Nifty spot hourly trend analysis for the next week - Nov 17-21As per my Time, Price and Pattern analysis, I expect the Nifty Spot to drop down in the

next week. The likely resistance levels are at 25988 and 26062 whereas the support

levels likely to be at 25534 and 25480.

My Technical Views may differ from the real-time market response due to various external factors. Traders are suggested to conduct own technical analysis while trading this instrument with proper risk management.

Niftyweeklyupdate

Nifty Analysis EOD – November 7, 2025 – Friday🟢 Nifty Analysis EOD – November 7, 2025 – Friday 🔴

Bulls fight back from the edge — but can they hold the ground?

🗞 Nifty Summary

Nifty opened with a sharp 77-point gap down and extended losses by another 128 points, testing the important support zone early in the session. After forming the day’s low, the index stayed range-bound between 25,318 ~ 25,383 till 11:10 AM, when a strong breakout lifted it above the IB High cum Day High, reaching 25,460 with confidence.

This level acted as a crucial resistance, triggering a mild pullback as price began forming a narrow upward-sloping channel, reflecting indecision. The battle between bulls and bears was clearly visible in these mid-session candles.

At 13:25 PM, Nifty again broke the PDL and climbed toward the 25,550 resistance, where both the horizontal resistance and the longer-timeframe trendline converged — pushing the index back to 25,460. Another breakout attempt failed at the trendline, and the index finally closed at 25,509.70, just 9 points below the previous day’s close.

Despite the flat finish, bulls celebrated a 192-point intraday recovery — a sign of returning confidence after multiple bearish sessions. For this momentum to sustain, Nifty must hold the 25,440 ~ 25,460 zone in the upcoming session.

As noted in yesterday’s commentary, bias remains bearish below 25,640 — hence, a decisive close above this level will be crucial to confirm a short-term shift in sentiment.

🛡 5 Min Intraday Chart with Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,433.80

High: 25,551.25

Low: 25,318.45

Close: 25,492.30

Change: −17.40 (−0.07%)

🏗️ Structure Breakdown

Type: Doji-like candle with a narrow body and long wicks on both ends.

Range (High–Low): 232.8 points → volatile, yet ended with indecision.

Body: ≈ 58.5 points → minor directional conviction.

Upper Wick: ≈ 58.95 points

Lower Wick: ≈ 173.85 points → strong intraday buying from lows.

📚 Interpretation

Nifty opened lower, slipped toward 25,320, but strong buying emerged from this support zone, driving prices higher through the morning and midday sessions. The recovery above 25,490 signals that bulls are defending crucial zones but still lack follow-through conviction. The long lower wick underscores short-term exhaustion of selling pressure, though the flat close reflects hesitation at overhead resistance.

🕯Candle Type

This session forms a Long-Lower-Wick Doji, typically seen near short-term supports. It hints at the possibility of a base-building phase, but confirmation will depend on a strong follow-up candle next session.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 204.31

IB Range: 128.65 → Medium

Market Structure: ImBalanced

Trade Highlights:

11:10 – Long Trade → Target Achieved (R:R 1:3.27)

12:50 – Long Trade → Target Achieved (R:R 1:2.58)

📌 Support & Resistance Levels

Resistance Zones:

25,550

25,585

25,615 ~ 25,635

Support Zones:

25,460 ~ 25,440

25,380

25,340

25,310 ~ 25,290

💡 Final Thoughts

After a streak of weak closes, today’s long-lower-wick candle shows visible buying interest near critical supports. Bulls defended the base well, but they must now prove strength through sustained follow-through above 25,640. For traders, the focus should stay on structure — as long as 25,440 holds, this rebound attempt remains valid.

“The first bounce doesn’t confirm reversal — it only tells you the bears have finally met resistance.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

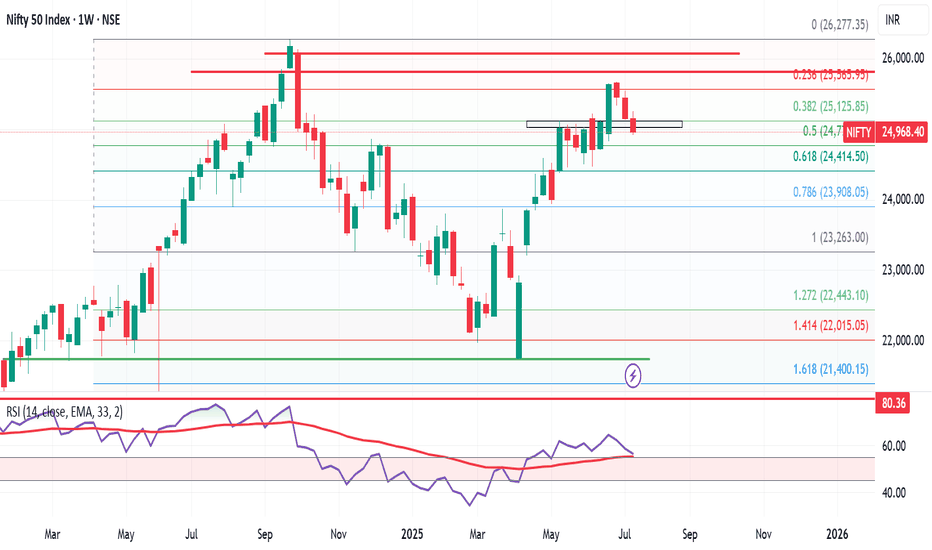

Wkly Market Wrap: Nifty Under Pressure, S&P 500 Hits Record HighThe Nifty 50 closed the week at 24,968, down 180 points from the previous week's close. It traded within a tight range, posting a high of 25,255 and a low of 24,918—perfectly aligning with the range I’ve been tracking between 25,600 and 24,700.

As I’ve been highlighting over the past few weeks, the monthly chart continues to show weakness, and now even the weekly chart is starting to reflect bearish signals. This growing weakness is a notable concern.

What to Watch for Next Week:

If Nifty sustains above 25,100, we could see a potential rebound toward the 25,400–25,450 resistance zone.

However, a breakdown below this week's low of 24,918 opens the door to a retest of key support near 24,500.

What’s interesting is that, despite Nifty’s indecision, the number of bullish stocks on the monthly time frame has increased significantly. Last week, there were 18 such stocks on my radar; now that number has jumped to 26, even after excluding about 10 others that showed bullish patterns but had high volatility.

This divergence—index showing weakness while quality stocks turn bullish—could indicate a possible bear trap being set by institutional players. If true, we might see a sharp short-covering rally after a final shakeout.

Nifty Outlook:

For the upcoming week, I expect Nifty to remain range-bound between 25,400 and 24,500. A decisive breakout or breakdown from this range could lead to sharp directional movement, so traders should stay alert.

Global Markets: S&P 500 Soars to New Highs

The S&P 500 closed at a record high of 6,296, with a weekly high of 6,315 and low of 6,201. The index remains in strong uptrend mode.

A breakout above 6,315 could see it testing 6,376, 6,454, and potentially 6,500 in the coming sessions.

My next major Fibonacci target is 6,568.

As long as 6,149 holds on a weekly closing basis, I continue to view every dip as a buying opportunity.

Final Thoughts:

The Indian markets are sending mixed signals, with the broader index showing caution while individual stock strength is quietly building. This divergence warrants a tactical approach—stay nimble, respect levels, and be ready for sharp reversals or breakouts.

Next week could be crucial. Stay focused, stay disciplined.

Nifty Showing signs of Weakness. Nifty is showing signs of weakness major factor being crisis in the Middle East. Few supports on the down side will be tested in the coming week. If the Nifty can take support at any of the support levels given below only then there will be chance of recovery by end of next week or by end of the month.

Supports For Nifty: 19489 (Weak support), 19328, 19029 (Strong support), 18822 (Very strong support).

Resistances for Nifty: 19602 (Strong Resistance), 19684, 19845.

Nifty Weekly Analysis Aug 7 - 11🔍 Analysis on Nifty for the Upcoming Week 🔮

Aug 7 - Aug 11

The Nifty index seems to exhibit a bullish trend in the long-term & bearish trend in the short-term, according to the market structure.

📈 Key Levels to Monitor:

In the upcoming week, it's important to monitor key levels 19190, 19200, 19235, 19300, 19750, 19800, and 19990.

🔎My outlook:

The outlook for the upcoming week’s trading suggests a non-directional view (Sideways).

📈 Bullish Scenario:

If Nifty breaks out above the significant level of 19800, supported by a strong and clear daily candle, it could indicate a bullish market trend.

📉 Bearish Scenario:

However, if Nifty breaks down below 19190, confirmed by a strong and clear daily candle, it may signal a decline towards the 18890 level.

Nifty Weekly Analysis Jul 31 - Aug 4🔍 Analysis on Nifty for the Upcoming Week 🔮

Jul 31 - Aug 4

The Nifty index seems to exhibit a bullish trend in both long-term & short-term as well, according to the market structure.

📈 Key Levels to Monitor:

In the upcoming week, it's important to monitor key levels 19190, 19200, 19560, 19865, & 19990.

🔎My outlook:

The outlook for the upcoming week’s trading suggests a directional view (Bullish).

📈 Bullish Scenario:

If Nifty breaks out above the significant level of 19990, supported by a strong and clear daily candle, it could indicate a bullish market trend.

📉 Bearish Scenario:

However, if Nifty breaks down below 19560, confirmed by a strong and clear daily candle, it may signal a decline towards the 19200 level.

📊 Support Level:

As long as Nifty sustains above the support level of 19560, the market can be viewed as bullish.

Nifty Weekly Analysis for Jul 24 - 28🔍 Analysis on Nifty for the Upcoming Week 🔮

Jul 24 - 28

The Nifty index seems to exhibit a bullish trend in both long-term & short-term as well, according to the market structure.

📈 Key Levels to Monitor:

In the upcoming week, it's important to monitor key levels 19190, 19200, 19560, 19990.

🔎My outlook:

The outlook for the upcoming week’s trading suggests a non-directional view (Sideways).

📈 Bullish Scenario:

If Nifty breaks out above the significant level of 19990, supported by a strong and clear daily candle, it could indicate a bullish market trend.

📉 Bearish Scenario:

However, if Nifty breaks down below 19560, confirmed by a strong and clear daily candle, it may signal a decline towards the 19200 level.

📊 Support Level:

As long as Nifty sustains above the support level of 19560, the market can be viewed as bullish.

Nifty Weekly Analysis for Jul 17 - 21🔍 Analysis on Nifty for the Upcoming Week 🔮

Jul 17 - 21

The Nifty index seems to exhibit a bullish trend in both long-term & short-term as well, according to the market structure.

📈 Key Levels to Monitor:

In the upcoming week, it's important to monitor key levels 19190, 19200, 19330, 19600.

🔎My outlook:

The outlook for the upcoming week’s trading suggests a non-directional view (Sideways).

📈 Bullish Scenario:

If Nifty breaks out above the significant level of 19600, supported by a strong and clear daily candle, it could indicate a bullish market trend.

📉 Bearish Scenario:

However, if Nifty breaks down below 19190, confirmed by a strong and clear daily candle, it may signal a decline towards the 18890level.

📊 Support Level:

As long as Nifty sustains above the support level of 19190, the market can be viewed as bullish.

Nifty Weekly Analysis for Jul 10 - 14🔍 Analysis on Nifty for the Upcoming Week 🔮

Jul 10 - 14

The Nifty index seems to exhibit a bullish trend in both long-term & short-term as well, according to the market structure.

📈 Key Levels to Monitor:

In the upcoming week, it's important to monitor key levels 18890, 19190, 19200, 19235, & 19525.

🔎My outlook:

The outlook for the upcoming week’s trading suggests a non-directional view (Sideways).

📈 Bullish Scenario:

If Nifty breaks out above the significant level of 19525, supported by a strong and clear daily candle, it could indicate a bullish market trend.

📉 Bearish Scenario:

However, if Nifty breaks down below 19190, confirmed by a strong and clear daily candle, it may signal a decline towards the 18890level.

📊 Support Level:

As long as Nifty sustains above the support level of 19190, the market can be viewed as bullish.

Nifty Weekly Analysis for Jun 26 - 30🔍 Analysis on Nifty for the Upcoming Week 🔮

Jun 26 - 30

The Nifty index seems to exhibit a bullish trend in both long-term & short-term as well, according to the market structure.

📈 Key Levels to Monitor:

In the upcoming week, it's important to monitor key levels 18535, 18650, 18660, 18890.

🔎My outlook:

The outlook for the upcoming week’s trading suggests a directional view (Bullish).

📈 Bullish Scenario:

If Nifty breaks out above the significant level of 18887, supported by a strong and clear daily candle, it could indicate a bullish market trend.

📉 Bearish Scenario:

However, if Nifty breaks down below 18534, confirmed by a strong and clear daily candle, it may signal a decline towards the 18250 level.

📊 Support Level:

As long as Nifty sustains above the support level of 18530, the market can be viewed as bullish.

Nifty Weekly Analysis for Jun 19 - 23🔍 Analysis on Nifty for the Upcoming Week 🔮

Jun 19 - 23

The Nifty index seems to exhibit a bullish trend in both long-term & short-term as well, according to the market structure.

📈 Key Levels to Monitor:

In the upcoming week, it's important to monitor key levels

🔎My outlook:

The outlook for the upcoming week’s trading suggests a non-directional market, potentially characterized by a sideways pattern.

📈 Bullish Scenario:

If Nifty breaks out above the significant level of 18887, supported by a strong and clear daily candle, it could indicate a bullish market trend.

📉 Bearish Scenario:

However, if Nifty breaks down below 18534, confirmed by a strong and clear daily candle, it may signal a decline towards the 18250 level.

📊 Support Level:

As long as Nifty sustains above the support level of 18530, the market can be viewed as bullish.

Nifty Weekly Analysis for Jun 12 - 16🔍 Analysis on Nifty for the Upcoming Week 🔮

Jun 12 - 16

The Nifty index seems to exhibit a bullish trend in both long-term & short-term as well, according to the market structure.

📈 Key Levels to Monitor:

In the upcoming week, it's important to monitor key levels 18250, 18530, 18535, 18660, 18775, & 18885.

🔎My outlook:

The outlook for the upcoming week’s trading suggests a non-directional market, potentially characterized by a sideways pattern.

📈 Bullish Scenario:

If Nifty breaks out above the significant level of 18780, supported by a strong and clear daily candle, it could indicate a bullish market trend.

📉 Bearish Scenario:

However, if Nifty breaks down below 18530, confirmed by a strong and clear daily candle, it may signal a decline towards the 18250 level.

📊 Support Level:

As long as Nifty sustains above the support level of 18530, the market can be viewed as bullish.

Nifty Weekly Analysis for Jun 5 - 9The Nifty index displays a bullish trend in both the long-term and short-term, as indicated by the market structure.

📈 Key Levels to Monitor:

In the upcoming week, it's crucial to keep an eye on the following key levels: 18251, 18465, 18535, 18660, 18890.

🔎 Outlook:

The outlook for the upcoming week's trading suggests a non-directional market, potentially characterized by a sideways pattern.

📈 Bullish Scenario:

If Nifty breaks out above the significant level of 18660, supported by a strong and clear daily candle, it could indicate a bullish market trend.

📉 Bearish Scenario:

However, if Nifty breaks down below 18465, confirmed by a strong and clear daily candle, it may signal a decline towards the 18050 level.

📊 Support Level:

As long as Nifty sustains above the support level of 18465, the market can be viewed as bullish.

👀 Stay vigilant and closely monitor the price action throughout the week to make informed trading decisions. Good luck! 🚀💼

Nifty Weekly Analysis for May 22-26Analysis on nifty for upcoming week May 22-26:

The Nifty index seems to exhibit a bullish trend in both long-term & short-term as well, according to the market structure.

In the upcoming week, it's important to monitor key levels 18060, 18065, 18090, 18105, 18250, & 18460.

My outlook:

The outlook for the upcoming week's trading appears to be non-directional, with the possibility of nifty remaining in a sideways pattern.

If nifty breaks out above 18460 with a strong and clear daily candle, it could indicate a bullish market trend.

However, if nifty breaks down below 18060 with a strong and clear daily candle, it could signify the entry of bears into the market.

As long as nifty sustains above the support level of 18060, the market can be viewed as bullish.

Nifty Weekly Analysis for May 15-19Analysis on nifty for upcoming week May 15-19:

The Nifty index seems to exhibit a bullish trend in both long-term & short-term as well, according to the market structure.

In the upcoming week, it's important to monitor key levels 18065, 18090, 18100, 18105, 18250, & 18389.

My outlook:

The upcoming trading week looks like non-directional, nifty may stay sideways.

If nifty BO 18390 with strong & clear daily candle then we can expect market to be bullish.

If nifty BD 18250 with strong & clear daily candle then we can expect bears are entering into market.

Until nifty sustains above 18250, we can remain bullish on market.

Nifty Weekly Analysis for May 8-12Analysis on nifty for upcoming week May 8-12:

The Nifty index seems to exhibit a bullish trend in the long-term while showing bearish in the short-term, according to the market structure.

In the upcoming week, it's important to monitor key levels 18040, 18065, 18090, 18105, 18250, & 18270

My outlook:

The upcoming trading week looks like crucial for bulls. Till now bulls had run a quick up trend with gap ups & big green candles of 1300 pts in 21 trading days.

Bulls looks like they have exhausted slightly, on the last trading day, the entry of bears are strong & clear with huge gap down & closed below the opening.

In coming week if nifty sustains above 18040-18105 then we can expect a minor consolidation, until nifty BREAKOUT strong resistance 18250 with strong & clear candle.

In case if nifty BREAKDOWN 18040 level with strong & clear candle in daily time frame, then bears will take control and we may see bear trend to unleash.

Nifty for week 9 Jan 2023 to 13 Jan 2023Weekly Analysis

Last week Nifty opens with a slight gap, tested the previous week high's though did not sustain at highs, and moved lower and closed near the week's low.

Formed: Bear Candle

Price action combined weeks: Sideways {Inside candle - the price has been consolidating in a candle range for the past two weeks}

Seems like the price would trade sideways in the coming week as well and the range can get narrower and time for strangles

Weekly Support at 17670- 17850

Weekly Resistance at 18200-18400

Nifty Outlook 1st to 5th July 2022. Can the rally continue?Will the rally continue or fizzle out? Is the big question. After a fantastic week where we saw Nifty end at 17158.25 after taking support from 200 days EMA we are set for another week where Nifty where Nifty is in the position to move forward if it can clear few resistances that are up and ahead. The support levels for Nifty on the down side are 17028, 16947, 16747 and finally 16535. Below 16535 which looks unlikely for now Nifty can go to the levels of 16430 or 16304. The resistances Nifty has on the way up are: 17213, 17333 and 17431. Above 17431 major hurdles will be 17649 and 17798. These 2 levels (17649 and 17798) can be crossed if and only if there is a massive participation from FIIs, DIIs and Retail investors.

Nifty Outlook for week starting 18th-22nd July 2022 - POSITIVE.NIFTY gave a strong closing on Friday as it ended above a long term support of 15917 and 16030. Yet the Important hurdle of 50 days EMA is still ahead of it which is at 16132. Crossing and closing above 16132 will be important for Nifty to go towards 16277.

above 16277 levels Nifty in a short to medium term can go towards 16525 which is it’s 200 days EMA and a strong resistance. Bulls will be in command only above this level. On the lower side again 16030 and 15917 will be the support zones.

Below 15917 Nifty can go towards 15738 zone, however during the next week if Nifty closes above key level of 16132, chances for positivity will be more.

Nifty outlook for 11th to 15th JulyNifty had another fascinating week where Bulls are trying to snatch initiative from the Bears. In case Nifty can sustain the levels above 16152 which it has successfully done on Friday when it closed at 16222.60 we can see Nifty rise till 16550 where it will face 200 days EMA resistance. In case Nifty falls below 16152 level we can see it searching for supports.

Nifty Resistance levels: 16343, 16400, 16549 and finally 16809.

Nifty Support levels: 16152, 16030, 15930 and finally 15500.

Market Outlook 16th to 20th May 2022.Nifty opened gap up today at 15977 just short of 16K. Went on to make a high of 16083 but could not sustain the levels amongst the selling pressure and ended negative at 15782. This indicates there is excessive fear in the market and selling pressure on every rise. The market mood index MMI measure of Excessive fear, fear, greed and excessive greed indicates that we are in the excessive fear zone. Buying during these times may create wealth for long term investors. The support and the Resistance zones are as under:

The Support Zones: 15734, 15671, 15507 (This is the final support, Nifty breaking that is highly unlikely but below these levels we can see a free fall to 15052 to 14484).

The Resistance Zones: 16083, 16235, 16484, 16819 and 16964.

Support for Nifty might be round the corner. (Weekly Outlook)It was a bad week for NIFTY all hopes of recovery vanished as NIFTY could not sustain above 200 EMA after failing to sustain above 50 days EMA last week. NIFTY is trapped in a downward parallel channel currently having broken even the mid channel support levels from where NIFTY can turn upwards now are at.

Important Support Levels for NIFTY will be: 16340, 16135 (key support), 16009 and finally 15500 (Channel bottom).

Important Resistance levels for NIFTY will be: 16484, 16616, 16858 and 17072.