Review and plan for 11th August 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

NIFTY

Nifty Analysis EOD – August 8, 2025 – Friday🟢 Nifty Analysis EOD – August 8, 2025 – Friday 🔴

From Yesterday’s Glory to Today’s Gloom — Bulls Knocked Off the Board

Today’s market was a textbook case of how quickly momentum can flip. Yesterday’s 289-point bullish surge was completely erased, with Nifty ending deep in the red and closing at the day’s low. Sellers clearly had the upper hand, leaving little room for bulls to breathe.

🗞 Nifty Summary

Friday opened with a 65-point gap-down — right below the crucial 24,580 support zone — and that level instantly showed rejection.

In the first 45 minutes, Nifty slipped 150 points from the day high and 200 points from the previous day high. The key Fibonacci retracement level from yesterday’s range — 24,406 ~ 24,412 — played the role of intraday savior multiple times, offering support and holding the market within a narrow zone for most of the day.

However, the bulls’ defense cracked after 3:00 PM. The support broke, triggering a sharp slide below 24,380 and even the Previous Day Low (PDL).

The upside was capped by 24,470 ~ 24,460, while 24,406 ~ 24,412 remained the battleground for most of the day until the breakdown.

In a single session, yesterday’s dramatic 289-point recovery rally was completely erased — with Nifty closing at the bottom of the PDL and CDL.

Today’s close is now below the low of 12th May, marking a 64-session (88-day) low.

Now the question for Monday: will bearish momentum extend, or will some positive news bring bulls back into play?

🛡 5 Min Intraday Chart with Levels

Intraday Walk

🔻 Gap-down open below major support at 24580.

⏳ First 45 minutes: Steep drop of 150 points from the day high.

🛡️ Fib support at 24406–24412 holds multiple times… until the late break.

🔻 Post 3 PM: Support collapse leads to fresh lows below PDL.

📉 Close near day’s low — erasing yesterday’s bullish rally.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,544.25

High: 24,585.50

Low: 24,337.50

Close: 24,363.30

Change: −232.85 (−0.95%)

Structure:

Real Body: 180.95 pts (Red Candle — Close < Open)

Upper Wick: 41.25 pts

Lower Wick: 25.80 pts

Interpretation:

Strong bearish sentiment — sellers maintained control from open to close.

Very small lower wick — indicates conviction from sellers in closing near the low.

Wiped out prior day’s gains — buyers have lost the short-term edge.

Candle Type:

Bearish Marubozu (near-full body) — signals decisive selling pressure, often a continuation pattern after weakness.

🛡 5 Min Intraday Chart

🥷 Gladiator Strategy Update

ATR: 210.45

IB Range: 134.05 → Medium

Market Structure: Balanced

Trade Summary:

10:35 AM – Short Entry → SL Hit

📌 What’s Next? / Bias Direction

Below 24,400: Bearish momentum likely to extend toward 24,250–24,200.

Above 24,470: Only a strong reclaim can shift bias back to neutral.

Gap-down/weak open on Monday may accelerate selling; bounce attempts will face resistance at 24,400–24,470.

🔍 Support & Resistance Levels

Resistance Zones:

24,406 ~ 24,412

24,460 ~ 24,470

24,500

24,580

Support Zones:

24,315

24,280

24,240 ~ 24,225

24,185

💬 Final Thoughts

"Markets don’t turn on hope — they turn on price. Respect the levels, and let price lead the story."

Bulls had the glory on Thursday, but Friday flipped the script completely. The market now sits at a multi-month low — momentum favors bears, but Monday’s open will decide if we see follow-through selling or a sharp dead-cat bounce.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty 50's Elliott Wave Analysis & Price ProjectionHey, so let's take a look at this chart of the Nifty 50. where the market might be heading. Just a heads-up, this is all for learning, not for making actual financial decisions. Think of it more like a potential roadmap than a guaranteed outcome.

From what I can see, the chart is laying out a classic five-wave pattern.

* Wave 1: The first big push up was in the latter half of 2022 into early 2023. It was the start of the uptrend.

* Wave 2: After that, the market pulled back a bit—a healthy correction, really—in the middle of 2023. It didn't drop below the starting point of the first wave, which is exactly what you'd expect.

* Wave 3: This was the huge run-up that we saw from mid-2023 all the way into early 2024. That's typically the strongest and longest part of the move. The chart marks it with a "(b)" which suggests it's part of a bigger picture, but for now, we can see it as the big third wave.

* Wave 4: Now, we're in the middle of a correction, a kind of zigzag, that started after that massive run-up. The chart shows it finding a bottom around mid-2025. It's like the market is taking a breather before the final push.

* Wave 5: And this is where it gets interesting. The chart is forecasting the final leg up, starting from this mid-2025 low. It's suggesting we could see a big rally, with the Nifty potentially hitting targets around 28,000 and even above 30,000 by late 2026 or 2027.

Basically, the chart is saying we've gone up, corrected, gone up big, and now we're in a smaller correction, getting ready for one last big move to the upside.

Again, this is just one way of looking at the market. No one has a crystal ball, and a ton of other things—like news, company earnings, and what's happening around the world—could change this forecast completely. So, always do your own homework and talk to a pro before you invest your hard-earned money.

This forecast report is for educational purposes only and should not be considered financial advice. Market analysis, especially projections based on technical indicators like Elliott Wave theory, is speculative and does not guarantee future results. Always conduct your own research and consult with a financial professional before making any investment decisions.

important Fibonacci retracement level approaching for NiftyVery important fibonacci retracement level for Nifty is arriving with ever increasing Trump tantrum and Indian defiance to toe US and EU line on Russian Crude and other trade practises. Market looks delicately placed at this juncture as investors fear that action from the West would undermine Indian growth story. The current fall can be utilized for shifting the balance of the portfolio towards goods that will be 100% made in India and will be consumed in India. For long term investors the current fall can be used to accumulate long term investment ideas with a horizon of 2 to 3 years.

Supports for Nifty remain at: 24438 (Important Fibonacci support), 24190 (Father line support, closing below this will enable bears to pull down Nifty towards next supports), 23832 (Next Fibonacci support), 23045 (Major Fibonacci support).

Resistance for Nifty remain at: 24896 (Mother Line Support), 25231 (Next Fibonacci resistance. A closing above this level will enable bulls to pull Nifty towards next trend line resistance), 25666 (Next Trend line resistance).

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

SETUP- PLAN FOR 8TH AUGUST 2025 Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Nifty Analysis EOD – August 7, 2025 – Thursday🟢 Nifty Analysis EOD – August 7, 2025 – Thursday 🔴

A Trap, a Reversal, and a Breathless Rally — Did You Catch It?

🗞 Nifty Summary

Today was expected to be volatile, but few were prepared for how wildly Nifty behaved.

After a gap-down of 110 points on the back of negative global cues, Nifty immediately started filling the gap and reached the Previous Day Low (PDL). However, strong rejection at PDL sent prices tumbling — slicing below the Open, IB Low, and even the Current Day Low, marking a sharp low at 24,387.

Then came the bear trap.

A brief breakdown to 24,344.15 looked like a breakdown, but instead triggered a sharp liquidity grab, launching a vertical move upward. From that bottom, Nifty surged in a breathtaking rally — not a single 5-min candle broke its previous candle’s low, signaling relentless buying. Almost every resistance zone — Swing High, VWAP, PDL/S1, CPR, Weekly Low — got taken out in one single breath.

Did you ride it?

Honestly — I didn’t. I was frozen watching this dramatic reversal unfold.

Still, today’s super recovery puts the index back within its known range. Now, bulls need a close above 24,660–24,675 to confirm momentum.

📉 Intraday 5 Min Chart Overview

🧭 Intraday Price Action Flow

9:15 AM: Opens 110 points down at 24,467.10

9:15–10:30 AM: Recovers swiftly to PDL, but fails there.

10:25 AM – 11:05 PM: Sharp fall — breaches CDL & IB Low → makes new day low at 24,387

1:20 PM Onwards: Attempts consolidation; false breakdown at 24,344.15

2:00 PM – 3:30 PM: Monster rally → No candle breaks prior low; bulls dominate to close at 24,626.65

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,464.20

High: 24,634.20

Low: 24,344.15

Close: 24,596.15

Change: +21.95 (+0.09%)

🔍 Candle Structure:

Real Body: Green → +131.95 pts

Upper Wick: 38.05 pts

Lower Wick: 120.05 pts

🧠 Interpretation:

Strong rejection from intraday lows near 24,344

Long lower wick shows dip buying strength

Closed near the highs = bulls dominated the end

Still within larger range → needs breakout above 24,675 for follow-through

🔥 Candle Type:

A bullish recovery candle, hammer-like, but within a sideways structure — shows aggressive buying near important demand zone (24,340–24,380).

📈 Updated Short-Term View – 7th August 2025

Support Zone: 24,340 – 24,380

Resistance Zone: 24,620 – 24,675

Bias: Neutral with a bullish tilt, unless 24,340 breaks decisively.

🎯 Trading Insight

A close above 24,660–24,675 may lead to further upside — possibly testing 24,735–24,780

Failure to hold above 24,460 will shift bias back to bearish

🛡 5 Min Intraday Chart

🥷 Gladiator Strategy Update

ATR: 205.09

IB Range: 82.85 → Medium

Market Structure: ImBalanced

⚔️ Trade Summary:

🕙 10:25 AM – Short Entry → Trail SL Hit (R:R = 1:1.8)

🧱 Support & Resistance Levels

🔼 Resistance Zones:

24,620

24,660 ~ 24,675

24,725 ~ 24,735

24,780 ~ 24,795

24,860 ~ 24,880

🔽 Support Zones:

24,542 ~ 24,535

24,500

24,470 ~ 24,460

24,380 ~ 24,344

💬 Final Thoughts

"Markets reward patience and punish rigidity."

Today was a masterclass in trap-reversal-breakout structure. While many were either trapped or missed the move, this type of price action reminds us — be ready, but never rigid.

Now all eyes on 24,675 — can bulls push above it and sustain?

✏️ Disclaimer:

This analysis reflects personal views and is not trading advice. Please consult your financial advisor before making decisions.

Intraday set up for 7th August 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Nifty Analysis EOD – August 4, 2025 – Monday🟢 Nifty Analysis EOD – August 4, 2025 – Monday 🔴

A Monday full of mind games.

Nifty opened with a slight positive gap and immediately tested the TC of CPR, but that optimism didn’t last long — sharp rejection took it to day’s low (24,554). What followed was a rollercoaster: a 100-point recovery, a 50-point pullback — all within 10 minutes. This wild price action defined the rest of the day.

Throughout the session, Nifty remained trapped within the CPR zone. Both sides experienced multiple fakeouts, especially around initial balance (IB) zones. Even when prices nudged toward R1, repeated failed attempts to break above reflected the market’s indecisiveness. The day finally closed near the high, but conviction was still lacking.

Many option buyers likely struggled due to deceptive shadows and unexpected fractal breakouts. The entire price action stayed within Friday’s range — forming an Inside Bar structure on the daily chart. This suggests a potential range breakout trade tomorrow.

The market faced resistance near the Fibonacci 0.618–0.786 retracement of the prior fall — aligning with 24,740–24,780 zones. A close above 24,780 tomorrow could shift momentum back in the bulls’ favour. If not, bears still hold the upper ground.

📈 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

📊 Daily Candle Breakdown

Open: 24,596.05

High: 24,736.25

Low: 24,554.00

Close: 24,722.75

Change: +157.40 (+0.64%)

Candle Type:

🟢 Bullish Marubozu-like — reflects a strong control by buyers after early weakness.

Structure Breakdown:

Real Body: 126.70 pts (Bullish)

Upper Wick: 13.50 pts (Minor resistance near close)

Lower Wick: 42.05 pts (Early dip got bought aggressively)

Key Insight:

Closed near the high of the day — positive bias for tomorrow

Inside Bar formed – Expect a breakout trade

24,780+ closing will turn sentiment bullish

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 209.36

IB Range: 115.95 → Medium

Market Structure: Balanced

Trade Summary:

🕚 11:30 AM – Long Entry → SL Hit

🕛 12:30 PM – Long Entry → SL Hit

🕐 13:10 PM – Short Entry → SL Hit

Tough day — strategy got chopped in noise-heavy moves.

🔍 Support & Resistance Levels

Resistance Zones:

24,725 ~ 24,735

24,780 ~ 24,795

24,860 ~ 24,880

Support Zones:

24,675 ~ 24,660

24,620

24,542 ~ 24,535

24,500

24,470 ~ 24,460

💭 Final Thoughts

"Markets love to test your patience before they reward your conviction."

Today was a lesson in restraint — avoid overtrading when structure lacks clarity. Inside bar gives us a clean slate for tomorrow. Let price lead.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Review and Intraday set up for 5th August 2025Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Good comeback candle by Nifty today. Nifty fought back against the Tariff odds today and gained 157.4 points. The combination of Friday's candle and today's candle are forming a Bullish Harami kind of pattern. Harami in Japanese means pregnant woman. Usually this is a Bullish pattern but it requires a follow up positive candle in its support. So if we get a positive candle tomorrow then we can consider Friday's low as a good temporary support.

Supports for Nifty currently remain at: 24482 (Important Trend line resistance), 24317, 24186 (Father line support on daily chart), The zone between 23932 (final support, below this level Bears can take total control of the index).

Resistances for Nifty currently remain at: 24802, 24906 (Mother line resistance on daily chart), 25007, 25249-25346 (Important trend line resistance zone, a closing above 25346 will give control of the index to Bulls).

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

renderwithme | Nifty 50 Under Preasure#Current Market Snapshot

Index Value: As of July 31, 2025, the Nifty 50 closed at approximately 24,565.35 INR, down 0.82% in the past 24 hours.

Recent Performance: Weekly: Down 1.78%.

Monthly: Down 4.00%.

Yearly: Down 1.86%.

Historical Context: The index hit its all-time high of 26,277.35 INR on September 27, 2024, but has since faced downward pressure.

#Technical Analysis

Trend: The Nifty 50 is currently in a bearish phase, with a five-week losing streak, the longest in two years, as over 35 of its constituent stocks posted losses.

The index is trading within a descending channel, with support around 24,475 and resistance at 25,925. A break above 25,925 could signal upside momentum toward, while a drop below 24,400 may indicate further weakness.

Key Indicators:Moving Averages: Mixed signals—30-minute charts show a "Strong Buy," while daily charts indicate a "Strong Sell." Weekly and monthly charts lean toward "Buy."

RSI (Relative Strength Index): Likely in the neutral-to-bearish zone (exact value unavailable), suggesting no extreme overbought or oversold conditions.

Support/Resistance:

Support at 24,475; resistance at 24,925–25,900. A sustained move above 25,000 is critical for bullish sentiment.

#Fundamental Factors

Market Sentiment: Heavy foreign institutional investor (FII) outflows (₹25,000 crore over eight sessions) have pressured the index, though domestic institutional investors (DIIs) have countered with net buying (e.g., ₹6,372.71 crore on a recent session).

Sectors like pharma, textiles, auto components, and electronics faced selling pressure due to trade concerns, particularly U.S. tariff fears under President Trump.

Earnings Impact: Strong Q1 earnings from companies like Mahindra & Mahindra and Tata Steel provided some support, but weak global cues and sector-specific challenges (e.g., pharma with Sun Pharmaceutical’s 5% drop) weighed on the index.

Global Context: The U.S. Federal Reserve’s decision to hold interest rates steady, with no rate cut expected in September, adds uncertainty. Asian markets are also cautious due to trade tensions.

Sectoral PerformanceWeak Sectors: Metals, Oil & Gas, Technology, Pharma, and Textiles saw significant losses.

Resilient Stocks: Stocks like Mahindra & Mahindra and Tata Steel showed strength amid the downturn.

Nifty Constituents: The index includes blue-chip companies like HDFC Bank, ICICI Bank, Reliance Industries, and Tata Motors, which are critical to its movement.

Trading Strategy

Sell on Weakness: Sell below 24,600 with targets at 24,510, 24,380, and 24,150 (stop-loss: 24,860).

Long-Term: The current dip offers attractive valuations for quality investments. A buy-on-dips strategy is recommended if the index holds above 24,475, with potential for a rally toward 26,000 if it sustains above 25,250.

Risk Management: High volatility (India VIX noted in broader market context) and FII outflows warrant caution. Use stop-losses to mitigate risks.

Key RisksGlobal Trade Tensions: U.S. tariffs and geopolitical concerns could continue to drive FII outflows.

Volatility: Persistent sectoral pressure and global economic uncertainty may lead to further downside.

Rupee Movement: The Indian rupee’s recent gain (10 paise to 87.53) provides some stability, but currency fluctuations could impact foreign investment.

Derivatives: Nifty 50 futures and options (e.g., HDFC Bank Options, ICICI Bank Futures) are active, but high risk.

Mutual Funds: Consider funds like ICICI Prudential India Opportunities Fund or Parag Parikh Flexi Cap Fund for diversified exposure.

ConclusionThe Nifty 50 is under pressure due to FII outflows, sectoral challenges, and global uncertainties, with a bearish short-term outlook. However, domestic demand and strong earnings from select companies provide some resilience. Traders should monitor key levels (24,475 support, 25,925 resistance) and adopt a cautious approach with strict risk management. Long-term investors may find current valuations appealing for selective buying, particularly if the index stabilizes above 25,000.For real-time updates, track the Nifty 50on renderwithme page

~~ Disclaimer ~~

This analysis is based on recent technical data and market sentiment from web sources. It is for informational \ educational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

# Boost and comment will be highly appreciated.

Reverse cup and Handle kind of structure formed in NiftyIn the short term time frame Nifty is seen to be forming reverse cup and handle kind of structure this is considered very bearish structure. However for this bear fest to manifest Nifty needs to close below 24543 or 24417. These 2 levels can save Nifty if not we will see it going into the bear grip.

Thus the most important supports for Nifty remain at 24543 and 24417. Below this level the supports for Nifty will be at 24248, 23989, 23789 and finally major support are is near 23442.

Important resistance areas for Nifty remain at 24652, 24821 (Mother Line Resistance), 24935, 25011 (Father Line Resistance), 25101 and finally 25249. Above 25249 Bulls can become very active.

Till the trade deal chess board and Tariffs do not relent or there is some other very important positive news Nifty will remain under pressure. Let us hope that 24253 or 24417 save us. Long term outlook on Nifty still remains positive. Long term investors should look at the tariff related event as a news that will slowly subside and give way to the Bullish outlook which has been prevailing in the market for decades all together.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

From Demand to Glory: Nifty’s Bullish March to 25,220 Nifty Bullish Outlook

-Current Price: 24,905 (approx)

- Key Demand Zone: 24,620 – 24,660

- Key Supply Zone: 25,200 – 25,240

Technical View

- Strong Demand Bounce: Nifty reversed sharply from the demand zone (24,620–24,660),

indicating strong buying interest.

- Trend Breakout Potential: Price is approaching resistance near 24,920; a breakout could push

towards the supply zone at 25,220 (target).

- Momentum Structure: Higher lows formed after the demand zone test, showing bullish

strength.

News & Data Supporting Bullish Bias

- India’s Q1 GDP Growth: The latest estimates show strong economic growth, supporting equity

market sentiment.

- FIIs Turning Buyers: Foreign Institutional Investors (FIIs) have been net buyers over the past

few sessions, supporting index upside.

- Global Market Tone: US and Asian equities are stable, and crude oil prices are moderating,

supporting risk appetite.

- RBI Policy Outlook: Market expects no immediate rate hikes, keeping liquidity positive for

equities.

Expectation

If Nifty sustains above 24,900, we expect a bullish move towards 25,220 in the short term.

Stop-loss: Below 24,780 (to manage risk).

Good turnaround by market as expected from the channel bottom.We had given a message that the market was nearing the bottom and there can be a turnaround sooner than later and market turned around today. This bounce can be currently seen as a technical bounce but it can become a full fledged fightback by bulls if it crosses key resistance levels of Mother line, Father line and Mid-channel resistance. These are the 3 key resistances in front of us currently. All eyes on the important trade deal announcements and with US and China which are on going any news on that from can disrupt the market proceedings in either way. Support and resistance levels for Nifty are as under:

Key Nifty Resistances: 24849 (Trend line resistance), 24922 (Motherline Resistance of hourly chart), 25028, 25070 (Father line resistance), 25189 (Mid-channel resistance), 25243 (Very important resistance for Bulls to conquer). Above 25243 Bulls can gain control of Nifty.

Key Support levels: 25741, 25627 (Channel bottom Support), 24519.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Review and plan for 30th July 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results- analysis.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Bollinger band indicates that we might see a recovery soon. Bollinger band in a beautiful tool of Technical analysis. There are three lines in it. The upper bandwidth line, the middle line and the lower band width line.

As you can see in the chart. Whenever the stock or an index price touches or crosses the upper line the indication it gives is that the market is overbought and there is an imminent selling pressure.

Middle line indicates either resistance or support depending on the position of the candle within the band. It further indicates that Middle line will be support when the price is above it. It also indicates that middle Bollinger band will be a resistnace when the candles are below it.

Lower bandwidth line indicates a support zone. When the candles touch or cross it the indication it gives is that the market is oversold and there can be an imminent up move once this phenomenon happens.

Bollinger band in like a channel or a parallel chanel but a more accurate one and a more asymmetric one.

Currently you can see in the chart that Bollinger band has not only touched but also crossed the bottom bandwidth. This is an indication of an over sold market. Thus the indications we get from this tool are that there are very high chances for a short covering recovery or relief rally.

The indication is in sync with Tariff deadline which is tomorrow. Thus any positive announcement on that front can also initiate a strong or mild recovery rally. Thus we might see a bottom formation and recovery rather sooner than later.

Current Nifty closing is at:24680.

Upper band width is at: 25683 (This zone will work as strong resistance zone).

Mid Bandwidth is at: 25217 (This zone will be a Strong resistance).

Mother Line: 24942 (Strong Resistance).

Lower band width is at: 24750 (Weak Resistance).

Nearby support: 24501 (Support).

Father Line: 24157 (Strong Support).

It is a good time to reshuffle your Portfolios and initiate fresh buying in the blue-chip stocks which might be available at a good valuation.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

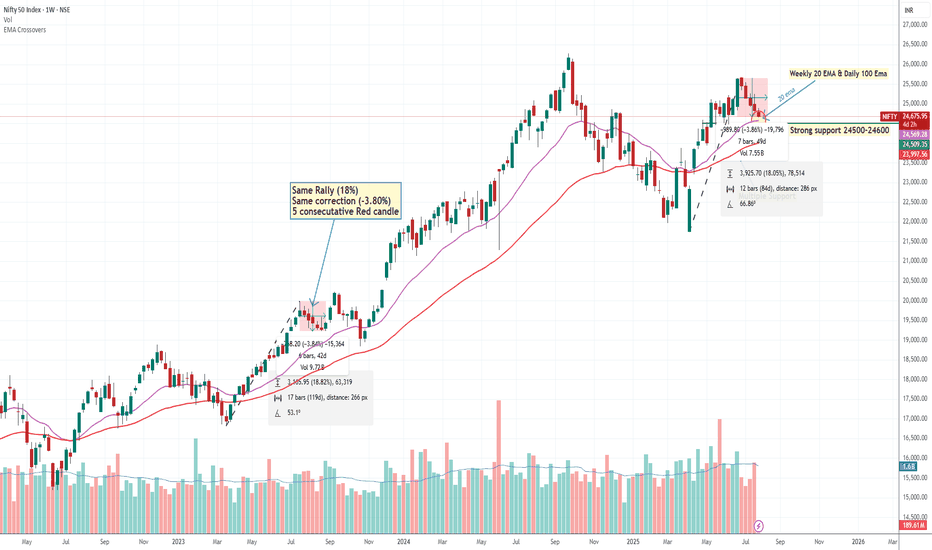

Nifty May Bouncing in Next Week We Are Expecting A bounce back from 24500-24600 level Why? let's Try to understand

(1) Nifty daily Chart 100 EMA

(2) Weekly Chart 200 EMA

(3) there is Multiple support testing around 24500 showing intuitional pending Order.

(4) Nifty bottom out with up move around 18 % & now We are seeing 5 Consecutive Falling

Weekly Candle same pattern happened in July 2023 when nifty Rallied around 18 % and there

was also correction around -3.80%.

(5) A 5-candle rule may apply (Means high possibility of bounce back or pullback if we got 5 consecutive candles either upside or downside)

This is pure technical analysis just based on market behaviour, pattern or historical data. not included any fundamental factor.

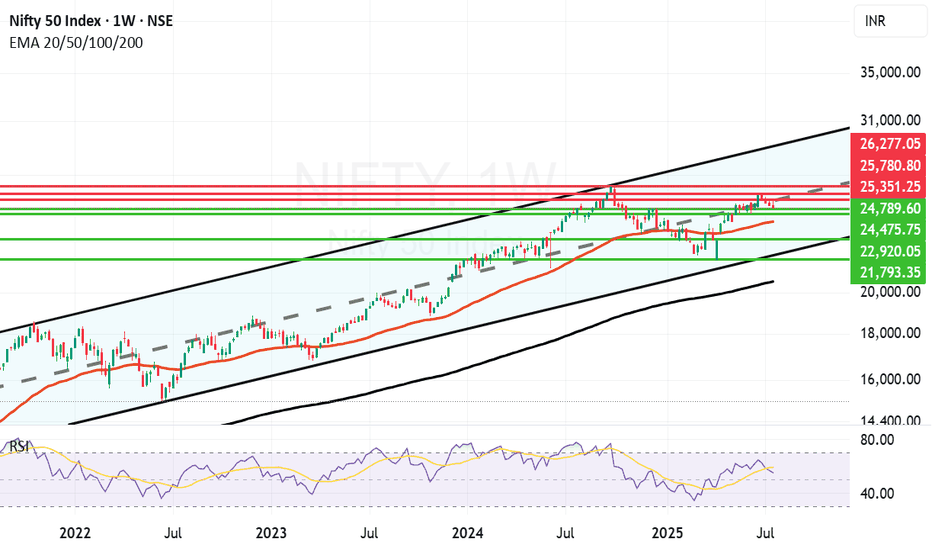

Long term Nifty Outlook Still upbeat. Long term outlook of Nifty is still upbeat. As you can see in the parallel channel in the weekly chart of Nifty. As you can see in the weekly chart Nifty attempted to break free above the Mid-Channel resistance went above it briefly but due to various geopolitical, Tariff and earning related concerns has not yet been successful. In a few years time the channel top can be around 30K and channel bottom seems to be around 21K. Supports for Nifty currently are near 24789, 24475, 23969 (Mother Line support of Weekly chart), 22920 and 21793 (Channel Bottom.) Below that 200 Weeks EMA ot the Father line is at 20577. Resistances for Nifty with long term perspective remain at 25351, 25780 and previous All time high of 26277. Once we get a weekly or monthly closing above 26277 the doors towards 27K+ will open.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

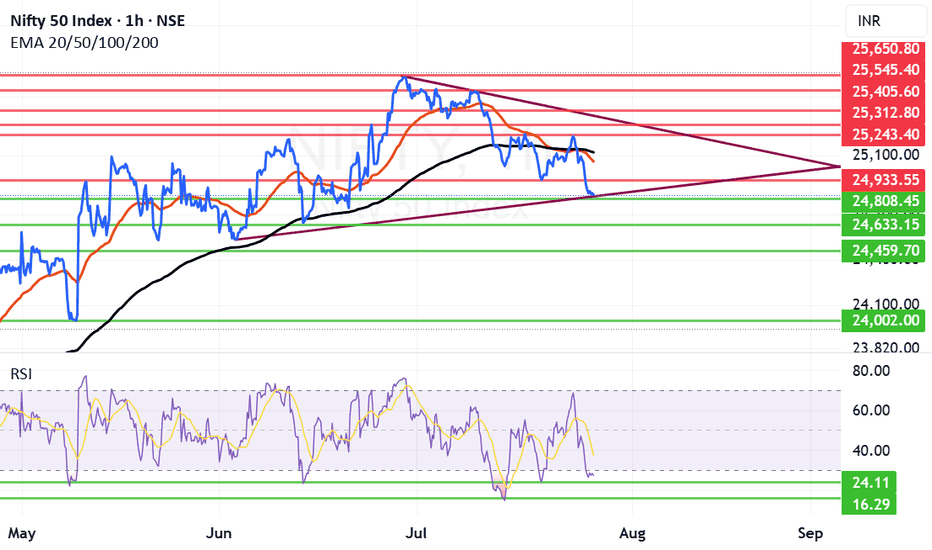

Nifty Next Week: Can Nifty make a comeback after drubbing?Nifty received proper drubbing after falling below critical supports of Mother and Father line. Trump's warning signals for IT companies and the continuing deadlock in Trade deal with US weighing on Indian markets. Additionally the earning season also giving many disappointing and few good result has broken the back of the Bull rally and now Nifty is reeling under 25K levels.

Only silver line in the cloud seems to be that RSI is below 30. Currently RSI is at 27.52. Usually RSI has found support near 24 if not 24 it might bounce back from 16. So hopefully we can see some short covering in the beginning or middle of next week. Also next week the decision for Tariffs should come. If the result will be in favour of India we might see a strong come back as lot of sectors / Large cap stocks currently are looking oversold.

The Supports for Nifty Remain at: 24808 (Strong support), 24633, 24459 Below 24459 the index will be in firm grip of Bears who might try to drag Nifty towards 24K levels or even below that in unlikely circumstances.

The Resistances for Nifty Remain at: 24933, 25058 (Mother Line Resistance of Daily Chart), 25119 (Father Line Resistance) and 25243. After we get a closing above 25243 the Bulls can gain some momentum.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Review and plan for 25th July 2025Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

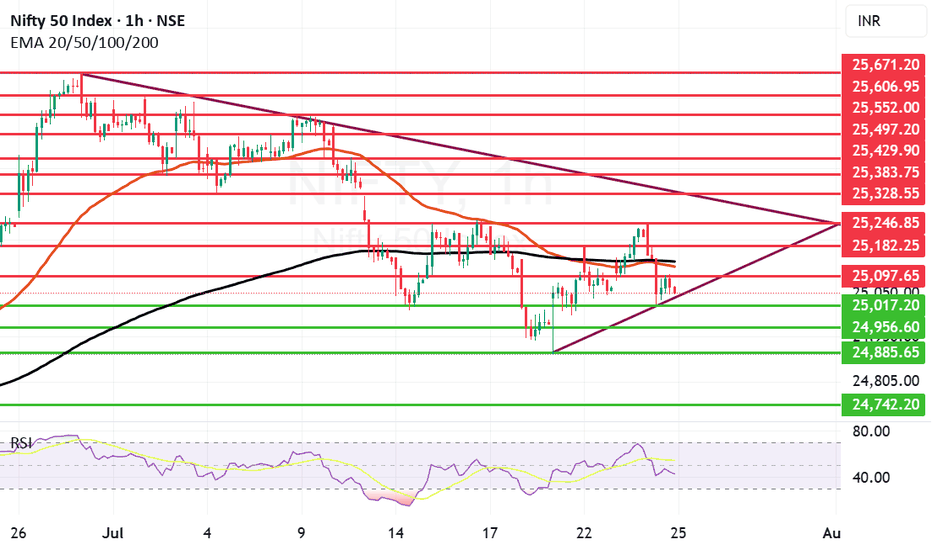

Nifty falls again as it can not sustain above 25240 level. Nifty again has shown some weakness as it was not able to sustain levels above 25240. The fall was lead by IT index which ended with deep cuts and fell 2.12% the other indices that saw fall were FMCG, Realty and Small Cap index. Trump's stance against Tech companies hiring from India and the deadlock in the trade deal also contributed to fall today. Index fell 157.8 points today and ended below both Mother and line on hourly chart. In the daily chart the candle we saw today was a bearish engulfing candle so further weakness can not be ruled out. The 2 major supports for nifty remain at 25017 and 24956 if these two supports are broken we may see Nifty falling towards 24885 or even 24742. Resistances for Nifty remain at 25097, 25138, 25182 and 25246. Only after we get a closing above 25246 we can see Nifty rally upwards.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.