantial increase in performance per clock. While these are leaked targets, the combination of AMD's proven design capabilities and TSMC's cutting-edge process technology makes these ambitious clock speeds appear highly achievable. This aggressive strategy aims to deliver compelling performance gains for PC enthusiasts and enterprise users, further solidifying AMD's competitive stance against Intel's forthcoming Nova Lake CPUs, which are also expected around 2026 and feature a modular design and up to 52 cores.

Can Geopolitics Power Tech's Ascent?The Nasdaq index recently experienced a significant surge, driven largely by an unexpected de-escalation of tensions between Israel and Iran. Following a weekend where U.S. forces reportedly attacked Iranian nuclear sites, investors braced for a volatile Monday. However, Iran's measured response - a missile strike on a U.S. base in Qatar, notably without casualties or significant damage - signaled a clear intent to avoid wider conflict. This pivotal moment culminated in President Trump's announcement of a "Complete and Total CEASEFIRE" on Truth Social, which immediately sent U.S. stock futures, including the Nasdaq, soaring. This rapid shift from geopolitical brinkmanship to a declared truce fundamentally altered risk perceptions, alleviating immediate concerns that had weighed on global markets.

This geopolitical calm proved particularly beneficial for the Nasdaq, an index heavily weighted towards technology and growth stocks. These companies, often characterized by global supply chains and reliance on stable international markets, thrive in environments of reduced uncertainty. Unlike sectors tied to commodity prices, tech firms derive their value from innovation, data, and software assets, which are less susceptible to direct geopolitical disruptions when tensions ease. The perceived de-escalation of conflict not only boosted investor confidence in these growth-oriented companies but also potentially reduced pressure on the Federal Reserve regarding future monetary policy, a factor that profoundly impacts the borrowing costs and valuations of high-growth technology firms.

Beyond the immediate geopolitical relief, other crucial factors are shaping the market's trajectory. Federal Reserve Chair Jerome Powell's upcoming testimony before the House Financial Services Committee, where he will discuss monetary policy, remains a key focus. Investors are closely scrutinizing his remarks for any indications regarding future interest rate adjustments, particularly given current expectations for potential rate cuts in 2025. Additionally, significant corporate earnings reports from major companies like Carnival Corporation (CCL), FedEx (FDX), and BlackBerry (BB) are due. These reports will offer vital insights into various sectors' health, providing a more granular understanding of consumer spending, global logistics, and software security, thereby influencing overall market sentiment and the Nasdaq's continued performance.

Who Silently Powers the AI Revolution?While the spotlight often shines on AI giants like Nvidia and OpenAI, a less-publicized but equally critical player, CoreWeave, is rapidly emerging as a foundational force in the artificial intelligence landscape. This specialized AI cloud computing provider is not just participating in the AI boom; it is building the essential infrastructure that underpins it. CoreWeave's unique model allows companies to "rent" high-performance Graphics Processing Units (GPUs) from its dedicated cloud, democratizing access to the immense computational power required for advanced AI development. This strategic approach has positioned CoreWeave for substantial growth, evidenced by its impressive 420% year-over-year revenue growth in Q1 2025 and a burgeoning backlog of over $25 billion in remaining performance obligations.

CoreWeave's pivotal role became even clearer with the recent partnership between Google Cloud and OpenAI. Though seemingly a win for the tech titans, CoreWeave is supplying the critical compute power that Google then resells to OpenAI. This crucial, indirect involvement places CoreWeave at the nexus of the AI revolution's most significant collaborations, validating its business model and its capacity to meet the demanding computational needs of leading AI innovators. Beyond merely providing raw compute, CoreWeave is also innovating in the software space. Following its acquisition of AI developer platform Weights & Biases in May 2025, CoreWeave has launched new AI cloud software products designed to streamline AI development, deployment, and iteration, further cementing its position as a comprehensive AI ecosystem provider.

Despite its rapid stock appreciation and some analyst concerns about valuation, CoreWeave's core fundamentals remain robust. Its deep partnership with Nvidia, including Nvidia's equity stake and CoreWeave's early adoption of Nvidia's cutting-edge Blackwell architecture, ensures access to the most sought-after GPUs. While currently in a heavy investment phase, these expenditures directly fuel its capacity expansion to meet an insatiable demand. As AI continues its relentless advancement, the need for specialized, high-performance computing infrastructure will only intensify. CoreWeave, by strategically positioning itself as the "AI Hyperscaler," is not just witnessing this revolution; it is actively enabling it.