LINK/USDT — Descending Trendline Test: Break or Rejection?LINK/USDT on the 12H timeframe is still moving within a medium-term bearish structure, but price is currently testing a major descending trendline resistance that has capped upside movement since the previous highs. This places LINK in a critical decision zone.

---

📐 Pattern & Price Structure

Primary Pattern: Descending Trendline (Bearish Structure)

Price has been forming consistent lower highs and lower lows.

Price is now approaching a dynamic resistance (yellow trendline), which has:

Acted as strong resistance for months

Become a key validation level for either continuation or reversal

Additionally, price is consolidating in a tight accumulation range below the trendline, often a precursor to a strong breakout or breakdown.

---

🧱 Key Levels

Resistance:

13.55 – 14.70 → Minor resistance / supply zone

16.50 → Next structural resistance

18.50 – 19.90 → Extended bullish targets after a confirmed breakout

23.40 → Major resistance / previous distribution area

Support:

12.40 – 12.00 → Nearest support & demand zone

11.70 → Critical support (bullish invalidation)

11.10 → Extreme support / last defense

---

🟢 Bullish Scenario

Price breaks and closes decisively above the descending trendline on the 12H timeframe.

Ideal confirmation includes:

Strong candle body

Trendline retest holding as support

Potential upside targets:

14.70 → 16.50

Extension toward 18.50 – 19.90

A valid breakout would:

End the lower-high structure

Signal a medium-term trend reversal or bullish continuation

---

🔴 Bearish Scenario

Price fails to break the trendline and prints a clear rejection (long upper wick / bearish engulfing).

A breakdown below the current range opens downside potential toward:

12.00 retest

Extension to 11.70 – 11.10

As long as price remains below the descending trendline, the primary bias stays bearish / corrective.

---

🧠 Conclusion

LINK/USDT is trading at one of the most important technical zones in recent months.

Price reaction at the descending trendline will define the next major move:

Breakout → structure shift & bullish opportunity

Rejection → continuation of the downtrend

Patience and confirmation are key to avoiding false breakouts in this area.

---

#LINK #LINKUSDT #Chainlink #CryptoAnalysis #TechnicalAnalysis #Altcoins #Downtrend #Trendline #Breakout #CryptoTrading

Linkusdtidea

LINK/USDT — Historical Block: Bull Revival or Demand Breakdown?LINK is now approaching the most critical level of its multi-year market structure. The price has returned to the exact same demand block that triggered the major bullish expansion in previous cycles. This isn’t just support — it’s a historical liquidity zone where smart money repeatedly positioned itself before every significant rally.

And once again, the market is testing this area.

---

**✨ Market Narrative:

“Back to Where the Trend Began”**

From 2023 to 2025, every approach to the $10–$8.8 zone resulted in heavy absorption, long wicks, and strong reversals. This proves that this area acts as a primary liquidity pool for institutional accumulation.

This current revisit could become:

A bullish revival into a new multi-month uptrend,

or

A full breakdown into deeper distribution if the zone fails.

Simply put:

👉 This is LINK’s “make or break” level.

---

📈 Bullish Scenario — “Demand Awakening”

The bullish thesis activates if price:

Holds above $10–$8.8,

Forms a new higher low,

And closes strongly above $13–$14 on the 4D timeframe.

Signs of accumulation:

Long downside wicks inside the block

Increasing volume after compression

Higher timeframe candle reclaiming previous breakdown points

If confirmed, upside targets unfold naturally:

🎯 Target 1: $15–$17

🎯 Target 2: $21–$26

🎯 Target 3: Retest of the 2024 macro highs (expansion phase)

A reclaim of $17 would signal that the macro bullish trend is re-establishing itself.

---

📉 Bearish Scenario — “Demand Collapse”

The bearish thesis confirms ONLY when price:

Prints a decisive 4D close below $8.8,

Followed by continuation (not just a liquidity wick).

If the demand block breaks, the market shifts from accumulation to full distribution.

Downside targets become likely:

🎯 Target 1: $6–$5

🎯 Target 2: $4.7 (historical low & liquidity magnet)

🎯 Target 3: Full macro range retracement

This breakdown would represent a structural trend shift on the higher timeframe.

---

📊 Pattern & Market Structure Breakdown

Historical Demand Revisit: Price has returned to the core area that defined the previous rally.

Liquidity Grab Evidence: Deep wicks below the block — classic stop hunts before accumulation.

Macro Range Structure: LINK remains inside a multi-year range, hovering at its lower boundary.

Trend Context: Lower highs formed in 2025, and now price is searching for macro direction.

This isn’t ordinary price action —

this is where accumulation and distribution collide.

#LINK #Chainlink #Crypto #Altcoins #TechnicalAnalysis #DemandZone #PriceAction #MarketStructure #SmartMoney #CryptoAnalysis #SupportResistance

#LINKUSDT:minor correction first | major bullish move towards 40The LINKUSDT price is expected to decline to a range between 11.72 and 14.72 before resuming its upward trend. This price range has historically seen significant trading volume, indicating that a drop within this range is likely in the near future.

Once a trading position is initiated, there are three primary targets to consider. The first target is set at 25, which is highly achievable due to its proximity to the current price levels. The second target is at 35, which is also within reach with favourable market conditions.

The final target is at 45, which may require more time to achieve and will depend on strong fundamental support and positive market developments.

Good luck and trade safely.

Team Setupsfx_

LINK/USDT - Ready to Explode? Uptrend Structure Tested?Chainlink (LINK) is now positioned at the most crucial zone in its mid-term technical structure — the 16.6–15.5 USDT area is not just a simple support, but a confluence zone between horizontal support and an ascending trendline that has been holding since April 2025.

Currently, price is reacting positively within this area, indicating that market participants are still defending the broader uptrend structure. However, if this zone fails to hold, the structure may collapse — paving the way for a deeper correction.

---

Pattern & Market Structure

Ascending Trendline Support: formed since April and still holding selling pressure.

Yellow Demand Zone (16.6–15.5): a strong accumulation area, tested multiple times this year.

Range-to-Trend Formation: price attempting to break out from sideways range into trend continuation.

Layered Resistances Above: 18.5 → 20.0 → 23.4 → 25.2 → 26.7 → 29.3 acting as step-by-step upside targets if the trend continues.

---

Bullish Scenario — Potential Reversal from a Strong Base

If price manages to hold and bounce strongly from the 16.6–15.5 zone, it opens the door for forming a new higher low that could become the foundation for the next rally.

Bullish confirmation: Daily close above 16.6 with reversal candle (hammer/bullish engulfing) and increasing volume.

Step-by-step upside targets:

18.5 → first psychological resistance.

20.0 → prior supply reaction area.

23.4–25.2 → potential breakout continuation zone.

Extended target: If momentum sustains, the ultimate target sits around 29.3–30.9, the yearly high.

Strategy:

Gradual buy within support zone with disciplined stop loss below 15.0. Additional confirmation entry if daily close >18.5.

---

Bearish Scenario — Breakdown as the Start of a Deeper Correction

However, if price breaks below 15.5 with strong volume, the bullish structure will be invalidated.

Bearish confirmation: Daily close below both trendline and 15.5.

Downside targets:

13.0 → previous horizontal support from May.

10.8 → macro base from 2024.

Additional signals: RSI breakdown, or failed retest below 16.6 after the break.

Strategy:

Wait for a failed retest around 15.5–16.0 for a short/hedge setup targeting 13.0.

---

Technical Perspective

The market is currently in a strategic neutral zone — between a potential major reversal and a confirmed breakdown. This is a decision phase, where volume and daily candle patterns will dictate the next dominant direction.

From a mid-term perspective, holding the ascending trendline means maintaining the macro uptrend structure, which could drive LINK back toward the 25–30 USD region. Conversely, losing this support may shift the structure into a new downtrend toward the long-term accumulation area below 13 USD.

---

Final Note

The 16.6–15.5 zone is more than just a number — it’s the psychological boundary between conviction and doubt.

Short-term traders look for a bounce, while long-term investors await directional confirmation.

Watch the daily close, volume, and trendline reaction closely. This is where the market decides: rebound toward 20+ or fall back to 13.

---

#Chainlink #LINKUSDT #CryptoAnalysis #TechnicalAnalysis #SupportAndResistance #Trendline #CryptoSetup #PriceAction #CryptoMarket

LINK Spot LONG LINK Spot LONG📈

Due to the formation of a zigzag structure, I am more inclined to form a triangle and further exit from it upwards. I no longer consider it as an impulse.

Expectations have not changed, I plan to start recording after updating the global maximum of 53.00. Only the time of the scenario implementation has changed, which may take a long time.

All altcoins with potential show approximately the same picture, which is encouraging. This structure provides the most accurate goals for profit-taking and scenario cancellation.

LINK/USDT — The Final Defense Zone: Will the Bulls Rise Again?Chainlink (LINK) has entered its final defense zone around $15.00–$17.00, a historically strong structural support area.

This zone isn’t just random — it’s the same level where the market once launched a major rally that drove LINK to $27.87.

The most recent daily candle shows a deep wick below the zone that was quickly reclaimed — a classic sign of a liquidity grab or false breakdown, hinting that the market might be accumulating before its next significant move.

Overall, the structure suggests a major retest phase: after a powerful breakout earlier this year, LINK is now retesting the origin of that move.

The key question — is this the start of re-accumulation before another leg higher, or the beginning of a market structure breakdown toward deeper lows?

---

Structure & Pattern

Yellow Zone ($15–$17) → Historical demand zone, validated by multiple previous bounces (marked by yellow arrows).

Macro Pattern → Retest of breakout zone, with the latest candle showing sweep and reclaim behavior.

Momentum → Sharp correction, but with a long lower wick and potential momentum divergence — a sign that the correction phase might be near its end.

Technical Context → Holding above this zone may form a double bottom or higher-low structure, indicating bullish strength recovery.

---

Bullish Scenario (Reversal Setup)

A daily close above $17 would confirm that buyers are defending the structure.

A sustained move above $19.99 could unlock upside targets at $21.69 → $23.30 → $25.12 → $26.82.

A strong rejection from the lower zone, combined with rising volume, may signal institutional accumulation in progress.

Market Narrative:

Bulls might be quietly preparing for Phase 2 of the rally after a classic shakeout.

As long as the $15–$17 zone holds, LINK retains the potential to resume its mid-term uptrend.

---

Bearish Scenario (Continuation Breakdown)

A daily close below $15 would signal structural failure and a loss of bullish control.

This could trigger a continuation drop toward $13.5 → $12.0 → $9.8.

A failed retest from below the zone ($16–$17 rejection) would further confirm bearish momentum.

Market Narrative:

If this support collapses, LINK may enter a distribution phase, where selling pressure strengthens and momentum fully flips bearish.

---

Conclusion & Perspective

The $15–$17 zone is the line between survival and surrender for LINK’s bullish structure.

As long as this level holds, the potential for a bullish reversal remains alive.

But once broken, the mid-term trend could shift decisively to bearish.

We are standing at a Decision Zone — the kind of area where institutions quietly position themselves and patient traders wait for confirmation before taking action.

---

LINK returns to its final defense zone at $15–$17 — the area separating a major reversal from a new downtrend.

The long wick signals a liquidity sweep, but confirmation awaits the next daily close.

Bulls are being tested — will they hold the line, or give in to market pressure?

Levels to watch:

Support: $15–$17

Resistance: $19.99 → $21.69 → $23.30 → $25.12 → $26.82 → $27.87

---

#LINK #Chainlink #LINKUSDT #CryptoAnalysis #TechnicalAnalysi #SupportAndResistance #CryptoMarket #PriceAction #Altcoins #MarketStructure #CryptoSetup #LINKPrice

LINK/USDT — Golden Zone Will Decide the Next Move!?Current Price: ~23.47 USDT

Chainlink (LINK) has just completed a strong rally from the yearly low at 10.10 to the peak of 30.94. Now, the price is consolidating and retesting the Fibonacci Golden Pocket — a critical area that will decide whether the uptrend continues or a deeper pullback occurs.

---

🔎 Market Structure Analysis

Primary Trend: Strong bullish reversal since June 2025, with higher highs and higher lows forming.

Current Condition: Price is pulling back from the recent top (30.94) and consolidating around 23–25, right above the Golden Pocket (21.18–19.86).

Key Demand Zone: The yellow area (19.8–21.2), previously a strong resistance, is now acting as support (supply → demand flip). Holding this zone is crucial for the next big move.

---

🟢 Bullish Scenario

If LINK holds above 21.18–19.86, the current move is likely just a healthy retracement before continuation.

Confirmation: Daily close above 25.24–26.65 with rising volume.

Upside Targets:

🎯 Target 1: 25.24 (minor resistance)

🎯 Target 2: 26.65 (key breakout level)

🎯 Target 3: 29.20

🎯 Target 4: 30.8–31.0 (previous high)

Breaking above 30.8 could open the door for new highs in the coming months.

---

🔴 Bearish Scenario

If price fails to defend the 19.86–21.18 zone, a deeper correction may unfold.

Confirmation: Daily close below 19.8 with strong selling volume.

Downside Targets:

⚠️ Target 1: 15.63 (Fib 0.5)

⚠️ Target 2: 14.69 (Fib 0.618)

⚠️ Extreme Target: 10.10 (yearly low in case of panic sell).

---

📌 Key Technical Patterns

Bullish Flag / Consolidation: Current price action resembles a bull-flag formation after a strong impulse.

Supply-Demand Flip: The yellow zone (19.8–21.2) flipped from resistance into support — a decisive area for market structure.

Golden Pocket Fib: 0.5–0.618 retracements are historically strong levels for trend continuation.

---

🧠 Conclusion & Strategy

LINK is currently at a make-or-break golden zone.

Bullish Case: Holding above 19.8–21.2 keeps the bullish structure intact → targets at 26.6, 29.2, and 31.

Bearish Case: A breakdown below 19.8 opens risk for a correction toward 14–15 or even back to 10.1.

Trading Plan:

Accumulate near 21–23 if signs of bounce appear.

Breakout entry above 26.65 for swing targets at 29–31.

Place stop-loss below 19.8 to protect long setups.

Take partial profits at each resistance level.

---

📌 LINK is standing at a critical decision zone. Will buyers defend this golden pocket to fuel another leg up toward 30+? Or will sellers drag the price back to 15 and below?

#LINK #LINKUSDT #Chainlink #CryptoAnalysis #Altcoins #SwingTrading #TechnicalAnalysis #CryptoTA #Fibonacci #PriceAction

$LINK Coiling for Breakout — $40 in Sight?CRYPTOCAP:LINK is pressing against a long-term resistance line after months of steady higher lows. This ascending structure shows strong underlying bullish momentum.

If price breaks and holds above this resistance, it could open the path toward the $30–$35 zone and potentially the broader resistance area around $40+.

Until then, bulls need to defend the rising trendline to keep the momentum alive.

DYOR, NFA

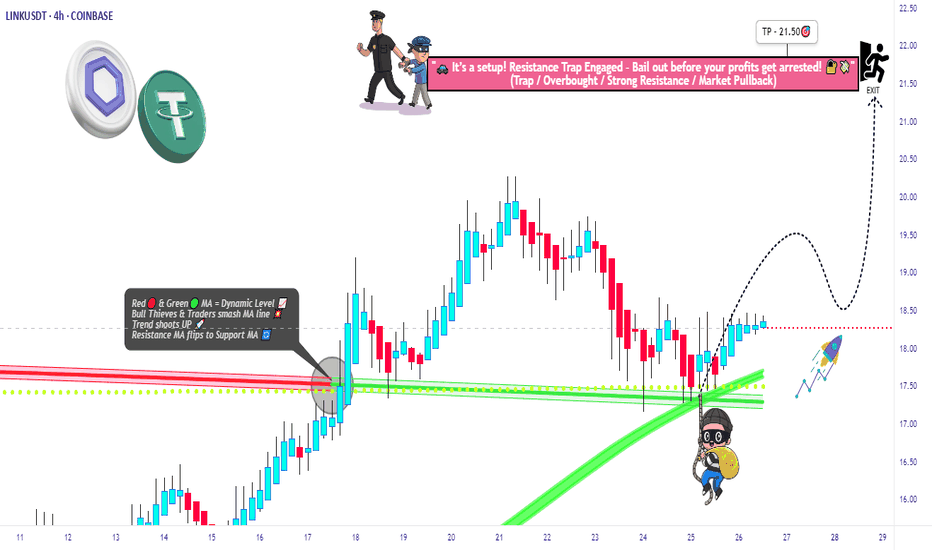

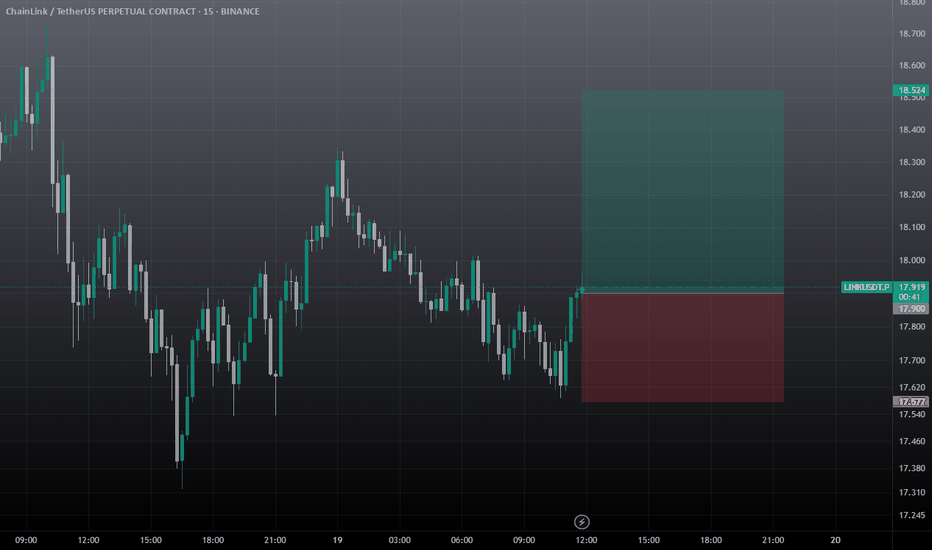

Smart Robbery Plan: LINK/USDT Long Setup | Swing/Day Trade Idea🚨CHAINLINK HEIST PLAN 🚨 | LINK/USDT Market Robbery (Thief Trader Style) 💰🔐

🌍 Hola! Bonjour! Hallo! Marhaba! What’s up, Money Makers & Market Robbers?! 🕶️💵

Get ready to raid the LINK/USDT vault with Thief Trader’s high-precision strategy based on 🔥 Technical & Fundamental fusion 🔥.

This is not your regular setup. This is a robbery roadmap. Designed for swing & day traders, and spiced with smart DCA entries, risk control, and a bold vision. Let's get into the game plan before the market alarms go off! 🚓📉📈

🎯 Master Plan – LINK/USDT | Bullish Setup

Entry:

📌 “The vault is open – grab the loot!”

Start entering long anywhere within the nearest price pullback zone. Use 15m to 30m TFs for sniper-style limit entries.

🛠️ Deploy DCA-style multiple limit orders (layered strategy), preferably around recent swing lows or major liquidity zones.

Stop Loss:

🔐 Place SL just below the 4H swing low wick (Currently at $16.50), adjusting for your risk, lot size, and how many limit orders you're stacking.

Take Profit:

🎯 Main TP target: $21.50

⛔ Or bail early if momentum weakens. Your profit, your decision.

⚡️Scalper’s Memo:

Only scalp on the bullish side – stay with the smart money.

Have deep pockets? Jump in now.

On a budget? Join swing traders and follow the full heist plan.

📉 Use trailing SL to secure profits during volatile rallies.

🔍 Fundamental & Sentiment Snapshot:

LINK is gaining bullish traction due to a combo of strong sentiment, favorable macro outlook, and on-chain flows aligning.

📊 Keep eyes on COT reports, intermarket data, and liquidity metrics.

🧠 Sentiment leans bullish while late bears are trapped in the supply zones above.

🛑 Risk & News Management Alert:

🚨 News releases can spike volatility and mess with clean entries.

📵 Avoid placing trades during high-impact events.

📍 Use trailing stop-loss to protect your running profits and preserve capital.

💖Support the Plan, Join the Heist:

Love the trade idea? 💥Hit the BOOST💥 button and show some love to the strategy that lets traders "rob the market" with confidence.

Every like helps build the strongest heist crew on TradingView.

✅ Stay sharp. Stay patient. Stay profitable.

👤 Thief Trader signing out… until the next raid. 🐱👤💰🚀

#LINK #LINKUSDT #CryptoTrading #ThiefTrader #SwingTrade #DayTrade #DCA #BullishSetup #TradingPlan #TA #RobTheMarket #ChainlinkHeist #SmartMoneyMoves

#LINKUSDT: Distribution Phase Has Started! Will It Hit $45? The accumulation phase has just ended, and the distribution phase has just begun. Our current concern is whether the bullish volume holds on and the trend continues to remain bullish. Please do your own research before blindly following the analysis, as this is just our bias and does not guarantee that the price will exactly follow the chart.

Thank you for your support throughout. We wish you the best!

Team Setupsfx_

LINK/USDT Chainlink Gearing Up for a Major Breakout?

🧠 Overview:

The LINK/USDT chart is showcasing a high-conviction technical setup — a well-defined Descending Triangle that has been forming for over 6 months. This pattern often acts as a pressure-cooker scenario, building up momentum before a major breakout.

The triangle is composed of consistent lower highs pressing against a strong horizontal support zone at $12.5 – $13.2, which has been tested and held multiple times since February 2025.

Currently, the price is approaching the apex of the triangle, signaling that a breakout is likely imminent.

📐 Pattern Details – Descending Triangle:

🔻 Descending Resistance Line: Connecting lower highs since the January 2025 peak.

🟨 Flat Support Zone: The $12.5 – $13.2 level has served as a strong demand zone.

⏳ Apex Nearing: Price action is compressing, and breakout pressure is building.

📉 Decreasing Volume: Volume is drying up — a classic precursor to a breakout move.

✅ Bullish Scenario (Breakout):

If LINK breaks above the descending trendline and reclaims resistance around $14.00 – $15.44, the chart could ignite a strong upside move.

🚀 Bullish Targets:

1. $15.44 (first key resistance & breakout validation)

2. $17.44 (prior structure resistance)

3. $19.38 (swing high from Q1)

4. $26.58 (major resistance zone)

5. $28.00 – $29.35 (long-term upside target)

📌 Breakout Confirmation: Look for high volume and a successful retest of the breakout level to confirm bullish momentum.

❌ Bearish Scenario (Breakdown):

If LINK fails to hold the $12.5 – $13.2 support zone and breaks below it with strong volume, downside risks increase significantly.

⚠️ Bearish Targets:

$11.00 (minor support)

$9.50 (next demand zone)

$8.00 (macro support from 2023)

A breakdown from this triangle would invalidate the bullish setup and could trigger a broader bearish continuation.

🧩 Conclusion & Strategy:

📊 Pattern: Descending Triangle

🕰️ Formation Duration: 6+ months (strong reliability)

🟨 Critical Zone: $12.5 – $13.2 = Key Support

📍 Breakout Trigger: Above $15.4

🔍 Breakdown Trigger: Below $12.5

📌 Trading Ideas:

🔼 Long Position: Upon breakout above $15.4 with confirmation

🔽 Short Position: Upon breakdown below $12.5 with increased volume

📚 Bonus Insight:

Chainlink remains one of the most widely adopted oracle solutions in DeFi and enterprise blockchain. A technical breakout from a long-term consolidation like this could attract both retail and institutional capital.

#LINKUSDT #Chainlink #CryptoBreakout #DescendingTriangle #Altseason #TechnicalAnalysis #BullishSetup #CryptoSignals #TradingView #AltcoinSetups

LINKUSDT: Inverse Head & Shoulders Breakout! The Reversal BeginsBINANCE:LINKUSDT has broken out of a classic inverse head and shoulders pattern — a well-known bullish reversal formation. After the breakout, price action showed strength by coming back to retest the neckline support and holding it successfully. This confirms the pattern and signals a potential shift in trend.

From a technical perspective, this setup is highly promising. The market structure indicates a likely reversal after an extended downtrend, and the breakout could be the start of a strong bullish phase. With solid fundamentals backing BIST:LINK , the rally could gain serious momentum once it gets going.

This pattern isn’t just any breakout — it’s a reversal of the reversal, a major turning point in trend. If bulls take control, this move has the potential to accelerate rapidly. However, it’s crucial to always manage risk, use a well-placed stop-loss, and avoid overexposure.

Get ready — once the rally starts, it might be unstoppable!

BINANCE:LINKUSDT Currently trading at $15.5

Buy level : Above $15

Stop loss : Below $13

Target 1: $17

Target 2: $1.4

Target 3: $2.1

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

LINK/USDT Setup: Structure Break + Fibonacci Confluence🚨 Market Watch: LINK/USDT Analysis 🚨

I'm currently keeping a close eye on LINK/USDT. 🧠 On the daily chart, we've observed a clear break in market structure 📉—and dropping down to the 4H timeframe, we see further confirmation of that shift.

At this point, price is looking a bit overextended 🏃♂️💨, and I’m anticipating a retracement back into equilibrium based on the current price swing 📊. This could set up a high-probability short opportunity 🎯.

📹 In the video, I dive into:

Overall trend direction 🔁

Market structure shifts 📐

Price action breakdown 🕵️♂️

And key support/resistance levels to monitor for target zones 🧱

My stop loss would be positioned just above entry, using around 2x ATR for smart risk control

🛡️. As for targets, we could see moves as wide as 6x ATR—but it's crucial to reference the left side of the chart for confluence 📅📈.

I’m aligning this setup with my Fibonacci retracement strategy, which we also covered in the video 🔢📏.

This is not financial advice. Always trade your own plan. ⚠️📉💼