#LUNA/USDT Bottom & Bullish Reversal#LUNA

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

We are seeing a bearish trend in the Relative Strength Index (RSI), which has reached near the lower boundary, and an upward bounce is expected.

There is a key support zone in green at 0.0922, and the price has bounced from this level several times. Another bounce is expected.

We are seeing a trend towards stabilizing above the 100-period moving average, which we are approaching, supporting the upward trend.

Entry Price: 0.0939

First Target: 0.0958

Second Target: 0.0980

Third Target: 0.1007

Remember a simple principle: Money Management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

LUNA

#LUNA/USDT Bottom & Bullish Reversal#LUNA

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.1016. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward move.

Entry price: 0.1030

First target: 0.1043

Second target: 0.1065

Third target: 0.1092

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

#LUNA/USDT Bottom & Bullish Reversal#LUNA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.2617, which represents a strong basis for the upside.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.2823

First target: 0.3000

Second target: 0.3133

Third target: 0.3331

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

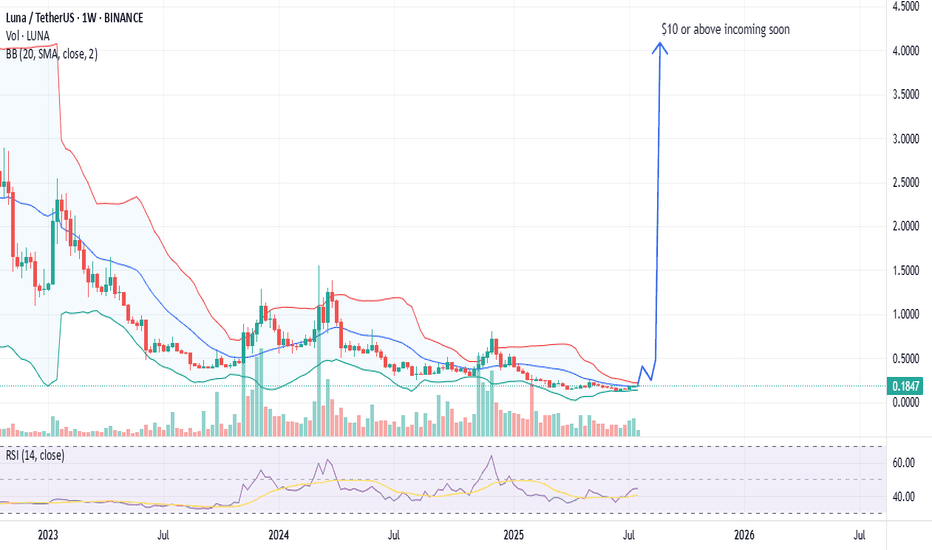

LUNA – Multiple Touches on the Long-Term Downtrend Line. LUNA has been moving within a consistent long-term downtrend , confirmed by several clean touches of the descending trendline over the past few years. Each retest has reinforced the strength of this resistance zone, but the recent volatility spike suggests that momentum may finally be shifting.

Price once again approached the trendline after an extended period of decline, and the reaction here will be crucial. If bulls manage to break above this multi-year structure, the chart opens a path toward a much deeper recovery.

The key target to watch is the $1.00 area , which aligns with the 0.618 Fibonacci retracement of the entire downside move. This level acts as a natural magnet during strong corrective rallies and could become the primary mid-term objective if the breakout confirms.

In short, the market has spent a long time suppressed under the trendline, and it may finally be time for some upside revival . A confirmed break and retest could trigger a strong relief rally toward the $1 zone.

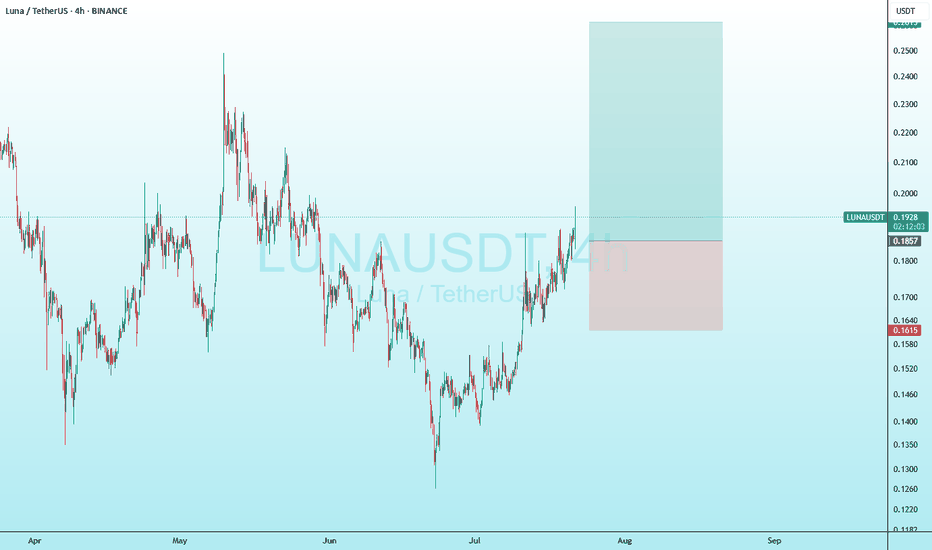

LUNAUSDT Forming Falling WedgeLUNAUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 90% to 100% once the price breaks above the wedge resistance.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching LUNAUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal.

Investors’ growing interest in LUNAUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

??? LUNAUSD ???? - The Most Controversial Setup Ever!!!Ladies and gentlemen, gather around — because I may have just discovered the setup that will either send me to Valhalla… or straight back to my 9–5 job.

Behold this absolute masterpiece of chaos: multi-year order blocks, forgotten liquidity, Fibonacci levels drawn with the precision of a sleep-deprived squirrel, and a reward-to-risk ratio so ambitious it should probably be illegal.

Will price go to the moon?

Will it nuke to zero?

Will it just… stay sideways for 3 years because it hates me personally?

Yes.

But hey — sometimes you don’t follow the chart… the chart follows you. 😎📈

(Or it doesn’t. It usually doesn’t.)

⚠️ Financial Disclaimer:

This post is not financial advice. I am not your financial advisor, your life coach, or your legally responsible adult.

Trading involves risk, including the risk of shouting at your screen, heavy coping, and the sudden urge to become a monk.

Always do your own research and never trade based solely on internet comedy.

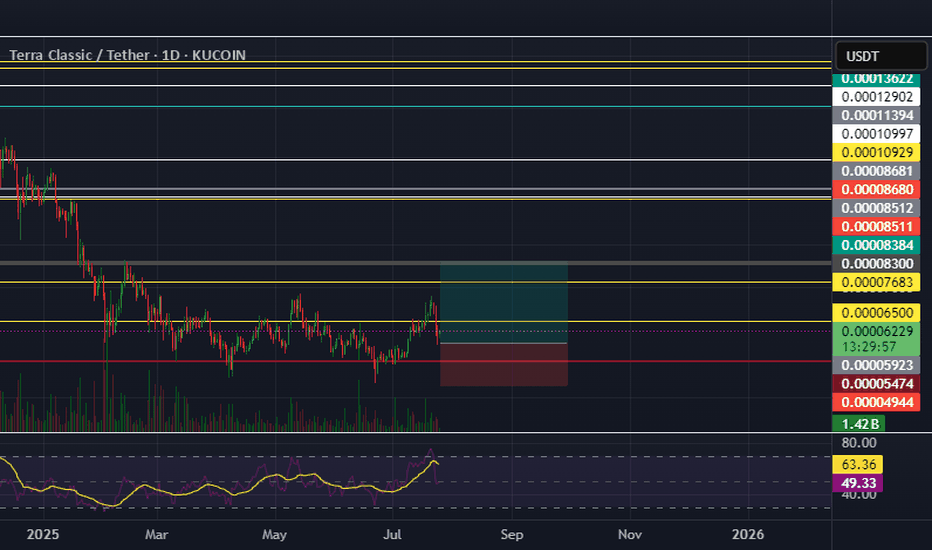

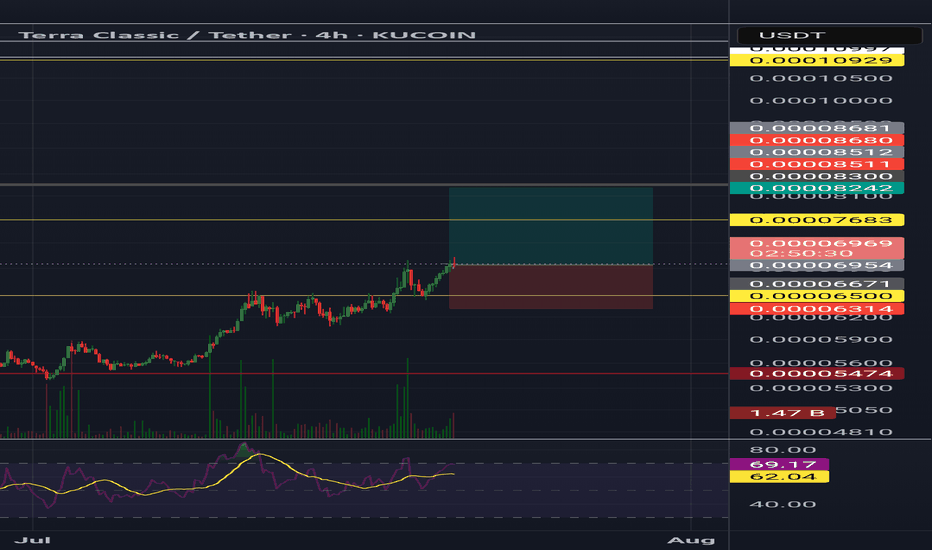

Breaking; Terra Classic ($LUNC) Spike 74% Today Terra Classic ( CRYPTOCAP:LUNC ) today a notable 65% albeit market sentiment was essentially bearish. the memecoin spike in early Friday morning placing the asset in an overbought region implying the possibility of a drawback.

The asset is set to spike 150% today should it break the ceiling of the falling wedge formed on the chart.

In another news, Terraform Labs secures $1.3B settlement court approval. Settlement impacts Terra Classic, LUNA, and USTC.

The $1.3 billion settlement by Terraform Labs is notable as it reflects significant regulatory and market shifts. It affects key crypto assets like Terra Classic and LUNA, while outlining a structured path for creditor reimbursements.

The Terraform Labs settlement finalized marks a pivotal moment in the crypto regulatory landscape. Courts approved the $1.3B figure for distribution. Overseen by the U.S. Bankruptcy Court, the settlement's impact resonates across the crypto sector.

What Is Terra Classic ( CRYPTOCAP:LUNC )?

Terra is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payments systems. According to its white paper, Terra combines the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin (BTC) and offers fast and affordable settlements

Terra Classic Price Data

The Terra Classic price today is $0.000047 USD with a 24-hour trading volume of $150,349,720 USD. Terra Classic is up 65.62% in the last 24 hours. The current CoinMarketCap ranking is #146, with a market cap of $256,910,315 USD. It has a circulating supply of 5,486,583,841,259 LUNC coins and the max.

LUNAUSDT Forming Falling WedgeLUNAUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 40% to 50% once the price breaks above the wedge resistance.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching LUNAUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal.

Investors’ growing interest in LUNAUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

USTC/USDT — Key Demand Zone: Rebound or Breakdown Toward?USTC is once again trading at a crucial demand zone (0.0105 – 0.0115 USDT) on the 4D chart (Binance). This area has repeatedly acted as a strong support since 2024, absorbing heavy selling pressure and triggering notable rebounds.

This zone is not just a normal support — it’s an accumulation area that has historically sparked strong bounces. Long downside wicks confirm liquidity sweeps, followed by quick recoveries, signaling active demand around this region.

---

🔎 Structure & Pattern

1. Range / Sideways Accumulation

Price is moving within a wide range between this demand zone and layered resistances above, showing mid-term accumulation before a bigger move.

2. Lower Highs after Spikes

Each strong rally has failed to break above major resistance, forming lower highs and signaling persistent supply pressure.

3. Liquidity Sweeps

Multiple fake breaks below support (long wicks) indicate liquidity grabs, where stop losses are triggered before price returns inside the range.

---

🚀 Bullish Scenario

If the 0.0105 – 0.0115 support zone holds:

Confirmation comes from a bullish rejection candle (pin bar / engulfing) on the 4D timeframe.

Upside targets:

🎯 0.01438 (nearest resistance)

🎯 0.01915 (mid resistance)

🎯 0.02386 – 0.02865 if momentum expands further

Logic: Repeated defense of this zone suggests accumulation, with potential for short covering and fresh buying that can drive price back into mid-range resistances.

---

⚠️ Bearish Scenario

If 0.0105 breaks on a 4D close:

Breakdown would confirm weakness → likely downside to 0.00813 (historical low).

A move below this level may open the door for deeper bearish continuation.

Logic: Many stops are placed below this zone. A breakdown with strong volume could trigger panic selling and accelerate bearish pressure.

---

📌 Key Levels

Main Support: 0.0105 – 0.0115

Layered Resistances: 0.01438 → 0.01915 → 0.02386 → 0.02865 → 0.03839 → 0.05434

---

🎯 Conclusion

USTC is standing at a decision point:

Holding above 0.0105–0.0115 may trigger a rebound toward 0.01438 and 0.01915 with attractive risk-to-reward potential.

A confirmed breakdown below 0.0105 opens room toward 0.00813 and possibly lower.

Wait for a clear 4D close and volume confirmation before committing to either side.

---

#USTC #USTCUSDT #CryptoAnalysis #Altcoins #SupportResistance #ChartPattern #TechnicalAnalysis #CryptoUpdate #BullishOrBearish

LUNC is going to go up from here.... The Luna Scammers are GoneLuna is going to become popular again as it is an OG to the crypto game.

Grab your LUNC while you can... This is the perfect time to whale in if you are looking for a high risk, high gain scenario.

LUNA is just simmering before it takes over again.

LUNC is the peg and governance token. Burning away by the day.

Let me know your bet on this one. I don't think there is a deeper pit for LUNC based on priced and reputation of LUNA. Ready to reverse!

BTC an go to the pits and I am confident we will stay strong.

#LUNA Extended ! lONG Term#LUNA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel. This support is at 0.1480.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.1430, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.1493

First target: 0.1532

Second target: 0.1565

Third target: 0.1608

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

LUNA/USDT crypto trading chart Breakout soon1. Technical Setup Favors Explosive Breakout

Moving Averages (Strong Buy Signal):

7/8 daily EMAs and SMAs (including critical 10-day, 21-day, and 50-day) show bullish alignment, with price trading above key averages. This indicates entrenched upward momentum.

Only the 200-day SMA ($0.23) acts as resistance—a clean break could trigger FOMO buying.

Divergence spotted in all major Indicators

Pattern Breakout: An 8-hour chart descending triangle breakout is noted, with measured move targets at $0.95 (TP1) and $1.30 (TP2) . While short of $10, this signals technical strength.

2. Terra Liquidity Alliance + DEFI Eris Protocol: The $10 Catalyst

The real game-changer isn't on charts yet—it's the flywheel effect of:

Inflation-Driven Rewards: TLA directs LUNA inflation into yield pools. At current prices, this funds $6.2M/year in rewards, but if LUNA hits $3, rewards explode to $62M/year .

Eris Protocol's Amplification:

Users stake LUNA to mint arbLUNA (liquid staking derivative).

arbLUNA enables governance voting + yield farming, generating ~250%+ net APY when combining:

Stablecoin pool rewards (200%+ APY in LUNA).

Governance incentives (50%+ APY for voting).

Strategy: Borrow stablecoins at <5% (e.g., via Mars Protocol), farm in Eris pools, and compound LUNA rewards.

Cross-Chain Capital Influx: Axelar bridges assets (wBTC, wETH) from Ethereum/Cosmos, directing external liquidity into Terra. A $1M Axelar DAO proposal is underway to turbocharge this .

3. Why This Could Fuel a $10 Surge

Demand Shock: To earn 250%+ APY, users must buy and stake LUNA → shrinking circulating supply.

Reflexive Price-Reward Feedback:

LUNA price ↑ → Value of farming rewards ↑ → More users join → LUNA demand ↑.

Example: A LUNA price rise to $1 would increase annual rewards to ~$20M, pulling in massive capital.

Scalability: The model supports $100M+ TVL: Current 24h volume shows liquidity depth, and Axelar integration could 10x inflows.

Short Squeeze Potential: With massive monthly gains already, sustained buying could force shorts (betting on declines) to cover, accelerating upside.

4. Feasibility Timeline: Path to $10

Phase Price Target Timeline Catalysts

1. Breakout $0.50-$1.30 1-2 weeks Triangle breakout, SMA 200 breach

2. Acceleration $3-$5 3-4 weeks TLA TVL hitting $50M+, Axelar DAO funding approval

3. Parabolic $10+ 6-8 weeks Reflexive APY >300%, exchange FOMO listings

Conclusion: A High-Probability moonshot

While $10 seems audacious, the Terra-Eris flywheel creates unprecedented buy pressure. Technicals confirm bullish momentum, and the 250%+ yield mechanism could attract billions in capital within weeks. $3 is a near-guarantee if TLA TVL doubles; $10 becomes viable if LUNA's market cap climbs toward top 50 coins. Watch for these triggers:

Axelar DAO approving TLA funding.

LUNA holding above $0.23 on weekly close.

Rising stablecoin deposits in Eris pools

Moonboi? 👦 You have to be a LUNA-tic ''Oh Professor you are a Moonboi, you only post Long positions.''

Well Thank God everything I post (and everything you post) stays here for EVER:

Show me just ONE author with Short ideas on Luna from 110$ to 5$ (i had around 9 posts proposing shorts, needless to say you can check everything here:

and here and here

Ethereum Short positions from close to 5,000$ here:

Dip on Ethereum bough here:

I am not going to go deeper into this, there is no need, you can check how many short positions i gave on Ape from 20$ and other projects.

In a few words:

- I post what i see (and what i trade)

- In the past month I have been Bullish and switched some shorts to longs (Ethereum for example)

- I always hedge even my posts: some Long some Short

- You do your own research, what we post here is just our ideas

- Try to post something too, it's the best way to make Tradingview better! Would be happy to give you my 5 cents of advise on any chart

And yes, remember to hedge but also remember to pick a side and stick with it... like right now: I have been LONG since this:

PS. all the Gurus/experts on Twitter: post some Tradingview ideas sometime..best feature of Tradingview is that EVERYTHING stays documented.

Twitter? OMG! It's a different story! I feel SO sorry for people looking at Twitter and Youtube and expecting to get nothing more than MOSTLY BULLCRAP!

One Love,

The FXPROFESSOR

LUNC Bullish Inverted Head and Shoulders – Testing Neckline Agai🚀 SEED_DONKEYDAN_MARKET_CAP:LUNC Bullish Inverted Head and Shoulders – Testing Neckline Again 📈

SEED_DONKEYDAN_MARKET_CAP:LUNC has formed a bullish inverted head and shoulders pattern and is now testing the neckline in red once again. This could be the final breakout we’ve been waiting for! 🔥

LUNC Bullish Inverted Head and Shoulders – Target Ahead!🚀 SEED_DONKEYDAN_MARKET_CAP:LUNC Bullish Inverted Head and Shoulders – Target Ahead! 📈

SEED_DONKEYDAN_MARKET_CAP:LUNC has formed a bullish inverted head and shoulders pattern. If confirmed, the first target could be the green line level! 📊

Let’s catch this breakout together! 💼💸

#LUNA/USDT#LUNA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1780.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.1860

First target: 0.1900

Second target: 0.1950

Third target: 0.2020

Terra Luna Bottom & Bullish Reversal (444% Profits Potential)We know for a fact that the main low of the correction happened 3-Feb., this is shown here with a red candle with a long lower wick. The lower lows after is a continuation of this move.

As soon as price action moves back above this low, we can say that the bulls are in, but this is not all for Terra, LUNAUSDT.

First, we have the candlestick pattern three white soldiers, three consecutive strong green sessions on the daily timeframe. This signal can be followed by a retrace that ends in a higher low followed by additional growth.

This signal is supported by rising volume. Volume is rising slowly each day and the third and last day has the highest volume in weeks. Of course, the downtrend has also been broken.

Finally, the action is happening above EMA55 and today above EMA89. So the long-term bullish bias and growth potential is being activated.

There is a more, the RSI is really strong and MACD on the bullish zone (not shown). All these are classic signals revealing that Terra Luna is set to experience long-term growth.

The correction is over.

The bottom is in.

Crypto is going up.

Namaste.

Breaking: Terraform Labs' claims portal opens on March 31, 2025Terraform Labs is set to open its claims portal for crypto creditors on March 31, 2025, allowing individuals impacted by its bankruptcy to submit claims. The portal will help those who suffered losses due to the collapse of TerraUSD and other cryptocurrencies related to Terraform Labs’ operations.

As part of the bankruptcy proceedings, the company is working to reimburse its creditors, with a deadline for Terraform Labs claims submission set for April 30, 2025.

Terraform Labs Claims Portal Opening Date and Deadline

According to TerraForm Labs, the claims portal will be accessible at claims.terra.money on March 31, 2025. Creditors who would wish to submit a claim should do so before the 30th of April in the year 2025, at 11:59 PM Eastern Time.

Any claims submitted after this date will not be considered and those involved will lose such an opportunity to recover. In filing the claim, the creditors will have to give an identification of their cryptocurrency assets comprising of wallet addresses, or read-only API key among others.

Technical Outlook

Despite the strategic development, the price of VIE:LUNA seems unbothered. The asset is down 10.39% as of the time of writing. Trading within a bearish engulfing pattern with the RSI at 29 hinting at a possible reversal as the asset is long oversold.

Should VIE:LUNA break above the 38.2% Fibonacci level, a trend reversal will be inevitable.

Terra Price Live Data

The live Terra price today is $0.189004 USD with a 24-hour trading volume of $18,694,216 USD. Terra is down 10.68% in the last 24 hours. The current CoinMarketCap ranking is #268, with a live market cap of $134,190,185 USD. It has a circulating supply of 709,984,439 LUNA coins and the max. supply is not available.