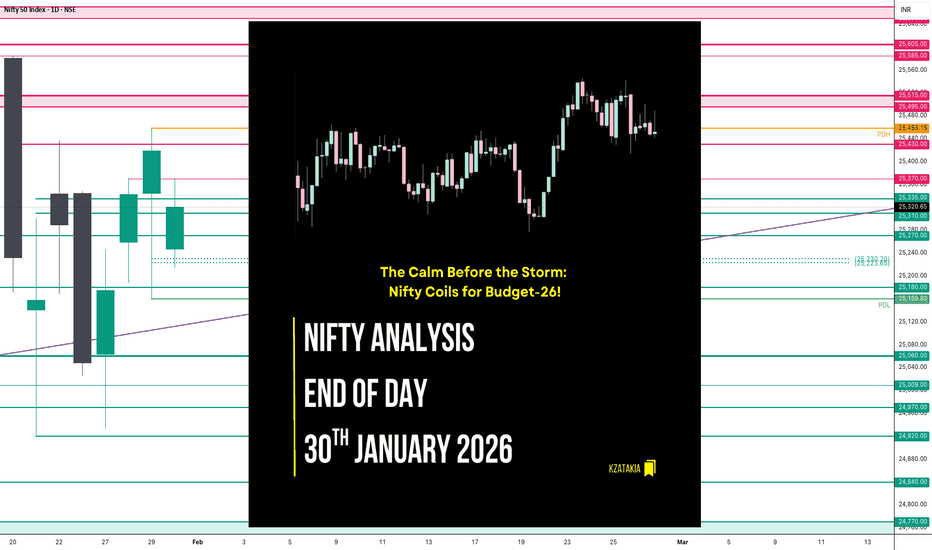

Nifty Analysis EOD – January 30, 2026 – Friday🟢 Nifty Analysis EOD – January 30, 2026 – Friday 🔴

The Calm Before the Storm: Nifty Coils for Budget-26!

🗞 Nifty Summary

As predicted, Friday was a “silent” consolidation session characterized by narrow range-bound movement and pre-event manipulation.

The day started with an unexpected 150-point Gap Down that tested our second support at 25,270. Nifty found its footing at the Fib 0.786 level, which acted as a rock-solid floor throughout the day.

A late-session attempt to break the IBH and the Long-Term Trendline at 1:50 PM briefly crossed the 25,335 mark, but the momentum faded precisely at the Fib 0.618 retracement level.

Nifty eventually closed at 25,320.65 (-0.39%), positioning itself exactly in the center of a high-stakes 700-point battlefield.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The session was a classic “wait-and-watch” game.

The 157-point range—significantly lower than the Gladiator average of 260—confirms that institutional players are sitting on the sidelines ahead of Sunday’s Budget.

While the intraday volatility offered some scalp opportunities, the false IBH breakout served as a trap for those over-anticipating the move.

The market is now balanced on a knife-edge, with the daily close sitting equidistant from major targets on both sides.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,247.55

High: 25,370.70

Low: 25,213.65

Close: 25,320.65

Change: -98.25 (-0.39%)

🏗️ Structure Breakdown

Type: Small Bullish Candle according CDO (Bearish according to PDC)

Range: ≈ 157 points — significantly compressed volatility.

Body: ≈ 73 points — mild selling pressure from the gap-up rejection. (Same size of Previous day)

Upper Wick: ≈ 123 points — strong supply rejection from the 25,370 zone.

Lower Wick: ≈ 34 points — limited buying interest at the extreme lows.

📚 Interpretation

The candle structure is the definition of indecision. The long upper wick proves that sellers are still capping any pre-emptive rallies, while the narrow body reflects a lack of directional conviction. The market has effectively “coiled,” and this compression usually leads to a violent expansion once the Budget news hits the tape.

🕯 Candle Type

Bearish Rejection / Consolidation Candle — Signals a standoff; the Budget session will be the ultimate tie-breaker for this structure.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 254.37

IB Range: 104..20 → Medium

Market Structure: Balanced

Trade Highlights:

12:23 Long Trade: SL Hit (Mistake: Assumed HTF break based on STF trend; recency bias).

13:54 Long Trade: Trailing Hit (1:0.76) (HTF Trendline Breakout).

Psychology Note: As explicitly mentioned in yesterday’s note, today was intended to be a “No-Trade” day due to expected pre-event consolidation. However, greed and recency bias triggered entries in a non-conducive environment.

The market punished the mistake, providing a stern reminder that discipline is more important than catching every tick.

🧱 Support & Resistance Levels

Resistance Zones:

25,370

25,430 ~ 25,460

25,515

25585 ~ 25605

25650 ~ 25,670

Support Zones:

25180 ~ 25160

25,060

25009

24970 ~ 24920

🧠 Final Thoughts

🧠 Special Budget-26 Note :

The Nifty has closed at 25,320, which is exactly the center point between the 25,670 resistance and the 24,970 support (350 points each way).

For the Budget day, it is highly probable that Nifty will test at least one of these extremes.

A sustained breach of the 25,160–25,460 range will be our “Prime Trade” signal.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Niftyintradaylevels

Nifty Analysis EOD – January 28, 2026 – Wednesday🟢 Nifty Analysis EOD – January 28, 2026 – Wednesday 🔴

Resistance Shattered: Bulls Reclaim 25,335 as Budget-26 Volatility Ignites!

🗞 Nifty Summary

Building on yesterday’s bullish conviction, Nifty opened flat to positive and launched an immediate 146-point rally to breach the 25,310 ~ 25,335 resistance zone.

While the initial move was met with a sharp rejection that dragged the index back to test the PDC/PDH support, the bulls were far from finished.

After a series of fakeouts and a deep mid-day dip to 25,180, a late-session surge at 2:40 PM changed the game. A powerful, non-stop recovery cleared all intraday hurdles, successfully closing the index at 25,348.05. By finishing nearly at the day’s high and above the expected resistance, the bulls have set a strong technical foundation as the market gears up for the Budget-26 event on February 1st.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

Today was a high-octane session filled with “territorial traps.” The morning breakout above 25,335 trapped early momentum buyers before the sharp retracement.

The subsequent “base-building” phase saw multiple fake breakouts that tested traders’ patience. The turning point occurred in the final hour; the breach of the intraday trendline acted as a catalyst for a vertical short-covering rally.

This price action reflects a classic “shakeout” before a major trend continuation. With the swing range expanding, the volatility clearly signals that the market is positioning for the Big Event on Sunday.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,258.85

High: 25,372.10

Low: 25,187.65

Close: 25,342.75

Change: +167.35 (+0.66%)

🏗️ Structure Breakdown

Type: Bullish candle with healthy participation.

Range: ≈ 184 points — moderate to high intraday volatility.

Body: ≈ 84 points — healthy buying strength and strong close.

Upper Wick: ≈ 29 points — mild profit-booking observed near the day high.

Lower Wick: ≈ 71 points — aggressive buyer defense at the 25,188 level.

📚 Interpretation

The candle confirms a successful breakout from the recent consolidation. Opening near the lower end of the daily body and closing near the high indicates that buyers absorbed all intraday supply. The long lower wick proves that the 25,180 zone has now become a high-conviction demand floor.

🕯 Candle Type

Bullish Continuation Candle — Reflects sustained buying interest; the trend remains firmly positive with structural targets shifting higher.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 255.54

IB Range: 146.40 → Medium

Market Structure: ImBalanced

Trade Highlights:

10:37 Long Trade: Trailing SL Hit (R:R 1:0.89) (Trendline Breakout attempt).

12:24 Short Trade: Target Hit (R:R 1:1.42) (Trendline Breakdown).

13:45 Short Trade: SL Hit (Volatility whipsaw).

14:43 Long Trade: Target Hit (R:R 1:1.86) (Inverse H&S Pattern + Trendline Breakout).

Trade Summary: A high-action day for the strategy. While the morning was choppy, the 2:43 PM Long trade was the structural winner. By identifying the Inverse Head & Shoulders pattern combined with a trendline breakout, the system captured the massive final-hour rally that secured the day’s bullish close.

🧱 Support & Resistance Levels

Resistance Zones:

25,372

25,430

25,495

25,605

Support Zones:

25,270

25,190

25,180

25,060

🧠 Final Thoughts

“The bulls have captured the 25,335 gate.”

With Nifty closing above the critical resistance zone, the path of least resistance is now to the upside.

Barring any negative global surprises, we expect the bullish continuation to trigger a significant short-covering rally tomorrow, potentially targeting the 25,430 ~ 25,500 range.

The volatility is purely a precursor to the Budget-26 event.

Stay disciplined, follow the Initial Balance (IB) guidelines, and respect the levels.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 27, 2026 – Tuesday🟢 Nifty Analysis EOD – January 27, 2026 – Tuesday 🔴

25K Resurgence: Bulls Reclaim 25,180 After Volatile Expiry Rollercoaster!

🗞 Nifty Summary

Nifty delivered a high-drama session on Tuesday, opening with a modest 21-point Gap Up despite much stronger global cues from Gift Nifty.

The bulls initially added 45 points but were met with a fierce 194-point slide that tested the critical 24,920 ~ 24,932 support zone. This area was defended with extreme conviction, sparking a massive V-shape recovery that retraced the entire fall.

After a mid-day battle and rejection at the 25,180 “fort,” the index entered a volatile consolidation phase near the CPR.

Finally, at 2:45 PM, a high-conviction trendline breach allowed bulls to conquer the 25,180 barrier, leading to a strong close at 25,234.10 (Adjusted close: 25,175.40), signaling that the buyers have officially moved back into the driver’s seat.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day was defined by “Expiry Chaos.” The failure of the opening gap to match global expectations invited early sellers who pushed the index to a new low of 24,932.55.

However, the “resurrection” from these lows was relentless. The most significant structural shift occurred in the final hour; the breach of the intraday trendline and the successful hold above 25,180 suggest that the bearish grip has loosened. While sellers remain active near the 25,270 zone, the average closing indicates that the bulls have successfully colonized the previous resistance territory.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,063.35

High: 25,246.65

Low: 24,932.55

Close: 25,175.40

Change: +126.75 (+0.51%)

🏗️ Structure Breakdown

Type: Bullish candle with high-volatility wicks.

Range: ≈ 314 points — Reflects intense territorial fighting.

Body: ≈ 112 points — Strong directional close above the opening.

Upper Wick: ≈ 71 points — Indicates supply pressure and profit-booking near the 25,250 mark.

Lower Wick: ≈ 131 points — Massive rejection of lower prices, confirming the 24,920 floor is solid.

📚 Interpretation

The long lower shadow confirms that every dip toward the 24,930 zone was viewed as a high-value buying opportunity. Although the upper wick shows that bears are still defending the 25,270 zone, the fact that Nifty closed deep in the green following a 194-point slide is a major win for the bulls.

🕯 Candle Type

Bullish / Rejection / Recovery Candle — Confirms that the demand at lower levels has absorbed the recent selling pressure. Follow-through above 25,250 is now the key.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 262.08

IB Range: 229.30 → Big

Market Structure: Balanced

Trade Highlights:

10:40 Short Trade: Trailing SL Hit (Pattern Breakdown attempt).

14:50 Long Trade: Target Hit (R:R 1:1.42) (Trendline Breakout).

Trade Summary: The morning’s volatility made short positions difficult to sustain as the V-shape recovery was too aggressive. However, the strategy excelled in the final hour, capturing the decisive trendline breakout that led to the high-conviction close.

🧱 Support & Resistance Levels

Resistance Zones:

25270

25310 ~ 25335

25430

Support Zones:

25060

25025 ~ 25000

24970

24920 (Critical Floor)

🧠 Final Thoughts

“The 25,180 fort has been breached.”

Bulls have successfully defended the structural floor and managed a strong territorial gain.

For the upcoming session, we expect a bullish continuation. The next major battle will take place at the 25,310 ~ 25,335 zone.

A closing above this level would significantly strengthen the bullish sentiment and open the path for a move back toward 25,500.

For now, the focus remains on holding the intraday gains and avoiding any sharp reversal below 25,060.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 23, 2026 – Friday🟢 Nifty Analysis EOD – January 23, 2026 – Friday 🔴

106-Day Support Snaps: Bears Breach the Gate ?

🗞 Nifty Summary

The Nifty started with a mild 27-point Gap Up, entering a high-voltage battle zone between 25,250 ~ 25,350. This 100-point range saw wild intraday swings that trapped both sides before a clear direction emerged.

At 11:35 AM, the bulls finally gave up, leading to a decisive IB Low breakout. The bearish sentiment accelerated as the PDL (Previous Day Low) was breached at 1:15 PM.

Despite a brief attempt to hold the 25,180 level, the index plummeted to its “last resort” support of 25,060, closing the session at 25,048.65 (-0.95%). This marks the lowest close in 72 sessions (106 days), dragging the index back to levels last seen on October 8, 2025.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

Today was a session of systematic distribution.

The morning’s 100-point “tug-of-war” served as a distribution phase before the floodgates opened. Once the 25,250 floor was lost, the slide was relentless.

The most significant technical event was the daily close below the channel’s bottom band. While the Jan 21 low of 24,920 still stands as the final line of defense, today’s close has significantly weakened the reversal thesis, shifting the focus toward a potential bearish continuation.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,344.60

High: 25,347.95

Low: 25,025.30

Close: 25,048.65

Change: -241.25 (-0.95%)

🏗️ Structure Breakdown

Type: Strong Bearish candle (Marubozu-style).

Range: ≈ 323 points — High intraday volatility.

Body: ≈ 296 points — Aggressive, unchecked selling pressure.

Upper Wick: ≈ 3 points — Absolute lack of buying strength at the open.

Lower Wick: ≈ 23 points — Minimal demand even at the extreme lows.

📚 Interpretation

This is a high-conviction Bearish Breakdown candle. Opening at the day’s high and closing near the day’s low suggests that the market is in a “Sell on Rise” mode. The breach of the 106-day closing low indicates that the medium-term trend has been severely damaged, and the previous recovery attempts are being invalidated.

🕯 Candle Type

Bearish Marubozu-Style / Breakdown Candle — Signals powerful downside momentum; further weakness is expected unless the index reclaims the channel bottom immediately.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 256.30

IB Range: 98.85 → Medium

Market Structure: Balanced

Trade Highlights:

10:18 Long Trade: SL Hit (Caught in the morning battle whipsaw).

11:38 Short Trade: Target Hit (R:R 1:1.73) (IBL Breakout).

13:16 Short Trade: Target Hit (R:R 1:3.03) (PDL Breakout).

Trade Summary: A disciplined performance despite the early stop-loss. The strategy correctly pivoted to the short side as the balance shifted. The PDL breakout trade was the star of the session, capturing the vertical drop to the 25,060 support zone with a strong 1:3.03 R:R.

🧱 Support & Resistance Levels

Resistance Zones:

25180

25270

25310 ~ 25335

25430

Support Zones:

25025 ~ 25000

24970

24920 (Critical Floor)

24840

24770 ~ 24740

🧠 Final Thoughts

“The 24,920 level is now the only shield left.”

The daily close below the channel is a major red flag.

If the 24,920 low is breached in the upcoming sessions, the bullish reversal sign from January 21 will be completely negated.

At that point, the structure will confirm a bearish continuation with targets shifting toward the 24,600 ~ 24,400 zone. Until then, expect the bears to maintain their grip, using every minor bounce as a supply window.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 22, 2026 – Thursday🟢 Nifty Analysis EOD – January 22, 2026 – Thursday 🔴

The 25,430 Wall: Bulls Stumble After 185-Point Gap Up!

🗞 Nifty Summary

Nifty delivered a session of extreme “exhaustion gap” dynamics. The day started with a massive 185-point Gap Up above the PDH, initially finding support at the breakout zone to test the 25,430 resistance.

However, this level acted as a formidable supply wall, triggering a violent rejection. Nifty plummeted 258 points from its day high, breaching the IBL, PDH, and PDC to test the 25,180 support zone.

After marking the day low, the index spent most of the session consolidating in a wide 100-point range. A desperate last-minute surge allowed Nifty to close at 25,289.90 (+0.53%). While the net change is positive, the red-bodied daily candle signals that bulls were unable to hold the premium opening, leaving the market in a state of high-tension indecision.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The opening gap-up was a classic “bull trap” for those chasing momentum. The failure to sustain above 25,430 led to a cascading sell-off that wiped out the entire gap and then some.

The 258-point drop was high-velocity, but the successful defense of the 25,180 base (PDC area) provided a platform for the late-session recovery.

The last 15 minutes were crucial, with bulls attempting to reclaim the PDH.

We are now entering a hyper-sensitive phase with a long weekend (Sat-Mon) and the Monthly Expiry on Tuesday.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,344.15

High: 25,435.75

Low: 25,168.50

Close: 25,289.90

Change: +132.40 (+0.53%)

🏗️ Structure Breakdown

Type: Bearish-bodied candle with long wicks (Net Bullish day).

Range: ≈ 267 points — High intraday volatility and expansion.

Body: ≈ 54 points — Red body indicates the close was lower than the gap-up open.

Upper Wick: ≈ 146 points — Severe rejection from the 25,430 resistance zone.

Lower Wick: ≈ 121 points — Strong buyer defense near the 25,168 lows.

📚 Interpretation

Technically, this is a high-wave candle within a recovery trend. It confirms that sellers are still active at higher altitudes (25,430), while buyers are bottom-fishing near the 25,170 zone. The close above the open of previous sessions keeps the “revival” hope alive, but the lack of follow-through from the gap-up suggests bulls need more firepower to clear the supply.

🕯 Candle Type

Bullish Recovery Candle with High-Volatility Wicks — Demand is present at lower levels, but overhead supply is capping the upside for now.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 248.93

IB Range: 133.30 → Medium

Market Structure: ImBalanced

Trade Highlights:

10:28 Short Trade: Target Hit (R:R 1:1.9) (IBL Breakout)

12:08 Long Trade: Trailing SL Hit (Mean Reversion)

Trade Summary: The system correctly identified the shift in momentum after the 25,430 rejection. The IBL breakout provided a clean high-velocity move to the downside. The subsequent long trade attempted to capture the V-shape recovery but was caught in the afternoon consolidation, exiting on a trailing stop.

🧱 Support & Resistance Levels

Resistance Zones:

25380

25430 (Major Ceiling)

25480 ~ 25495

25550

Support Zones:

25270

25180 ~ 25145

25060 (Last Resort)

🧠 Final Thoughts

“The Monthly Expiry fuse is lit.”

We are at a crossroads.

Optimistic View:

If Nifty opens between the current close and 25,430, a breach of the day high could trigger a massive short-covering rally toward 25,520+. The setup is screaming for a breakout if bulls can find the strength.

Pessimistic View:

If we fail to sustain above 25,430 again, expect a choppy “inside bar” session with the 25,060 level as the final line of defense.

Given the long weekend and upcoming expiry, Friday will be a battlefield of volatility. Stay disciplined and watch the IB formation.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 20, 2026 – Tuesday🟢 Nifty Analysis EOD – January 20, 2026 – Tuesday 🔴

25K Revival: Nifty’s Epic 380-Point V-Shape Recovery!

🗞 Nifty Summary

The Nifty delivered a session of extreme theater, starting with an 80-point Gap Down at the 25145 support. After a failed 5-minute attempt to reclaim 25270, the index collapsed, slicing through the PDL and the 25060 support.

Panic intensified as the psychological 25,000 mark was breached, leading to a deep low of 24,919.80. However, the bottom band of the daily channel acted as a trampoline, triggering a spectacular 380-point V-shaped recovery back to the day’s highs.

The 25270 level proved to be a stubborn ceiling once more, pushing the index back down by 180 points.

Nifty eventually closed at 25,157.50, essentially flat relative to the open, but having survived a near-catastrophic breakdown.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day was a masterclass in volatility. The morning breakdown below 25,060 was a high-conviction bearish move that targeted the 24970 zone.

Once the “final flush” hit 24920, the vacuum created by exhausted sellers allowed for an aggressive short-covering rally.

This 380-point bounce was one of the sharpest in recent history, though the secondary rejection at 25270 confirms that supply remains heavy on every significant rise.

The market is now in a state of high-tension equilibrium at the channel’s edge.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,141.00

High: 25,300.95

Low: 24,919.80

Close: 25,157.50

Change: −75.00 (−0.30%)

🏗️ Structure Breakdown

Type: Long-Legged Doji.

Range: ≈ 381 points — Extreme intraday volatility.

Body: ≈ 17 points — Negligible real body, signaling total indecision.

Upper Wick: ≈ 143 points — Massive rejection from the 25,300 supply zone.

Lower Wick: ≈ 221 points — Aggressive, institutional-grade defense of the channel bottom.

📚 Interpretation

A Long-Legged Doji forming at the bottom band of a channel is a textbook reversal signal. It indicates that while bears had the power to break 25,000, they lacked the conviction to stay there.

However, the equal power of the rejection from the top suggests that the bulls are not out of the woods yet. This structure marks a transition from a trending environment to a high-volatility “battle zone.”

🕯 Candle Type

High-Volatility Indecision (Long-Legged Doji) — Indicates a potential pivot point; validation of today’s low is the only thing keeping the current channel structure alive.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 245.67

IB Range: 147.60 → Medium

Market Structure: ImBalanced

Trade Highlights:

10:22 Short Trade: Target Hit (R:R 1:4.1) (IBL Breakout)

Trade Summary: The strategy successfully identified the morning’s bearish imbalance. The IBL breakout provided a high-probability entry that captured the slide through the 25,000 psychological level, yielding a massive 1:4.1 R:R before the V-shaped recovery commenced.

Personal Note: The system also alerted for a reversal long trade, but I avoided it due to fear and a technically far Stop-Loss (SL).

🧱 Support & Resistance Levels

Resistance Zones:

25180

25270 ~ 25300 (Crucial)

25380

25430

Support Zones:

25060

25009 ~ 24970

24920 (Line in the Sand)

🧠 Final Thoughts

“The channel bottom has been tested—and it held.”

Today was a survival test for the bulls. The Long-Legged Doji at these levels suggests that a bottom might be in, but turning bullish won’t be easy.

For the upcoming session, if Nifty respects the 24,920 low, the channel remains valid. However, if that low is breached, the structure is discarded, and we enter a new bearish phase. Expect extreme choppiness as both sides fight for control over the next directional move.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 20, 2026 – Tuesday🟢 Nifty Analysis EOD – January 20, 2026 – Tuesday 🔴

100-Day Low Breach: Nifty Panics as 25,500 Support Crumbles.

🗞 Nifty Summary

The Nifty opened with a misleading 30-point Gap Up, but the bullish sentiment was vaporized within the first minute.

Mirroring yesterday’s bearish intent, the index slipped 150 points from the first tick. While bulls attempted to form a base around 25,435, the 25,500 level acted as a massive supply barrier, repelling every recovery attempt.

The subsequent breach of the November 7, 2025, swing low triggered a wave of panic selling that no support level could arrest. Nifty plummeted to test 25,180, marking a deep low of 25,171.35. Closing at 25,232.50, the index has recorded its lowest close in the last 100 days, losing -353.00 points (-1.38%).

The primary catalyst for this carnage was a classic structural failure; once key supports were breached, the vacuum created led to a complete “washout” of long positions.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day was a masterclass in “Momentum Expansion.” The initial gap-up was a clear trap, and the 150-point slide set a grim tone for the session.

The mid-day attempt to hold 25,435 was crushed by the overhead supply at 25,500. As soon as the “Line in the Sand” from November ‘25 was crossed, the algorithmic selling took over.

The index is now trading at the bottom band of the channel on the Daily Time Frame. After such a massive 414-point range expansion, the market is severely stretched, suggesting that while the bias is bearish, a “dead cat bounce” or a narrow consolidation phase is likely in the upcoming session.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,580.30

High: 25,585.00

Low: 25,171.35

Close: 25,232.50

Change: −353.00 (−1.38%)

🏗️ Structure Breakdown

Type: Strong Bearish Momentum candle.

Range: ≈ 414 points — Very high volatility; major range expansion.

Body: ≈ 348 points — Aggressive selling with almost no intraday recovery.

Upper Wick: ≈ 5 points — Total lack of buying interest at the open.

Lower Wick: ≈ 61 points — Late short-covering from the extreme lows.

📚 Interpretation

The candle structure represents a complete breakdown of market confidence. Opening at the high and closing near the low (despite a minor bounce) confirms that the bears are in absolute control. The breach of the 100-day closing low and the November swing low confirms that the medium-term structure has turned bearish. Distribution is at its peak.

🕯 Candle Type

Strong Bearish Momentum Candle — Indicates decisive selling dominance. This is a “breakout” candle from a larger structural range; typically leads to further downside unless a sharp reversal occurs.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 230.62

IB Range: 150.40 → Big

Market Structure: ImBalanced

Trade Highlights:

12:41 Short Trade: Target Hit (R:R 1:6.76)

Trade Summary: The setup was a textbook “Narrow CPR” play. Despite the Big IB, the combination of an Important Level Breakout and extreme bearish sentiment supported a high-conviction trade. The sustained fall allowed the strategy to capture a massive 1:6.76 R:R, effectively leveraging the panic selling.

🧱 Support & Resistance Levels

Resistance Zones:

25380

25430

25480 ~ 25495

25550

25605

Support Zones:

25270

25180 ~ 25145

25060

25000 ~ 24970

🧠 Final Thoughts

“Panic is the harvest of broken levels.”

The Nifty has reached the bottom of its daily channel, and the RSI is likely approaching oversold territory.

For tomorrow, expect a decrease in volatility with a smaller range movement. We might see 25,060 act as a temporary floor, or potentially triggering a “dead cat bounce” back toward the 25,380 resistance.

Regardless of the bias, we will wait for the Initial Balance (IB) to form before committing to any intraday actions. The strategy is to respect the trend but be wary of a sharp, low-volume bounce from the channel extremes.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 13, 2026 – Tuesday 🟢 Nifty Analysis EOD – January 13, 2026 – Tuesday 🔴

Fib 0.618 Defense: Expiry Day Rollercoaster Ends in 296-Point Volatility!

🗞 Nifty Summary

The Nifty started the session with a promising 90-point Gap Up, seemingly continuing yesterday’s bullish momentum. However, the optimism evaporated instantly as the index dived 195 points from the first tick, hitting the 25,700 mark.

After forming a temporary base and recovering 120 points to 25,820, Nifty encountered a textbook Double Top pattern, which triggered a second collapse back to the day’s low. A period of consolidation followed before a final flush-out broke the IBL, dragging the index to a day low of 25,603.30.

Interestingly, this low coincided exactly with the Fib 0.618 level, sparking a violent 150-point recovery to close at 25,714.20 (-0.22%).

While heavyweights like Reliance, LT, and Trent acted as major anchors, the intraday swings provided a paradise for agile traders.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day was a masterclass in “stop-hunting” and liquidating over-leveraged positions on both sides. The initial “Open = High” (almost) structure led to a vertical drop that trapped morning bulls.

The recovery to 25,820 was promising until the Double Top confirmed that the bears weren’t finished. The breakdown to 25,603 was the ultimate “capitulation” move. The subsequent sharp recovery suggests that the 0.618 Fibonacci level is being defended as a major structural floor.

Despite the bearish close, the massive 129-point lower wick indicates that demand remains potent at the extreme discount zone.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,897.35

High: 25,899.80

Low: 25,603.30

Close: 25,732.30

Change: −57.95 (−0.22%)

🏗️ Structure Breakdown

Type: Bearish candle with a long lower wick.

Range (High–Low): ≈ 296 points — exceptionally high intraday volatility.

Body: ≈ 165 points — reflects firm selling pressure from the opening gap.

Upper Wick: ≈ 2 points — zero buying strength observed near the highs.

Lower Wick: ≈ 129 points — strong, aggressive buying rejection from the Fibonacci base.

📚 Interpretation

The candle is a portrait of a market in flux. Opening at the top and closing significantly lower confirms that the morning gap was used as a massive distribution window.

However, the recovery of nearly 130 points from the lows (the lower wick) confirms that the 25,600 zone is a high-demand territory. The market is oscillating violently, looking for a stable equilibrium after the recent “Phoenix” recovery.

🕯 Candle Type

Bearish Candle with Strong Lower-Wick Rejection — Signals heavy overhead supply but strong underlying support at the 0.618 Fibonacci level.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 214.01

IB Range: 198.95 → Medium

Market Structure: Balanced

Trade Highlights:

10:04 Long Trade: Target Hit (R:R 1:1.08) (Trendline Breakout)

12:41 Short Trade: Target Hit (R:R 1:1.95) (IBL Breakout)

Trade Summary: Despite the chaotic expiry day swings, the strategy remained disciplined. The morning long capture was a quick scalp before the Double Top formed. The afternoon Short trade on the IBL breakdown was the high-conviction move of the day, capturing the slide toward the Fib 0.618 target.

🧱 Support & Resistance Levels

Resistance Zones:

25820

25855 ~ 25880

25940 (Crucial)

Support Zones:

25600

25550

25475

🧠 Final Thoughts

“The Fibonacci levels don’t lie, even on expiry day!”

Today’s price action proves that 25,600 is the line in the sand for the bulls.

If we gap down below this tomorrow, things could get ugly. But if we sustain above it, the “reversal” story is still on the table.

I’ll let President Trump decide if he wants to tweet the Nifty back to 26,000 or if he’s too busy “hiring and firing” to worry about our 0.618 levels! Let’s see what the opening tick brings on Wednesday.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 12, 2026 – Monday🟢 Nifty Analysis EOD – January 12, 2026 – Monday 🔴

The Phoenix Recovery: Bulls Resurrect Nifty with 340-Point V-Shape Swing!

🗞 Nifty Summary

After hitting multi-month lows, the Nifty performed a spectacular “Phoenix Recovery.”

The session started flat but quickly turned into a bloodbath as the index plunged 172 points to find initial support at 25,530. A symmetrical triangle formed near the lows, eventually breaking down to test the 25,473 level.

However, as noted in previous sessions, the market was deeply oversold. Fueled by short covering and potential positive news, Nifty executed a vertical reversal, reclaiming the 25,750 ~ 25,780 resistance zone with ease.

The index closed at 25,790.25 (with intraday highs hitting 25,806.10), effectively wiping out the morning panic and signaling a powerful structural reversal.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day was a tale of two halves. The morning belonged to the bears, who exploited the initial flat open to drive a high-velocity sell-off toward the 25,470 zone.

The symmetrical triangle breakdown looked like a final flush-out of weak hands. The afternoon, however, saw one of the sharpest recoveries in recent history.

The vertical ascent crossed the 25,750 barrier without any significant pullback, leaving late-entry bears trapped at the bottom.

The close near the day’s high confirms that the “oversold” spring has finally uncoiled.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,669.05

High: 25,813.15

Low: 25,473.40

Close: 25,790.25

Change: +106.95 (+0.42%)

🏗️ Structure Breakdown

Type: Bullish Rejection Candle.

Range (High–Low): ≈ 340 points — extreme intraday volatility.

Body: ≈ 121 points — reflecting strong bullish participation in the second half.

Upper Wick: ≈ 196 points — massive rejection of lower prices, signaling a potential bottom.

Lower Wick: ≈ 23 points — minimal resistance at the close.

📚 Interpretation

The massive lower wick (nearly 200 points) is a classic “Hammer” signal appearing after a prolonged downtrend. It indicates that supply has been exhausted and demand has aggressively returned. The close above the opening price, despite the deep early plunge, is a high-conviction signal that the short-term sentiment has flipped from “Sell on Rise” to “Buy on Dip.”

🕯 Candle Type

Bullish Rejection / Hammer-Like Recovery Candle — Traditionally marks the end of a bearish sequence; follow-through above 25,820 is now critical.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 204.84

IB Range: 171.90 → Medium

Market Structure: ImBalanced

Trade Highlights:

10:58 Short Trade: Target Hit (R:R 1:1.71) (Symmetrical Triangle Breakout)

12:04 Long Trade: Target Hit (R:R 1:6.34) (Trendline Breakout)

Trade Summary: A legendary day for the Gladiator Strategy. While the morning short trade captured the final flush-out, the 12:04 PM Long signal on the trendline breakout was the star performer. It captured the entire V-shape reversal, delivering a massive 1:6.34 R:R as Nifty relentlessly marched toward the day’s high

🧱 Support & Resistance Levels

Resistance Zones:

25820

25855 ~ 25880

25940 (Crucial)

Support Zones:

25600

25550

25475

🧠 Final Thoughts

“The bulls have found their spine.”

Technically, this is a perfect reversal setup, but caution is still the word of the day.

I am staying neutral-to-bullish but will remain cautious until we get a decisive daily close above 25,940. As for the weekend “Trump Fate,” it seems the market decided not to wait for a tweet to start the recovery! Let’s see if he provides the “HUGE” momentum needed to cross the 26K hurdle again, or if this was just a short-covering bounce. For now, let’s watch the opening tick tomorrow with a smile.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 9, 2026 – Friday🟢 Nifty Analysis EOD – January 9, 2026 – Friday 🔴

Back to Square One: 59 Days of Gains Vaporised.

🗞 Nifty Summary

The Nifty opened flat and initially sought support at the 25,860 ~ 25,840 zone. However, the recurring resistance at 25,920 ~ 25,930 proved fatal for the bulls, pushing the index back with extreme intensity.

The subsequent breakdown through the Initial Balance Low (IBL) at 25,818.35 triggered a steady slide through 25,740, eventually marking a day low at 25,623.00. A late 80-point recovery helped the index close at 25,683.30, resulting in a sharp loss of -193.55 (-0.75%).

This session marks a major structural milestone:

Nifty has returned to its November 11, 2025 closing level. The entire 632-point zone built over the last 42 sessions (59 days) has been neutralized. Technically, the market is back to “Square One,” with many stocks entering oversold territory.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day was a masterclass in bearish dominance. After the failed attempt to reclaim the 25,930 resistance, the selling pressure became systematic. The breach of the 25,740 support was a high-conviction move that led to a vertical drop to 25,623.

While the 80-point recovery from the lows provided some intraday relief, the overall structure remains heavily skewed to the downside.

The market appears to be in a “wait-and-watch” mode, likely anticipating major news or global cues to arrest the fall.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,840.40

High: 25,940.60

Low: 25,623.00

Close: 25,683.30

Change: -193.55 (-0.75%)

🏗️ Structure Breakdown

Type: Bearish Candle.

Range (High–Low): ≈ 318 points → High intraday volatility/Expansion.

Body: ≈ 230 points → Reflects aggressive selling pressure and panic.

Upper Wick: ≈ 100 points — aggressive rejection from the 25,940 resistance.

Lower Wick: ≈ 60 points — some profit booking emerged at the extreme lows.

📚 Interpretation

The market opened near 25,840 and attempted an early spike, but was met with overwhelming supply. The long upper wick confirms that sellers used every bounce to add short positions. While the lower wick shows some demand at the 25,623 level, the recovery was insufficient to close the index above the opening price, confirming a state of distribution.

🕯 Candle Type

Bearish Continuation Candle with Volatility Expansion — Indicates sellers are in firm control; the trend remains weak despite the oversold readings.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 189.85

IB Range: 122.25 → Medium

Market Structure: ImBalanced

Trade Highlights:

10:00 Long Trade: SL Hit (Bulls trapped at early resistance)

11:14 Short Trade: Target Hit (R:R 1:2.17) (IBL Breakout)

12:24 Short Trade: Target Hit (R:R 1:1.95) (Structural Support Breakout)

Trade Summary: After an initial trap for the long side, the strategy correctly pivoted to the bearish imbalance. The IBL breakout provided the first high-conviction short, followed by a successful secondary short as the 25,740 level crumbled.

🧱 Support & Resistance Levels

Resistance Zones:

Will discuss in Weekly Note.

Support Zones:

Will discuss in Weekly Note.

🧠 Final Thoughts

“The clock has been reset to November.”

Nifty has completed a full circle, returning to price levels seen nearly two months ago. With the index and several heavyweights in an oversold state, the technical potential for a bounce is high, but the price action lacks a reversal trigger.

I will wait for Monday’s opening tick to assess if the “Square One” level acts as a floor or a trap.

For now, I’m closing the terminal and spending some quality time with my family—I’ll let President Trump decide our fate this weekend; let’s see if he tweets us a “HUGE” recovery or if he’s just going to “fire” the bulls altogether. Time to relax and recharge!

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 8, 2026 – Thursday🟢 Nifty Analysis EOD – January 8, 2026 – Thursday 🔴

Bears Rampage: 12-Session Gains Liquidated as Nifty Crashes 260 Points.

🗞 Nifty Summary

The Nifty opened with a 45-point Gap Down, and despite an initial attempt to fill the gap, the bearish intent was undeniable. Within minutes, the index breached 26,070 and the PDL, triggering a sustained cascade.

Bears confidently drove the index through the 25,930 ~ 25,920 zone, eventually testing the 25,890 support. After a three-hour period of sideways consolidation (12 PM – 3 PM), a final wave of selling broke the 25,890 floor to test the next support at 25,860.

Nifty concluded the session at 25,868.90, just 10 points above the day’s low. This massive 275-point expansion effectively wiped out 19 days (12 sessions) of accumulation, bringing the market back to its December 19th starting point.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day was a masterclass in trend expansion. With the Gladiator range at 175.66 and the actual range hitting 275 points, the market moved into a clear “Imbalance” state.

The failed early gap-fill was the first warning; once the PDL and IB broke in unison at 10:10 AM, the floodgates opened. The three-hour pause between 12 PM and 3 PM acted merely as a distribution phase before the final breakdown to 25,860.

Sellers were in absolute control from start to finish, with almost no meaningful retracements.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,106.50

High: 26,133.20

Low: 25,858.45

Close: 25,876.85

Change: −263.90 (−1.01%)

🏗️ Structure Breakdown

Type: Strong Bearish Candle (Full Body).

Range (High–Low): ≈ 275 points → High intraday volatility/Expansion.

Body: ≈ 230 points → Reflects aggressive selling pressure and panic.

Upper Wick: ≈ 27 points → Failed early buying attempt near the open.

Lower Wick: ≈ 18 points → Almost no demand or absorption near the lows.

📚 Interpretation

This is a high-conviction Bearish Marubozu-Style candle. Closing near the absolute low of a 275-point range indicates strong distribution. By closing below the December 19th lows, the market has invalidated the entire holiday rally. The lack of a lower wick suggests that the sell-off was not a “stop-run” but actual portfolio liquidations.

🕯 Candle Type

Bearish Breakdown Candle — Signals powerful bearish momentum; continuation is likely unless a significant “V-shape” reversal occurs at the major 25,840 support.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 175.66

IB Range: 83.35 → Medium

Market Structure: ImBalanced

Trade Highlights:

09:29 Short Trade: SL Hit (Early Volatility)

10:10 Short Trade: Target Hit (1:4.45) (PDL + IB Breakout)

Trade Summary: After an initial stop-loss during the volatile opening minutes, the strategy performed exceptionally well. The 10:10 AM signal provided a high-conviction entry at the confluence of the PDL and IBL. The sustained trend allowed for a massive 1:4.45 R:R win, capturing the meat of the 230-point body move.

🧱 Support & Resistance Levels

Resistance Zones:

25985

26030

26070

26104

Support Zones:

25860 ~ 25840 (Current Critical Support)

25800 (Psychological)

25740 ~ 25715 (Ultimate Support Zone)

🧠 Final Thoughts

“We are back to square one.”

The market is at a massive crossroads at the 25,840 ~ 25,860 support zone. After such a violent fall, we must prepare for two scenarios:

A ‘Dead Cat Bounce’ toward the 25,985 zone which will likely be sold into.

A bearish continuation that tests the ultimate support zone of 25,740 ~ 25,715.

I will strictly wait for the Initial Balance (IB) to form tomorrow before approaching the market, as today’s momentum might lead to a volatile opening gap.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 7, 2026 – Wednesday🟢 Nifty Analysis EOD – January 7, 2026 – Wednesday 🔴

The 26070 Rescue: Long-Lower-Wick Doji Signals Buyer Resilience.

🗞 Nifty Summary

The Nifty started the session with a 15-point Gap Down and faced immediate pressure, slipping a further 60 points to test the 26104 support level. After marking an initial low at 26,096.65, a sharp 90-point recovery attempt tested the PDC.

However, the index was unable to sustain above the PDC or IBH, facing a secondary rejection that pushed prices below the PDH and the 26104 level. A deeper test of the 26070 support zone followed, marking a new day low at 26,067.90.

In a showing of late-session strength, buyers stepped in aggressively, facilitating a 75-point recovery from the lows to close at 26,140.75 (-0.14%).

The resulting “Doji” structure confirms a state of equilibrium and intense base-building near the 26,100 territory.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The session was characterized by a triple-move sequence. First, an early breakdown that found a temporary floor at 26104. Second, a “bull trap” recovery that failed to hold above the PDC/IBH, leading to a capitulation toward the 26070 zone. Third, a high-conviction recovery in the final hour.

The rejection from the PDC highlights that overhead supply is still capping immediate upside, but the massive lower wick proves that institutional buyers are protecting the 26070 ~ 26100 band with significant volume.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,143.10

High: 26,187.15

Low: 26,067.90

Close: 26,140.75

Change: −37.95 (−0.14%)

🏗️ Structure Breakdown

Type: Indecision candle (Doji)

Range (High–Low): ≈ 119 points — moderate intraday volatility.

Body: ≈ 2.35 points — almost zero net change between open and close, signaling total balance.

Upper Wick: ≈ 44 points — sellers rejecting prices near the 26,187 resistance.

Lower Wick: ≈ 73 points — Strong defense by buyers at the 26,068 level.

📚 Interpretation

The candle is a portrait of a classic market tug-of-war. The long lower wick is the dominant feature, showing that every attempt to crash the market below 26,100 was met with aggressive absorbing demand. However, the upper wick and the flat close suggest that bulls lack the momentum to initiate a trending move. This structure often precedes a base formation, indicating that the 26,070 level is currently the “floor” for the short-term trend.

🕯 Candle Type

Doji / Long-Lower-Wick Indecision Candle — Signals a potential pause and base formation at support; the breakout from today’s High/Low will determine the direction of the upcoming expiry.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 163.81

IB Range: 69.35 → Medium

Market Structure: Balanced

Trade Highlights:

11:54 Short Trade: Target Hit (1:1.48) (PDL Breakout)

Trade Summary: Strategy capitalised on the breakdown of the PDL during the second leg of the day’s decline. Although the market recovered later, the system’s focus on the structural breakdown below 26,104 provided a high-probability scalp before the lower-wick defence started.

🧱 Support & Resistance Levels

Resistance Zones:

26155

26220 ~ 26235 (Major Hurdle)

26275

Support Zones:

26104

26070 (Immediate Floor)

26030

25985

🧠 Final Thoughts

“The 26,070 line has been drawn in the sand.”

The market is in a state of high-tension equilibrium. The successful defense of 26,070 keeps the bullish hopes alive, but the inability to reclaim the PDC is a warning.

For the upcoming session: if Nifty sustains above 26,155, we target the 26,220 zone. However, if the 26,067 low is breached on a closing basis, the index will likely head toward the 26,030 and 25,985 zones rapidly.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 6, 2026 – Tuesday🟢 Nifty Analysis EOD – January 6, 2026 – Tuesday 🔴

Expiry Day Drama: Supply at 26275 Triggers Indecision as Heavyweights Drag.

🗞 Nifty Summary

The Nifty started with a 45-point Gap Down, diverging from the positive cues indicated by Gift Nifty. The first five minutes were extremely volatile, covering a 94-point range as the index filled the gap and slipped before recovering. Nifty attempted to breach the PDC but faced stiff resistance at the 26275 level and a descending trendline, which pushed prices back to the day’s low.

Most of the session was spent in a narrow 40-50 point range between 26155 (Support) and 26200 (Resistance). A dramatic 2 PM breakdown of the IBL/Day Low turned into a fakeout, with the index snapping back into the range to close at 26,178.70 (-0.27%), below the Previous Day Low.

Despite Nifty holding some green patches intraday, heavyweights Reliance and HDFC saw significant corrections, leading to an overall inconclusive and divergent sentiment.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The session’s core movement was effectively contained within the first five minutes; the rest of the day was an “inside-IB” struggle.

The supply wall at 26275 was the defining feature of the morning, while the 26155 zone acted as a resilient floor. The 2 PM fakeout below the IBL was a classic expiry day liquidity hunt, trapping aggressive shorts before reverting to the mean.

The divergence in heavyweights like Reliance and HDFC against the broader index kept the directional conviction low, confirming that while the index looked stable, the underlying pillars were under pressure.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,189.70

High: 26,273.95

Low: 26,124.75

Close: 26,178.70

Change: −71.60 (−0.27%)

🏗️ Structure Breakdown

Type: Small bearish candle (Spinning Top structure)

Range (High–Low): ≈ 149 points → Moderate intraday volatility

Body: ≈ 11 points → Extremely small real body, signaling total indecision

Upper Wick: ≈ 84 points → Strong rejection from the 26,275 supply zone

Lower Wick: ≈ 54 points → Buyers defended the 26,125 zone

📚 Interpretation

The candle is a portrait of equilibrium and overhead supply. The long upper wick confirms that every attempt to push toward the previous highs was met with aggressive selling. However, the lower wick prevents a bearish engulfing, showing that the 26100-26150 support cluster is still active. Closing almost at the open price after such a wide swing highlights a market waiting for a fundamental or news trigger.

🕯 Candle Type

Indecision Candle with Long Upper Wick — Signals heavy supply at higher levels; confirmation is required from the next session to determine if this is a top or a pause.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 168.76

IB Range: 114.65 → Medium

Market Structure: Balanced

Trade Highlights:

No Trade Day

Trade Note:

The system declared a No Trade Day for four critical reasons: 1) High-risk Weekly Expiry volatility; 2) 70% of the daily Gladiator range was consumed within the Initial Balance (IB); 3) Mixed sentiment where major stocks were green/neutral while heavyweights corrected, making short bets risky; 4) A total lack of directional clues.

Staying away from the market was the most profitable action today to preserve capital.

🧱 Support & Resistance Levels

Resistance Zones:

26210 ~ 26235

26275 (Immediate Supply)

26320

Support Zones:

26104 (Crucial Support)

26070

26030

25985

🧠 Final Thoughts

“The 26,100 level is the current line in the sand.”

The day was inconclusive, but the battle lines are clear. The 26,100 zone is vital for maintaining any bullish sentiment.

For the upcoming session: if Nifty opens with a Gap Up above 26,210 and manages to cross 26,275 with sustainability, the bulls regain control.

However, if the index fails to hold 26,100, the bears—who are already in the driving seat following today’s heavyweight correction—will likely target deeper supports.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – January 5, 2026 – Monday🟢 Nifty Analysis EOD – January 5, 2026 – Monday 🔴

Bears Strike Back: 26,375 Rejection Triggers 140-Point Breakdown.

🗞 Nifty Summary

Nifty started the session on a flat note but immediately witnessed an early slip of 95 points, finding initial support at the 26,275 level.

A strong recovery followed, briefly shifting sentiment to bullish as the index breached the day’s high. However, the 26,375 resistance zone proved to be a formidable ceiling, gradually pushing prices back into the Initial Balance (IB).

The afternoon session was marked by extreme volatility; around 2 PM, an IBL breakdown was attempted, but the CPR BC support triggered a sharp “false breakout” spike back into the IB.

Ultimately, the bears regained control, dragging the index down nearly 140 points from the peak. Nifty concluded the day 34 points above the low but a significant 90 points below the PDC, marking a clear bearish victory after a day of intense tug-of-war.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The session was a masterclass in market “drama.” The first hour saw high-velocity swings of 100 points, exhausting both early bulls and bears.

The mid-session sideways grind lured traders into a false sense of security before the 140-point breakdown commenced. The most critical technical event was the 2 PM IBL break; while the CPR provided a temporary floor, the inability of bulls to sustain the recovery confirmed that supply was overwhelming demand.

Bears successfully shifted the battlefield lower, ending the day with a dominant stance.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,315.40

High: 26,378.20

Low: 26,238.50

Close: 26,272.15

Change: −43.25 (−0.16%)

🏗️ Structure Breakdown

Type: Bearish Rejection Candle

Range (High–Low): ≈ 140 points → High intraday volatility

Body: ≈ 43 points → Moderate bearish close

Upper Wick: ≈ 63 points → Strong rejection from the 26,375 resistance zone

Lower Wick: ≈ 34 points → Some late buying interest from the day’s lows

📚 Interpretation

The long upper shadow is the defining feature of today’s candle, confirming heavy supply at higher altitudes. While the market attempted a bullish extension, the failure to hold above the IBH suggests a lack of follow-through conviction. The close near the lower third of the range indicates that momentum has shifted in favour of the bears for the short term.

🕯 Candle Type

Bearish Candle with both Side wicks

(Signals potential reversal or cooling of bullish momentum; the breach of today’s low will confirm further downside.)

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 170.93

IB Range: 94.65 → Medium

Market Structure: Balanced

Trade Highlights:

13:59 Short Trade: Trailing Exit (1:0.93) (IBL Breakout)

Trade Summary: The system successfully identified the IBL breakdown at 13:59. However, the subsequent interaction with the CPR support zone created a volatile “whipsaw” environment. A trailing stop was utilized to protect capital, resulting in a near 1:1 exit as the market entered its late-day “drama” phase.

🧱 Support & Resistance Levels

Resistance Zones:

26277

26320

26375 (Major Supply Wall)

Support Zones:

26235 ~ 26210 (Immediate Floor)

26155

26104

🧠 Final Thoughts

“The bulls have lost the immediate high ground.”

After today’s rejection at 26,375, the short-term bias has tilted toward the bears. For the upcoming session, the 26,235 ~ 26,210 zone is the final line of defense for the bulls. If this floor gives way, we could see a swift test of 26,155. Bulls need a decisive gap-up or a strong reclamation of today’s IBH to regain their footing.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – December 29, 2025 – Monday🟢 Nifty Analysis EOD – December 29, 2025 – Monday 🔴

26,100 Rejection: Bears Break Support Zones to Test Fib 0.618!

🗞 Nifty Summary

The Nifty started the week on a flat to positive note but faced immediate rejection at 26,104 within the first five minutes. After failing to hold above the PDC and the 26,080 retest, the index turned decisively bearish. Sellers confidently broke through 26,030, the PDL, and the 25,985 levels. Following a 90-minute consolidation, the index slipped below the most critical support zone of 25,920 ~ 25,930.

The session ended with the Nifty closing at 25,942.10, marking a loss of -100.20 points (-0.38%).

Notably, today’s low coincided with the 0.618 Fibonacci retracement level. Structurally, Nifty remains trapped in a massive 450-point range (25,750 ~ 26,200) that has persisted for 32 sessions (47 days).

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day’s narrative was one of total bearish control after the morning failed to sustain the 26,100 breach. The breakdown of the 25,985 level initiated a period of consolidation that acted as a bear flag before the final drop into the 25,920 zone.

In the afternoon, the 25,920 ~ 25,930 zone flipped from support to resistance, with the 25,960 level capping any recovery attempts.

The fact that we are closing near the day’s low suggests that the bearish momentum is still active as we approach the lower boundary of the 47-day range.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,063.35

High: 26,106.80

Low: 25,920.30

Close: 25,942.10

Change: −100.20 (−0.38%)

🏗️ Structure Breakdown

Type: Bearish candle.

Range (High–Low): ≈ 187 points — reflecting relatively high intraday volatility.

Body: ≈ 121 points — indicating strong selling pressure and a lack of buyer conviction.

Upper Wick: ≈ 43 points — early buying attempt at 26,100 was sharply rejected.

Lower Wick: ≈ 22 points — minimal buying interest near the day’s lows at the Fibonacci support.

📚 Interpretation

The candle is a strong bearish continuation signal. Opening near the day’s high and closing near the low signifies that sellers dominated the entire session. By breaking multiple support levels (PDL, 26,030, and 25,985), the bears have signalled that they are aiming for the bottom of the long-term 450-point range.

🕯 Candle Type

Strong Bearish Continuation Candle — Reflects seller dominance; bulls need an immediate and powerful reversal candle at the Fib levels to regain control.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 174.80

IB Range: 71.20 → Medium

Market Structure: Balanced

Trade Highlights:

10:18 Short Trade: Target Hit (1:3.79) (IBL Breakout)

Trade Summary: Today’s strategy execution was flawless. By identifying the Initial Balance Low (IBL) breakout early in the morning following the 26,100 rejection, the system captured a high-conviction move that yielded a massive 1:3.79 R:R ratio as Nifty cascaded through multiple support zones.

🧱 Support & Resistance Levels

Resistance Zones:

25985

26030

26070

26104 (Major Ceiling)

Support Zones:

25890

25860 ~ 25840 (Immediate Support)

25800

🧠 Final Thoughts

“The 47-day range is under threat.”

The market is currently at a critical juncture. While the 0.618 Fibonacci level at 25,920 provided temporary relief, the overall structure favors the bears.

If Nifty cannot reclaim 25,985 quickly, the next support zone at 25,860 ~ 25,840 will likely be tested.

We are now closer to the bottom of the 25,750 ~ 26,200 range; watch for a potential “double bottom” or a catastrophic breakdown below 25,750. (I know it’s too early to say…!).

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – December 26, 2025 – Friday🟢 Nifty Analysis EOD – December 26, 2025 – Friday 🔴

Bears Breach 26,100: Psychological 26K Tested as Support Levels Crumble.

🗞 Nifty Summary

The Nifty started with a weak footing, opening below the PDL. Although it initially found support near 26,104 and attempted to fill the gap, a sharp rejection at the PDC pushed prices back down through the CDO, CDL, and the 26,104 level.

After a brief range-bound period near 26,070 where a symmetrical triangle formed, the subsequent breakdown dragged the index into the previous gap zone near 26,030. Following 45 minutes of high uncertainty and tight consolidation, a final leg down marked the day’s low at 26,008.60.

A late Bull Flag pattern facilitated a 50-point recovery, allowing the Nifty to close at 26,047.65, down -99.80 points (-0.38%). As predicted in our previous notes, the breakdown below 26,120 successfully triggered tests of 26,104 and 26,070.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day was a masterclass in bearish control, with sellers swiftly grabbing 100 points of ground from the bulls.

The failure to sustain the initial gap-fill and the sharp rejection at the PDC set a negative tone that persisted for most of the session.

The symmetrical triangle breakdown and the subsequent uncertainty near 26,050 highlighted the lack of buyer conviction until the very end of the day.

The late recovery is a small silver lining, but the structural damage below 26,100 is evident.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,121.25

High: 26,144.20

Low: 26,008.60

Close: 26,042.30

Change: −99.80 (−0.38%)

🏗️ Structure Breakdown

Type: Bearish candle.

Range (High–Low): ≈ 136 points — moderate volatility.

Body: ≈ 79 points — reflecting clear selling pressure and bearish dominance.

Upper Wick: ≈ 23 points — weak buying attempt near the open quickly rejected.

Lower Wick: ≈ 34 points — buying interest emerged near the psychological 26,000 level.

📚 Interpretation

The market opened near 26,121 but failed to find any follow-through buying. Sellers maintained control throughout the session, pushing the price to the brink of the 26K mark. While the partial recovery from the lows shows that buyers are defending the psychological round number, the close remains significantly below the open. This structure reflects sustained short-term bearish pressure within the broader consolidation zone.

🕯 Candle Type

Bearish Candle with Lower-Wick Support Attempt — Signals selling dominance; buyers are active near lower levels but require a strong follow-up session to confirm a bottom.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 173.50

IB Range: 72.65 → Medium

Market Structure: ImBalanced

Trade Highlights:

09:32 Short Trade: Target Hit (1:1.15) (PDL Breakout)

11:07 Short Trade: Target Hit (1:1.85) (Range Breakout)

13:45 Long Trade: SL Hit (Contra Trend)

Trade Summary: The strategy capitalized on the clear bearish intent early on, hitting targets on both the PDL breakdown and the mid-morning range breakout. However, the late-afternoon attempt to catch the contra-trend recovery resulted in a stop-loss hit as the market remained volatile near the lows.

🧱 Support & Resistance Levels

Resistance Zones:

26070

26104 (Major Polarity Resistance)

26155

Support Zones:

26030

26000 (Psychological)

25985 ~ 25965 (Critical Defensive Zone)

🧠 Final Thoughts

“The 26,000 psychological zone is the next battleground.”

The upcoming session will be tricky.

While 26K acts as a psychological cushion, the structural momentum is currently with the bears. We must wait for the opening tick and the formation of the Initial Balance (IB).

I am expecting a potential test of 25,985; if we see recovery signs there, a relief rally could be in the cards.

However, any failure to reclaim 26,104 will keep the pressure firmly on the downside.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – December 23, 2025 – Tuesday🟢 Nifty Analysis EOD – December 23, 2025 – Tuesday 🔴

The 26235 Ceiling: Nifty Pauses After Early Volatility.

🗞 Nifty Summary

The Nifty opened with a 44-point Gap Up above the PDH, but the optimism was short-lived as the first minute candle immediately filled the gap.

The index slipped 87 points from the high to mark the day low at 26,119.05. A sharp 77-point recovery ensued, bringing the index back to the 26200 level, where it spent the majority of the session oscillating in a narrow 35-point range (26165 ~ 26200).

Around 2 PM, an attempt to break out was met with heavy rejection at the 26220 ~ 26235 resistance zone.

Nifty eventually closed virtually flat at 26,177.15 (+0.02%), signaling a period of digestion after the recent rally.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The session was characterized by a quiet, range-bound environment post the initial volatility. Most of the action took place within the Initial Balance (IB), indicating a lack of directional conviction among institutional players during this weekly expiry.

The failure to sustain above the 26220 zone for the second time is a technical warning that supply is building at these elevated levels.

However, the successful defense of the 26119 low suggests that bulls are not ready to retreat just yet.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,205.20

High: 26,233.55

Low: 26,119.05

Close: 26,177.15

Change: +4.75 (+0.02%)

🏗️ Structure Breakdown

Type: Small-body indecision candle (Spinning Top).

Range (High–Low): ≈ 115 points — moderate intraday movement.

Body: ≈ 28 points — minimal real body, reflecting a lack of directional conviction.

Upper Wick: ≈ 28 points — selling pressure confirmed near the 26233 high.

Lower Wick: ≈ 58 points — significant buying response defending the 26119 level.

📚 Interpretation

The Spinning-Top formation at these heights typically indicates exhaustion or consolidation. While the buyers defended the lower levels aggressively (evident in the longer lower wick), the rejection at the top suggests that the bulls are struggling to maintain the momentum required for a breakout. This is a classic “wait-and-watch” candle.

🕯 Candle Type

Spinning-Top / Indecision Candle near Highs — Signals a tug-of-war; the next session will determine if this is base-building for a move to 26320 or the start of a reversal.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 184.86

IB Range: 87.50 → Medium

Market Structure: Balanced

Trade Highlights:

11:10 Long Trade: SL Hit (Trendline Breakout)

Trade Summary: The market’s refusal to trend today made breakout attempts difficult. The 11:10 long attempt on a trendline break was caught in the range-bound chop, resulting in a stop-loss hit as the price reverted to the mean (26180).

🧱 Support & Resistance Levels

Resistance Zones:

6220 ~ 26235 (Key Supply)

26277

26320 (Major Target)

Support Zones:

26155 (Immediate Pivot)

26104 (Major Support)

26070 ~ 26045

26030

🧠 Final Thoughts

“The 26220 zone is the gatekeeper.”

The market is at a crossroads. For the bulls to regain control, we need a gap-up above 26235 followed by a sustained hold of the 26180 level; this would open the path toward 26320. Conversely, if the index opens below the current range and faces rejection again, we are likely to see a test of the deeper support levels at 26104 and 26070.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – December 22, 2025 – Monday🟢 Nifty Analysis EOD – December 22, 2025 – Monday 🔴

26150 Conquered! Bulls Charge Into New Territory.

🗞 Nifty Summary

The Nifty opened with an explosive 119.25-point Gap Up from the PDC, positioning itself more than 87 points above the PDH.

After a brief 32-point step back to mark the day low at 26,047.80, buyers took charge with immediate conviction. Within the first five minutes, the index crossed the strong resistance of 26104 and began a confident climb toward 26155.

After multiple attempts during the afternoon session, Nifty successfully breached 26155, marking a day high of 26,180.70. The session concluded at 26,172.40, gaining a massive +206.00 points (+0.79%).

While the bulls successfully held the ground and closed above the critical 26155 mark, the relatively narrow intraday range of 133 points (post-gap) suggests that while momentum is high, a retracement might be on the cards if rejection occurs at the 26220 ~ 26235 zone tomorrow.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The primary story of the day was the market’s ability to sustain such a large gap up without immediate profit booking. Breaking 26104 so early in the session converted a major resistance into a rock-solid floor.

The subsequent grind toward the day high showed controlled buying. However, traders should note that the actual intraday expansion was limited compared to the opening gap, which sometimes hints at “exhaustion gaps” if follow-through is missing tomorrow.

For now, the successful close above 26155 keeps the short-term bias firmly in the bulls’ court.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,055.85

High: 26,180.70

Low: 26,047.80

Close: 26,172.40

Change: +206.00 (+0.79%)

🏗️ Structure Breakdown

Type: Strong Bullish candle (Near Marubozu).

Range (High–Low): ≈ 133 points — healthy intraday expansion after the gap.

Body: ≈ 117 points — reflecting strong bullish dominance and price acceptance.

Upper Wick: ≈ 8 points — almost no rejection near the day’s high.

Lower Wick: ≈ 8 points — buyers immediately absorbed the minor early dip.

📚 Interpretation

The candle is a classic momentum indicator. The close near the day’s high with minimal wicks suggests that participants were comfortable holding positions at elevated levels. It reinforces the breakout from the previous week’s consolidation and places the index within striking distance of the next major psychological barriers.

🕯 Candle Type

Bullish Marubozu-Style / Momentum Candle — Shows strong continuation strength; bulls firmly in control.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 192.68

IB Range: 89.95 → Medium

Market Structure: ImBalanced

Trade Highlights:

No Trade

Trade Summary: The strategy rules restricted an IBH breakout trade today. The combination of an imbalanced market structure and a large Gap Up (covering nearly half the expected daily range), followed by a very narrow initial move, correctly led to a “no-trade” day. This preserved capital in a session that offered limited R:R once the initial gap was priced in.

🧱 Support & Resistance Levels

Resistance Zones:

26220 ~ 26235 (Immediate Hurdle)

26277 (All-Time High / Major Target)

26320

Support Zones:

26104 (Major Support)

26070 ~ 26045

26030

25985

🧠 Final Thoughts

“The bulls are breathing thin air at 26170.”

While the price action is undeniably strong, the narrow intraday range compared to the massive gap suggests we might see a brief cool-off.

Tomorrow’s session is critical: a breach of 26235 opens the doors to a new All-Time High. However, if Nifty faces a sharp rejection at the 26220 zone, expect a retracement back toward the 26104 support level to fill the “hidden” liquidity void created by today’s gap.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – December 18, 2025 – Thursday🟢 Nifty Analysis EOD – December 18, 2025 – Thursday 🔴

The Great Tug-of-War: Nifty Ends Flat After 176-Point Intraday Swing.

🗞 Nifty Summary

The Nifty opened with a 52-point Gap Up, which was immediately liquidated within the first candle, leading to a slip toward the 25715 ~ 25740 support zone. After marking an intraday low at 25,726.30, a sharp recovery rally pushed the index north to test the 25840 ~ 25860 resistance.

Bulls showed conviction by breaching this zone and reaching a day high of 25,902.35. However, the 25890 level proved to be a formidable wall, triggering a sharp reversal of over 125 points.

The 25800 psychological level eventually came to the rescue, and a late 50-point recovery allowed the Nifty to close at 25,815.55. The day ended virtually unchanged (-3.00 points, -0.01%), reflecting a fierce battle for territory where neither side could secure a decisive victory.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The session was a classic example of “two-way business.” The initial plunge and V-shaped recovery presented excellent opportunities for agile traders.

The most significant technical event was the failure to sustain above 25900, which led to a waterfall sell-off back to the 25800 base. This “round trip” highlights the heavy supply sitting near the 25890 ~ 25920 zone.

While bulls defended the 25700 base early on, their struggle to hold higher ground indicates that the market remains in a cautious consolidation phase.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,764.70

High: 25,902.35

Low: 25,726.30

Close: 25,815.55

Change: −3.00 (−0.01%)

🏗️ Structure Breakdown

Type: Small-body indecision candle (Spinning Top).

Range (High–Low): ≈ 176 points — reflecting relatively high intraday volatility.

Body: ≈ 51 points — small real body, indicating a lack of clear directional consensus.

Upper Wick: ≈ 87 points — strong rejection from higher levels (25900 zone).

Lower Wick: ≈ 38 points — buyers modestly defended the downside near the 25725 mark.

📚 Interpretation

The spinning top candle after such wide intraday swings signifies total equilibrium between supply and demand at the current levels. The long upper wick is the dominant feature, showing that sellers are very aggressive near 25900. However, the fact that the close remained above the open and the PDC suggests that bulls are unwilling to give up the 25800 territory just yet.

🕯 Candle Type

Spinning-Top / Indecision Candle — Signals uncertainty; the direction of the next candle will be crucial for confirming a breakout or a further breakdown.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 191.66

IB Range: 100.85 → Medium

Market Structure: Balanced

Trade Highlights:

10:06 Long Trade - Target Hit (RR 1:3.39) (Contra Trade)

11:21 Long Trade - Target Hit (RR 1:2.28) (IBH Breakout)

Trade Summary: An exceptional day for the strategy. By identifying the early base-building at the 25726 support, the system captured a high R/R contra-long. A successful IBH breakout trade followed this as momentum shifted bullish in the mid-session, maximising profits before the afternoon reversal.

🧱 Support & Resistance Levels

Resistance Zones:

25890 (Immediate Major Resistance)

25930 ~ 25920

25985 (Crucial for Bullish Survival)

26030

Support Zones:

25800 (Psychological Base)

25740 ~ 25715 (Last Resort Zone)

🧠 Final Thoughts

“The floor and ceiling are now clearly defined.”

Today’s low of 25,726.30 is now the most important level on the chart. If tomorrow’s session breaches this low, a new downside zone will open up for the Nifty.

Conversely, bulls are in a fight for survival; they need to reclaim and close above 25985 to shift the narrative back to a bullish expansion. Expect a volatile Friday as weekly positions are squared off.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – December 15, 2025 – Monday🟢 Nifty Analysis EOD – December 15, 2025 – Monday 🔴