$MSTR — Multi-Month Support in Play

NASDAQ:MSTR is sitting right on multi-month support, and it’s hard for me to see this breaking much lower. The last time we highlighted this setup, it delivered a very clean move — I’m adding it here again for reference.

This is a straightforward swing trade to hold over the next couple of months.

What I’m expecting:

* Near-term resistance around 300–350

* Bigger picture: a test of new ATHs remains on the table if momentum builds

I’m adding here and would be open to adding more if price dips closer to the yearly open.

Simple structure, defined risk, and a clear path if the market continues to firm up.

Mstrforecast

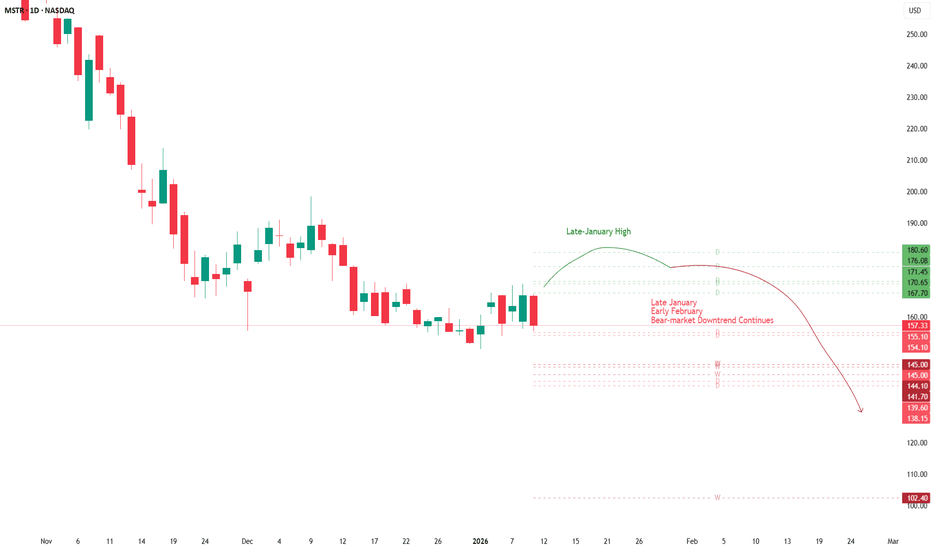

MicroStrategy ¡WARNING! Bull-Trap Forming Week of January 19thHappy New Year! Please take a look at my related Idea below: BTC Bitcoin 2026 Outlook 🔥 for a more detailed long-term explanation.

Be WARNED though , the 3 months February through April are showing EXTREMELY STRONG therefore, if the bear-market downtrend is confirmed in the week 2 weeks, you can expect a devasting crash in MicroStrategy market 😮

MSTR is following a slightly different near-term pattern compared to BTC, ETH & SOL. The strongest WEEKLY TARGET for a Turning Point is NEXT week January 19th , more precisely around Thursday 22nd however, we could see a short-term HIGH this Tuesday 13th along with BTC, ETH & SOL with a continued rally while BTC, ETH & SOL begin to show weakness and begin turning down or MSTR could simply fail to continue RALLYING into the weekly target of January 19th.

The trading playbook is to sell either around Tuesday 13th or as soon as price begins to cross the $170-$175 levels. Or, if it shows strong strength at the open this Monday through Wednesday, hold on to your LONGs until next week.

We should see a resumption of the bear-market downtrend with a 3-month heavy sell-off from February into late April, early May 🩸🐻.

Today I'm posting separate Ideas for BTC, ETH & SOL 📈 please follow me and check out my ideas.

Good luck! stay safe 🙏🏻

Strategy Inc (NASDAQ: $MSTR) Might Be Gearing For A BreakoutStrategy Inc (NASDAQ: NASDAQ:MSTR ) shares might be set for a bullish move albeit market drawback. With the RSI at 49 NASDAQ:MSTR needs to break the 61.8% Fib level to accentuate the next levels for $MSTR.

Since the month of June 2025, the asset has lost 66% of its value moving in tandem with CRYPTOCAP:BTC 's momentum.

In recent news, Index provider MSCI late Tuesday said it would not boot publicly traded companies with big holdings of digital assets such as bitcoin from its indexes—for now. Fans of Strategy (MSTR), the company made famous for stockpiling cryptocurrency, applauded the decision: Its stock was recently up about 4%, a bit off earlier highs.

The news removed, or at least delayed, an overhang from Strategy's shares. MSCI last fall proposed removing digital asset treasury companies, or DATCOs, from its indexes following a proliferation of firms of that ilk, saying they resemble investment funds, which aren't eligible for inclusion. That spooked investors, as analysts estimated the move could spur other index providers to follow suit and cost the company billions in outflows.

Analyst Summary

According to 15 analysts, the average rating for MSTR stock is "Strong Buy." The 12-month stock price target is $485.86, which is an increase of 200.23% from the latest price.

About MSTR

Strategy Inc, together with its subsidiaries, operates as a bitcoin treasury company in the United States, Europe, the Middle East, Africa, and internationally. The company offers investors varying degrees of economic exposure to Bitcoin by offering a range of securities, including equity and fixed income instruments. It also provides AI-powered enterprise analytics software, including Strategy One.

BTC ETH SOL MSTR Bullish ConsolidationSo far so good. This week is the strongest WEEKLY TARGET and today Monday 15th is the strongest DAILY target and it is, thus far, suggesting a LOW (obviously).

If you have been following my Ideas carefully, Socrates computer has been correctly predicting all TARGET DATES but I must admit I switched BULLISH about 1 week late and I wasn't sure if today would be a HIGH or a LOW due to the recent extreme volatility but, I am still sticking to my initial call that the second half of December would see the start of RALLY into January.

As bearish as today feels, this is what happens on STRONG TARGETS, they are either VERY bullish or bearish, which is the energy required to change the trend.

Today's prices are actually positive, HIGHER LOWs, except MSTR but it actually does follow a slightly different patterns, BTC ETH SOL strong target was NOVEMBER. For MSTR is December.

All 4 markets should start making HIGHER HIGHS in the following weeks for a possible HIGH late in January then back to the BEAR MARKET crash trend.

As usual, let's see what price does at the close of today and let's see if tomorrow confirms the BULLISH TREND by closing the day GREEN.

Take care, good luck!

BTC ETH SOL MSTR Bullish Consolidation (Closer Look)I want to post this follow-up on the Hourly time-frame to my earlier post on the Daily time-frame so you can see how BTC SOL have bounced strongly from their initial two REVERSAL levels and are pushing to close the day ABOVE, which is VERY BULLISH.

ETH is a bit far from crossing above its two REVERSAL LEVELs but you can see it bounced off strongly from a CHANNEL LINE.

Final confirmation will be a GREEN close tomorrow Tuesday...

Good luck!

BTC ETH SOL MSTR (NDX, S&P500) WARNING Preparing To Breakout!Watchout! Socrates is indicating that MSTR and S&P 500 is PREPARING TO BREAKOUT to the upside.

NASDAQ "Weekly Rally Underway"... "Quarterly Still Breaking Out".

BTC: achieved a Breakout Mode Indicator at the Daily close yesterday. This is an exceptionally strong signal at this time implying a rally in the longer term may unfold.

The November 21st LOW MAY HAVE HELD! Price refused to continue breaking down and so it appears that we have a RALLY unfolding on all markets into end of December. It seems that the BOTTOM has formed.

Remember, January could be a HIGH on Crypto and it could resume a BEAR MARKET trend into February... we shall see where we are when January arrives.

Good luck! stay safe 🙏🏻

BTC ETH SOL MSTR ¡This Ship Is Going DOWN HARD!You STILL don't believe me, don't you? back in 2014, in my tiny NYC Queens apartment and against my ex-wife's wishes, I was mining Litecoin. What poopcoin where you mining in 2014? I dumped my ex-wife, and my next fiancée, do you think I won't dump BTC? I bought my first 2 BTCs at $250, how much did you pay for your first BTC? or poopcoin for that matter?

I have never HODLed ANY coin during any downturn and that's why I survived 4 Bitcoin cycles and today I am stronger than ever.

How many Bitcoin cycles have you survived yet? Let me know in the comments!!

Guess what... all the money I've been wanting to make in this cycle, I ended up making it while SHORTING from the ATH since October. I noticed the crappy chart pattern being form in the last 6 months, especially on ETH SOL XRP etc...

Perhaps, I know a thing or two about crypto.

That being said! the question is not whether this market will continue crashing or not. The question I try to figure out daily is: in WHICH EXACT PATTERN will it do so , just so I can open either LONGs or SHORTs, that's all.

The next 10 days are CRITICAL! all 4 markets are forming a BOTTOM here in December but we must focus on the two big elephants in the room, BTC & MSTR on the MONTHLY level where the real strong trend is formed.

BTC: November through February is all UP and DOWN. We should see a real rally up on the 2nd half of December but January will attempt to push down again, then February push opposite HOWEVER there is always a POSSIBILITY that instead of changing trend, it continues on the same trend. Will we see a V-Shape rally to new ATH? or a side-ways boring consolidation? I do not know yet but eventually I will know ahead of the move, as time progresses.

IF these markets were getting ready to RALLY then Socrates would say so, it would literally say PREPARING TO RALLY or ENTERING BREAKOUT MODE. It keeps saying WARNING SUGGESTING TESTING SUPPORT ON MONTHLY LEVEL .

MSTR: we could see a strong rally mid-December into January but again it has a possible TREND CHANGE in January as well. The volatility from February through April is, possibly, going to be INSANE.

Good luck crypto fans! enjoy the ride ❤️🔥 please BOOST my Idea and follow me for future updates! much appreciated 😁

BTC ETH SOL MSTR Key TARGET HIGH Was Yesterday Wednesday 3rdWhat a ride! All 4 markets were able to penetrate higher outside their immediate DOWNTREND CHANNEL but... Socrates is confirming that Wednesday 3rd was the KEY TARGET and it was a local HIGH and all 4 should begin moving lower into next week.

BTC failed to even close above its first REVERSAL resistance at $93,790.

ETH was the strongest for sure, it managed to go a meager $150 higher than last week's HIGH, was able to close above first REVERSAL resistance at $3169 but failed to even touch $3248.

SOL was also strong but, it actually managed to go just $2 higher than last's weeks HIGH and close above 3 REVERSAL resistance levels.

I'm not covering XRP however, it couldn't even touch last week's HIGH.

MSTR barely crossed higher outside the DOWNTREND CHANNEL but it couldn't even get close to its first REVERSAL level $213.80. However though, Socrates is suggesting that its WATERFALL is subsiding, the MONTHLY WATERFALL has disappeared, the QUARTERLY WATERFALL remains.

BTC ETH SOL MSTR Absolutely Insane VolatilityYou cannot make this stuff up! Insane crypto volatility at its best.

Today is a TARGET for a Turning Point, you can see on the charts that prices are all at strong resistance levels... let's see what happens today but, they're all still within DOWNTREND CHANNELS.

We have a new month and week and so the REVERSAL LEVELS have been updated and new channels have been formed.

ETH has formed a new Daily Channel with a slightly upwards trajectory that implies that it wants to begin moving sideways, at least, but the stronger channels are all downwards.

MSTR wants to push a bit higher still but again it will hit resistance today and tomorrow.

CRAZY STUFF!!

BTC ETH SOL MSTR The Bounce Seems To Be OverRemember that Socrates analysis has daily closings at 6pm Eastern Time and Weekly closing on Friday at 6pm. It appears that November 28th was an important HIGH, Socrates is pointing to a likely resumption of the downtrend for the next 3 weeks, which price action should begin to confirm in the next 2 days or so however, price action will do what it will do, meaning that if by Wednesday price action continues to push strongly higher then we should immediately turn BULLISH but, I'm betting that the price will resume its downward trajectory starting around December 2nd.

Now for much better news for crypto: BTC, ETH and SOL have generated a new channel lines from the HIGH on November 28th which implies a more sideways trajectory to an eventual important LOW in mid-December. I suspect that for BTC the bottom support of the long-term up-trend channel around +$70k will probably hold by mid-December which should give us a very strong rally into February.

As for MSTR, this coming week is a WEEKLY PANIC CYCLE which implies that this coming week should open higher than last week and close the week BELOW the prior week, in other words, a move back down to around 167 by end of this coming week.

BTC ETH SOL MSTR The Higher It Bounces, The Better The ShortI've been opening and closing SHORTs with a small profit this week. The higher it bounces it provides for an even better SHORT trade entry. Remember, for the price to swing opposite it needs to start from an extreme, typically it needs to move either higher or lower than the market anticipates for it to suddenly stall and change direction.

The next target is tomorrow Thursday however, Socrates system closes its daily session at 6pm Eastern Time, not midnight like TradingView. It also closes its week on Friday 6pm, not Sunday 8pm. Which means that a HIGH today AFTER 6pm EST counts as an INTRADAY HIGH for tomorrow Thursday... therefore, I'll be re-entering my shorts once again at this bounce high when the SMI Bearish Divergences begin.

Happy Thanksgiving!

BTC ETH SOL XRP MSTR Did You Sell Your Bags? Of Course Not!I'm reposting this idea from early this morning because I got banned for a few hours, and the original idea post was hidden, because I mistakenly made a mention to a social media account in the idea description and it's a House Violation.

Now 12hrs later and my original forecast from early this morning now confirmed, here we go:

Last night we had a great SHORT entry and price was unable to break above key resistance channel lines. We should have a CHOPPY next few days so, the forecast is that today was a possible direction change so I closed my SHORTs with a profit and I'll wait for a better entry later tonight or overnight once this brief reaction rally is complete.

I am still expecting the collapse to continue into next week and I'll be entering new shorts as soon as the Stochastic Momentum Indicator confirms Bearish Divergences on each market.

As for MSTR, I misread the forecast and the drop was into today, not tomorrow, therefore we had a bounce into the current Tuesday overnight session and tomorrow Wednesday is a very strong target hence, it should be an important HIGH followed by a continued decline. But either way, if it's a HIGH then my SHORT is already opened, if it's a LOW then I'll close the SHORT when the LOW is complete and open LONGs... 😎

MSTR Monthly & Quarterly Waterfall Crash In MotionI'm adding MSTR (MSTU 2x, MSTZ -2x ETFs) to my trading portfolio.

If there is a knife that I do not want to catch, THIS IS IT! MSTR is going to the toilet, even if you thought it's already in it... it's not in the toilet yet.

This Monday there's a possibility of a single-day reaction HIGH which could give us a new SHORT entry window. I will open a SHORT Monday night or Tuesday morning if the Indicators confirm a Bearish Divergence. If Tuesday closes higher than Monday then the bounce should last a bit longer.

$MSTR Swing Trade Setup: Layered Short Entries on Breakout📉 MSTR "STRATEGY INC" STOCK – Bearish Thief Plan (Swing/Scalp Setup)

⚡ Trade Setup (Bearish Pending Order Plan)

Asset: NASDAQ:MSTR (MicroStrategy Inc.)

Plan: Bearish (waiting for support breakout confirmation).

Entry Zone:

Pending breakout entry @ 320.00 ⚡

Layered “Thief” Strategy (scaling entries):

Sell Limit Layers: 340.00 / 330.00 / 320.00

You may add or adjust layers based on your own risk tolerance.

🔔 Set TradingView alerts at breakout levels to track price action.

Stop Loss (Thief Style):

Protective SL @ 360.00 (after breakout confirmation).

Adjust per your strategy & risk management.

Target Zone (Exit):

Police barricade support @ 290.00

Note: Take profit is discretionary — escape with profits at your own chosen level 🚪💰.

🔑 Why This Plan? (Thief Strategy Context)

The Thief Plan = using multiple layered limit entries after a breakout for better risk/reward.

Scaling entries gives flexibility while reducing FOMO and chasing.

Exit early at support barricades or oversold traps.

📊 MicroStrategy (MSTR) Market Data Report

As of September 7, 2025

1. Retail & Institutional Sentiment 🤝

Retail: Mixed / cautious (crypto exposure volatility).

Institutional: Neutral → slightly bearish (Bitcoin correlation + regulatory risk).

Estimated Sentiment: 55% Neutral / 30% Bearish / 15% Bullish.

2. Fear & Greed Index 😨😋

Current level: Neutral ~50/100

Suggests balanced emotions → no extreme greed or fear.

3. Fundamental & Macro Scores 📈📉

Fundamental ~60/100: MSTR tied to Bitcoin trends, highly volatile.

Macro ~55/100: Pressures include crypto regulation, tech volatility, interest rates.

Bitcoin remains the key driver.

4. Market Outlook 🐂🐻

Bull Case: BTC rally → MSTR boost, institutional adoption helps.

Bear Case: Regulatory clampdowns, BTC volatility → downside pressure.

Overall: Neutral → Slightly Bearish (short-term caution).

🚀 Key Takeaways

NASDAQ:MSTR moves in sync with Bitcoin → monitor BTC charts closely.

Sentiment is not strongly bullish → short setups have edge here.

Thief layering strategy aligns with volatility.

Always respect SL & manage risk 🔐.

🔗 Related Pairs to Watch

BITSTAMP:BTCUSD

NASDAQ:COIN (Coinbase)

NASDAQ:RIOT (Riot Platforms)

NASDAQ:MARA (Marathon Digital)

SP:SPX / NASDAQ:NDX (macro impact on tech/crypto plays)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#MSTR #MicroStrategy #Stocks #SwingTrade #Scalping #BearishSetup #CryptoStocks #LayeredStrategy #ThiefPlan #BitcoinCorrelation #TradingViewIdea

Microstrategy: Further DeclineAfter a brief consolidation, MSTR continued its decline since our last update, further developing turquoise wave 2, where we still see price positioned. We continue to anticipate the low of this wave above the support at $153.49. In the meantime, we have revised the magenta substructure of wave 2 to a - - formation, with the final (wave- ) leg currently unfolding. Once turquoise wave 2 completes, we expect a strong rally above resistance at $674.18, which should significantly advance the broader upward impulse. However, under our new alternative scenario, a different wave count could prevail: price may currently be forming magenta wave alt. to the upside, developing a blue three-part substructure in the process. In this 25% likely scenario, the next move would be for blue wave alt. (b) to finish within the nearby blue alternative Target Zone between $306.60 and $252.67, before wave alt. (c) pushes up toward the top of magenta wave alt. near $674.18. Within this alternative, the blue zone could offer long entry opportunities, though heightened caution is warranted: since this remains only an alternative scenario, risk is elevated, and we consider strict risk management—such as setting a stop 1% below the lower edge of the zone—absolutely essential.

Bearish MSTR is temporary; Rise to more than 412$ in the future.As it's obvious, MSTR has broken it's bullish trendline and a great pullback has happened. I believe after breaking a support at 293$, It will head toward 239$ then will rise and break the bearish trendline. After surpassing the 293$ resistance, It will catch 412$. Also it's evident that buying crypto by Michael Saylor can improve the stock price.

Targets for Bitcoin Bullish outlook for BTC in the coming days IF we close above 106,1 k.

The 3 day candles indicates we could have a "Three White Soldier Pattern" coming up for BTC. It would be a pattern showing a trend reversal and potenially trigger the next trend to retest the old ATH. Although, I would like to see increase in volume to confirm this during the rest of the day to be more certain on this pattern.

Expecting NASDAQ:MSTR to get really bullish aswell if this occur.

Navigating MSTR’s Price Swings: A Smart Options ApproachOverview

MicroStrategy (MSTR) has continued to capture market attention due to its aggressive Bitcoin strategy and significant stock price volatility. In 2025, MSTR surged 41% in one quarter but also reported a massive $4.22 billion net loss in Q1, raising concerns about long-term financial stability. Analysts remain divided, setting price targets ranging from $200 to $650, largely dependent on Bitcoin’s performance and broader market conditions.

Key Developments Impacting MSTR

✔ Bitcoin Exposure: MSTR maintains a large Bitcoin position, making its stock highly correlated to BTC’s price movements.

✔ AI Integration: The company is investing in AI-driven products, which could provide diversification outside of Bitcoin.

✔ Institutional View: Analysts remain split on MicroStrategy’s valuation due to its uncertain revenue model.

✔ Macro Volatility: Market-wide sentiment, interest rates, and crypto regulations will influence MSTR’s trajectory.

Options Strategy for the Week

🚀 Iron Condor Setup for June 6 Expiration

To capitalize on MSTR’s volatility while managing risk, an Iron Condor strategy is structured within a controlled range:

- Inner Range: Sell Calls at 395 and Puts at 335

- Coverage: Buy Calls at 415 and Puts at 315

✅ Objective: Profiting from sideways price movement while minimizing exposure to extreme volatility.

✅ Risk Management: If MSTR breaks above 415 or below 315, the long positions hedge against excessive losses.

MSTR I Pullback and More Potential GrowthWelcome back! Let me know your thoughts in the comments!

** MSTR Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!