Microstategy Vs Bitcoin Vs SP500Can you see the correlation? SP500 controls BTC for the most part and therefore microstrategy.

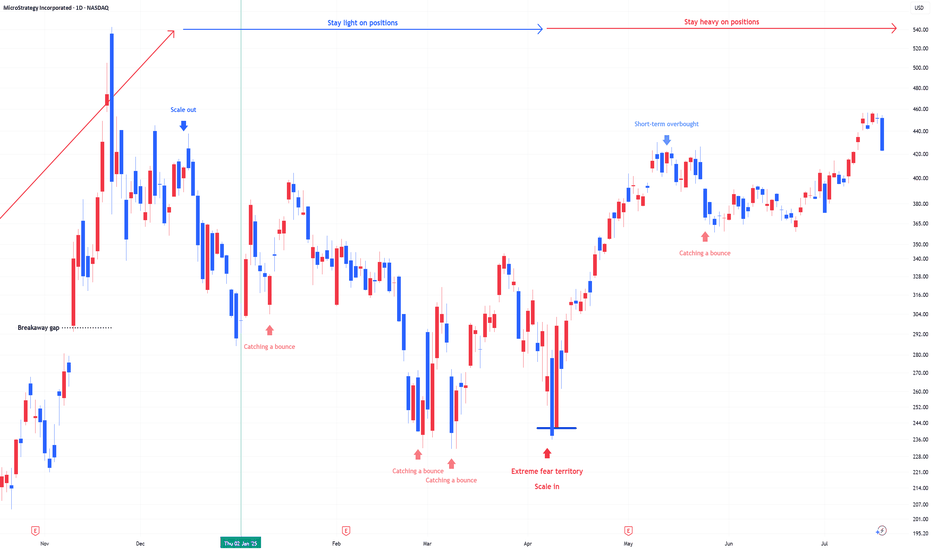

MicroStrategy ( NASDAQ:MSTR ) has become a key proxy for Bitcoin exposure in traditional markets. With nearly 600,000 BTC on its balance sheet, its stock’s performance strongly correlates with Bitcoin’s price action.

In 2025, Bitcoin's correlation with the S&P 500 has climbed to 0.90, reflecting Bitcoin's growing role as a macroeconomic risk asset. MicroStrategy’s pending inclusion in the S&P 500 would force index funds to buy NASDAQ:MSTR shares, indirectly increasing institutional Bitcoin exposure through traditional equity portfolios.

This convergence shows how digital assets and major equity indices are increasingly intertwined, creating new pathways for Bitcoin adoption by institutional investors while tethering crypto markets closer to broader market dynamics.

#bitcoin #MSTR #SP500 #crypto #investing CBOE:MSTU AMEX:SPY

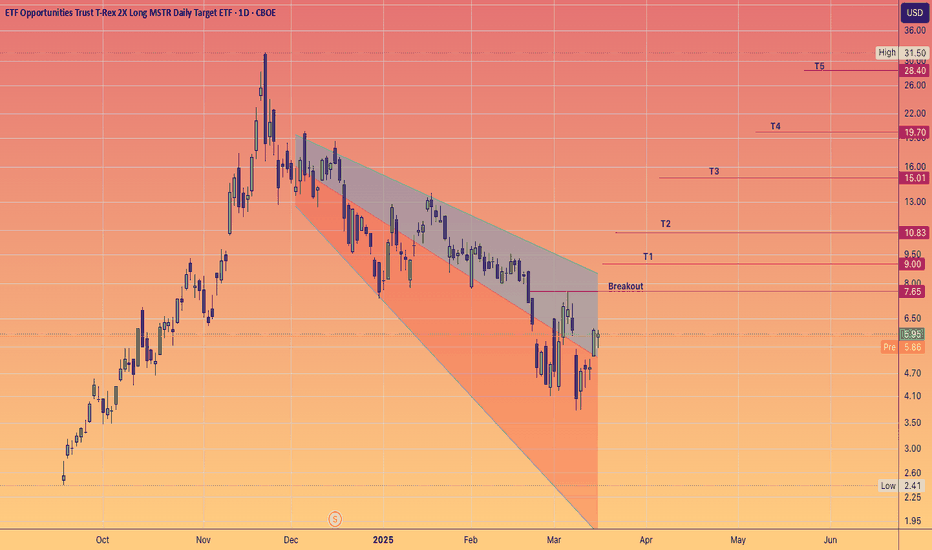

MSTU

MSTU chasing BTCThere is a nice delay on MSTR and MSTU proportional to BTC on smaller timeframes, allowing for nice entries and exits. It's already run 8% for me, but you might find a nice entry on MSTU when BTC pulls back. However, if you are long term bullish you might not want to wait. My first target is around $9 , at which point, I may just hold it for continuation depending on what BTC is doing at that time. Not financial advice, DYOR.

MSTU, Microstrategy 2x leverage etfThis ETF is a great way to get degenerately long on Bitcoin. If Microstrategy doesn't wet your beak, this one might. We have some gaps in the chart that I didn't see before. They are not visible on the higher time frames. I have been long on call options for a few days and was considering taking profit but because they are long dated leaps I am holding tight for now. Not financial advice, DYOR.

Double down like Michael Chad Saylor - MSTR ----> MSTU 2X"Are you convicted?"

Of Bitcoin achieving a new All time high if so Saylor will greatly rewarded and lauded.

MicroStrategy's unwavering focus on acquiring Bitcoin through unconventional financing methods, rather than building a sustainable revenue-generating business, carries significant risks, especially if a major bear market were to hit the cryptocurrency sector again. This exposure to Bitcoin offers a distinctive investment opportunity for those looking to gain leverage in the crypto space without direct participation.

While MicroStrategy's inherent volatility may deter more traditional investors, it also provides a platform for those eager to engage with market dynamics. The MSTU adds an additional layer of volatility, but unlike options, it does not have an expiration date.

Investors should closely monitor Bitcoin's market fluctuations, as these directly influence MSTR's stock price, potentially creating advantageous entry points for savvy traders.