#GBPJPY , Next one !📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #GBPJPY

⚠️ Risk Environment: High

📈 Technical Overview:

Another Sell setup at yesterday POI ? lets see

🚀 Trading Plan:

• Need valid Momentum Structure

• LTF ENTRY NEEDED

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

NQ

NASDAQ NQ A Breakout Can Come, Wait For The ConfirmationAs I posted earlier, all of our FCP levels and zones have been working great and have given us tremendous opportunities. Now NQ is back at the upper zone and the momentum is looking great. If this breakouts we can test previous high and possibly go to all time highs.

I have updated a few new levels on the chart.

Trade what you see, wait for the confirmations and manage the risk as always.

Follow for more. Please support this analysis by liking, commenting, and sharing with friends, colleagues, traders, and trading communities. Thanks👍🙂

NQ Trading Inside Pivot Zone — Expansion Incoming 1/27/26📊 NQ (Nasdaq 100 Futures) — Premarket Trading Plan

Timeframe: 30-min

Session Theme: Balance → Expansion from Pivot

🟡 Primary Pivot Zone (Decision Area)

25,984 – 25,960

This zone defines control for the session.

Above pivot → bullish continuation bias

Below pivot → rotational / risk-off behavior

No bias without acceptance.

🔴 Upside Levels (If Pivot Holds)

26,007 – 26,043 → First resistance / acceptance test

26,085 – 26,130 → Major supply / upside extension zone

Failure here likely rotates price back toward the pivot.

🟢 Downside Levels (If Pivot Fails)

25,912 – 25,880 → First support / responsive bids

25,845 (Prior Week High) → Structural bull line

25,738 (Prior Week Close) → Breakdown confirmation

25,680 – 25,630 → Major demand / liquidation pocket

Acceptance below 25,845 signals real momentum shift.

🧠 Market Structure Read

Higher-timeframe trend remains bullish

Price is compressing above weekly structure

Current action = balance, not rejection

Expect range expansion once pivot resolves

This is a decision day, not a chase environment.

🧭 Trade Thesis

🟢 Bull Case

Hold 25,984–25,960

Buyers defend pullbacks into the pivot

Acceptance above 26,007 opens: 26,043

26,085 → 26,130

Best longs = pivot holds + higher low + volume confirmation

🔴 Bear Case

Acceptance below 25,960

Rotation toward 25,912 → 25,880

Loss of 25,845 opens: 25,738

25,680 – 25,630 if momentum accelerates

Shorts only make sense after pivot failure, not inside it.

📌 BOTTOM LINE — REAL IMPACT FACTORS FOR NQ TODAY

🟢 Bullish / Supportive

✅ Positive premarket futures bias

✅ Strong tech earnings anticipation

✅ Softer USD supporting risk assets

✅ Global equities resilient despite tariff rhetoric

🔴 Bearish / Risk Factors

⚠ Fed policy caution — no aggressive easing signal

⚠ Tariff headlines & geopolitical risk remain overhangs

⚠ Sector divergence (weak insurers) could spill into sentiment

📊 Quantum Regime Snapshot (QRS)

🟡 Neutral → Conditional Risk-On

Risk appetite remains constructive above the pivot, but this is not full risk-on. Structure confirmation required before pressing size.

⚡ Volatility Expectation

Moderate → Elevated

Compression near pivot = expansion potential

Earnings + macro uncertainty = fast rotations

Expect two-way trade, not a straight trend day

🎯 Execution Rules

Trade reactions, not predictions

Above pivot → lean long, buy pullbacks

Below pivot → fade strength, expect rotation

No acceptance = patience

Nasdaq Retests January Highs + BSL – Rejection Here?Hello Fellow Traders,

We're looking at the Nasdaq (NQ or NDX) today.

The index has retested and taken out the January highs again — hitting major buy-side liquidity from earlier in the month.

Right now, the market is in a major consolidation phase and could stay range-bound through much of Q1. We're trading in premium territory relative to the broader dealing range — so a correction down to the discount area (below equilibrium) feels likely and healthy in this environment.

If we see clear rejection signs from the current area (e.g., strong wicks, failure to hold highs, or displacement lower), expect a potential waterfall move down to the highlighted discount PD Arrays.

Focus on reactions at those PD Arrays (like FVGs, NDOG/NWOG, Order Blocks, etc.) — not just price.

Example: If the top highlighted FVG breaks with displacement (strong move through it), it flips to an iFVG (inverted FVG). Any retracement back into that iFVG becomes a solid short signal.

Vice versa for lower arrays — bullish reactions there could confirm continuation or reversal.

Bias: Still overall bullish macro, but short-term correction to discount zones is expected to reload buyers. Watch for confirmation at those PD Arrays before acting — patience pays!

Keep risk tight, especially in choppy consolidation. What's your view on Nasdaq? Expecting rejection and drop, or breakout higher first? Drop your thoughts below!

#Nasdaq #NQ #NDX #TechnicalAnalysis #SMC #ICT #PDArrays #FVG #Forex #Indices

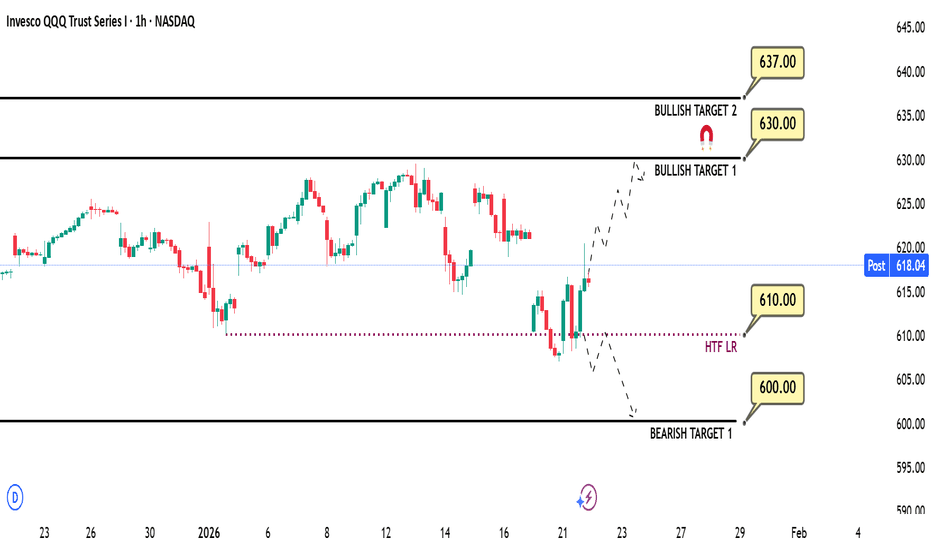

QQQ Weekly Outlook – Week 4 of 2026 (Jan 26–30)QQQ Weekly Outlook – Week 4 of 2026 (Jan 26–30)

Technical Look

QQQ moved exactly as expected on the bearish side, hitting its downside targets with the Tuesday open last week and finding a bounce from those levels.

In the Mid Week Update I shared afterward, I highlighted that the structure had shifted into a bullish phase and that price was now more likely to target higher levels. I’m also linking last week’s outlook on the side for reference.

Scenarios – Prediction

Scenario 1: Bullish Scenario (Likely)

With the current bullish structure established during the week, I expect price to continue higher and potentially target all time highs. Overall bullish sentiment remains strong, which makes this continuation reasonable.

That said, risks remain on the table. Escalation around Iran or a potential 100% tariff on Canada could quickly flip market structure back to bearish, so staying cautious is important.

This bullish scenario can play out in two ways:

1-A direct gap-up open followed by continuation toward bullish targets

2-A pullback toward the 687 area, a brief deviation, then a bounce with a strong close above that level, leading to higher targets

Bullish scenario targets:

626 – 629.5 – 636.5

Scenario 2: Bearish Scenario

Geopolitical tension around Iran or a potential tariff shock could still trigger a bearish shift, keeping this scenario in play.

A strong break and close below 618.5 would activate the bearish scenario for me. On any retest, price should fail to reclaim and close back above 618.5. If that happens, I would look to actively trade this scenario using puts.

Potential bearish targets:

607 and 599.5

Position Management Notes

I manage risk by scaling out of positions at key reaction levels and adjusting exposure as structure confirms. Partial profit taking at major levels is a core part of my approach.

I share deeper SPY-QQQ breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

#GBPJPY , Continue to hell ?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #GBPJPY

⚠️ Risk Environment: High

📈 Technical Overview:

I believe there is a chance we do see retracement from the point and goes up a bit then drop , but lets have this plan in our watchlist either.

🚀 Trading Plan:

• Wait for Momentum around key levels

• LTF ENTRY NEEDED

• Manage risk aggressively, and secure ASAP.

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

QQQ Mid Week Update (22-23 JAN)QQQ Mid Week Update

Technical Look:

Price opened with a strong breakdown, exactly as I expected in my Weekly Outlook from Sunday. After the initial move, we got a retest, and price continued lower into the bearish target. (Checked the linked idea.)

Then before the market close, Trump’s tariff cancellation comments shifted sentiment, and the structure flipped back to a bullish setup.

With Wednesday’s close, QQQ has fully transitioned into a bullish structure. Price action confirms that the bullish scenario is currently active and in control.

As long as there is no major sentiment shift (such as a cancellation of the Greenland deal), I expect the market to maintain its bullish structure.

Given the current momentum, price may reach upper targets relatively quickly.

Bullish Scenario (Active):

As long as the bullish structure remains intact, I expect price to continue higher.

Upside targets:

Target 1: 630

Target 2: 637

If price breaks the 610 level aggressively due to a sentiment shift, this bullish idea would be considered invalidated.

Bearish Scenario (Unlikely):

A bearish scenario would come into play only if Trump reintroduces EU tariff rhetoric and signals that the Greenland deal has been canceled.

In that case, a decisive break below 610 would open the door for put positions, and a downside continuation could follow.

The first downside target in this scenario would be 600.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

NQ - More chop aheadOn a daily time frame, market structure says we are bullish above 24,900, but honestly, a sweep of that level or even a drop all the way down to the green box (demand) would have me wanting to look for longs as I would anticipate a pretty strong bounce if that happened.

The best trades this coming week will be between the extremes of this range which I marked with grey boxes. Those are the top and bottom 20%.

Avoid trading the middle of this range unless you want to be chopped

NASDAQ (US100) – Trading Plan for Today | Jan 23🔥 NASDAQ (US100) – Trading Plan for Today | Jan 23

The previous period showed a bullish move,

followed by a consolidation phase.

Today’s session opened below the key daily level,

while the key daily level itself is located below the Point of Control,

which keeps the bearish intraday bias intact.

Primary scenario (short)

As long as price remains below the key daily level,

the downside scenario is preferred.

Targets:

– lower daily zone

– lower reverse zone

These areas may trigger a pause or a technical reaction.

Alternative scenario (long)

A long scenario will be considered

only if price accepts above the upper daily zone.

In this case, the upside target would be the upper reverse zone,

which remains a valid alternative scenario.

If the idea was useful, support it 🚀 and follow.

This is not financial advice. Risk management is required.

ES Weekly Levels: Reversal Zone 6865–6875 → Target 6950/6955🔱 ES WEEKLY SNAPSHOT — EXECUTIVE SUMMARY (NEW WEEK | JAN 2026)

✨ Bull reversal setup is the focus — but weakness remains until key sell-side is reclaimed

🧲 Fresh overhead sell-side liquidity / bear FVG: 6950 plus key level 6955

📌 Context: ES gapped down at the open → signals continued weakness into the week

🧲 Bull FVG + preferred reversal zone: 6865–6875 = best area to scale into longs

🛡 Failure zone / risk-off trigger: loss of 6865–6875 opens downside to 6795 → 6790

🎯 Bull target: 6950 fresh liquidity pocket overhead

🏦 Core play: scale buys 6865–6875, manage risk if the zone fails, take profit into 6950–6955

🗳️ ES Weekly Scenarios — What’s Your Play?

Which path do you have for ES next week?

🅰️ Hold 6865–6875 → reversal works → rotation into 6925 → tag 6950

🅱️ Sweep below 6875 → reclaim 6865–6875 → squeeze into 6950–6955

🅲 Drive into 6950–6955 → rejection from sell-side → pullback toward 6925 → 6865

🅳 Break/hold below 6865–6875 → weakness confirms → downside opens to 6795 → 6790

Your key levels: 6955 / 6925 / 6865 / 6795 / 6790

Your FVGs: 6950 (bear sell-side) / 6865–6875 bull reversal

TSLA D1 Institutional Buy/Sell Levels by ProjectSyndicate 🔱 TSLA DAILY SNAPSHOT — EXECUTIVE SUMMARY (NEW WEEK | JAN 2026)

✨ Dip-accumulation reversal setup is the focus — but upside is capped until overhead sell-side is cleared

🧲 Fresh overhead sell-side liquidity / fresh supply: 495 plus key level 460

📌 Context: price is range-bound between fresh supply 495 and fresh demand 300 → institutional levels define the map

🧲 Bull FVG + preferred reversal zone: 365 USD = best area to scale into longs (360–380)

🛡 Failure zone / risk-off trigger: loss of 340 opens downside to 300 fresh demand

🎯 Bull target: 495 fresh supply pocket overhead

🏦 Core play: accumulate on dips at/near 360/380, manage risk if 340 fails, take profit into 495

🗳️ TSLA Daily Scenarios — What’s Your Play?

Which path do you have for TSLA next week?

🅰️ Hold 360–380 → reversal works → reclaim 420 → rotation into 460

🅱️ Sweep below 360 → reclaim 365 FVG → squeeze into 420 → 460

🅲 Drive into 460 → stall/reject → pullback toward 420 → 380

🅳 Break/hold below 340 → weakness confirms → downside opens to 300

Your key levels: 460 / 420 / 380 / 340

Your FVGs: 365 (bulls)

Your fresh zones: 495 supply / 300 demand

Plot same levels on your TSLA chart with

Supply Demand Zones PRO | ProjectSyndicate

GBPUSD , a Short is coming up 📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #GBPUSD

⚠️ Risk Environment: High

📈 Technical Overview:

a Sell side QuickScalp Setup

🚀 Trading Plan:

• Wait for Momentum around key levels

• LTF ENTRY NEEDED

• Manage risk aggressively, protect capital first

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

QQQ Weekly Outlook – Week 3 of 2026 (Jan 19–23)QQQ Weekly Outlook – Week 3 of 2026 (Jan 19–23)

Technical Look:

Last Monday, price pushed into 629.25, which I marked as Bullish Target 1 in last week’s outlook, but failed to secure a close above that level. As mentioned in my Sunday outlook, with CPI scheduled for Tuesday, I did not expect sustained upside continuation beyond those levels before the data release.

QQQ tapped 629.25, failed to hold above it, and began its retracement exactly as anticipated.

Since QQQ was the stronger index relative to SPY, it found support earlier and did not need to reach its full downside target at 610.25. SPY had already reached its key support zone, which allowed QQQ to stabilize sooner.

(Please refer to the linked idea for visual confirmation.)

Scenarios – Prediction:

At this stage, I am tracking two potential scenarios.

Scenario 1: Bearish Scenario (Higher Probability)

This is currently the more likely scenario due to the macro environment, particularly Trump–EU tensions and potential EU tariffs related to Greenland.

I believe price may open the week with a sharp downside move.

My bearish targets are:

614.5 – 610.25 – 599.5

If price breaks 614.5 decisively and closes a 4H candle below it, I would expect a move toward 610.25.

Likewise, if 610.25 is broken aggressively and holds below, price could extend toward 599.5.

Each of these bearish targets also represents a potential bounce or reversal zone, so I prefer taking partial profits (around 1/3) at each level.

If price breaks 614.5 decisively, I would look to engage on the short side using put options.

Scenario 2: Bullish Scenario

This scenario becomes valid only if Trump–EU tensions ease before the market opens (with Monday being a holiday and trading resuming on Tuesday).

The 626 level acts as a call wall in options positioning for QQQ. If price breaks above 626 aggressively, I would look to buy calls on a retracement, targeting 629.5 and 636.5.

Position Management Notes:

I rely on confirmation-based entries around key levels. Once in a position, I manage risk by taking partial profits at reaction zones and adjusting exposure as price structure develops.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

$MSFT Microsoft Potential BUY/Support AreasNASDAQ (NQ) did not have a good start to the new year. It has been hitting lows after lows so far and yet to make a proper 2026 high. This downward correction is being reflected in nearly all major tech stocks.

MSFT (Microsoft) clearly created a double top while running inside and touching upper end of a channel. It is now retracing and can possibly come to one of the support areas/levels which can act possible targets for shorts and levels for buys.

As the channel is upwards, this can be good retracement for buy opportunities and if NASDAQ makes anew high, it can pull MSFT higher to new highs too.

Lets wait and watch and always this is not and advice but just an observation. Risk management is extremely important as always.

NQ Weekly Levels: Reversal Zone 24775/24900 → Target 25425/2544🔱 NQ WEEKLY SNAPSHOT — EXECUTIVE SUMMARY (NEW WEEK | JAN 2026)

✨ Liquidity collection → bounce setup is the focus — patience until sell-side is swept

🧲 Fresh overhead sell-side liquidity magnet / massive FVG target: 25425–25440

📌 Context: Plan is not to chase strength — wait for price to collect liquidity below market first

🧲 Bull FVG: ~25000 but noted as weak — treat as minor support / reaction only

🛡 Preferred reversal / long scale zone: 24775–24900

🛡 Failure zone / risk-off trigger: sustained acceptance below

24770 opens downside continuation / no-bid conditions

🎯 Bull target: rotation into 25425–25440 to tap fresh overhead liquidity pocket

🏦 Core play: let NQ sweep lower liquidity → scale buys 24775–24900

→ manage risk if 24770 fails → take profit into 25425–25440

________________________________________

🗳️ NQ Weekly Scenarios — What’s Your Play?

🅰️ Hold 24775–24900 → reversal works → reclaim 25000 → rotation into 25425–25440

🅱️ Sweep below 24770 → reclaim back into 24775–24900 → squeeze higher → tag 25425–25440

🅲 Drive into 25425–25440 → rejection from fresh sell-side liquidity

→ pullback toward 25000 → 24900

🅳 Break/hold below 24770 → weakness confirms → bounce thesis invalid → downside continuation (stand aside / reassess)

________________________________________

Your key levels: 25440 / 25425–25425 / 25420 / 24900 / 24770

Your FVGs: ~25000 bull / 25425–25440 massive overhead liquidity pocket

Market Maker Model on NQThe algorithm is currently engineering a Market Maker Buy Model to reprice towards the Buy Side Liquidity resting at 25900. The present action within the Sunday Open and Monday session is the final accumulation phase at the Weekly Bias Level before the primary expansion leg targets the premium Volume Imbalance.

Entry: 25325.00 (68 points lower)

Stop loss: 25125.00 (200 points from entry)

Take profit: 25925.00 (600 points from entry)

Risk to reward ratio: 3.00R

The absolute truth at the center of this chart is that the algorithm has transitioned from a rebalancing phase into a high probability expansion state targeting the external range liquidity.

You are witnessing a fractal expansion where the Monthly and Weekly order flow is unilaterally bullish and seeking new all time highs.

The Draw on Liquidity for the Month is the parabolic projection target at 26750 which acts as the ultimate magnetic draw for the institutional order flow.

The Draw on Liquidity for the Week is the distinct cluster of Buy Side Liquidity resting above the relative equal highs at 25900.

The Draw on Liquidity for the Day is the internal Volume Imbalance and Void residing between 25600 and 25700 which must be filled before the higher timeframe expansion can complete.

The market has spent the previous sessions consolidating around the 25300 level which is functioning as the dynamic fulcrum for this move.

This consolidation is not indecision it is the engineering of liquidity to fuel the next leg higher.

The entry logic is predicated on the mitigation of the Bullish Order Block and Breaker structure formed around the 25300 region.

The algorithm has successfully displaced above this level and is now holding it as a floor.

We are looking for a subtle retracement or a stop hunt into this 25300 to 25325 pocket during the London or New York Killzone.

This price point represents the equilibrium of the local range and the launchpad for the attack on the highs.

Buying here aligns with the institutional intent to defend the trend and forces you to act when the retail mind is fearful of a reversal.

The temporal window for this entry is the opening range of the week where the initial balance is established before the true expansion begins.

The invalidation of this thesis occurs if the algorithm achieves a daily close below the 25125 swing low.

Such a move would violate the immediate bullish market structure and suggest that the consolidation at 25300 was distribution rather than accumulation.

It would indicate that the algorithm is seeking a deeper discount potentially targeting the 24200 level before any resumption of the uptrend.

If price trades heavy through 25125 with displacement the probability of the bullish expansion collapses and we enter a defensive posture.

Until that structural damage occurs every tick lower is an inducement to trap shorts.

Target 1: 25600.00 | Type: Internal BSL / Void Fill | Probability: 90% | ETA: Monday Tuesday

Target 2: 25925.00 | Type: External BSL / Swing Highs | Probability: 75% | ETA: Mid Week Expansion

Target 3: 26750.00 | Type: Monthly Projection / Discovery | Probability: 60% | ETA: End of Month

A 25% probability exists for the antithetical reality: a Complex Correction.

In this scenario the rejection from the 26000 region was significant enough to warrant a return to the mean of the larger range.

The current holding of 25300 is a trap to induce early longs before a violent flush to the 24500 Order Block.

This reality is confirmed if price breaches the Omega Point at 25100.

Breakdown after Jan 14 Volatility Event - Get some.This video highlights the continued price action I suggested would take place after the Jan 14 volatility event.

Honestly, watching the markets open tonight, moving in the direction of my trades (metals, SPY/QQQ/TECS/XLK/others). I could not be happier.

Additionally, Nat Gas is starting to make a big move higher. I've been positioning into this move for more than 30 days. Now, the dual Polar Vortex may setup driving very cold temps into the US/UK.

Sometimes, you have to trust the ADL predictive modeling and play those bigger moves for profits.

I just wanted to share this success and to ask you if you were able to follow my research and GET SOME as well.

We could see a big breakdown over the next 24 hours on news or social issues in the US/UK.

Get some.

NQ Weekly analysis 1/18/2026Short idea is based on technical analysis and SPX gex exposure.

Essentially the main thesis is that we are due to sweep liquidity before going higher.

This week bearish -> followed by next week bullish to all time highs.

stop is 2.5x of ATR on 4-hour timeframe

take profit is at conservative price point.

SPY Mid-Week Update (Jan 15–16)SPY Mid-Week Update (Jan 15–16)

Technical Look:

As mentioned in my Sunday SPY Weekly Prediction, price followed the downside move exactly as expected. The market reached 687.50, which I labeled as Bearish Target 1, and once again behaved in line with the outlined plan.

After price printed a daily close back above 687.50, a reversal confirmation was triggered from that level.

Prediction – Outlook:

In my view, once SPY secured a daily close above 687.5, the upside move started to develop. Based on this confirmation, I entered my call contracts approximately one hour before the market close.

I am currently expecting the following upside targets, in sequence:

691.75 – 694 – 695.25

The 688–689 zone now acts as a key support area, where price may find support if a pullback occurs. That said, it is also possible for the market to open strong and continue directly toward the bullish targets without a meaningful retracement.

Bearish Scenario:

If price breaks strongly and closes above the 686 level, I will exit my call positions and look to buy puts from that level. In this scenario, my downside target would be 680.

Options flow shows a concentration of a put wall around the 680 level. Price may first run toward 691.75 and then reverse back to the downside, shifting into a bearish move.

Position Management Notes:

Once price reaches the first target, I plan to close 1/2 of my position and move the stop loss on the remaining size to breakeven. This is how I personally manage my positions.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

US100 Short at Trendline🔍 Quick Summary

I’m looking for a short here on US100 as price reacts into a clear confluence of descending trendline resistance and a weak high. The rejection and compression under resistance suggest downside expansion back into demand ⚠️📉.

📊 Deep Analysis

On the 15-minute chart, price made a strong impulsive move up, breaking structure (BOS) and creating higher lows. However, that move has now stalled directly into a long-term descending trendline, which has capped price multiple times before.

Key observations:

Price tapped a Weak High / PWH zone and failed to hold above it

Clear rejection wicks at trendline resistance

Momentum slowing with choppy candles → signs of distribution

Price currently sitting below the trendline, not above it

This looks like a classic lower-high into resistance rather than continuation. Liquidity has been built above the highs, but price has failed to accept above resistance, increasing the probability of a downside sweep first.

The green demand zone below around 25,640 is the obvious magnet. If that level goes, the next downside push could accelerate quickly as late longs get trapped.

📰 News Supporting My Bias

The short bias is also supported by the macro backdrop:

Bond yields remain volatile, keeping pressure on tech valuations

Market participants are cautious ahead of key US data, leading to profit-taking near resistance

Nasdaq positioning remains crowded, increasing the risk of sharp pullbacks on rejection

This environment favours fade-the-rally setups rather than breakout chasing.

🎯 Trade Idea Scenario

Bearish Scenario (Primary)

Entry: Into trendline resistance / current consolidation zone

Confirmation: Rejection candles + failure to reclaim trendline

TP1: 25,640 (first demand / liquidity sweep)

TP2: 25,535 → 25,440 (next demand + imbalance)

SL / Invalidation: Clean break and acceptance above the trendline + weak high

Bullish Invalidation

If price breaks and holds above the trendline with strong volume, the short idea is invalid and I step aside — no fighting acceptance.

📌 What I’m Watching Next

I’m watching the next few candles at the trendline. Strong bearish closes or long upper wicks confirm the short. Acceptance above resistance cancels the idea.

⚠️ Disclaimer

This is my personal analysis and not financial advice. Always do your own research and manage risk carefully 📉📚.