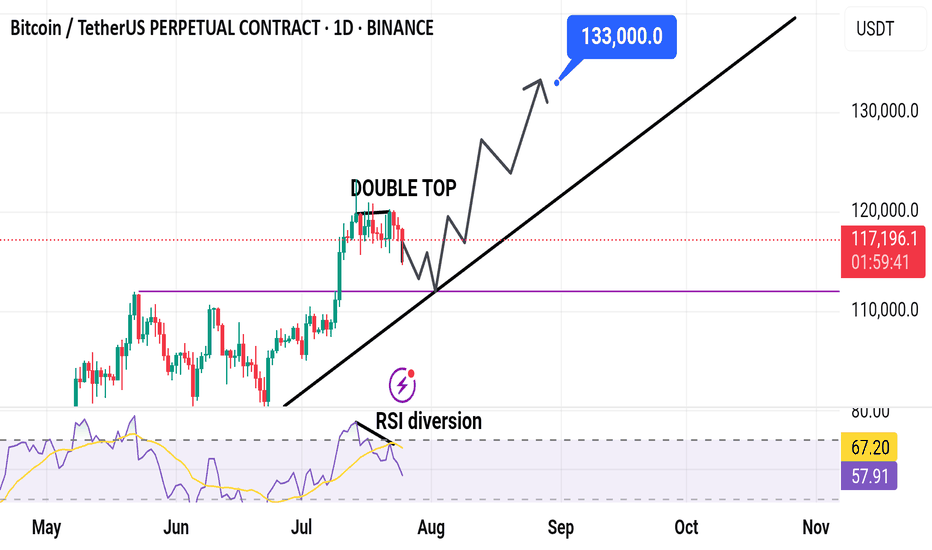

Warning!!! Critical Moment For Bitcoin! Could the top be in?!Chart says it all. You can see how Bitcoin is about to break or pullback from a multi-cycle trend line. This is a critical juncture and resistance is strong, which is why it has to do a lot of convincing to make me become bullish again. We certainly need to pay attention to these lines and how Bitcoin behaves in this range.

Market

Nightly $SPY / $SPX Scenarios for Friday, August 22, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for Friday, August 22, 2025 🔮

🌍 Market-Moving News

Powell’s Jackson Hole keynote is the main event (10:00 AM ET). Markets want clarity on the path to cuts and any framework tweaks; the Fed’s own calendar lists the speech and KC Fed confirms the Aug 21–23 agenda. $SPY/$TLT/ TVC:DXY are the most sensitive.

Risk tone turned cautious into the speech. Stocks faded Thursday as traders de-risked ahead of Powell; positioning is tight and headline-sensitive.

Dollar firm / gold steady into Jackson Hole. Classic pre-keynote safety bid; futures price a high probability of a September cut, keeping two-way risk for rates and equities.

Global cues: Japan CPI lands overnight; UK retail sales postponed. Japan’s July inflation print hits before U.S. cash open; the U.K.’s July retail sales were pushed to Sep 5, trimming one macro catalyst from the tape.

📊 Key Data & Events (ET)

10:00 AM — Fed Chair Powell @ Jackson Hole (Keynote). Why it matters: Sets near-term curve path and risk appetite; watch $TLT/ TVC:TNX and TVC:DXY → AMEX:SPY reaction.

1:00 PM — Baker Hughes U.S. Rig Count. Why it matters: Energy activity → supply expectations → $CL_F/ AMEX:XLE ; persistent rig drift can nudge inflation expectations. (Released weekly at noon CT/1 PM ET.)

Overnight — Japan CPI (Jul). Why it matters: Yen rates and global FX spillovers; a surprise could ripple into U.S. risk before the keynote.

All day — Jackson Hole Symposium continues. Why it matters: Secondary speakers can color post-Powell reaction as positioning resets.

⚠️ Disclaimer: Educational/informational only — not financial advice.

📌 #trading #stockmarket #SPY #SPX #Fed #JacksonHole #Powell #DXY #TLT #Gold #Energy #RigCount

Nightly $SPY / $SPX Scenarios for Thursday, August 21, 2025 🔮 Nightly AMEX:SPY / SP:SPX Scenarios for Thursday, August 21, 2025 🔮

🌍 Market-Moving Headlines

Tech jitters spill as Jackson Hole kicks off. Global equities slipped following a tech sell‑off driven by concerns over U.S. intervention in chipmakers, while traders await Fed Chair Powell’s policy cues. AMEX:SPY and NASDAQ:TLT under pressure as rate‑cut expectations waver.

Sony hikes PS5 prices amid tariffs. Effective August 21, PlayStation 5 models in the U.S. see a $50 price increase—tariff impact spilling into consumer electronics. Raises inflation whispers amid already elevated tech cost narrative.

Healthcare activism heats up. Boards at firms like Medtronic, Pfizer, and Novo Nordisk shift under investor pressure—governance shake‑ups adding a layer of corporate risk and potential M&A signals.

⏱ Key Data Releases & Events (ET)

10:00 AM — Advance Services Report (Q2) (Census bureau). Quarterly weight of service economy—strong print supports Pro side of markets; weak could dial back rate‑cut hopes.

10:00 AM — Summer Youth Labor Force Survey (Annual). Goes with job‑market narrative from July—may tweak Fed sentiment depending on labor softening/stability.

Jackson Hole Symposium begins. Markets now fully focused on Powell; tone could make or break short‑term equity and bond positions.

⚠ Disclaimer: Educational/informational only — not financial advice.

📌 #trading #stockmarket #Fed #JacksonHole #SPY #SPX #TLT #Sony #tech #tariffs #services #labor #activism #healthcare

Nightly $SPY / $SPX Scenarios for Wednesday, August 20, 2025🔮 Nightly AMEX:SPY / CBOE:SPX Scenarios for Wednesday, August 20, 2025 🔮

🌍 Market-Moving News

Jackson Hole in focus; dollar firms. Traders lean ~84% odds of a 25bp cut in September; watch TVC:DXY vs. $SPY/ NASDAQ:TLT as Powell risk approaches.

Retail baton passes from HD to LOW/TGT. After HD’s hold-guidance rally, attention shifts to Lowe’s/Target for read-throughs on DIY vs. pro spend and tariff pass-through.

Risk tone jittery into minutes. Tech led a pullback Tuesday; positioning lightens ahead of Fed minutes and Jackson Hole.

📊 Key Data Releases & Events (ET)

7:00 AM — MBA Mortgage Applications (weekly). Prior: +10.9% w/w (8/13). Why it matters: housing demand pulse → rates/affordability → AMEX:XHB and growth tone.

10:30 AM — EIA Weekly Petroleum Status. Prior crude change: +3.036M bbl. Why it matters: oil balance → gasoline/diesel → inflation & AMEX:XLE path.

1:00 PM — U.S. 20-Year Treasury Auction. Typical close: 1:00 ET; also 17-week bill today. Why it matters: term-premium & risk appetite; tails/stop-throughs can shake $TLT/$TNX.

2:00 PM — FOMC Minutes (July 29–30). Watch for: depth of cut debate, tariffs → inflation, labor cooling. Why it matters: reprices path-of-rates across curve and equities.

Earnings (before open): LOW, TGT, TJX, ADI (+ others). Why it matters: U.S. consumer & capex reads; category mix shifts. Lowe’s call 9:00 AM.

⚠️ Disclaimer: Educational/informational only — not financial advice.

📌 #trading #stockmarket #SPY #SPX #Fed #FOMCMinutes #JacksonHole #DXY #TLT #XLE #LOW #TGT #TJX #ADI

Nightly $SPY / $SPX Scenarios for August 19, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 19, 2025 🔮

🌍 Market-Moving Headlines

Global markets tread water ahead of Jackson Hole. Asian equities slipped while European futures edged up on signs of diplomatic progress in the Russia–Ukraine crisis, as markets await Fed Chair Powell’s keynote. AMEX:SPY / SP:SPX still anchored to central-bank risk tone.

Jackson Hole in focus. Investors are positioning for signals of a dovish tilt or rate cut cues in Powell’s speech later this week—data releases are in the shadow of event risk.

Home Depot earnings loom. Retail heavyweight Home Depot reports today; strong results could buoy equities, while a miss would fan caution on consumer resilience.

💼 Key Market Developments

Meta and Palo Alto highlight tech divergences. Meta shares slipped 2.3% on AI-leaning costs and metaverse skepticism, while Palo Alto surged 5% with robust Q4 and 2026 outlook—creating bifurcated leadership in tech.

Stagflation & AI risk lurk. Analysts warn of stagflation threats and fading AI momentum as catalysts for a broader pullback—S&P 500 still up ~10% YTD, but vulnerable.

⏱ Key Data Releases & Events (ET)

📅 Tuesday, August 19, 2025

Canada Inflation Rate (July): Expected 2.0% y/y — a minor but global inflation cue

U.S. Building Permits (July): Forecast ~1.39M — housing sector signpost ahead of Powell’s speech

Corporate Highlight:

Home Depot (HD) earnings — earnings and commentary on inflation, tariffs, demand dynamics

⚠ Disclaimer: Educational/informational only — not financial advice.

📌 #trading #stockmarket #economy #JacksonHole #Fed #SPY #SPX #HD #HomeDepot #JacksonHole #inflation #earnings #tech #AI #SP500

Weekly $SPY / $SPX Scenarios for August 18–22, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for August 18–22, 2025 🔮

🌍 Market-Moving News 🌍

🏔️ Jackson Hole (Thu–Sat): Chair Powell headlines the Kansas City Fed symposium—path-of-rates + growth vs. inflation = front-page risk for AMEX:SPY SP:SPX TVC:DXY $TLT.

📝 FOMC Minutes (Wed): Deeper read on July meeting dissents and tariff/inflation views—rate-cut odds in play.

🛒 Retail Heavyweights: Earnings updates from NYSE:WMT NYSE:HD NYSE:TGT NYSE:LOW NASDAQ:ROST = real-time consumer pulse for AMEX:XRT and broader risk tone.

🏠 Housing Check: Starts/Permits + Existing Home Sales frame construction demand and affordability; watch AMEX:XHB and long rates.

📊 Key Data Releases & Events (ET) 📊

📅 Tue, Aug 19

• Housing Starts & Building Permits (8:30 AM)

📅 Wed, Aug 20

• FOMC Minutes (July meeting) (2:00 PM)

📅 Thu, Aug 21

• Initial Jobless Claims (8:30 AM)

• Philly Fed Manufacturing Index (8:30 AM)

• S&P Global Flash PMIs (Mfg/Services) (9:45 AM)

• Existing Home Sales (Jul) (10:00 AM)

• Conference Board Leading Index (10:00 AM)

• Jackson Hole Symposium begins (all day; speeches through Sat)

📅 Fri, Aug 22

• No major U.S. releases (focus: Jackson Hole headlines + positioning)

⚠️ Disclaimer: Educational/informational only — not financial advice.

📌 #trading #stockmarket #economy #Fed #FOMC #JacksonHole #housing #PMI #retailsales #SPY #SPX #DXY #TLT #XHB #XRT

Nightly $SPY / $SPX Scenarios for August 15, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 15, 2025 🔮

🌍 Market-Moving News 🌍

🔥 PPI Shock Keeps Cuts in Question — July producer prices +0.9% m/m (largest in ~3 yrs) with broad gains in goods & services. Rate-cut odds pared; watch front-end yields, TVC:DXY , NASDAQ:TLT , and cyclicals.

💵 Dollar Firmer, Gold Softer — The hot PPI print lifted the dollar; gold is set for a weekly dip as hopes for a big cut fade.

📊 Key Data Releases & Events (ET) 📊

📅 Friday, Aug 15

8:30 AM — Retail Sales (July); Retail Sales ex-Autos.

8:30 AM — NY Fed Empire State Manufacturing (Aug).

8:30 AM — Import & Export Price Indexes (July).

9:15 AM — Industrial Production & Capacity Utilization (July).

10:00 AM — Business Inventories (June).

10:00 AM — Univ. of Michigan Consumer Sentiment (Prelim, Aug).

⚠️ Disclaimer: Educational/informational only — not financial advice.

📌 #trading #stockmarket #economy #retailsales #EmpireState #industrialproduction #MichiganSentiment #SPY #SPX #DXY #TLT

Crypto Market Slows Down For A Pullback Within A Bullish TrendGood morning Crypto traders! Cryptocurrencies are coming slightly lower on the intraday basis due to stock market decline yesterday, but we still see them approaching support, so still be aware of a bounce and recovery at the end of the week or maybe next week because of an upcoming weekend. Crypto TOTAL market cap chart can be trading in wave »y« of a complex w-x-y correction in wave 4, unless it's a flat correction, but support is the same at 3.6T – 3.5T area, from where we may see a bullish continuation within wave 5.

Nightly $SPY / $SPX Scenarios for August 14, 2025 🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 14, 2025 🔮

🌍 Market-Moving News 🌍

📉 CPI cooldown keeps cut odds alive — July CPI held at +0.2% m/m (2.8% y/y); Core +0.3% m/m (3.1% y/y) heading into today’s PPI. Watch $SPY/ SP:SPX vs TVC:DXY and NASDAQ:TLT for inflation momentum cues.

🤝 Tariff truce extended 90 days — U.S.–China pause now runs through Nov 10, removing near-term trade shock risk for NASDAQ:NVDA NASDAQ:AMD NASDAQ:AAPL and other SP:SPX heavyweights.

🇨🇳 China credit contraction — July new bank loans fell for the first time in 20 years, signaling weak demand and adding a global growth headwind to the tape.

📊 Key Data Releases & Events (ET) 📊

📅 Thu, Aug 14

• 8:30 AM — Initial Jobless Claims (week ending Aug 9)

• 8:30 AM — PPI (July) — Headline & Core

• 2:00 PM — Richmond Fed’s Tom Barkin speaks

⚠️ Disclaimer:

Educational/informational only — not financial advice.

📌 #trading #stockmarket #economy #CPI #PPI #Fed #SPY #SPX #DXY #TLT

Nightly $SPY / $SPX Scenarios for August 13, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 13, 2025 🔮

🌍 Market-Moving News 🌍

📉 CPI cooldown keeps cut odds alive — July CPI came in +0.2% m/m, +2.7% y/y; Core +0.3% m/m, +3.1% y/y, reinforcing a “disinflation but not done” vibe. Watch $SPY/ SP:SPX vs. TVC:DXY and NASDAQ:TLT as markets handicap a September cut.

🛢️ EIA sees crude sliding sub-$60 — The EIA’s August outlook projects Brent <$60 in Q4 ‘25 as supply growth outpaces demand; energy equities ( AMEX:XLE ) and $USO/$CL_F stay sensitive to this path.

🏦 Fed-speak cluster today — Three regional Feds on deck (Barkin, Bostic, Goolsbee). Any shift in tone on tariffs vs. labor softness can move the front end and equities.

📊 Key Data Releases & Events (ET) 📊

📅 Wed, Aug 13

• 7:00 AM — MBA Mortgage Applications (weekly).

• 8:00 AM — Richmond Fed’s Tom Barkin speaks (Greenville Chamber).

• 10:30 AM — EIA Weekly Petroleum Status Report (inventories, products).

• 1:00 PM — Chicago Fed’s Austan Goolsbee Q&A (12:00 CT luncheon; livestream).

• 1:30 PM — Atlanta Fed’s Raphael Bostic remarks (economic outlook).

• 1:00 PM — U.S. 10-Year Note Auction (Treasury) — usual mid-month supply; watch $TLT/$TNX.

⚠️ Disclaimer: Educational/informational only — not financial advice.

📌 #trading #stockmarket #economy #CPI #Fed #oil #bonds #SPY #SPX #TLT #DXY #XLE

Nightly $SPY / $SPX Scenarios for August 12, 2025 🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 12, 2025 🔮

🌍 Market-Moving News 🌍

🇨🇳 Tariff Truce Extended 90 Days

The White House signed an order late Monday extending the U.S.–China tariff pause by 90 days—removing a key overnight risk into CPI day. Watch AMEX:SPY / SP:SPX , TVC:DXY , NASDAQ:TLT for the reaction.

💵 Dollar Firms Into CPI

The dollar edged higher ahead of this morning’s inflation print as traders recalibrate rate-cut odds; stocks and long U.S. yields were choppy into the release.

🗓️ Quiet Tape, Big Catalyst

Futures and global markets stayed cautious into CPI; positioning is tight after Monday’s drift lower.

📊 Key Data Releases & Events (ET) 📊

📅 Tue, Aug 12

6:00 AM — NFIB Small Business Optimism (July).

8:30 AM — CPI (July) & Core CPI (official BLS release).

10:00 AM — Richmond Fed Pres. Tom Barkin speaks (Chicago; 9:00 CT).

10:30 AM — Kansas City Fed Pres. Jeff Schmid speaks (9:30 CT).

2:00 PM — Monthly U.S. Federal Budget (July) (Treasury MTS, 8th business day).

⚠️ Disclaimer: Educational/informational only — not financial advice.

📌 #trading #stockmarket #economy #CPI #Fed #SPY #SPX #DXY #TLT

Weekly $SPY / $SPX Scenarios for August 11–15, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for August 11–15, 2025 🔮

🌍 Market-Moving News 🌍

🇺🇸 Inflation Double-Header: CPI Tue + PPI Thu set the tone for AMEX:SPY / SP:SPX , rates, TVC:DXY , $TLT.

🏦 Fed Speaker Blitz: Barkin, Schmid, Goolsbee, Bostic—watch headlines for rate-path hints.

🛍️ Consumer Pulse Friday: Retail Sales + Industrial Production/Capacity Utilization = read on demand & output.

🧭 Keep it tight: Focus on CPI, PPI, Claims, Retail Sales, IP/CapU. Everything else is background noise.

📊 Key Data Releases (most impactful only) 📊

📅 Tue, Aug 12

• CPI (July) — Headline & Core (8:30 AM ET)

• Fed: Barkin & Schmid speak (10:00 AM ET)

📅 Thu, Aug 14

• Initial Jobless Claims (8:30 AM ET)

• PPI (July) — Headline & Core (8:30 AM ET)

• Fed: Barkin (2:00 PM ET)

📅 Fri, Aug 15

• Retail Sales (July) — Headline & Ex-Autos (8:30 AM ET)

• Industrial Production (July) (9:15 AM ET)

• Capacity Utilization (July) (9:15 AM ET)

• Consumer Sentiment (Prelim, Aug) (10:00 AM ET)

⚠️ Disclaimer:

Educational/informational only — not financial advice. Consult a licensed financial advisor before investing.

📌 #trading #stockmarket #economy #CPI #PPI #retailsales #Fed #SPY #SPX

XRP - Wait for It!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈XRP has been overall bullish trading within the rising wedge pattern marked in blue, and it is currently retesting the lower bound of the wedge.

Moreover, it is retesting a strong demand zone marked in orange.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the orange demand zone and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #XRP retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Nightly $SPY / $SPX Scenarios for August 8, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 8, 2025 🔮

🌍 Market-Moving News 🌍

🧾 Tariff Shock → Day 2 Positioning

Markets are still digesting the new tariff regime (10%–41% on broad imports) and the proposed 100% levy on imported semiconductors with carve-outs for firms investing in U.S. production. Expect continued dispersion: U.S.-capex-heavy names bid; globally exposed hardware, autos, and consumer electronics face margin risk until rules are clarified.

💬 Policy Signaling Risk

Fed speakers are leaning cautious on growth and inflation pass-through from tariffs; Bostic flagged skepticism that tariff-driven price effects fade quickly. Translation: don’t count on a rapid dovish pivot because of tariffs alone.

⛽ Energy & Positioning Into the Weekend

Oil beta in focus: Baker Hughes U.S. rig count (1:00 pm ET) and CFTC COT (3:30 pm ET) hit this afternoon—both can nudge energy, USD, and risk appetite into the close.

📊 Key Data Releases & Events 📊

📅 Friday, August 8, 2025

10:20 AM ET – St. Louis Fed President Alberto Musalem (remarks)

Market angle: watch for any tariff-inflation commentary and guidance on the path/timing of cuts.

1:00 PM ET – Baker Hughes U.S. Rig Count

Reads on drilling activity; oil services beta and crude sentiment.

3:30 PM ET – CFTC Commitments of Traders (weekly)

Positioning update across futures/FX; risk heading into next week.

(No major Tier-1 U.S. macro prints scheduled today; next CPI is Tuesday, Aug 12.)

Bureau of Labor Statistics

⚠️ Disclaimer:

Educational info only, not financial advice. Do your own research.

📌 #trading #stockmarket #economy #Fed #tariffs #chips #energy #rigcount #COT

Nightly $SPY / $SPX Scenarios for August 6, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 6, 2025 🔮

🌍 Market‑Moving News 🌍

🪙 Citi Lifts Gold Price Forecast Amid Global Uncertainty

Citi raised its short-term gold outlook to $3,500/oz, citing surging safe-haven demand driven by trade instability, softening labor metrics, and heightened geopolitical risk. Risk premiums and volatility remain elevated.

📉 Equities Tumble as Risk Aversion Returns

U.S. stocks slipped on renewed caution—investors rotated into bonds and precious metals following weaker job indicators and escalating trade friction. The dollar and gold strengthened, while equity futures pulled back.

📊 Key Data Releases & Events 📊

📅 Wednesday, August 6:

No major U.S. economic data releases scheduled for today. Markets are closely monitoring corporate earnings reports and commentary from Fed officials, including San Francisco Fed President Mary Daly later in the day.

⚠️ Disclaimer:

This content is for educational and informational purposes only—it is not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #trade #currency #gold #earnings

Nightly $SPY / $SPX Scenarios for August 5, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 5, 2025 🔮

🌍 Market‑Moving News 🌍

🔹 PBOC Moves Prompt FX Backlash

On August 5, 2019, China’s central bank allowed the yuan to depreciate over 2% to its lowest level since 2008. That same day, the U.S. Treasury officially designated China as a currency manipulator, citing the PBOC’s moves as retaliation for recent U.S. tariff actions. In response, China ordered state-owned enterprises to suspend purchases of U.S. agricultural goods—a significant blow to U.S. exporters.

🔹 EU Suspends Counter-Tariffs for Six Months

Following a negotiated framework with the U.S., the European Union suspended retaliatory tariffs on U.S. goods for six months. The move aims to de-escalate trade tensions while joint discussions continue.

🔹 Citi Raises Gold Price Outlook to $3,500/oz

Citi revised its short-term trading range for gold to $3,300–$3,600 per ounce, based on weakening U.S. labor data, rising inflation pressure from tariffs, and growing demand for safe-haven assets. Spot gold traded around $3,356 oz on Monday.

📊 Key Data Releases & Events 📊

📅 Tuesday, August 5:

8:30 AM ET – U.S. Trade Balance (June)

Expected to improve modestly to –$67.6 billion (from –$71.5B), reflecting tariff-influenced shifts in import/export volumes.

9:45 AM ET – S&P Global U.S. Final Services PMI & ISM Non-Manufacturing Index (July)

Key indicators of service-sector strength. Readings above 50 suggest expansion; below 50, contraction. Flash estimates forecast moderated growth in activity.

⚠️ Disclaimer:

This content is for educational and informational use only—not financial advice. Consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #trade #data #inflation #currency

Weekly $SPY / $SPX Scenarios for August 4–8, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for August 4–8, 2025 🔮

🌍 Market-Moving News 🌍

📦 U.S. Tariffs Finalized as August 7 Deadline Nears

President Trump’s administration confirmed newly finalized tariff rates—ranging from 10% to over 40%—on dozens of countries, set to take effect starting August 7. The announcement has heightened global trade uncertainty and injected volatility into equity markets

📉 Weak Jobs Data Spurs Concern

July’s nonfarm payrolls came in at just 73,000 jobs added, far below expectations, while revisions to May and June data subtracted a combined 258,000 jobs. In response, the administration fired the Bureau of Labor Statistics head, escalating political risk around economic transparency

📈 U.S. Shows Resilience Amid Policy Chaos

Despite the tariff-era turbulence and labor softness, U.S. Q2 GDP rose by 3%—outperforming forecasts. Businesses racked up inventory as a hedge, absorbing initial price shocks. Still, concerns about sustained inflation pressures and waning consumer confidence linger

🎯 Earnings Week Spotlight on Tech & Industrial Names

Major companies reporting include Palantir (Monday), AMD, Uber, Disney, McDonald’s, Gilead, Pfizer, Constellation Energy, and Eli Lilly. Markets will watch for AI signals, consumer demand, and industrial trends

📊 Key Data Releases & Events 📊

📅 Monday, August 4

Factory Orders (June) — Critical for industrial demand and trade momentum.

📅 Tuesday, August 5

ISM U.S. Services PMI (July) — Thermometer for expansion in the biggest part of the economy.

S&P U.S. Services PMI (July, flash) — Preliminary signal on service-sector strength.

Trade Balance (June) — Watching for impact of tariffs and shifting cross-border flows.

📅 Thursday, August 7

Initial & Continuing Jobless Claims — Weekly labor-market readings post weak payroll report.

Productivity & Labor Costs (Q2) — Reflect business efficiency and wage trend shifts.

Wholesale Inventories (June) — Key for supply-chain and inventory cycle insights.

Consumer Credit (June) — Measures household borrowing resilience.

📅 Friday, August 8

Fed Speech: St. Louis Fed President Musalem — Market-watchers will look for cues on the near-term rate path.

⚠️ Disclaimer:

This weekly outlook is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #tariffs #jobs #earnings #inflation #Fed #technicalanalysis

Nightly $SPY / $SPX Scenarios for July 31, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 31, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Fed Holds Rates — Dissent Indicates Division

The Federal Reserve maintained its benchmark rate at 4.25%–4.50%. Notably, two governors—Christopher Waller and Michelle Bowman—dissented in favor of a 25 bp rate cut, underscoring internal divisions amid growing political pressure

📈 Strong Q2 Growth, But No Rate-Cut Signal

U.S. GDP expanded at a 3.0% annualized rate in Q2, rebounding sharply from Q1's contraction. Despite this, Powell emphasized persistent inflation, particularly from tariffs, reinforcing the Fed’s cautious policy stance

🛢️ Oil Climbs as Tariff Tensions Rise

Brent crude rose to ~$73.51 and WTI to ~$70.37 on fears of supply disruptions tied to President Trump’s threats of new tariffs on Russian oil and new tariffs imposed on Brazil and South Korea

📊 Key Data Releases & Events 📊

📅 Thursday, July 31:

8:30 AM ET – Initial Jobless Claims (week ending July 26)

Initial claims rose to 222,000, up from 217,000 previously—an early gauge of labor-market trends

8:30 AM ET – Employment Cost Index (Q2)

Quarterly growth in labor costs edged lower to 0.8%, down from 0.9%—a signal of moderate wage pressures

8:30 AM ET – Personal Income (June)

Data released on household income and spending patterns—crucial for assessing consumer resilience heading into Q3

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #inflation #jobs #technicalanalysis

Nightly $SPY / $SPX Scenarios for July 30, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 30, 2025 🔮

🌍 Market‑Moving News 🌍

🧭 Fed Holds Steady Amid Uncertainty

As the FOMC enters its July 29–30 meeting, the Fed is expected to keep rates unchanged at 4.25%–4.50%, even as one or two governors may dissent in favor of rate cuts amid mixed economic data. Recent strength in consumer spending contrasts with weakness in housing and construction.

🌐 U.S.–China Trade Talks Resumed in Stockholm

Talks are under way aimed at extending the tariff truce before the August 12 deadline. Both sides described progress as constructive, though analysts remain cautious on the timeline and potential outcomes.

🛢️ Oil Up / Dollar Firmer, But Risks Remain

Brent crude hit ~$72.50/barrel (+3.5%) while WTI rose to ~$69.20 on a mix of geopolitical tension (possible new Russia tariffs) and trade optimism. The U.S. dollar edged higher following the U.S.–EU trade agreement.

📈 IMF Revises Up Global Growth—but Flags Tariff Risks

The IMF raised its 2025 growth forecast to 3.0% and maintained 3.1% for 2026, citing pre-emptive consumer demand—but warned that ongoing U.S. tariffs and policy inconsistency could dampen momentum.

📊 Key Data Releases & Events 📊

📅 Wednesday, July 30:

FOMC Rate Decision & Powell Press Conference

The Fed is expected to hold interest rates steady. Powell’s remarks will be closely watched for signals on the timing of future cuts and views on inflation and labor markets.

Advance Q2 U.S. GDP Estimate

The first look at Q2 growth is expected around +1.9% YoY, potentially validating a rebound after Q1’s contraction.

June PCE & Core PCE (Personal Consumption Expenditures Index)

The Fed's preferred inflation gauge. Markets will monitor if core inflation remains elevated, which may reinforce policy caution.

⚠️ Disclaimer:

This summary is for educational and informational purposes only—it is not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #GDP #inflation #trade #tariffs #markets

Nightly $SPY / $SPX Scenarios for July 29, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 29, 2025 🔮

🌍 Market‑Moving News 🌍

U.S.–EU Trade Deal Sparks Optimism

The U.S. and EU signed a trade framework allowing a 15% tariff rate on most EU imports, averting harsher penalties. The S&P 500 and Nasdaq both closed at fresh record highs, supported by upbeat tech earnings sentiment—Tesla advanced on a new $16.5B AI chip deal with Samsung—while U.S.–China trade talks resume in Stockholm.

Fed Likely to Hold Rates; Political Pressure Mounts

The Fed is expected to leave its benchmark rate at 4.25%–4.50% at the July 29–30 FOMC meeting. Chair Powell faces growing political pressure from President Trump to cut rates and concerns about central bank independence remain elevated.

Trade Talks Extension to Avoid Tariff Hike Deadline

The August 1 tariff deadline looms. Markets are watching to see if trade deals with China, Canada, and the EU extend the pause or risk new tariffs. Volume in AI/chip stocks and industrials reflects sensitivity to trade developments.

📊 Key Data Releases & Events 📊

📅 Tuesday, July 29

FOMC Meeting Begins — All eyes on Fed rate decision and updated projections.

GDP (Advance Q2 Estimate) — Expected around +1.9% on signs of economic rebound.

⚠️ Disclaimer:

This summary is for educational and informational purposes only—it is not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #trade #tariffs #PCE #jobs #technicalanalysis

Weekly $SPY / $SPX Scenarios for July 28–August 1, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 28–August 1, 2025 🔮

🌍 Market‑Moving News 🌍

🏦 Fed Holds Steady, Faces Political Pressure

The Federal Reserve is expected to keep rates at 4.25%–4.50% during its FOMC meeting midweek. While rates are unchanged, political pressure from President Trump continues as calls intensify for rate cuts and questions arise over the Fed’s independence—including dissent from Governors Waller and Bowman.

📦 Trade Truce Extends & New Deal With EU

A new trade framework with the EU reduces tariffs to 15%, easing tensions. Meanwhile, U.S. and Chinese trade teams begin talks in Stockholm on Monday aiming to avoid an early-August tariff deadline.

💻 Tech and Mega-Cap Earnings Spotlight

This week features earnings from tech giants including Meta, Microsoft (Wednesday), followed by Amazon and Apple (Thursday). Markets will prioritize forward guidance around AI investments, capital expenditures, and sales trends.

📊 Key Data Releases & Events 📊

📅 Monday, July 28

No major releases

📅 Tuesday, July 29

Chicago PMI (July flash) – early indicator of regional manufacturing trends.

Global PMIs – flash readings for Europe and Asia gauge economic health.

📅 Wednesday, July 30

FOMC Rate Decision & Powell Press Conference – investors will scrutinize tone, forward guidance on rates, labor markets, and inflation.

Q2 U.S. GDP (Advance Estimate) – expected at ~1.9%, signaling rebound after Q1 contraction.

📅 Thursday, July 31

June PCE & Core PCE Indexes – Fed’s preferred inflation measure. Core PCE expected at ~2.7% YoY.

Consumer Confidence (July) – key for household spending trends.

Trade Balance (June) – provides data on U.S. import/export dynamics.

📅 Friday, August 1

July Nonfarm Payrolls, Unemployment & Wage Data – forecast for ~102,000 new jobs and ~4.2% unemployment; markets await for labor-market cooling signs.

Tariff Deadline – new tariffs loom unless trade agreements with EU, Canada, China etc. materialize by today’s cutoff.

⚠️ Disclaimer:

This summary is educational and informational only. It is not financial advice. Always consult a licensed financial advisor before making any investment decisions.

📌 #trading #stockmarket #economy #Fed #earnings #inflation #tariffs #GDP #PCE #jobs #technicalanalysis

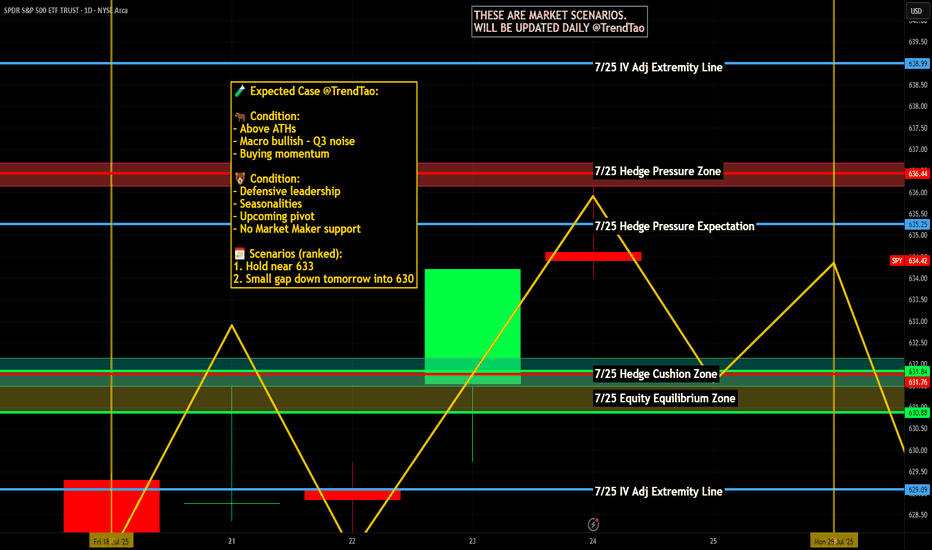

Nightly $SPY / $SPX Scenarios for July 25, 2025🔮 Nightly AMEX:SPY / CBOE:SPX Scenarios for July 25, 2025 🔮

🌍 Market‑Moving News 🌍

🏔️ Copper Market Flashpoint

Following President Trump’s announcement of steep copper tariffs (15–50% range), U.S. copper futures surged, then sharply reversed. Inventory arbitrage between CME and LME markets surged, distorting pricing dynamics and triggering concern over metal market stability.

🇪🇺 EU–China Summit Signals Trade Reset

EU leaders concluded their 25th summit with China, fostering deeper economic and strategic ties. Observers expect follow-up on mutual trade agreements, particularly regarding tech and sustainability sectors.

🌍 EM Equity Rally Consolidates Gains

Emerging markets continue to outperform global equities in 2025—with MSCI EM up ~18% vs. S&P 500. Analysts highlight strong opportunities in AI/fintech stocks in China and Latin America, suggesting further rotations out of U.S. markets.

📊 Key Data Releases & Events 📊

📅 Friday, July 25:

8:30 AM ET – Durable Goods Orders (June):

Forecast shows a sharp drop (~–10%), following a ~16% gain in May—signaling possible cooling in business-related equipment purchases.

10:00 AM ET – U.S. Imports of Steel Products (June):

Trade-data release monitoring steel flows amid evolving tariff frameworks.

All Day – Corporate Earnings Reports:

Companies such as First Financial Bancorp (FFBC), HCA, AON, Charter, and others report earnings. Outlooks may influence small- to mid-cap sentiment.

⚠️ Disclaimer:

This report is for educational and informational purposes only—not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #data #earnings #commodities #EM #technicalanalysis