Neo Wave

BITCOIN...Possible future movementBitcoin is in the 4 wave of the fifth wave of the MAJOR 5th wave...As per Neo waves..4th is correcting and forming a Ending diagonal 4th leg..after which a major 5 violent move up will come..a Rocket move next year...lasting a year probably..So..makes sense to hold or buy on a dip...All the best

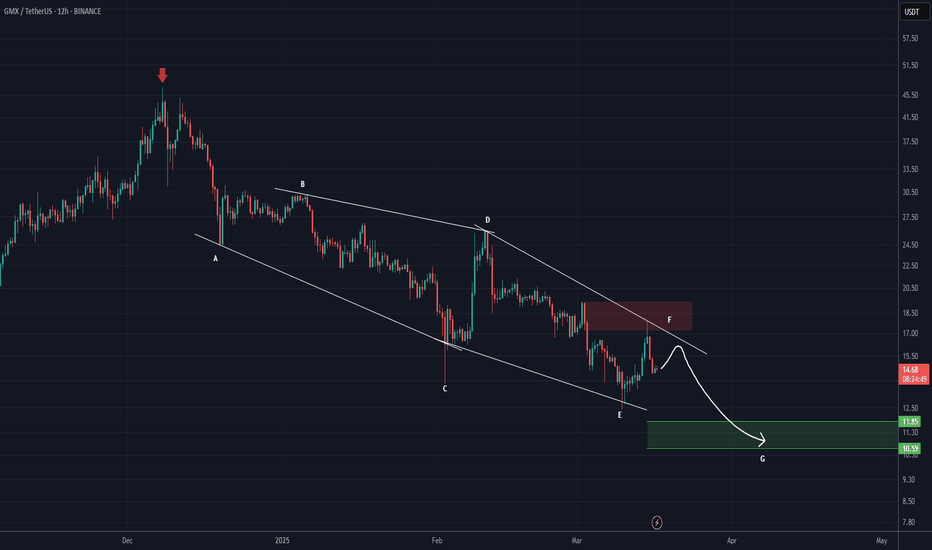

GMX is Still Bearish (12H)From the point where we placed a red arrow on the chart, it appears that GMX has entered a bearish diametric pattern.

It now seems that wave F is nearing completion.

The target is marked on the chart. it could be the green target box. If a daily candle closes above the upper red box, this analysis will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

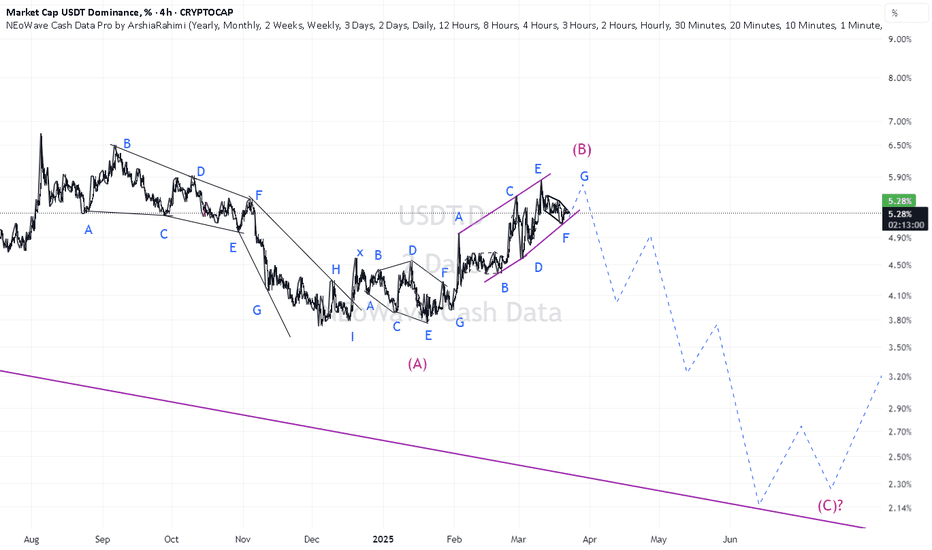

RED looks bearish (4H)From the point where we placed the red arrow on the chart, the RED correction has begun.

It seems to be inside an ABC structure, and we are currently in wave C, which is bearish.

A demand zone is visible on the chart, which could temporarily reject the price upward.

Since wave B did not retrace more than 0.618 of wave A, it is expected that the low of wave A will be taken out.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

RED New Update (4H)This analysis is an update of the analysis you see in the "Related publications" section

The previous analysis scenario has expired, and this update's scenario is valid.

Given the time correction of recent waves and the absence of sharp drops, this scenario for RED is valid, and buyers' footprints can be seen on the chart.

We expect a strong rejection to the upside from the green zone.

From the point where we placed the red arrow on the chart, it seems that RED's correction has started, which appears to be either a diametric or a triangle.

Wave C itself has formed a diametric, and it is expected to end in the green zone, leading to a bullish wave D.

The closure of a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

NEIROETH Looks Bullish (4H)The correction of NEIROETH started from the point where we placed the red arrow on the chart.

This correction appears to be a diametric pattern, and we are currently in wave f.

Wave g could complete in the green zone, leading to the start of a bullish wave.

The closure of a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

MKR Looks Bearish (1D)The correction of MKR seems to have started from the point marked START on the chart.

This correction appears to be a diametric pattern, and we are now in the late stages of wave F, which has been a bullish wave.

It is expected that from the red zone, wave G a bearish wave will begin.

The closure of a daily candle above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

MUBARAK sell/short setup (2H)Given the bearish CH in lower timeframes and the formation of a supply zone, a downward move is expected.

There is a liquidity pool and an order block at the bottom of the chart, and candles are expected to move downward toward this area soon.

The closure of a 4-hour candle above the invalidation level will invalidate this setup.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

DOGE New Update (3D)This analysis is an update of the analysis you see in the "Related publications" section

It seems to be forming a large diametric pattern. Currently, wave F is completing.

Wave F is a bearish wave.

Upon reaching the green zone, we expect the price to bounce upward.

A weekly candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

IMX looks bullish (12H)The IMX pair has hunted a strong origin of movement, which is the key factor behind our bullish outlook on this coin.

After the hunt, this strong origin broke the trigger line, forming a bullish CH on the chart. Now, as the price pulls back toward support zones, we are looking for buy/long positions.

The targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Ethereum vs. Bitcoin (3D)This analysis is an update of the analysis you see in the "Related publications" section

We have slightly updated the Demand zone.

Ethereum has reached a strong support zone compared to Bitcoin. From this green zone, we expect a bullish move towards the red zone. This indicates that in the coming weeks and months, Ethereum is likely to outperform Bitcoin.

These zones should not be ignored. Ignoring these high-timeframe support zones would be a critical mistake.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

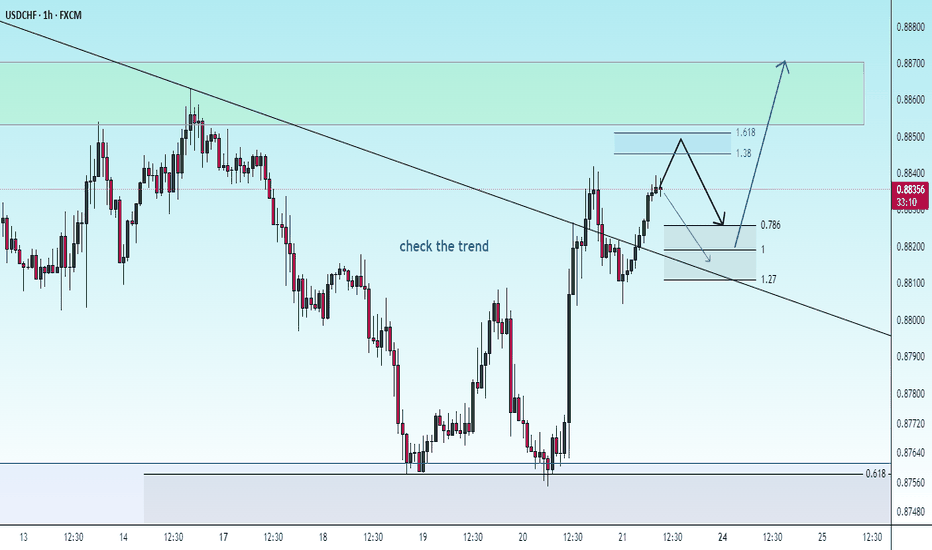

TUT ANALYSIS (1H)It seems that wave A has completed, and this token has entered wave B, which is bearish. The wave B structure appears to be symmetrical.

In the green zone, the price may sweep the liquidity pool and bounce upward.

Targets are marked on the chart. A 4-hour candle closing below the invalidation level will invalidate this analysis.

invalidation level: 0.015680$

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

BMT rebuy setup (4H)Given the momentum drop, lack of reaction to hourly support zones, and candlestick formation, it is recommended that if you're looking for a rebuy on BMT, you should wait for a setup in the demand zone at the lower part of the chart.

It seems we have a large triangle, with wave D likely to end in the green zone.

After buying, once you're 20% in profit, start scaling out gradually and break even.

A daily candle closing below the invalidation level will invalidate our buy outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

ICP Is Bearish For MidTerm (3D)On the chart, it appears that we have a large-degree ABC structure, where Wave B formed a triangle and has now completed.

Wave C should take more time than Wave A. Since Wave B has retraced 0.382% of Wave A, it is expected that Wave C will also be deep

We have marked the price and time boxes on the chart.

A daily candle closing above the invalidation level will invalidate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

SEI ANALYSIS (1D)SEI appears to be in the C leg of a corrective structure. The correction for this coin is not yet complete in terms of time and price. Wave C is a time-consuming wave, and it is expected to push the price down to the green zone. After reaching this area and accumulating orders, the price is likely to start its move in the form of Wave D.

The targets for the next wave are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You