Microsoft - The worst day in 5 years!🚀Microsoft ( NASDAQ:MSFT ) remains bullish despite the crash:

🔎Analysis summary:

Today Microsoft created its worst day in five years. But at the same time, Microsoft is also approaching a significant confluence of support. And if we soon see bullish confirmation, Microsoft will just create another bullish all time high break and retest.

📝Levels to watch:

$430

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Msftstock

Microsoft (MSFT) Shares Post a Record DeclineMicrosoft (MSFT) Shares Post a Record Decline

On Wednesday, after the close of the regular trading session, Microsoft (MSFT) released its quarterly earnings report, which exceeded analysts’ expectations:

→ Earnings per share: actual $4.14, forecast $3.90;

→ Gross revenue: actual $81.2bn, forecast $80.3bn;

→ Operating profit: up 21%.

Despite the strong results, MSFT shares suffered a dramatic sell-off of around 10% by the close of yesterday’s trading. According to media reports, this was the largest one-day drop in Microsoft’s share price on record, with the company losing roughly $360bn in market capitalisation.

Why MSFT Shares Collapsed

Market participants were most likely disappointed by the following factors:

→ A sharp rise in capital expenditure: capex surged by 66% to $37.5bn as Microsoft continued to invest heavily in data centres and AI infrastructure, while the timing of meaningful returns on these investments remains uncertain.

→ Slowing growth in the cloud computing segment.

Technical Analysis of Microsoft (MSFT) Shares

When analysing the MSFT chart on 15 January, we identified a key ascending channel reflecting the stock’s long-term price structure. At that time, we suggested that the market might find a temporary balance ahead of the earnings release.

Since then, although volatility persisted, the price showed an ability to recover from 22 January onwards, indicating that buyers were attempting to wrest control from sellers.

Yesterday’s record decline significantly altered the picture, but two factors are worth noting:

1 → The price fell below the 1 May low, entering the area of a broad bullish gap located above the psychological $400 level.

2 → In 2026, the market has been forming a descending channel (shown in red), with the price now reaching its lower boundary.

It is reasonable to assume that these two factors could act as support. The structure of yesterday’s candle supports this view: the session closed well above the low, and trading volumes were the highest in several years. This suggests active buying interest, with the price rebounding from around $422 to $433.

As a result, it is possible that the initial emotional reaction may fade and MSFT shares will avoid a further acceleration of the downtrend. However, a meaningful shift back to a bullish market structure would require strong fundamental catalysts.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Microsoft: Back in the Target Zone!Microsoft’s stock has slid back, settling again within our green Target Zone between $477.87 and $451.84. We anticipate an imminent upward movement as part of the magenta wave (5), which is expected to push price beyond the resistance at $562.17. Just above this level, the large blue wave (I) is likely to complete before a significant correction begins. There’s also a 38% chance of additional selling pressure below the support at $392.97. In this case, the high of $562.17 would align with the beige wave alt.III , while the low of wave alt.IV would form below $392.97.

MSFT Selling Pressure Activated — Time to Short!🔥 MSFT Bearish Profit Playbook — Thief-Style Layer Attack Activated! 🔥

Asset: MSFT — Microsoft Corporation (NASDAQ)

Style: Swing / Day-Trade Playbook 📉💼

📉 Plan: Bearish Pressure Play — Smart Sell-Side Thief Approach

Microsoft is showing potential exhaustion on the upside, and this setup focuses on a structured bearish move using a layered sell-limit strategy (Thief Layer Method) 😎🕵️♂️.

🎯 Entry Strategy (Thief Layer Method)

Using the thief-style multi-layer approach, we stack multiple sell-limit orders at different levels to catch premium liquidity:

Sell Limit Layers:

$500, $490, $480

(You can increase or adjust layers based on your own risk tolerance.)

This method aims to fade upward pushes, catching price exhaustion during liquidity grabs.

🛑 Stop Loss (Risk Control)

This is the Thief SL @ $510 🛑

Note: Dear Ladies & Gentlemen (Thief OG’s), I’m not recommending that you use only my stop-loss. It’s your money — your rules. Manage your risk like a pro. 💼⚠️

🎯 Target (Exit Zones)

We are aiming toward strong support zones + potential oversold zones where bearish momentum may slow.

Main Target: $450

Trap may form — escape with profits before the market police catch us 🚓💨

Note: Dear Ladies & Gentlemen (Thief OG’s), I’m not recommending using only my target. Exit where you feel safe and profitable. 🏦✨

📊 Market Summary (Clean, TV-Safe Explanation)

Bearish attempt based on overextended zones

Layered entries help clip premium during upside wicks

Targeting liquidity pockets near support

SL above structural invalidation

Setup respects TradingView House Rules: No financial advice, no promises, no signals, educational thief-style humor only ✔️

🔗 Related Pairs to Watch (Correlation Insights)

Because MSFT is a heavyweight in tech + NASDAQ index weighting:

1️⃣ NASDAQ:QQQ (NASDAQ 100 ETF)

Strongly correlated

If QQQ rejects from local resistance → MSFT bearish play strengthened

QQQ weakness = tech sector weakness

2️⃣ AMEX:SPY (S&P500 ETF)

Broader market risk sentiment

SPY pullback often pressures mega-caps like MSFT

3️⃣ NASDAQ:AAPL (Apple Inc.)

Moves similarly during liquidity rotations

Apple weakness = added pressure to mega-cap tech basket

4️⃣ NASDAQ:NVDA (Nvidia Corp.)

High-beta tech name

When NVDA loses momentum, MSFT downside probability increases through sector rotation

5️⃣ NASDAQ:GOOGL (Alphabet Inc.)

If large-cap tech corrects collectively, MSFT rarely moves opposite

Perfect correlation watch ⚡

Watching these pairs helps confirm bearish bias through sector-wide confirmation, not isolated signals.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer:

This is a thief-style trading strategy just for fun.

Educational only — not financial advice. Trade at your own risk. 😄🕵️♂️

MSFT Market Blueprint: From Pullback to Profit Zone💼 Asset: Microsoft Corporation (MSFT) — NASDAQ

Type: Swing Trade Setup

Bias: Bullish Pullback Play

🔍 Plan Overview

MSFT is showing a clean bullish pullback confirmation with the Hull Moving Average acting as dynamic support. A Heikin Ashi reversal doji candle has appeared — a strong hint that buyers are gaining control again 🟢.

Momentum looks ready to shift back to the upside as the pullback finds its footing. The plan focuses on catching this move with layered entries (a.k.a. “Thief Strategy” style).

⚙️ Entry Plan (Layered “Thief” Style Method)

This approach uses multiple limit orders to build a strong position during pullbacks. You can add or adjust based on your own risk appetite.

📍 Layered Entry Points:

🟩 520.00 — first buy zone (initial position)

🟩 530.00 — second layer (confirmation add-on)

🟩 540.00 — third layer (momentum add)

💡 Tip: You can increase or decrease the number of layers depending on volatility or confidence in trend continuation.

🔒 Stop Loss (SL)

🛑 Thief OG’s SL idea: 510.00

Note: Dear Ladies & Gentlemen (Thief OG’s), I’m not recommending to stick strictly to my SL — trade with your own risk management. Make money and protect it wisely. 💰

🎯 Target Profit (TP)

🎯 Target zone: 580.00

The “Police Force” (strong resistance zone) is waiting up there — where the market could become overbought or trap late buyers. That’s where we take our profit and vanish with gains like pros 😎.

Note: Dear Ladies & Gentlemen (Thief OG’s), again — you can set your own TP. This level is my personal exit zone for safety and profit lock.

🔗 Related Pairs & Market Watchlist

Keep an eye on correlated tech giants and ETFs to confirm momentum:

💻 NASDAQ:AAPL (Apple Inc.) – often leads the NASDAQ tech sentiment.

🌐 NASDAQ:GOOGL (Alphabet Inc.) – confirms sector strength.

📊 NASDAQ:QQQ (NASDAQ 100 ETF) – index pressure or breakout signal for techs.

⚙️ AMEX:XLK (Tech Sector ETF) – broader sector health indicator.

🧠 Correlation Insight:

When Apple ( NASDAQ:AAPL ) or Google ( NASDAQ:GOOGL ) show the same bullish reversal near their moving averages, it reinforces MSFT’s bullish continuation. Strong moves on NASDAQ:QQQ and AMEX:XLK also validate that the entire tech sector is moving in sync.

⚠️ Disclaimer

This is a Thief-style trading strategy, designed for educational and entertainment purposes only — just for fun 🎭.

Trade responsibly and manage your risk accordingly.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#MSFT #SwingTrade #BullishSetup #TechStocks #LayeredEntry #HeikinAshi #HullMA #TradingPlan #StockMarket #ThiefStyle #TradingView #Investing #NASDAQ #PriceAction

Microsoft (NASDAQ: $MSFT) Drops as AI Sales Miss Targets Microsoft (NASDAQ: NASDAQ:MSFT ) slid more than 2% after a report from The Information claimed that the company had reduced growth targets for its AI products because sales teams failed to meet expectations. The report highlighted that several Azure sales units missed ambitious quotas tied to Foundry—Microsoft’s enterprise AI platform used to build and manage autonomous AI agents. According to the report, less than 20% of salespeople in one U.S. Azure division hit the 50% Foundry growth target, while another team initially faced a quota requiring them to double sales.

Microsoft quickly refuted the claims, stating that The Information conflated growth projections with internal quotas. The company emphasized that “aggregate sales quotas for AI products have not been lowered,” reaffirming the strength and ambition of its broader AI roadmap. Despite the clarification, the stock reacted sharply, reflecting heightened sensitivity around AI monetization as enterprise adoption continues to lag expectations.

Although AI is transforming workflows and offering automation opportunities, the adoption curve for enterprise-scale AI agents remains slower compared to consumer AI breakthroughs. Competitors including Google, Amazon, Anthropic, Salesforce, and OpenAI all face similar challenges as traditional organizations navigate data integration, reliability issues, and operational risk.

Technical Outlook

From the chart, MSFT has pulled back sharply from its $555 resistance zone and is now retesting a key support level around $465. This area aligns with previous structure and may act as short-term demand. A breakdown below $465 opens room for a deeper decline toward the $450 level. However, holding this support could trigger a rebound back toward the $555 region. Momentum remains neutral-bearish, with price sitting below the recent swing highs.

Microsoft: Target Zone Hit!Microsoft has reached our green Long Target Zone between $451.84 and $477.87 as anticipated. In the meantime, the stock has successfully completed the magenta wave (4) and has since broken out of the Target Zone to the upside. We now expect further gains as wave (5) unfolds, targeting a move above the resistance at $562.17, where the larger blue wave (I) is expected to conclude. After that, we anticipate a pronounced correction phase. However, there remains a 38% chance that MSFT could break down through the Target Zone and fall below the support at $392.97. In this case, we would reclassify the last significant high at $562.17 as the top of the beige wave alt.III and prepare for a new low in wave alt.IV .

Why is Microsoft Stock $MSFT dropping hard?Microsoft just did what every impatient trader hates… after a massive rally, the candles are shrinking, emotions are rising, and here comes the correction everyone said ‘couldn’t happen.’ Today I’ll show you—using pure supply and demand—why MSFT is being magnetically pulled back into the monthly demand imbalance like a toddler to a candy shop. No fundamentals, no drama… just price action, imbalances, and patience. Let’s dive in.

Microsoft Monthly Supply & Demand Analysis

After Apple’s strong monthly correction setup, Microsoft (MSFT) is showing the exact same pattern — but even cleaner.

This is what I love when I teach traders to learn to trade stocks using pure price action and supply and demand imbalances. You don’t need news, earnings, or any guru opinion — everything is already priced in at the higher timeframes. Just like I explained in the Supply and Demand Free Course , the bigger timeframes tell you what the professionals already did months ago.

Let’s break it down.

Candles Shrinking = Momentum Weakening

Fast-forward to mid/late 2025:

- The wide-bodied candles disappeared

- Small-bodied candles appeared

- Then came the big bearish candle

This is classic momentum decay. This is exactly when most traders start acting emotionally:

- They zoom into 5-minute charts

- Their IQ drops by 50 points

- They forget the trend

- They forget the imbalance

- They become chart zombies

But price action never lies — we’re simply seeing exhaustion after a massive markup.

MSFT: Final Dip Before the Next LeapPrevious Idea:

Microsoft (MSFT) shows the stock is enduring a significant correction, which is the final pullback before a massive rally. This phase, labeled wave (4), is expected to find its bottom within a key support area. Traders are looking for this downswing to complete anywhere between the $452 and $492 zones. Hitting this target range would conclude the current multi-month drop and clear the path for the next major advance.

Once the correction successfully bottoms out in that crucial support range, the market expects a powerful final bullish surge, known as wave (5), to begin. This next wave is projected to drive the stock significantly higher, easily surpassing the previous all-time high of $555.45 . This bullish scenario will remain valid as long as the stock respects the identified support zone and begins its ascent from that area.

Microsoft: Stuck in Sideways PatternMicrosoft shares have continued to show weakness recently, although the stock has shifted into more of a sideways pattern. In the near term, we anticipate another downward move, which should establish the low for wave (4) in magenta within our green Target Zone between $477.87 and $451.84. From our perspective, this range remains attractive for long entries, as we expect a new upward impulse to follow as part of magenta wave (5). This move should push the stock above resistance at $562.17 and complete the larger blue wave (I). Alternatively, there is a scenario in which the high at $562.17 marks the end of beige wave alt.III (probability: 36%). In that case, we would expect a substantial decline below support at $392.97, where the low of wave alt.IV would be found.

Microsoft - This bullrun will end soon!💊Microsoft ( NASDAQ:MSFT ) might reverse soon:

🔎Analysis summary:

Microsoft created a textbook bullish break and retest back in the beginning of 2025. After this retest, we then witnessed a major rally of about +50% over the past couple of months. But considering the recent weakneses and resistance, this rally might be over very soon.

📝Levels to watch:

$550

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Microsoft: The Perfect Pullback Is Coming. Are You Ready?🌟 MSFT HEIST ALERT! 🌟 Steal from the Cops, Not from the Citizens! 🚔➡️🤑

Dear Ladies & Gentleman of the Thief Trading Guild, 🎩👒

Based on the 🔥Thief Trading Style Analysis🔥, here is our master plan to heist the Microsoft Corporation (MSFT) fortress. Our intel confirms a BULLISH ambush is setting up! It's time to loot! 💰💸✈️

🦹♂️ THE HEIST PLAN (SWING TRADE) 🦹♂️

Entry Point: The Perfect Pullback Loot Zone! 🎯

We're waiting for the asset to pull back to our LAYERED LIMIT ORDER TRAP! 🪤 Thief OG's use multiple entries to maximize the steal!

LAYER 1: 510.00 (First dibs!)

LAYER 2: 505.00 (Loading the bag!)

LAYER 3: 500.00 (MAIN HEIST - Perfect Pullback!)

LAYER 4: 498.00 (Bonus loot! Add more layers based on your own risk, thieves!)

Stop Loss: The Getaway Car Location! 🛑🏎️

This is Thief SL @ 485.00. This is where the trade idea is invalidated. Dear Thieves, adjust your final SL based on your own risk, strategy, and how many layers you used. Don't get caught! 👮♂️🚔

Target: The Police Barricade! 🚧🚨

Intel shows a major resistance wall (Police Barricade) at 565.00. Our mission is to escape with the stolen money BEFORE we get there! Escape Target: 560.00! Count your profits and live to trade another day! 💵🎉🤝

📢 THIEF'S BROADCAST 📢

Yo! Listen up, crew! 🗣️ If you're placing limit orders on this pullback, your stop loss should be set ONLY AFTER your order is filled! You feel me? Now, if you're smart, you'll place that stop loss where I told you 📍, but if you're a rebel, you can put it wherever you like 🤪 - just remember, you're playing with fire 🔥, and it's your risk, not mine! 👊

⚠️ TRADING ALERT : EARNINGS & NEWS ⚠️

MSFT is a big cap stock, and news/earnings can cause extreme volatility! To protect your stolen loot:

Avoid entering new layers before major news.

Consider taking some profit before earnings.

Use trailing stop-loss orders to protect running positions!

💖 Supporting our robbery plan = 💥Hitting the Boost Button💥 It fuels our getaway car and helps us find the next big heist! Let's make stealing money look easy! 🏆💪❤️🎉

I'll see you at the next heist, so stay tuned! 🤑🐱👤🤗🤩

PLTR 1D Time frameCurrent Price & Market Metrics

Current Price: $162.36 USD

Previous Close: $156.10 USD

Day Range: Not available

52-Week Range: Not available

Market Cap: Not available

P/E Ratio: Not available

EPS: Not available

🔎 Technical Indicators

Relative Strength Index (RSI): 41.18 — Neutral

Moving Averages:

5-day: $155.47 — Buy

10-day: $156.69 — Sell

20-day: $164.09 — Sell

50-day: $156.92 — Sell

100-day: $140.04 — Buy

200-day: $111.35 — Buy

Moving Average Convergence Divergence (MACD): -1.74 — Sell

Commodity Channel Index (CCI): -47.49 — Neutral

Price Rate of Change (ROC): -10.30 — Sell

Trend Strength Indicator (ADX): 24.55 — Neutral

📈 Support & Resistance Levels

Support: $152.80 – $154.27

Resistance: $164.77

📅 Outlook

Bullish Scenario: A breakout above $164.77 could signal a move toward higher levels.

Bearish Scenario: A drop below $152.80 may lead to further downside.

Overall Bias: Neutral, with mixed signals from momentum indicators and moving averages.

AAPL 1D Time frameCurrent Price & Market Metrics

Current Price: $234.35 USD

Market Cap: $3.01 Trillion

P/E Ratio: 30.28

EPS: $6.59

Beta: 1.15

Volatility: 2.32%

52-Week Range: $139.34 – $200.00 USD

🔎 Technical Indicators

Relative Strength Index (RSI): 67.00 — Neutral

Moving Averages:

5-day: $237.11 — Buy

10-day: $233.72 — Buy

20-day: $231.59 — Buy

50-day: $219.01 — Buy

100-day: $210.66 — Buy

200-day: $220.99 — Buy

Moving Average Convergence Divergence (MACD): 5.61 — Sell

Stochastic Oscillator: 89.58 — Sell

Commodity Channel Index (CCI): 136.25 — Sell

Average True Range (ATR): 4.41

📈 Support & Resistance Levels

Support: $220.11

Resistance: $239.78

📅 Outlook

Bullish Scenario: A breakout above $239.78 could signal a move toward $255.59.

Bearish Scenario: A drop below $220.11 may lead to further downside.

Overall Bias: Neutral to Bullish, with mixed signals from momentum indicators and moving averages.

Microsoft - A very profitable repetition!💰Microsoft ( NASDAQ:MSFT ) just repeats the cycle:

🔎Analysis summary:

At this exact moment, Microsoft is once again retesting the upper channel resistance trendline. Following all previous cycles, there is a 100% chance that we will see a short term retracement. Since the trend remains bullish, the all time high break and retest will follow.

📝Levels to watch:

$450, $700

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Microsoft - This chart is too obvious!💡Microsoft ( NASDAQ:MSFT ) perfectly respects structure:

🔎Analysis summary:

Back in April of 2025, Microsoft created a textbook all time high bullish break and retest. After this move, Microsoft started a rally of +50%, perfectly in conformity with the rising channel pattern. The trend remains bullish for now, but a shorter term correction will follow quite soon.

📝Levels to watch:

$650

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

MSFT Weekly Calls on Fire – Can Bulls Beat the Clock?🚀 MSFT Bulls Charge at \$530 – Can They Double Before Expiry?

**Sentiment:** 🟢 *Strong Bullish*

* **Daily RSI:** 61.3 📈

* **Weekly RSI:** 81.4 🔥

* **Trend:** Bullish above key MAs & resistance

* **Volume:** Weak (0.5× last week) → watch for consolidation

* **C/P Ratio:** 2.34 (Institutional bullish flow)

* **VIX:** 15.0 → favorable for calls

---

### 📊 **Consensus Snapshot**

✅ Strong RSI + bullish options flow across all models

✅ Low volatility supports directional trades

⚠️ Volume weakness = possible pause before push

---

### 🎯 **Trade Setup**

* **Type:** CALL (Naked)

* **Strike:** \$530.00

* **Expiry:** 2025-08-15

* **Entry:** \$0.69

* **Profit Target:** \$1.38 (+100%)

* **Stop Loss:** \$0.34 (–50%)

* **Confidence:** 75%

* **Entry Timing:** Market open

---

💬 *One-day gamma sprint — manage risk, exit quick.*

📌 *Not financial advice. DYOR.*

---

**#MSFT #OptionsTrading #WeeklySetup #TradingSignals #StocksToWatch #DayTrading #OptionsFlow #GammaSqueeze**

Microsoft: Wave (3) Complete – Wave (4) Pullback in ProgressAs Microsoft has reached a pronounced peak, followed by a notable move to the downside, er now consider wave (3) finished. Thus, we see price currently in the corrective phase of wave (4), which still has some immediate downside potential but should hold above support at $454. The subsequent wave (5) is expected to mark the high of the broader blue wave (I). At this point, we assign a 36% probability to the scenario where wave alt.(3) makes a higher high above the new resistance at $562.17.

Microsoft Soars to Record High Following Strong Earnings ReportMicrosoft Stock (MSFT) Soars to Record High Following Strong Earnings Report

As the chart illustrates, Microsoft (MSFT) shares surged sharply after the close of the regular trading session – an immediate market reaction to the company’s strong quarterly results.

According to available data, MSFT's post-market price jumped to $555 per share, exceeding its previous all-time high by more than 8%.

Why Did MSFT Share Price Rise?

The quarterly report provided several reasons for optimism, including:

→ Earnings per share (EPS) came in at $3.65, beating analysts’ expectations of $3.37 by over 8%. Revenue also exceeded forecasts, totalling $76.4 billion versus the projected $73.9 billion.

→ Microsoft’s cloud revenue rose by 27% to $46.7 billion, while Azure’s annualised revenue exceeded $75 billion, driven by growing demand for AI-related services.

In response to these results, Barclays analysts quickly raised their price target for Microsoft shares from $550 to $625.

Technical Analysis of MSFT Chart

It is worth noting that the previous quarterly report was also strong, resulting in the formation of a large bullish gap on 1 May, followed by a sustained upward trend (highlighted by the purple trendline S). Importantly, the gap in the $395–425 range remains unfilled.

Yesterday’s report is also likely to result in a large bullish gap at the market open today, though this time, the market context could lead to a different scenario.

The key factor here is the long-term ascending channel (shown in blue), which reflects MSFT’s price movements throughout 2024–2025. After the previous strong report, the share price moved from the median to the upper boundary of the channel without setting a new record high. However, following the most recent report, the price has surged deep into overbought territory, potentially setting a multi-month high on the RSI and achieving a significant breakout to a new record.

As a result, once the initial excitement around the earnings subsides – and the desire of investors to close long positions intensifies – MSFT could undergo a correction from the upper boundary of the channel. In this scenario, the following support levels could come into play:

→ The psychological level of $550 in the short term;

→ The S trendline, as a possible support during a deeper correction.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Microsoft’s Big Moves This Quarter | From Activision to AI AgentMicrosoft’s Revenue Surge: The Power of AI, Gaming, and Strategic Investments

Microsoft has released its Q1 FY25 earnings for the quarter ending in September

The stock saw a 6% drop, indicating the results fell short of investors' high hopes. Trading at over 30 times projected earnings for next year, expectations for Microsoft were significant.

CEO Satya Nadella stated

“Our AI business is set to exceed an annual revenue run rate of $10 billion next quarter, making it the fastest business in our history to reach this milestone.”

This means that AI will soon account for about 4% of Microsoft's total revenue in under three years a remarkable feat for a global giant.

If you need a quick summary, here are three main points:

1. ☁️ Azure’s growth is slowing. As Microsoft’s key player in the AI competition, Azure grew 34%, down slightly from 35% in the prior quarter (after adjustments). This comes as Google Cloud raised the bar, with its growth accelerating from 29% to 35% during the same period.

2. 🤖 AI growth is limited by hardware supply, as capacity struggles to meet demand. Data center expansion is a long-term process, and Microsoft is investing heavily in infrastructure, aiming for a growth boost by 2025.

3. 👨👩👧👦 Consumer-focused products like Gaming and Devices are underperforming. Although not essential to Microsoft's core business, their poor performance has impacted overall results.

Here’s a breakdown of the insights from the quarter.

Overview of today’s insights:

- New segmentation.

- Microsoft’s Q1 FY25 overview.

- Key earnings call highlights.

- Future areas to monitor.

1. New Segmentation

Revised Business Segments

In August, Microsoft announced a reorganization of its business segments, effective this quarter. The purpose? To better align financial reporting with the current business structure and strategic management.

Summary of the main changes

- Microsoft 365 Commercial revenue consolidation: All M365 commercial revenue, including mobility and security services, now falls under the Productivity and Business Processes segment.

-Copilot Pro revenue shift: Revenue from the Copilot Pro tool was moved from Productivity and Business Processes to the More Personal Computing segment under Search and news advertising.

-Nuance Enterprise reallocation: Revenue from Nuance, previously part of Intelligent Cloud, is now included in Productivity and Business Processes.

-Windows and Devices reporting combination: Microsoft now reports Windows and Devices revenue together.

Impact of These Changes:

Core Segments Overview:

In summary:

- The Productivity and Business Processes segment has grown significantly.

- The Intelligent Cloud segment has decreased due to the reallocation of Nuance and other revenue.

Products and Services Overview:

- M365 Commercial now includes Nuance, shifted from the Server products category, along with integrated mobility and security services.

- Windows & Devices have been merged into a single, slower-growth category.

Additional Insights:

- Azure, Microsoft's cloud platform, is reported within 'Server products and cloud services.' Although its growth rate is shared by management, exact revenue figures remain undisclosed.

Azure’s past growth figures have been adjusted for consistency, with the last quarter’s constant currency growth recast from 30% to 35%, setting a higher benchmark. Tracking these metrics is challenging due to limited revenue disclosure, but this recast indicates Azure's raised growth expectations.

2. Microsoft’s Q1 FY25 Performance

Financial Summary:

-Revenue: Up 16% year-over-year, reaching $65.6 billion (exceeding estimates by $1 billion). Post-Activision Blizzard acquisition in October 2023, the growth was 13% excluding the merger.

New Product and Services Segmentation Results

- Server products & cloud services: $22.2 billion (+23% Y/Y).

- M365 Commercial: $20.4 billion (+13% Y/Y).

- Gaming: $5.6 billion (+43% Y/Y), influenced by Activision.

- Windows & Devices: $4.3 billion (flat Y/Y).

- LinkedIn: $4.3 billion (+10% Y/Y).

- Search & news advertising: $3.2 billion (+7% Y/Y).

- Enterprise & partner services: $1.9 billion (flat Y/Y).

- Dynamics: $1.8 billion (+14% Y/Y).

- M365 Consumer products: $1.7 billion (+5% Y/Y).

Core Business Segments Breakdown:

- Productivity and Business Processes: Increased 12% Y/Y to $28.3 billion, supported by M365 Commercial, especially Copilot adoption.

- Intelligent Cloud: Grew 20% Y/Y to $24.1 billion, with Azure AI driving growth.

- More Personal Computing: Grew 17% Y/Y to $13.2 billion, including a 15-point boost from Activision. Devices fell, but search and ad performance improved under new segmentation.

Key Observations:

- Microsoft Cloud revenue climbed 22% Y/Y to $39 billion, making up 59% of total revenue (+3 percentage points Y/Y).

- Azure continues to drive cloud services and server products' growth.

- Xbox growth has surged due to the Activision acquisition since Q2 FY24, expected to stabilize by Q2 FY25.

- Windows OEM and devices combined, showing a 2% decline in Q1 FY25.

- Office rebranded to Microsoft 365; updated naming will be used starting next quarter.

- Margins: Gross margin at 69% (down 2pp Y/Y, 1pp Q/Q); operating margin at 47% (down 1pp Y/Y, up 4pp Q/Q).

- EPS: Increased 10% to $3.30, beating by $0.19.

Cash Flow and Balance Sheet:

- Operating cash flow: $34 billion (52% margin, down 2pp Y/Y).

- Cash**: $78 billion; Long-term debt**: $43 billion.

Q2 FY25 Outlook:

- Productivity and Business Processes: Anticipated 10%-11% Y/Y growth, steady due to M365, Copilot inclusion, and expected LinkedIn growth of ~10%. Dynamics set to grow mid-to-high teens.

- Intelligent Cloud: Projected 18%-20% Y/Y growth, slightly slowing, with Azure growth expected between 28%-29%.

- More Personal Computing: Forecasted ~$14 billion revenue, declines in Windows, Devices, and Gaming anticipated, with some offset from Copilot Pro.

Main Takeaways:

- Azure's growth slowed to 34% Y/Y in constant currency, with AI services contributing 12pp, up from 11pp last quarter. This marks a dip from the recast 35% prior and included an accounting boost.

- Capacity limitations in AI persist; more infrastructure investments are planned, with reacceleration expected in H2 FY25.

- Commercial performance obligations grew 21% to $259 billion, up from 20% in Q4.

- Margins were pressured by AI infrastructure investments; Activision reduced the operating margin by 2 points.

- Capital expenditures increased by 50% to $15 billion, half dedicated to infrastructure, with further Capex growth expected.

- Shareholder returns included $9.0 billion through buybacks and dividends, matching Q4 repurchases.

Earnings Call Highlights:

Azure AI saw a doubling of usage over six months, positioning it as a foundation for services like Cosmos DB and SQL DB. Microsoft Fabric adoption grew 14% sequentially, signaling rapid uptake.

AI Expansion: GitHub Copilot enterprise use surged 55% Q/Q, with AI-powered capabilities used by nearly 600,000 organizations, a 4x increase Y/Y.

M365 Copilot has achieved a 70% adoption rate among Fortune 500 companies and continues to grow rapidly.

LinkedIn saw accelerated growth in markets like India and Brazil and a 6x quarterly increase in video views, aligning with broader social media trends.

Search and Gaming: Bing’s revenue growth surpassed the market, while Game Pass hit a new revenue record, propelled by Black Ops 6

Capital Expenditures: CFO Amy Hood highlighted that half of cloud and AI investments are for long-term infrastructure, positioning the company for sustained growth.

4. Future Outlook

Energy Needs: Microsoft, facing higher power demands, plans to revive a reactor at Three Mile Island with Constellation Energy by 2028 to power its AI data centers sustainably.

Autonomous AI Agents: Coming in November, these agents will perform tasks with minimal human input, enhancing efficiency. Copilot Studio will allow businesses to customize these agents, with 10 pre-built options to start.

Industry Impact: Salesforce has launched Agentforce, signaling increased competition. CEO Mark Benioff recently compared Microsoft’s Copilot to the nostalgic Clippy, stoking rivalry.

For further analysis stay tuned

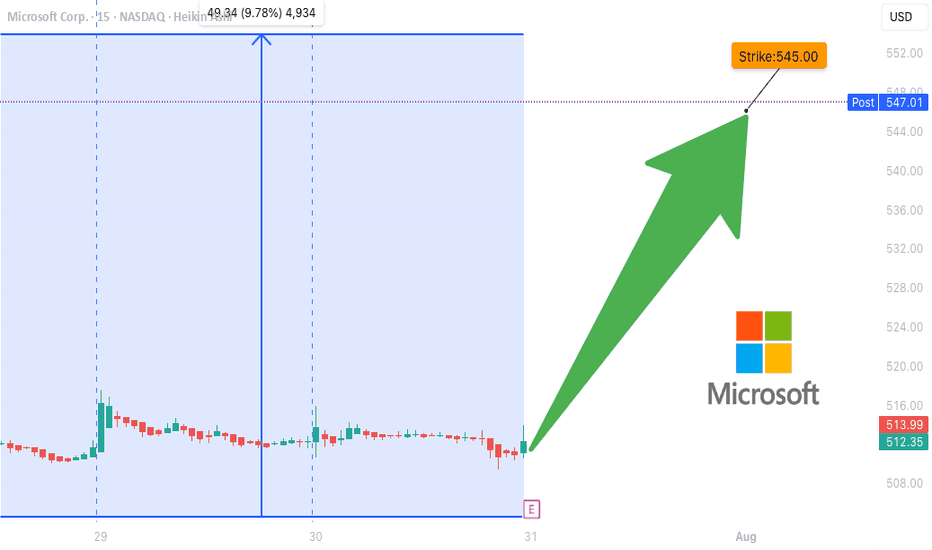

MSFT Earnings Play (2025-07-31) — STRONG BULLISH SETUP

**🚨 MSFT Earnings Play (2025-07-31) — STRONG BULLISH SETUP 🚨**

**Microsoft \ NASDAQ:MSFT Pre-Earnings Trade Idea — 545C (Aug 1)**

---

### 🧠 **Earnings Thesis (🔥 80% Conviction)**

MSFT is set to report **BMO July 31**, and all signs point *bullish*:

📈 **Revenue Growth**: +13.3% YoY, driven by **AI + Cloud** momentum

💰 **Margins**: Profit 35.8%, Op 45.7%, Gross 69.1% — textbook pricing power

📊 **Guidance**: 100% beat history, avg. +5.8% surprise

📌 **Analyst Consensus**: 💪 Strong Buy | Target: \$549.90

📊 **Sector Tailwinds**: Tech favored in current macro with Fed on hold

➡️ **Score: 9/10 Fundamentals | Bullish Momentum Across the Board**

---

### 🔍 **Options Flow & Technicals**

🔥 **Implied Move**: \~6.3% by Aug 1

📉 **IV Rank**: 0.75 (Room to expand post-earnings)

💸 **Call Flow**: Strong OI in 540–550 zone, gamma buildup may fuel squeeze

📊 **RSI**: 70.14 → Bullish, close to overbought

📈 **Support**: \$505 | **Resistance**: \$518.29

➡️ **Score: 8/10 Options | 8/10 Technicals**

---

### 🧨 Trade Setup: 545 CALL (Aug 1 Exp)

🎯 **Entry Price**: \$0.90

📅 **Expiry**: 2025-08-01

📈 **Profit Target**: \$1.80 (⚡️+100%)

🛑 **Stop Loss**: \$0.45

📐 **Size**: 2 contracts (2% portfolio risk)

💡 **Timing**: Enter **EOD July 30 (Pre-earnings)**

⚠️ **IV Crush Alert** → Exit within 2 hours *post-earnings*

---

### ✅ RISK PLAN

* Position: Max 2–3% of portfolio

* IV crush & gap protection: Tight stop and quick post-earnings exit

* Exit Plan: \$1.80 or Stop \$0.45, OR close manually after earnings move

---

📊 **Trade JSON Snapshot**

```json

{

"ticker": "MSFT",

"direction": "CALL",

"strike": 545,

"entry": 0.90,

"target": 1.80,

"stop": 0.45,

"expiry": "2025-08-01",

"entry_time": "EOD Jul 30",

"earnings_date": "2025-07-31 BMO",

"confidence": "80%",

"expected_move": "6.3%",

"iv_rank": "0.75"

}

```

---

🧠 **Summary**

MSFT is poised for a **clean earnings beat** with bullish fundamentals, strong options flow, and upside momentum. This is a **high-conviction, short-dated trade** with defined risk.

🎯 **Watchlist it. Size smart. Exit fast.**