Niftyoptions

23 May Nifty50 trading zone #Nifty50 #option trading

99% working trading plan

👉Gap up open 24683 above & 15m hold after positive trade target 24860, 24980

👉Gap up open 24683 below 15 m not break upside after nigetive trade target 24480, 24330

👉Gap down open 24480 above 15m hold after positive trade target 24683, 24860

👉Gap down open 24480 below 15 m not break upside after nigetive trade target 24330, 24170

Trade plan for education purpose I'm not responsible your trade

More education follow & support me

Golden Rejection Candle Strategy–Catch Explosive Intraday Moves!Hello Trader!

Are you tired of buying options and watching premiums die slowly?

Or chasing breakouts that reverse the moment you enter?

Here’s your solution – the Golden Rejection Candle Strategy , designed especially for option buyers who want timed entries, fast momentum, and defined risk .

What is a Golden Rejection Candle?

A special candlestick that forms when price hits a strong level (like VWAP, trendline, or demand/supply zone) and gets instantly rejected.

It leaves behind a long wick (shadow), showing that buyers or sellers stepped in with force .

This candle often marks the start of a sharp intraday reversal .

It's not just a random wick — it’s a smart money footprint .

Live Chart Example – Nifty Spot vs Option Premium (23950 CE)

Date: 9th May 2025

Timeframe: 1 min (Spot), 1 min (Options)

Spot Chart Setup: Nifty approached a marked green support zone and created a strong wick rejection with a small body candle — classic sign of buyers defending the level.

Confirmation Candle: The next candle broke above the rejection candle’s high, confirming the reversal setup.

Premium Reaction: On the 1-min ATM Option chart (23950 CE), premiums jumped from 270 to 344 – a clean 26% gain within few minutes.

Risk-Reward Snapshot: Entry was at breakout, SL just below rejection wick, and target hit in a single momentum burst — the kind of move option buyers live for.

How to Trade It as an Option Buyer

Choose the Right Strike: Use ATM or slightly ITM options to get faster movement when price reverses.

Entry Strategy: Wait for the next candle to break the rejection candle’s high/low. No break = No trade.

SL Placement: Keep it just beyond the wick. Small loss if wrong, big reward if right.

Exit Plan: Aim for intraday resistance/support or spike-based exits — option premiums often give quick moves post-rejection.

What NOT to Do:

Don’t enter on the rejection candle itself — wait for confirmation.

Avoid trading this pattern in low volume or middle of the range.

Don’t hold blindly — if premium spikes, take the money and run!

Rahul’s Tip:

“Sudden reversals are where option buyers make money — not slow trends. The rejection candle shows intent. The breakout shows confirmation. Combine both.”

Conclusion:

The Golden Rejection Candle Strategy gives you an edge that most random trades lack — timing, context, and structure.

If you're an option buyer, this can be your go-to setup to avoid traps and enter only when smart money steps in.

No more guessing. No more fear.

Just clean, price-action-based entries that make sense.

👇 Have you ever used rejection-based setups? Drop your favorite trade below! Let’s learn together.

If you found this post valuable, don't forget to LIKE and FOLLOW!

I regularly share real-world trading setups, actionable strategies, and learning-focused content — all from real trading experience , not theory . Stay connected if you're serious about growing as a trader!

24000PE Nifty Intraday Analysis for May 12, 202524000PE Outlook:

The 24000PE is currently in the sell zone. As I maintain a bearish view on Nifty for tomorrow, I will wait for a buy confirmation on the 24000PE before considering any entry.

Based on my analysis (excluding gap considerations), I estimate the support zone around 141 and resistance near 451. However, please note that these zones may shift if price action begins to factor in gap areas on either side.

Disclaimer: This is my personal view and not a trading recommendation. All traders are advised to conduct their own technical analysis and trade with strict stop-loss and risk management.

Surgical strike on Nifty call sellers at 24800-900Market Update: Nifty Outlook

Today, amid news of an Indian Army operation, Nifty opened with a significant gap down but swiftly recovered, showing strong upward momentum.

Currently, the chart structure indicates the need for a higher low to set the stage for the next leg of the uptrend towards the 24,800–24,900 zone. A flat opening in the next session could provide the ideal setup for a strong rally.

Notably, a sustained move above 24,500 could trigger a "surgical strike" on call sellers positioned at the 24,800–24,900 levels, potentially leading to sharp short-covering.

We recommend closely tracking price behavior near key support areas for confirmation of the next move.

Nifty 24200CE intraday analysis for April 21, 2025On Nifty 24200CE 15minutes interval, Scalper indicator has confirmed Buy entry at 19.15 with Stop-loss at 11.85 and still continuing its bullish trend. I am still bullish on this Call options. Fresh trades are not suggested at this point unless there is a technical reconfirmation with proper stop loss. Traders are advised to follow own technical study before taking the trades. Trade with Stop-Loss.

Decoding NIFTYDear Traders,

I hope this message finds you well in your trading endeavours and personal pursuits. I am excited to share a compelling opportunity with you through a new NIFTY analysis that sheds light on the continuation of the market shift.

Preliminary Analysis Overview:

The downtrend from all-time highs has reached approximately 65% of its progression.

The recent upward surge is somewhat concerning due to concerns about a new trend or a correction within a correction in a larger degree (downtrend).

Let us discuss the key points to distinguish between these two scenarios:

The second leg of the downtrend is experiencing a correction, having completed approximately 89/90 days (which reinforces the interim trend’s completion).

The current correction is progressing rapidly, exhibiting limited sub-waves, which is typically not a characteristic of a motive wave (especially at the beginning of a trend).

The accompanying chart illustrates this point.

Let us elucidate the reasons behind this assertion:

Reason I:

As a staunch believer and ardent follower of Master WDG , the significance of time cannot be disregarded.

The primary downtrend commenced on September 27, 2024, and is poised to encounter a pivotal juncture, namely 180 days from its commencement on March 25, 2025 (Tuesday). This date also coincides with a cross-over with the Fibonacci value of 21 from March 4, 2025, where the interim correction commenced (21,964.60).

The 180D is a component of both the tetragram and the hexagram, and it also represents the midway point of a complete circle (360).

There is also another weird correlation, 4th MAR’25 & 25th MAR’25 both falls on Tuesday marking initiation & termination, the same day.

Reason II:

The geometric patterns of preceding and ongoing movements further support this analysis.

Analyzed both on a daily and weekly basis. The correction responded favorably to both Fibonacci retracements and trendlines. Upcoming resistance levels include:

RI: 23,590~23,600

RII:23,653 (23.6% of the downtrend)

RIII: 23,807

The previous support level is acting as a crucial resistance.

I also observe that there will not be a positive close in 3M charts.

Reference:

Important Dates to Remember:

As suggested, March 25, 2025, marks a significant juncture in the overall trend.

This is pure technical based analysis & does not involve any economic data releases other factors.

** Final Verdict: **

The market is anticipated to conclude its final leg of the downtrend, commencing from this Tuesday. However, the duration of this leg can range from 1 to 2 months.

I have identified several crucial dates for monitoring the upcoming trend. Stay informed!

**Strategy:**

Given the prevailing market conditions, adopting a bearish stance appears prudent.

Any sell positions executed after 23,550 will yield positive returns.

While it may seem counterintuitive to deviate from the prevailing trend, I am merely adhering to the established rules (without expressing any personal sentiment). However, it is inherently risky. Therefore, it is imperative to implement robust risk management strategies during such high-risk trades that are significantly influencing the market.

Additionally, please exercise caution regarding option buying. The low volatility environment is concerning, but it is anticipated to normalize as the downtrend progresses.

Fellow Traders,

The creation of this valuable analytical resource has required countless hours of dedication and effort. If you find it useful, I humbly request your support by boosting the idea and following me (updates will be provided via this post, new posts, and through minds). Your comments and thoughts on this idea are highly valued, and I am committed to engaging with each one personally.

Thank you for investing your time in reading this article.

Wishing you profitable and fulfilling trading endeavors!

Disclaimer:

Before concluding, I must emphasize that the insights shared are based on my analysis. It is crucial for you to conduct your own research and, if necessary, consult with a financial advisor before making any trading decisions. The dynamic nature of financial markets necessitates that your strategies align with your financial objectives and risk tolerance.

Nifty Futures Daily Trend analysis for April 17, 2025As mentioned in my post yesterday (April 15, 2025), we have been eyeing the Nifty Futures resistance level at 23,460. Today, the price is approaching this level. Our Masters Cycle has confirmed a buy signal today, with a stop-loss set at 21,859.

Now, how should we approach intraday trading for tomorrow (April 17, 2025)?

As highlighted in yesterday’s update, our Future Candle Reversal Projection indicator has signaled a reversal day for April 17. Additionally, the Dynamic Candle Reversal indicator (note the small blue line plotted today) has confirmed an intraday bearish setup for tomorrow.

Considering these signals, we will focus on intraday shorting opportunities for April 17. However, for positional trades, we continue to maintain a bullish bias.

Disclaimer:

The views shared here reflect my personal analysis and are intended for educational purposes only. Market conditions may differ in real-time. If you are a trader, please conduct your own research and analysis before making any trading decisions. Always ensure that you trade with a proper Stop-Loss in place.

Nifty Futures intraday trend analysis on April 7th & 8thAccording to my Trend Analysis, on 7th Nifty Futures is likely to bounce back and the raise will not sustain on April 8th. The levels provided in the chart are calculated without taking Gaps into account. In the first 15mts on 7th April, there is a bullish candle formation. Trade with Stop-Loss.

Nifty Futures Daily analysis for April 2025I expect Nifty to be bearish for the month of April 2025. According to my analysis, my Dynamic Buy/Sell indicator confirmed sell signal today with Stop-Loss. After sell confirmation, I adjusted the EOD targets to 720 degrees and I foresee the Nifty Futures to drop down to target 2 or 3 by April 21st or 25th. It may not be a continuous fall, there may be a pull back before the fall.

NIFTY : Trading Levels and Plan for 31-Mar-2025📌 NIFTY Trading Plan – 31-Mar-2025

📊 Market Overview:

Nifty closed at 23,495, showing mixed sentiment near the Opening Support Zone (23,401 – 23,465). The market is at a crucial juncture, with potential bullish momentum above resistance levels, while breakdowns below key supports may trigger selling pressure.

This plan will help you react strategically to different opening scenarios, ensuring a favorable risk-reward ratio.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,600)

A gap-up above 23,600 signals bullish momentum, but for sustained upside, Nifty must stay above 23,642 – 23,842. Watch for rejection at resistance zones, as profit booking can lead to reversals.

✅ Plan of Action:

If Nifty sustains above 23,772, expect a move towards the next resistance at 23,925 – 23,990. A breakout above 23,990 could open doors for 24,050+.

If price faces rejection at 23,842, a pullback towards 23,642 → 23,495 is possible. If it breaks below 23,495, expect further downside.

Avoid aggressive longs inside 23,642 – 23,842, as this is a potential reversal zone. Wait for a decisive breakout or rejection confirmation.

🎯 Pro Tip: If the gap-up is filled within the first 15-30 minutes, it suggests weak buying pressure and increases the probability of a reversal.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,500)

A flat opening near 23,495 indicates indecision. The market will take direction after the first few candles, so breakouts or breakdowns from key levels should be closely monitored.

✅ Plan of Action:

Upside case: If Nifty breaks and sustains above 23,642, it may head towards 23,772 → 23,925. Monitor price action near these resistance levels before entering fresh longs.

Downside case: If Nifty breaks below 23,495, it could test 23,336 → 23,164. A breakdown below 23,164 will shift the trend bearish.

Avoid trading inside the No Trade Zone (23,495 – 23,642), as price could consolidate before a breakout.

🎯 Pro Tip: In a flat opening, wait for a clear 15-minute candle close above or below key levels before entering trades.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,400)

A gap-down below 23,400 may indicate fresh selling pressure, making it crucial to observe whether buyers step in at support zones.

✅ Plan of Action:

If price sustains below 23,400, expect a decline towards 23,336 → 23,164. A breakdown below 23,164 could lead to a sharp fall towards 23,100.

If price finds support at 23,164 and rebounds, it may recover towards 23,336 → 23,495. A strong close above 23,495 will shift momentum back to the bulls.

Be cautious of bear traps – If the market gaps down but quickly recovers, it could trigger short covering, leading to a strong upside reversal.

🎯 Pro Tip: If the gap-down occurs near a strong buyer’s support zone, wait for a bullish price action confirmation before entering long trades.

⚠️ Risk Management Tips for Options Traders

🔹 Avoid over-leveraging – Use proper position sizing to manage risk.

🔹 Theta Decay Awareness – If the market consolidates, option premiums will erode rapidly.

🔹 Use Spreads for Protection – Instead of naked options, use spreads to limit risk and improve probability.

🔹 Trade at Key Levels – Avoid impulsive trades; focus on defined support and resistance zones.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,772 → 23,925 → 23,990

🟧 No Trade Zone: 23,495 – 23,642

🟩 Support: 23,336 → 23,164 → 23,100

🔸 Bullish Bias: Above 23,642, targeting 23,772 – 23,925

🔸 Bearish Bias: Below 23,400, expecting a fall towards 23,336 – 23,164

🔸 Neutral/Choppy: Inside 23,495 – 23,642, avoid unnecessary trades

🎯 Final Advice:

Stick to the structured trading plan and execute only at key levels.

Avoid emotional trading—wait for confirmation before entering trades.

The first 15-30 minutes after market open will provide better clarity—observe price action before committing to a trade.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your own research or consult a financial advisor before making any trades.

NIFTY : Trading Levels and Plan for 28-Mar-2025📌 NIFTY Trading Plan – 28-Mar-2025

📊 Market Overview:

Nifty closed at 23,601, consolidating within a No Trade Zone after a strong uptrend. The market is at a critical juncture, and the price action at key levels will determine the next directional move.

This plan provides clear trade setups for different opening scenarios and helps you navigate market volatility with a structured approach.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,700)

A gap-up opening above 23,700 will push Nifty closer to the Last Intraday Resistance Zone (23,772). The key factor will be whether Nifty sustains above resistance or faces rejection.

✅ Plan of Action:

If Nifty sustains above 23,772, it can move towards the next resistance at 23,931. A breakout above 23,931 could trigger a rally towards 24,000+, but watch for profit booking at higher levels.

If price faces rejection at 23,772 and reverses, expect a pullback towards 23,650 → 23,600. A strong rejection here could lead to an intraday sell-off.

Avoid fresh longs inside 23,700 – 23,772, as this area may act as a profit-booking zone. Wait for confirmation before taking trades.

🎯 Pro Tip: If the gap-up is quickly filled within the first 15 minutes, it signals weak buying strength and increases the probability of an intraday correction.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,600)

A flat opening suggests indecision among traders, and the market will likely take direction after the first few candles. The best strategy is to trade breakouts or breakdowns from key levels.

✅ Plan of Action:

Upside case: If Nifty breaks and sustains above 23,650, it may head towards 23,700 → 23,772. Observe the price action near resistance before taking fresh longs.

Downside case: If Nifty breaks below 23,520, it could test 23,450 → 23,300. A breakdown below 23,300 will turn the trend bearish.

Sideways caution: If Nifty remains inside the No Trade Zone (23,451 – 23,642), avoid taking trades as volatility could trap both buyers and sellers.

🎯 Pro Tip: In a flat opening scenario, wait for a clear 15-minute candle close above or below key levels before entering trades.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,500)

A gap-down below 23,500 could indicate profit booking or fresh selling pressure. The critical factor will be whether buyers defend key support zones.

✅ Plan of Action:

If price sustains below 23,500, expect a decline towards 23,300. A breakdown below 23,300 may accelerate selling towards the Buyer’s Support Zone (23,136 – 23,300).

If price finds support at 23,300 and rebounds, it may attempt a recovery towards 23,450 → 23,520. A strong close above 23,520 could shift momentum back to the bulls.

Be cautious of bear traps – If the market gaps down but quickly recovers, it could trigger short covering, leading to an upside reversal.

🎯 Pro Tip: If the gap-down occurs near a strong buyer’s support zone, wait for a bullish price action confirmation before entering long trades.

⚠️ Risk Management Tips for Options Traders

🔹 Avoid over-leveraging – Use proper position sizing to manage risk.

🔹 Theta Decay Awareness – If the market consolidates, option premiums will erode rapidly.

🔹 Use Spreads for Protection – Instead of naked options, use spreads to limit risk and improve probability.

🔹 Trade at Key Levels – Avoid impulsive trades; focus on defined support and resistance zones.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,772 → 23,931 → 24,000

🟧 No Trade Zone: 23,451 – 23,642

🟩 Support: 23,520 → 23,300 → 23,136

🔸 Bullish Bias: Above 23,772, targeting 23,931 – 24,000

🔸 Bearish Bias: Below 23,500, expecting a fall towards 23,300 – 23,136

🔸 Neutral/Choppy: Inside 23,451 – 23,642, avoid unnecessary trades

🎯 Final Advice:

Stick to the structured trading plan and execute only at key levels.

Avoid emotional trading—wait for confirmation before entering trades.

The first 15-30 minutes after market open will provide better clarity—observe price action before committing to a trade.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your own research or consult a financial advisor before making any trades.

Nifty Futures Intraday Trend on March 27, 2025I anticipate a bearish trend for tomorrow. 23719 looks like a strong resistance and the support levels are at 23441 and 23198 (If breaks 23 441).

I foresee a good bearish trading opportunity and I avoid all Buy Signals and Focus on my PUTs.

Ready to trade? Trade with proper stop-loss.

NIFTY : Levels and Plan for 27-Mar-2025📊 Market Context:

NIFTY closed at 23,464.30, experiencing a minor pullback after a previous uptrend. The index is currently at a crucial support zone, where price action will determine the next movement.

Let’s analyze the plan for different opening scenarios and structure our trades accordingly.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,590)

A gap-up above 23,590 will place NIFTY near its Opening Resistance. This level is important because it has previously acted as a supply zone, and bulls need strong momentum to sustain above it.

✅ Plan of Action:

If price sustains above 23,590, we can expect a bullish move towards the Last Intraday Resistance at 23,660. A breakout above this level may extend gains to 23,780+.

If price gets rejected from 23,590 and starts reversing, look for a shorting opportunity, targeting 23,501 → 23,464.

Avoid aggressive long trades inside the 23,590 – 23,660 zone unless there is a clear breakout with volume.

🎯 Pro Tip: If the gap-up is weak and fills within 15 minutes, it indicates profit booking, leading to a possible retracement.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,464)

A flat opening suggests market indecision, requiring confirmation before entering a trade.

✅ Plan of Action:

Upside case: If NIFTY breaks above 23,501, it can move towards 23,590. Observe price action at this level before deciding on further longs.

Downside case: If NIFTY breaks below 23,464, expect a decline towards the Opening Support Zone (23,501 – 23,477). A breakdown below 23,477 could trigger a deeper fall to 23,297.

Neutral Zone: If the index trades between 23,464 – 23,501, it indicates a choppy market. Avoid unnecessary trades here.

🎯 Pro Tip: A flat opening often leads to fake breakouts in the first 15 minutes. Wait for a strong candle close before entering a position.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,350)

A gap-down below 23,350 will put NIFTY near its Last Intraday Support Zone (23,297 – 23,343). If this level fails, further downside is possible.

✅ Plan of Action:

If price sustains below 23,350, expect a test of 23,297. A breakdown here could lead to heavy selling towards 23,182 – 23,100 levels.

If price rebounds from 23,297, it could trigger a pullback towards 23,464. Watch price action at 23,464 – 23,501 for signs of rejection or continuation.

Be cautious of bear traps—if price quickly reverses after a sharp gap-down, it might indicate a short-covering rally.

🎯 Pro Tip: In a gap-down scenario, avoid panic selling. Watch for reversals from key support levels before initiating fresh shorts.

⚠️ Risk Management Tips for Options Traders

🔹 Avoid over-leveraging – Keep your position sizing disciplined to minimize potential losses.

🔹 Theta Decay Awareness – If the market consolidates, option premiums will erode quickly.

🔹 Hedge Your Trades – Use spreads instead of naked options to reduce risk.

🔹 Wait for Confirmation – Enter trades only after a breakout/breakdown is retested with volume.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,590 → 23,660 → 23,780

🟧 No Trade Zone: 23,501 – 23,464

🟩 Support: 23,501 → 23,297 → 23,182

🔸 Bullish Bias: Above 23,590, targeting 23,660 – 23,780

🔸 Bearish Bias: Below 23,350, expecting a fall towards 23,297 – 23,182

🔸 Neutral/Sideways: If price remains between 23,501 – 23,464, avoid unnecessary trades.

🎯 Final Advice:

Stick to the plan and trade only at key levels.

Avoid trading inside No Trade Zones.

Let the market settle for 15-30 minutes before making big moves.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your research or consult a financial advisor before trading.

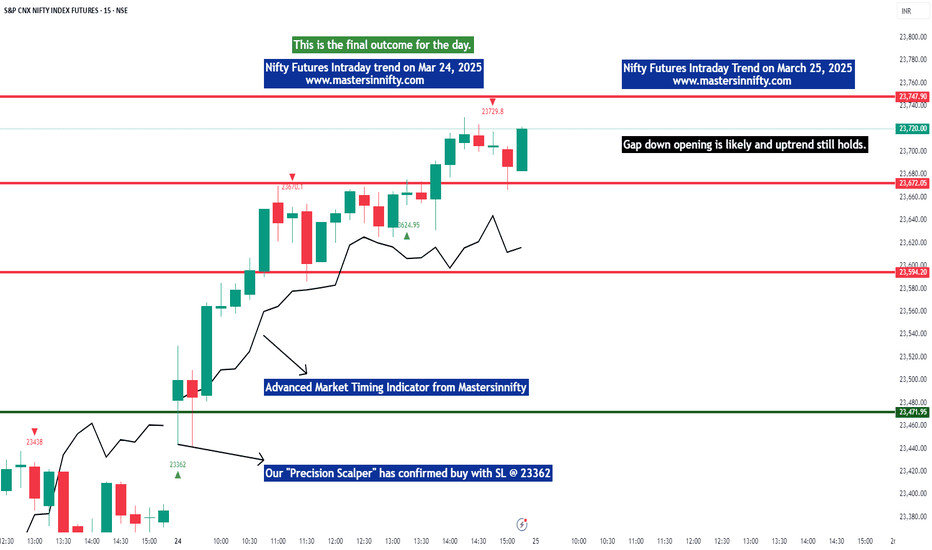

Nifty Futures intraday trend for March 25, 2025Nifty Futures broke the key resistance at 23623 and closed higher and the further uptrend is anticipated to take resistance at 23825.

Nifty futures may begin with a gap down opening tomorrow ie March 25th and a down trend in the morning may give us an opportunity to enter long.

NIFTY : Intraday Trading levels and Plan for 25-Mar-2025📊 Nifty Trading Plan – 24-Mar-2025 (Educational & Strategy-Oriented)

Chart Timeframe: 15-Min | Key reference zones marked on chart

📍

🚀 GAP-UP Opening (Above 23,407)

If Nifty opens with a gap-up above 23,407, it will enter the Wave 3 Resistance Zone (23,508 – 23,582), which is a high-probability reversal zone.

✅ Plan of Action:

• Don’t rush into buying after the gap-up. Wait and observe the price behavior around 23,508 – 23,582.

• This area is likely to witness profit booking or short build-up.

• Look for signs of reversal like bearish engulfing, shooting star, or bearish divergence on RSI.

• If such patterns form, consider buying Put Options (OTM PE) with a stop-loss on a 15-min candle closing above 23,585.

• If Nifty sustains above 23,582 with strong volume, then we might be heading into an extended up-move, but this is lower probability.

• Safer trades are shorting on signs of exhaustion at higher levels.

📌 Key Zone to Watch: 23,508 – 23,582 (Wave 3 Resistance)

📈 FLAT Opening (Between 23,245 – 23,407)

This is the Opening Resistance / Support Band (23,345 – 23,407), acting as a decision-making zone.

✅ Plan of Action:

• Let the market settle in the first 15–30 mins.

• If price holds and builds strength above 23,345, Nifty may climb towards 23,407, and if broken, test 23,508+.

• Weak price action (rejection wicks or low volumes) from 23,345–23,407 signals weakness. In that case, look for short opportunities with SL above 23,407.

• Avoid CE entries unless price sustains above 23,407 with momentum and volume breakout.

• If price starts to slip below 23,245, sellers will get more active and price could drop quickly to next support.

📌 Key Decision Zone: 23,345 – 23,407

📌 Support Trigger: 23,245 (Opening Support)

📉 GAP-DOWN Opening (Below 23,245 or near 23,185 – 22,985)

If Nifty opens below the Opening Support at 23,245, or even near deeper support zones of 23,185 or 22,985, it will bring in volatility and create both breakdown and reversal opportunities.

✅ Plan of Action:

• A gap-down near 23,185 should be watched carefully. This is a minor intraday support. If held with a bullish candle (like a hammer), consider buying CE with SL below 23,160.

• If the gap-down extends to 22,985 (Last Support for Intraday), it's a strong bounce zone. A bullish reversal candle here provides high RR long trades.

• If price fails to hold 22,985, sellers may dominate and drag Nifty further down. Consider PE trades only after a 15-min close below 22,985.

• Avoid panic trading – let the zone react and only act based on confirmation candles.

📌 Bounce Zones: 23,185 and 22,985

📌 Breakdown Trigger: Below 22,985

🛡️ Risk Management Tips for Options Traders:

• Avoid trading first 5–15 mins after opening, especially on gap days – let price give structure.

• Use hedged strategies like Bull Call or Bear Put Spreads to reduce premium loss due to theta decay.

• Trade light near reversal zones – don’t go all-in on emotional conviction.

• Always place stop-loss on closing basis (15-min candle), not fixed points, especially during volatile moves.

• If VIX is high, premiums are inflated – focus on quick entry & exit, no holding hoping for magic.

📌 Summary & Conclusion:

• Nifty has entered a critical decision zone.

• Watch 23,407 carefully – above it, bulls may attempt a final push to 23,582, but signs of exhaustion there are likely.

• On the downside, supports at 23,185 & 22,985 will act as bounce zones.

• Directional trades should be initiated only after price confirms intent post opening.

• Use structure + volume for confidence in setups.

⚠️ Disclaimer: I am not a SEBI-registered analyst. The above content is for educational purposes only. Please do your own analysis or consult a certified financial advisor before making any trading decisions.

Nifty Review & Analysis - Daily

Nifty opened Gap up again following Global Cues and saw surge throughout the day making a high of 23216 and closing at 23190 +1.25%.

Price Action : - Bullish

Nifty closed 1.25% in positive. Consequtive 4 days green candle and closing above 10,20,50 dEMA and forming big weekly green candle breaking out above Trend line connecting Life thigh and previous highs.

Candle Pattern:

Formed a Big Green candle with a small wick on upside.

Daily EMA Positioning:

10dEMA 22713

20dEMA 22710

50dEMA 22997

200dEMA 23397

EMA Trend:

Closed above 10dEma ,20dEma & 50DEMA,

Daily MA suggests Buy

Hourly suggests Strong Buy

15mins Suggests Strong Buy

The momentum indicator, RSI - Relative Strength Index is above 60 now at 63

Momentum gaining towards Upside

Support/Resistance Levels:

Major Support 23000

Immediate Support 22150

Immediate Resistance 22250

Major Resistance 23500

Trend:

Short Term Trend is Bullish

Daily Options Activity:

Highest CE OI was at 23500 with highest addition at 23400 and 23500- Resistanc

Highest PE OI was at 23000, highest Put addition seen at 23000 followed by 23200 - support

PCR is 1.1 indicating Bullishness

Daily Futures Activity FII + Pro F&O Data:

FII Long/Short ratio at 30%/70% indicating slowly addition of Longs by FIIs - Bullish

Change in Futures OI:

FII Future positions saw little addition in longs +9K with -10K change in shorts -Bullish

Nifty Futures price was higher by 0.9% 3.5 %OI decreasing indicating weakness is current upmove

Observation:

Nifty looks strong above 23000 forming daily positive green candles and weekly huge green candle closing above 10,20,50dEMA and FII long addition

Overall Trend:

Sentiment turning Positive

Outlook for Next Session:

Nifty looks strong around 23200, might consolidate abobe 23000 before another upmove

Approach & Strategy:

Long with 22850 as SL in April contract

My Trades & Positions:

Long in 23200CE April

NIFTY Trading Levels and Plan for 21-Mar-2025📅 NIFTY Trading Plan – 21-Mar-2025

📍 Reference Price: 23,190 (Close on 20-Mar-2025)

📊 Chart Structure: Price is nearing exhaustion at highs, so we need to observe for either continuation or reversal from resistance zones.

📌 Opening Scenario 1: GAP-UP Opening (100+ Points)

🟢 Expected Open Zone: 23,270 – 23,330

👉 If Nifty opens with a strong gap-up above 23,270: Watch for price action near 23,345 , marked as the last strong intraday resistance . If you see rejection (like wick rejections or bearish engulfing on 5m/15m), consider initiating short positions with a stop loss above 23,370. On clean breakout and sustained move above 23,345, target the Profit Booking Zone: 23,407–23,445+ . Be cautious chasing longs on a gap-up unless price consolidates and confirms breakout.

🎯 Key Tip: Don't short just because it's a gap-up. Let the candle give confirmation through rejection patterns.

📌 Opening Scenario 2: FLAT Opening

🟠 Expected Open Zone: 23,150 – 23,190

👉 In case of flat to mild gap open: Watch 23,185 as the immediate Opening Resistance / Support .

If price sustains above 23,185 with strength, you can look for a long entry targeting 23,345 and beyond.

However, if price struggles and fails to cross 23,185 with rejection patterns, short toward 23,068 and 22,994.

Breakdown below 23,068 may accelerate profit booking till the lower zone of 22,994–22,882.

🎯 Key Tip: The first 15–30 mins are crucial. Avoid rushing into trades. Use the breakout-retest model for safer entries.

📌 Opening Scenario 3: GAP-DOWN Opening (100+ Points)

🔻 Expected Open Zone: 23,050 – 22,950

👉 If Nifty opens with a significant gap-down: Observe price action near Opening Support Zone: 23,068 – 22,994 .

If bulls defend this zone with strong reversal patterns (hammer, bullish engulfing), it could be a dip-buying opportunity. Below 22,994, next major support lies at 22,882 . Breakdown of this zone could trigger sharp fall. Avoid shorting after a gap-down unless 22,882 breaks convincingly.

🎯 Key Tip: Never knife-catch a falling market. Let the base build before entering reversal trades.

🛡 Risk Management Tips for Options Traders 🧠 Use defined risk trades: Prefer vertical spreads (bull call/bear put) instead of naked options. Avoid buying OTM options post 11:00 AM unless momentum is strong. Always risk less than 2% of your capital per trade. Trail your stop loss once the trade moves in favor to protect capital. Don't overtrade – quality setups > quantity.

✅ Summary & Conclusion:

📍 Nifty is trading near crucial resistance levels.

📍 23,345 remains the make-or-break zone for bulls.

📍 Support zones: 23,068 → 22,994 → 22,882

📍 React to price action at key zones rather than predicting it.

📍 Let the first 15–30 minutes settle before jumping into trades for optimal RR setups.

⚠️ Disclaimer:

I am not a SEBI-registered analyst . This trading plan is shared for educational purposes only. Please consult your financial advisor before taking any trades based on this plan. Risk wisely and trade with discipline. 🙏

NIFTY : Intraday Trading Levels and Plan for 20-Mar-2025📅 NIFTY TRADING PLAN – 20-Mar-2025

🕒 Timeframe: 15 Min | 📌 Reference Close: 22,911.80

📏 Gap Opening Threshold: 100+ points

📈 1. GAP-UP Opening Scenario (Opening Above 23,010)

If NIFTY opens 100+ points higher — around or above 23,010 — it enters the Profit Booking Zone: 22,995 – 23,067 .

✅ Action Plan:

- If Nifty opens in the 22,995–23,067 zone, avoid aggressive long trades at open. This zone has historically triggered selling pressure.

- Observe the behavior near 23,067 . If candles start rejecting higher prices or form reversal patterns (e.g., bearish engulfing), plan short trades with SL just above 23,067 .

- If Nifty crosses 23,067 with momentum and volume, upside extension is possible toward 23,185 — the Last Intraday Resistance .

- Avoid shorting blindly above 23,067 . Let price consolidate or form lower highs before initiating any counter-trend short.

📌 Educational Note: Profit booking zones often create whipsaws. Let the market decide the intent before jumping in.

🚫 Don't chase gaps — instead, wait for re-entry opportunities once price confirms direction.

📊 2. FLAT Opening Scenario (Between 22,850 – 22,950)

If NIFTY opens within a tight 40–50 point range around its closing level (±50 points), it's considered a flat opening.

✅ Action Plan:

- Allow the market to settle for the first 15–30 minutes . Avoid early entries.

- If Nifty sustains above 22,995 , we may see a quick move toward 23,067 . One can consider intraday longs above 22,995 with a stop loss near 22,950 .

- If price faces rejection at 22,995 and drops below 22,912–22,880 (previous close zone), short opportunities may arise toward 22,800 (Opening Support) .

- Keep an eye on 22,800 as it is a key intraday support. Breakdown below it can lead to a deeper fall toward 22,728 and 22,632 .

📌 Educational Note: Flat openings often provide the best setups if you let price action settle. Stay nimble and neutral till breakout/breakdown confirms.

📉 3. GAP-DOWN Opening Scenario (Opening Below 22,812)

If NIFTY opens with a gap-down of 100+ points (around or below 22,812 ) — look for action near support zones like 22,800, 22,728, and 22,632 .

✅ Action Plan:

- If Nifty opens near 22,800 and holds, wait for a reversal pattern. Intraday long trades are possible toward 22,912+ .

- A clean breakdown below 22,728 (Last Intraday Support) may trigger a slide toward 22,632 (Buyer’s Support) .

- Avoid catching falling knives. Only buy near 22,632 if there’s clear bullish reversal with volume confirmation.

- If price opens below 22,728 and tries to retest and fails to reclaim that level, short trades can be considered with a stop above 22,728 .

📌 Educational Note: Big gap-downs often attract panic exits in the first 15 mins. Wait for a base to form before looking for reversal trades.

🧠 OPTIONS TRADING – RISK MANAGEMENT TIPS

💼 Use defined stop losses based on 15-min or 30-min candle close. Avoid emotional exits.

⚖️ Avoid buying deep OTM options during rangebound conditions — prefer ATM or ITM for better delta control.

🛡️ Use hedged strategies like bull call spreads or bear put spreads during high IV scenarios.

📉 On breakdown or breakout days, trade with the trend using limited-risk directional strategies.

💰 Never risk more than 1.5–2% of capital per trade — capital preservation is key for consistency.

📌 SUMMARY & CONCLUSION:

Gap-Up above 22,995: Profit booking zone. Wait for reversal signs or breakout to 23,185.

Flat Opening: Best setups possible — breakout above 22,995 or breakdown below 22,880.

Gap-Down below 22,812: Watch 22,800–22,632 support zones for potential reversal or breakdown.

🎯 Let price lead the way — react, don’t predict. Enter only on confirmation. Stay disciplined and respect the market structure.

📢 Disclaimer: I am not a SEBI-registered analyst . This trading plan is purely for educational purposes. Please consult with your financial advisor before taking any position.

NIFTY : Intraday Trading Levels and Plan for 19-March-2025🔥 NIFTY – Intraday Trading Plan for 19-Mar-2025

Current Market Price (CMP): 22,848.75

Chart Time Frame: 15-min

📘 Opening Scenario 1: GAP-UP Opening (100+ points)

If NIFTY opens with a strong gap-up above 22,950, it would directly open into the Profit Booking Zone: 22,995 – 23,067 .

Avoid aggressive long entries near the opening if prices directly hit the profit booking zone, as early buying could trap latecomers. Wait and observe price action in the 22,995 – 23,067 range. If the index forms bullish consolidation with strength, breakout above 23,067 can push it towards the final resistance at 23,185. If rejection occurs near this zone, look for reversal signals like a 15-min bearish candle with follow-up selling to consider short scalps targeting back to 22,850 – 22,775.

🧠 Tip: Avoid call option entries if IVs are inflated and premiums are already factored in after a big gap-up. Time decay can eat your premiums fast.

📗 Opening Scenario 2: FLAT Opening (within 50-80 pts)

In case of a flat or minor gap opening near 22,800 – 22,850, the price will open just above the key consolidation zone: 22,727 – 22,801 .

Look for first 15-30 minutes consolidation. If NIFTY sustains above 22,801, fresh buying can push it to test 22,995. A failure to sustain above 22,801 and breakdown below 22,775 will drag prices back into the range. The downside targets then would be 22,656 and 22,532. No trade zone for flat opening: avoid trades inside 22,727 – 22,775, unless a directional breakout occurs.

🧠 Tip: For flat openings, best setups come after the first 15-30 minutes. Let the market decide the direction first—then align your trade.

📙 Opening Scenario 3: GAP-DOWN Opening (100+ points)

A gap-down below 22,700 will place the index back into or below the consolidation zone. Major supports are at 22,656**, 22,532, and Buyers’ Support: 22,270 – 22,320.

Aggressive buying should be avoided unless NIFTY shows strong reversal signals from support zones like 22,532 or 22,270. If prices bounce from the Buyers’ Support Zone, a quick upside retracement towards 22,656 or even 22,727 is possible. However, if NIFTY breaks below 22,270, it could enter a deeper correction territory—so keep strict stop losses.

🧠 Tip: When buying the dip in a gap-down scenario, use options spreads (e.g., bull call spreads) to reduce premium decay risk while maintaining upside exposure.

💡 Risk Management Tips for Options Traders:

✅ Use defined-risk strategies like spreads (Bull Call / Bear Put)

✅ Avoid chasing momentum in the first 15 minutes of market opening

✅ Stick to 1–2 high probability trades per day

✅ Always place stop loss based on structure or candle close

✅ Never average into losing options trades—respect time decay

✅ Focus on ATM or slightly OTM contracts with 1–2 day expiry for best gamma moves

📊 Summary & Conclusion:

Key Zones to Watch:

🔸 Resistance Zone: 22,995 – 23,067

🔸 Support Zone: 22,656 – 22,532

🔸 Buyers’ Zone: 22,270 – 22,320

🔸 No Trade Zone: 22,727 – 22,775

Be reactive, not predictive. Let price action guide your trades based on these levels. Respect volatility and avoid emotional trades.

⚠️ Disclaimer: I am not a SEBI registered analyst. The above levels and insights are for educational purposes only. Please consult your financial advisor before taking any positions. Trade responsibly! 💼📉