Liquidity Grab into Reversal (PDH / AM High → Sellside Move)1/13 Session Recap — Liquidity Grab into Reversal (PDH / AM High → Sellside Move)

Today’s price action gave a clean, teachable sequence:

Market Structure

• Price pushed into an upside resistance pocket (PDH + upper POI area / AM High zone).

• After the tag, the market showed rejection + displacement down, signaling the reversal was active.

• The rest of the session delivered a sellside expansion into lower levels.

What I looked for

1. Tag of key upside level (PDH / AM High region)

2. Rejection candles / failure to hold above level

3. Shift in momentum → continuation lower

Execution (Options)

I executed the move using QQQ puts and scaled:

• 626P (starter / main)

• 624P and 620P (adds as confirmation strengthened)

Outcome

✅ Clean reversal execution

✅ Scaled entries + profit-taking into the dump

✅ Net: +$165.68

Key takeaway

The edge was NOT predicting — it was waiting for price to reach the level, then reacting to confirmation.

(Educational only, not financial advice.)

Nasdaq

Are tech stocks about to surge? Nasdaq New Highs? The market is very close to making a big move.

We believe the market is still bullish and will likely trend higher.

Today crypto was strong when the market was weak. This could be signaling tech is about to capture some bullish liquidity.

Banks got decimated today, which allows lots of capital to rotate back into tech.

The Nasdaq is lagging and the only indices to not make new all time highs.

NASDAQ (NAS100) – 15-Minute Timeframe Tradertilki AnalysisMy friends, greetings,

I have prepared a NASDAQ-NAS100 analysis for you.

My friends, if NAS100 reaches the levels of 25754.54-25731.54 on the 15-minute timeframe, I will open a buy position.

My target will be the 25905.40 level.

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏✨

Thank you to all my friends who support me with their likes.❤️

USNAS100: Consolidation Near 25720 Ahead of CPI & EarningsUSNAS100 | Market Overview

U.S. stock index futures edged lower ahead of key U.S. inflation data and Q4 earnings from JPMorgan Chase, which will kick off the earnings season. Investors remain cautious as both events may significantly influence the interest-rate outlook and short-term market direction.

TECHNICAL VIEW (USNAS100)

Volatility is expected to remain elevated ahead of today’s inflation release.

Price is currently consolidating between 25720 and 25835, awaiting a breakout.

📈 Bullish Scenario

Bullish bias remains valid while trading above 25720

A 1H candle close above 25835 would confirm upside continuation toward:

25985 - 26170

📉 Corrective / Bearish Scenario

A 1H candle close below 25720 would trigger a correction toward:

25510 - 25250

Key Levels

Pivot Line: 25720

Resistance: 25835 – 25985 – 26170

Support: 25510 – 25250

Walmart - Good PotentialCounting waves and assessing technical potential. Here’s what we see:

We are drawing a classic five-wave structure. The move started in November 2015.

November 2015 - April 2022 - Wave 1

June 2022 - February 2025 - Wave 3

April 2025 - present - Wave 5

The upside potential is estimated at 18 - 38 %.

Key targets:

136

156

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

MNQ - Ascending Channel Range Play | FVG Zones Holding

Hey TradingView community! 👋

NASDAQ futures are in classic range mode right now. Let me break down what I'm seeing on the 45-minute chart.

The Setup

MNQ1! is trading at 25,941 inside an ascending channel, currently sitting right in the upper FVG zone around 25,880-25,920. Price has been respecting this channel beautifully - bouncing between the upper and lower boundaries like clockwork.

This is a range-bound market. Until we get a decisive breakout, expect more of the same: test resistance, pull back to FVG, bounce, repeat.

Why I'm Neutral Here

Ascending channel intact - but price is RANGING, not trending

Two FVG zones acting as magnets - price keeps retesting them

S&P 500 at record highs but NASDAQ lagging slightly

Fed pressure headlines creating uncertainty (Powell vs Trump drama)

CPI data Tuesday could be the catalyst for breakout

Bank earnings starting this week (JPM Tuesday)

The News Context

Mixed signals keeping the market choppy:

S&P 500 hit record high Friday - but NASDAQ underperforming

Trump vs Powell drama - DOJ threatening Fed Chair over "renovation" testimony

Credit card rate cap proposal hitting bank stocks hard

Soft jobs data (50K vs 60K expected) - but unemployment dropped to 4.4%

Banks pushing back rate cut expectations after jobs report

Walmart joining Nasdaq-100 on Jan 20 - could bring passive fund flows

CPI report Tuesday - this is the big catalyst to watch

Key Levels I'm Watching

Resistance:

26,000 - Psychological level / upper channel

26,280 - Major resistance (near 52-week high)

26,399 - 52-WEEK HIGH

Support:

25,880-25,920 - Upper FVG zone (current)

25,800-25,860 - Lower FVG zone

25,600 - Channel midline support

25,320 - Lower channel support

My Game Plan

Range scenario (MOST LIKELY): Price continues to oscillate within the ascending channel. Expect retests of the FVG zones. Trade the range - buy at lower FVG, sell at upper channel resistance. This is a scalper's market until we get a breakout.

Bullish scenario: If CPI comes in soft and we break above 26,000 with volume, next target is 26,280, then 26,399 (52-week high). Walmart joining Nasdaq-100 on Jan 20 could bring passive buying.

Bearish scenario: If CPI comes in hot or Fed drama escalates, we could break below 25,600 and test 25,320 lower channel support. Watch bank earnings for sentiment.

The Bottom Line

I'm NEUTRAL here. The channel is intact but we're just ranging. No clear trend until we break out. The FVG zones are acting as support/resistance - trade the range or wait for the breakout.

CPI Tuesday is the key. That's likely the catalyst that decides direction.

What do you think? Breakout or more chop? Let me know in the comments! 👇

NASDAQ Testing 1 month Resistance. Break or rejection?Nasdaq (NDX) has been on a Higher Lows uptrend since the November 21 2025 bottom but following the December 05 high, it has failed to break above that 25830 Resistance (1) on 5 tests. Today it is attempting it for the 6th time.

A break and 1D candle closing above Resistance 1 then, will confirm the bullish break-out of that Ascending Triangle and transitioning into a Channel Up. If it maintains a high symmetry with the first one (+4.31%) then we expect to see 26150, falling just below Resistance 2 (26260) and the All Time High.

If however the price gets rejected again on Resistance 1 (close a candle below it), the minimum Target would be the 4H MA200 (orange trend-line) at 25450, falling just above the 0.618 Fibonacci retracement, which is the level that all Higher Lows since November 21 approached.

It has to be noted at this point that the 1D RSI is now hitting the Lower Highs trend-line that started on September 22 2025. If rejected here again, the market will confirm a huge Bearish Divergence that can shift the long-term trend to bearish.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Update: IREN Limited (IREN) - structure beats emotionsIREN Limited operates in Bitcoin mining and AI cloud infrastructure, focused on renewable energy and scalable data centers. Mining is the core revenue driver, AI services are still small but growing fast.

On the daily chart, a falling wedge has been broken to the upside, followed by a clean retest. The structure is holding. Price is now sitting in a strong daily support zone at 36–38, aligned with the 0.618 Fibonacci level.

MACD is turning bullish on higher timeframes, and short- to mid-term moving averages are stabilizing. This looks like accumulation after a deep correction, not a random bounce.

By the end of 2025, IREN scaled materially.

Revenue grew from $184M in 2024 to roughly $485M in 2025.

Bitcoin mining remains the main contributor, while AI Cloud Services added about $16M and continue expanding.

Consensus estimates point to ~$230M revenue in Q2 2026. EPS is still negative, which fits a capital-intensive expansion phase.

As long as price holds 36–38, the market is pricing a move toward 50 → 60 → 70.

This is not a one-day trade. It’s a structural recovery setup.

The chart already did the talking.

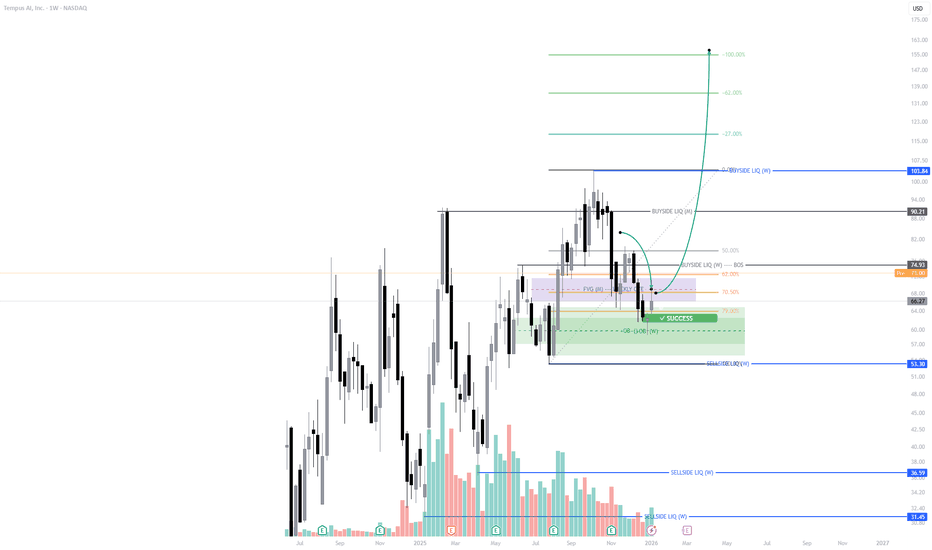

TEMS | Earnings Catalyst Ignites Technical BreakoutTempus AI ($TEMS) delivered impressive earnings, with recent reports showing triple-digit diagnostic growth — and price action responded strongly.

From a technical perspective, this move aligns perfectly with our previously marked-up zones.

The weekly order block (OB) and fair value gap (FVG) identified weeks ago have held exceptionally well, confirming those levels as key areas of support.

This reaction validates the importance of structure and confluence-based analysis — highlighting how combining technical precision with fundamental catalysts can offer strong directional clarity.

With price respecting key zones and showing bullish continuation signs, the upside path remains technically supported in line with market sentiment.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before trading.

WDC - Revisiting the ChartIn the previous idea, we didn’t see a deep correction at the designated targets; the chart moved upward.

Let’s look at what could happen next. So far, only the 3rd wave is complete, and we’re now drawing the 5th wave to finish the move. The correction looks like a running flat .

We can’t be completely certain about the exact point where the correction ended, so the final scenario isn’t clear. Still, we’ll focus on the most likely scenario. Unlike Sandisk, where the chart is straightforward, here things are less obvious

Key targets to complete the movement: 210 and 241 (possibly higher).

Less likely scenario:

With 210 already reached, the movement is complete. The correction is wrapping up, and then the price is expected to drop.

More likely scenario:

Heading towards 241 .

The movement after the correction overlaps the first wave - this happens in a fifth wave, which means we are drawing a wedge (ending diagonal).

Alternative scenario:

Heading well above 241 .

Conclusion:

Most probable target for completing the movement: 241

Pattern of the movement: wedge .

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

NASDAQ: Bulls Took Control Last Week! Buy It!Welcome back to the Weekly Forex Forecast for the week of Jan. 12 - 16th.

In this video, we will analyze the following FX market: NASDAQ (NQ1!) NAS100

The NASDAQ is the sick sister of the S&P and the Dow Jones, both of which hit ATHs last week. The NAS could potentially follow suit this week, but it doesn't need to. It can still push higher towards the buy side liquidity at 26,128 and achieve a huge bullish goal.

The bullish close to last week warrants buys this week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

APLD: Momentum Confirms Triangle BreakoutAPLD - CURRENT PRICE : 37.68

APLD Breaks Symmetrical Triangle – Momentum Confirms Trend Continuation

Applied Digital Corporation (APLD) continues to trade within a strong long-term uptrend, with price holding well above the rising EMA 200 , signaling sustained institutional support and a structurally bullish market environment.

From a price-structure perspective, APLD has broken out of a bullish symmetrical triangle , supported by clear volume expansion, confirming genuine buying interest rather than a false breakout. This pattern reflects a period of healthy consolidation before trend continuation, with price now attempting to resume its prior upside trajectory.

Momentum further reinforces the bullish setup. The three highlighted green vertical lines mark previous instances where RSI crossed above 70, and in each case, price continued to rise afterward, demonstrating that overbought readings in this stock have historically acted as trend-confirmation signals rather than reversal warnings. RSI has once again moved above 70, aligning with the current breakout and strengthening the case for continued upside.

Based on the technical structure, the first upside target is $47, while the second target at $58 represents the x-to-x measured move of the symmetrical triangle . On the downside, $28 remains the key support and invalidation level. As long as price holds above this level and the EMA 200, the technical bias remains firmly bullish, with pullbacks viewed as opportunities within an ongoing uptrend.

ENTRY PRICE : 35.00 - 37.68

FIRST TARGET : 47.00

SECOND TARGET : 58.00

SUPPORT : 28.00

Notes : On 09 Jan 2026, major Wall Street analysts update their ratings for Applied Digital Corporation (APLD), with price targets ranging from $40 to $58. (Source: moomoo)

Nasdaq - Tech is rallying during 2026!💰Nasdaq ( TVC:NDQ ) is remaining totally bullish:

🔎Analysis summary:

The Nasdaq and the entire tech sector is about to finish a very strong year of 2025. Going into 2026, market structure remains totally obvious and is clearly showing massive upside potential. Every major dip, especially going into 2026, leads to a massive buying setup.

📝Levels to watch:

$25,000 and $21,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

MNQ: De-Risking Into NFP After Trendline FailureTLDR

Early-year strength → positioning likely crowded

30m trendline loss + failure below weekly VWAP suggests short-term de-risking

Weekly pivot acts as a natural downside reference into NFP

After a strong start to the year, I’m leaning toward short-term de-risking into NFP, not because the trend is broken, but because positioning + timing matters.

On the 30m MNQ:

We’ve lost the rising trendline that guided the recent leg higher.

Price has failed back below weekly VWAP (red), which has acted as dynamic support throughout the move.

That combination suggests momentum cooling, not outright bearish continuation yet.

With NFP approaching, this looks like a risk-off pause rather than aggressive selling. Markets often lighten exposure ahead of high-impact data, especially after early-year gains.

Levels I’m watching:

Acceptance below weekly VWAP keeps pressure on.

A move toward the weekly pivot zone would make sense as a natural de-risking target.

Reclaiming VWAP would invalidate the pullback thesis and reopen upside.

Bias:

Short-term defensive / de-risking into NFP

Bigger-picture trend still intact unless structure continues to deteriorate

Not predicting the number. Just respecting positioning.

The Insider Intel Community Is Now Live!We’re excited to announce that our new Insider Intel Community is officially open — built for traders who want to level up their analysis, connect with others, and discuss real market structure setups across Forex and Stocks.

Inside the community, members can access two dedicated trading hubs:

💹 The Trading Floor FX – Focused on Forex price action, ICT concepts, and macro drivers.

📈 The Equity Exchange – Covering stock setups, swing ideas, and long-term plays.

We’re posting more frequent breakdowns, setups, and weekly bias updates within the community to keep discussions structured and informative. You’ll also find built-in trading tools like a heat map, news feed, and economic calendar to support your analysis workflow.

This is a space for traders who value structure, collaboration, and clarity — designed to learn, share, and grow together.

If you’re part of the Insider Intel network, you can now explore the new community area directly through our main portal.

Stay sharp. Trade smart.

— Insider Intel Team

Tesla (TSLA) | Maintaining Bullish Structure & Supporting Key Levels

Tesla continues to show strong bullish structure across the higher timeframes.

Price has respected the monthly Fibonacci golden zone (234–212) as a solid re-entry area, aligning with a bullish order flow and structural break to the upside.

We can see price now consolidating above a key monthly POI (around 384–359), forming a potential continuation zone as it builds liquidity for the next leg higher.

The long-term bullish projection remains intact, with extended targets toward 831–850, completing a full swing move if momentum persists.

The overall structure remains supported by broader NASDAQ tech strength, reinforcing Tesla’s alignment with sector performance.

In our private trading discussions, we explore deeper setups like this — identifying structure shifts, key liquidity pools, and macro confluence zones across multiple assets.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before making investment decisions.

the nasdaq descends down to 13260.00gm,

i'm predicting the nasdaq loses 50% of its value over the next 2 years.

---

the global liquidity cycle is the recurring expansion and contraction of money and credit across the world, driven mainly by central bank policy, interest rates, and financial conditions. when liquidity expands, borrowing becomes easier, money moves freely, and risk assets like stocks, crypto, and real estate tend to rise as optimism and leverage increase. when liquidity contracts, credit tightens, money retreats, leverage unwinds, and risk assets fall as fear replaces confidence. this cycle acts like the financial system’s breathing pattern, quietly setting the backdrop for booms, bubbles, corrections, and resets long before most people notice.

---

to put it simply, the global markets go through phases of inflows and outflows, it's cyclical by nature. 2026 has always been the expected top year using michael howell's global liquidity cycle oscillator.

---

i'm not saying the market is going to crash, just saying i think it will bleed out for multiple years. "easy money" as you might be used to, will become "hard money" for awhile. don't let this deter you, just exercise more caution and higher levels of risk management during the times which are to come.

---

as for an ewt perspective - nasdaq could have potentially finished a macro ending diagonal on a weekly frame. if my postulation is correct, the breakdown from this diagonal could be violent, and it will have a minimum downside target of 13260.00

---

🎯 = 13260.00

Trio-Tech (NYSE: TRT) Breaks to New HighsTrio-Tech International (NYSE: TRT) continues to show strong momentum post-2-for-1 forward stock split, confirming the confidence we've highlighted.

Since the split took effect on January 5, 2026, TRT has extended its upside move, reaching a new post-split high of $7.59, marking a 9% gain in the most recent session alone. From our initial alert levels, the stock has now delivered approximately 46.81% in gains, confirming sustained buyer interest and continued strength at higher prices.

As previously reported, the split was executed through an amendment to the Company’s Articles of Incorporation, with shareholders of record as of December 29, 2025 receiving one additional share per share held. The action was designed to enhance liquidity and improve market accessibility without changing the company’s underlying valuation.

Importantly, the market’s response since the split has been constructive rather than corrective. Instead of post-event consolidation, TRT has continued to push higher, suggesting that improved liquidity and visibility are supporting ongoing demand rather than short-term speculation.

#EURJPY , BuySide QuickScalp ?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #EURJPY

⚠️ Risk Environment: High

📈 Technical Overview:

Lets have it in BUY side as well .

🚀 Trading Plan:

• Wait for Momentum around key levels

• LTF ENTRY NEEDED

• Manage risk aggressively, protect capital first

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

US100 H4 BPR Reaction and Buy-Side Liquidity Expansion Setup📝 Description

US100 on H4 is holding a bullish HTF structure after a strong impulse. Price reacted cleanly from the H4 UNICORN, showing absorption on pullbacks rather than acceptance lower. With structure intact, the market looks positioned for upside expansion toward buy-side liquidity.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish continuation above 25,570–25,600

Long Setup (Preferred):

• Entry (Buy): 25,590

• Stop Loss: Below 25,490

• TP1: 25,683

• TP2: 25,812 (BSL)

• TP3: 25,929 (HTF liquidity)

________________________________________

🎯 ICT & SMC Notes

• Strong bullish impulse with controlled pullback

• Buy-side liquidity stacked above recent highs

• No bearish CHOCH + BOS on HTF

________________________________________

🧩 Summary

As long as US100 holds above 25,500 the higher-probability path is continuation higher toward 25,813 and 25,930 liquidity. Pullbacks are viewed as opportunities, not reversals.

________________________________________

🌍 Fundamental Notes / Sentiment

Strong ISM Services supports economic strength but reinforces higher-for-longer rates. Softer JOLTS only adds short-term consolidation, not a trend change.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

XAUUSD | Still bullish! (READ THE CAPTION)In the hourly chart of XAUUSD we can see that after reaching 4500 in the early hours of Wednesday, Gold dropped all the way to 4415, a massive drop of 850 pips! However, after hitting the C.E. of the FVG and closing the smaller FVG in that zone, it retraced and reached 4439. At the moment, it is being traded 4430, and I believe Gold will go back up soon enough.

For now the targets are: 4440, 4453, 4466 and 4479.

MNQ LONGS head and shoulders was pretty obvious today bear flag and trap after trap. We havent quite swept NYSE PM low;s. For a short term scalp im targetting my neckline with a SL of 822.5. forming a possible tripple bottom bear just be cautious you still are in a bear flag but that doesnt mean you can scalp longs for free money within a bearish pattern

The Robinhood vs. Coinbase War is raging. Is the Battle decided?While Robinhood has certainly been faster at launching traditional banking features, Brian Armstrong has explicitly confirmed a pivot for Coinbase to become a "financial super app" (or "everything app") to directly compete in that same space.

As of late 2025 and early 2026, Armstrong has shifted Coinbase’s narrative from being just a "crypto exchange" to becoming a "bank replacement"

The Coinbase "Everything App" Pivot

In his 2026 roadmap and recent interviews, Armstrong outlined a vision that looks very similar to what Robinhood is building, but powered by blockchain rails:

The "Everything Exchange": In December 2025, Coinbase officially launched tokenized stock trading and prediction markets (via Kalshi) within its main app. They also flagged plans for 24/7 perpetual futures on both crypto and stocks for 2026.

Primary Financial Account: Armstrong stated his goal is for Coinbase to be a "bank replacement" where users handle all spending, savings, and investing. This includes an aggressive push for the Coinbase Card and using stablecoins (USDC) for everyday payments.

On-Chain "Super App": Coinbase recently rebranded its wallet as an "everything app," integrating messaging, social networking, and "mini-apps" that run on its Base network. This model is more akin to China’s WeChat than a traditional US brokerage.

Robinhood currently feels like the "Amazon of Finance" because they already offer the full "Prime" experience (credit cards, 3% IRA matches, and gold subscriptions) using traditional rails.

Coinbase’s counter-argument is that traditional rails are "outdated". Armstrong's bet is that by building the same services on Base (their Layer 2 network), they can offer faster, cheaper, 24/7 global services that Robinhood’s traditional banking partners can't match—like instant 200-millisecond transaction "Flashblocks".

What do you think?