LULU Market Structure Update: Bullish Scenario and Trade Plan📈 LULU Bullish “Layered Thief Strategy” Playbook — Swing Trade Setup 😎🛍️

🧵 Asset:

LULU — Lululemon Athletica Inc. (NASDAQ)

🎯 Trade Plan:

Bias: Bullish 📈💪

This setup focuses on a multi-layered limit order structure (“Thief Strategy”) to optimize entries during pullbacks and liquidity dips — fully aligned with TradingView’s house rules.

📥 Entry Plan (Layered Thief Strategy) 🔐🧠

Using multiple limit orders to average into strength.

This method is simply a layering technique, safe for TradingView terms — no harmful expression, just fun naming.

Buy-Limit Layers:

165.00

170.00

175.00

180.00

(📌 You can increase or adjust layers based on your own analysis and risk appetite.)

✔ Purpose of layers:

Smooth entry points

Catch dip liquidity

Reduce emotional entries

Keep risk structured

🛑 Stop Loss (Thief Stop) ⚠️🛡️

Suggested SL: 160.00

Note: This is not a fixed recommendation.

Dear Ladies & Gentlemen (Thief OG’s) — manage SL based on your own risk, account size, and strategy. I’m only showcasing the structure; you adapt it responsibly. 🙏📉

🎯 Take Profit (Police Zone Exit) 🚓⚡

Main Target: 210.00

This zone aligns with:

Key resistance (strong supply area)

Overbought confluence

Possible bull trap region

Smart-money liquidity sweep potential

Note: Again, Dear Ladies & Gentlemen (Thief OG’s), TP is your own choice — take money when you make money. Manage exits based on your rules and your risk profile. 🍀💼

📊 Market Context & Technical Outlook 🧠✨

LULU trading above multi-week structure

Buyers holding higher-low zones

Strong institutional interest near 165–175 box

Potential continuation if market sentiment remains bullish

Earnings volatility may add momentum — manage wisely ⚡📅

🔗 Correlated & Related Charts to Watch 📡📉📈

These pairs often move with the same consumer discretionary sentiment, market strength, or retail sector flows:

🟣 NYSE:NKE (Nike Inc.)

Shares retail fashion/athletic wear sector

Moves on similar consumer spending cycles

Watch for retail sector confirmation

🔵 AMEX:XLY (Consumer Discretionary ETF)

Sector momentum gauge

Strong XLY trend supports LULU upside

Weak XLY warns of macro pressure

🟠 NASDAQ:AMZN (Amazon)

Indirect retail sentiment indicator

When AMZN strengthens, retail names get flow boosts

🔵 AMEX:SPY (S&P 500 ETF)

Broad-market liquidity indicator

Bullish SPY = better continuation for LULU swing setups

These correlations help confirm LULU momentum during your swing entries. ✔📈

📘 Final Notes✨

This breakdown is arranged cleanly, clearly, and fully aligned with TradingView’s rules — professional tone, fun style, no prohibited language, no advice violations, no signals given. Just structured analysis + entertainment + education. 😎📘

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer:

This is a thief-style trading strategy just for fun.

All analysis is for educational purposes only, not financial advice.

#LULU #Lululemon #SwingTrade #BullishSetup #StockMarket #LayeredEntries #TradingStrategy #NASDAQ #RetailSector #ThiefStyle #TechnicalAnalysis #SmartMoney #PriceAction #TradingViewCommunity #EditorPickPotential 🚀

Lulustockchart

LULU Swing Trade Setup: Watching SMA Breakout Confirmation⚡ LULU “Lululemon Athletica Inc.” — Bullish Pullback Profit Playbook 🧘♂️💰

Type: Swing / Day Trade Setup

Idea: Bullish Pullback + Breakout Confirmation Play

🧠 Plan Summary

We’re watching LULU for a Bullish Pullback setup, waiting for confirmation through a HULL Moving Average breakout, followed by a Simple Moving Average breakout around $183.00 🟢

Once the SMA breakout is confirmed, entries can be taken at any price above the breakout zone — or for the “thief-style traders,” there’s a layered limit order approach below key levels.

💸 Entry Strategy (Thief Layer Style)

The Thief Strategy uses a “layering method” — stacking multiple buy limit orders for precision entries and better average cost.

Buy Limit 1️⃣ — $168.00

Buy Limit 2️⃣ — $172.00

Buy Limit 3️⃣ — $176.00

Buy Limit 4️⃣ — $180.00

(You can increase the number of layers based on your own comfort and risk appetite.)

🛑 Stop Loss — Thief SL @ $160.00

⚠️ Note: Dear Ladies & Gentlemen (Thief OGs) — I’m not recommending you to use my SL blindly.

You have full freedom to set your own stop depending on your position size and risk comfort.

🎯 Target — $200.00

The ATR line acts as a strong resistance zone where overbought signals or potential traps can appear.

The smart move: Escape with profits before getting caught in a reversal trap 😎

⚠️ Note: Dear Ladies & Gentlemen (Thief OGs) — again, this is not a mandatory TP.

You make money → you take money → at your own risk 💵

🔍 Related Pairs & Correlations to Watch

Keep your eyes on correlated names and sector strength to confirm momentum:

NYSE:NKE (Nike Inc.) → Major competitor; sector sentiment mirror.

OTC:EADSY (Adidas) → Global apparel demand trends can impact LULU sentiment.

AMEX:XRT (Retail ETF) → Reflects broader retail market health.

AMEX:SPY / SP:SPX (S&P 500) → General market direction adds confirmation weight.

If these tickers are moving in sync with bullish setups, it strengthens LULU’s upside potential 🔥

🧩 Trade Management Notes

Layered entries reduce exposure and provide flexibility — thief-style discipline is key.

Monitor HULL MA slope and volume reaction during breakout.

Adjust stops dynamically when the market confirms momentum.

⚠️ Disclaimer

This is a Thief Style Trading Strategy — just for fun 😄

Not financial advice. Always trade responsibly and assess your own risk levels before taking action.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#LULU #Lululemon #SwingTrade #DayTrade #StockMarket #BullishSetup #PullbackStrategy #BreakoutPlay #HullMA #SMA #ThiefStyle #TradingStrategy #TechnicalAnalysis #TradingViewIdeas #EditorPick #StockTrader #MarketSetup #RetailStocks

LULU Trade Plan – Buy Zones, Risk Levels, and Profit Goals🧘♂️ LULU "Lululemon Athletica Inc" – Thief Cash Flow Management Strategy 💰👟

Plan: 📈 Bullish (Swing / Day Trade)

🎯 Trade Setup

Entry (Thief Style Layering): Multiple limit buy layers placed like a thief sneaking in 🕵️♂️

$166.00

$168.00

$170.00

$172.00

(You can add more layers as per your own flow management)

Stop Loss (Thief SL): $160.00 ⚔️

Note: Dear Ladies & Gentlemen (Thief OG’s), I’m not recommending you set only my SL. Manage risk your way — you take money, then you make money.

Take Profit Targets:

🎯 TP1: $190.00

🎯 TP2: $205.00

Again, Thief OG’s, I’m not recommending only my TP. Profit booking is your own hustle 💼.

🗝️ Strategy Key Points

Thief Strategy = Cash Flow Layering: placing multiple limit orders (instead of 1 big risky entry).

Flow Management: works best in bullish momentum swings when volatility gives chance to “steal” good entries.

Risk Discipline: thief’s survival = flexible SL & TP, not fixed.

🔗 Related Stocks & Correlations

NYSE:NKE (Nike): Competitor correlation. If Nike earnings show strength, LULU often benefits.

NYSE:UAA (Under Armour): Similar sector — watch sentiment shifts.

AMEX:SPY (S&P 500 ETF): LULU often tracks broad market sentiment.

AMEX:XLY (Consumer Discretionary ETF): Sector ETF, gives broader picture of consumer spending trends.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer: This is a Thief Style Trading Strategy — created for fun, education & vibes only. Not financial advice. Trade at your own risk.

#LULU #SwingTrading #DayTrading #StockMarket #ThiefStrategy #CashFlow #BullishSetup #TradingHumor #EditorPickVibes

LULU Bears in Control: Strike $160 Put Ready to Pop

🔥 **LULU Weekly Put Alert | 2025-09-11** 🔥

**🚨 Directional Bias:** Strong Bearish (75% Confidence) ✅

**Why This Trade?**

* 🔹 RSI deeply oversold (Daily 23.8, Weekly falling)

* 🔹 4.5x volume spike = institutional distribution

* 🔹 Options flow neutral; put OI strong at \$160 → high liquidity

* ⚠️ 1 DTE = high gamma & theta risk → scalp only

**💡 Recommended Trade:**

* **Instrument:** LULU weekly PUT

* **Strike:** \$160 💰

* **Expiry:** 2025-09-12

* **Entry Price (Ask):** \$0.75

* **Direction:** SHORT / LONG PUT ✅

* **Position Size:** 1 contract (scale small due to 1 DTE)

* **Entry Timing:** Market open

**🎯 Targets & Stops:**

* **Profit Target:** \$1.50 (+100%)

* **Stop Loss:** \$0.37 (-50%)

* **Exit Rule:** EOD Thursday if neither target nor stop is hit

**⚡ Key Risks:**

* High gamma & rapid theta decay → very sensitive 1-day option

* Intraday bounce possible (oversold RSI)

* Slippage / bid-ask spreads → use limit orders

* Unexpected positive news can quickly reduce put premium

**💎 Trade Strategy:**

* Single-leg naked put, tight risk controls

* Asymmetric scalp: small position, high-probability downside capture

* Monitor intraday price action closely; exit at stop/target or EOD

**📊 JSON Snapshot:**

```json

{

"instrument": "LULU",

"direction": "put",

"strike": 160.0,

"expiry": "2025-09-12",

"confidence": 0.75,

"profit_target": 1.50,

"stop_loss": 0.37,

"size": 1,

"entry_price": 0.75,

"entry_timing": "open",

"signal_publish_time": "2025-09-11 09:20:21 UTC-04:00"

}

```

💥 **TL;DR:** LULU is showing strong bearish momentum. Buy \$160 put at open, tight stop \$0.37, target \$1.50, exit by EOD Thursday. Small size, high gamma scalp — risk controlled, potential quick payoff!

LULU Earnings Alert: Big Beat Potential! 208Call Plays

🚀 **LULU Earnings Trade Setup (2025-09-04)** 🚀

**Market Bias:** **Moderate Bullish** 📈

**Confidence:** 72% ✅

**Trade Idea:**

🎯 **Instrument:** LULU

🔀 **Direction:** LONG CALL

💵 **Strike:** \$208.00

📅 **Expiry:** 2025-09-05 (Weekly)

💰 **Entry Price:** \$12.10

📈 **Profit Target:** \$36.30 (200%+ return)

🛑 **Stop Loss:** \$6.05 (50% of premium)

📏 **Size:** 1 contract

⏰ **Entry Timing:** Pre-earnings close (AMC on 2025-09-04)

**Rationale:**

* Strong fundamental beat history: 100% last 8 quarters 💪

* Durable margins & high earnings quality 🏆

* Asymmetric upside if modest beat + guidance lift ⚡

* Risk: IV crush & binary guidance shock ⚠️

**Key Levels:**

* Support: \$185–\$190 🛡️

* Resistance: \$208–\$215 🔝

* Expected gap on beat: \~\$215–\$220

* Expected move (implied): \~9–11%

**Risk/Reward:**

* Max loss: \$1,210

* Reward potential: \$2,420 → **2:1+ asymmetric upside**

* Breakeven: \$217.10

**Execution Notes:**

* Use **limit orders or algo** to reduce slippage

* Exit **by market open post-earnings** or at profit/stop targets

* IV crush expected: 30–50% ⚡

**Options Liquidity:**

* 205 call OI: 1,205 ✔️

* Ask/Bid: 12.10 / 11.85

* Sufficient for single-leg trade

📊 **Trading JSON (for exact execution)**

```json

{

"instrument": "LULU",

"direction": "call",

"strike": 208.0,

"expiry": "2025-09-05",

"confidence": 72,

"profit_target": 36.30,

"stop_loss": 6.05,

"size": 1,

"entry_price": 12.10,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-09-04",

"earnings_time": "AMC",

"expected_move": 9.5,

"iv_rank": 0.75,

"signal_publish_time": "2025-09-04 14:33:52 UTC-04:00"

}

``

LULU Weekly Bearish Setup – 7/21/2025

📉 LULU Weekly Bearish Setup – 7/21/2025

💥 RSI Breakdown | 📉 Institutional Bearish Flow | 💰 Premium Risk-Reward

⸻

🧠 Multi-Model Consensus Summary

🟥 RSI: Daily 36.1 / Weekly 29.9 – Bearish Momentum Confirmed

📉 Volume: Consistent sell pressure across models

📊 Options Flow: Mixed signals, but bearish price action dominates

⚠️ Conflicting flow ≠ bullish reversal… yet.

⸻

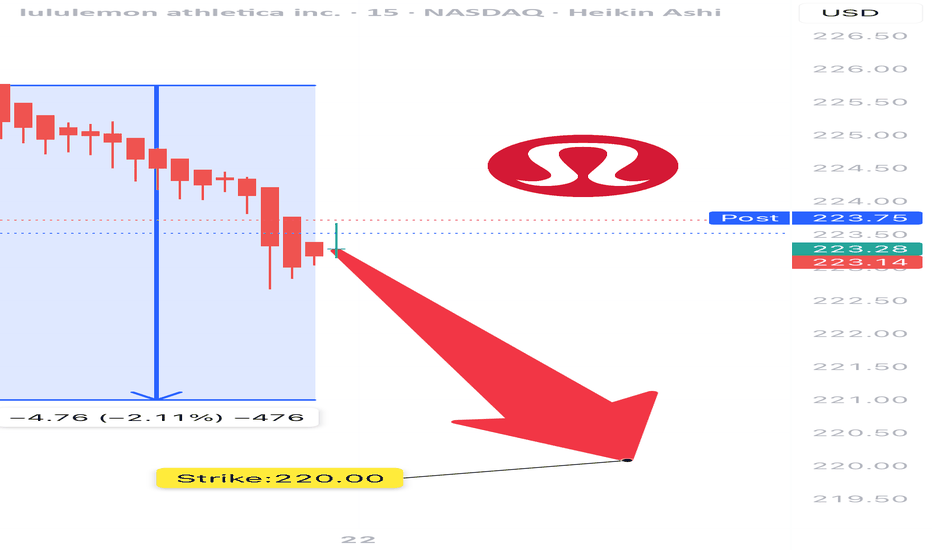

🎯 TRADE IDEA – LULU $220 PUT

💥 Direction: Bearish

🧾 Strike: $220 Put

📆 Expiry: July 25, 2025

💵 Entry: $1.33

🛑 Stop: $0.80 (≈40% loss cap)

🎯 Target: $1.95 (≈50% gain)

📈 Confidence: 65%

⏰ Entry Time: Market Open (Monday)

⸻

📎 Why it Works:

✅ RSI Collapse across timeframes

✅ Bearish price action confirmed by volume

✅ Favorable IV and gamma setup

🚫 No trade suggested by some models = opportunity in the noise

⸻

📊 TRADE_DETAILS

{

"instrument": "LULU",

"direction": "put",

"strike": 220.00,

"expiry": "2025-07-25",

"confidence": 0.65,

"profit_target": 1.95,

"stop_loss": 0.80,

"size": 1,

"entry_price": 1.33,

"entry_timing": "open",

"signal_publish_time": "2025-07-21 12:45:12 EDT"

}

⸻

🔥 #OptionsTrading #LULU #BearishSetup #WeeklyTrade #PutOptions #TradingStrategy #MarketMomentum #RSI

📍 Save this setup, share with your trading group, and set alerts!

Big Disappointment LULU is one of the stock in Abu Dhabi Securities Exchange that has disappointed many investors and traders. Right from the successful IPO everyone had a high hope for good returns from this stock and it did exactly the opposite. After the listing it could not take off we are seeing selling pressure almost everyday, Red candles are printed all over the chart. I was watching 1.28 zone very closely for a bounce but still no buyers are interested at current levels. My next area of interest is between 1.17-2.00 if we can see some buying pressure with good volumes i would take small position and wait for more price action to add more quantities. Overall of course its in a down trend.

Hit the like button and show your support guys ;)