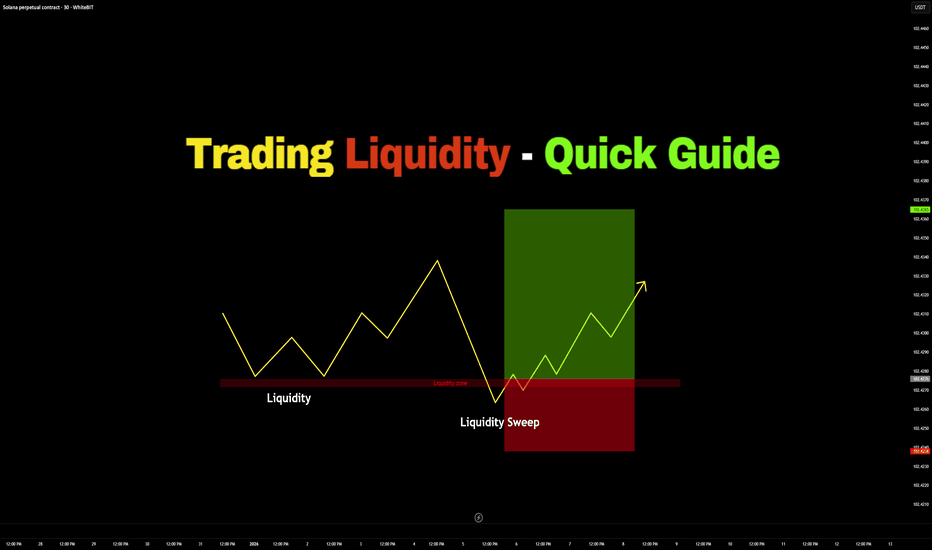

Trading Liquidity – Quick Guide in 5 StepsWelcome back everyone to another guide, today we will speed run "Trading Liquidity" in a quick 5 step guide. Be sure to like, follow and join the community!

1) Identify Liquidity:

- Equal highs or cluster of highs (Buy-side Liquidity)

- Equal lows or cluster of lows (Sell-side Liquidity)

- Obvious highs & lows

2) Identify Liquidity Direction (Price moves towards liquidity first):

- Equal highs > Price is likely to sweep above

- Equal lows > Price is likely to sweep below

3) Wait for Liquidity Sweeps

- Price takes out lows

- Stops get triggered

- Look for rejection or close back inside

Do NOT enter before the sweep or before the confirmation.

4) Enter Trade:

Enter after confirmation, away from liquidity

- Stop loss: Longs > Below Swept Lows

- Stop loss: Shorts > Above Swept Highs

5) Take Profits:

- Take Profit: Nearest opposing liquidity

- Take Profit: Previous high/low

- Take Profit: Range boundaries

RESULTS:

Liquidity sweep > confirmation > clean move

Thank you all so much for reading! Hopefully this is a useful guide in the future or present! If you would like me to make any simplified guides, articles or tutorials, let me know in the comment section down below - or even contact me through trading view.

Thank you!

Mindset

How Overconfidence Destroys Profitable TradersHow Overconfidence Destroys Profitable Traders

Understanding Overconfidence in Trading

Welcome everyone to another article.

One of the most dangerous stages a trader can walk into is not fear… but overconfidence. (EGO)

Overconfidence in trading is essentially ego.

However, there is still an important difference:

- Confidence is a real belief built on proof, statistics, and discipline.

- Overconfidence is an inflated belief in your ability beyond the proof. This is driven by ego.

Many traders do not fail because they do not know enough.

They fail because at some point, they believe they know enough or know “everything.”

What Overconfidence appears as in Trading:

A trader builds a system. ( yay! )

They go on a clean winning streak maybe 10, 12, even 15 profitable trades in a row.

At this point, the trader begins to think and assume:

“ I’ve cracked the code. ”

- Risk gets increased .

- Position sizes get bigger .

- Rules start to bend .

Confidence continues grow until it crosses a dangerous path where belief is no longer supported by data, statistics and proof.

Reality eventually steps in.

You will never again feel as confident as you did during your first major winning streak when it looked like the market finally made sense and success was “ figured out. ”

That feeling is exactly what traps traders.

Overconfidence WILL break Risk Management

Overconfidence destroys a trader by slowly dismantling their risk management, their system, their discipline, their psychology and their consistency.

It rarely happens all at once.

First:

- “ I’ll just risk a little more this time. ”

- “ This setup looks perfect. ”

- “ I’m on a winning streak. ”

Over time, the trader begins to:

• Ignore position sizing rules ( Too many LOTS or contracts )

• Move stop losses (Increases risk)

• Add to losing trades ( Does not accept the original loss )

• Trade larger to “maximize opportunity” (Stick to what you can afford to lose )

The trader thinks and believes the system will continue to work, because it worked before.

But markets do not reward belief, they reward discipline. (I have mentioned this many times in my previous posts.)

Once risk management breaks, even a profitable system becomes dangerous and can lead to zero profits, or even down to negatives.

Overconfidence Blocks Positive criticism and continuous Learning

There is no such thing and there will never be a 100% perfecto trading system/strategy.

Losses are part of the game.

Overconfident traders struggle when reality does not meet their expectations.

Instead of adapting to the market by adjusting their strategy they:

- Resist feedback (Or consider any feedback as hate/negative criticism)

- Ignore changing market conditions (Consolidation, flat lining, barcoding etc)

- Refuse to admit the system is underperforming (Bad performance & results)

- Believe the problem can’t be them (“It’s not the system, it’s the computer!”)

But Why…?

Well because… their mind keeps rewinding the dopamine high from when everything worked perfectly and the win rate was 99%

They only remember the wins, and “ GREEN ” $$$ %%% not the probability.

The exact moment a trader believes they “can’t be wrong,” learning comes to a halt.

And in trading, when learning stops, losses accelerate, revenge trading increase, risk management collapses, and consistency becomes scrambled.

Overconfidence changes Traders into > Gamblers

Overconfidence does not just cause losses it can also change behavior.

Frustration from unexpected losses turns into:

- Anger

- Impatience

- Forced trades

- Revenge trading

Rules get ignored.

Emotions take control.

The trader may still look like a trader, but they are acting like a gambler.

The most dangerous part?

They still believe they are right…

Example: How Overconfidence Destroyed a Profitable Trader

Let’s look at Bobby.

Bobby was a profitable trader. A very successful one in his 4th year of trading.

He discovered what he believed was a 99% win-rate system.

The first month was incredible.

The second month was just as good. Cash flowing in, heaps of green.

By the third month, losses started to appear.

Instead of falling back, taking a breather and reassessing , Bobby doubled down.

Continuing to trade the same system despite clear signs of underperformance.

He was no longer focusing on perfect executions and setups, he was chasing the high.

Losses turned into frustration .

Frustration turned into anger .

Anger turned into impatience .

Soon Bobby was:

• Forcing trades

• Revenge trading

• Ignoring risk management

Bobby refused to take responsibility.

“It was my internet.”

“My computer lagged.”

“My family distraccted me.”

The excuses piled up, but the account kept shrinking.

Bobby did not fail because of the system.

Bobby failed because ego stopped him from adapting to the market and adjusting his system.

Markets Will Always Humble Ego

Markets will humble traders in ways they never expect.

No matter how experienced you are, there is always something else to learn.

Trading is not a destination, it is a constant process of adaptation towards the market. Traders who believe they “know everything” will always be reminded by the market that They. Do. Not.

Overconfidence doesn’t end trading careers immediately.

But it slowly erodes them trade by trade turning it into mental torture.

Final Thoughts

Confidence is necessary to trade.. But Ego is fatal!

The very moment a trader believes they have cracked the code is often the moment their decline begins.

Stay humble.

Respect risk.

Let statistics, not emotion, guide your decisions.

Because in trading, the market doesn’t punish ignorance it punishes ego.

The Attachment to a Bias: When Analysis Turns BlindThe Attachment to a Bias: When Analysis Turns Blind

“The market didn’t change.

Your attachment did.”

Every trader begins with a view.

Bullish or bearish.

That’s normal.

The problem starts when a view becomes an identity.

You stop observing.

You start defending.

How Bias Is Formed

Bias is rarely created by logic alone.

It forms from:

• A strong winning trade

• A painful loss you want to recover

• A convincing analysis or opinion

• News, narratives, or predictions

Slowly, analysis turns into belief.

Belief turns into attachment.

Why Bias Feels Like Confidence

Bias feels powerful because it removes uncertainty.

It gives comfort.

You stop questioning.

You stop waiting.

You start seeing only what supports your view.

But comfort is not clarity.

And certainty is not accuracy.

What Bias Does to Your Trading

• You ignore early warning signs

• You skip confirmation

• You hold losing trades longer

• You miss clean reversals

• You fight structure instead of reading it

The market keeps giving information.

Bias stops you from receiving it.

Flexibility vs Conviction

Professional traders are not directionless.

They are flexible.

They have a plan — but no attachment.

They follow structure, not opinions.

They let price speak first.

Conviction says, “I know.”

Flexibility says, “Show me.”

How to Detach From Bias

• Treat every trade as independent

• Update bias only after structure confirms

• Journal when you feel “sure” — that’s a warning

• Ask: “What would invalidate my view?”

• Let price lead, not belief

The market doesn’t reward conviction.

It rewards awareness.

📘 Shared by @ChartIsMirror

Have you ever held onto a bias even when price was clearly changing?

Awareness begins the moment you let go.

After the Win: When Ego Takes OverAfter the Win: When Ego Takes Over

“Losses hurt the account.

Wins test the mind.”

A good trade works.

The plan was followed.

The market respected your level.

And then something subtle happens.

Confidence rises.

Rules soften.

The next trade feels easier to take.

That’s not growth.

That’s ego quietly stepping in.

Why Wins Are Dangerous

A win rewards behavior — but it also rewards emotion.

The brain links profit with personal ability.

You start trusting yourself more than your process.

Thoughts begin to shift:

• “I’m in sync with the market.”

• “I can see it clearly now.”

• “This one will work too.”

This is how discipline slowly erodes.

Confidence vs Ego

Confidence is calm.

Ego is loud.

Confidence respects rules.

Ego bends them.

Confidence accepts uncertainty.

Ego assumes control.

The moment a trader feels “special,”

the market prepares a lesson.

The Common Pattern

Many traders lose money not after losses,

but after a strong winning trade.

Why?

• Position size increases

• Entries become aggressive

• Confirmation is skipped

• Patience disappears

The account doesn’t collapse immediately.

It leaks slowly.

How to Stay Grounded After a Win

• Treat wins like losses — review them

• Take a short pause after big profits

• Reset size to default

• Ask: “Did I follow process, or did I get lucky?”

Your edge is consistency, not confidence.

The market doesn’t punish success.

It punishes arrogance.

📘 Shared by @ChartIsMirror

Do you feel more disciplined after a win…

or more confident than your rules allow?

How to build a Healthy Trading MindsetMany traders underestimate how much psychology shapes their results. This guide outlines the foundations of a strong trading mindset that supports consistent and disciplined decision-making.

1. Understand That Emotional Discipline Is a Skill

Trading naturally triggers emotions such as fear, frustration, greed, and impatience. These reactions are not weaknesses; they are human. What separates consistent traders from inconsistent ones is their ability to recognize emotions without acting on them.

A resilient mindset comes from training, not talent.

2. Create Distance Between Yourself and Your Trades

Do not tie your self-worth to the outcome of a single position. A loss does not mean you failed, and a win does not mean you are skilled. When traders begin to link identity to results, they make impulsive decisions.

Use phrases like “this trade” instead of “my trade” to remove ownership bias.

3. Focus on Process, Not Profit

Most traders sabotage themselves by obsessing over the end result. The market does not reward effort; it rewards alignment with probability.

Instead of thinking “How much can I make?”, think “Did I execute according to my plan?”

Your trading plan should define your entries, exits, risk, and market conditions. Follow it even when it feels uncomfortable.

4. Accept Uncertainty as Part of the Game

No setup is guaranteed. Every trade, no matter how perfect, carries uncertainty. Accepting this prevents you from forcing control where none exists.

When you fully accept uncertainty, you no longer fear it.

5. Build Consistency Through Routine

A stable routine reduces mental noise. Examples include:

• Reviewing your plan before each session

• Limiting how many markets you monitor

• Taking breaks after high-stress situations

• Logging your trades with honest notes

When your routine is consistent, your decisions become consistent.

6. Use Losses as Data, Not Drama

A loss is not a personal attack from the market. It is information.

Ask: “What does this loss teach me about my system or my mindset?”

If you can extract value from losses, they become opportunities instead of obstacles.

7. Master Patience

Most trading errors come from acting too soon, not too late. Patience means waiting for your setup without deviation.

If you need to be in a trade at all times, it is no longer trading; it is compulsion.

8. Protect Your Mental Capital

Mental capital is as important as financial capital. Overtrading, revenge trading, and excessive chart time drain your cognitive energy.

Stop trading when you notice fatigue, frustration, or impulsiveness. A clear mind is an advantage.

9. Develop Long-Term Thinking

Think in terms of series, not individual outcomes. A single win or loss means little. What matters is the overall direction of your equity curve.

Professional traders think in months and years. Amateurs think in minutes.

Conclusion

A powerful trading mindset is built through consistency, self-awareness, and emotional control. By focusing on process and discipline rather than short-term results, you create a stable internal environment that supports longevity in the markets.

The Identity Trade“When I’m winning, I feel unstoppable. When I’m losing, I feel worthless.”

That rollercoaster isn’t just emotional - it’s existential.

Follow along. I hope this helps.

BUT FIRST

NOTE – This is a post on mindset and emotion. It’s not a trade idea or system designed to make you money.

My intention is to help you preserve your capital, focus and composure - so you can trade your own system with calm and confidence.

HERE’S WHAT HAPPENS

You start to merge with your results.

A green day feels like proof you’re good.

A red day feels like proof you’re not.

The screen becomes a mirror.

Every tick feels personal.

Every drawdown feels like rejection.

And slowly... trading stops being something you do

and starts being who you are.

That’s when the smallest loss hits like a character flaw

and the biggest win can’t quiet the noise for long.

WHY IT MATTERS

When your identity fuses with your PnL,

you stop managing trades and start managing your self-worth.

You trade to feel whole.

To feel enough.

And that’s when emotional risk becomes financial risk.

THE SHIFT

You are not your last result.

You are the awareness behind it - the one capable of learning, adapting and evolving.

Next time the chart moves against you, notice what hurts more - the loss itself or what it means about you.

That’s your real edge.

Ask yourself:

Who are you when you’re not trading?

Old Wounds, New Trades - Echoes of the Past... “I don’t know what’s wrong with me. Every time I take a loss, even a small one, I freeze. It’s like a switch flips and I feel off, I just can’t explain why”

If you’ve ever felt that sudden wave of tension, self-doubt, or urgency that doesn’t quite fit the size of the trade… You’re not alone.

Follow along. I hope this helps.

BUT FIRST

NOTE – This is a post on mindset and emotion.

It’s not a trade idea or system designed to make you money.

My intention is to help you preserve your capital, focus, and composure so you can trade your own system with calm and confidence.

HERE’S WHAT HAPPENS

You’re trading normally.

Nothing dramatic.

Then price moves against you.

The heart rate spikes, breathing shortens, the body tenses.

You hesitate or you overreact.

Logically, it makes no sense.

It’s just one trade.

But the emotion feels bigger than the moment.

That’s because it’s not just the market you’re responding to.

It’s memory.

WHAT’S REALLY GOING ON UNDERNEATH

Your nervous system stores emotional imprints, moments of uncertainty, criticism, fear, failure.

They don’t disappear; they get filed under “avoid this feeling.”

When something in the present, like a losing trade hits a similar emotional frequency, the old file reopens.

And you find yourself reacting. Not just to the market in the here and now but to an echo from the past.

That echo might sound like:

🔹 “I can’t mess this up again.”

🔹 “I should’ve known better.”

🔹 “What if this proves I’m not cut out for it?”

It’s not the trade that’s hurting.

It’s the part of you that once felt unsafe, unseen, or not enough.

HOW TO CATCH IT BEFORE IT RUNS YOU

1️⃣ Notice the size of your reaction.

If it feels disproportionate, too intense for what just happened, that’s your cue.

2️⃣ Name the echo.

Say quietly: “This is an old memory, not a new threat.”

It separates the past from the present.

3️⃣ Ground your body.

Unclench the jaw.

Drop the shoulders.

Breathe out longer than you breathe in.

Remind your nervous system that this moment is safe.

4️⃣ Reframe the signal.

The intensity isn’t weakness, it’s information.

Your system is showing you where an old wound still seeks resolution.

Trading doesn’t just reveal your skill.

It reveals your history.

And every emotional flashback you meet with awareness,

is one less echo shaping your next trade.

Why Most Traders Lose After a Big Win

Winning streaks distort your sense of control, turning confidence into overconfidence after just a few wins. You start believing success is pure skill instead of a mix of skill and luck, and that’s when discipline fades. Position sizes grow, stops are skipped, and trades you’d normally avoid start to look appealing. Risk management and careful analysis fall away as emotion takes over. Each trade remains independent, no streak changes the odds, and without resetting after every win, you eventually give back what you gained. Overconfidence feels like progress, but it’s usually the start of decline.

Your best trade often comes right before your worst.

Here’s how to avoid that trap:

Reset after every win. Treat each trade as a new game.

Keep size consistent. Don’t let emotions dictate position size.

Journal the trade. Note what worked and what didn’t.

Set limits. If you hit a profit goal for the day, stop trading.

Protect your edge. A single bad day can erase a week of gains.

Discipline is what separates traders who survive from those who restart every cycle.

Your next mistake begins when you think you can’t make one.

The Empty Feeling After A WinA trader messaged me recently after closing a big win.

He said, “I should’ve felt great but I just felt… flat.”

That sudden emptiness after the high it’s more common than you think.

Follow along. I hope this helps.

BUT FIRST

NOTE – This is a post on mindset and emotion. It’s not a trade idea or system designed to make you money.

My intention is to help you preserve your capital, focus, and composure — so you can trade your own system with calm and confidence.

HERE’S WHAT HAPPENS

You execute beautifully.

Plan followed. Risk managed.

Trade hits target. Account up.

You should feel satisfied.

But instead… there’s a drop.

The charts look dull.

The mind goes searching.

“Maybe one more setup.”

“Just check the next pair.”

That’s not greed.

That’s chemistry.

When you’re in a trade, your brain is flooded with dopamine the chemical of pursuit, anticipation and drive.

When you exit, that hit disappears almost instantly.

To the nervous system, that chemical drop feels like loss .

And loss, even after a win, triggers the instinct to get it back.

WHAT’S REALLY GOING ON UNDERNEATH

You’re not chasing profit.

You’re chasing stimulation, the feeling of being alive in the action.

The mind interprets that feeling as boredom or missed opportunity.

But really, it’s your biology craving more.

The subconscious has learned to equate stillness with emptiness.

So it pushes for movement to escape the come-down.

That’s why so many traders give back profits after doing everything right.

They’re not making bad decisions.

They’re trying to fix a feeling.

HOW TO CATCH IT BEFORE IT CATCHES YOU

1️⃣ Notice your come-down cue.

After closing a trade, does your body feel restless?

Do you scroll, check charts, or reopen the platform out of habit?

That’s the withdrawal in motion.

2️⃣ Name it, don’t fight it.

Say it internally: “This is dopamine dropping.”

It takes the mystery out of the urge.

3️⃣ Breathe through the drop.

A long exhale through the mouth… six seconds out tells the body it’s safe.

Let your eyes rest on something still.

4️⃣ Reframe the pause.

That quiet space after a win isn’t emptiness.

It’s integration.

It’s the moment your nervous system resets for the next run.

Trading mastery isn’t just execution.

It’s emotional regulation before, during and after execution.

I put a lot of time and thought into every post that goes out here so I appreciate your support.

Thank you

Halloween Special: The Risk “Treats” That Keep You Alive!🧠 If October has a lesson, it’s this: fear is useful, panic is fatal. Great traders don’t fight the monsters; they contain them.

Here’s my Halloween mindset & risk playbook:

🧪 Keep your “lifeline” small: Risk a fixed 1% per trade until your balance moves ±10%, then recalibrate. This makes loss streaks survivable and hot streaks meaningful.

⏰ Set a nightly curfew: a max daily loss (e.g., 3R or 3%). Hit it? Close the platform. No “one last trade.” Curfews save accounts.

🛑 Define your invalidation before you enter: If that level prints, you’re out, no arguments, no “maybe it comes back.” Plans beat feelings.

🎯 Hunt asymmetry: If you can’t see at least 2R cleanly (preferably 3R), pass. You don’t need more trades; you need better trades.

🧟 Kill the zombie trade: the one you’re babysitting, nudging stops, praying. If you’re managing hope more than risk, exit and reset.

🧘 Protect your mind equity: Two back-to-back losses? Take a 20-minute break. After a big win? Journal before you click again. Calmness compounds.

📜 Make a ritual: pre-trade checklist → position size → entry → stop → targets → log. Rituals turn uncertainty into routine, and routine into consistency.

What’s your #1 rule that keeps the “revenge-trading demon” out of your account❓

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Why Traders Lose Focus After Winning StreaksWinning streaks are dangerous.

They make you feel in control.

You stop thinking in probabilities and start thinking in outcomes.

That shift ends most profitable runs.

After several wins, your brain links confidence with success.

You assume the next trade will also work.

You increase risk, ignore signals, and force setups that do not fit your plan.

This is not trading. It is gambling with momentum.

Your goal is not to feel good.

Your goal is to execute a repeatable process.

Follow these steps:

• Keep your position size fixed for a set number of trades. This prevents emotional scaling.

• Log every trade with entry, exit, and reason. Review data, not emotions.

• Take one day off after three or more wins. It resets focus and stops greed loops.

• Set rules for re-entry after a big win. Do not revenge trade the market in reverse.

• Use alerts instead of constant chart watching. It reduces impulsive entries.

Example:

A trader wins five trades in a row. Balance rises from $10,000 to $11,500.

He increases size from $1,000 per trade to $2,000.

The next trade hits stop loss. He loses $400 instead of $200.

Confidence drops, he forces a recovery trade, loses again.

The account returns to $10,700. Three days of progress lost to one emotional decision.

The fix is mechanical execution.

Do not scale until data shows consistency across at least 30 trades.

Use statistics to guide size, not emotion.

Focus on staying neutral.

Your job is to follow process under pressure.

Discipline after wins separates traders from gamblers.

How to Analyze Your Trading Performance ScientificallyBy Skeptic – Founder of Skeptic Lab

Most traders know how to analyze charts — but few know how to analyze themselves.

A professional trader doesn’t just look at last month’s profit or loss; they examine consistency , volatility , and long-term stability.

Earlier today, as part of my usual routine, I was reviewing my trading performance and reflecting on my recent results. That’s when I decided to share my analysis process with you :) — a framework built from personal study and research that might help others turn raw data into real improvement.

In this tutorial , we’ll walk through a data-driven framework to evaluate your trading performance like a portfolio manager — using metrics such as cumulative return, volatility, Sharpe ratio, and trend analysis.

1. Data Collection: Turning Trades into Monthly Returns

Instead of focusing on single trades, record your monthly returns in percentage terms.

It can look as simple as this:

This structure helps you see the bigger behavioral pattern behind your system — not just isolated results.

“If you can’t describe what you’re doing as a process, you don’t know what you’re doing.” – W. Edwards Deming

2. Cumulative Return: The Power of Compounding

Your total return isn’t the average of each month — it’s compounded over time:

This shows whether your trading system has truly grown across time, not just fluctuated.

A positive total means your system is resilient; a negative one signals structural issues.

3. Key Statistical Metrics

Once your data is ready, calculate the following metrics — the backbone of every professional performance review:

4. Coefficient of Variation (CV) – Stability Indicator

A CV below 1 implies your returns are stable and predictable.

Above 1.5 suggests your system’s risk-to-reward profile is unstable — and may need adjustment.

5. Sharpe-like Ratio – Measuring Efficiency

Assuming a zero risk-free rate, the Sharpe ratio measures how much return you generate per unit of volatility:

Sharpe > 0.5 → healthy performance

Sharpe > 1 → professional-level consistency

Sharpe < 0.3 → the system needs review

“It’s not about being right, it’s about being consistent.” – Mark Douglas

6. Trend Analysis – Detecting Growth or Decay

Run a simple linear regression between time (month number) and return.

Positive slope: system improving

Negative slope: decline in edge or discipline

Positive slope with high variance: profitable but unstable behavior

Combining this with the Sharpe ratio gives a complete health check of your strategy.

📝Summary Table

Data without action is noise.

Use these insights to correct weaknesses and scale strengths:

Identified Issue: High volatility

→ Practical Fix: Reduce position size in range-bound markets

Identified Issue: Consecutive drawdowns

→ Practical Fix: Add trailing stops or break-even adjustments

Identified Issue: Low average return

→ Practical Fix: Reassess position sizing or strategy fit

Identified Issue: Overconfidence after wins

→ Practical Fix: Apply daily or weekly risk caps

🧩 Final Thoughts

Analyzing your performance is not just about profits — it’s about understanding your patterns .

By measuring Sharpe, CV, and trend, you can answer three crucial questions:

Is my growth consistent or random?

Is my risk proportional to my return?

Can I replicate this performance?

If the answer is yes, you’re not just improving your system —

you’re evolving as a trader :)

🩵If you found this tutorial helpful, give it a boost and share it with your fellow traders. Let’s grow together, not alone!

Happy trading, and see you in the next tutorial ! 💪🔥

The Billy Big Balls MomentA trader reached out to me by direct message here on Trading View highlighting a challenge that many of us face from time to time. We’re talking about self sabotage. That moment you know what to do - but do something entirely different and get a result that frustrates the **** out of you.

Follow along, I hope this helps.

BUT FIRST

NOTE – This is a post on mindset and emotion. It’s not a trade idea or strategy designed to make you money. My intention is to help you preserve your capital, focus, and composure so you can trade your own system with calm and confidence.

Here's a scenario you might be familiar with...

You nail a sequence of trades.

Precision. Flow. Everything lines up.

And then something flips.

You start pushing harder, sizing up, breaking your own rules.

A few minutes later, you’re staring at a screen wondering,

“What the hell just happened?”

It’s not lack of discipline nor is it a technical problem.

You have an emotional pattern that hasn’t been mapped out yet.

This pattern has roots into your subconscious and it’s sabotaging your efforts.

WHATS REALLY HAPPENING AND WHERE DOES THE DRIVER REALLY COME FROM

When you start winning, your brain gets flooded with dopamine , the chemical of reward and anticipation.

If your nervous system has ever learned that success leads to loss, losing control, losing safety, losing connection it quietly associates “winning” with risk .

The mind says, “Let’s keep this going.” Deeper down though is the silent warning … “This isn’t safe.”

Doesn’t sound logical right? It’s not. It’s emotional. Deeply embedded in your psyche and activated whenever the mind feels that familiar feeling again.

The mind wants to go forward - the body wants to intervene. And so you get an internal split. A moment of pressure that your mind just has to resolve. And the fastest way the subconscious knows to relieve that pressure… is to end the win.

So you do something impulsive, not because you want to fail,

but because deep down, you're trying to protect yourself or believe or not, you might be even trying to punish yourself.

Weird stuff happens in the subconscious.

That’s why the sabotage happens right after a run of success.

It’s not logic breaking down.

It’s the mind trying to restore an emotional equilibrium.

HOW TO CATCH IT BEFORE IT HAPPENS

Listen. The moment you size up impulsively is not random.

It’s a repeatable signal that your emotional system has been triggered.

You can’t fix what you can’t see - so start tracking it.

1. Notice your signature cue.

For some, it’s tension in the chest or a fidgety feeling of restlessness.

For others, it’s the need to “just check one more chart.”

For you it might be something else. Pay attention and start to become aware of what comes up for you.

2. Map the pattern

Keep a short log : what happens right before you go rogue?

Notice the time of day, physical tension, thoughts.

You are looking for a repeatable sequence.

3. Identify your threshold

There’s always a tipping point where clarity narrows: your breath shortens, attention tunnels or you start fantasising about bigger gains.

That’s your signal.

4. Interrupt the pattern and create a recovery plan (as you notice the cues)

Physically step away from the desk.

Exhale through the mouth long, slow, 6 seconds.

Let your eyes rest on something still . This shifts the nervous system out of fight-or-flight and back into focus.

This isn’t about controlling emotion.

Its about expanding your capacity so emotion doesn't control you.

Next time you’re on a hot streak, notice where focus ends and thrill begins.

That’s the edge that makes or breaks the run.

When Winning Feels UnsafeNOTE – This is a post on mindset and emotion. It is not a trade idea or strategy designed to make you money. My intention is to help you preserve your capital, focus, and composure so you can trade your own system with calm and confidence.

You’re in profit.

The trade’s working.

Your system’s doing exactly what it should.

But instead of ease, something tightens.

A flicker of doubt.

You can hear that inner voice: “Don’t mess this up. You wouldn’t want to give this back now would you? How much is enough anyway?”

You scan the chart again.

Check your unrealized PnL.

Move the stop closer.

Start managing… what doesn’t need managing.

Here’s what’s really happening:

Your subconscious is remembering what happened the last time you saw success…

The time you relaxed and it reversed.

The time you felt proud and someone cut you down.

The time you won and it didn’t last.

So even when the market moves in your favour, part of you braces.

Waiting for the other shoe to drop.

So that voice saying, don’t mess this up - is actually a memory trying to protect you.

And in so doing, never really lets you feel safe

The point here is that your work as a trader is to be in the here and now. Not in the past.

Be cognisant to the cues of your memory and body that don’t work in your favour.

So when you notice tension rising,

Take one slow breath. Feel your feet on the floor. And repeat. ‘Right here, right now’.

And then …

Follow your trade plan.

Stay true to your trading plan.

Manage your risk

And let the market do what it does.

The Phantom TradeThe Phantom Trade .... In the spirit of Halloween ...

NOTE – This is a post on mindset and emotion. It is not a trade idea or strategy designed to make you money. My intention is to help you preserve your capital, focus, and composure — so you can trade your own system with calm and confidence.

You missed it.

The setup you’d been watching for days, maybe weeks finally played out.

Clean. Precise. Exactly as planned.

But you weren’t in it.

Maybe you hesitated.

Maybe the trigger didn’t line up perfectly.

Or maybe you just weren’t at your desk.

Either way, it’s done.

But your mind doesn’t let it go.

You replay it.

Frame by frame.

You check where you would have entered, where you would have exited.

You tell yourself it’s “reviewing.”

But it’s not.

It’s rumination.

A mental loop that feels productive but keeps you stuck in what can’t be changed.

You’re not trading the market anymore… you’re trading your memory of it.

And every replay reinforces the belief that you should’ve done better.

The body joins in too.

Tight chest. Restless legs.

An urge to make it back .

That’s the real danger.

Because the next trade isn’t about opportunity, it’s about redemption.

And redemption trades rarely end well.

The skill isn’t in ignoring the regret.

It’s in recognising it for what it is: the echo of unmet expectation.

Ask yourself: what am I actually trying to fix here?

The missed trade… or the feeling of not being enough?

The point here is:

Reflection helps you grow.

Rumination keeps you stuck.

Learn to tell the difference.

That’s where real mastery begins.

Meme Coins: Gambling or Genius? The Untold Psychology!Hello Traders!

From Dogecoin to Shiba Inu to PEPE, meme coins have turned ordinary investors into overnight millionaires… and just as quickly, wiped them out.

But behind all the hype, memes, and moonshots, lies a deeper question:

Are meme coins pure gambling, or is there actually a kind of genius hidden inside this madness?

Let’s explore the real psychology that drives the meme coin phenomenon and what it teaches us about market behavior.

1. The Allure of “Quick Rich” Dreams

Meme coins sell emotion, not utility. They trigger the most powerful desire in human nature, the dream of instant wealth.

Traders jump in not because of fundamentals, but because of FOMO (Fear of Missing Out).

When people see others getting rich on Twitter or Telegram, logic disappears, replaced by hope and greed.

Meme coins don’t just trade on charts; they trade on human emotion.

2. The Hidden Genius of Community Psychology

While most treat meme coins as jokes, their creators understand one truth, markets move on attention .

Every meme coin is a masterclass in viral marketing.

They combine humor, belonging, and financial dreams, creating powerful communities that believe, promote, and act together.

It’s not fundamentals, it’s faith.

And when millions believe at the same time, even a joke becomes valuable, at least for a while.

3. The Bubble Psychology – Why It Repeats

Each meme coin cycle starts the same: early adopters accumulate silently.

Then comes the hype wave, influencers, trends, and social media buzz.

Late buyers rush in, liquidity explodes, and eventually, the supply outpaces the demand.

Finally, prices collapse, but the story repeats with a new name next month.

Humans never learn because our emotions never evolve. The pattern stays the same, only the logos change.

4. Genius or Gambling – The Thin Line

If you treat meme coins as “investments,” you’re gambling.

But if you treat them as short-term speculative plays with strict risk limits, you’re being strategic.

The key difference is not in the coin, it’s in your mindset.

Even BNF-level discipline can’t save someone trading emotionally in meme markets.

The real genius is not in predicting the next PEPE, it’s in managing risk when emotions run wild.

Rahul’s Tip:

Meme coins reveal more about human behavior than any economic theory ever will.

If you can understand why people chase hype, and control the urge within yourself, you’ll already be ahead of 90% of traders.

Conclusion:

Meme coins are not just digital jokes, they are mirrors reflecting our collective greed and hope.

They remind us that markets are not rational, they are emotional.

In the end, whether meme coins make you rich or broke depends less on the coin, and more on your ability to stay grounded while everyone else loses control.

If this post gave you a new perspective on meme coins, like it, share your view in comments, and follow for more deep trading psychology insights!

How Takashi Kotegawa (BNF) Turned $15,000 into $160 Million!Hello Traders!

Every trader dreams of freedom, to make money from anywhere, without bosses, without limits.

But very few turn that dream into reality. One man did, quietly, with no show-off, no team, no hype, just discipline.

His name is Takashi Kotegawa , known as BNF , and his journey remains one of the greatest stories in trading history.

He didn’t chase the market. He observed it, studied it, and understood the mind behind every candle.

This is not just the story of how he made millions, it’s the story of how he mastered himself.

1. The Beginning, A Trader With No Mentor, No Plan, and Just a Dream

BNF started with about ¥1.6 million (around $15,000) in early 2000s Japan, when markets were highly volatile after the dot-com crash.

He had no formal financial education, no teacher, no fancy tools, just curiosity and the internet.

His small Tokyo apartment became his world, one desk, one screen, and endless observation.

In interviews, he said he began by watching how prices moved during panic and euphoria.

He wasn’t trying to predict the future, he was trying to understand human behavior.

“People repeat the same mistakes in the market, every single day. Once you understand that, you don’t need predictions.”

2. His Core Belief, Trading Is 80% Psychology, 20% Logic

BNF believed that markets don’t move on information, they move on emotion.

He often said the real skill is not in finding the next big stock, but in controlling your reactions when others lose theirs.

He avoided leverage because he didn’t want fear to control his decisions.

He didn’t follow gurus or predictions, he trusted data and patterns.

He didn’t chase “profit goals”, he focused on protecting his capital and mental stability.

He treated trading as a mental battlefield , not a money machine.

For him, staying emotionally calm was more valuable than catching a big move.

“Once you lose emotional control, the game is over.”

3. His Strategy, Buy Panic, Sell Relief

BNF’s entire strategy was built around human emotion .

He didn’t try to predict, he reacted when the crowd lost balance.

He studied every panic, company news, bad results, crashes, and identified when fear was overdone.

He looked for stocks that fell due to market-wide panic, not because of real problems.

He entered when the crowd had already given up, when fear turned into despair.

He exited when confidence came back, before greed took over again.

This was not just a “buy-the-dip” idea. It was about understanding how emotions cycle, fear, denial, hope, greed, and where to position himself.

He once said, “When people are scared to buy, I buy. When people feel safe, I sell.”

That single sentence explains his entire philosophy.

4. The Livedoor Shock, His Defining Moment

In 2006, Japanese markets were hit by the Livedoor scandal .

Stocks crashed violently, retail traders panicked, and brokers were flooded with sell orders.

But while everyone else was frozen in fear, BNF saw an opportunity.

He noticed fundamentally strong companies dropping for no reason other than panic.

He quietly started buying in small quantities as the market collapsed.

In just a few weeks, as panic faded, his portfolio exploded in value.

That single event turned him from a small trader into a millionaire.

But even after making that money, he didn’t change his routine, same room, same computer, same focus.

“My life doesn’t need luxury. My satisfaction comes from mastering myself.”

5. His Daily Routine, The Discipline Behind the Calm

BNF treated trading like a profession, not a gamble.

He started his day by reviewing past trades, not charts.

He noted where he got emotional, not where he lost money.

He avoided media and noise, no financial TV, no social chatter.

He kept his body healthy and avoided stress, because he believed mental sharpness required physical balance.

His trading was so precise that he could go days without taking a trade.

For him, “No trade is also a trade.”

He believed the market rewards patience, not activity.

6. Why He Never Lost Control, The Philosophy of Detachment

BNF viewed money as a tool, not a goal.

He said that once you start trading “for money,” you lose clarity.

Money was the byproduct of good decision-making, not the purpose of it.

He never celebrated big wins.

He never took revenge trades after losses.

He kept emotions flat, whether profit or loss, his behavior stayed the same.

This is what made him different.

Most traders rise and fall emotionally with every tick, he remained centered, observing the storm instead of becoming part of it.

“If I get too happy or too sad, I stop trading. That means I’ve lost control.”

7. The Lessons BNF Left for Every Trader

Trading is a psychological war, not a mathematical one.

Numbers don’t matter if your emotions control your decisions.

Capital protection is your first profit.

He never let ego force him to risk everything for quick gains.

Patience is the real edge.

He could wait for days for the perfect entry, and strike once without hesitation.

Ignore the noise.

He didn’t care what analysts said or where the market “should” go. He traded what he saw, not what he hoped.

BNF proved that consistency and calmness beat every advanced strategy.

Rahul’s Tip:

You don’t need to trade like BNF to be successful, but you can learn to think like him.

Your biggest goal in trading should be to master your reactions, not predict the market.

Money will follow when you stop chasing it.

Conclusion:

Takashi Kotegawa, the man the world calls BNF, didn’t just make $160 million.

He made something more powerful, he achieved peace in chaos.

He showed that trading is not about defeating others, it’s about defeating your own impulses.

His legacy is proof that in markets, patience is the ultimate power, and silence is the greatest strategy.

If this story inspired you to slow down, think deeper, and trade wiser, like it, comment your thoughts, and follow for more lessons from legends.

Patience - When Calm Feels WrongNOTE – This is a post on mindset and emotion. It is not a trade idea or strategy designed to make you money. My intention is to help you preserve your capital, focus, and composure — so you can trade your own system with calm and confidence.

Markets quiet down.

Price moves slow.

Everything looks still, maybe too still.

Part of you relaxes.

Another part tenses.

It’s that sense that something’s coming.

And sometimes, it is.

But here’s the hard part

Your body doesn’t always know the difference between anticipating danger and feeling unsafe.

For traders, the nervous system reads uncertainty like threat.

Even a normal pause in volatility can trigger the same internal siren:

Something’s wrong. Do something.

You start scanning: news, charts, signals

anything to justify the unease.

But often, the danger isn’t out there.

It’s inside you... a learned association between stillness and not knowing what's going to happen next

Which causes restlessness, uncertainty and a need to fidget and meddle.

The skill isn’t in shutting that instinctive unease down.

It’s in listening without reacting impulsively.

Ask yourself - what is really going on right here, right now?

The point here is:

Patience isn’t passive.

It’s regulated awareness.

It’s being alert, not alarmed.

Ready, but not restless.

Sometimes there is indeed a risk out there.

We are trading the financial markets after all.

However. You have a trading plan.

You know to be risk measured.

All that is needed now is the ability to regulate yourself

Stay calm and patient so you can execute your plan as intended.

The Illusion of Readiness - Creeping DoubtNOTE – This is a post on mindset and emotion. It is not a trade idea or strategy designed to make you money. My intention is to help you preserve your capital, energy, and focus - so you can trade your own system with calm and confidence.

You know that feeling before you click buy or sell .

You pause…

You check your levels again.

Re-measure your stop.

Recalculate your size.

Zoom in, zoom out.

Add one more confirmation just to be sure.

You tell yourself it’s discipline.

That you’re waiting for the “perfect” setup.

But there's no denying it…

You can feel it

Creeping doubt entering your trading room

Listen. The truth is you already know your plan.

You’ve tested it.

You’ve seen it work.

You are ready.

But your mind doesn’t trust that yet.

So it creates the illusion of readiness

a loop of micro-adjustments and checks that feel productive…

when really, they keep you safely on the sidelines.

It’s control in its most subtle form.

A way of saying,

“I’ll act when I feel completely certain.”

Except in trading that feeling never comes.

Every tweak strengthens the belief that you’re not ready.

Every delay tells your system,

“Not yet… not safe.”

The work isn’t in waiting for confidence.

It’s in acting through the uncertainty

and building trust in motion.

Next time you find yourself double-checking for the fifth time, pause and ask:

“Who is in the driving seat here?”

Take a deep steadying breath and then follow your plan.

The Tension Between Trust and ControlNOTE – This is a post on mindset and emotion . It is not a trade idea or system designed to make you money. My aim is to help you protect your capital, energy, and composure, so you can trade your own system with clarity and confidence. This is a shorter post than normal with a challenge embedded. If you choose to follow, let me know how you get on.

Imagine the scenario

BTCUSD - you’re in.

The trade has moved your way and you KNOW you ought to trail

Afterall...

You’ve built the system and you have rules to follow

You’ve tested them.

They have an edge. You know you ought to trust the edge

And yet… in the middle of a live trade, your hand drifts toward the mouse.

You want to tweak the stop.

Take profit early.

Do something .

You tell yourself it’s prudence.

But what’s really happening is a tug-of-war between trust and control .

Your system says: Stay put. Let it play out.

Your instinct says: Take it and run.

The more you interfere, the more you teach your brain one thing:

“I can’t trust myself.”

That interference doesn’t protect you.

It keeps you trapped in a loop of doubt and micromanagement

In reality, it erodes self-trust, trade by trade.

So here’s your challenge:

Sit through 30 trades, a statistically significant data set. Follow your rules with a position size that is big enough so you pay attention but not so big to cause you to interfere. Once you’ve entered - follow your rules to a T. No adjusting. No tinkering. By all means, makes notes in a journal.

When the urge to step in comes up for you, pause and ask:

💭 What emotion is this?

Notice it.

Name it.

Then let the system do its job, while you practice doing yours: staying disciplined.

Part 2 – After the Crash Comes the Silence📉 Part 2 – After the Crash Comes the Silence

How to rebuild yourself when the market breaks you

Losses hurt.

But the real damage isn’t the money –

it’s what they trigger inside you.

When you stare at the screen after a big loss,

question everything, hold the mouse –

and still click even though you know you shouldn’t…

That’s when you finally meet your real opponent: yourself.

🧩 After the Crash Comes the Silence

After major losses, you don’t get angry –

you go quiet.

You start analyzing, justifying, searching for someone to blame.

That’s when you often hear:

“The markets are manipulated.”

And yes – there’s truth in that.

Professionals make money because they understand how manipulation looks and where it begins.

They study liquidity pockets, order flow, and timing –

they don’t react, they anticipate.

Techniques like spoofing – placing fake orders to trick others – are technically illegal,

but nearly impossible to prove in real time.

It’s a grey zone where regulation lags behind speed.

But that’s exactly the point:

you don’t need to prove manipulation –

you need to see it coming.

To build your positioning so you’re not the liquidity that’s being hunted.

The market isn’t a monster.

It’s an ecosystem full of intent, strategy, and psychology.

And in this ecosystem, survival belongs to those who can see before they react.

💭 The Tuition of Trading

Losses are part of the game.

The faster you accept them, the faster you learn to control, process, and transform them.

They’re not failures – they’re tuition fees, the unavoidable price of experience.

Without them, there’s no growth, no structure, and no discipline.

Every professional trader you admire has paid heavily in that same currency.

🔁 Reset – Rebuild – Refine

1️⃣ Reset – Detox your thinking

Turn everything off.

No charts, no groups, no noise.

Just you, a blank page, and silence.

Write down what really happened – and what you felt while it did.

Recognizing emotions isn’t “soft.” It’s elite risk management.

2️⃣ Rebuild – Remove the lies

Most strategies don’t fail because they’re bad –

they fail because they’re built on self-deception.

“I’ll stick to my stop this time.”

“I just need to win back what I lost.”

No. You want validation, not profit.

Only when you stop lying to yourself can you build a system that protects you – not destroys you.

3️⃣ Refine – Become the architect of your risk

Find out who you are as a trader.

Aggressive or conservative?

Impulsive or patient?

Until you know, you’ll always trade against your own nature – and lose every time.

⚙️ The Turning Point

There comes a moment:

You see the perfect setup –

and you don’t take it.

That’s not weakness. That’s enlightenment.

Because you’ve finally learned that doing nothing is sometimes the most profitable move.

From that moment, you start reading markets not to be right –

but to understand.

You realize:

👉 The market isn’t against you.

It’s testing whether you’re truly ready.

💡 The Deepest Realization

The market doesn’t punish you.

It mirrors what you haven’t mastered yet.

Every repeated mistake isn’t bad luck –

it’s proof that mentally, you’re still the same person from your last drawdown.

And that’s the real game:

Not mastering the market – but mastering yourself.

💬 Reflection Questions

When was the last time you didn’t take a trade – and felt proud of it?

Which of your “rules” are actually emotional shields?

How many of your losses come from setups – and how many from emotions?

What would your system look like if you built it around you, not the market?

🔑 Final Thought

Trading isn’t a fight against numbers.

It’s a daily confrontation with your ego, greed, and impatience.

Success begins the moment you realize:

The market was never the problem – you were.

And that’s your opportunity.

Because once you truly understand yourself,

no chart in the world can scare you again.

The 3 KEYS to Trading SUCCESSToday we will discuss about the 3 Keys I believe are required for succeeding in trading.

When you enter into the trading field, you quickly understand that it’s not just about charts and setups — it’s about mastering yourself mentally.

There are 3 keys that separate those who last from those who don’t in Trading:

( 1 ) Psychology

( 2 ) Risk Management

( 3 ) Consistency

Every single one is equally important, but how you balance them determines your long-term outcome when trading.

1 ) Psychology — Master Your Mind Before You Master the Market

Trading, the mental game disguised as a financial one displaying 1s and 0s winners and losers. The market, the charts, the currency, they do not care who you are, what you think, or how badly you want to win.

It simply exposes your strengths and weaknesses in the world of psychology .

Most traders lose, this is not because they lack knowledge, but because they cannot control their emotions, feelings — fear of losing, fear of missing out, greed after a win, hesitation after a loss, anxiety, frustration, impatience.

Every emotional outburst leads to poor decision-making: closing early, revenge trading, over-leveraging, or ignoring your plan, right after you told yourself you were going to lock in and turn $100 into $1000000.

To master psychology:

( 1 ) Detach from the outcomes/end-result. Focus on executing well, not whether a trade wins or loses. Follow your plan.

( 2 ) Think of probability. Every setup, every trade must have an edge — not a guarantee.

( 3 ) Accept losses as part of the process. Losses are tuition fees in this business. Every loss is a win, because there is a lesson to be learned.

( 4 ) Stay grounded. Journaling, mindfulness, and post-trade reflection go a long way. Keep track of trades and review them during down time.

When your mindset stabilizes, when your thoughts are calm, your trading skills become consistent. The charts don’t change — you do.

In terms of training your mindset, see my previous post below which explains the difference between a Trader and Gambler. This is an excellent article for those who want to BECOME a trader.

2. Risk Management — Protect Before You Profit

If psychology keeps your calm, risk management keeps you alive.

This is the part most traders skip — until they learn the hard way and blow their own capital, or 10 fundeds in a row.

Your number one job as a trader is not to make money. It’s to protect capital so you can focus on staying in the game long enough for your strategy and edge to play out well.

Practical risk rules:

( 1 ) Never risk more than 1–2% of your capital on a single trade. (If you do, you increase the emotions of greed)

( 2 ) Always know your max loss before entering — no guessing, if you do not? Your loss, your fault.

( 3 ) Use stop-losses logically, not emotionally. Set them at resistances or supports. Key levels.

( 4 ) Avoid over-leveraging. Leverage magnifies both wins and mistakes. Higher the leverage, higher the risk.

( 5 ) Don’t chase. Missed trades are better than blown accounts. Record them down and log emotions.

Good risk management doesn’t make you rich overnight — but poor risk management will make you broke instantly .

You don’t need huge wins to grow; you just need small, controlled losses and consistent execution throughout your trading journey.

3. Consistency — Discipline Over Drama

Consistency is the glue that holds everything together, risk management to Psychology.

It’s easy to stick to your plan for a week; but it is hard to do it for months without deviation and drifts. But that’s exactly what separates traders who make it from those who burn out.

Consistency means:

( 1 ) Showing up daily, sticking to a fixed plan of study, back testing, assessing.

( 2 ) Following your trading plan with discipline.

( 3 ) Reviewing your trades honestly — both wins and losses. (Are YOU doing THIS?)

( 4 ) Avoiding impulsive changes just because of one bad day. Take a break if the loss affects you badly.

Progress in trading is slow and often invisible. You might not notice improvements week to week but look back after six months of focused consistency — and you’ll realize how far you have come. Remember, slow and steady wins the race. This is a game of Tortoise v Rabbit. Push fast and hard and you will make mistakes – be slow and steady and you will win the race.

Stepping back to view the bigger picture

Trading success isn’t luck — it’s the result of compound discipline, calculated trades and timing.

( 1 ) Psychology gives you control.

( 2 ) Risk management gives you longevity.

( 3 ) Consistency gives you results.

When you align all three, everything starts to click.

You don’t need to master the market — just master your mindset, your risk, and your routine . The profits follow naturally.

Thank you all so much for Reading. I hope this post becomes beneficial to you!