Nebius Group N.V. (NBIS) when growth stops being randomI am looking at the weekly chart of NBIS and this is no longer about emotions, it is about structure. Price has formed a stable bullish cycle, broke out from a wide base and is now holding above key moving averages. On the weekly timeframe most indicators have already shifted into buy mode, while the market does not look overheated. RSI remains in a neutral bullish zone, momentum is intact, and pullbacks are being absorbed without aggressive selling pressure.

The 50, 100 and 200 week moving averages are starting to align into a bullish configuration, which often signals a transition into a medium term trend. Volume confirms the move. This is not an empty or purely speculative rally, but one supported by growing participation from longer term capital. Technically, this structure suggests trend continuation with potential for new highs as long as the current range is held.

From a fundamental perspective, Nebius has gone through a major transformation over recent years. Company revenue has increased multiple times compared to prior periods, while the income structure has become more diversified. The core contribution now comes from cloud solutions, infrastructure services and technology driven segments that continue to grow even in a challenging macro environment. EBITDA has returned to a positive trend in recent reporting periods, and operational metrics are improving due to cost optimization and a stronger focus on higher margin business lines.

Yes, the company is still in an investment phase and this is not a classic profit here and now story. However, revenue growth rates, business scaling and expansion of core segments provide a clear long term value setup. This is not hype. It is a bet on a technology platform that is only entering its value realization phase.

Tactically, I view NBIS as a growth stock where the market can continue higher without a deep correction as long as the current structure holds. While price remains above key weekly levels and moving averages, the bullish scenario stays valid. This is not a one day idea. It is a trend that is just beginning to form.

Sometimes the market already knows where the money is going, and in those moments it is better to listen to the chart rather than the headlines.

NBIS

$NBIS Tags A-VWAP And Previous HighNBIS printed a clean hammer candle on the weekly chart. The wick tagged the A-VWAP and its previous high creating strong confluence. Buyers stepped in exactly where you want to see them. Key levels are marked around $100 and $135. I'll be looking for continuation and watching how price reacts around those areas.

$NBIS AI Infrastructure Gold Rush with Strategic Foresight Appearing in an interview with Reuters on December 3, 2025, Nebius Group N.V. (NASDAQ:NBIS)’s co-founder Roman Chernin spoke with optimism. He argued that demand for AI infrastructure can potentially expand ten- to hundred-fold once enterprises start to adopt rapidly evolving AI models. He shared that the company is building high-margin services and long-term customer relationships to prepare itself for potential downturns. This, he believes, positions the company to act as a consolidator if market conditions tighten.

Nebius Group N.V. (NASDAQ:NBIS)’s expansion strategy includes multibillion-dollar agreements with Microsoft and Meta. These include a $17 billion Microsoft deal signed in September and a $3 billion Meta partnership announced in November. Thanks to these strategic plays, NBIS has risen 248% so far in 2025, with its market cap surpassing the $25-billion mark. Chernin added that these efforts will now be leveraged to expand the company’s client base across traditional enterprises and emerging AI companies amid concerns about an AI bubble.

Meanwhile, the significance of these partnerships was highlighted in earlier analyst commentaries.

Reaffirming its “Buy” rating on November 13, BWS Financial cited strong demand for Nebius Group N.V. (NASDAQ:NBIS)’s AI cloud services and sees the Meta agreement as evidence of growing market confidence, despite short-term operational headwinds.

On the other hand, Citizens JMP initiated coverage of Nebius Group N.V. (NASDAQ:NBIS) on November 19, 2025, setting a $175 price target and an “Outperform” rating. The investment firm noted a shift in broader sentiment, with analysts now seeing the company as a credible ecosystem player, thanks to the Microsoft and Meta deals. The firm added that partnerships with these tech giants dismissed investor concerns tied to the company’s historical links to Yandex.

Through its Avride and TripeTen assets, as well as stakes in Toloka and ClickHouse, Nebius Group N.V. (NASDAQ:NBIS) delivers advanced AI infrastructure solutions to support large-scale compute and data workloads.

Nebius is expected to experience a faster increase in revenue next year, driven by its huge backlog.

The company's capacity expansion plans should support its revenue growth ramp-up in 2026.

Though the stock is expensive, it is still capable of rising impressively in the coming year due to the significant sales increase it is poised to deliver. Nebius' business model should supercharge its growth next year

Nebius rents out its computing power to customers that require it to run AI workloads, store AI-related data in the cloud, train large language models (LLMs), develop custom AI solutions, and execute AI inference solutions. More importantly, the company goes beyond just providing the hardware. It is a full-stack AI company offering managed software services that enable customers to build and fine-tune models and inference applications.

As such, it is in a position to capitalize on two key aspects of the AI market.

First, hyperscalers and AI companies are seeking to acquire computing power to run AI workloads in the cloud. There is a deficit in available AI computing power, which is why major cloud computing companies aren't able to fulfill their contracts. As a result, the contractual backlogs of these companies have skyrocketed.

Second, an increasing number of businesses, governments, and AI companies are likely to develop and deploy AI applications, both for their in-house use and for customers. That's because the technology is driving productivity gains for companies adopting it. Market research firm IDC estimates that each $1 spent on AI in 2030 could generate $4.60 in value.

This should pave the way for Nebius to keep growing at a blistering pace in the coming year, given the full-stack nature of its services. Its revenue in the first nine months of 2025 shot up by 437% to $302 million. Moreover, Nebius also reduced its adjusted net loss by 61% during this period to $170 million.

Management expects to achieve annualized run-rate revenue of $7 billion to $9 billion by the end of 2026. It calculates this metric by multiplying the revenue in the final month of the quarter by 12. This means sales in December 2026 could be as high as $750 million. That's significantly higher than what the company has generated so far in 2025.

For comparison, Nebius is expected to close 2025 with $556 million in revenue, up by 374% from last year. Analysts expect an acceleration in its top-line growth to $3.3 billion in 2026.

Nebius' revenue, therefore, could jump sixfold next year. This ambitious target seems achievable because the company has landed a couple of huge contracts from Meta Platforms and Microsoft that are likely to supercharge its growth in 2026. These two companies alone have created a revenue backlog of more than $20 billion for the company.

As a result, Nebius now plans to increase its connected data center capacity to a range of 800 megawatts (MW) to 1 gigawatt by the end of 2026. That would be a major increase over the 220 MW of connected power that it's projecting by the end of 2025. This major capacity expansion should support the incredible revenue growth that analysts are expecting from the company next year.

But will this blistering growth be enough to send the stock higher?

Investors may be worried about one thing

The stock's stunning rally in the past year is the reason it's now trading at a costly 65 times sales. That's way higher than the U.S. technology sector's average price-to-sales ratio (P/S) of 9.

But then, Nebius' red-hot growth, which is set to get better next year, justifies its valuation. In fact, the company's forward sales multiples are significantly lower due to the huge growth that it is expected to deliver. Even if Nebius trades at a significantly discounted 10 times sales (almost in line with the tech sector's average) next year and delivers $3.3 billion in revenue, its market cap could hit $33 billion. That points toward potential gains of 33% from current levels. However, this AI stock could deliver more than that since it is likely to enjoy a premium valuation due to its huge backlog, which could help it beat Wall Street's revenue expectations for 2026.

$NBIS Fundamental Catalysts and Institutional Confidence

NASDAQ:NBIS The core investment thesis for Nebius is powerfully underpinned by its recently secured position as a critical infrastructure partner for AI industry leaders. The landmark $17.4 billion, five-year agreement with Microsoft, announced in September, served as a transformative catalyst, propelling the share price 47% higher and fundamentally resetting the market's perception of the company. This was decisively followed by a $3 billion deal with Meta, confirming that the Microsoft partnership was not an isolated event but rather indicative of Nebius's proven capability in the high-stakes AI capacity arena.

Citizens Financial's Market Outperform rating and $175 price target underscore this shift, explicitly noting that these endorsements from Microsoft and Meta effectively mitigate any prior market concerns regarding the company's historical ties to Yandex, validating its security and operational integrity. Furthermore, the growing institutional interest is quantifiable, with 65 hedge funds reporting positions in their Q3 13F filings, including a notable 56% increase in stake from Jericho Capital Asset Management.

Crucially, management's commentary indicates these mega-deals are not the ceiling but a foundation. CEO Arkady Volozh stated that the Meta deal was "limited only by the capacity we had available," signaling immense, unmet demand. These contracts provide Nebius with formidable, pre-committed revenue streams to finance the aggressive expansion of its core AI cloud business, which continues to serve a broader base of AI startups and enterprises.

Technical Analysis and Price Structure

Complementing these robust fundamentals, the stock's price action is currently tracing a recognizable bullish XABCD harmonic pattern, suggesting the completion of a corrective phase and the initiation of a new upward impulse wave.

Key Support and Hierarchy: The primary and strongest support level rests firmly at $80.00, which aligns with the pattern's structure and recent consolidation. Should broader market volatility induce a deeper pullback, two subsequent Fibonacci-based support zones are identified:

Support 1: $62.60 (at the 0.618 Fibonacci retracement level).

Support 2: $50.00 (a significant psychological and technical level).

Critical Risk Zone: A breach below $50.00 would enter a "danger zone" around $40.00, which would threaten the integrity of the current bullish pattern and necessitate a fundamental reassessment of the trade thesis.

Momentum Trigger: A defined "blue line" resistance trendline (often corresponding to the pattern's completion point or a key moving average) is acting as immediate overhead resistance. A sustained break and close above this blue line is critical, as it is expected to trigger the next wave of bullish momentum, confirming the pattern's predictive move.

Projected Targets: Upon a confirmed breakout, the pattern projects two primary upside price objectives:

Initial Target: $140.00

Extended Target: $160.00

These technical targets, when viewed alongside Citizens Financial's $175 fundamental price target, create a convergent band of expected appreciation, offering a clear risk-reward framework.

Synthesis and Outlook

In summary, Nebius Group has successfully transitioned into a credentialed and sought-after player in the AI infrastructure landscape, backed by multi-billion-dollar votes of confidence from industry titans. This fundamental momentum is now mirrored in the technical chart, where a bullish XABCD pattern indicates a high-probability setup for a significant advance. The convergence of a $175 analyst price target and technical projections toward $140-$160, guarded by well-defined support near $80, presents a structured opportunity. Investors should monitor for a decisive breakout above the noted blue line resistance to confirm the anticipated bullish momentum is underway.

Is it time to reload $BITF? We caught the breakout in NASDAQ:BITF when it was below 3 earlier this year. It ripped all the way to $6+. Since then, the stock imploded back to the original crime scene amidst the AI overvaluation selloff. The $2.30 area provides good support and the stock has reacted off that level. If Bitfarms can scale its entrance into AI/HPC capabilities, the stock should be able to see the $3.8-4 area barring any further market selloff on AI names.

Stock is current trading around $2.70. I would put my stop at $2.30 if taking this idea.

Best of luck if tailing.

$NBIS – Massive Reversal Setup! Watching the $48.64 Zone for a CNASDAQ:NBIS has finally rebounded off its $28.68 low, delivering a sharp recovery move back toward the key mid-range zone near $47.39.

For weeks, this ETF has been trading under heavy pressure, but the recent surge in volume suggests early accumulation and a potential shift in trend momentum.

Price is now approaching a major confluence zone:

Long-term descending resistance (red trendline)

Long-term ascending support (green trendline)

Horizontal structural level (yellow) around $48.64

This intersection typically produces large direction-defining moves, making the next few sessions extremely important.

📊 Technical Overview

Support Levels: $47.39 → $36.72 → $28.68

Resistance Levels: $48.64 → $56.00 → $64.00

Structure: Squeezing between descending macro trendline & rising support

Momentum: First strong bullish pivot in weeks; volume spike confirms renewed interest

Trend Bias: Bullish above $47.39, neutral-to-bearish below that

A clean breakout above $48.64 would confirm a trend reversal and open the path toward the $56–$64 range.

This ETF has historically produced aggressive expansions after breaking key compression points like this one.

📈 Market Context

NASDAQ:NBIS tracks 2X leveraged exposure to NBIS — and leveraged ETFs often lead broader sector rotation signals.

When trendlines converge this tightly, algo-driven volatility frequently takes over, meaning:

Traders should watch for a surge in volume

A breakout candle often runs much farther than expected

Failed breakouts typically retrace to the lower trendline quickly

Macro conditions in related sectors (biotech, health innovation indices) have begun stabilizing, increasing the probability of bullish continuation.

💡 My Plan

Entry Zone: On breakout above $48.64 or retest of $47.39

Targets: $56.00 → $64.00

Stretch Target: $98.48 (long-term range expansion target)

Invalidation: Close below $36.72 = bearish continuation likely

Aggressive rotation plays like this often run fastest when the market least expects it — and NASDAQ:NBIS is approaching the most critical level of its entire 2024–2026 structure.

NASDAQ:NBIS is sitting right at a compression apex — breakouts from this pattern typically turn into massive moves 🚀

Do you think we blast through $48.64 or get rejected at the trendline?

Drop your thoughts ⬇️

I’ll post the breakout confirmation update once we get the move 📈

AMEX:XBI AMEX:LABU AMEX:SPY

NBIS US🌎Nebius (NBIS) — Strong Growth on the AI Wave

In Q3, revenue from the core data center business reached $146.1 million, a staggering 355% year-over-year growth.

The partnership with Microsoft is fundamentally changing the scale of Nebius's business. Annual recurring revenue (ARR), the company's key metric, is projected to be $7-9 billion next year, up from $0.9-1.1 billion this year. This implies sevenfold growth and is a conservative valuation, given the potential for new deals.

Nebius is a select NVIDIA partner, providing it with priority access to the most advanced GPUs (AI chips).

The launch of its own inference platform (deployment of AI models) enhances Nebius's overall value proposition, enabling customers to implement their AI-based solutions faster and more efficiently.

Although the company is still unprofitable overall, gross profit is growing at a faster pace (+365% year-on-year), and margins have increased by 2 percentage points. This is a key indicator of future profitability.

Adjusted EBITDA losses narrowed by 89% year-on-year to $5.2 million, and the core AI infrastructure division is already profitable on this metric with a 19% margin.

Compared to some competitors (such as CoreWeave), Nebius uses a less aggressive debt strategy, mitigating the risk of a slowdown in AI investments.

The company is expected to achieve operating profitability by fiscal 2027-2028, with the potential to achieve positive adjusted EBITDA as early as next year.

Following the earnings report, shares fell 40% from their peaks, bringing an attractive entry point closer. The market overreacted despite outstanding fundamental results.

NBIS Bearish Setup?NBIS spent most of 2025 trending higher, but the tone flipped after late-October’s peak. Price sliced below the 20- and 60-day MAs and is now pressing a critical demand zone at 101.91–99.80 (neckline/MA60 vicinity). A clear Double Top at 135.00 caps the structure, while MACD momentum is decisively negative and Bollinger Bands are opening—classic fuel for continuation if support gives way.

Primary path: a daily close beneath 99.80—and especially <97.00—confirms the breakdown and activates the double-top objective. That opens 95.00 first, then the 90.00–88.00 support zone, with an extension risk toward 82.00 on a measured move. Any weak bounce that stalls under 110.00 keeps sellers in control. For risk control on shorts, an invalidation is a daily close back above 115.50 (reclaiming the 20-day and negating the breakdown).

Alternative: if buyers defend 99.80–102.22 and price reclaims 115.50, that would suggest a failed breakdown. In that case, squeeze pressure can unwind higher toward 112.00–120.00, with 135.00 the larger supply to watch. Bulls are only back in charge on a sustained hold above 115.50; lose 99.80 on a closing basis and the bearish thesis remains the higher-probability track.

Thought of the Day 💡

At turning points, clarity comes from behavior at the line in the sand. Trade the confirmation, not the hope.

This is a study, not financial advice. Manage risk and invalidations

NBIS : Long worth TryingNebius group stocks are technically strong.

The downtrend since November 9, 2021 has been broken and the price is trading above the 50 and 200-period moving averages.

When we draw a medium-term Fibonacci level, we can take the take profit point at 0.618 and the stop-loss point at 0.382.

This gives us a Risk/Reward Ratio of 3.00.

A small position size is ideal.

Risk/Reward Ratio : 3.00

Stop-Loss : 43.46

Take-Profit : 60.00

$NVDA - $280 PT WEEKLY BULL FLAGStay Positioned with Nvidia's Weekly Bullish Chart. A Bull Flag is setting up with an imminent breakout. Long/Short Ratio is also very bullish at almost 60%. Price Target is $280. Remember Pole length of the flag = extended measured move at the breakout point of the flag.

NBIS Weekly Put Alert | $65 Targeting Weak Momentum

# 🐻 NBIS Weekly Put Play? | Neutral-to-Bearish Setup (Sep 1, 2025) 📉

📊 **Summary:**

Most models see NBIS as **neutral-to-weak** this week — RSI falling, volume light, and options flow neutral.

👉 Only **Claude/Anthropic** calls for a bearish weekly put, citing overbought weekly RSI + weak institutional volume.

---

## ✅ Trade Idea (from Claude’s model)

* 🎯 **Instrument:** NBIS

* 🔀 **Direction:** PUT (Short bias)

* 💵 **Entry Price:** \~0.95 (accept up to 1.00)

* 🎯 **Profit Target:** 1.40 (+47%)

* 🛑 **Stop Loss:** 0.47 (–50%)

* 📅 **Expiry:** 2025-09-05

* 📈 **Confidence:** 65%

* ⏰ **Entry Timing:** Market Open

---

## ⚠️ Risks

* 🌀 Range-bound chop → premium decay

* 📉 Bounce risk near **\$67.25 support**

* 🕒 Time decay: only 4 days left

* ⚡ Gamma spikes → faster moves near expiry

---

## 📌 Consensus Call

* 🟨 **Majority models:** Stay sidelined (neutral view)

* 🟥 **Claude:** Take a small bearish shot with \$65 puts

---

💡 **Takeaway:**

This is a **high-risk, short-dated weekly play**. Most signals are neutral, but if you like fading weakness → this put offers a controlled risk bet. Position **small**.

---

\#️⃣ **Tags:**

\#NBIS #OptionsTrading #PutPlay #BearishSetup #RSI #WeeklyOptions #TradingSignal #MarketAnalysis #NeutralBias

NBIS Nebius Group Among My Top 10 Picks for 2025 | Price TargetNebius Group N.V. (NBIS) presents a compelling bullish case for a potential doubling of its stock price by the end of 2025, driven by several fundamental factors that highlight its growth trajectory within the rapidly expanding AI infrastructure market.

NVIDIA Corporation (NVDA) has made a significant investment in Nebius Group N.V. (NBIS), contributing to a $700 million funding round aimed at expanding Nebius's AI infrastructure capabilities. This investment aligns with NVIDIA's strategic focus on enhancing its presence in the rapidly growing AI market.

Explosive Revenue Growth:

Nebius Group has demonstrated remarkable revenue growth, with Q3 2024 revenues reaching $43.3 million, representing a 1.7-fold increase compared to the previous quarter and a staggering 766% year-over-year increase. This surge is primarily driven by the company's core AI infrastructure business, which grew 2.7 times quarter-over-quarter and 6.5 times year-over-year. Analysts expect this momentum to continue, projecting annual revenues of approximately $731.96 million for 2025, reflecting a robust demand for AI-centric services and solutions.

Strategic Investments in AI Infrastructure:

The company is heavily investing in expanding its GPU cluster capabilities and data center capacity, with plans to allocate over $1 billion towards these initiatives. This strategic focus on enhancing AI infrastructure positions Nebius to capture significant market share as the global demand for AI technologies continues to rise. The annualized run-rate for its cloud revenue has already surpassed $120 million, indicating strong customer adoption and a growing client base that includes Fortune 500 companies.

Strong Market Position and Competitive Advantage:

Nebius Group is uniquely positioned within the AI infrastructure landscape, specializing in full-stack solutions that cater to developers and enterprises looking to leverage AI technologies. As businesses increasingly prioritize AI integration into their operations, Nebius's comprehensive offerings make it an attractive partner for organizations seeking to enhance their technological capabilities. The company’s ability to provide scalable solutions will be crucial as the demand for AI services expands.

Healthy Financials and Cash Reserves:

As of September 30, 2024, Nebius reported cash and cash equivalents totaling approximately $2.29 billion, providing a solid financial foundation to support its growth initiatives without excessive reliance on debt. This strong liquidity position allows Nebius to invest aggressively in technology and infrastructure while maintaining operational flexibility 14. Additionally, with gross margins projected to remain robust at around 55% in 2025, the company is well-positioned to improve profitability as revenues grow.

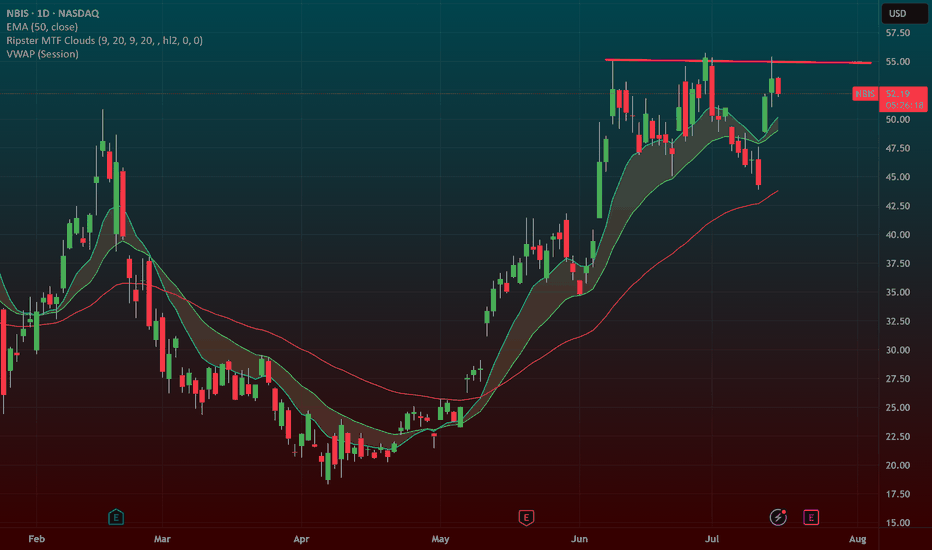

NBIS 55 BREAKOUT in the works!NBIS is an AI darling and a big momentum stock. When it goes it goes! it has been testing this 55 level for some time now.

We recently had a big GS upgrade that "woke" it up. A rest day here and another one will let the 9ema catch up to it and allow for a big breakout. If we take out this trendline at 55 ill put the stop 9ema and swing this.

NBIS Swing Trade Plan – 2025-06-09🧾 NBIS Swing Trade Plan – 2025-06-09

Bias: Moderately to Strongly Bullish

Timeframe: 3–4 weeks

Catalysts: AI sector strength + institutional buying + momentum breakout

Trade Type: Long equity (shares)

🧠 Model Summary Table

Model Direction Entry Price Stop-Loss Target Price Risk Size Confidence

DS Long $48.28 $44.50 $54.00 1% of account 70%

LM Long $48.50 $46.08 $55.75 ≤5% of account 80%

GK Long $48.28 $43.80 $57.90 2% on $10K 70%

GM Long $48.28 $43.80 $57.90 2% on $10K 75%

CD Short $48.30 $50.50 $42.75 2–3% of account 72%

✅ Consensus: Long bias (4 out of 5)

📈 Core Setup: Trend-following continuation play

⚠️ Outlier: CD favors a tactical short due to overbought RSI

🔍 Technical & Sentiment Recap

Trend: Strong bullish across M30 / Daily / Weekly timeframes

Momentum: RSI Daily (82.9) & Weekly (71.9) → overbought

Volume: 199% above average = strong institutional interest

Volatility: VIX ~16.8 = low risk-on environment

Narrative: AI/Nvidia tailwinds + hedge fund accumulation

✅ Final Trade Recommendation

Parameter Value

Instrument NBIS

Strategy LONG (shares)

Entry Price $48.28

Stop-Loss $44.50

Take-Profit $55.75

Holding Period 3–4 weeks

Size 44 shares (on $10K portfolio, ~2% risk)

Confidence 75%

Entry Timing Market open

🎯 Rationale: Riding strong institutional buying, macro tailwinds, and multi-timeframe bullish trend.

⚠️ Risk Checklist

Overbought RSI may lead to temporary consolidation

Bollinger upper band breakout suggests volatility ahead

Sentiment cooling around AI/Nvidia could slow rally

Broader market volatility (e.g., VIX spike > 20) could reverse trend

📊 TRADE DETAILS SNAPSHOT

🎯 Instrument: NBIS

📈 Direction: LONG

💵 Entry Price: 48.28

🛑 Stop Loss: 44.50

🎯 Take Profit: 55.75

📊 Size: 44 shares

💪 Confidence: 75%

⏰ Entry Timing: open

Nebius - A MASSIVE 113% Upside Potential!NASDAQ:NVDA recently bought shares of NASDAQ:NBIS

I'm riding as I see a 113% upside to $85! 🎯

- Bullish Channel

- Inverse H&S Breakout-retest-HIGHER!

- At Green Support Beam

- At Volume Shelf

- At Previous resistance to flip into support.

Not financial advice

Nebius Group (NBIS) - Long-Term Bullish OpportunityNebius Group presents a strong long-term investment opportunity backed by robust financials, strategic partnerships, and significant positioning in the growing AI sector. With no debt, $2.3B in cash reserves, and a substantial $700M investment from NVIDIA (10% stake), the company is well-positioned for aggressive growth. Its AI cloud leadership and GPU expansion plans further support long-term revenue growth, while potential deals with major AI clients and non-core asset sales (Avride, ClickHouse) could enhance profitability.

🔎 Catalysts to Watch:

✅ NVIDIA’s strategic partnership and validation.

✅ Increasing GPU capacity to meet rising AI demand.

✅ Talks with a potential anchor AI client.

✅ Possible asset sales to fund core business development.

✅ Earnings report tomorrow before market open – could act as a key price mover.

📈 Trade Setup (Long-Term Focus):

Entry: Around $48.00

Take Profit Targets:

TP1: $53.60

TP2: $57.00

TP3: $87.00

📊 Market Sentiment & Price Targets:

BWS Financial: "Buy" rating, $51 target (+6.1% upside).

CoinCodex: Projects $332.97 by 2030 (+592.67% potential gain).

Strong insider confidence: 28% ownership with recent institutional buying.

⚠️ Risk Considerations:

✅ High volatility – ensure proper risk management and position sizing.

✅ Long-term trade – not intended for short-term gains.

✅ Competitive AI landscape and potential regulatory shifts.

💹 Bottom line: With strategic backing from NVIDIA, a solid financial base, and multiple growth catalysts, Nebius offers a compelling long-term opportunity. Stay disciplined with risk management and keep an eye on tomorrow’s earnings report, which could set the tone for upcoming price action.

NBIS | InformativeNASDAQ:NBIS

Trend Analysis

Trend Direction: Bullish

The price is trading above both the orange (long-term) and blue (short-term) moving averages.

Formed a Higher Low (HL), followed by a Higher High (HH), confirming an uptrend.

Support from Trendline:

The ascending black trendline is supporting the price action, confirming bullish momentum.

Volume Analysis

Rising Volume: Recent bullish movements are backed by increasing volume, suggesting strong buying interest.

Strategy Suggestions

Long Position:

Entry: On a breakout above $38.69 with volume confirmation.

Targets: $44.75, $48.88, $53.00

Stop-loss: Below $34.84 or the $31.10 bearish line for safety.

Short Position:

Entry: Only if the price breaks below $31.10.

Targets: $30.97, $24.76, $19.57

Stop-loss: Above $34.84 to minimize risk