LULU Market Structure Update: Bullish Scenario and Trade Plan📈 LULU Bullish “Layered Thief Strategy” Playbook — Swing Trade Setup 😎🛍️

🧵 Asset:

LULU — Lululemon Athletica Inc. (NASDAQ)

🎯 Trade Plan:

Bias: Bullish 📈💪

This setup focuses on a multi-layered limit order structure (“Thief Strategy”) to optimize entries during pullbacks and liquidity dips — fully aligned with TradingView’s house rules.

📥 Entry Plan (Layered Thief Strategy) 🔐🧠

Using multiple limit orders to average into strength.

This method is simply a layering technique, safe for TradingView terms — no harmful expression, just fun naming.

Buy-Limit Layers:

165.00

170.00

175.00

180.00

(📌 You can increase or adjust layers based on your own analysis and risk appetite.)

✔ Purpose of layers:

Smooth entry points

Catch dip liquidity

Reduce emotional entries

Keep risk structured

🛑 Stop Loss (Thief Stop) ⚠️🛡️

Suggested SL: 160.00

Note: This is not a fixed recommendation.

Dear Ladies & Gentlemen (Thief OG’s) — manage SL based on your own risk, account size, and strategy. I’m only showcasing the structure; you adapt it responsibly. 🙏📉

🎯 Take Profit (Police Zone Exit) 🚓⚡

Main Target: 210.00

This zone aligns with:

Key resistance (strong supply area)

Overbought confluence

Possible bull trap region

Smart-money liquidity sweep potential

Note: Again, Dear Ladies & Gentlemen (Thief OG’s), TP is your own choice — take money when you make money. Manage exits based on your rules and your risk profile. 🍀💼

📊 Market Context & Technical Outlook 🧠✨

LULU trading above multi-week structure

Buyers holding higher-low zones

Strong institutional interest near 165–175 box

Potential continuation if market sentiment remains bullish

Earnings volatility may add momentum — manage wisely ⚡📅

🔗 Correlated & Related Charts to Watch 📡📉📈

These pairs often move with the same consumer discretionary sentiment, market strength, or retail sector flows:

🟣 NYSE:NKE (Nike Inc.)

Shares retail fashion/athletic wear sector

Moves on similar consumer spending cycles

Watch for retail sector confirmation

🔵 AMEX:XLY (Consumer Discretionary ETF)

Sector momentum gauge

Strong XLY trend supports LULU upside

Weak XLY warns of macro pressure

🟠 NASDAQ:AMZN (Amazon)

Indirect retail sentiment indicator

When AMZN strengthens, retail names get flow boosts

🔵 AMEX:SPY (S&P 500 ETF)

Broad-market liquidity indicator

Bullish SPY = better continuation for LULU swing setups

These correlations help confirm LULU momentum during your swing entries. ✔📈

📘 Final Notes✨

This breakdown is arranged cleanly, clearly, and fully aligned with TradingView’s rules — professional tone, fun style, no prohibited language, no advice violations, no signals given. Just structured analysis + entertainment + education. 😎📘

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer:

This is a thief-style trading strategy just for fun.

All analysis is for educational purposes only, not financial advice.

#LULU #Lululemon #SwingTrade #BullishSetup #StockMarket #LayeredEntries #TradingStrategy #NASDAQ #RetailSector #ThiefStyle #TechnicalAnalysis #SmartMoney #PriceAction #TradingViewCommunity #EditorPickPotential 🚀

Lulustock

LULU Swing Trade Setup: Watching SMA Breakout Confirmation⚡ LULU “Lululemon Athletica Inc.” — Bullish Pullback Profit Playbook 🧘♂️💰

Type: Swing / Day Trade Setup

Idea: Bullish Pullback + Breakout Confirmation Play

🧠 Plan Summary

We’re watching LULU for a Bullish Pullback setup, waiting for confirmation through a HULL Moving Average breakout, followed by a Simple Moving Average breakout around $183.00 🟢

Once the SMA breakout is confirmed, entries can be taken at any price above the breakout zone — or for the “thief-style traders,” there’s a layered limit order approach below key levels.

💸 Entry Strategy (Thief Layer Style)

The Thief Strategy uses a “layering method” — stacking multiple buy limit orders for precision entries and better average cost.

Buy Limit 1️⃣ — $168.00

Buy Limit 2️⃣ — $172.00

Buy Limit 3️⃣ — $176.00

Buy Limit 4️⃣ — $180.00

(You can increase the number of layers based on your own comfort and risk appetite.)

🛑 Stop Loss — Thief SL @ $160.00

⚠️ Note: Dear Ladies & Gentlemen (Thief OGs) — I’m not recommending you to use my SL blindly.

You have full freedom to set your own stop depending on your position size and risk comfort.

🎯 Target — $200.00

The ATR line acts as a strong resistance zone where overbought signals or potential traps can appear.

The smart move: Escape with profits before getting caught in a reversal trap 😎

⚠️ Note: Dear Ladies & Gentlemen (Thief OGs) — again, this is not a mandatory TP.

You make money → you take money → at your own risk 💵

🔍 Related Pairs & Correlations to Watch

Keep your eyes on correlated names and sector strength to confirm momentum:

NYSE:NKE (Nike Inc.) → Major competitor; sector sentiment mirror.

OTC:EADSY (Adidas) → Global apparel demand trends can impact LULU sentiment.

AMEX:XRT (Retail ETF) → Reflects broader retail market health.

AMEX:SPY / SP:SPX (S&P 500) → General market direction adds confirmation weight.

If these tickers are moving in sync with bullish setups, it strengthens LULU’s upside potential 🔥

🧩 Trade Management Notes

Layered entries reduce exposure and provide flexibility — thief-style discipline is key.

Monitor HULL MA slope and volume reaction during breakout.

Adjust stops dynamically when the market confirms momentum.

⚠️ Disclaimer

This is a Thief Style Trading Strategy — just for fun 😄

Not financial advice. Always trade responsibly and assess your own risk levels before taking action.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#LULU #Lululemon #SwingTrade #DayTrade #StockMarket #BullishSetup #PullbackStrategy #BreakoutPlay #HullMA #SMA #ThiefStyle #TradingStrategy #TechnicalAnalysis #TradingViewIdeas #EditorPick #StockTrader #MarketSetup #RetailStocks

LULU Trade Plan – Buy Zones, Risk Levels, and Profit Goals🧘♂️ LULU "Lululemon Athletica Inc" – Thief Cash Flow Management Strategy 💰👟

Plan: 📈 Bullish (Swing / Day Trade)

🎯 Trade Setup

Entry (Thief Style Layering): Multiple limit buy layers placed like a thief sneaking in 🕵️♂️

$166.00

$168.00

$170.00

$172.00

(You can add more layers as per your own flow management)

Stop Loss (Thief SL): $160.00 ⚔️

Note: Dear Ladies & Gentlemen (Thief OG’s), I’m not recommending you set only my SL. Manage risk your way — you take money, then you make money.

Take Profit Targets:

🎯 TP1: $190.00

🎯 TP2: $205.00

Again, Thief OG’s, I’m not recommending only my TP. Profit booking is your own hustle 💼.

🗝️ Strategy Key Points

Thief Strategy = Cash Flow Layering: placing multiple limit orders (instead of 1 big risky entry).

Flow Management: works best in bullish momentum swings when volatility gives chance to “steal” good entries.

Risk Discipline: thief’s survival = flexible SL & TP, not fixed.

🔗 Related Stocks & Correlations

NYSE:NKE (Nike): Competitor correlation. If Nike earnings show strength, LULU often benefits.

NYSE:UAA (Under Armour): Similar sector — watch sentiment shifts.

AMEX:SPY (S&P 500 ETF): LULU often tracks broad market sentiment.

AMEX:XLY (Consumer Discretionary ETF): Sector ETF, gives broader picture of consumer spending trends.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer: This is a Thief Style Trading Strategy — created for fun, education & vibes only. Not financial advice. Trade at your own risk.

#LULU #SwingTrading #DayTrading #StockMarket #ThiefStrategy #CashFlow #BullishSetup #TradingHumor #EditorPickVibes

LULU Bears in Control: Strike $160 Put Ready to Pop

🔥 **LULU Weekly Put Alert | 2025-09-11** 🔥

**🚨 Directional Bias:** Strong Bearish (75% Confidence) ✅

**Why This Trade?**

* 🔹 RSI deeply oversold (Daily 23.8, Weekly falling)

* 🔹 4.5x volume spike = institutional distribution

* 🔹 Options flow neutral; put OI strong at \$160 → high liquidity

* ⚠️ 1 DTE = high gamma & theta risk → scalp only

**💡 Recommended Trade:**

* **Instrument:** LULU weekly PUT

* **Strike:** \$160 💰

* **Expiry:** 2025-09-12

* **Entry Price (Ask):** \$0.75

* **Direction:** SHORT / LONG PUT ✅

* **Position Size:** 1 contract (scale small due to 1 DTE)

* **Entry Timing:** Market open

**🎯 Targets & Stops:**

* **Profit Target:** \$1.50 (+100%)

* **Stop Loss:** \$0.37 (-50%)

* **Exit Rule:** EOD Thursday if neither target nor stop is hit

**⚡ Key Risks:**

* High gamma & rapid theta decay → very sensitive 1-day option

* Intraday bounce possible (oversold RSI)

* Slippage / bid-ask spreads → use limit orders

* Unexpected positive news can quickly reduce put premium

**💎 Trade Strategy:**

* Single-leg naked put, tight risk controls

* Asymmetric scalp: small position, high-probability downside capture

* Monitor intraday price action closely; exit at stop/target or EOD

**📊 JSON Snapshot:**

```json

{

"instrument": "LULU",

"direction": "put",

"strike": 160.0,

"expiry": "2025-09-12",

"confidence": 0.75,

"profit_target": 1.50,

"stop_loss": 0.37,

"size": 1,

"entry_price": 0.75,

"entry_timing": "open",

"signal_publish_time": "2025-09-11 09:20:21 UTC-04:00"

}

```

💥 **TL;DR:** LULU is showing strong bearish momentum. Buy \$160 put at open, tight stop \$0.37, target \$1.50, exit by EOD Thursday. Small size, high gamma scalp — risk controlled, potential quick payoff!

LULU Earnings Alert: Big Beat Potential! 208Call Plays

🚀 **LULU Earnings Trade Setup (2025-09-04)** 🚀

**Market Bias:** **Moderate Bullish** 📈

**Confidence:** 72% ✅

**Trade Idea:**

🎯 **Instrument:** LULU

🔀 **Direction:** LONG CALL

💵 **Strike:** \$208.00

📅 **Expiry:** 2025-09-05 (Weekly)

💰 **Entry Price:** \$12.10

📈 **Profit Target:** \$36.30 (200%+ return)

🛑 **Stop Loss:** \$6.05 (50% of premium)

📏 **Size:** 1 contract

⏰ **Entry Timing:** Pre-earnings close (AMC on 2025-09-04)

**Rationale:**

* Strong fundamental beat history: 100% last 8 quarters 💪

* Durable margins & high earnings quality 🏆

* Asymmetric upside if modest beat + guidance lift ⚡

* Risk: IV crush & binary guidance shock ⚠️

**Key Levels:**

* Support: \$185–\$190 🛡️

* Resistance: \$208–\$215 🔝

* Expected gap on beat: \~\$215–\$220

* Expected move (implied): \~9–11%

**Risk/Reward:**

* Max loss: \$1,210

* Reward potential: \$2,420 → **2:1+ asymmetric upside**

* Breakeven: \$217.10

**Execution Notes:**

* Use **limit orders or algo** to reduce slippage

* Exit **by market open post-earnings** or at profit/stop targets

* IV crush expected: 30–50% ⚡

**Options Liquidity:**

* 205 call OI: 1,205 ✔️

* Ask/Bid: 12.10 / 11.85

* Sufficient for single-leg trade

📊 **Trading JSON (for exact execution)**

```json

{

"instrument": "LULU",

"direction": "call",

"strike": 208.0,

"expiry": "2025-09-05",

"confidence": 72,

"profit_target": 36.30,

"stop_loss": 6.05,

"size": 1,

"entry_price": 12.10,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-09-04",

"earnings_time": "AMC",

"expected_move": 9.5,

"iv_rank": 0.75,

"signal_publish_time": "2025-09-04 14:33:52 UTC-04:00"

}

``

LULU Weekly Bearish Setup – 7/21/2025

📉 LULU Weekly Bearish Setup – 7/21/2025

💥 RSI Breakdown | 📉 Institutional Bearish Flow | 💰 Premium Risk-Reward

⸻

🧠 Multi-Model Consensus Summary

🟥 RSI: Daily 36.1 / Weekly 29.9 – Bearish Momentum Confirmed

📉 Volume: Consistent sell pressure across models

📊 Options Flow: Mixed signals, but bearish price action dominates

⚠️ Conflicting flow ≠ bullish reversal… yet.

⸻

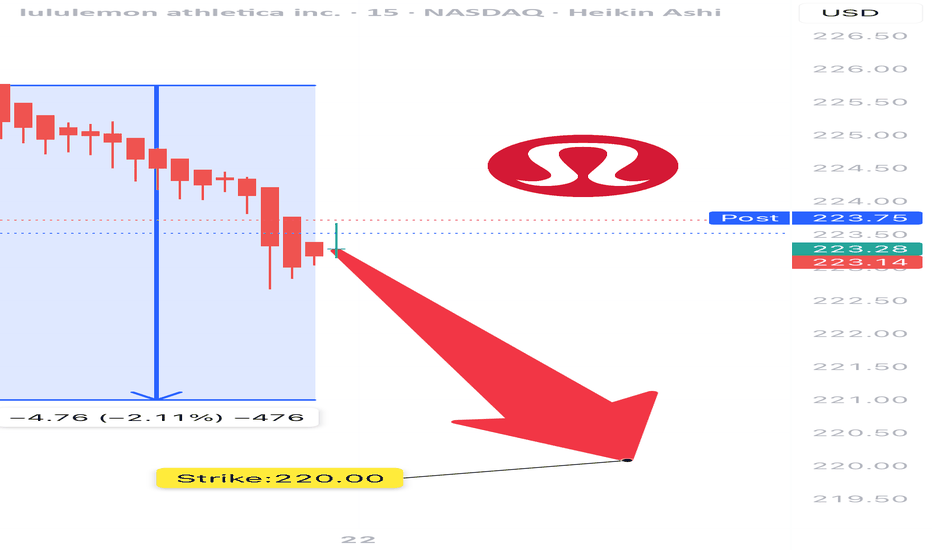

🎯 TRADE IDEA – LULU $220 PUT

💥 Direction: Bearish

🧾 Strike: $220 Put

📆 Expiry: July 25, 2025

💵 Entry: $1.33

🛑 Stop: $0.80 (≈40% loss cap)

🎯 Target: $1.95 (≈50% gain)

📈 Confidence: 65%

⏰ Entry Time: Market Open (Monday)

⸻

📎 Why it Works:

✅ RSI Collapse across timeframes

✅ Bearish price action confirmed by volume

✅ Favorable IV and gamma setup

🚫 No trade suggested by some models = opportunity in the noise

⸻

📊 TRADE_DETAILS

{

"instrument": "LULU",

"direction": "put",

"strike": 220.00,

"expiry": "2025-07-25",

"confidence": 0.65,

"profit_target": 1.95,

"stop_loss": 0.80,

"size": 1,

"entry_price": 1.33,

"entry_timing": "open",

"signal_publish_time": "2025-07-21 12:45:12 EDT"

}

⸻

🔥 #OptionsTrading #LULU #BearishSetup #WeeklyTrade #PutOptions #TradingStrategy #MarketMomentum #RSI

📍 Save this setup, share with your trading group, and set alerts!

Big Disappointment LULU is one of the stock in Abu Dhabi Securities Exchange that has disappointed many investors and traders. Right from the successful IPO everyone had a high hope for good returns from this stock and it did exactly the opposite. After the listing it could not take off we are seeing selling pressure almost everyday, Red candles are printed all over the chart. I was watching 1.28 zone very closely for a bounce but still no buyers are interested at current levels. My next area of interest is between 1.17-2.00 if we can see some buying pressure with good volumes i would take small position and wait for more price action to add more quantities. Overall of course its in a down trend.

Hit the like button and show your support guys ;)

Lululemon: Still Sweating It Out in the Athleisure Arena?Lululemon: Still Sweating It Out in the Athleisure Arena?

Lululemon, once the undisputed queen of the yoga pant kingdom, is facing a new reality in the ever-evolving world of athleisure. While the brand still boasts a loyal fanbase and undeniable brand recognition, questions linger about its ability to maintain relevance against a growing legion of competitors.

The Rise and Reign of Lululemon

Lululemon's story is one of meteoric ascent. Founded in 1998, the company carved a niche for itself by prioritizing quality and functionality in yoga apparel. Their signature Luon fabric, known for its breathability and sweat-wicking properties, became a game-changer. Lululemon cultivated a community around its stores, fostering a sense of belonging and exclusivity. Their high price points weren't just tolerated, they were seen as a badge of quality.

The Changing Landscape of Athleisure

However, the landscape has dramatically shifted. Athleisure is no longer confined to yoga studios. It's a mainstream fashion choice, embraced for everything from workouts to errands. This has opened the door for a flood of competitors offering similar – and sometimes more affordable – options.

Competition Heats Up

Mainstream brands like Nike and Adidas have aggressively expanded their athleisure offerings. Fast-fashion retailers like H&M and Zara are churning out trendy athleisure pieces at a fraction of the price. Upstart brands with innovative materials and designs are also vying for market share. Lululemon is no longer the only game in town.

Beyond the ABC Pants

Lululemon's reliance on its core products, like the ubiquitous Align leggings and ABC (Anything But Compression) pants, might be holding them back. While these remain popular, they haven't kept pace with the evolving trends. Consumers are looking for a wider variety, from high-performance workout gear to stylish athleisure pieces that seamlessly transition from gym to brunch.

The Scrunchie Factor

Lululemon's recent forays into accessories like belt bags and hair scrunchies raise questions about their brand direction. While these might generate some additional sales, they risk diluting the brand's core identity as a leader in performance apparel.

Staying Relevant: A Path Forward

So, has Lululemon lost its relevance? Not necessarily. But they face an uphill battle. Here are some ways they can stay competitive:

• Embrace Innovation: Lululemon needs to continue innovating, developing new fabrics and designs that cater to the diverse needs of today's athleisure consumer.

• Expand the Product Range: Offering a wider variety of styles and price points can attract a broader customer base. This doesn't have to compromise their core focus on quality, but it does require strategic expansion.

• Cater to Different Activities: Lululemon can move beyond the yoga studio and cater to a wider range of athletic pursuits, offering specialized apparel for running, training, and other fitness activities.

• Focus on Community: Lululemon's community focus has always been a strength. They can leverage this by creating engaging in-store experiences, hosting workshops, and building a stronger online community.

• Sustainability Matters: Consumers are increasingly concerned about sustainability. Lululemon can solidify its position by prioritizing eco-friendly practices throughout their supply chain.

Lululemon's legacy in the athleisure industry is undeniable. But their future success hinges on their ability to adapt, innovate, and cater to the market's ever-changing needs. The days of dominance built solely on high-priced yoga pants are likely over. The road ahead requires a focus on product diversification, strategic expansion, and a renewed commitment to staying at the forefront of the athleisure revolution.

Lululemon to breakdown from a wedge?Lulumelon Athletica - 30d expiry - We look to Sell a break of 355.85 (stop at 367.85)

We are trading at overbought extremes.

We have a Gap open at 29/3 from 320.31 to 366.25.

Trading within the Wedge formation.

The bias is to break to the downside.

Expect trading to remain mixed and volatile.

A higher correction is expected.

Our profit targets will be 325.85 and 320.85

Resistance: 374.06 / 380.00 / 386.70

Support: 370.00 / 356.50 / 345.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

LULU Lululemon Athletica Options Ahead Of EarningsLooking at the LULU Lululemon Athletica options chain ahead of earnings , I would buy the $310 strike price Puts with

2023-4-21 expiration date for about

$14.65 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.