Nasdaqfutures

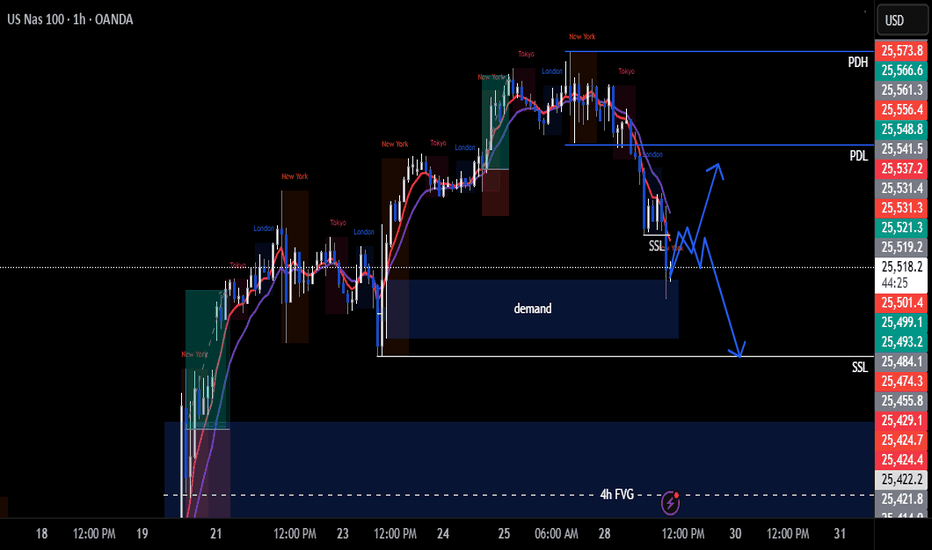

NAS100 Trade Set Up Jan 7 2026Price swept PDH during Asia and came down to fill a 4h bullish FVG and now is sweeping London highs, so i will wait to see if price can test the 4h bearish FVG to then look for 1m-5m IFVG/CISD to take sells to London lows but if price can stay bullish above the 1h IFVG i will look for buys to PDH