Intel - Starting 2026 with a +50% rally!💰Intel ( NASDAQ:INTC ) just remains completely bullish:

🔎Analysis summary:

Over the course of the past three weeks, Intel has been rallying an incredible +50%. Following this very bullish momentum, there is a high chance of new all time highs soon. Just give Intel some time and don't get caught up in all of this short term volatility.

📝Levels to watch:

$70

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Intclong

Intel Corporation | INTC | Long at $44.26Entered Intel NASDAQ:INTC after-hours at $44.26. The US government is too heavily invested in this one to let it truely slide. The earnings / EPS projections show a likely major turnaround. Any dips are purely programmatic for entry (watch insiders and politicians . I may sound like a conspiracy theorist here, but a $8.9 billion investment from the US government is absolutely going to lead to major returns by 2028/2029. There is a major price gap a lot of people aren't seeing all the way back to the year 2000 between $71.38 and $73.44. That's my main target. And, like dot-com crash, it may go further until.... So, in the near-term, there could be weakness and a dip to retouch the historical average band ($30's - another entry). But my outlook is longer. And, given the need for chips and the government wanting a major return on their investment, I suspect this one is going to lead to a solid return.

Targets into 2029

$60.00 (+35.6%)

$73.00 (+64.9%)

Intel - Here comes the bullish breakout!💾Intel ( NASDAQ:INTC ) will soon break out:

🔎Analysis summary:

During 2025, Intel has over and over again been retesting major support. That was exactly the reason why I told everyone to enter longs here on Intel. Just a couple months later we witnessed a +150% rally and Intel is about to create another bullish breakout soon.

📝Levels to watch:

$45 and $70

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Breaking: Intel (NASDAQ: INTC) Rallies Ahead of Earnings Intel Corporation (NASDAQ: NASDAQ:INTC ) stock has been on a tear lately, as expectations grow ahead of the chipmaker's quarterly results due after the closing bell Thursday.

The shares jumped nearly 12% amid a broad market rally to close above $54 Wednesday, extending the stock's recent gains as several Wall Street analysts pointed to signs of better-than-expected demand for the company's AI products.

Shares of Intel, which have added nearly half their value in January alone, have already surpassed the consensus price target around $45.

Technically, NASDAQ:INTC is in a bullish symmetrical triangle, the ceiling of the triangle has been broken with eyes on the $80 zone should earnings beat analyst estimates.

About INTC

Intel Corporation designs, develops, manufactures, markets, and sells computing and related products and services worldwide. It operates through Intel Products, Intel Foundry, and All Other segments. The company offers microprocessor and chipset, stand-alone SoC, and multichip package; Computer Systems and Devices; hardware products comprising CPUs, graphics processing units (GPUs), accelerators, and field programmable gate arrays (FPGAs

$INTC Is Extremely Oversold ... and frustrating

- Every time that Intel is oversold on Williams indicator, meaning -80 to -100 (current is -91.62 - extremely oversold), it bounces hard

- I have highlighted every instance since November 2024, where the momentum indicator was at oversold levels - and every single time came a massive bounce / rally

- It has been a frustrating downtrend, but every single indicator is showing bullish momentum

-- In fact, the 100 and 200 day moving averages are still rising, and has maintained the golden cross since late September

-RSI-based MA is going to converge with RSI levels over the next 2 weeks, as RSI rises - looking for volume buyers

The market is great at convincing you that "it's over". Until it isn't. Price moves sentiment.

Inevitable that Intel will bounce on this uptrend I have highlighted.

Intel - This behavior is wonderful!🎉Intel ( NASDAQ:INTC ) respects all structure:

🔎Analysis summary:

Just in the end of 2024, Intel perfectly retested a major long term horizontal support. After we then witnessed bullish confirmation, it was so obvious, that Intel will create a move higher. Now, Intel rallied +120% and is ready for a shorter term correction now.

📝Levels to watch:

$45

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Breaking: Intel Corporation (INTC) Surge 8.6% Set for $70 MoveThe price of Intel Corporation (NASDAQ: NASDAQ:INTC ) saw a noteworthy uptick of 8% in Tuesday's extended trading session breaking out of the ceiling of a symmetrical triangle- eyeing the $70 resistant amidst increase in bullish sentiment.

The rise came as the S&P 500 and the Nasdaq Composite jumped 0.2% and 0.5%, respectively.

Intel's stock continued to climb tod, driven by Friday's unconfirmed report that the chipmaker is set to begin manufacturing semiconductors for Apple's MacBook Air and iPad Pro.

If the report is confirmed, it would be a massive win for the embattled chipmaker. Intel once dominated the semiconductor industry with its efficient CPUs, but it has fallen behind in the era of artificial intelligence (AI), a technology that is powered primarily by GPUs. A vote of confidence from Apple would go a long way in aiding the company's turnaround efforts.

About INTC

Intel Corporation designs, develops, manufactures, markets, and sells computing and related products and services worldwide. It operates through Intel Products, Intel Foundry, and All Other segments. The company offers microprocessor and chipset, stand-alone SoC, and multichip package; Computer Systems and Devices; hardware products comprising CPUs, graphics processing units (GPUs), accelerators, and field programmable gate arrays (FPGAs); and memory and storage, connectivity and networking, and other semiconductor products.

$INTC - Intel Corp - $32.02 Re-Entry - $44.93 PTNASDAQ:INTC broke out to $38.91 before running into the previous resistance leve and consolidating since. We're watching to see if it holds that mid-level (light blue) support or if it continues back to $32.02 for a Re-Entry & Hold to find support, push through $38.91 finally, to retest the $44.93 Levels again.

Intel - The parabolic bullrun!💸Intel ( NASDAQ:INTC ) rallies significantly:

🔎Analysis summary:

After Intel retested a major support a couple of months ago, we already witnessed an expected rally of about +100%. Considering that the next horizontal resistance is about +25% higher, a bullrun continuation remains totally likely. Intel just perfectly plays out.

📝Levels to watch:

$45

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Intel - The breakout happens now!💰Intel ( NASDAQ:INTC ) will break out quite soon:

🔎Analysis summary:

For the past two decades, Intel has overall been moving sideways. While we witnessed significant swings during this period of time, Intel recently retested another strong support area. If Intel now breaks the short term resistance, we will officially see the bottom formation.

📝Levels to watch:

$25

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Intel | INTC | Long at $20This is going to be purely about technical analysis since Intel NASDAQ:INTC has a 90x P/E and has not proven themselves to be a viable challenger in the semiconductor market (yet...). Bad news could continue to destroy this ticker, but without that news, there could be some recovery in the near term.

The NASDAQ:INTC chart is in an overall downward trend. However, based on a few of my selected simply moving averages (SMAs), there is some predictability around support/resistance areas. Some of my favorite setups are a nice bounce on the lowest (green) selected SMA, occurring in October 2022 for a "rip then dip" to the second lowest (blue) - which it hit now. Often, but not always (I can't stress this enough), this green to blue SMA bounce represents a very strong support area during a downward trend. The other move is a further dip to retest the green SMA, but I suspect that would come with tremendously bad news for Intel... let's hope not, though.

Currently, NASDAQ:INTC is in a personal buy zone at $20.00 based on technical analysis only. A stop has been set if it drops below the blue SMA (which is may further test).

Target #1 = $28.00

Target #2 = $32.00

Target #3 = $60.00+ (very long-term, but high-risk unless fundamentals change)

Intel (INTC) silent accumulation pattern and projection of priceThe last time INTC broke out of its sideways range, it re-tested support three times.

After that, price surged upward, pulled back to the Centerline (an 80% probability move), and then began accumulating again within a sideways coil — or “Battery,” as I like to call it (see the TSLA example).

This setup looks similar now.

In fact, we even have a stronger filter: Price must first break out of the downsloping red Fork. Once that happens, we can expect a re-test of the upper median line (U-MLH). That’s the point where I decide whether or not to take a position.

My target is the Centerline of the grey “What If Fork.”

I want to emphasize that the inventor of the Forks highlighted this idea in his original course: always project and think, “What if…?” That’s exactly what I do — and maybe it will help you as well.

Let’s see if Intel’s “Battery” gives us a solid trade. §8-)

Intel - The bottom is in!🔮Intel ( NASDAQ:INTC ) forms a clear bottom:

🔎Analysis summary:

After a consolidation of about three decades, Intel is now creating a strong bottom formation. With the retest of a major horizontal support area, Intel is respecting clear market structure. Quite likely therefore that Intel will soon start its next major higher timeframe bullrun.

📝Levels to watch:

$25

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

INTC $26C Swing Play—Don’t Miss Out🔥🚀 **INTC Swing Options Play — Moderate Bullish Setup!** 🚀🔥

📊 **Swing Trade Breakdown (2025-08-22)**

* 🎯 **Ticker**: \ NASDAQ:INTC

* 🔀 **Direction**: CALL (LONG)

* 🎯 **Strike**: \$26.00

* 💵 **Entry Price**: \$0.80

* 🛑 **Stop Loss**: \$0.55 (-35%)

* 🎯 **Profit Target**: \$1.60 – \$2.00 (+100% to +150%)

* 📅 **Expiry**: 2025-09-05 (14DTE)

* 📈 **Confidence**: 70%

* ⏰ **Entry Timing**: Market Open

💡 **Why this trade?**

✅ **Momentum Rising**: Daily RSI at 65.0, 10D gain of +25.46% 📈

✅ **Low VIX (14.4)** = Safer holding, less decay risk ⚡

✅ **Bullish Bias Confirmed** across timeframes

⚠️ **Risks**: Weak volume (1.0x avg) & neutral options flow → breakout confirmation needed!

\#INTC #OptionsTrading #SwingTrade #CallOptions #StockMarket #MomentumTrading #BullishSetup #TradingStrategy #DayTrading

INTC on Fire! Swing Traders, Don’t Miss This Call!

🚀 **INTC SWING TRADE ALERT – 2025-08-15** 🚀

**Moderate Bullish Momentum – Calls in Play!** 📈

**🔍 Market Context:**

* **Daily RSI:** 72.2 (strong overbought thrust)

* **5-Day Gain:** +24.79% 💥

* **Volatility:** Low VIX – great for swing setups

* **Volume:** Weak (⚠️ watch for fakeouts)

* **Options Flow:** Neutral – institutions not leaning heavily yet

**📊 Consensus from 5 Models:**

✅ Bullish momentum across all timeframes

⚠️ Caution on weak volume & neutral sentiment

🏹 Perfect short-term swing environment if monitored closely

---

**💡 Trade Plan:**

* **Instrument:** INTC Aug 29 ’25 26C

* **Entry:** \$0.78 (at open)

* **Stop Loss:** \$0.55 (-30%)

* **Profit Target 1:** \$1.17 (+50%)

* **Profit Target 2:** \$1.56 (+100%) – let runners ride!

* **Confidence:** 75%

---

**⚠️ Risk Notes:**

* RSI > 72 = possible pullback

* Volume weakness could kill breakout

* Options sentiment neutral – watch for big money moves

📆 **Signal Time:** 2025-08-15 11:02 EDT

💎 **Execution:** Buy single-leg naked calls at open

---

💬 If you trade this, keep stops tight & scale out at targets. Momentum is hot, but the tape needs confirming volume.

\#INTC #SwingTrading #OptionsAlert #StockMarket #CallOptions #TradingSignals #NASDAQ #BullishMomentum

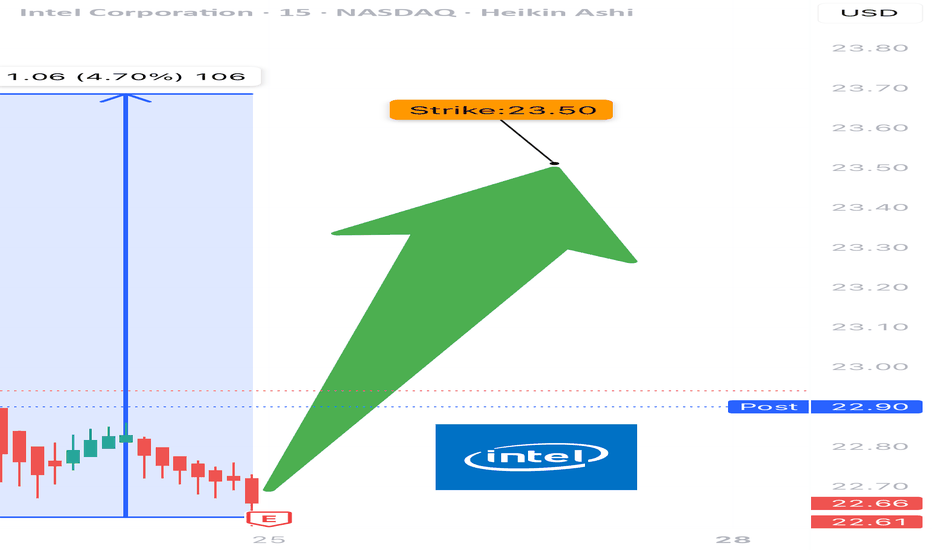

INTC EARNINGS TRADE (07/24)

🚨 INTC EARNINGS TRADE (07/24) 🚨

🎧 Earnings drop after close — here’s the high-conviction setup 📊

🧠 Key Highlights:

• 💥 Surprise Beat Rate: 88%, avg surprise = 419%

• 📉 Margins: Ugly (-36% net margin) but improving sentiment

• 📈 Volume Surge + $24 resistance test = pre-earnings drift 🚀

• 🔎 Mixed options flow → cautious bulls leaning in

• 🎯 Sector: SEMI = 🔀 rotating hard, competition vs AMD/NVDA rising

💥 TRADE SETUP

🟢 Buy INTC $23.50 Call exp 7/25

💰 Entry: $0.59

🎯 Target: $1.18

🛑 Stop: $0.29

📈 Confidence: 75%

⏰ Entry: Before Earnings (Close 07/24)

📆 Earnings: Today After Market (AMC)

📊 Expected Move: 5%

⚠️ Play the earnings drift → gap up = profit. Miss = cut fast. Risk = defined. Reward = explosive.

#INTC #EarningsPlay #OptionsTrading #IntelEarnings #UnusualOptionsActivity #TechStocks #Semiconductors #TradingView #EarningsSeason #DayTrading #CallOptions

Intel - The rally starts!Intel - NASDAQ:INTC - creates a major bottom:

(click chart above to see the in depth analysis👆🏻)

For approximately a full year, Intel has not been moving anywhere. Furthermore Intel now trades at the exact same level as it was a decade ago. However price is forming a solid bottom formation at a key support level. Thus we can expect a significant move higher.

Levels to watch: $25.0

Keep your long term vision!

Philip (BasicTrading)

Intel (INTC): Bullish Signs Emerging, Eyes on $75 ATHIntel (INTC) has started to show strong bullish signals, confirming a reversal after refusing to drop below $18. The stock has since climbed to $27, signaling renewed investor confidence and a potential breakout in the coming months.

Key Resistance Levels: The Path to $75

$30: The first critical resistance level that Intel must break to continue its bullish momentum.

$37: A key milestone that, if surpassed, would strengthen the uptrend.

$75 (All-Time High): The ultimate long-term target.

If Intel successfully breaks above $37, it could trigger a sustained rally toward its ATH of $75, potentially supported by industry advancements and stronger financial performance.

Risk Scenario: Consolidation and Potential Drop to $12

If Intel fails to break $30, it could enter a multi-year consolidation phase.

A prolonged range between $12 and $30 could play out if bullish momentum fades.

In a worst-case scenario, Intel could hunt the $12 level, creating a long-term accumulation zone before attempting another breakout.

Summary: Bullish Structure with Key Levels to Watch

Intel’s refusal to drop below $18 and its climb to $27 signal growing bullish momentum.

Break Above $30: Signals continuation to $37, then a long-term push toward $75.

Failure at $30: Could lead to a multi-year consolidation, ranging between $12 and $30.

The next few months will be crucial in determining whether Intel resumes a strong uptrend or enters a long accumulation phase before the next major breakout.

Intel ($INTC) at a Crossroads: Breakup Talks, Market PressuresIntel Corporation (NASDAQ: NASDAQ:INTC ) finds itself at a critical juncture as reports emerge about Broadcom and Taiwan Semiconductor Manufacturing Co. (TSMC) exploring potential deals that could split the storied chipmaker into two entities. This revelation comes amidst Intel’s ongoing struggles in maintaining its dominance in the semiconductor industry, intensified by leadership changes, manufacturing setbacks, and increasing market competition.

Broadcom & TSMC’s Interest in Intel

The Wall Street Journal recently reported that Intel rivals Broadcom and TSMC are each considering deals that would divide the company. Broadcom is reportedly analyzing Intel’s chip design and marketing business, with discussions about a potential bid, though any move would depend on securing a partner for Intel’s manufacturing division. Meanwhile, TSMC has expressed interest in taking control of Intel’s chip plants, potentially through an investor consortium.

The U.S. government is closely monitoring these developments, as Intel is viewed as a company of national security significance. Reports indicate that the Trump administration is unlikely to support a foreign entity operating Intel’s U.S. factories, adding an additional layer of complexity to any potential deal.

Intel was a major beneficiary of the Biden administration’s push to onshore semiconductor manufacturing, securing a $7.86 billion government subsidy. However, the company has struggled to execute its ambitious plans. Former CEO Pat Gelsinger set high expectations for Intel’s manufacturing and AI capabilities, but his failure to deliver led to lost contracts, a 60% drop in the company’s stock value in 2023, and layoffs affecting 15% of its workforce.

Technical Outlook

Intel’s stock (NASDAQ: NASDAQ:INTC ) closed last Friday’s session down 2.2%, but premarket trading on Monday shows signs of recovery with a 0.06% uptick. The technical indicators suggest that NASDAQ:INTC could be on the cusp of a bullish reversal, contingent on broader market sentiment.

The Relative Strength Index (RSI) for Intel stood at 68 on Friday. This reading positions the stock near the overbought threshold but also signals that momentum is building towards a potential breakout. Also, Intel is currently trading above key moving averages, reinforcing a bullish sentiment in the near term.

Should a pullback occur, immediate support is found at the 38.2% Fibonacci retracement level, which may serve as a demand zone for NASDAQ:INTC shares. In the event of extreme selling pressure, a drop to the one-month low of $18.50 could materialize, though such a scenario would require a significant bearish catalyst.

If bullish momentum takes hold, a breakout above resistance levels could push Intel’s stock higher, aligning with analyst expectations. The 12-month price forecast for NASDAQ:INTC stands at $25.69—an 8.86% increase from its current price.

Conclusion

Intel’s potential breakup remains speculative, but the fundamental challenges it faces underscore why such discussions are taking place. While concerns about cash flow, leadership changes, and market competition weigh on the stock, technical indicators suggest that NASDAQ:INTC may be approaching a bullish reversal.

With a critical trading week ahead, investors should monitor key support and resistance levels while staying informed about any further developments in the Broadcom and TSMC discussions. If Intel successfully capitalizes on government support and restructures its strategy, a resurgence in investor confidence could follow, pushing NASDAQ:INTC back into bullish territory.

Intel Time To Wake UpIntel, which has received a very strong reaction, I think it will now try the above prices. Especially the last 3 dips it made look good. We can also expect a rapid rise when it breaks the falling resistance. I think pullbacks will be a buying opportunity. The 29 area awaits as a serious resistance.