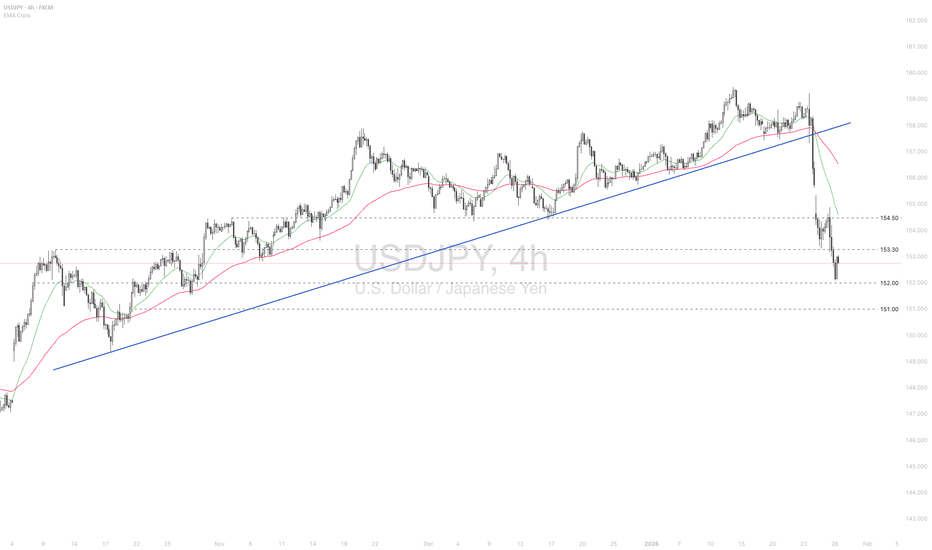

USDJPY H4 | Bearish ContinuationThe price has rejected off our sell entry level at 154.04, which is a pullback resistance that is slightly above the 23.6% Fibonacci retracement.

Our stop loss is set at 155.20, which is a pullback resistance that is slightly above the 38.2% Fibonacci retracement.

Our take profit is set at 151.66, which is a swing low support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Jpy

Potential bullish bounce?USD/JPY is falling towards the support level, which is a pullback support and could bounce from this level to our take profit.

Entry: 152.98

Why we like it:

There is a pullback support level.

Stop loss: 152.13

Why we like it:

There is a pullback support level.

Take profit: 154.76

Why we like it:

There is a pullback resistance level that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

TradingView (www.tradingview.com)

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZDJPY LONG CONTINUATION NZD/JPY has been making higher highs and higher lows showing a clear uptrend for a number of months.

We can see after last weeks retracement the pair has found support at 91.6 zone - which is also in line with the 100MA on the four hour. This shows a strong level of supports where buyers are ready to re enter the market to push the pair higher hopefully to create its next swing high.

TP1 - 94.017

50% Fib resistance ahead?EUR/JPY is rising towards the resistance level whihc is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 184.38

Why we like it:

There is a pullback resistance that aligns with the 50% Fibonacci retracement.

Stop loss: 186.39

Why we like it:

There is a swing high resistance level.

Take profit: 181.42

Why we like it:

There is an overlap support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Potential bullish reversal?AUD/JPY is falling towards the support level, which is a pullback support, and could bounce from this level to our take profit.

Entry: 106.46

Why we like it:

There is a pullback support level

Stop loss: 106.12

Why we like it:

There is a pullback support level.

Take profit: 107.87

Why we like it:

There is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDJPY - Interventions strengthen the JPY (price decline)FX:USDJPY is in a negative rally phase, passing through the entire trading range, breaking through the daily timeframe support at 154.450 and closing below the level, hinting at a possible continuation of the decline.

The dollar is falling, the yen is strengthening. The Bank of Japan intervened, which contributed to the strengthening of the national currency. The current movement may continue...

The currency pair breaks through the fairly important support level of 154.500 (154.45) as part of the rally and closes below the level. Consolidation is forming on the local timeframe, which may be aimed at a further decline. A short squeeze in the 154.45 zone could trigger a decline to 153 - 151.8

Resistance levels: 154.45, 155.65

Support levels: 152.96, 151.85

A breakdown from the local consolidation could trigger a continuation of the decline, as could a retest of the nearest resistance (liquidity hunt).

The market still has the potential to continue falling to 151.85 and to the intermediate bottom of 149.5.

Best regards, R. Linda!

EURJPY H4 | Could We See A Bullish Reversal?Based on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 182.42, which his an overlap support.

Our stop loss is set at 181.36, which is a pullback support.

Our take profit is set at 184.77, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Could we see a reversal from here?CAD/JPY is reacting off the pivot, which acts as a pullback support that aligns with the 161.8% Fibonacci extension and could bounce to the 1st resistance which lines up with the 50% Fibonacci retracement.

Pivot: 111.82

1st Support: 110.88

1st Resistance: 113.47

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish drop off?NZD/JPY has rejected off the pivot and could drop to the 1st support, which acts as an overlap support.

Pivot: 92.22

1st Support: 90/69

1st resistance: 93.17

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDJPY slid on US uncertainty and Japan’s intervention risk< Fundamentals>

The dollar-yen continued to weaken amid speculation of intervention, weighing on sentiment.

Meanwhile, the BoJ Dec meeting minutes revealed that the board anticipates several rate hikes to reach the expected neutral rate, though the pace will remain gradual and data-dependent.

Concerns over intervention and the broader weakening of the US dollar remain to support the yen.

USDJPY breached above 154.50 but failed to hold above the level and fell below 153.30. Diverging bearish EMAs indicate a downtrend extension potential. If USDJPY breaks below 152.00, the price may retreat further toward the next support at 151.00. Conversely, returning above 153.30 may lead to an advance toward the subsequent resistance at 154.50.

NZDJPY LONGS 0 NZD/JPY has been making higher highs and higher lows showing a clear uptrend for a number of months.

We can see after last weeks retracement the pair has found support at 91.6 zone - which is also in line with the 100MA on the four hour. This shows a strong level of supports where buyers are ready to re enter the market to push the pair higher hopefully to create its next swing high.

TP1 - 94.017

CHFJPY LONGS - NEXT LEG UPCHF/JPY has been making higher highs and higher lows showing a clear uptrend for a number of months.

We can see after last weeks retracement the pair has found support at 198.480 zone - which is also in line with the 100MA on the four hour. This shows a strong level of supports where buyers are ready to re enter the market to push the pair higher hopefully to create its next swing high.

TP1 - 201.020

Heading towards 38.2% Fib resistance?USD/JPY is rising towards the pivot, which acts as a pullback resistance that aligns with the 38.2% Fibonacci retracement and could reverse to the 1st support.

Pivot: 155.63

1st Support: 152.96

1st Resistance: 157.19

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Key resistance ahead?GBP/JPY is rising towards the pivot and could reverse to the 1st support, which has been identified as a pullback support.

Pivot: 211.96

1st Support: 208.94

1st Resistance: 214.29

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Could we see a reversal from here?EUR/JPY is reacting off the pivot, a pullback resistance slightly below it, which could reverse to the overlap support.

Pivot: 183.52

1st Support: 181.72

1st Resistance: 184.82

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDJPY Strongest Buy Signal in 4 months on the 1D MA100.The USDJPY pair has hit its 1D MA100 (green trend-line) for the first time in more than 4 months (since September 17 2025), which was the last Higher Low exactly at the bottom of the 9-month Channel Up.

With the 1D RSI oversold, exactly like when the Channel Up started on April 21 2025, we treat this as the strongest long-term buy opportunity towards a potential Resistance (July 03 2024 High) test. As a result, we turn bullish here targeting 162.000.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USD/JPY Rate Check - What's NextUSD/JPY broke down in a big way to finish last week and that weakness has so far held through the weekly open. There's already widespread allegation of intervention but I think that remains a murky topic, and this is something that we often can't confirm for a while although that won't stop many on social media from spreading the rumors.

In my mind this just may be an organic move fueled by a really crowded trade, and the BoJ may have just accomplished what they would want from an intervention without actually having to intervene. The reason that I think this may be the case is the way that the sell-off happened: There was an initial shock of weakness in USD/JPY around the BoJ meeting on Friday, but the big sell-off in the pair hit after the US open, and it was a cascading affair with the selling intensifying into the close.

This seems more likely to be from institutional traders removing hedges on JPY-linked trades, and if we look at the threat of more rate hikes from the BoJ at the meeting just a night earlier it makes sense as to why these market participants would want to remove hedges.

With USD/JPY getting so close to the 160.00 level that was widely believed to be the price that the finance ministry would defend - combined with a Bank of Japan that's gearing markets up for more rate hikes combined with a Fed that seems too shell-shocked to even think rate hikes and are still contemplating more cuts - all capitalized by the idea that President Trump will get to name a new Chair at the FOMC - it made little sense for traders and hedge funds to hold on to those hedges.

And as we often see from a crowded trade, a snowball can quickly turn into an avalanche as the exit door for getting out is only so wide, and nobody wants to be left holding that bag.

if there is an actual intervention, that snowballing effect is often the desired trait of the intervening party and the intervention itself is basically compacting snow to begin the process.

Given the impossibility of knowing whether this was legitimately intervention until or unless actually confirmed by Japanese data or Japanese policymakers - the 'why' matters far less than the 'what' here, and at this point, with USD/JPY well-below that 160.00 handle. We're probably going to find out whether this was more of a market driven dynamic or whether it was engineered to run some stops.

At this point, price is testing support at 153.41 which is the 61.8% retracement from the last carry unwind episode back in 2024. The 154.45-155.00 zone remains a key spot as this is what was defended in December around when the BoJ was prepping markets for rate hikes and if bulls can force a move back above that, then there would appear to be little fear of intervention given the ~500 pips up to the 160.00 handle. In that scenario GBP/JPY or EUR/JPY might be even more attractive but the battleground for the theme is without a doubt the USD/JPY pair. - js

USDJPY Breakout and Potential RetraceHey Traders, in tomorrow's trading session we are monitoring USDJPY for a selling opportunity around 156.000 zone, USDJPY was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 156.000 support and resistance area.

Trade safe, Joe.

JPY Index — Reversal Signal Confirmed. EurJpy&GbpJpy in focusA week ago, I argued that a strong reversal could be next for JPY pairs, based on one key observation:

✅ the JPY Index was trading at an all-time low, but price action was contained inside a falling wedge — a pattern that often signals trend exhaustion and a reversal just around the corner.

And as always, the market did what it does best…

👉 it made one more new low, just to shake everyone out, before reversing.

🔥 Friday: The First Real Confirmation

Friday delivered a very important technical signal: a strong bullish engulfing candle

and even more importantly…

✅ a close above the descending trendline of the falling wedge

That’s a key detail, because wedge breaks matter only when the market accepts above the structure, not when it simply spikes and fades.

📈 Today: Gap Up and Strong Continuation

Today, the market opened with a clear gap above horizontal resistance and is trading strongly to the upside.

This is exactly how a real reversal begins:

- break the structure

- reclaim the level

- continue with momentum

✅ Going Forward: I Expect JPY Strength to Continue

From this point, I expect the JPY recovery / strength to extend further.

Which means my focus shifts to the pairs that can “pay” the best if JPY strengthens:

👉 EURJPY

👉 GBPJPY

📌 Trading Plan

My plan is simple:

✅ Sell rallies in EURJPY and GBPJPY as long as JPY strength remains the dominant theme.

If this reversal continues to develop, these crosses have the potential to deliver powerful downside corrections. 🚀

UsdJpy- Confluence Support Under PressureYesterday, I shared my view on the JPY Index, where I explained that a strong JPY recovery could be the next major move.

The first and most obvious candidate to reflect that shift is USDJPY.

🔎 What the Chart Is Telling Us

After an initial rise from support, USDJPY attempted another push higher, but the overnight spike faded completely — and price is now back into the same support area again.

What makes this level important is the fact that we are sitting on a confluence support, reinforced by:

- a key horizontal support zone

- the rising trendline drawn from mid-December

This is exactly the type of level where the market should react strongly if bulls are still in control.

⚠️ Spike & Fade = Weakness Signal

For me, the fact that USDJPY spiked up and then fully reversed back into support is not bullish.

It’s a clear sign of failed upside acceptance, and it often precedes:

➡️ a breakdown through support

If buyers were truly strong, they wouldn’t allow price to slip back so easily.

📌 Bearish Scenarios & Targets

If this confluence support breaks, the next downside path becomes realistic:

🎯 Shorter-term target: 155.75 (interim support)

🎯 Main support target: 154.50 (major floor inside the broader range)

A move into 154.50 would be fully aligned with the idea of JPY strength building across the board, as discussed in yesterday’s JPY Index post.

✅ Conclusion

USDJPY is sitting at a critical decision zone — but based on the rejection structure, I lean toward:

👉 support breaking, not holding

If price confirms the breakdown, the market could quickly accelerate lower toward 155.75, and potentially 154.50 next. 🚀