US30 My Opinion! BUY!

My dear friends,

Please, find my technical outlook for US30 below:

The instrument tests an important psychological level 49354

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 49464

Recommended Stop Loss - 49297

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

LONG

BTCUSDT Long: Buyers in Control Above 94K, Next Stop 98.5KHello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure shown in the screenshot. BTCUSDT previously traded inside a well-defined descending channel, reflecting strong bearish pressure and consistent lower highs and lower lows. This bearish phase ended near a clear pivot point, where selling momentum weakened and buyers stepped in aggressively. From this pivot, price initiated a recovery move and successfully broke out of the descending channel, signaling a shift in short-term market control. Following the breakout, BTC transitioned into a broad consolidation range, where price moved sideways for an extended period. This range represented a balance between buyers and sellers, with multiple internal reactions confirming accumulation and uncertainty before the next directional move. Eventually, BTC broke out from the upper boundary of the range, confirming renewed bullish interest. After the range breakout, price formed a well-structured ascending channel, characterized by higher highs and higher lows. This structure confirms a bullish corrective-to-impulsive transition, with buyers maintaining control. Within this channel, BTC recently broke above a key Demand / Support Zone around 94,000, which previously acted as resistance and is now acting as support.

Currently, BTCUSDT is approaching a major Supply Zone around 98,000–98,500, where selling pressure has previously appeared. This zone aligns with the upper boundary of the ascending channel, increasing the probability of a reaction or short-term pullback. The most recent price action shows hesitation near this area, suggesting that sellers are beginning to defend higher levels.

My scenario: as long as BTCUSDT remains above the 94,000 Demand Zone and continues to respect the ascending channel structure, the bullish bias remains intact. I expect buyers to defend pullbacks toward demand and attempt another push into the 98,000–98,500 Supply Zone (TP1). A clean breakout and acceptance above this supply would confirm bullish continuation and open the door for further upside. However, a strong rejection from the supply zone followed by a breakdown below the ascending channel and 94,000 support would signal weakness and increase the probability of a deeper corrective move back toward the prior range highs. For now, price is at a key decision area near supply. Manage your risk!

XAUUSD Holds Bullish Structure Above Support - Eyes on $4,680Hello traders! Here’s my technical outlook on Gold (XAUUSD, 3H) based on the current chart structure. Gold is trading within a well-defined bullish trend after reclaiming key levels and establishing a sequence of higher highs and higher lows. Earlier on the chart, price formed a consolidation range, signaling accumulation before continuation. This range was later broken to the upside, confirming renewed buyer control and continuation of the broader bullish structure. Following the breakout, price moved higher but then entered a corrective phase, pulling back toward the rising trend line and the Support Level around the 4,510 area. This pullback appears corrective rather than impulsive, with buyers stepping in to defend the trend. Price respected the support line multiple times, forming fake breakouts to the downside before reversing higher, which further confirms underlying buying strength. Currently, XAUUSD has broken above the descending resistance line and is consolidating above it, signaling a successful breakout and potential continuation. Price is now trading above the Buyer Zone and approaching the Seller Zone / Resistance Level around 4,640. This area represents a key reaction zone where selling pressure may appear. My scenario: as long as Gold holds above the Support Level and continues to respect the rising trend line, the bullish structure remains intact. A clean breakout and acceptance above the 4,640 Resistance Level would confirm continuation toward the next upside target 4,680 (TP1). However, rejection from resistance could lead to a short-term consolidation or corrective pullback toward support before the next attempt higher. For now, the bias remains bullish, and price is positioned for a potential continuation move. Please share this idea with your friends and click Boost 🚀

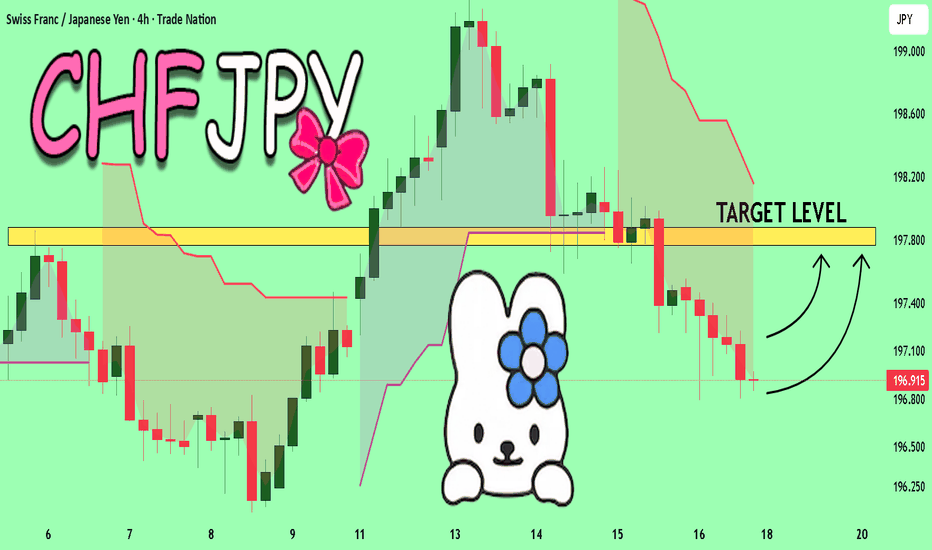

CHFJPY: Market Sentiment & Price Action

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current CHFJPY chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZDUSD Trading Opportunity! BUY!

My dear friends,

My technical analysis for NZDUSD is below:

The market is trading on 0.5737 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.5743

Recommended Stop Loss - 0.5733

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCHF: Long Trade Explained

EURCHF

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long EURCHF

Entry - 0.9313

Sl - 0.9310

Tp - 0.9318

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURJPY: Will Keep Growing! Here is Why:

The analysis of the EURJPY chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

APPLE: Long Trade with Entry/SL/TP

APPLE

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy APPLE

Entry - 255.48

Stop - 254.29

Take - 257.63

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPUSD Set To Grow! BUY!

My dear subscribers,

GBPUSD looks like it will make a good move, and here are the details:

The market is trading on 1.3379 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.3416

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

US100 Will Explode! BUY!

My dear subscribers,

My technical analysis for US100 is below:

The price is coiling around a solid key level - 25525

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 25611

My Stop Loss - 25477

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD The Target Is UP! BUY!

My dear followers,

This is my opinion on the EURUSD next move:

The asset is approaching an important pivot point 1.1598

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1630

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CADCHF Sellers In Panic! BUY!

My dear followers,

I analysed this chart on CADCHF and concluded the following:

The market is trading on 0.5770 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.5777

Safe Stop Loss - 0.5766

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

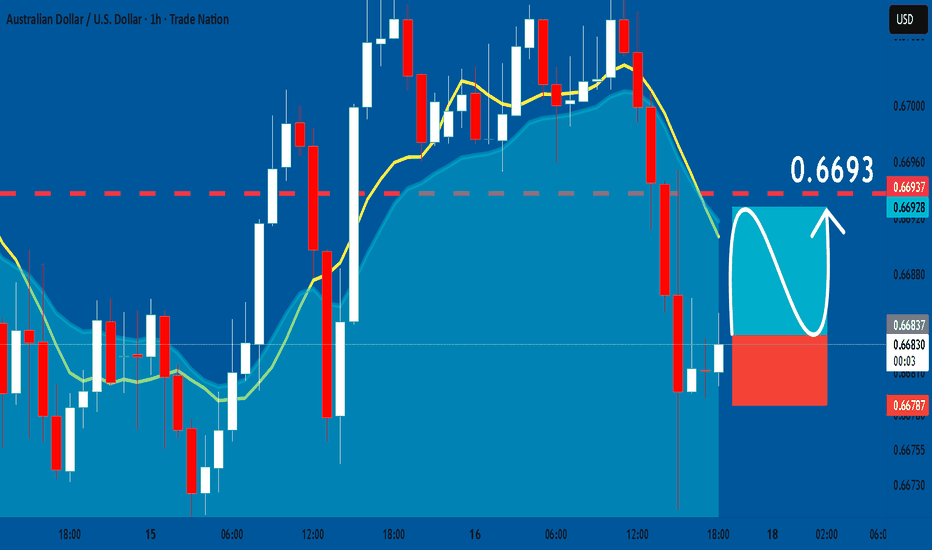

AUDUSD Ready to Push Higher? | 0.66700 Support+Gold Correlation!Hey Traders,

In the coming week, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66700 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.66700 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a strong bullish tone, this correlation could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Is EURUSD Loading for Another Rally? Key Zone at 1.15800!Hey Traders,

In today’s trading session, we are closely monitoring EURUSD for a potential buying opportunity around the 1.15800 zone. EURUSD remains in a well-defined uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 1.15800 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

With the broader market environment still favoring USD weakness, the technical structure continues to support a bullish continuation scenario on EURUSD.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

US30 is Nearing an Important Support! Hey Traders, in today's trading session we are monitoring US30 for a buying opportunity around 49,120 zone, Dow Jones is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 49,120 support and resistance area.

Trade safe, Joe.

AUDUSD: Bullish Continuation & Long Trade

AUDUSD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long AUDUSD

Entry Point - 0.6683

Stop Loss - 0.6678

Take Profit - 0.6693

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CHFJPY My Opinion! BUY!

My dear friends,

Please, find my technical outlook for CHFJPY below:

The instrument tests an important psychological level 196.92

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 197.77

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUDNZD Massive Long! BUY!

My dear friends,

AUDNZD looks like it will make a good move, and here are the details:

The market is trading on 1.1621 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1638

Recommended Stop Loss - 1.1612

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BITCOIN Will Go Higher From Support! Buy!

Take a look at our analysis for BITCOIN.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 94,951.39.

Considering the today's price action, probabilities will be high to see a movement to 96,189.10.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

AUD/JPY BULLS ARE GAINING STRENGTH|LONG

AUD/JPY SIGNAL

Trade Direction: long

Entry Level: 105.605

Target Level: 106.012

Stop Loss: 105.332

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPJPY: Bulls Will Push Higher

The analysis of the GBPJPY chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURJPY Technical Analysis! BUY!

My dear subscribers,

My technical analysis for EURJPY is below:

The price is coiling around a solid key level - 183.56

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 184.27

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK