Nasdaqsignals

APLD :: Bullish Price Action After Controlled Pullback🟢 APLD (Applied Digital Corporation) — NASDAQ

Market Profit Playbook | Day / Swing Trade

🧠 Trade Thesis (Why This Setup?)

APLD is showing bullish continuation behavior after prior expansion, now respecting a Double Exponential Moving Average (DEMA) pullback on the 3H timeframe.

This type of pullback often attracts institutional dip participation when trend structure remains intact.

Think of this as a controlled pullback inside a broader bullish environment, not a random dip.

📊 Technical Structure Breakdown

🔹 Trend

Primary bias: Bullish

Price holding above key trend structure

Pullback into Double EMA zone (3H) → classic trend continuation zone

🔹 Entry Method (Layered Accumulation)

Institutional-style scaling, not a single all-in entry.

Buy Limit Layers (example):

🟩 36.00

🟩 35.00

🟩 34.00

🟩 33.00

📌 You may add or adjust layers based on your own risk model and volatility tolerance.

🎯 Target Zone (Profit Escape)

Target: 🎯 42.00

📍 Rationale:

Prior supply / resistance zone

Momentum historically stalls here

Overbought + liquidity trap potential

Smart money often distributes here — grab profits, don’t negotiate

🛑 Risk Control (Capital Protection)

Stop Loss: ❌ 30.00

📌 Below key structure → invalidates bullish thesis if breached.

⚠️ Risk Notes (Read Carefully)

Targets and stops are reference levels, not mandatory instructions

Partial profits are always valid

Manage position size responsibly

This playbook shows structure — execution discipline is on you.

🏦 Fundamental & Macro Context (Why This Matters):

🔹 Company Angle (APLD)

Applied Digital operates in high-performance computing & digital infrastructure

Sector sensitive to:

AI / data center demand

Energy costs

Capital market liquidity

🔹 Macro Factors to Watch

📈 US Treasury Yields → higher yields can pressure growth stocks

🏦 Fed Policy Expectations → easing bias supports speculative tech

⚡ Energy Prices → impacts operational costs

📊 NASDAQ sentiment → APLD moves with risk-on / risk-off flows

Upcoming macro data that may impact volatility:

US CPI / PPI

FOMC statements

Bond auction demand

🔗 Correlated Assets to Monitor

NASDAQ:NDX / NASDAQ:QQQ → Tech sentiment driver

SP:SPX → Broader risk appetite

CRYPTOCAP:BTC → Speculative capital flow proxy

TVC:US10Y → Yield pressure indicator

📌 If NASDAQ weakens sharply or yields spike, expect higher volatility in APLD.

🧠 Final Thought

This is not prediction trading — it’s probability management.

The edge comes from structure + patience, not hype.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

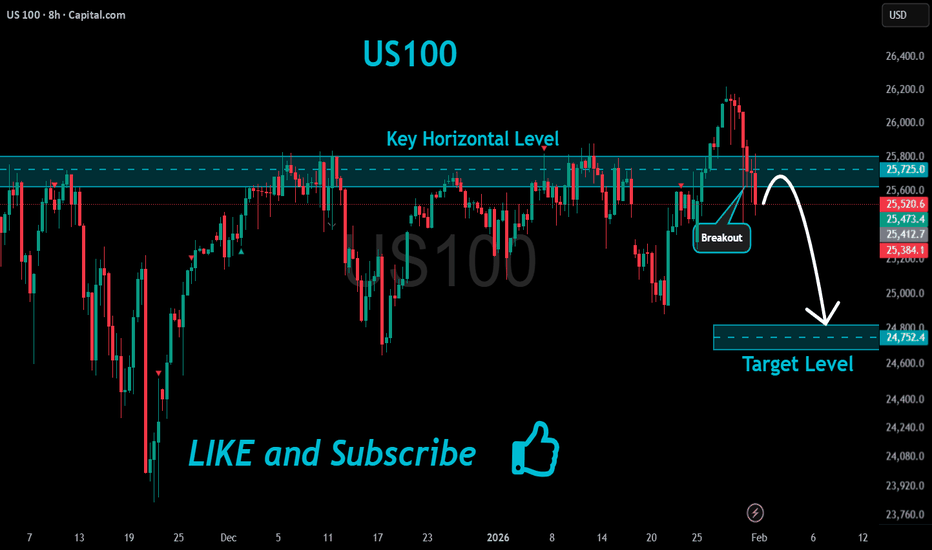

NASDAQ similarities with the 2022 Bear Cycle are striking.Nasdaq (NDX) almost tested last week its October 2025 High and got rejected. Unless it breaks soon, this is technically considered a Double Top. With the 1W RSI being already on a Lower Highs Bearish Divergence since July 2023, the whole pattern draws similarities to the bullish build-up that led to he 2022 Bear Cycle.

As long as the market doesn't make a new High, it is possible to that we are in a similar situation as January 2022, with the 1W RSI (ellipse) virtually identical to today's and lower than the High 3 months ago.

The 2022 Bear Cycle bottomed just after it breached below the 1W MA200 (orange trend-line). Based on the trend-lines current trajectory, this could be below 19500 by the end of 2026.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

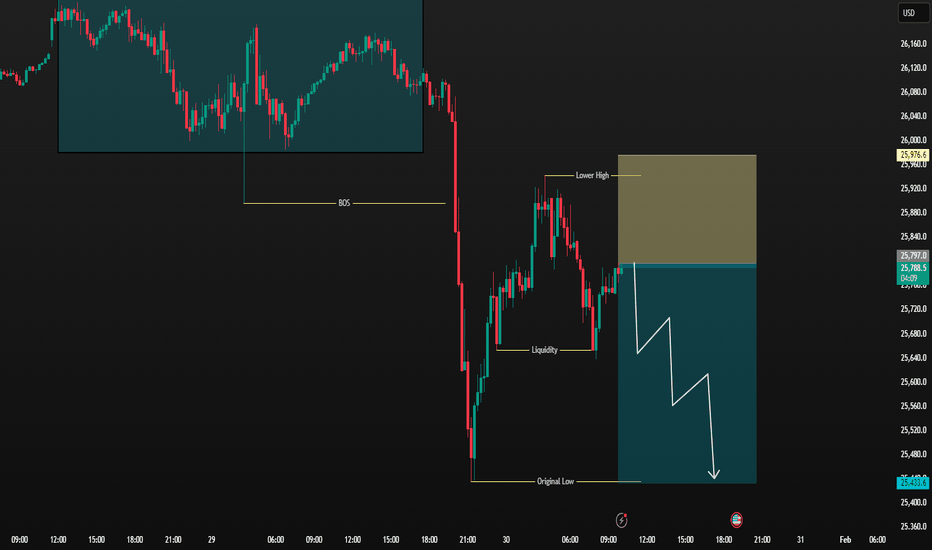

NAS100 - SECOND ROUND - Read CarefullyTeam Update – Read Carefully

Earlier today we had two targets hit.

We are now entering at a much better price:

25292–25305

Important Note

The market has completed a second retest, but based on current structure, I expect a recovery either during the European session or before the US market opens.

Targets

Target 1: 25345–25385 - Take 50% partial. Move stop loss to BREAKEVEN

Target 2: 25415–25465

Momentum is still aligned with our bias.

LETS GO

NQ Trading Inside Pivot Zone — Expansion Incoming 1/27/26📊 NQ (Nasdaq 100 Futures) — Premarket Trading Plan

Timeframe: 30-min

Session Theme: Balance → Expansion from Pivot

🟡 Primary Pivot Zone (Decision Area)

25,984 – 25,960

This zone defines control for the session.

Above pivot → bullish continuation bias

Below pivot → rotational / risk-off behavior

No bias without acceptance.

🔴 Upside Levels (If Pivot Holds)

26,007 – 26,043 → First resistance / acceptance test

26,085 – 26,130 → Major supply / upside extension zone

Failure here likely rotates price back toward the pivot.

🟢 Downside Levels (If Pivot Fails)

25,912 – 25,880 → First support / responsive bids

25,845 (Prior Week High) → Structural bull line

25,738 (Prior Week Close) → Breakdown confirmation

25,680 – 25,630 → Major demand / liquidation pocket

Acceptance below 25,845 signals real momentum shift.

🧠 Market Structure Read

Higher-timeframe trend remains bullish

Price is compressing above weekly structure

Current action = balance, not rejection

Expect range expansion once pivot resolves

This is a decision day, not a chase environment.

🧭 Trade Thesis

🟢 Bull Case

Hold 25,984–25,960

Buyers defend pullbacks into the pivot

Acceptance above 26,007 opens: 26,043

26,085 → 26,130

Best longs = pivot holds + higher low + volume confirmation

🔴 Bear Case

Acceptance below 25,960

Rotation toward 25,912 → 25,880

Loss of 25,845 opens: 25,738

25,680 – 25,630 if momentum accelerates

Shorts only make sense after pivot failure, not inside it.

📌 BOTTOM LINE — REAL IMPACT FACTORS FOR NQ TODAY

🟢 Bullish / Supportive

✅ Positive premarket futures bias

✅ Strong tech earnings anticipation

✅ Softer USD supporting risk assets

✅ Global equities resilient despite tariff rhetoric

🔴 Bearish / Risk Factors

⚠ Fed policy caution — no aggressive easing signal

⚠ Tariff headlines & geopolitical risk remain overhangs

⚠ Sector divergence (weak insurers) could spill into sentiment

📊 Quantum Regime Snapshot (QRS)

🟡 Neutral → Conditional Risk-On

Risk appetite remains constructive above the pivot, but this is not full risk-on. Structure confirmation required before pressing size.

⚡ Volatility Expectation

Moderate → Elevated

Compression near pivot = expansion potential

Earnings + macro uncertainty = fast rotations

Expect two-way trade, not a straight trend day

🎯 Execution Rules

Trade reactions, not predictions

Above pivot → lean long, buy pullbacks

Below pivot → fade strength, expect rotation

No acceptance = patience

1/26/26 NQ Premarket Playbook — Levels First, Noise LastNQ 📊 | Premarket Trading Plan (30-Min)

🧲 Premarket Pivot: 25,710

→ Line in the sand for today’s bias

🔴 Resistance / Supply

25,738 – 25,845 → prior rejection / supply shelf

25,880 – 25,912 → upper resistance band

25,960 → stretch target if risk fully flips on

🟢 Support / Demand

25,630 – 25,600 → first demand / pullback support

25,555 → key structural level

25,380 – 25,365 → major demand zone

25,127 → last support before range damage

🧭 TRADE THESIS

🟢 Bull Case

Acceptance above 25,710 keeps upside pressur

Holding 25,630–25,600 on pullbacks = buy structure

Sustained trade above 25,738 opens rotation toward

25,845 → 25,880+

➡️ Buyers must defend dips, not allow value to slip back below pivot

🔴 Bear Case

Failure to hold 25,710 = rejection at value high

Acceptance back below 25,630 opens 25,555

Loss of 25,555 exposes 25,380 demand

➡️ Shorts favored on failed reclaims into resistance

NASDAQ Will the 2-month Resistance hold and cause a correction?Nasdaq (NDX) opened lower today but quickly recovered as it hit its 1D MA50 (blue trend-line). With last week's Low being on the 1D MA100 (green trend-line), the level that has caused the last two major rebounds since November 21 2025, the market focus shifts again on Resistance 1 (almost 2 months intact), which has caused the last 4 top rejections.

With the Lower Highs trend-line also since its All Time High holding and a huge 1D RSI Lower Highs Bearish Divergence since September 22 2025, as long as the market doesn't close a 1D candle above Resistance 1, we expect a bearish reversal first to 24900 (just above Support 1) and if Support 2 breaks, bearish extension targeting the 1D MA200 (orange trend-line) around 24200.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇