NASDAQ is Approaching an Important Support Level! Hey Traders,

In tomorrow’s trading session, we are closely monitoring NAS100 (NASDAQ 100) for a potential buying opportunity around the 24,900 zone. NAS100 remains in a well-defined uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 24,900 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

LONG

EURUSD: Bullish Setup After Corrective Channel PullbackHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD is trading within a broader bullish structure, supported by a rising trend line that has guided price action from the recent swing lows. Earlier in the move, price formed a clear accumulation range, where the market consolidated before initiating an upside breakout. This breakout was followed by continuation to the upside, confirming strong buyer participation and a bullish shift in market control. After the impulsive move higher, EURUSD entered a corrective phase, forming a well-defined descending channel. This pullback appears corrective rather than impulsive, as price action remains orderly with overlapping candles and decreasing momentum — a typical bullish retracement behavior. Importantly, this correction is occurring above the higher-timeframe ascending trend line, preserving the overall bullish structure.

Currently, price is reacting from the Support Zone around 1.1600–1.1620, which aligns with: The lower boundary of the descending channel. A key horizontal support level. The rising trend line from prior lows. This confluence increases the probability of buyers stepping in. On the upside, the Resistance Zone near 1.1680 represents the prior breakout level and the top of the corrective structure. A successful reclaim of this zone would confirm the end of the correction and signal bullish continuation.

My Scenario & Strategy

My primary scenario remains bullish as long as EURUSD holds above the 1.1600 Support Zone and respects the rising trend line. I expect buyers to defend this area and attempt a push higher toward the 1.1680 Resistance Level (TP1). A clean breakout and acceptance above 1.1680 would confirm bullish continuation and open the path toward higher targets.

However, a decisive breakdown below the support zone and trend line would weaken the bullish structure and suggest a deeper corrective move or potential range formation. For now, structure favors buyers while price holds above support. As always, manage your risk and wait for confirmation at key levels.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

XAUUSD: Bullish Channel Intact - Upside Toward 4,660 in FocusHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD is trading within a broader bullish structure, supported by a well-defined upward channel that has guided price action from the recent swing lows. Inside this channel, gold has consistently formed higher highs and higher lows, confirming sustained buyer control. During the advance, price experienced several corrective pullbacks, all of which were contained within the channel, highlighting strong demand on dips. As price moved higher, XAUUSD broke above a prior consolidation area and successfully retested the former resistance as support, confirming the strength of the breakout. This area is now marked as a clear Support Zone around 4,570–4,580, which aligns with the mid-channel structure and previous breakout reactions.

Currently, price is consolidating just below a major Resistance Zone near 4,650–4,660, located at the upper boundary of the ascending channel. Multiple tests of this area show hesitation, but there is no clear bearish rejection yet. The price action near resistance appears corrective and controlled, suggesting consolidation rather than distribution. As long as price holds above the key support zone, the bullish structure remains intact.

My Scenario & Strategy

My primary scenario remains bullish while XAUUSD trades above the 4,570–4,580 Support Zone and continues to respect the upward channel structure. A sustained hold above support increases the probability of another attempt to push toward the 4,650–4,660 Resistance Zone. A clean breakout and acceptance above this resistance would confirm bullish continuation and open the door for further upside expansion.

However, a strong rejection from resistance followed by a decisive breakdown below the support zone would weaken the bullish bias and signal a deeper corrective move within the broader structure. Until that happens, market structure favors buyers, with dips into support viewed as potential continuation opportunities.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

19/01/26 Weekly OutlookLast weeks high: $97,925.71

Last weeks low: $90,140.82

Midpoint: $94,033.27

So close, yet so far!

After a strong start to the week BTC pushed through the all important $94,000 level with strength and purpose reaching a high of ~$98,000, shy of the bullish target at $100,000. However the resistance approaching that level is clearly strong as price was quickly rejected and pushed towards retesting the $94,000 level.

This coincided with last weeks outlook as the weekly high, after two clear retests price consolidated above the level, price compression takes place and from there the probability of a breakdown increases dramatically. Which is how we have started this week with an aggressive move lower within the opening hour of the week. In essence the bulls are back to square one, trying to flip the $94,000 level.

The bears are still in control on the larger time frame, the Midpoint is the key battleground area once again with whoever controls that line looking to push towards either the weekly high for the bulls or the weekly low for the bears.

BTC Stalls Below Resistance — Distribution Before the Next Bitcoin on the H1 timeframe is showing clear signs of exhaustion beneath a well-defined resistance zone around 95,700–96,000, following the strong impulsive rally from the lower range. The initial breakout was clean and aggressive, but price has since transitioned into choppy, overlapping price action, signaling a loss of momentum rather than continuation.

Structurally, BTC has failed to reclaim the previous high near 97,600–98,000, and each rebound into the resistance zone has been met with selling pressure and weak follow-through. The short-term structure now resembles a lower-high sequence, suggesting that buyers are no longer in control of expansion, but instead distributing positions at premium prices.

From a trend and EMA perspective, price is still hovering above the EMA 89, but the distance between price and EMA has narrowed significantly. This often precedes a mean reversion move, especially when price is repeatedly rejected from resistance. The EMA itself is acting as a magnet rather than support, increasing the probability of a pullback toward the 94,000–94,100 demand zone, where stronger bids may reappear.

If BTC fails to break and hold above 96,000 with strong volume, the current structure favors a bearish continuation toward lower liquidity, with 93,100–93,200 as the next major downside objective. Any upside attempts without a decisive breakout should be viewed as sell-the-rally opportunities rather than trend resumption.

➡️ Market state: Distribution / range at resistance

➡️ Bias: Bearish below 96,000

➡️ Key downside targets: 94,000 → 93,100

➡️ Invalidation: Strong acceptance above 96,000–96,200

At this stage, Bitcoin is not trending it is deciding, and the structure currently favors a downside resolution unless buyers regain control decisively.

BTC Is Stalling at Resistance — Distribution Before the Next Dro1. Current Market Structure

Bitcoin remains in a broader bullish context, but the short-term structure on H1 is showing clear signs of exhaustion. After a strong impulsive rally from the 91K–92K region, price expanded aggressively into the 97.5K–98K resistance zone. Since then, momentum has faded and the market has shifted into sideways-to-lower consolidation, suggesting buyers are no longer in full control. This is not a reversal yet, but it is no longer a clean continuation either.

2. Key Zones & Market Positioning

Major Resistance Zone: 97,600 – 98,000 → Multiple rejections and long upper wicks indicate heavy sell pressure

Immediate Support: 95,700 → Breakdown here would confirm short-term weakness

Dynamic Support (EMA 89): ~94,100

Deeper Support Targets:

- 93,100

- 91,800 (major demand / prior base)

As long as price trades below the resistance zone, upside potential remains capped.

3. Liquidity & Price Behavior

The rally into 98K appears to have swept buy-side liquidity, followed by rejection a classic sign of distribution at the highs. The current choppy price action reflects order absorption, not accumulation. Buyers are defending locally, but without strong follow-through, increasing the probability of a downside rotation.

4. Short-Term Market Scenari os

🔽 Primary Scenario – Bearish Pullback (Higher Probability)

Price fails to reclaim 97.6K–98K

Breakdown below 95.7K confirms distribution

Price rotates toward EMA 89 (~94.1K)

Extension targets: 93.1K → 91.8K

🔼 Alternative Scenario – Bullish Continuation (Lower Probability)

Clean breakout and acceptance above 98K

Strong volume expansion

Opens the path toward higher highs above 100K

Without a confirmed breakout, this scenario remains secondary.

5. Trading Perspective

Bias: Sell rallies into resistance, not chase longs

Best approach: Patience wait for confirmation below support

This is not accumulation at the highs; it is a pause after expansion

Summary

Bitcoin is no longer trending impulsively.

It is stalling at resistance, distributing liquidity, and preparing for a corrective leg.

As long as the 97.6K–98K zone holds, the roadmap remains clear:

Rejection → Breakdown → Pullback to key demand zones.

Breakdown Continuation or Reversal Setup in the Making?Hello traders! Here’s a clear technical breakdown of FX:EURUSD (1H) based on the current chart structure. FX:EURUSD remains in a broader bearish structure, defined by lower highs and consistent downside pressure since the rejection from the recent highs. After a sharp impulsive drop, price attempted a recovery but failed to reclaim key structure levels, transitioning into a descending corrective channel beneath a well-respected trendline. Recent price action shows weak bullish responses and overlapping candles, suggesting that buying momentum is corrective rather than impulsive. Sellers continue to defend rallies, keeping the short-term structure tilted to the downside.

🟦 SUPPLY & DEMAND – KEY ZONES

Major Resistance / Supply Zone:

The 1.1658–1.1665 area acts as a strong supply zone, aligned with:

- Previous structure support turned resistance

- Descending trendline confluence

- EMA resistance overhead

This zone continues to cap upside attempts and confirms seller dominance on pullbacks.

Primary Demand Zone:

The 1.1620–1.1623 region is the key demand zone currently being approached. This area marks prior accumulation and represents the last meaningful support before a deeper bearish continuation.

Higher-Timeframe Resistance:

Above, the 1.1685–1.1700 zone remains a major resistance ceiling and would only come into play if structure shifts bullish.

🎯 CURRENT MARKET POSITION

- Currently, EURUSD is trading just above the demand zone, placing price at a critical inflection point. The market is compressed between descending resistance and horizontal demand, a setup that typically precedes directional expansion.

- Momentum remains bearish, but downside follow-through is slowing as price reaches demand.

🧠 MY SCENARIO

- As long as EURUSD holds above the 1.1620 demand zone, there is room for a technical bounce, potentially leading to a corrective push back toward the 1.1658–1.1665 supply zone. However, unless price can reclaim and hold above that supply with strong bullish acceptance, any bounce should be treated as corrective within a bearish trend.

- If price breaks and accepts below the 1.1620 demand zone, bearish continuation is likely, opening the door for a deeper move lower as sellers regain full control.

- For now, EURUSD is testing demand within a bearish structure, not confirming a reversal yet.

⚠️ RISK NOTE

Decision zones demand patience. Wait for confirmation at demand or rejection from supply, avoid premature bias, and always manage your risk.

Gold Price Respects Ascending Trend Line - Next Target 4,680Hello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure shown in the screenshot. XAUUSD is trading within a broader bullish structure, supported by a well-defined ascending trend line that has guided price action since the market formed a solid base and started to grow. After the initial recovery, gold transitioned into a consolidation range, where price moved sideways, showing temporary balance between buyers and sellers. This range was eventually resolved to the upside with a clean breakout, confirming renewed bullish momentum. Following the breakout, price continued higher along the rising trend line, forming higher highs and higher lows. During this advance, the market experienced several false breakouts and shallow corrections, all of which were absorbed above the trend line, highlighting strong demand on pullbacks. The area around 4,540–4,560 is clearly defined as a Buyer Zone / Support Level, where previous resistance flipped into support and buyers repeatedly stepped in. Currently, XAUUSD is trading above the Buyer Zone and holding above the ascending trend line, which keeps the bullish structure intact. Price is now approaching the Seller Zone / Resistance Level around 4,660–4,680, which aligns with a descending resistance line from prior highs. This area represents a key supply zone where selling pressure may emerge and cause a reaction or short-term consolidation. My scenario: as long as XAUUSD remains above the Buyer Zone and continues to respect the rising trend line, the bullish bias remains valid. I expect buyers to defend pullbacks into support and attempt a continuation move toward the 4,680 Resistance Level (TP1). A clean breakout and acceptance above this resistance would confirm further bullish continuation and open the door for higher targets. However, a strong rejection from the Seller Zone followed by a decisive breakdown below the Buyer Zone and trend line would weaken the bullish structure and signal a deeper corrective move. For now, price is at a key decision area near resistance, and patience with proper risk management is essential. Please share this idea with your friends and click Boost 🚀

EURUSD: Trendline Rejection Confirms Bearish ControlFX:EURUSD Is currently trading in a clear short-term downtrend, defined by a sequence of lower highs and lower lows. The dotted descending trendline is acting as a dynamic resistance, and price has respected it with high accuracy.

Two key moments stand out:

- The first rejection from the trendline marked the start of bearish momentum.

- The second retest and rejection (highlighted by the orange circle) confirms that sellers remain firmly in control and that bullish pullbacks are corrective, not impulsive.

This behavior reinforces the idea that the market is not accumulating for reversal, but rather distributing before continuation to the downside.

🟢 Demand Zone – Reaction, Not Revers al

Price has now reached a short-term demand/support zone, where we see a temporary slowdown and small consolidation candles. However, it’s important to note:

The move into the demand zone was impulsive and aggressive, indicating strong sell-side pressure.

The current bounce lacks volume expansion and structure → no clear bullish confirmation.

This type of price action typically represents pause + absorption, not a trend change.

In strong trends, demand zones are often broken on the second or third test, especially when they are approached with momentum.

🧠 Probable Scenarios

Primary scenario (higher probability):

Price makes a weak corrective bounce from the demand zone.

Fails below the descending trendline.

Breaks and closes below the demand zone → continuation lower toward 1.158x – 1.156x liquidity.

Alternative scenario (lower probability):

Price forms a clear higher low, breaks the trendline with acceptance, and reclaims prior structure.

Only then would a short-term bullish correction be considered valid.

il that happens, any upside is corrective.

🎯 Key Takeaway for Traders

As long as EURUSD remains below the descending trendline, the market structure favors sell-the-rally logic, not bottom fishing. The demand zone is being tested under bearish pressure, and without strong confirmation, it is more likely to fail than hold.

Trend first, zones second. And the trend is still bearish.

Trade patiently, wait for confirmation, and manage risk accordingly.

Bitcoin Completes an Impulsive CycleHello traders! Here’s a clear technical breakdown of BTCUSD (1H) based on the current chart structure. Bitcoin has completed a full impulsive Elliott Wave sequence (1–5), with wave (5) marking the local top and momentum exhaustion point. The advance into wave (5) was strong, but notably lacked continuation follow-through afterward, which is a classic early warning of a trend transition.

Following the completion of wave (5), price has shifted into a corrective market phase, forming an ABC structure. The price action is now characterized by overlapping candles, lower highs, and weaker rebounds, confirming that bullish momentum has faded and the market is no longer in impulse mode. This transition signals a cycle shift from expansion to correction, not just a random pullback.

SUPPLY & DEMAND – KEY ZONES

Major Distribution / Wave (5) Supply Zone:

The region around the wave (5) high represents distribution at premium, where smart money typically exits long exposure. The sharp rejection from this zone confirms strong seller presence.

Corrective Structure Levels (ABC):

Wave (A): Initial impulsive sell-off, breaking bullish momentum

Wave (B): Weak corrective bounce, failing to reclaim prior highs

Wave (C): Ongoing decline, currently developing with expanding downside risk

Macro Support / Cycle Low:

The 90,000–90,300 zone stands out as a critical higher-timeframe support, aligned with the base of the prior accumulation range and the projected completion zone of wave (C).

🎯 CURRENT MARKET POSITION

Currently, BTC is trading inside the corrective phase, with price action suggesting wave (C) is still unfolding. The inability to reclaim prior structure highs confirms that bounces are corrective, not impulsive.

Momentum structure now favors continuation lower, unless the market invalidates the corrective count by reclaiming key resistance levels with strength.

🧠 MY SCENARIO

As long as Bitcoin remains below the wave (B) high and fails to re-enter the impulsive structure, the probability favors continued downside toward the 90,000 support zone, where wave (C) may complete.

That area is critical:

- A strong reaction there could mark cycle reset and re-accumulation

- A clean breakdown would signal deeper corrective extension and broader trend weakness

Only a decisive reclaim above the corrective highs would invalidate the ABC scenario and reopen the path for bullish continuation.

For now, Bitcoin is in correction after impulse, not in trend continuation.

⚠️ RISK NOTE

Corrective phases are volatile and deceptive. Trade reactions, not predictions, respect key invalidation levels, and always manage your risk.

Bitcoin Compressing at Demand Bitcoin on the 45-minute timeframe is currently holding above a well-defined demand zone around 95,180–94,700, while price continues to respect a descending trendline acting as dynamic resistance. This structure reflects compression, not weakness.

Price has already completed a corrective pullback from the prior impulse and is now stabilizing above demand, with downside attempts failing to gain follow-through. The yellow EMA is flattening and aligning closely with current price, signaling loss of bearish momentum and a transition into balance.

As long as Bitcoin defends the demand zone, the market is positioned for a bullish resolution. A clean break and acceptance above the descending trendline would confirm a shift in short-term structure, opening the path toward 96,800 → 97,600 → 98,600 as upside objectives.

However, a decisive breakdown below 94,700 would invalidate the bullish setup and expose deeper downside liquidity.

➡️ Support: 95,180–94,700

➡️ Key trigger: Break & close above descending trendline

➡️ Bias: Neutral → Bullish on breakout

➡️ Invalidation: Acceptance below demand zone

Bitcoin is not trending yet it’s loading liquidity.

Ethereum Holding the Line — Range Compression Before ExpansionEthereum on the H1 timeframe is currently trading inside a clear consolidation range after a strong impulsive rally. Price is oscillating between a key support band around 3,280–3,300 and multiple overhead resistance levels at 3,397 → 3,433 → 3,475. This is classic post-impulse behavior, where the market pauses to rebalance liquidity before choosing direction.

From a price action perspective, buyers have repeatedly defended the same horizontal support zone, with several clean rejections to the downside but no sustained acceptance below it. Each pullback into this zone is met with demand, suggesting that sellers lack strength to extend a deeper correction. The structure inside the range is overlapping and corrective a sign of consolidation, not distribution.

The EMA (yellow) is rising and running directly through the support area, reinforcing this zone as dynamic support. As long as price holds above this EMA and the horizontal base, the broader bullish structure remains intact. The recent downside probe labeled “BREAK” appears more like a liquidity sweep rather than a true breakdown, as price quickly reclaims the range.

Bullish scenario:

If ETH continues to respect the 3,280–3,300 support and builds acceptance, a push toward 3,397, followed by 3,433 and ultimately 3,475, becomes the higher-probability path. A clean breakout and close above the upper resistance would confirm continuation.

Bearish scenario:

A decisive H1 close below 3,280, with acceptance under the EMA, would invalidate the range support and expose the lower liquidity pocket near 3,180–3,200.

➡️ Key support: 3,280–3,300

➡️ Key resistance: 3,397 → 3,433 → 3,475

➡️ Market state: Consolidation after impulse

➡️ Bias: Neutral → Bullish while support holds

Ethereum is not trending yet it’s coiling energy for the next expansion.

EURUSD at a Make-or-Break Demand Zone — Bounce Setup bearish impulsive move from the prior supply zone near 1.1660–1.1670. The sell-off was aggressive, breaking structure cleanly and confirming that sellers remain in control on the H1 timeframe. However, after reaching demand, price has shifted into short-term consolidation, signaling hesitation rather than immediate continuation.

From a structure and trend perspective, the market is still bearish overall. Price remains below the descending trendline and below the EMA, both of which are acting as dynamic resistance. Any bullish movement from the current demand zone should be treated as a corrective pullback, not a trend reversal, unless price can reclaim the trendline and hold above it with strong momentum.

Scenario-wise, there are two clear paths. If buyers manage to defend the demand zone and push price upward, the most likely upside reaction would be a pullback toward the trendline and EMA confluence, where sellers are expected to re-enter from a premium area. Failure at that level would reinforce the bearish continuation narrative. On the other hand, if the demand zone fails to hold, a clean breakdown below 1.1590 would likely trigger another bearish expansion, opening the door toward lower liquidity levels around 1.1560 and below.

➡️ Market bias: Bearish, corrective bounce possible

➡️ Key focus: Reaction at demand zone vs. trendline rejection

➡️ Invalidation: Strong acceptance above trendline and EMA

This is a classic sell the rally environment, with demand acting as a temporary pause rather than a confirmed reversal zone.

Ethereum Is Completing a Classic Head & Shoulders1. Current Market Structure

Ethereum has transitioned from a strong bullish impulse into a clear distribution structure on the H1 timeframe. After the vertical rally from the 3,100 area, price formed a well defined Head & Shoulders pattern, signaling exhaustion rather than continuation. The left shoulder and right shoulder are symmetrical, while the head marks the final aggressive push that failed to attract sustained demand. Since then, price has shifted into lower highs and overlapping candles, confirming loss of bullish control.

This is no longer an impulsive uptrend it is a corrective-to-distributive phase.

2. Key Zones & Market Positioning

Major Supply / Head Zone: 3,390 – 3,420 → Strong rejection, distribution confirmed

Neckline / Key Support: ~3,280 – 3,265 → Structural decision level

Intermediate Demand: ~3,220

Final Downside Liquidity Target: 3,080 – 3,100

Price is currently hovering just above the neckline, which is typical behavior before a decisive breakdown in classical H&S structures.

3. EMA & Momentum Context

The EMA 98 is still rising and located below price, which explains the temporary pauses and bounces. However, price is now trading below prior momentum highs, and EMA support is flattening. This often occurs before deeper pullbacks as late buyers get trapped above the neckline.

Momentum is clearly weakening bullish candles are corrective, not impulsive.

4. Liquidity & Pattern Psychology

The Head & Shoulders structure reflects a distribution of long positions:

- Early buyers took profit near the head

- Late buyers entered near the right shoulder

- Liquidity now rests below the neckline

Once the neckline breaks and acceptance occurs, price typically accelerates quickly as stop-loss liquidity is released.

5. Market Scenarios

🔽 Primary Scenario – Bearish Continuation (High Probability)

Clean break and close below 3,265

Retest of neckline fails

Expansion toward 3,220 → 3,080

This move would be a healthy correction within the broader uptrend, not a macro reversal.

🔼 Invalidation Scenario

Strong reclaim and acceptance above 3,360

Break of right-shoulder structure

This would neutralize the H&S pattern and reopen bullish continuation — currently unlikely without volume.

6. Trading Perspective

Bias: Bearish (short-term)

Avoid longs near the neckline

Shorts favored on rejection or confirmed breakdown

Best long opportunities appear after liquidity is swept lower

Summary

Ethereum is no longer in expansion it is distributing.

The Head & Shoulders pattern is mature, momentum is fading, and liquidity is clearly building below the neckline. As long as price remains capped below the right shoulder, the roadmap remains straightforward:

Distribution → Neckline Break → Liquidity Expansion Downward

Bitcoin Is Losing Momentum at Range Mid1. Higher-Timeframe Context & Trend Quality

Bitcoin remains structurally bullish on the higher timeframe, but the current H1 structure is no longer impulsive. After a strong vertical expansion from the 91k area, price failed to hold above the prior highs and has now transitioned into overlapping, corrective price action. This signals that momentum has slowed and the market is digesting liquidity, not trending cleanly.

The EMA 98 is still rising and located well below price, meaning the broader trend is intact however, short-term control has shifted away from buyers.

2. Key Supply & Demand Zones

Major Resistance Zone: 96,700 – 97,800 → Clear supply absorption, repeated rejections, failure to hold highs

Mid-Range Resistance (Now Acting as Cap): ~96,000 → Price repeatedly stalls here, showing weak follow-through

Key Support Zone: 94,600 – 94,800 → First meaningful demand aligned with EMA 98 trajectory

Deeper Demand / Liquidity Pool: 92,300 – 92,500 → Likely downside magnet if support breaks

Price is currently trapped between resistance overhead and weakening demand below, which is a classic environment for stop-hunting and fake recoveries.

3. Price Action & Liquidity Behavior

The recent bounce attempts are corrective in nature shallow, overlapping candles with no impulsive bullish continuation. This suggests buyers are reactive, not proactive.

The curved downside projection on the chart reflects a typical distribution → breakdown → expansion sequence:

First, price holds sideways to trap late buyers

Then, liquidity is taken below local lows

Finally, price accelerates toward deeper demand zones

Importantly, no higher high has been formed since the rejection from the upper resistance zone, confirming loss of bullish control on H1.

4. Scenario Outlook

🔽 Primary Scenario – Corrective Breakdown (Higher Probability)

Failure to reclaim and hold above ~96,000

Loss of 94,600 support

Acceleration toward 92,300 – 92,500 liquidity zone

This would still be a pullback within a broader uptrend, not a trend reversal.

🔼 Alternative Scenario – Bullish Reclaim (Lower Probability)

Strong impulsive reclaim above 96,800

Acceptance above the prior range highs

Opens path back toward 97,800+

Without volume and momentum, this scenario remains secondary.

5. Trading Perspective

Bias: Neutral → Bearish (short-term)

Avoid longs in the middle of the range

Shorts only make sense on rejection from resistance or confirmed breakdown

Best longs are patience-based, waiting at deeper demand zones

Summary

Bitcoin is not breaking down yet but it is clearly distributing momentum after a strong rally.

As long as price remains below key resistance and momentum stays corrective, downside liquidity remains the more attractive target.

This is a cooling phase, not a continuation leg and the market is preparing for its next decisive move.

Bitcoin Keeps Printing Higher Highs — Trend Continuation On the H1 timeframe, Bitcoin is maintaining a textbook bullish market structure, clearly defined by a consistent sequence of higher highs (HH) and higher lows (HL). After reclaiming and holding above the key moving averages, price transitioned into a strong impulsive phase, with each pullback remaining shallow and corrective rather than aggressive. The most recent retracement respected the prior higher-low zone and the rising MA, confirming that buyers are still firmly in control and that selling pressure remains limited to profit-taking, not distribution.

From a structural perspective, the current pullback is forming a healthy higher low, which is a critical condition for trend continuation. Momentum has already re-engaged after the pullback, signaling that demand is stepping in earlier rather than waiting for deeper discounts. This behavior typically appears in strong trending markets, where price does not allow extended corrections. As long as Bitcoin holds above the recent HL area and above the moving averages, the bullish structure remains fully intact.

Looking ahead, the market roadmap remains straightforward: continuation toward the next upside liquidity zone. A sustained push above the recent HH opens the path toward the 98,700 region, with a further extension toward the psychological 99,500–100,000 zone if momentum accelerates. Any short-term dips into the higher-low region should be viewed as continuation opportunities, not weakness. The bullish scenario would only be invalidated if price breaks decisively below the last higher low, which would signal a deeper corrective phase. Until then, Bitcoin is not topping — it is trending, reloading, and preparing for the next expansion leg.

EURUSD Holding Demand — Compression Before a Trendline Break?Price has reacted strongly from the demand zone, confirming the presence of buyers after the sharp sell-off. However, the broader structure remains bearish, with price still capped below the descending trendline and dynamic EMA resistance, keeping upside moves corrective for now.

In the short term, EURUSD may continue sideways-to-slightly-bullish consolidation, forming higher lows from demand as liquidity builds. A decisive breakout and close above the descending resistance would be the first signal of a potential trend shift, opening room toward the higher supply zone.

If price fails to break the trendline and loses the demand zone, bearish momentum would likely resume, exposing the market to another continuation leg lower.

➡️ Key focus: Demand zone defense vs. trendline resistance breakout.

EURUSD Stuck Under Descending ResistanceOn the H1 timeframe, EURUSD remains firmly in a bearish structure, with price continuing to respect a well defined descending trendline that acts as dynamic resistance. After the impulsive drop from the upper supply zone, the market attempted several corrective pullbacks, but each rebound was capped below prior highs and rejected around the trendline and moving averages. This behavior confirms that upside moves are corrective in nature, not trend reversals.

Structurally, the market is printing lower highs and lower lows, while price is trading below both short- and medium-term moving averages, which are still sloping downward a clear sign that bearish momentum remains dominant. The recent pullback into the highlighted resistance zone failed to attract strong buying interest, leading to another rejection and continuation to the downside. This reflects active sell pressure and a lack of bullish commitment at key levels.

Looking ahead, price is now approaching the demand zone around 1.1620–1.1618, which is the next critical area to watch. A short-term bounce from this zone is possible due to profit-taking, but as long as price remains below the descending trendline and supply zones, any bounce is expected to be corrective. A clean break and acceptance below demand would open the door for further downside expansion toward lower liquidity levels. Overall, EURUSD is still in a sell-the-rally environment, and only a decisive breakout above the descending resistance would invalidate the current bearish bias.

ETH Trapped in a High-Range Box — Distribution or Another FakeEthereum is currently moving sideways inside a clearly defined range, following a strong impulsive rally. Price has been rejected multiple times from the upper boundary (~3,400) while repeatedly finding temporary support near the lower range (~3,270–3,280), signaling distribution behavior rather than healthy continuation.

From a structure perspective, ETH is no longer printing higher highs. Each bounce from the lower range is becoming weaker and more compressed, while the EMA cluster below price is flattening, showing a loss of bullish momentum. This is a classic sign that buyers are absorbing liquidity without follow-through, often preceding a deeper correction.

If price fails to reclaim and hold above the mid–upper range, the probability increases for a range breakdown, which would open downside toward the next liquidity pool around 3,180–3,140, where prior imbalance and unfilled orders sit. Only a clean breakout and acceptance above the range high would invalidate this bearish bias and restore trend continuation.

➡️ Market bias: Neutral → Bearish while below range high

➡️ Key focus: Range low reaction vs. breakdown confirmation

Ethereum Stuck Between Supply and DemandHello traders! Here’s a clear technical breakdown of ETHUSD (1H) based on the current chart structure. Ethereum previously delivered a strong impulsive bullish expansion, breaking out aggressively from the lower consolidation range. However, after reaching premium levels, price action has shifted into sideways-to-bearish rotation, with momentum clearly slowing. Recent structure shows failed continuation above the highs, followed by overlapping candles and weaker rebounds. This behavior suggests the market has transitioned from impulsive buying into distribution, rather than healthy consolidation for continuation. The overall structure is now neutral-to-bearish in the short term, as buyers struggle to reclaim control after the impulse.

🟦 SUPPLY & DEMAND – KEY ZONES

Major Supply Zone:

The 3,380–3,400 area is a clearly defined supply zone, where multiple bullish attempts were rejected. This zone represents strong sell-side interest and caps upside momentum.

Immediate Demand Zone:

The 3,270–3,290 region acts as near-term demand, where price has repeatedly bounced. However, reactions from this zone are becoming progressively weaker, indicating demand absorption.

Lower Support Zone:

If the current demand fails, the next major support lies around 3,160–3,180, which aligns with prior consolidation and higher-timeframe structure support.

🎯 CURRENT MARKET POSITION

Currently, ETH is trading just above the immediate demand zone, but the bounce lacks impulsive strength. Price remains trapped between overhead supply and weakening demand, a classic setup that often precedes a breakdown rather than a breakout.

This is a compression phase with bearish risk building, not bullish expansion.

🧠 MY SCENARIO

As long as Ethereum remains below the 3,380–3,400 supply zone, upside is limited and rallies should be treated as corrective moves. A clean break and acceptance below the 3,270–3,290 demand zone would confirm distribution and likely trigger a move toward the 3,160–3,180 support zone.

If buyers manage to defend demand and reclaim supply with strong bullish acceptance, the bearish scenario would be invalidated. Until that happens, the structure favors downside continuation.

For now, Ethereum is compressing under supply, not preparing for continuation.

⚠️ RISK NOTE

Compression zones can resolve aggressively. Wait for confirmation at demand or supply, avoid early bias, and always manage your risk.

Bitcoin (BTC) – 4-Hour Timeframe Tradertilki AnalysisGood morning my friends,

I have prepared a Bitcoin analysis for you on the 4-hour timeframe.

My friends, Bitcoin is currently moving in an HH-HL structure. Never forget: markets always move rhythmically in waves. Every rise has a correction, and every drop has a rebound. This rhythmic wave never breaks.

Since we are in an HH-HL structure, if Bitcoin reaches the levels of 90,847.0 - 89,361.0 on the 4-hour timeframe, I will open a buy position.

My targets:

1st Target: 92,500

2nd Target: 95,000

3rd Target: 102,000

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏

Thank you to all my friends who support me with their likes.❤️

USDCAD – 1-Hour Timeframe Tradertilki AnalysisMy friends, greetings,

I have prepared a USDCAD analysis for you.

My friends, if USDCAD reaches the levels of 1.38845-1.38663 on the 1-hour timeframe, I will open a buy position.

My target will be the 1.39286 level.

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏

Thank you to all my friends who support me with their likes.❤️

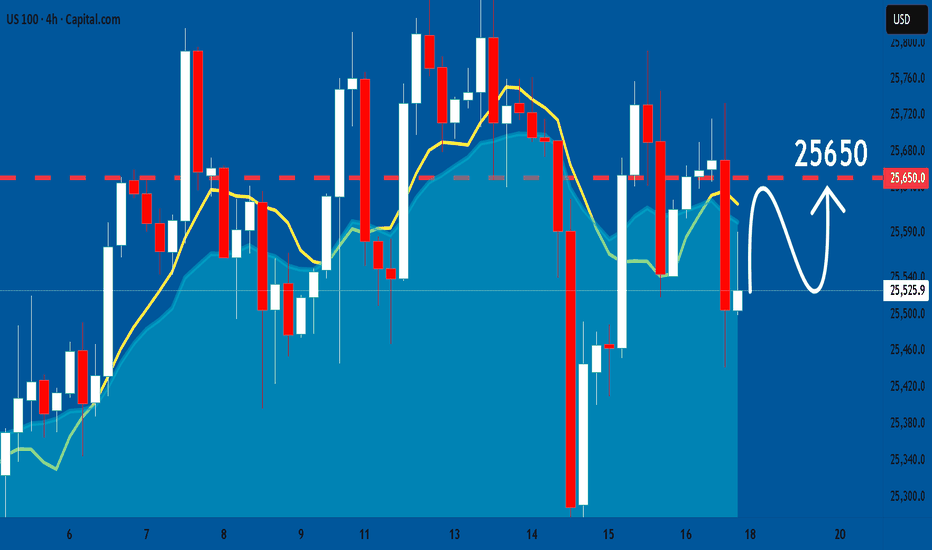

US100: Bullish Forecast & Bullish Scenario

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy US100.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️