Mapping the Next Possible Move | Key Breakout and Demand ZonesGold (XAUUSD) is currently consolidating between key structural zones, showing a balanced tug-of-war between buyers and sellers. The 4025 area remains the short-term resistance to watch — a clean break and close above this level could confirm bullish continuation toward 4075 and the major supply zone around 4150.

On the other hand, failure to sustain above 4025 may trigger a short-term pullback. The 3925–3960 zone has acted as a strong demand area where buyers have consistently stepped in, making it a crucial support for potential bullish rejections and trend continuation.

At this stage, the next possible move will likely depend on how price reacts around these two major zones:

Bullish scenario: Break and retest above 4025 → potential rally toward 4150.

Bearish scenario: Rejection at 4025 → possible correction toward 3925 demand.

Overall sentiment remains neutral-to-bullish as long as price holds above the demand area. Watching for a confirmed breakout or clear rejection structure before taking directional trades is key.

Nextmove

EURCHF Bullish Wait for a bullish confirmation around the FVG zone (0.9335–0.9340) or the OB This could include:

A bullish candle formation like a bullish engulfing candle or a pin bar.

A break of structure: Look for a shift from lower lows and lower highs to higher highs and higher lows, which signals the market is starting to form an uptrend.

Order block confirmation: If the price moves into the yellow order block (OB) and reacts with bullish price action, that can be another signal to go long.

NEXT: big move in the makingNEXT: recent trend change from down ward to up in combination with increased volumes and positive corporate developments - closest target at $0.93C.

*** Graphite - as every mining corporation/ governments are chasing new graphite projects and and industrial corporations are trying to secure enough graphite "ex-china" to continue their normal operations - NEXT already is producing and recently got its first graphite supply contract, also NEXT has capacity to rapidly increase production and get more contracts.

*** Graphite is needed almost everywhere - from Nuclear plants to tanks, plains and electric cars and with 700%+ tariffs on Chinese graphite are coming by Dec/2025 - most of the western world will be under supplied by a minimum of 30% for at least next 5 yrs+. Perfect Cash Storm for NEXT is in the making.

Closest price test for NEXT is $0.93 (probably will break it with ease) - 2nd stop - $1.78 - also possibility of FOMO run in Dec/2025(once tariffs finalized) that could drive NEXT to test $4.85 by end of FEB/2026.

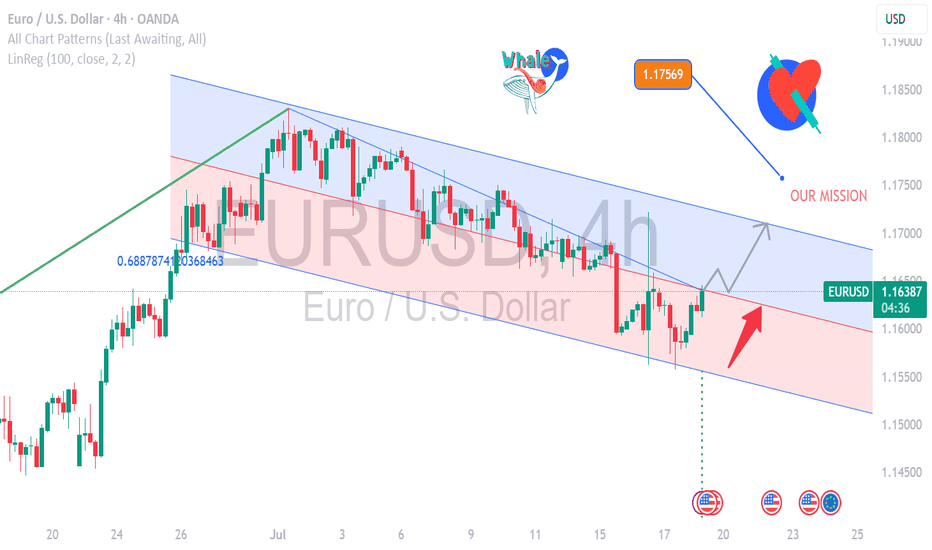

EUR/USD Flexing Strength- Is the Next Big Coming? EUR/USD Market Update – Bullish Setup at 1.16440

EUR/USD is trading around 1.16440, maintaining its bullish momentum in the current uptrend.

🔹 Current Price: 1.16440

🔹 Support Zone: 1.1600 – 1.1620

🔹 Resistance Zone: 1.1680 – 1.1700

🔹 Trend: Strong bullish structure with clear upward momentum

The pair is holding above key support and aiming for the next resistance at 1.1700. A breakout above this level could open the door to further upside. Traders watching for a retest near support or breakout entry above resistance.

🎯 Trading Plan:

Buy on dips above 1.1620 or wait for a confirmed breakout above 1.1680 with volume.

#EURUSD #ForexAnalysis #BullishSetup #ResistanceSupport #TechnicalAnalysis #PriceAction #TrendTrading #SmartTrader #FXSignals

BTC next boom beginning I'm going to see boom in btc

Here’s the analysis of Bitcoin’s (BTC) next expected move in English, based on current market conditions and technical indicators:

---

### **1. Short-Term Outlook (Next 24-48 Hours)**

- Bitcoin is currently trading around **$107,400**, with **$108,000-$109,000** acting as a strong resistance zone.

- If BTC breaks above **$109,870** and closes above it, the next target could be **$114,950**.

- If the price fails to break resistance, a pullback to **$105,300** or **$103,900** (support levels) is possible.

- The **30-minute RSI is at 52.22** (neutral-bullish), and the MACD histogram is in positive territory.

---

### **2. Medium-Term Outlook (1 Week to 1 Month)**

- **Coincodex predicts**:

- **$116,914** (+8.98%) by July 2025.

- **$136,858** in the next 3 months.

- **DigitalCoinPrice forecasts**:

- Average price of **$221,961** by late 2025, with a potential high of **$235,354**.

---

### **3. Key Technical Indicators**

- **4-Hour Chart**:

- BTC is testing the **upper Bollinger Band ($108,672)**. A breakout could target **$114,956**.

- **Support Levels**:

- Immediate support: **$105,358** (EMA 100).

- Strong support: **$103,996**.

---

### **4. Market Sentiment**

- The **Fear & Greed Index** is currently at **74 (Greed)**, indicating bullish sentiment but also potential overbought conditions.

- **Volume**: Stable buying volume suggests sustained interest, but a drop could signal consolidation.

---

### **5. Potential Scenarios**

- **Bullish Case**: Break above **$109,870** → Rally toward **$114,950-$116,000**.

- **Bearish Case**: Rejection at resistance → Drop to **$105,300-$103,900**.

NEXT LEVELSnext move ahead for Bitcoin

Bitcoin Could Reach $140,000 in the Coming Months

Market analysts and crypto enthusiasts are increasingly confident that Bitcoin is on track to reach new highs. After strong institutional adoption, growing interest from retail investors, and the impact of recent halving events, many experts believe Bitcoin could surge to $140,000 in the coming months.

Macroeconomic factors like inflation concerns, limited BTC supply, and a weakening dollar are all contributing to the bullish momentum. If current trends continue, a breakout toward the $140K level is not just possible—it’s becoming more likely.

Stay informed, stay strategic, and get ready for what could be a historic move in the world of crypto.

GBP/USD - Outlook Update.We caught a nice trade of 555Pips yesterday. We are now making HH's and expecting to make a Bullish break out of this Liquidity Trend.

1H View Only

Before this happens I expect us to be oversold currently and Id be looking for sellers to come in to mitigate the recent Imbalance towards the next Demand zone of which I will either hold my sell or look to buy long term

Please feel free to follow my trade setups along this journey

What Gold is exactly want to tell us ? Gold is making lower high in short term therefore we are looking 2038-40 range to sell. Meanwhile long term trend is bullish.

The expected trading range for current week is between 2007.00 support and 2045.00 resistance.

Open:

2024.000

Close:

2016.810

High:

2029.150

Low:

2019.370