GBPJPY Trading Opportunity! BUY!

My dear subscribers,

This is my opinion on the GBPJPY next move:

The instrument tests an important psychological level 212.42

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 213.11

My Stop Loss - 212.02

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

LONG

EURUSD: Trend Shift in Play as Buyers Defend Rising SupportHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD is trading within a broader bullish context after completing a corrective phase. Earlier, price moved higher inside a well-defined ascending channel, confirming strong buyer control with a clear sequence of higher highs and higher lows. After reaching the upper boundary of the channel, the market transitioned into a corrective bearish move, forming a descending channel that reflected temporary seller dominance rather than a full trend reversal. During this correction, price interacted multiple times with key structure levels, producing several breakouts and fake breakouts, which highlighted increased volatility and stop-hunting behavior. Eventually, EURUSD broke below the descending channel but failed to sustain downside momentum. Sellers lost control near the Support Zone around 1.1700, where price found strong demand aligned with previous structure and a rising support line. Buyers stepped in aggressively from this area, leading to a sharp bullish impulse and a confirmed breakout above the descending channel resistance. This breakout suggests a structural shift back in favor of buyers.

Currently, price is consolidating above the support zone and holding above the rising support line, indicating acceptance and strengthening bullish intent. Overhead, the market is approaching the Resistance Zone around 1.1780, which previously acted as a rejection area and remains a key level to watch.

My Scenario & Strategy

My primary scenario remains bullish as long as EURUSD holds above the 1.1700 support zone and continues to respect the rising support structure. A sustained move toward the 1.1780 resistance area is likely, with this level acting as the first target (TP1). A clean breakout and acceptance above resistance would confirm continuation and open the door for further upside.

However, if price gets rejected from resistance, a period of consolidation or a shallow pullback toward the support zone could occur before the next attempt higher. A decisive breakdown below the 1.1700 support would weaken the bullish bias and signal a deeper corrective move. For now, structure and price action favor buyers while support continues to hold.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

EURJPY Will Go Higher! Buy!

Take a look at our analysis for EURJPY.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 184.306.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 185.387 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

Bitcoin Buyer Zone Reaction Signals Potential Move to $90,500Hello traders! Here’s my technical outlook on BTCUSD (3H) based on the current chart structure. Bitcoin previously traded within a broader bullish context, supported by a rising trendline and a well-defined Buyer Zone around the 88,300–88,600 area. After a strong impulsive move higher, price entered a consolidation range and later formed a corrective descending channel, signaling a temporary pause in bullish momentum rather than an immediate trend reversal. During this correction, multiple fake breakouts occurred near the channel boundaries, highlighting indecision and liquidity grabs on both sides of the market. Recently, BTC broke below the descending channel support and briefly dipped into the Buyer Zone, where buyers reacted and defended the level. This area aligns with a key Support Level and prior structure, making it a critical demand zone to watch. The current price action suggests a corrective pullback within the larger structure, as the move down lacks strong impulsive continuation. Above price, the market is capped by the Seller Zone and Resistance Level around 90,500, which coincides with a previous breakout area and the underside of the former range. My scenario: as long as BTC holds above the 88,300 Buyer Zone and maintains higher lows from this support, the broader bullish structure remains valid. A sustained reaction from demand could lead to a recovery move toward the 90,500 Resistance Level (TP1). Acceptance and a clean breakout above this level would signal renewed bullish strength and open the path for continuation higher. However, a decisive breakdown and acceptance below the Buyer Zone would invalidate this scenario and increase the probability of a deeper corrective move toward lower support levels. For now, price is at a key decision point, with buyers and sellers actively battling for control. Please share this idea with your friends and click Boost 🚀

US30 What Next? BUY!

My dear friends,

Please, find my technical outlook for US30 below:

The price is coiling around a solid key level - 49015

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 49220

Safe Stop Loss - 48919

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD Outlook | Bullish Structure + Key Demand Zone!Hey Traders,

In today’s trading session, we are closely monitoring EURUSD for a potential buying opportunity around the 1.17000 zone. EURUSD remains in a well-defined uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 1.17000 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

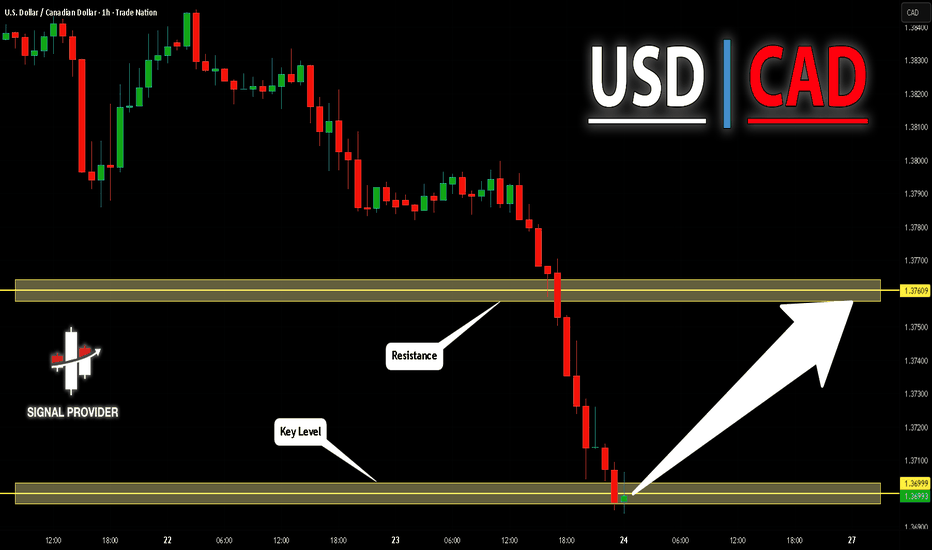

USDCAD Will Move Higher! Long!

Here is our detailed technical review for USDCAD.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 1.369.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 1.376 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

USDCHF Is Bullish! Buy!

Take a look at our analysis for USDCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 0.780.

The above observations make me that the market will inevitably achieve 0.791 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

BTC Reacts at Demand After Sharp Sell-Off Relief Bounce On the H1 chart, Bitcoin remains in a clear bearish short-term structure following the impulsive sell-off from the 93,000–93,500 resistance zone. That rejection marked the start of a strong markdown phase, with price breaking multiple minor supports and staying consistently below the EMA, confirming seller control. The move down was fast and directional, characteristic of distribution resolving to the downside, not a healthy pullback.

Price has now reached and reacted from a key support zone around 87,800–88,300, where downside momentum has visibly slowed. The strong rejection wick from this area suggests sell-side exhaustion, making a technical relief bounce reasonable. Current consolidation just above support indicates short-term balance after the impulse, rather than immediate continuation lower.

From a structural perspective, any upside at this stage should be treated as corrective. The first logical upside target sits near 90,200–90,500, followed by 91,200–91,300, where prior structure and the descending EMA align. The major resistance remains the 93,000–93,500 zone, and as long as price trades below it, the broader bearish bias remains unchanged.

Only a sustained reclaim above 91,300 would suggest a deeper corrective phase. A full bullish shift would require acceptance back above 93,000, which currently appears unlikely without a clear change in momentum.

In summary, Bitcoin is bouncing from strong demand after a completed markdown, making a short-term recovery plausible. However, until key resistance levels are reclaimed, this remains a relief rally within a bearish trend, favoring cautious longs and a continued sell-the-rally mindset for trend traders.

Demand Holding, Relief Rally in Play but Corrective StructureOn the Bitcoin H1 chart, price has completed a sharp bearish impulse from the upper distribution area and is now reacting cleanly from a well-defined demand zone around 87,500–88,000. This zone has already proven its relevance with a strong bullish rejection, signaling short-term absorption of sell pressure rather than continuation to the downside. Structurally, BTC remains in a lower-high environment after the breakdown from the prior consolidation near the resistance zone (~93,000–93,500). The rebound from demand is constructive, but it is still best classified as a corrective pullback, not a confirmed trend reversal. Price is currently consolidating around 89,800–90,000, while the EMA 89 overhead (~90,900) continues to act as dynamic resistance reinforcing the idea that upside momentum is capped for now. From a market logic perspective, downside liquidity has already been partially swept at the demand zone, making a mean-reversion move toward inefficiency above more likely. A controlled push higher could target the 90,800–91,500 area first, followed by a potential test of the major resistance zone near 93K, where sellers previously stepped in aggressively. However, unless BTC can reclaim and hold above the EMA and resistance, this move should be viewed as a relief rally within a broader corrective phase, not the start of a new bullish leg.

BTC is bouncing from demand with short-term bullish potential, but the structure remains corrective. The upside path is open toward resistance, while failure to build higher acceptance above 90.9K would keep the market vulnerable to another rotation back into demand.

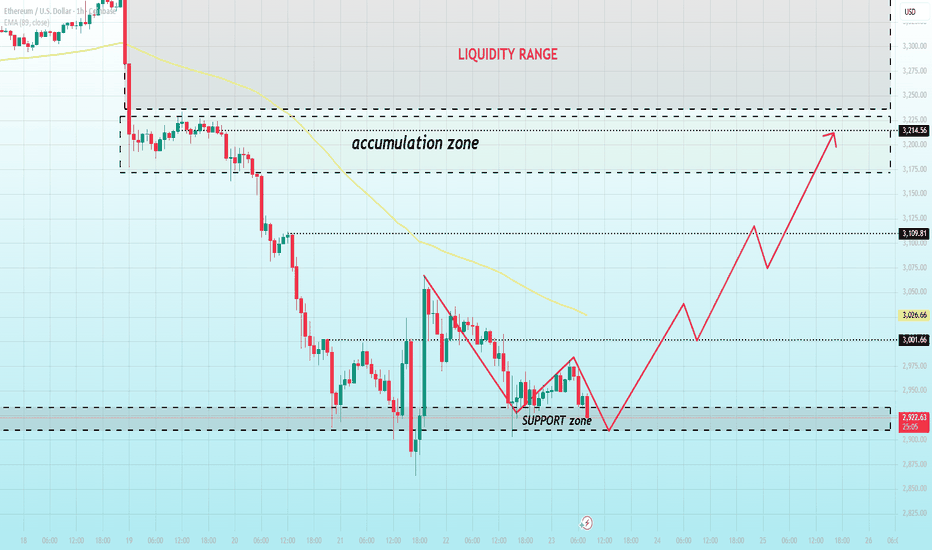

Liquidity Compression Before FLY ? Key Support Holds the LineOn the H1 chart, ETHUSD is currently trading inside a well-defined liquidity range, following a sharp impulsive sell-off that transitioned the market into a controlled accumulation phase. After the aggressive downside move, price began compressing between clear upper and lower boundaries, signaling liquidity absorption rather than continuation selling. This behavior suggests that large players are building positions, not chasing price lower.

Structurally, the support zone around 2,920–2,950 is the most important area on the chart. Price has already reacted multiple times from this level, confirming it as a defended demand zone. Each reaction from support has been followed by higher internal lows, indicating selling pressure is weakening. Although ETH is still trading below the EMA, momentum loss on the downside and range compression often precede expansion, not continuation.

From a price-action standpoint, as long as ETH holds above the support zone, the current structure favors a range breakout to the upside, targeting the upper liquidity band around 3,100 → 3,215. A clean break and acceptance above the accumulation range would confirm bullish intent and open the door for a broader recovery move. However, if support fails decisively, price risks being pulled into a deeper liquidity sweep below the range.

Invalidation:

A strong breakdown and acceptance below 2,900 would invalidate the accumulation thesis and confirm bearish continuation.

ETH is not trending yet it’s coiling. This is a classic liquidity-building environment, where patience pays. Watch the support closely: hold = expansion higher, lose = continuation lower.

Bounce From Demand, Trend Still Bearish Until Proven OtherwiseOn the H4 timeframe, Bitcoin has completed a clear distribution-to-markdown transition. After failing to hold the prior range high around 95–96k, price compressed, broke structure, and accelerated lower confirming trend exhaustion and supply control. The impulsive sell-off that followed was not corrective in nature; it was a clean markdown leg, taking out multiple intraday supports and pushing price directly into a higher-timeframe demand zone around 87–88k.

At this location, the market is doing what it typically does after a sharp displacement: pause and react. The current bounce should be read as a technical reaction from demand, driven by short-covering and liquidity absorption not a trend reversal. Structurally, BTC remains in a lower-high / lower-low sequence, and any upside from here is best treated as a retracement into resistance, with key levels stacked around 91.9k → 93.3k → 95k (prior breakdown levels and supply).

As long as price fails to reclaim and hold above the 93–95k resistance band, the broader bias stays bearish, and the rally scenario remains corrective. A clean acceptance back above that zone would be required to invalidate the bearish structure. Until then, this is a sell-the-rally environment, with demand acting as a temporary floor not a foundation for continuation higher.

Elliott Wave: Bearish Impulse Done — But This Is a CorrectionOn the H4 timeframe, Bitcoin is displaying a textbook Elliott Wave bearish impulse followed by a developing corrective structure. The prior bullish trend clearly terminated near the highs, where momentum stalled and price began distributing before the decisive breakdown.

The sell-off from the top unfolds cleanly as a 5-wave impulsive decline:

- Wave (1) breaks structure and decisively loses the EMA 98, signaling a trend shift.

- Wave (2) is a weak corrective retracement into dynamic resistance (EMA 98), failing to reclaim it a key bearish tell.

- Wave (3) extends sharply to the downside with strong momentum, confirming bearish dominance.

- Wave (4) forms a shallow, overlapping correction, respecting prior structure and maintaining bearish pressure.

- Wave (5) completes the impulse with a final sell-off leg, typically driven by capitulation and late short entries.

With Wave (5) now printed, the impulsive bearish cycle is considered complete. What follows is not an immediate trend reversal, but a corrective ABC recovery phase:

- Wave (A): an initial counter-trend rally, currently developing.

- Wave (B): a pullback that may retest or slightly undercut recent lows, designed to trap premature longs.

- Wave (C): a stronger recovery leg, with a realistic upside magnet toward the EMA 98 / ~92,000 zone, which aligns with prior breakdown structure.

Crucially, this recovery should still be viewed as corrective unless price impulsively reclaims and holds above the EMA 98. Failure at that level would imply the larger bearish structure remains intact, opening the door for renewed downside later.

The downside impulse is done, but the upside is reactionary, not trend-confirming trade the bounce with caution.

ETH Breaks Descending Structure On the 1H ETH chart, price has successfully broken the short-term descending trendline, signaling a potential shift from bearish continuation into corrective recovery. This breakout occurred after a prolonged downtrend and a strong reaction from the key support zone around 2,900–2,920, where sell-side momentum clearly weakened and buyers stepped in with force. The impulsive bounce that followed confirms this zone as a valid demand area rather than a temporary pause.

However, structure is not yet bullish. ETH is currently in the break-and-retest phase, pulling back toward the former trendline and horizontal support. This is a critical moment: acceptance above the support zone would validate the breakout and open the door for a mean-reversion move higher toward the 2,980 → 3,050 target area, with the broader upside capped by the major resistance zone near 3,080–3,120, which also aligns with the declining higher-timeframe EMA.

From a market-structure perspective, this looks like a corrective rally within a larger bearish context, not a trend reversal yet. As long as price remains below the resistance zone and under the falling EMA, rallies are technically counter-trend and vulnerable to rejection. That’s why the retest matters more than the breakout itself — strong holding and higher lows above support would signal continuation toward resistance, while a clean breakdown back below 2,900 would invalidate the bullish scenario and likely trigger another leg lower toward 2,850 and below.

In short, ETH has broken structure but not confirmed trend. The market is transitioning, and the next reaction at support will determine whether this is the start of a larger recovery leg or just another pullback before continuation lower. Patience and confirmation at this level are key.

CHFJPY My Opinion! BUY!

My dear subscribers,

CHFJPY looks like it will make a good move, and here are the details:

The market is trading on 199.14 pivot level.

Bias - Bullish

My Stop Loss - 198.81

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 199.73

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCHF Is Bullish! Buy!

Take a look at our analysis for EURCHF.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 0.926.

Considering the today's price action, probabilities will be high to see a movement to 0.930.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

US30 SENDS CLEAR BULLISH SIGNALS|LONG

US30 SIGNAL

Trade Direction: short

Entry Level: 49,128.6

Target Level: 49,509.4

Stop Loss: 48,876.2

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURGBP: Will Start Growing! Here is Why:

The recent price action on the EURGBP pair was keeping me on the fence, however, my bias is slowly but surely changing into the bullish one and I think we will see the price go up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD: Long Signal with Entry/SL/TP

GOLD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GOLD

Entry - 4936.8

Sl - 4926.3

Tp - 4654.5

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURCAD Set To Grow! BUY!

My dear followers,

This is my opinion on the EURCAD next move:

The asset is approaching an important pivot point 1.6162

Bias - Bullish

Safe Stop Loss - 1.6152

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.6181

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD Long: Buyers Step In After Bearish Structure FailsHello traders! Here’s a clear technical breakdown of EURUSD (4H) based on the current chart structure. EURUSD previously experienced a corrective bearish phase, trading inside a descending channel after forming a rounding top near the highs. However, this bearish structure has recently weakened. Price broke above the descending channel, signaling a loss of seller control and the beginning of a potential structural shift. After the breakout, EURUSD formed a pivot low and reacted strongly from the Demand Zone around 1.1690, which aligns with previous structure and acts as a key support area. This demand zone is now being defended by buyers, and the latest bullish impulse suggests that the breakout from the descending channel is valid rather than a fake move.

Currently, price is consolidating above demand and below the Supply Zone near 1.1760, indicating short-term compression after the breakout. This consolidation looks constructive, as price is holding above former resistance turned support and is not showing strong bearish rejection.

My scenario: as long as EURUSD holds above the 1.1690 Demand Zone and continues to print higher lows, the bullish bias remains valid. I expect buyers to maintain control and attempt a continuation toward the 1.1760 Supply Zone (TP1). A clean breakout and acceptance above 1.1760 would confirm bullish continuation and open the door for a move toward higher resistance levels. Manage your risk!

XAUUSD: Holds $4,770 Support With Upside Potential Toward $4,890Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold is trading within a well-defined bullish structure, supported by a clear ascending channel that reflects sustained buyer control. Earlier in the move, price respected the lower boundary of the channel and formed a sequence of higher highs and higher lows, confirming strong bullish momentum. During the advance, XAUUSD entered a consolidation range, signaling a temporary pause and accumulation before continuation. This range eventually resolved to the upside, reinforcing the prevailing bullish trend. After the breakout, price experienced a brief corrective move, including a fake breakout to the downside, which was quickly absorbed by buyers. This false break further validated underlying demand and led to a strong impulsive move higher back into the channel. Most recently, Gold broke above a key intraday resistance and successfully retested the former resistance as support near the 4,770 Support Zone, confirming acceptance above this level.

Currently, XAUUSD is trading above support and pushing toward the upper boundary of the ascending channel. Price is approaching a major Resistance Zone around 4,880–4,890, which aligns with the channel high and represents a critical reaction area where profit-taking or short-term selling pressure may appear.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the 4,770 support zone and continues to respect the ascending channel structure. A sustained move and acceptance above the 4,890 resistance would confirm continuation toward higher levels within the channel.

However, rejection from the resistance zone could lead to a short-term consolidation or a corrective pullback toward the 4,770 support area before the next attempt higher. A clear breakdown and acceptance below support would weaken the bullish bias and signal a deeper correction. For now, market structure and momentum favor buyers while price remains supported above key levels.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

XAUUSD Ascending Channel Holds, Upside Toward $4,950Hello traders! Here’s my technical outlook on XAUUSD (1H) based on the current chart structure. Gold is trading within a well-defined bullish structure, supported by a rising price channel formed after a clear shift in market control from sellers to buyers. Earlier on the chart, price respected the ascending support line, creating higher lows and confirming sustained buying pressure. This gradual advance led to a consolidation phase, where price formed a clear range, reflecting temporary balance before continuation. Following the range, XAUUSD broke out to the upside, confirming trend continuation. This breakout was supported by a clean impulse move and acceptance above the former range high. After the breakout, price successfully retested the Buyer Zone around 4,820, which aligns with the prior resistance turned support and the lower boundary of the bullish channel. This area is acting as a strong demand zone, where buyers are actively defending the structure. Currently, price is moving higher within the ascending channel and approaching a key Resistance Level and Seller Zone near 4,950. This zone represents a major upside objective and a potential area for profit-taking or seller reaction. The bullish momentum remains intact as long as price holds above the Buyer Zone and respects the rising support line. My scenario: as long as XAUUSD stays above the 4,820 Buyer Zone, the bullish structure remains valid. Continued strength could drive price toward the 4,950 resistance level (TP1). A clean breakout and acceptance above this seller zone would open the door for further upside continuation. However, a decisive rejection from resistance could lead to a corrective pullback toward the Buyer Zone. A breakdown below support would weaken the bullish bias and signal a deeper correction. For now, the market structure favors buyers while price remains supported within the ascending channel. Please share this idea with your friends and click Boost 🚀