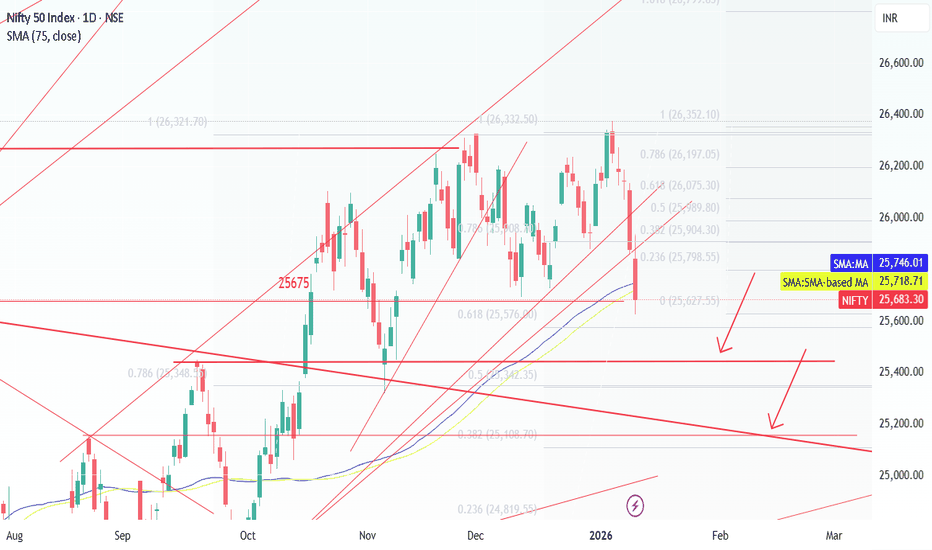

Nifty Short medium Long term 9-Feb to 13-Feb-26Nifty 25693 (last week 24820 )

Nifty dipped to 24,691 on the first day of the week. Following the announcement of the trade deal with the US, the market bounced back sharply on Monday, rising to 26,337. Thereafter, it consolidated and eventually settled at 25,693.

Though Budget was a disappointment, there was a support in nifty near to 24740.

Since the GST was reduced in Oct 2025 and also the Income Tax slab reduction last year, there was no much changes in Direct and Indirect Taxes in the budget.

Trade deal framework was released with reduction in tax to 18% for export of apparel, leather, chemicals & marine products.

Tea, Coffee, Spices, Few auto parts & machinery, Diamonds are taxed at 0%.

Simillary US gains from industrial goods, Alchohol, Cars over 3000 Cc, Bikes above 800CC with zero tax.India managed to impose same tariff for sensistive agri products.

RSI 54%, MACD crossed the signal, Stochastic 64% all indicators denote upward rally in the coming week.

However, Broader range bound movement will be upto 26372 (all time high)/26400 to 24500.

Decisive break above 26372/26400 will pave way for nifty to 27000.

As still global tension prevails, high volatility expected, use this opportunity to buy slowly. Since the short term suppport is broken, there is no need in any urgency to buy the stocks.

As far as India is concerned, economy is moderate.

The Nifty 500 stocks have shown a mix of performance in Q3 FY25-26. Some stocks have performed well, while others have lagged.

Q3 results are moderate as public sector banks like union bank, punjab sind, Federal & IOB posted good results. Reliance with moderate 1% up, hdfc bank posted 12% up, ICICI bank -3%, IDBI Bank is flat, Yes Bank is up but sales and EBIT are negative, South indian bank 9%, Infosys 11%, wipro -7% and Tech Mah 33%, Polycab 36%, HDB Fin Services 36% , HDFC Life -1% and ICICI Pru Life 12% and ICICI AMC 45% up and budget for 2026-27 to be proposed on Ist Feb 2026. Persistent system, Waaree Energies , CPCL , BPCL, SBFC Fin, Ultratech Cem, mcx, laurus lab, KVB gave very good results this week. SBI posted 24% growth last week,

On Budget Day, Muthoot Fin, Gold related stocks like Muthoot , Thangamayil, MAnappuram, Titan have fallen, Nalco, Hindalco have fallen by 10% in last two sessions.

Also Public Sector banks are reduced,

Gold have dropped more than 15 % in last two trading session but slightly recovered, silver fell near to 50%.

As i am emphasizing for more than 3 months now, that the situation is highly Volatile, SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years ( Medium to Long term) will workout.

Considering the global situation, diversify the portfolio with Debt and liquid fund ( approx 20-30% portfolio) and 10-20% in Gold & Silver for Year 2026, this funds ( especially liquid funds will create funds availability for further buying opportunity incase of market dips like a Systematic transfer plan.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,HPCL, BPCL, IOCL, Carysil, MAS Financial Services and BSE . Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

New stocks proposed for watchout for 29-Dec-25 to 02-Jan-26 is Indian Bank and NBCC, buy on dip as market in volatile situation. Both stocks reduced further and in buyable range.

New Stocks ( to watchout For Jan Ist Week 2026) are ITC & Lupin.

For 18-Jan-26, after Q3 Results HDFC AMC ( already provided in the call above), Poly cab, union bank, Tech Mah, Infosys are some of the picks for Watchlist.

New Stocks to watchout for 01-Feb-26 are Capri Global, persistent systems, narayana hrudayala, nalco, Dixon & CG Power ( Semiconductor Push).

All the above stocks can be considered slowly ( as multiple parcels) in case of stock price has fallen.

Nifty Short Term Supports :

24819 (Trend Line as shown)

25000

25200 ( 25154 Aug 2025 high)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25450 ( 25442 is the Aug 2025 high)

25500 ( 25441 Sep 18th 2025 High )

Short Term Resistance ( Many from 25000-26320)

1.26329 ( All time High)

25670 (Jun 2025 High)

Medium Term Support:

1. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

2. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

3. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

2. 26500

3. 26700 ( Finonacci 1.618 as shown in graph)

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

Niftyit

Infobean technologies ltd #relativestrength #nifty🔍 Chart Structure & Price Action

• Primary trend: Medium-term uptrend (higher highs & higher lows since Dec)

• Current pattern:

👉 Descending trendline consolidation after a strong rally

👉 This is a Bullish Flag / Falling Channel type setup

• Today’s move: Strong bullish candle (+7%+) pushing into the falling trendline resistance

• Volume: Expansion on up-move → demand returning

• Relative Strength (vs Nifty): Rising → stock outperforming the index

This is a trend-continuation setup, not a reversal gamble.

⸻

🎯 Trade Plan (Clear & Rule-Based)

✅ Ideal Entry (Two Options)

Option 1 – Aggressive (Breakout Play)

• Buy above: ₹920 (daily close basis)

• Logic: Confirmed breakout above falling trendline

Option 2 – Conservative (Retest Buy)

• Buy on pullback: ₹880–890 zone

• Logic: Retest of breakout + demand zone

⸻

🛑 Stop-Loss (Non-Negotiable)

• Swing SL: ₹845

• Below recent swing low + structure support

• Aggressive SL: ₹870 (only for breakout traders)

If price closes below ₹845 → setup invalid

⸻

🎯 Targets (Measured & Logical)

Target Level Logic

T1 ₹980 Prior supply / swing high

T2 ₹1,050 Flag height projection

T3 (Stretch) ₹1,120 Momentum continuation

⸻

📊 Risk–Reward Analysis

Breakout Entry @ ₹920

• Risk: ~₹75 (920 → 845)

• Reward:

• T1: ~₹60 ❌ (partial booking only)

• T2: ~₹130 ✅

• T3: ~₹200 ✅

➡ Effective R:R ≈ 1:2.5 to 1:3

⸻

🧠 Why This Trade Works (Logic Summary)

• ✔ Strong prior impulse move

• ✔ Healthy consolidation (no panic selling)

• ✔ Rising relative strength

• ✔ Volume confirmation on breakout attempt

• ✔ Market structure intact

⸻

🎯 Probability of Making Profit

• 55–60% if taken at breakout

• 65–70% if bought on pullback near ₹880–890

• Higher probability if Nifty IT / broader market stays supportive

(Remember: probability + risk control = consistency)

⸻

🧾 Professional Trader Note

This is not a “buy and pray” stock.

This is a “buy strength or buy support” setup.

Nifty Short,Mid and Long Term 27=Jan-26 to 30-Jan-26Nifty 25048 (last week 25694 )

Nifty dipped by 650 points last week on profit booking due to global tensions, Q3 results and Pre Budget dip. It would be good opportunity for bottom fish the stocks and to buy mutual funds if it dips.

As far as India is concerned, economy is moderate.

The Nifty 500 stocks have shown a mix of performance in Q3 FY25-26. Some stocks haveperformed well, while others have lagged.

Q3 results are moderate as public sector banks like union bank, punjab sind, Federal & IOB posted good results. Reliance moderate 1% up, hdfc bank posted 12% up, ICICI bank -3%, IDBI Bank is flat, Yes Bank is up but sales and EBIT are negative, South indian bank 9%, Infosys 11%, wipro -7% and Tech Mah 33%, Polycab 36%, HDB Fin Services 36% , HDFC Life -1% and ICICI Pru Life 12% and ICICI AMC 45% up and budget for 2026-27 to be proposed on Ist Feb 2026. Persistent system, Waaree Energies , CPCL , BPCL, SBFC Fin, Ultratech Cem, mcx, laurus lab, KVB gave very good results this week.

Other Q3 Results and 1St Feb Budget will take the market to next level.

Since it is a Volatile situation SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years ( Medium to Long term) will workout.

Considering the global situation, diversify the portfolio with Debt and liquid fund ( approx 20-30% portfolio) and 10-20% in Gold & Silver for Year 2026, this funds ( especially liquid funds will create funds availability for further buying opportunity incase of market dips like a Systematic transfer plan.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,Muthoot Finance have already given more than 10% return in this 1 month,HPCL, BPCL, IOCL, Carysil, MAS Financial Services and BSE . Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

New stocks proposed for watchout for 29-Dec-25 to 02-Jan-26 is Indian Bank and NBCC, buy on dip as market in volatile situation. Both stocks reduced further and in buyable range.

New Stocks ( to watchout For Jan Ist Week 2026) are ITC & Lupin.

For 18-Jan-26, after Q3 Results HDFC AMC ( already provided in the call above), Poly cab, union bank, Tech Mah, Infosys are some of the picks for Watchlist.

All the above stocks can be considered slowly ( as multiple parcels) in case of stock price has fallen.

RSI, MACD, Stochastic all indicators are in oversold situation and caution to be emphasized till each indicators move past its respective signal.

Nifty Short Term Supports :

25000 ( Milestone)

24900

24700 & 24814 (Trend Line as shown)

Short Term Resistance ( Many from 25000-26320)

1.26329 ( All time High)

25670 (Jun 2025 High)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25500 ( 25441 Sep 18th 2025 High )

25450 ( 25442 is the Aug 2025 high)

25200 ( 25154 Aug 2025 high)

Medium Term Support:

1. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

2. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

3. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

2. 26500

3. 26700 ( Finonacci 1.618 as shown in graph)

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

Nifty Short & Medium Term Support&Resistance_19-Jan-26 to 23-JanNifty 25694 (last week 25683 )(Last week 26328)

Nifty dipped upto 25473 last week (near to major support mentioned 25420 mentioned in last week report) due to global tension related to US- Greenland, Iran internal riots, US-Iran & China- Taiwan issue continuing for last two weeks.

Nifty touched 25623 and bounced back to 25694 ( Closed above 2nd Short term Support 25670 provided for last few weeks). Market expected to go sideways consoldiation or dip furthermore till the major support provided( 25300-25420) in the coming week but there is good short term support are there for indian market as mentioned below. Hence the broad movement will be between 25300-26000. It will be good opportunity for bottom fish the stocks and to buy mutual funds if it dips.

As far as India is concerned, economy is moderate, Q3 results are slowly coming out. public sector banks like union bank, punjab sind, Federal & IOB posted good results. Reliance moderate 1% up, hdfc bank posted 12% up, ICICI bank -3%, IDBI Bank is flat, Yes Bank is up but sales and EBIT are negative, South indian bank 9%, Infosys 11%, wipro -7% and Tech Mah 33%, Polycab 36%, HDB Fin Services 36% , HDFC Life -1% and ICICI Pru Life 12% and ICICI AMC 45% up and budget for 2026-27 to be proposed on Ist Feb 2026. So far Q3 results are Mixed.

Other Q3 Results and 1St Feb Budget will take the market to next level.

Since it is a Volatile situation SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years ( Medium to Long term) will workout.

Considering the global situation, diversify the portfolio with Debt and liquid fund ( approx 20-30% portfolio) and 10-20% in Gold & Silver for Year 2026, this funds ( especially liquid funds will create funds availability for further buying opportunity incase of market dips like a Systematic transfer plan.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,Muthoot Finance have already given more than 10% return in this 1 month,HPCL, BPCL, IOCL, Carysil, MAS Financial Services and BSE . Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

New stocks proposed for watchout for 29-Dec-25 to 02-Jan-26 is Indian Bank and NBCC, buy on dip as market in volatile situation. Both stocks reduced further and in buyable range.

New Stocks ( to watchout For Jan Ist Week 2026) are ITC & Lupin.

For 18-Jan-26, after Q3 Results HDFC AMC ( already provided in the call above), Poly cab, union bank, Tech Mah, Infosys are some of the picks for Watchlist.

All the above stocks can be considered slowly ( as multiple parcels) in case of stock price has fallen.

RSI, MACD, Stochastic all indicators are in oversold situation and caution to be emphasized till each indicators move past its respective signal.

Nifty Short Term Supports (Multiple Supports are there between 25000-25500):

25670 (Jun 2025 High)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25500 ( 25441 Sep 18th 2025 High )

25450 ( 25442 is the Aug 2025 high)

25200 ( 25154 Aug 2025 high)

25000 ( Milestone)

Short Term Resistance

1.26329 ( All time High)

2. 26500

3. 26700 ( Finonacci 1.618 as shown in graph)

Medium Term Support:

1.24700 (Trend Line as shown)

2. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

3. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

2. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

Nifty Short & Medium Term Support&Resistance_12-Jan-26 to 16-JanNifty Short & Medium Term Support&Resistance_12-Jan-26 to 16-Jan-26

Nifty 25683 (Last week 26328)

Nifty lost near to 2.5% last week. Due to a new bill upto 500% tariff proposed by US for China, Brazil & India, global tensions related to US- Greenland, Iran & China- Taiwan issue.

Nifty touched 25623 and bounced back to 25683 ( Closed above 2nd Short term Support 25670 provided last week).

Market expected to dip further in the coming week but there is good short term support are there for indian market as mentioned below. It will be good opportunity for bottom fish the stocks and to buy mutual funds if it dips.

As far as India is concerned, economy is moderate, awaiting Q3 results and budget for 2026-27 to be proposed on Ist Feb 2026.

Market is in sideways and rangebound movement from Oct 2025 and created a new high 26329 two weeks before.

Multiple Short Term resistances are there from 25000 - 25670 as listed below (especially 25200 to 25450 will be major support), hence downward movement below 25000 is not expected. on Upper side nifty need to break the resistance 26328 decisively to move up to 27000 target in med-long term.

Since it is a Volatile situation SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years ( Medium to Long term) will workout.

Diversify the portfolio with Debt and liquid fund ( approx 20-30% portfolio) and 10-20% in Gold & Silver for Year 2026, this funds ( especially liquid funds will create funds availability for further buying opportunity incase of market dips like a Systematic transfer plan.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,Muthoot Finance have already given more than 10% return in this 1 month,HPCL, BPCL, IOCL, Carysil, MAS Financial Services and BSE . Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

New stocks proposed for watchout for 29-Dec-25 to 02-Jan-26 is Indian Bank and NBCC, buy on dip as market in volatile situation. Both stocks reduced further and in buyable range.

New Stocks ( to watchout For Jan Ist Week 2026) are ITC can be bought as it reduced significantly last week due to rumors in increase in tax on cigrattes. Other buy stock is Lupin, Consider buying with multiple parcel while it dips.

All the above stocks can be considered slowly ( as multiple parcels) in case of stock price has fallen.

RSI, MACD, Stochastic all indicators are in oversold situation and caution to be emphasised till each indicators move past its respective signal.

Nifty Short Term Supports (Multiple Supports are there between 25000-25500):

25670 (Jun 2025 High)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25500 ( 25441 Sep 18th 2025 High )

25450 ( 25442 is the Aug 2025 high)

25200 ( 25154 Aug 2025 high)

25000 ( Milestone)

Short Term Resistance

1.26329 ( All time High)

2. 26500

3. 26700 ( Finonacci 1.618 as shown in graph)

Medium Term Support:

1.24700 (Trend Line as shown)

2. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

3. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

2. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

Nifty Short & Medium Term Support&Resistance_05-Jan-26 to 09-JanNifty Short & Medium Term Support&Resistance_05-Jan-26 to 09-Jan-26

Nifty 26328 (Last Week 26042)

Long call ( Buy) was given on 12-Oct-25 at 24896, Nifty have crossed near to 1430 points.

Market is in sideways and rangebound movement from Oct 2025 and now created a new high 26329 last week. Near to 290 Points have increased.

Current Short Term Resistance 26000 (Trend line and significant support). It need to break the resistance 26328 decisively to move up to 27000 target in med-long term.

Two major incident to be watched out next week are US Capturing Venuzuela President and China conducting massive drill surrounding Taiwan after US sanctioned weapons for Taiwan. Global Concern, Q3 results, Feb Ist Budget for any reforms and Tariffs deal will decide the future path for the Nifty. Since it is a Volatile situation SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years will workout.

Diversify the portfolio with Debt and liquid fund ( approx 20-30% portfolio) and 10-20% in Gold & Silver for Year 2026, this funds ( especially liquid funds will create funds availability for further buying opportunity incase of market dips like a Systematic transfer plan.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,Muthoot Finance have already given more than 10% return in this 1 month,HPCL, BPCL, IOCL, Carysil, MAS Financial Services and BSE . Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

New stocks for 29-Dec-25 to 02-Jan-26 is Indian Bank and NBCC, buy on dip as market in volatile situation.

New Stocks ( For Jan Ist Week 2026) are ITC can be bought as it reduced significantly last week due to rumors in increase in tax on cigrattes. Other buy stock is Lupin, Consider buying with multiple parcel while it dips.

As RSI is slighly improved 62% (58%) and MACD just cross the signal line, caution to be emphasized due to global political tension, though the strategy continued to buy for long.

Nifty Short Term Supports (Multiple Supports are there between 25000-25500):

25850 (Trend line shown)

25670 (Jun 2025 High)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25500 ( 25441 Sep 18th 2025 High )

25450 ( 25442 is the Aug 2025 high)

25200 ( 25154 Aug 2025 high)

25000 ( Milestone)

Short Term Resistance

1.26329 ( All time High)

2. 26500

3. 26700 ( Finonacci 1.618 as shown in graph)

Medium Term Support:

1.24700 (Trend Line as shown)

2. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

3. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

2. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

Nifty Short & Medium Term Support&Resistance_29-Dec to 2-Jan-26Nifty Short & Medium Term Support&Resistance_29-Dec to 2-Jan-26

Nifty 26042 ( Last week 25966)

Long call ( Buy) was given on 12-Oct-25 at 24896, Nifty have crossed near to 1150 points.

Market is in sideways and rangebound movement from Oct 2025.

Market Touched high of 26232 and ended lower at 26042 last week.

Current Short Term Resistance 26321 ( all time high). It need to break the resistance 26321 decisively to move up to 27000 target in med-long term.

Overall Q3 results, Feb Ist Budget for any reforms and Tariffs deal will decide the future path for the Nifty. Combination of Q3 results and Feb Budget reform ( Guidance) it will be a stock specific buying opportunity, Since it is a Volatile situation SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years will workout.

Diversify the portfolio with Debt and liquid fund ( approx 20-30% portfolio) and 10-15% in Gold for Year 2026, this funds ( especially liquid funds will create funds availability for further buying opportunity incase of market dips like a Systematic transfer plan.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,Muthoot Finance have already given more than 10% return in this 1 month. Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

New Stocks ( For Dec 22-26-Dec 2025) can be watched and considered are HPCL, BPCL, IOCL, Carysil, MAS Financial Services and BSE ( For Long term as when market pickup.

New stocks for 29-Dec-25 to 02-Jan-26 is Indian Bank and NBCC, buy on dip as market in volatile situation.

As RSI is below 60% (52%) and MACD didnt cross the signal line, caution to be emphasized, though the strategy continued to buy for long.

Nifty Short Term Supports (Multiple Supports are there between 25000-25500):

25850 (Trend line shown)

25670 (Jun 2025 High)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25500 ( 25441 Sep 18th 2025 High )

25450 ( 25442 is the Aug 2025 high)

25200 ( 25154 Aug 2025 high)

25000 ( Milestone)

Short Term Resistance

1.26321 ( All time High)

2. 26500

Medium Term Support:

1.24700 (Trend Line as shown)

2. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

3. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

2. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

Nifty Short & Medium Term Support&Resistance_22-Dec to 26-Dec-25Nifty Short & Medium Term Support&Resistance_22-Dec to 26-Dec-25

Nifty 259666 (Last week 26046)

Long call ( Buy) was given on 12-Oct-25 at 24896, Nifty have crossed near to 1100 points.

Market is in sideways and rangebound movement from Oct 2025.

Market Touched low of 25688 two weeks ( near to support Jun 2025 High and 0.618 Fibonacci Resistance) and bounced back and ended at 26046. Again last week it touched 25724.

It was a buying opportunity.

8.2% GDP growth of Q2 was released and may created a positive sign in the market despite trade deals issues. Q3 results expected to be mixed results.

However overall, Q3 results, Feb Ist Budget for any reforms and Tariffs deal will decide the future path for the Nifty. Combination of Q3 results and Feb Budget reform ( Guidance) it will be a stock specific buying opportunity, Since it is a Volatile situation SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years will workout.

Diversify the portfolio with Debt and liquid fund ( approx 20-30% portfolio) and 10-15% in Gold for Year 2026, this funds ( especially liquid funds will create funds availability for further buying opportunity incase of market dips like a Systematic transfer plan.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,Muthoot Finance have already given more than 10% return in this 1 month. Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

New Stocks ( For Dec 22-26-Dec 2025) can be watched and considered are HPCL, BPCL, IOCL, Carysil, MAS Financial Services and BSE ( For Long term as when market pickup.

Current Short Term Resistance 26321 ( all time high). It need to break the resistance 26321 decisively to move up to 27000 target in med-long term.

As RSI is below 60% (52%) and MACD didnt cross the signal line, caution to be emphasized, though the strategy continued to buy for long.

Nifty Short Term Supports (Multiple Supports are there between 25000-25500):

25850 (Trend line shown)

25670 (Jun 2025 High)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25500 ( 25441 Sep 18th 2025 High )

25450 ( 25442 is the Aug 2025 high)

25200 ( 25154 Aug 2025 high)

25000 ( Milestone)

Short Term Resistance

1.26321 ( All time High)

2. 26500

Medium Term Support:

1.24700 (Trend Line as shown)

2. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

3. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

2. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

Nifty Short & Medium Term Support&Resistance_15-Dec to 19-Dec-25Nifty Short & Medium Term Support&Resistance_15-Dec to 19-Dec-25

Nifty 26046 (Last week 26186)

Long call ( Buy) was given on 12-Oct-25 at 24896, Nifty have crossed near to 1150 points.

Market Touched low of 25688 last week ( near to support Jun 2025 High and 0.618 Fibonacci Resistance) and bounced back and ended at 26046.

It was a buying opportunity.

Initially it was profit booking and Fed Rate Cut pushed the market up.

9.2% GDP growth of Q2 was released and may created a positive sign in the market despite trade deals issues. Putin's Visit to India, gave a hope for export and import deals other than petroleum imports.

However overall, Tariffs deal will decide the future path till Dec - Jan for the Nifty. Since it is a Volatile situation SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years will workout. US Trade deal, 1st Feb budget and reforms if any will decide Nifty's path. US trade deal not being signed may create a worry for the market.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,Muthoot Finance have already given more than 10% return in this 1 month. Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

Current Short Term Resistance 26321 ( all time high). It need to break the resistance 26321 decisively to move up to 27000 target in med-long term.

As RSI is below 60% and MACD didnt cross the signal line, caution to be emphasized, though the strategy continued to be long and use the opportunity to buy on dips similar to SIP.

Nifty Short Term Supports (Multiple Supports are there between 25000-25500):

26000

25670 (Jun 2025 High)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25500 ( 25441 Sep 18th 2025 High )

25450 ( 25442 is the Aug 2025 high)

25200 ( 25154 Aug 2025 high)

25000 ( Milestone)

Short Term Resistance

1.26321 ( All time High)

2. 26500

Medium Term Support:

1.24700 (Trend Line as shown)

2. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

3. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

2. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

Nifty Short & Medium Term Support&Resistance_08-Dec to 12-Dec-25Nifty Short & Medium Term Support&Resistance_08-Dec to 12-Dec-25

Nifty 26186 (26202 Last week)

Long call ( Buy) was given on 12-Oct-25 at 24896, Nifty have crossed near to 1300 points.

Quarterly results of companies are released and so far it have mixed to Postive results.

Margins and revenue growth are major concern, Net profit being achieved by savings on employee cost and other savings. To be more cautious on picking the right stock and rebalance the portfolio. The stocks posted Moderate to Good Results have increased and taken the Nifty near to all time high.

Last week, 9.2% GDP growth of Q2 was released and may created a positive sign in the market depsite trade deals issues. Putin's Visit to India, gave a hope for export and import deals other than petroleum imports.

However overall, Tariffs deal will decide the future path till Dec - Jan for the Nifty. Since it is a Volatile situation SIP route or buy in multiple parcel route ( On Dips) with a goal of 3-5 years will workout. US Trade deal, 1st Feb budget and reforms if any will decide Nifty's path. US trade deal not being signed may create a worry for the market.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco ( Buy on Dip as still there is negative trend), Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,Muthoot Finance have already given more than 10% return in this 1 month. Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

The strategy continued to be long and use the opportunity to buy on dips similar to SIP.

Current Short Term Resistance 26321 ( all time high). It need to break the resistance 26321 decisively to move up to 27000 target in med-long term. As RSI is at 60%, room to go higher will be less in short term.

Nifty Short Term Supports ( Multiple Supports are there between 25000-25500):

26000

25670 (Jun 2025 High)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25500 ( 25441 Sep 18th 2025 High )

25450 ( 25442 is the Aug 2025 high)

25200 ( 25154 Aug 2025 high)

25000 ( Milestone)

Short Term Resistance

1.26321 ( All time High)

2. 26500

Medium Term Support:

1.24700 (Trend Line as shown)

2. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

3. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

2. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

TCS: SMA 200 for long positionHello traders,

The stock we are going to watch is $NSE:TCS. This stock is related to IT sector. This stock is mostly moving in an upward direction. Currently, it is taking some additional support of SMA200 in 4h time frame. This stock can shoot upwards at anytime.

If you're a option trader, consider buying the premium which is having the liquidity. Consider exiting near 4100 to protect your profits.

Thanks & regards,

Alpha Trading Station

INFY 1H Chart Analysis (Bullish Bat + Falling Wedge)NSE:INFY

INFY 1H Chart Analysis (Bullish Bat + Falling Wedge)

In this 1-hour chart of Infosys Ltd (NSE: INFY), a Bullish Bat Harmonic Pattern has completed at point D, suggesting a potential reversal zone. Additionally, a falling wedge formation adds to the bullish confluence.

1. Pattern Structure:

The chart displays a complete Bullish Bat Pattern (X-A-B-C-D).

Point D aligns with the PRZ (Potential Reversal Zone), with a CD leg extending \~1.618 of BC, supporting a bullish reversal.

2. Falling Wedge Pattern;

A falling wedge, generally a bullish pattern, has formed from point C to D.

A breakout above the wedge trendline may confirm a bullish move.

3. Price Action:

The price is testing the upper boundary of the wedge.

Buying interest is visible at the P,R,Z near ₹1,540–₹1,545.

Trade Plan:

Buy Entry: Above ₹1,555 (confirmation breakout above wedge)

Stop Loss: Below ₹1,538 (beneath point D and wedge support)

Target 1: ₹1,568 (previous resistance)

Target 2: ₹1,611 (mid-term resistance)

Target 3: ₹1,631 (major swing high)

A strong bullish confluence exists with the harmonic pattern and falling wedge. Wait for confirmation above ₹1,555 before entering. Maintain proper risk-reward with a stop below ₹1,538.

NSE:INFY NSE:NIFTY NSE:CNXIT

PERSISTENT - Persistent Systems Ltd (45 minutes, NSE) - LongPERSISTENT - Persistent Systems Ltd. (45 minutes chart, NSE) - Long Position; short-term research idea.

Risk assessment: Medium {volume structure integrity risk}

Risk/Reward ratio ~ 2.44

Current Market Price (CMP) ~ 5740

Entry limit ~ 5710 on May 20, 2025

1. Target limit ~ 5900 (+3.33%; +190 points)

2. Target limit ~ 6100 (+6.83%; +390 points)

Stop order limit ~ 5550 (-2.80%; -160 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

US-China Rift: India's Golden Hour?Heightened trade tensions between the United States and China, characterized by substantial US tariffs on Chinese goods, inadvertently create a favorable environment for India. The significant difference in tariff rates—considerably lower for Indian imports than Chinese ones—positions India as an attractive alternative manufacturing base for corporations seeking to mitigate costs and geopolitical risks when supplying the US market. This tariff advantage presents a unique strategic opening for the Indian economy.

Evidence of this shift is already apparent, with major players like Apple reportedly exploring increased iPhone imports from India and even accelerating shipments ahead of tariff deadlines. This trend extends beyond Apple, as other global electronics manufacturers, including Samsung and potentially even some Chinese firms, evaluate shifting production or export routes through India. Such moves stand to significantly bolster India's "Make in India" initiative and enhance its role within global electronics value chains.

The potential influx of manufacturing activity, investment, and exports translates into substantial tailwinds for India's benchmark Nifty 50 index. Increased economic growth, higher corporate earnings for constituent companies (especially in manufacturing and logistics), greater foreign investment, and positive market sentiment are all likely outcomes. However, realizing this potential requires India to address persistent challenges related to infrastructure, policy stability, and ease of doing business, while also navigating competition from other low-tariff nations and seeking favorable terms in ongoing trade negotiations with the US.

Infosys Vs Nifty IT The markings on the chart are based on the Elliott Wave theory.

The IT index has lagged in strength over the last 1+ year and now seem to enter the next wave C down. While the index made a new high, the internal moves are corrective and divergent on the RSI which makes it a better wave (B) candidate.

The next few weeks should be a sharp fall in the IT stocks as wave (c) tend to be quick and less time taking.

Nifty Short, Medium & Long Term : 06-Dec-2025Nifty Short, Medium & Long Term : 06-Dec-2025

Nifty closed at 24004 (2 weeks before 23587), for last 50 days nifty was in rangebound movement from 23200 to 25000.

RSI at 48 ,Macd signal is negative 115 and stochastics levels is 41%, Still RSI should cross its MA, MACD to reach positive and Stochastics should cross its signal decisively.

Buy call on dips was given month before. Market yet to cross crucial 24800-25000resistance decisively. Hence please filter the stock, diversify investment in equities with lesser risk stocks. However, SIP on stocks/ MFs always better at this critical time instead of bulk investment.

Hence, Q3 results, Interest Rate reduction and Feb Budget is the key for the market to sustain above 25000, move above 26000 to next targets of 27000.

I started adding the stocks and Mutual Funds during this downfall for the last two weeks and continue to buy if there is further fall. Use the opportunity and grab the good value stocks or invest in Mutual funds. Assume each parcel can be 5-7 % parcel of your total investment planned in the near term.

Kindly read the Bitcoin Blog which i have written in Sep & Oct 24 with clear Indications to Buy with target of atleast 77000 and it touched 100,000 as Trump won the US Presidential election .

Caution was emphasized on Nifty for last 5 months as nifty PE (Currently in 22.1) is still in high level with high valuation especially in Mid cap & Small Cap index with PE ratio >40 and >35 respectively. Hence more in large cap MF in allocation over Mid & Small Cap.

Invest in MF as the goal is for more than 5-10 years at this critical period, further market correction can happen upto nifty index to 22800 from current level, Individual value stock picking is a key at this critical time.

Fundamentally good stocks to be invested at these times. My Stock analysis of diwali recommendation from major financial agencies/ analyst and also some of the stock which is good as per my analysis will be provided upon request in comment section . Individual need to analyse on their own. Further additional fundamental good value stocks ( which i have analysed ) . Please note these are all not stock recommendation, rather an analysis. Individual Can analyze and add to your portfolio based on your risk profile.

as/

Nifty 24004 short term

Nifty short term resistance at 24800 to 25000 level (0.5 Fib Resistance), once crossed 25122 (0.618 Fib Resistance) and 25350( Shoulder Pattern) is the next target.

Support at 24329, and 24199( Last week Low) and 24000

Medium Term next target if move up decisively above 25350, next target is 26268 ( all time high)and 26968 (1.618 Fib Resistance)

Medium term Support 23265 ( Nov low),23000 and 22800

Long Term : Nifty have a target of 27740, 28000 & 28190 ( Fibonacci Resistance).

Support at 21240

Nifty Short, Medium & Long Term : 23-Dec-24 to 27-Dec-24Nifty Short, Medium & Long Term : 23-Dec-24 to 27-Dec-24

Nifty closed at 23587 (last week) , for last 30-40 days nifty was in rangebound movement last week on the last day market went below 24000 and went near to 23500.

RSI at 34 ,Macd signal is negtaive 45 and stochastics levels is 3.5%, all three indicates oversold.

Buy call on dips was given two week before. Market fell near to 600 points in the last day and broke the support. market may fall to 23000. Hence please filter the stock, diversify investment in equities with lesser risk stocks. However, SIP on stocks/ MFs always better at this critical time.

Interest Rate reduction and Feb Budget is the key for the market to sustain above 25000, move above 26000 to next targets of 27000.

I started adding the stocks and Mutual Funds during this downfall for the last two weeks and continue to buy if there is further fall. Use the opportunity and grab the good value stocks or invest in Mutual funds. Assume each parcel can be 5-7 % parcel of your total investment planned in the near term.

Kindly read the Bitcoin Blog which i have written in Sep & Oct 24 with clear Indications to Buy with target of atleast 77000 and it touched 100,000 as Trump won the US Presidential election .

Caution was emphasized on Nifty for last 4 months as nifty PE (Currently in22.8) was in high level with high valuation especially in Mid cap & Small Cap. PE ratio 21.7.

Mutual Funds SIP shall be invested as the goal is for more than 5-10 years at this critical period , further market correction can happen upto nifty index to 22800 from current level, Individual value stock picking is a key at this critical time.

Fundamentally good stocks to be invested at these times. My Stock analysis of diwali recommendation from major financial agencies/ analyst and also some of the stock which is good as per my analysis will be provided upon request in comment section . Individual need to analyse on their own. Further additional fundamental good value stocks ( which i have analysed ) . Please note these are all not stock recommendation, rather an analysis. Individual Can analyse and add to your portfolio based on your risk profile.

as/

Nifty 2357 short term

Nifty short term resistance at 24800 0.5 Fib Resistance, once crossed 25122 (0.618 Fib Resistance) and 25350( Shoulder Pattern) is the next target.

Support at 24329, and 24199( Last week Low) and 24000

Medium Term next target is , if move up decisively above 25350, next target is 26268 ( all time high)and 26968 (1.618 Fib Resistance)

Medium term Support 23265 ( Nov low),23000 and 22800

Long Term : Nifty have a target of 27740, 28000 & 28190 ( Fibonacci Resistance).

Support at 21240

Nifty Short, Medium & Long Term : 16-Dec-24 to 20-Dec-24Nifty Short, Medium & Long Term : 16-Dec-24 to 20-Dec-24

Nifty closed at 24677 (last week 4276) , for last 30-40 days nifty was in sideways movement. last week on the last day market touched 24200 and bounced back to 24677 .

RSI at 60.37 ,Macd signal is more than MACD and in positive for last 2 weeks (after 2 months).

But stochastics levels is sustaining above 90%, overbought position for the last 3 weeks.

Buy call on dips was given last week. Market bounced back in the last day and near to key resistances. FII started buying, in positive for Dec month, however not full fledge buying, hence please filter the stock, diversify investment in equities with lesser risk stocks. However, SIP on stocks/ MFs always better at this critical time.

Maharashtra election win and US acquittal of Adani in bribe crime is a positive news and definitely helped Indian market to sustain above 24000. Outgoing RBI governor didnt change the interest rate. Interest Rate reduction and Feb Budget is the key for the market to move above 26000 to next targets of 27000.

I started adding the stocks and Mutual Funds during this downfall for the last two weeks and continue to buy if there is further fall. Use the opportunity and grab the good value stocks or invest in Mutual funds. Assume each parcel can be 5-7 % parcel of your total investment planned in the near term.

Kindly read the Bitcoin Blog which i have written in Sep & Oct 24 with clear Indications to Buy with target of atleast 77000 and it touched 100,000 as Trump won the US Presidential election .

Caution was emphasized on Nifty for last 4 months as nifty PE (Currently in22.8) was in high level with high valuation especially in Mid cap & Small Cap. PE touched 21.5 and bounced back.

Mutual Funds SIP shall be invested as the goal is for more than 5-10 years at this critical period , further market correction can happen upto nifty index to 22800 from current level, Individual value stock picking is a key at this critical time.

Fundamentally good stocks to be invested at these times. My Stock analysis of diwali recommendation from major financial agencies/ analyst and also some of the stock which is good as per my analysis will be provided upon request in comment section . Individual need to analyse on their own. Further additional fundamental good value stocks ( which i have analysed ) . Please note these are all not stock recommendation, rather an analysis. Individual Can analyse and add to your portfolio based on your risk profile.

Nifty 24768 (PrevWeek 24677 ) Short term

Nifty short term resistance at 24800 0.5 Fib Resistance, once crossed 25122 (0.618 Fib Resistance) and 25350( Shoulder Pattern) is the next target.

Support at 24329, and 24199( Last week Low) and 24000

Medium Term next target is , if move up decisively above 25350, next target is 26268 ( all time high)and 26968 (1.618 Fib Resistance)

Medium term Support 23265 ( Nov low),23000 and 22800

Long Term : Nifty have a target of 27740, 28000 & 28190 ( Fibonacci Resistance).

Support at 21240