Today's pick : EVX BTCPosition name : EVX BTC

Coin /token info : Everex is a blockchain-based capital transfer system that aims to enable and ease the financial inclusion of unbanked, or underbanked people around the world.

Everex proposes the Cryptocash, a cryptocurrency, where each unit has its value pegged to, and a name based on, the fiat currency it represents. Users convert local fiat currencies to Cryptocash using a currency exchange and transfer the coins to their Everex wallet.

Cryptocash balances are provably underwritten by actual balances held in accounts of licensed financial institutions. The Everex system provides its users access to financial services using Cryptocash, without the volatility issues of existing, non-stable coin cryptocurrencies.

Everex (EVX) has climbed out of oblivion and into the top 200 following the latest news that the company may now onboard U.S clients, according to their latest announcement.

The announcement by the company saw a pump which reached 250% yesterday, with the project currently up 170% today. The latest news from Everex, which launched in January, is that the company has received approval to begin onboarding clients in the U.S state of New Jersey.

Everex (EVX) is a decentralized app which enables Peer-2-Peer payments and trading of financial products using digital assets and smart contracts.

The news saw EVX pump nearly 250% and triple its market cap from $6.7 million to over $18 million, boosting the project into the top 200.

EVX saw its daily trading volume climb 8200% at its peak price yesterday, which was just under $1. The price has since seen a small correction down to $0.80, however trading volume has climbed to over $109 million, making it the 20th most traded coin on the market according to Coin Market cap.

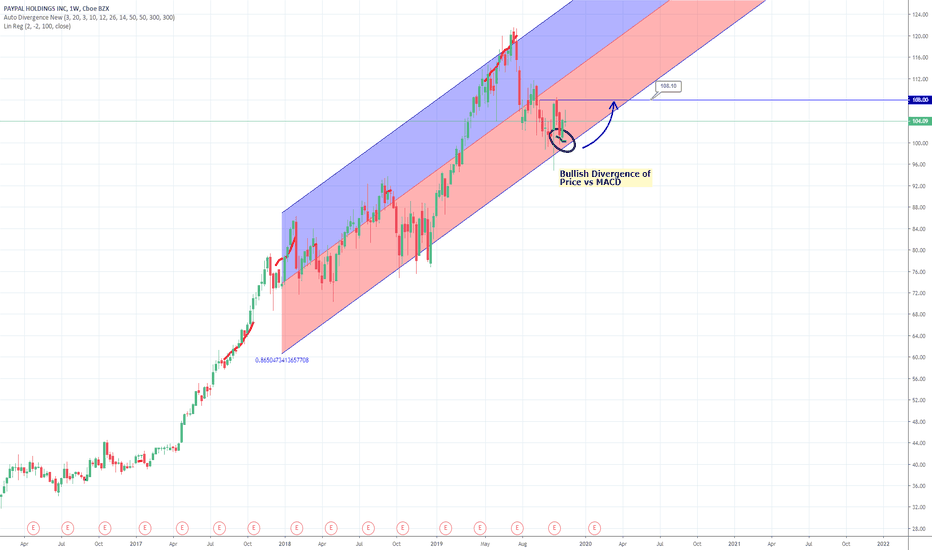

Reason for going long now : The only info we got to predict, let me pass the term, the future price is using divergence , and an other way to see if divergence worked is to watch past same type of divergence and what result occurred , for this particular pair we can see that the same type of macd divergence produced from as little (if we can say so) 13% to astounding 56%.

Macddivergence

OCEAN/BTCA retest of the the top at 912 sats before a correction or a dump to the support line near 600 sats?

Divergence between 3 tops in MACD and the price.

Price close to a strong resistance.

Other scenario : price breaks the resistance and fly to 1000 sats and more.. and invalidate the MACD divergence.

GOLD sell set up (high risk)The market has completed the 5th wave so we are expecting it to start the correction wave.

There is high volatility at the moment but we are expecting it to start the bearish movement soon.

There is a MACD divergence with the 3rd and 5th wave confirming that there will be a change of trend, be careful with this one.

Comment your thoughts!

AUDJPY for buyThe price is near the support zone so we are expecting it to bounce and head towards the resistance.

There is a MACD divergence shown in the graphic.

There is also the possibility to put a buy limit even close to the support zone in order to have greater bullish momentum.

Comment your thoughts

Long Tezos After Bullish divergenceOn the daily we see we are still in a strong uptrend.

On the 4H timeframe we're pulling back, and the impulse is probably turning to yellow around this price. This does not allow me to take this trade yet, as the impulse is red, but it is about

On the 45 minute timeframe, we see a bullish divergence, which, if it plays out, will also turn yellow.

SL: 3.35

Entry: 3.40

TP 1: 3.55

TP 2: 3.61

I expect the result of the divergence to get the price to the +1,5 to +2 ATR level.

If this plays out well, we might also have a new trade for longer term, because then we possibly will have formed a new higher low on the 4H timeframe, and we will see a continuation of the uptrend on the daily and weekly. This remains to be seen.

I will define my exit depending on the strength of the result of the divergence

BTCUSD Short - Rising WedgeHi folks, I’m going to keep this one short and simple.

- There is this big rising wedge on Bitcoin that can be easily seen on the 12 hour time frame.

- Price is also at a critical resistance zone where I expect distribution.

- Bearish divergence can be seen on RSI and MACD.

- Market sentiment is starting to get overly bullish which typically leads to a correction.

I am looking to short from here with a stop loss just above 10,000.

1st target is at the 0.236 fib (around $9,000) but I am anticipating further retracement.

As you know I have been bullish since $6,500 and made the perfect call to go long in previous ideas seen below. I am still very bullish on the long term and I am prepared to close out my shorts as soon as it appears the downside is over.

Previous ideas:

How to Spot Hidden Divergence with the Maverick MACDThis is a brief tutorial on how to spot divergence using the Maverick MACD .

It's so simple and all done completely for you using this indicator.

Here we can see where the indicator spotted hidden bearish divergence and price continues downwards soon after.

You can also receive alerts for when the divergence occurs.

Hope you enjoy :)

How to Spot Divergence with the Maverick MACDThis is a brief tutorial on how to spot divergence using the Maverick MACD .

It's so simple and all done completely for you using this indicator.

This used to take me time and energy to try to find divergence in the market.

Now, I don't have to thing twice about it, this indicator does it all for me.

Divergence can tell us a lot about what price is likely going to do next.

This indicator allows us to find Regular Bullish and Bearish Divergence, as well as Hidden Bullish and Bearish Divergence.

It allows us to find divergence in both the MACD Lines and the Histogram as well.

You can also receive alerts for when the divergence occurs.

Super handy tool!

Hope you enjoy :)

DDAIF Rectangular bottomContinuous reversal points in this rectangular formation, will it continue at (5)? MACD looks bearish, however there is a bullish divergence on the MACD. Risky trade.

AUDUSD for sellThe price has formed an ascending channel within the resistance zone and it formed a MACD divergence even though is small it is still a divergence so we are waiting for the price to continue the channel into the support trendline.

Also the price made 2 false breaks so now it is time for the pullback into the support zone as well.

The RSI indicates 50 level so it will be a good opportunity to enter the sell

Comment your opinions!

EURUSD for sellThe price has reached the resistance zone and it has already rejected it so we are expecting it to change trend and seek the support zone once again.

There is also a MACD divergence within the resistance zone.

Also, the price was in an overbought position without confirming the rupture so it is the verification of the pullback

Sorry for the absence!

Comment your thoughts

SPX500 – MACD Divergence Indicates for Reversal Opportunity soonThe SPX500 has reached a new record last week.

The price has a significant divergence with the MACD indicator which indicates for a reversal opportunity.

If the price will breakout the support below it will be the right signal to look for a price action setup to sell the SPX500 index.

The demand at the bottom will be the target for this position.

WMT double top with MACD divergence downLooks to be headed lower here, the previous low area just above 114, picking up some of the November 15 expiration 114 puts for 72c