Medpace Holdings (MEDP)Medpace Holdings (MEDP): A Masterclass in Capital Allocation and Niche Dominance in Clinical Research

Medpace Holdings, Inc. (NASDAQ: MEDP) represents a compelling case study in how a focused, well-managed company can create extraordinary shareholder value by dominating a high-value niche within a critical industry. As a leading global Clinical Research Organization (CRO), Medpace specializes in guiding small to mid-sized biopharmaceutical companies through the complex and costly process of drug and medical device development. The recent spotlight from Giverny Capital Asset Management—which successfully navigated significant volatility to see the holding become a top performer—highlights the core attributes that make MEDP a sophisticated and potentially rewarding long-term investment choice: resilient demand, exceptional operational execution, and shareholder-aligned capital management.

The Investment Thesis: A Specialized Partner in the Innovation Ecosystem

Medpace operates in the essential but often overlooked infrastructure layer of the life sciences industry. While large pharmaceutical giants have internal capabilities, hundreds of emerging biotech companies rely on specialized CROs like Medpace to design, manage, and execute their clinical trials. This creates a powerful business model anchored by:

Structural Growth Tailwinds: The global biopharmaceutical R&D pipeline continues to expand, driven by advances in genomics, oncology, and rare diseases. Outsourcing to CROs remains a secular trend as sponsors seek expertise, speed, and cost efficiency.

High Client Stickiness and Value: Clinical trials are mission-critical, highly regulated, and difficult to transfer mid-stream. Medpace’s deep therapeutic expertise, particularly in complex areas like cardiometabolic and oncology, fosters long-term partnerships and creates significant switching costs.

A Focused Niche: By concentrating on small and midsize sponsors, Medpace avoids the low-margin, commoditized bidding wars that can occur with large, volume-based contracts from Big Pharma. This focus allows for closer collaboration, premium pricing, and often more efficient trial execution.

The Giverny Capital Case Study: Navigating Volatility with Conviction

Giverny Capital’s experience with Medpace is instructive for all investors. Their initial purchase around $381 was followed by a steep decline toward $300, driven by market fears that a potential shift in FDA leadership could stifle new drug approvals and dry up funding for trials. This highlights an important aspect of MEDP’s profile: while its long-term drivers are robust, its stock can be susceptible to sentiment-driven volatility related to biotech funding cycles and regulatory perceptions.

However, Giverny’s decision to buy more on weakness was rooted in fundamental analysis, not sentiment. They noted management’s consistent and credible communication that underlying business remained healthy, evidenced by continued hiring for future growth. This disciplined approach was spectacularly rewarded when Medpace reported Q2 2025 earnings, revealing two critical actions:

Exceptional Operational Performance: Strong revenue and backlog metrics that dispelled the bear thesis.

Aggressive, Value-Creating Capital Allocation: The company had repurchased a staggering 9% of its outstanding shares during the quarter at deeply depressed prices.

This combination triggered a 50%+ single-day rally and validated the investment thesis that Medpace is not only a superb operator but a shrewd steward of capital, actively enhancing per-share value for long-term owners.

Financial Resilience and Shareholder Alignment

Medpace’s financial profile is characterized by high profitability, strong cash flow conversion, and a clean balance sheet. This strength provides the flexibility to navigate industry cycles and, as demonstrated, to aggressively buy back stock when management perceives a disconnect between price and intrinsic value. This capital allocation discipline is a key differentiator and a primary reason sophisticated investors are attracted to the stock.

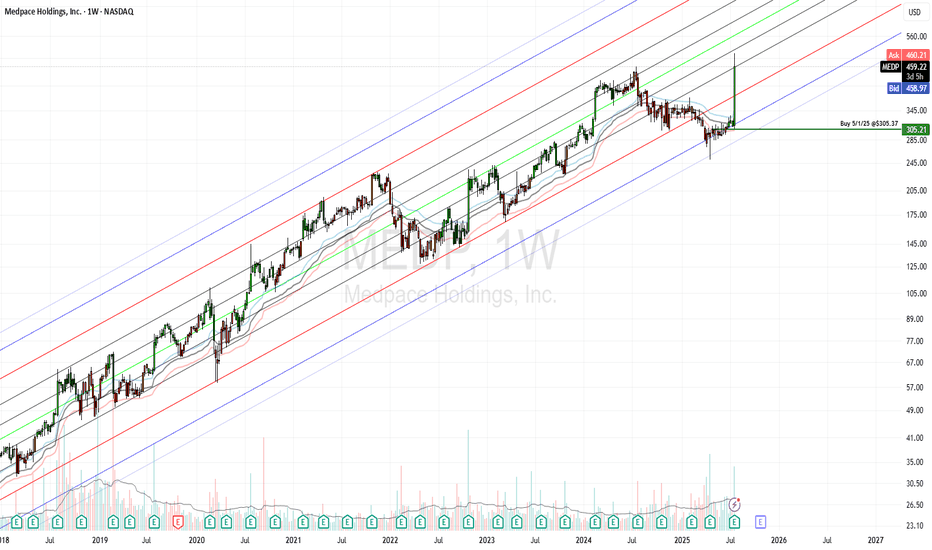

Technical Perspective: Defining the Risk/Reward Framework

Following its dramatic rally, Medpace’s stock has entered a consolidation phase. Technical analysis provides a map of potential support levels and a clear upside target, framing the risk/reward scenario.

Support Zone 1: ~$537.47 (0.236 Fibonacci Retracement): This represents a shallow, healthy pullback level following a powerful uptrend. A successful hold here would indicate sustained bullish momentum and that the new, higher trading range is being established.

Support Zone 2: ~$482.54 (0.382 Fibonacci Retracement): A retreat to this level would represent a deeper, but still corrective, move. It would likely test the conviction of newer investors and align with a broader market or biotech sector pullback.

Support Zone 3: ~$438.15 (0.5 Fibonacci Retracement): This is a critical support area. A decline to this zone would signal a more significant retracement of the prior advance, potentially revisiting the levels around Giverny’s later purchases. It would represent a high-conviction buying area for long-term believers in the story, assuming fundamentals remain intact.

Take-Profit Target: $700: This upward target represents the next major psychological and technical milestone. Achieving it would require Medpace to continue its track record of earnings growth, maintain robust backlog conversion, and potentially benefit from a renewed cycle of biotech funding optimism. It offers a clear, significant upside objective for investors.

Long-Term Investment Conclusion

Medpace Holdings is not a passive index bet; it is an active investment in exceptional management and a specialized, resilient business model. Its journey from $300 to over $550 illustrates the market’s occasional tendency to over-discount short-term fears, creating opportunities for disciplined investors.

The key takeaways for a prospective investor are:

Embrace the Volatility: Understand that the stock will be sensitive to biotech sentiment, but that the underlying demand for its services is structurally sound.

Trust in Execution and Capital Allocation: Management has proven its ability to guide the business through uncertainty and to act decisively to create shareholder value.

Use Technicals for Context: The defined support zones offer a roadmap for positioning, allowing investors to align entry points with their risk tolerance and conviction level.

For investors seeking a high-quality, owner-operated business within the essential healthcare R&D supply chain, Medpace presents a compelling choice. It is a company that demonstrates how operational excellence, combined with shrewd capital stewardship, can translate into outstanding long-term returns, even—and sometimes especially—amidst short-term turbulence.

MEDP

Medpace Holdings (MEDP): From Molecule to MarketMedpace is a late-stage contract research organization that provides full-service drug-development and clinical trial services to small and midsize biotechnology, pharmaceutical, and medical-device firms. It also offers ancillary services such as bioanalytical laboratory services and imaging capabilities. The company was founded over 30 years ago and has over 5,400 employees across 40 countries. Medpace is headquartered in Cincinnati and its operations are principally based in the US, but it also operates in Europe, Asia, South America, Africa, and Australia.

ClinTrak®: Integrated Clinical Trial Management System.

Electronic Data Capture (EDC), ePRO/eCOA, eConsent: Digital tools for patient-reported outcomes and consent.

Interactive Response Technology (IRT): Randomization and drug supply management.

Wearables & Apps: TrialPACE (patient app), OnPACE (site app), and centralized monitoring tools.

Narrow Moat: Intangible assets, high switching costs.

Differentiation: Speed and precision in trial execution, especially for complex therapies like biologics and gene therapies.

Ranks: Strong

GreenRed: 363 / 3,147

GreenBlue: 258 / 2,500

Early entry in small cap health services, $MEDPSince late 2021 NASDAQ:MEDP is being forming a head & shoulders base with pivot buy above $230.

This is the beahvior of a potential leader. It shows when comparing it against the AMEX:IWO as is still in a downtrend.

The play for me would be to buy 1/2 or 1/3 of a position just above yesterday's high with a STOP-LOSS below $196. And then add at the $230 pivot.

Medpace Holdings is ranked #1 in its industry by IBD. I recomend to also check NYSE:VPG which is also setting up.

Its being hard for small caps to get demand as the indices are still in downtrends making the sentiment stay bearish.

But as JC Parets always likes to remember, "is a market of stocks, not a stock market".

MEDP approaching new all-time highMedpace is a scientifically-driven, global, full-service clinical contract research organization (CRO) providing Phase I-IV clinical development services to the biotechnology, pharmaceutical and medical device industries.

They do clinical trials for new drugs, including a recent trial for a neutralizing antibody for SARS-CoV-2 for the treatment and prevention of COV19.

With earnings surprises the last two quarters and a Zacks estimate for a strong Q4, Medpace is on track to make a new all-time high.

As it approaches the all-time high, volatility is decreasing while volume is shrinking. There is not much selling going on, so a little demand will cause this to pop above the all-time high and accelerate from there.

Buy point is at 144.49 with a stop loss of 7.63% based on the 10d ATR (x2.7). Position size of R13.1.

Buy Point: 144.49

Stop Loss: 133.47

Position Size: R13.1

MEDP - Upward channel breakdown short from 60.87 to 33.13MEDP seems running within an upward channel formation. Right now it's getting back from its upper Chanel line. It also has some 100% selles from insider. We think it has good downside potential.

To trade one could consider June $55 or $60 Puts

-------------------

*Trade Idea*

Date First Found- February 11, 2019

Pattern/Why- Upward Channel formation

Entry Criteria- $60.87

Exit Criteria- 1st Target: $50.33, 2nd Target: 33.13

Stop Loss Criteria- $65.73