MNT Pullback to Key Support – Bounce Incoming?MNT has seen a significant drop over the past few days, but it's now entering a major support zone where price previously found strong demand. This could present a high-reward opportunity for traders watching for a potential reversal or bounce from this level.

📌 Entry Zone: $1.053 – $1.060

🎯 Take Profits: $1.35, $1.54

⛔ Stop Loss: $1.03

The entry area aligns with a strong demand zone, and if price reacts positively here, there's room for a technical bounce toward the next resistance levels. Look for confirmation via price action – bullish candles, volume spikes, or divergence setups could all strengthen the case.

🧠 Trade Smart: Always use proper risk management. This is not financial advice, just an idea based on chart structure and support/resistance zones. Trade at your own discretion.

MNT

TradeCityPro | MNT Testing Key Levels for Bullish Breakout👋 Welcome to TradeCityPro!

In this analysis, I want to review MNT, a Layer-2 Ethereum project with a $3.4 billion market cap, currently ranked 31st on CoinMarketCap.

⏳ 4-Hour Timeframe

On the 4-hour timeframe, this coin has been in a downtrend, and after reaching 0.9596, it entered a range phase.

✔️ Currently, a range box has formed between 0.9596 and 1.1207, and the price is reacting to the top of the box at 1.1207.

💥 On the RSI, we have a very important resistance level at 65.80.

🔔 A break of this level on the RSI would confirm the entry of bullish momentum, and in this case, we can open a long position after the 1.1207 level is broken.

✨ Breaking 1.1207 will be the first confirmation of the bullish trend for MNT, and the coin could initiate an upward wave.

🧩 This upward movement could continue toward 1.3478.

⚖️ However, if the price gets rejected at 1.1207 and moves back toward 0.9596, we can open a short position after breaking the 0.9596 support level.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

MNT/USDT — Decision Zone! Strong Rebound or Deeper Breakdown?MNT/USDT (3D) is entering the most critical phase since its parabolic rally to 2.87. After an aggressive vertical run driven by pure momentum and euphoria, the market is now in a decisive phase — where the next major trend will be defined.

The sharp drop from the peak indicates heavy distribution and a clear shift in control from buyers to sellers. But the bigger story isn’t finished yet—because price is now approaching the key historical demand zone at 0.62–0.555, an area that has acted as the main defensive wall for bulls and the birthplace of multiple strong reversals over the past year.

This is where “smart money” usually plays.

This is the battlefield that will determine whether MNT revives its mid-term bullish trend or enters a full macro downtrend.

---

🔥 Key Technical Patterns & Structure

1. A Complete Blow-Off Top

The vertical rally to 2.87 followed by a large reversal candle signals exhaustion and strong distribution.

2. Structured Correction Toward Demand

Price is sliding downward in a controlled wave structure toward the highlighted 0.62–0.555 zone.

3. Demand Zone = The Make-or-Break Area

This zone has repeatedly acted as:

strong rebound origin (Jul–Sep 2024)

major accumulation base (Q1–Q2 2025)

launchpad for the rally to local highs

If this zone holds again, bulls regain the upper hand.

If it breaks, momentum shifts decisively to bears.

---

🟢 BULLISH SCENARIO — The Path to a Strong Rebound

A bullish reversal becomes valid only if:

1. Price taps the 0.62–0.555 zone and prints a strong 3D reversal candle

(hammer, bullish engulfing, long rejection wick).

2. Market forms a Higher Low on the 3D timeframe

This signals the end of the downturn and the birth of a new bullish leg.

3. Break & 3D Close above the 1.20–1.40 region

This resistance cluster is the gateway to a full recovery.

➡️ Bullish Targets:

1.20 → 1.40 → 1.70 → 2.20 → 2.80 (local peak)

➡️ Smart-Money Accumulation Zone:

0.62 – 0.555

---

🔴 BEARISH SCENARIO — If the Demand Zone Breaks

The bearish narrative activates if:

1. Price closes below 0.555 on the 3D chart

This is a strong structural breakdown.

2. 0.62–0.555 flips into resistance after a failed retest

This is the most reliable confirmation of bearish continuation.

3. Price moves toward the liquidity pool at 0.45

A historically untouched low-level liquidity zone.

➡️ Bearish Targets:

0.555 break → 0.45 → potential deeper capitulation

---

🎯 Final Conclusion

The 0.62–0.555 demand zone is the most important level of the year for MNT.

If it holds → a major bullish recovery is possible.

If it breaks → the market shifts into a deeper correction phase.

This is the moment where the next big directional move will be decided.

#MNTUSDT #Mantle #CryptoAnalysis #KeyLevels #DemandZone #PriceAction

#MarketStructure #BullishScenario #BearishScenario #SmartMoney #ReversalZone

Mantle Bearish Chart showing Alts Bear phaseCentralized Exchange Tokens always leads the Alts bull phase and generally ends 1 month after Eth and Alts top out. This chart is clearly showing a Pattern which indicates that their could be a flush out of the Alt coins again. Alts Bearish Phase is ongoing currently.

#MNT/USDT Mantle Momentum: Still Full Throttle#MNT

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at the price of 1.39, representing a strong support point.

We have a trend to stabilize above the 100-period moving average.

Entry price: 1.43

First target: 1.47

Second target: 1.51

Third target: 1.58

Don't forget a simple money management rule:

Place your stop-loss order below the support zone in green.

Once the first target is reached, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

MNT/USDT —Retest: Will Mantle Hold the Line or Break Down?MNT has just completed a major breakout cycle from a long accumulation range below 1.40 USDT, marking the beginning of a strong expansion phase that pushed the price up to a peak of 2.87 USDT.

After this sharp rally, however, the chart shows a strong rejection, pulling the price back toward the historical breakout zone at 1.25–1.40, which now acts as the primary support base.

This area is more than just a technical level — it’s a decision zone that will determine whether MNT is ready to continue its mid-term bullish trend or confirm a distribution and potential trend reversal.

---

Structure & Price Pattern

The chart currently displays a breakout → retest → decision point structure, where price is testing a former supply area that has flipped into demand.

The latest 3D candle shows indecision after a strong selloff, signaling a tug-of-war between buyers defending structure and sellers pushing for breakdown.

As long as price holds above 1.25, the higher-low formation remains intact, keeping the mid-term uptrend technically valid.

---

Key Technical Zones

Main Support: 1.25–1.40 (key structural zone).

Minor Resistance: 1.73 (pivot retest zone).

Major Resistances: 2.48 and 2.87 (liquidity zones).

Next Supports if breakdown occurs: 1.00 → 0.85 → 0.45.

---

Bullish Scenario

If MNT manages to close a solid 3D candle above 1.40, this move would confirm a successful retest of the major breakout.

Such confirmation could trigger Expansion Wave 2, with potential upside targets at 1.73 → 2.48 → 2.87.

This scenario highlights the strength of buyers maintaining control over demand and extending the mid-term continuation trend.

---

Bearish Scenario

If selling pressure continues and the price closes below 1.25, the prior breakout risks becoming a false breakout or bull trap.

This scenario could trigger a liquidity sweep toward 1.00 – 0.85, and in more aggressive conditions, an extended retracement down to 0.45.

Such movement would signal the end of the expansion phase and the start of a redistribution phase.

---

Market Narrative & Conclusion

MNT is now sitting in the most critical zone of its technical cycle.

The 1.25–1.40 range will decide the next chapter:

Holding above = foundation for a new expansion phase.

Breaking below = confirmation of distribution and corrective structure.

Technically, this is the “make-or-break retest” — a moment that often precedes the next major move in the altcoin market.

---

#MNT #Mantle #Crypto #Breakout #Retest #AltcoinAnalysis #TechnicalAnalysis #KeySupport

TradeCityPro | MNT: Key Support Holds for Now👋 Welcome to TradeCity Pro!

In this analysis, I want to review the MNT coin for you. One of the most well-known Ethereum Layer 2 projects, with a market cap of $5.03 billion, ranked 26th on CoinMarketCap.

⏳ 4-Hour Timeframe

On the 4-hour chart, after an upward trend, this coin reached 2.7104 and has now entered a corrective and bearish phase.

✨ There is a very important support zone around 1.5. The price has reacted to it once, formed a lower high, and is now back on support.

💥 The RSI oscillator is near the Oversell area. Breaking 24.99 will push the RSI into Oversell.

✔️ For short positions, we can enter on a break of this range. However, since the higher timeframe trend is bullish, we should also consider confirmation from volume, RSI, and Bitcoin.

🔍 For long positions, we need to wait until the market structure creates a proper trigger for a long. Currently, the main confirmation for bullishness is a break of 2.2406.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

BNB (Binance) vs OKB (OKX) vs MNT (Bybit)🔥 While the whole market is trembling again ahead of Trump’s highly anticipated evening speech (19:00 UTC)…

Let’s take a look at how the tokens of the TOP-3 CEX exchanges by trading volume behaved during the “night of 10.10” — and how much they’ve bounced back 5 days later 👇

📉 Drop → 📈 Rebound (as of now):

OKX:BNBUSDT –32.2% (–$410) → +37.5% (+$324)

OKX:OKBUSDT –40.2% (–$83) → +45.5% (+$56)

BYBIT:MNTUSDT –48.7% (–$1.1) → +60.4% (+$0.7)

Seems like the market still hasn’t decided which exchange token deserves more love 💥

🤔 Who’s your favorite right now — #BNB, #OKB or #MNT ?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

Mantle Momentum: Still Full ThrottleMantle’s uptrend remains strong — the key question now is whether this wave cools off for a reset or goes full parabolic from here. Strong fundamentals and real utility continue to drive the rally.

Mantle is breaking new ground in RWA tokenization through strategic partnerships. The recent Bitfinex listing clearly ignited momentum, pushing MNT hard across markets.

MNT ripped to $2.87, extending its multi-day rally with strong volume. Price is now consolidating around $2.70–$2.75, hinting at a healthy breather before the next potential leg up — provided bulls defend the current zone.

Support: $2.50 - $2.45

Resistance : $2.85 - $3.00

Holding above $2.50 keeps the structure firmly bullish. A clean breakout over $2.85 could open the way toward the $3-$3.20. On the flip side, losing 2.50 support or if Bitcoin loses 120k level may trigger a short-term pullback to $2-$1.80 before continuation.

MANTLE Hit the top of its 2-year Channel Up. Correction ahead?Mantle (MNTUSD) has been trading within a Channel Up since its October 18 2023 market bottom and right now the price just hit the top (Higher Highs trend-line) of this pattern.

The current Bullish Leg has almost risen as much as the first one (+388.45%) so technically a pull-back wouldn't be unexpected at this point. Before it resumes the long-term trend and potentially breaks above the Channel Up, we expect the price to test at least its 1D MA100 (green trend-line), which is the typical Support during such Legs, a 1.600.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AVL BREAKOUT ZONE WILL GET THIS TOKEN TO UP $0,50 - BEST 2025AVL/USDT — Setting Up for a Major Breakout Toward $0.50 🚀

AVL continues to show strong technical structure after completing both A and B increase phases, now consolidating near the breakout zone around $0.30.

✅ Breakout zone approaching: Price action is tightening within a key range, preparing for a potential impulsive move upward.

✅ Open space above $0.30: Once AVL confirms a breakout, there’s minimal resistance all the way to the $0.50 target, suggesting a possible sharp rally.

✅ Cycle continuation: Historical patterns show AVL tends to build momentum in stages — the current setup suggests the start of the next expansion leg.

Technical Outlook:

As long as AVL holds above $0.20, the bullish structure remains valid. A confirmed move above $0.30 could trigger a strong breakout run toward the $0.50 open space zone — a potential gain of nearly 100% from current levels.

📊 Bias: Strongly Bullish

🎯 Targets: $0.30 → $0.42 → $0.50

⚠️ Invalidation: Below $0.19

MNTUSDT Weekly Chart Analysis | Momentum & Key Targets UnveiledMNTUSDT Weekly Chart Analysis | Momentum & Key Targets Unveiled

🔍 Let’s dive into MNTUSDT perpetual contracts and decode the current price action, focusing on order flow, volume, liquidations, and momentum for top trading setups.

⏳ Weekly Overview

The weekly chart shows MNTUSDT surging out of a prolonged consolidation box, supported by a massive volume spike. This breakout is adding significant bullish momentum, as the RSI closes above the 71.55 level — a classic signal for trend acceleration and institutional interest.

🔺 Key Bullish Setup:

- Consolidation Box Break: Closing above the $1.57 level marks a safe entry; the order book above is lighter, giving price more freedom to move.

- Short Liquidation Cluster: Between $1.40-$1.60, nearly 471,300 MNT shorts are set for liquidation. Once price pushes through, liquidity fuel could trigger rapid upside.

- Upside Targets: Next objectives are $2.90 (approx. 90% up) and $4.25 (approx. 180% from the breakout), perfectly aligning with RR1 projections out of consolidation.

- Volume & Momentum: A massive volume influx supports the move, and RSI bolting past 71.55 on weeklies brings undeniable momentum.

📊 Order Flow & Futures Netflow:

- CoinGlass Futures Netflow: Recent statistics point to a healthy net inflow for MNT after a period of outflows, reflecting renewed market interest and capital rotation into longs.

- Market Cap: $4.50B, cementing its presence among high-liquidity altcoins.

🚨 Conclusion:

Breaking the current consolidation box, backed by a huge volume spike and overbought weekly RSI, signals powerful momentum. The $1.57 level offers a low-risk entry, and clearing short liquidation pockets between $1.40-$1.60 could send MNT to $2.90 and $4.25 in quick succession. Order book dynamics favor further upside, especially as resistance thins above $1.57.

Stay sharp, watch volume and RSI, and monitor liquidations for confirmation of the bullish continuation.

Mantle Eyes Explosive 22% Rally Toward Key $1.29 TargetHello✌️

Let’s analyze Mantle’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

Mantle is launching a crypto bank and a $400M MI4 fund with BTC, ETH, SOL, and stablecoins in Q3 2025. If it takes off, MNT could see more use and interest from big investors.💹

📊Technical analysis:

BYBIT:MNTUSDT has held its value and respected key Fibonacci support levels during the latest market pullback 📉. Backed by solid fundamentals and strong bullish volume, I maintain a positive outlook, projecting a potential 22% move toward the 1.29 target 🚀.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

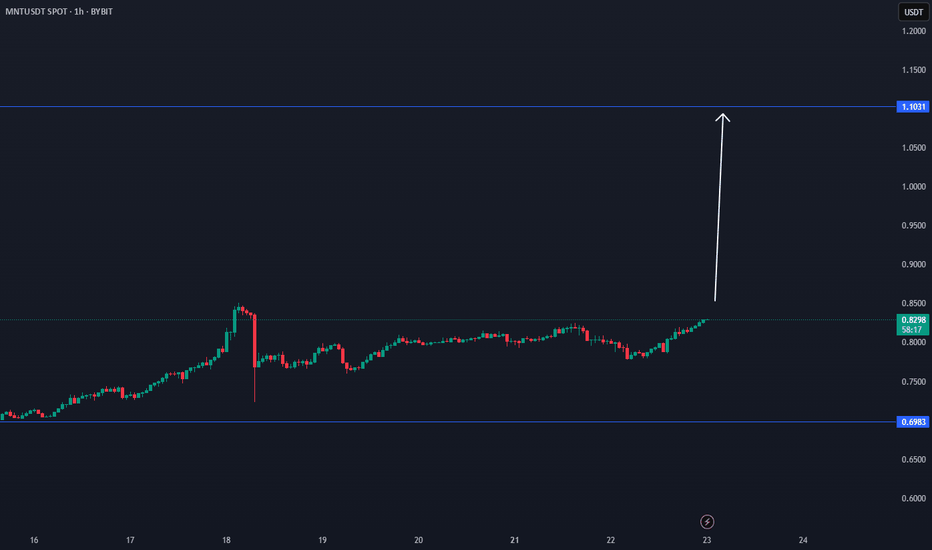

Will MNT/USDT 5x to 10x Potential Post BreakoutTSX:MNT Forming Bullish Structure – 5x to 10x Potential Post Breakout

#MNT is currently trading very close to a major resistance level at $0.82.

We’re waiting for a clean breakout above this zone. Once confirmed, price can potentially deliver a 5x–10x move in the coming days.

If price retraces, the best long-term entry zone would be around $0.70–$0.60 — right inside the accumulation box.

This bull run has strong structural support around $0.55–$0.50. As long as we stay above this zone, we remain highly confident in the upside move toward $5.

Key levels to watch:

Accumulation Zone: $0.60 – $0.70

Resistance: $0.82

Support: $0.50 – $0.55

Bull Run Targets: $1.42 / $3 / $5

NFA & DYOR

MNT/USDT Testing Strong Demand Zone – Rebound or Breakdown AheadDetailed Analysis of MNT/USDT (2D Timeframe):

The MNT/USDT pair is currently testing a strong demand zone between $0.44 – $0.58, which has acted as a key accumulation area since 2024. This level has previously triggered strong bullish reversals, making it a crucial point for the next move.

📈 Bullish Scenario:

Active Demand Zone: Price is currently sitting in a well-established demand area (highlighted in yellow), indicating potential for a strong bounce if buying pressure increases.

Upside Potential: A bounce from this zone may push price toward key resistance levels:

$0.6612 (initial minor resistance)

$0.8002 (psychological and technical barrier)

$0.9038 and $0.9500 (previous resistance zones)

Further Fibonacci extension and major resistance levels at: $1.0632, $1.2255, and $1.4126

Pattern Formation: There is potential for a Double Bottom pattern if price rebounds and breaks above $0.80, confirming a medium-term bullish reversal.

📉 Bearish Scenario:

Breakdown Risk: A confirmed breakdown below the $0.5836 support and especially under $0.44 would flip the structure to bearish.

No Strong Support Below: A drop beneath $0.44 could trigger a free fall toward $0.35 or lower, with minimal technical support in that range.

Bearish Confirmation: A breakdown with high selling volume would signal a strong distribution phase and continuation of the downtrend.

🔍 Pattern & Market Structure Summary:

The zone between $0.44 and $0.58 represents a long-term accumulation base.

If this level holds, it could spark a significant bullish move, especially if accompanied by strong volume and market sentiment.

If it fails, the chart will confirm a structural breakdown, with potential for deeper bearish continuation.

📌 Key Levels to Watch:

$0.44 – $0.58 Main Support / Demand Zone

$0.6612 Minor Resistance

$0.8002 Historical Resistance

$0.9038 – $0.9500 Key Resistance Zone

$1.0632 – $1.4126 Bullish Extension Targets

#MNTUSDT #CryptoAnalysis #TechnicalAnalysis #AltcoinSetup #DemandZone #BreakoutTrade #BullishScenario #BearishScenario #CryptoSignal

MNT – Accumulating Nicely, Ready to Join the TrendMNT is accumulating beautifully—this looks ready to follow $AAVE.

Stepping in and adding it to the basket of coins I’m comfortable holding.

It’s forming a solid weekly base, and a new trend could trigger as early as next week.

Anticipating the move here, with risk defined below 70c.

Targeting a 2x, as it’s still consolidating within a massive range. BYBIT:MNTUSDT