QQQ Weekly Outlook – Week 6 of 2026 (Feb 09–13)QQQ Weekly Outlook – Week 6 of 2026 (Feb 09–13)

Weekly Recap

Last week, my base projection was that the market would lack a clear directional trend and trade in a range, reacting from key levels. Price behaved exactly as expected, rejecting from those levels and forming short term bounces throughout the week.

Relative to SPY, QQQ was noticeably weaker, which made put side trades significantly more effective on QQQ.

After a strong break and acceptance below 618, we entered puts and shorted QQQ. Price moved quickly, reaching 607 on Wednesday and 599.5 on Thursday, where we took profits.

When price closed back above 599.5 on Thursday, we exited the remaining puts in profit and flipped long with calls. By Friday, those call positions had already started printing gains.

Overall, the execution followed the plan cleanly, and it was a highly profitable week.

Scenarios – Prediction

Bullish Scenario (Likely)

I am tracking two potential bullish paths for the coming week.

Scenario 1:

Price opens with a gap up above 609.5, or breaks and holds above this level with two consecutive 1H candle closes.

In this case, my upside targets are:

616.75 → 630 → 636.5

Scenario 2:

Price fails to hold above 609.5 and pulls back to build energy. A retracement into the 600 or 593 area followed by a bounce, confirmed by price running liquidity and closing above the level with two 1H candles, would be treated as a deviation and signal bullish continuation.

In this case, bullish targets remain:

609.5 → 616.75 → 630 → 636.5

Bearish Scenario

If price closes below 593, I will shift my bias to bearish and look to short the market.

Bearish Target:

580

This level represents the strongest potential bounce zone, so I would plan to close approximately 75% of the position there.

Position Management Notes

I only consider a level broken after two consecutive 1H candle closes above or below it. If price deviates into a level and then reclaims or loses it with confirmation, I treat that as a valid deviation setup.

No trades are taken without confirmation. If price closes back inside the level we assumed was broken or deviated from, again confirmed by two 1H closes, the trade idea is invalidated and positions should be exited.

I share deeper US Market breakdowns and mid week scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

Nq!

SPY Mid Week Update (FEB 12–13)SPY Mid Week Update (FEB 12–13)

New Plan – Range Play

Price is now clearly trading inside a defined range. This range is compressed between higher time frame (HTF) Supply above and higher time frame (HTF) Demand below.

If price loses 690, it may quickly move down toward the lower range area defined as HTF Supply.

For now, the healthiest approach is to trade the range between 696 and 676.

Range Trading Plan:

If price taps HTF Demand (676) and closes with two 4H candles above, I will look to buy Calls / go long.

If price taps HTF Supply (696) and closes with two 4H candles below, I will look to buy Puts / go short.

Bullish Scenario

If price breaks 698 aggressively and secures a daily close above, the range will be considered broken and market structure shifts to bullish.

On a retest of 698, Calls can be taken to position long SPY.

Bearish Scenario

If price breaks 676 (HTF Demand) aggressively and closes with a daily candle below, the range support is lost.

On the retest of 676 from below, Puts can be taken targeting a deeper retracement.

Bearish Target:

651

I share deeper SPY-QQQ breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

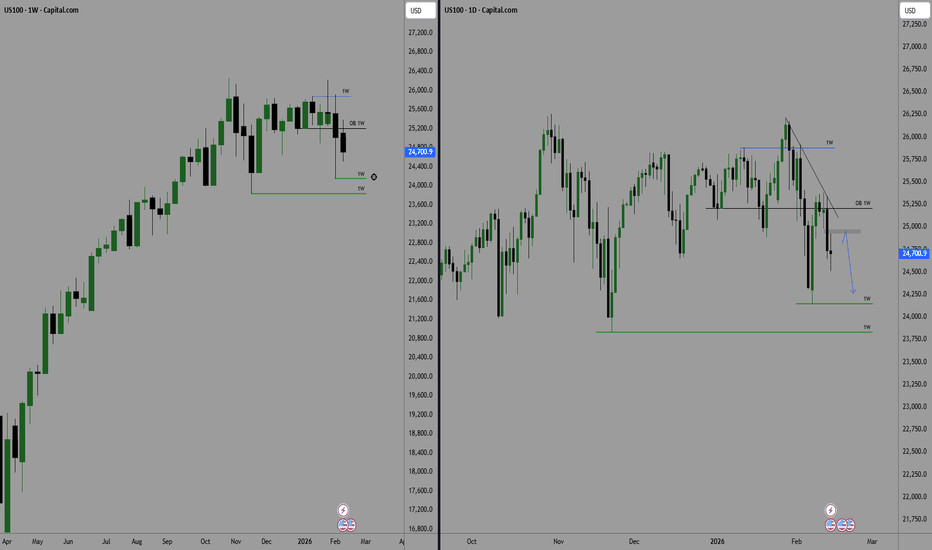

NQ Looks Weak. Downside Incoming.Watch out here folks. Vey ominous that NQ did not make a new high on the monthly chart.

Immediate target is going to be below that monthly wick at 23,900. As you can see there is a FVG around here but since its already been played by that wick would expect lower.

There is another unplayed FVG around 22,000 which will most likely be the targets on the monthly.

Seemingly distribution happening after not grabbing that new ATH on NQ.

Indicators are both printing "bullish" on the monthly chart, this is beacuse there are 15 days left this month and technically it wont be bearish until they lose this pivot. However, weekly is bearish already.

Long term target is 19,970. 2026 is going to dump hard into 2027. Would be bearish biased all year.

Almost 5,000 points of action setting up to dump big time.

Indicators used:

TrenVantage LITE

Rejection Zone LITE

ICT Confluence Engine LITE

#USDCAD , Lets be friend with it 📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #USDCAD

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality setup but lets have it in our watchlist.

—

#GOLD is still VALID

—-

🚀 Trading Plan:

• Need to check Momentum at POI

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

#GOLD , Lets Play it 📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #GOLD

⚠️ Risk Environment: High

📈 Technical Overview:

After Many months , i added GOLD on Watchlist of PUBLIC channel ... but i don't wanna it be like a TRAP so mostly will just Watch it ... and if it be 100% good will take it .

—

#EURUSD IS STILL VALID

—-

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

NQ - ES comparison for the coming weekI do expect an accumulation early in the week and a sell off to NQ sell side liquidity in the PIC.

I do truly believe this is the beginning of a very HARD price capitulation that will take us to a long term retracement .

in the previous posts I posted all the target and my personal analysis .

QQQ Weekly Outlook – Week 5 of 2026 (Feb 02–06)QQQ Weekly Outlook – Week 5 of 2026 (Feb 02–06)

Weekly Recap

Last week, the market followed our bullish framework perfectly. QQQ fully respected the bullish scenario, delivering a clean and profitable week. The market opened with a gap up and reached all bullish targets, allowing positions to be closed in profit.

After hitting those targets, price moved back into a range and started to show some retracement following the Mid Week update. I’m also sharing last week’s QQQ Weekly Outlook on the side for reference.

At this stage, I see increasing indecision in the market. Below, I’m outlining my strategy to navigate this uncertainty.

Scenarios – Prediction

Scenario: The Range

At the moment, I do not see a clear directional bias. Price is trading between well defined key levels, and I expect range behavior unless those levels are decisively broken.

My base case is a range bound market, where price reacts from the Range High and Range Low zones and rotates back into the range.

Deviations into these areas followed by a close back inside the range would keep price compressed within its internal structure. A strong break and acceptance beyond the range boundaries would signal the market’s true directional bias.

Key Levels to Watch / Trade

Range High: 636.5

Range Low: 607 – 599.5

Mid Range / Internal Liquidity: 630 – 618

Game Plan

If price sweeps liquidity at one of these key levels and then closes back inside the range, I will look to trade in the opposite direction of the liquidity grab.

The core idea is to fade moves where traders get trapped thinking the level has broken, only for price to reverse back into the range.

Example:

If the 618 level gets tapped and price closes back above it with either two 1H candles or one 4H candle, I will treat that as a deviation and look for call side setups.

If, instead, price breaks a key level with strong acceptance and closes firmly above or below it, that would suggest continuation in that direction.

Example:

A strong close below 618 would shift my focus toward the Range Low at 607, where I would look to trade the downside using puts.

Position Management Notes

Positions should only be taken after confirmation, either through a clean break or a clear deviation at key levels. If price closes back against the direction of the expected move, the setup is invalidated and the position should be stopped.

For example, if 618 breaks strongly and I enter short, but price then reclaims 618 with two consecutive 1H closes above it, that would invalidate the short setup and signal the need to exit.

I share deeper US Market breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.

NASDAQ (US100) – Trading Plan for Today | February 06🔥 NASDAQ (US100) – Trading Plan for Today | February 06

The session started with a bearish open.

Price opened below the key level at 24,686,

while the key level itself is located below the Value Area.

This structure confirms a short-biased intraday context.

Additional cluster context:

Intraday plan

Primary scenario (short):

– short positions remain the priority.

Downside target:

– daily short zone.

Alternative scenario:

– longs will be considered only after acceptance above the daily long zone,

– in that case, the target shifts toward the long reversal zone at 25,069.

As long as price remains below 24,686,

bearish bias remains valid.

This is not financial advice. Risk management is required.

#EURUSD , Time to Fly?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #EURUSD

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality setup at all but with a valid structure we can have it as QuickScalp

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

MNQClassic Bearish Pennant. Invalidation level where it's marked. I missed a head and shoulders that was clear as day. Not really but didn't size accorindgly retrospectively. It is waht it is it's 3:00am. Anyways break 130 and youll be flying to 345 by the am. 130 is your head fyi have a blessed day

NQ and ES quarterly theory cycle.There you have it ,the manipulation has happened ,just go check on my previous analisi here attached.

IF the leg in the purple box will be broken ,meaning that the weekly down colse candle will close below the lower previous swing ,we will certainly see new lower targets for the year to come .

Another one on #GBPUSD ? lets see 📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #GBPUSD

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality setup as well . Don't rush on it ...

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

Updated January 14 Volatility Event BreakdownThis video will help you understand how the markets are playing out related to my original prediction of a big volatility event on January 14.

Watching the markets swing up and down over the past two weeks while almost perfectly following my predicted price trends has been incredible.

But, I'm not always this accurate in my predictions - no one is.

I believe this market move is following my longer-term prediction of a moderate breakdown in Q1/Q2 of 2026. If my research is correct, we will continue to see an ABC or ABCDE wave structure where price continues to move downward and attempts to find a base near July 2026.

The one thing I really wanted to point out is the use of Fibonacci Defense Levels and how you can use them to better determine when and how price is breaking from a moderate pullback into an extended or deeper pullback/trend reversal.

I've been using these Defense Levels for quite a while, and I find they work well.

Please take a minute to watch this video.

I also highlight Gold/Silver and Natural Gas in this video.

Hope all of you are GETTING SOME today.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

NASDAQ (US100) – Trading Plan for Today | Jan 30🔥 NASDAQ (US100) – Trading Plan for Today | Jan 30

Today’s session opened below the key level at 25,853,

with the lower key level positioned below the Point of Control.

This structure defines a short-biased intraday context.

Price failed to reclaim and accept above the key level,

confirming seller control.

Intraday plan (short)

Primary target:

– lower daily reversal zone boundary

In this area, I expect:

– partial profit-taking,

– potential short-term reaction.

As long as price remains below 25,853, the short bias stays valid.

Acceptance back above this level would invalidate the short setup.

This is not financial advice. Risk management is required.

#USDCAD , First one after many month !📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #USDCAD

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality Setup as EJ ... just will observe it .... no need to rush on it

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

#EURJPY , Gonna be sweet with us ?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #EURJPY

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality Setup , if it Moves Perfectly will take it , if not .... just let it go

🚀 Trading Plan:

• Need Valid momentum Structure over the POI

• LTF ENTRY NEEDED

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

QQQ Weekly Outlook – Week 4 of 2026 (Jan 26–30)QQQ Weekly Outlook – Week 4 of 2026 (Jan 26–30)

Technical Look

QQQ moved exactly as expected on the bearish side, hitting its downside targets with the Tuesday open last week and finding a bounce from those levels.

In the Mid Week Update I shared afterward, I highlighted that the structure had shifted into a bullish phase and that price was now more likely to target higher levels. I’m also linking last week’s outlook on the side for reference.

Scenarios – Prediction

Scenario 1: Bullish Scenario (Likely)

With the current bullish structure established during the week, I expect price to continue higher and potentially target all time highs. Overall bullish sentiment remains strong, which makes this continuation reasonable.

That said, risks remain on the table. Escalation around Iran or a potential 100% tariff on Canada could quickly flip market structure back to bearish, so staying cautious is important.

This bullish scenario can play out in two ways:

1-A direct gap-up open followed by continuation toward bullish targets

2-A pullback toward the 687 area, a brief deviation, then a bounce with a strong close above that level, leading to higher targets

Bullish scenario targets:

626 – 629.5 – 636.5

Scenario 2: Bearish Scenario

Geopolitical tension around Iran or a potential tariff shock could still trigger a bearish shift, keeping this scenario in play.

A strong break and close below 618.5 would activate the bearish scenario for me. On any retest, price should fail to reclaim and close back above 618.5. If that happens, I would look to actively trade this scenario using puts.

Potential bearish targets:

607 and 599.5

Position Management Notes

I manage risk by scaling out of positions at key reaction levels and adjusting exposure as structure confirms. Partial profit taking at major levels is a core part of my approach.

I share deeper SPY-QQQ breakdowns and weekly scenario updates on Substack. Link is in my profile.

This analysis is for educational purposes only and reflects my personal opinion. It is not financial advice.