#GOLD , Lets Play it 📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #GOLD

⚠️ Risk Environment: High

📈 Technical Overview:

After Many months , i added GOLD on Watchlist of PUBLIC channel ... but i don't wanna it be like a TRAP so mostly will just Watch it ... and if it be 100% good will take it .

—

#EURUSD IS STILL VALID

—-

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

Intradaytrading

XAUUSD (Gold) – H1 Market Structure AnalysisContext: Liquidity → Structure Shift → Reaction Zones

Price previously respected a descending trendline. A clean breakout has occurred, followed by a pullback, indicating a potential change in market character.

🔍 Key Technical Observations

Trendline Breakout Confirmed

Price has broken above the descending trendline, suggesting bearish momentum is weakening.

Market Structure Shift (MSS)

A bullish displacement from the lows signals a possible short-term structural shift.

Liquidity Sweep Completed

Sell-side liquidity was taken below prior lows before the impulsive move upward, often seen before reversals.

Fair Value Gaps (H1 FVGs)

Upper FVG (Premium zone): Acts as resistance; reaction or rejection possible.

Lower FVG (Discount zone): Potential reaction area if price retraces.

Order Block Zone (H1 OB)

Below price, this zone represents a strong demand area where buyers previously stepped in.

🧠 Scenarios to Watch (No Predictions)

If price reacts from the upper FVG, short-term pullbacks toward imbalance zones are possible.

If price retests the lower FVG / OB and holds, continuation toward recent highs may develop.

Acceptance above the upper imbalance would indicate strength, while rejection signals range behavior.

⚠️ Notes

This idea is for educational and technical discussion purposes only.

Always wait for confirmation and manage risk according to your own plan.

No buy/sell instructions are provided.

XAU/USD ~ Gold Building Momentum from Key Support📝 Description 🔍 Setup OANDA:XAUUSD

✅Gold has been respecting a descending trendline with multiple rejections, showing clear bearish structure. Now price is attempting a breakout + retest while holding above a strong demand zone.

✅Buyers stepped in aggressively from support, forming higher lows and pushing price back toward the cloud resistance area.

✅Geopolitical tensions (Middle East concerns) continue to support safe-haven demand for gold — adding a fundamental tailwind.

📍 Support & Resistance

🟥 Support Zone: 4,760 – 4,650

🟥 Major Support: 4,570 – 4,400

🟩 1st Resistance: 5,310

🟩 2nd Resistance: 5,550

Volume profile shows strong acceptance near support — buyers defending the zone.

⚠️ Disclaimer

This analysis is for educational purposes only.

Trading involves risk. Always use proper risk management and your own strategy.

💬 Support the Idea👍 Like if you’re bullish on Gold

💬 Comment: Breakout rally or fakeout? 🔁 Share with fellow gold traders

#XAUUSD #Gold #Forex #PriceAction #TrendlineBreakout #SafeHaven #TradingView #SupportResistance #IntradayTrading #Kabhi_TATrading

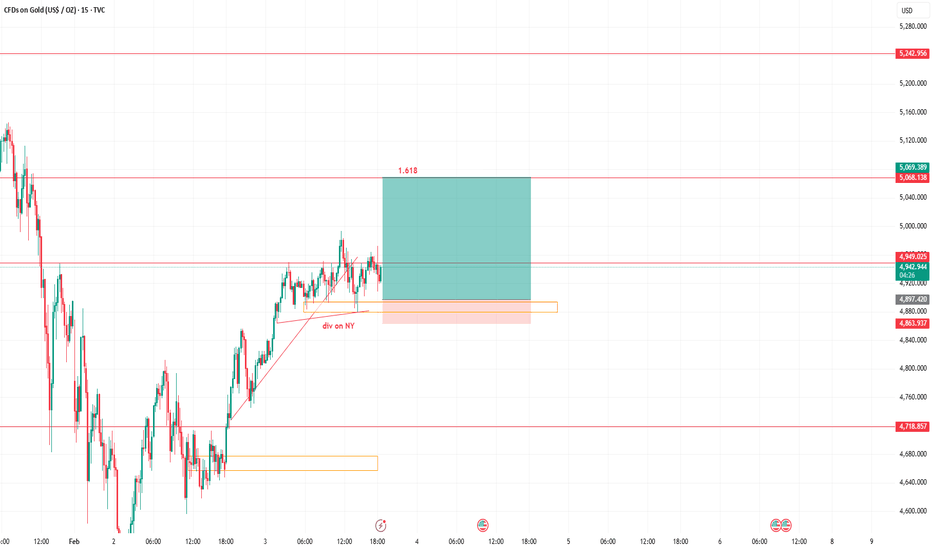

Gold (15m) – Bullish Continuation SetupPrice is holding above the prior demand zone after a strong impulsive move up. We’re seeing higher lows forming with NY session divergence acting as fuel, not weakness. This consolidation looks like a healthy pause before expansion.

The highlighted buy zone aligns with structure support and liquidity protection, while upside targets are mapped toward the 1.618 extension, where previous sell-side liquidity rests. As long as price holds above the base, bias remains bullish.

📈 Idea: Buy the dip → Hold structure → Target expansion

⚠️ Invalidation below demand zone

📌 Follow for real-time scalping & intraday signals

I share structure-based entries, liquidity targets, and risk-defined trades — no indicators, just price.

DM for more entries and professional help..

#GBPJPY , Another Short ??📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #GBPJPY

⚠️ Risk Environment: High

📈 Technical Overview:

Maybe , We can have GJ again but this time would be so Risky.

🚀 Trading Plan:

• Check Momentum around Entry point . if it be high momentum , SKIP IT

• LTF ENTRY NEEDED

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

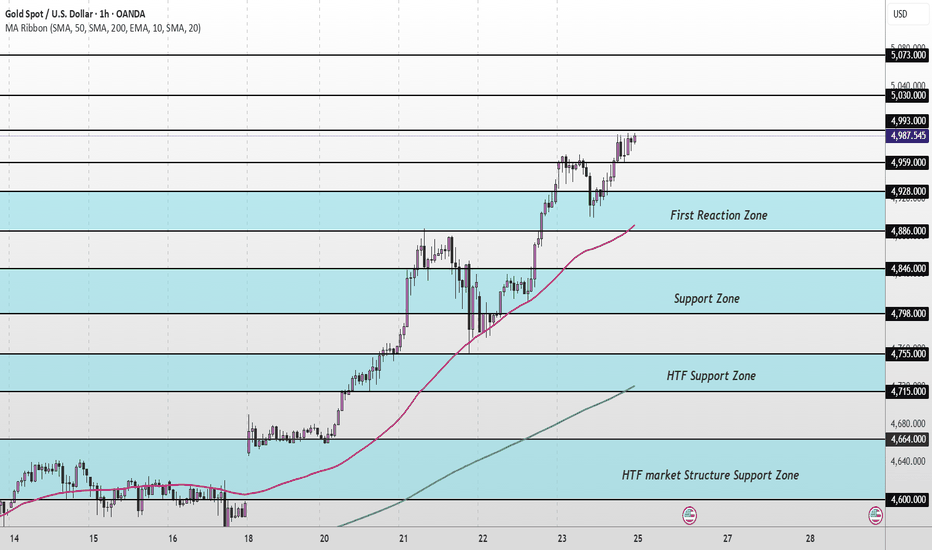

XAUUSD Weekly Forecast | Levels to Watch This WeekGold finished Friday with another leg higher, extending the bullish momentum into the weekly close.

Support and resistance zones have been updated. Immediate resistance sits at 4993, and a clean break above this level is needed for bullish momentum to continue toward 5030.

Rejection at 4993 would likely trigger a pullback into lower support zones. The first reaction zone aligns with the MA50 and will be the first area to watch for support. Failure to hold there could lead to a deeper retracement into the lower support zone.

It’s also worth noting that the MA200 hasn’t been tested for some time, so a retest of the MA200 remains possible at some point during a deeper pullback.

📌Key levels to watch:

Resistance:

4993

5030

5073

Support:

4959

4928

4886

4846

4798

👉Let key levels guide your decisions — wait for confirmation and manage risk accordingly.

🔎Fundamental Focus:

The main event this week is the FOMC decision, including the rate statement and press conference.

Alongside macro events, ongoing geopolitical tensions remain in play and may continue to support gold as a safe-haven, adding an extra layer of volatility around key levels.

XAUUSD Intraday Plan | Pullback Within Bullish TrendGold’s rally continued into the Tokyo session, and we’re now seeing a much-needed pullback. The overall structure remains strongly bullish, and pullbacks into key levels may offer opportunities for buyers.

Resistance sits at 4928. A break back above this level would reopen the 4970 target, and if momentum builds, a test of the 5000 mark remains possible.

Here’s a clean, natural rewrite that fits your style:

If selling pressure builds, a deeper retracement may follow. Watch the lower support zones closely for potential reactions.

📌Key levels to watch:

Resistance:

4928

4970

5009

Support:

4883

4847

4808

4764

👉 Let key levels guide the way and wait for confirmation.

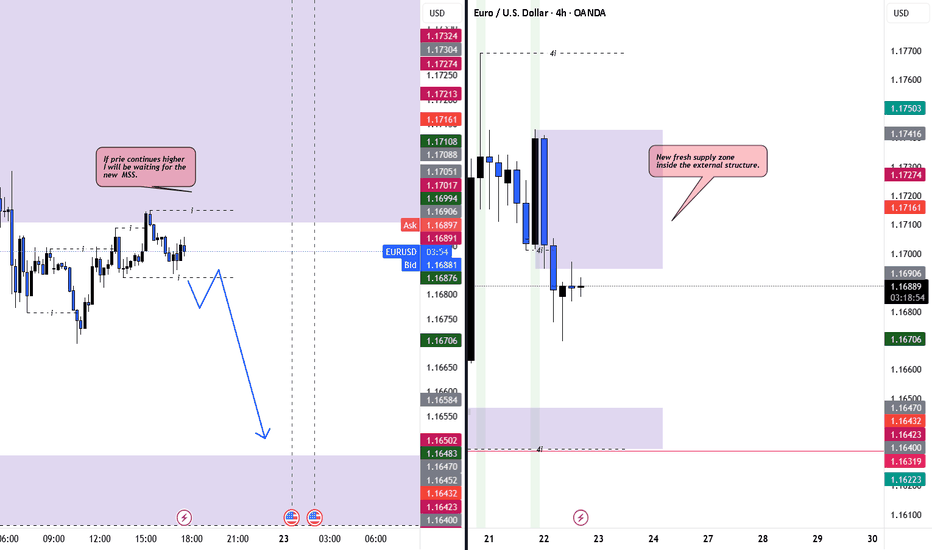

Key 15m Structure Break Will Set Today’s DirectionToday I’m closely monitoring how price reacts around the current 15‑minute structure. If the market breaks below the strong 15m Higher Low (HL), I expect bearish continuation, with momentum likely accelerating as liquidity beneath that level gets taken.

However, if price holds the bullish structure and continues pushing higher, I will remain patient and wait for a fresh Market Structure Shift (MSS) to form. A clean MSS to the downside will give me the confirmation needed to look for short setups aligned with the prevailing trend.

My focus today is purely on structure, liquidity, and reaction points—no chasing, just waiting for the market to show its hand. Whichever direction unfolds, the plan is to follow the break, wait for confirmation, and execute with discipline.

BTR Update | 16 Jan 2026 |+30 POINTS PROFIT | BSE LTD📉 BTR Update | 16 Jan 2026 | Clean Short Trade

Stock: BSE LTD

Timeframe: Intraday

Indicator: BTR Price Action

🔴 Trade Execution

Signal: Short

Entry: 2840

Exit: 2810

Points Gained: +30 Points

🧠 Why This Trade Worked

✔ Clear trend confirmation

✔ No overthinking

✔ No early exit

✔ No revenge trade

✔ Followed BTR rules step by step

This was a textbook BTR short —

clean entry, clean exit, zero emotion.

📌 Key Message

❝ Profits don’t come from prediction,

they come from discipline & execution. ❞

BTR doesn’t chase price.

BTR waits for structure.

When signal appears — action is simple.

ETHUSDT M15 BPR Rejection and Short-Term Pullback Setup📝 Description

BINANCE:ETHUSDT has pushed back into a prior H1 BPR / liquidity zone after a strong recovery leg. The current move appears corrective, with price reacting near resistance rather than showing clean continuation strength.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price holds below the H1 BPR and recent high

Preferred Setup:

• Entry: 3,141

• Stop Loss: Above 3,148

• TP1: 3,134

• TP2: 3,121

• TP3: 3,093 (lower liquidity)

________________________________________

🎯 ICT & SMC Notes

• Rejection from H1 BPR signals supply presence

• No confirmed bullish BOS after the rally

• Downside liquidity remains unfilled

________________________________________

🧩 Summary

CRYPTOCAP:ETH is showing signs of rejection at resistance. As long as price remains capped below the BPR, a controlled pullback toward lower PD arrays is favored over upside continuation.

________________________________________

🌍 Fundamental Notes / Sentiment

This week’s US macro data supports a stronger USD and higher-for-longer rates, keeping liquidity tight for risk assets. In this environment, Ethereum remains vulnerable to downside, with bearish continuation favored and any short-term rebounds likely corrective rather than trend-changing.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

USDCAD | Strategic SELL Opportunity🔻💼 USDCAD | Strategic SELL Opportunity (Multi-Target Setup)

Overview:

USDCAD is displaying bearish continuation behavior, with price reacting near a well-defined supply area, favoring further downside movement.

Sell Zone (Focus Area):

🔴 1.3920 – 1.3915

This zone acts as a strong resistance area where selling pressure is expected to dominate.

Downside Objectives:

🎯 1.3900 – First reaction target

🎯 1.3880 – Momentum extension

🎯 1.3860 – Structure continuation

🎯 1.3840 – Deeper downside move

🚀 1.3820 – Possible stretch target if selling accelerates

Why This Setup Works:

✔ Price reacting from a clear supply zone

✔ Bearish market structure remains intact

✔ Momentum aligns with downside continuation

Trade Management Insight:

Step-by-step profit booking helps secure gains while keeping exposure for extended moves. Capital protection remains the priority.

Execution Guidance:

Wait for price rejection or confirmation within the sell zone before execution. Avoid chasing price.

Final Note:

As long as price respects the resistance area, downside continuation toward lower targets remains the higher-probability scenario.

⸻

✨ Special Note for Serious Traders

If you believe in clean levels, disciplined execution, and professional risk control rather than noisy signals, feel free to connect. I work with traders who value clarity, patience, and long-term consistency.

🔒 Trade with structure. Manage risk. Stay consistent.

XAUUSD: Pre-NY Resistance Plan → Rejection & PullbackThe following analysis was shared Friday January 2nd before the New York session (11:46am) while price was approaching resistance:

XAUUSD – Intraday Update (Pre-NY)

We established a clear support base in the 4305–4320 area, which held well.

During the Asian session, price pushed higher and took out Wednesday’s highs, confirming short-term strength.

Price was trading around 4395, approaching a key resistance zone near 4404, aligned with Tuesday’s highs.

What I was watching:

Reaction as price approached 4400–4404

Acceptance above 4401 with a body close → continuation toward 4420+

Wick above 4401 with a close back below → rejection and pullback toward 4353 or lower

At resistance, the focus was on confirmation — not prediction.

Outcome

Price wicked above 4401 without a candle body close, showing clear rejection at resistance, and traded lower, reaching the 4353 support zone.

This is a clean example of how waiting for reaction and confirmation at key levels removes the need to chase or guess direction.

Structure first.

Patience always.

Happy New Year 2026! BTR Price Action Indicator 🎆 WELCOME 2026 🎆

Let this year be full of discipline, consistency & winning trades

— AdiJohn

📊 BTR Price Action Indicator

🎯 December 2025 Intraday Performance Report — BSE Ltd

Total Intraday Trades 13

Winning Trades 13

Losing Trades 0

Win Rate 🔥 100%

Total Points Profit 🟢 +430 Points

Instrument BSE LTD

Time Frame 15-Minute

Indicator BTR Price Action

📌 Trade-by-Trade Performance (Intraday Only)

Date Signal Entry Exit Result

05-12-2025 Buy 2790 2820 +30

08-12-2025 Sell 2845 2790 +55

09-12-2025 Buy 2730 2730 0

11-12-2025 Buy 2615 2700 +85

12-12-2025 Sell 2690 2720 -30 (Exit Reverse)

12-12-2025 Buy 2720 2740 +20

15-12-2025 Sell 2705 2655 +50

17-12-2025 Buy 2620 2670 +50

18-12-2025 Buy 2670 2700 +30

19-12-2025 Sell 2700 2685 +15

22-12-2025 Buy 2700 2780 +80

23-12-2025 Sell 2745 2715 +30

31-12-2025 Buy 2620 2635 +15

💹 Final Results for Dec-2025

🚀 Total Profit: 🟢 +430 Points

💯 Win Rate: 100%

🔥 No Forced Trades — Only Follow BTR Signals

⏳ Focus: Quality Over Quantity

🛑 Stoploss: Swing High/Low

🎯 Targets: 25-50-75-100 Points

🎉 Happy New Year 2026!

From BTR Price Action Indicator & AdiJohn

✨ May 2026 bring you:

✔️ More Confidence than Fear

✔️ More Discipline than Doubt

✔️ More Profit than Loss

✔️ More Consistency than Expectations

🙏 Thank you for supporting this journey.

🚀 2026 will be our year of growth.

💛 Stay Disciplined — Stay Profitable.

🎯 Want to trade like this?

📥 DM me to get BTR Indicator

🏷️ Search in TradingView: BTR Price Action Indicator

⚡ Works Best On: BSE LTD (15 Min)

NSE:BSE NSE:NIFTY BSE:SENSEX NSE:BANKNIFTY

#IntradayTrading #BTRIndicator #PriceAction #BSE #TradingViewIndia #DisciplineTrading #Welcome2026 #Bullish #Bearish #ProfitableMindset #ConsistencyIsKey #AdiJohn

IFL Finance Limited BUY Setup Entry: ₹506-508 (Current Level)

Target 1: ₹516-520

Target 2: ₹525-530

Stop Loss: ₹495

Technical Rationale:

Stock trading above EMA (469.90), showing bullish momentum

RSI at 68.69 indicating strength but not yet overbought

Price consolidating in a rectangular pattern between 490-507

Recent breakout with strong volume (2.38M)

Support from rising trendline visible

+4.43% gain today shows buying interest

Risk-Reward: Favorable 1:2+ ratio

GBPAUD potential SELL setupBearish Breakdown Setup

Summary

Analysing Price action from yesterday we have got a very nice distribution leg push that broke down below our accumulation zone a good indication of downside momentum, therefore the anticipation is that price will retest our BOS an ideal zone to look for SELL setups.

📉 GBPAUD Daily Breakdown Potential setup

🔴 Distribution leg: 2.06875 - 2.05697

📉 Sell level: 2.06423 (Confirmed Break)

🎯 Target 1: R:R 1:2

🎯 Target 2: R:R 1:3

🎯 Target 3: R:R 1:4

🛑 Stop Loss: Above Resistance Zone

🔍 Watch: Break above resistance zone invalidates idea

LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

GBPJPY Potential BULLISH Setup🚀 GBPJPY: BULLISH Setup

Summary:

Analysing price action from yesterday, breakout from the Daily timeframe accumulation zone has materialized with strong conviction.

TRADE SETUP Metrics:

- Entry: ✅

- Stop loss - Below Support Zone

- Target 1: (R:R 1:2)🎯

- Target 2: (R:R 1:3)🎯

- Target 3: (R:R 1:4)🎯

Technical Anticipations:

- Price action to show a Bullish follow-through

- Support zone to hold

Position Management:

- partial profits secured at Target 1

- Stop loss adjusted to breakeven upon reaching Targets

- Final Target 3

LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

XAU/USD Intraday Plan | Support & Resistance to WatchGold is extending its rally, now trading around $3,813 after breaking out of the $3,796 resistance. Momentum accelerated once price cleared $3,776, with strong follow-through toward the next upside targets.

Current resistance sits at $3,828, while support is established at $3,776.

A clean break above $3,828 would keep momentum intact, opening the path to $3,846. Failure to clear $3,828 may trigger a retracement into $3,796 or deeper toward $3,776.

The $3,753 -$3,734/ First Reaction Zone remains a major pullback area if sellers regain control.

📌 Key levels to watch:

Resistance:

$3,828

$3,846

Support:

$3,812

$3,796

$3,776

$3,753

$3,734

🔎 Fundamental Focus – Week of Sep 29–Oct 4

It’s a heavy week for USD with key risk events:

🚩JOLTS Job Openings, Consumer Confidence

🚩ADP Employment, ISM Manufacturing, OPEC Meetings

🚩Jobless Claims

🚩NFP, Unemployment Rate, Average Hourly Earnings, ISM Services PMI

👉 This is jobs week — labour market data will dominate. Expect high volatility, especially into Friday’s NFP release.

EIGEN Breakout Confirmation, Eyes on 2.20+$EIGEN has broken above a key resistance zone, signaling a shift in momentum. The breakout comes after weeks of consolidation with strong support holding at the ascending trendline.

Trade Setup

Entry: Around current breakout levels

Stop Loss: Below 1.33 (trendline support)

Targets:

TP1: 2.20

TP2: 2.86

TP3: 3.78

TP4: 5.27

As long as price holds above the reclaimed zone, the structure favors bulls with upside targets in play.

DYOR, NFA

#PEACE

NQ100 Intraday Outlook – Sept 8, 2025🧠 NQ100 Intraday Outlook – Sept 8, 2025

Bias: Intraday Bearish after NY Open

Price is currently trading within a well-defined premium zone, between the Sunday-Monday Order Block and the BPR M30 area.

🧩 Key Observations:

Price tapped into a minor M5 Order Block (OB) right after the 8:30 NY macro event.

We're seeing a reaction to a short-term OB, with a small push up likely to grab liquidity above the London session high.

Expecting liquidity run + rejection from the upper OB zone (23,810–23,830).

🔽 Bearish Scenario:

After the sweep of local highs, I anticipate a sell-off toward the Imbalance zone below (23,710 area).

Main targets are:

Imbalance fill

Possibly further down toward Weekly Open near 23,680

🔧 Confluence:

Midnight Open has already been reclaimed.

NY AM session is about to open – expecting expansion to provide confirmation.

Potential divergence between NQ (stronger) and ES (weaker) gives context for relative weakness later in the session.

📌 Idea Summary:

I expect one final push into the premium zone to grab liquidity before reversing down toward the Imbalance and possibly into the Weekly Open.

XAU/USD Intraday Plan | Support & Resistance to WatchGold rallied strongly yesterday, reaching into the $3,422 resistance zone, but failed to hold above and has since pulled back to around $3,409. Price is consolidating just above the $3,406 level, with short-term momentum still supported by the 50MA (pink) and 200MA (green) trending higher.

For the bullish case to continue, gold needs a decisive break and hold above $3,422, which would open the way toward $3,445. If price remains capped, we may see a deeper correction, first into $3,386, then $3,363, and potentially retesting the First Support Zone ($3,347–$3,328).

📌Key Levels to Watch

Resistance:

$3,422

$3,445

Support:

$3,406

$3,386

$3,363

$3,347

$3,328

🔎 Fundamental Focus – Friday, Aug 29

Today brings key U.S. data including Core PCE Price Index, Personal Income & Spending, Chicago PMI, and UoM Consumer Sentiment. These reports will give fresh signals on inflation and growth.

⚠️ It’s also the last trading day of August — expect higher volatility. Manage exposure carefully heading into the weekend.