Nqfutures

NQ Sell Setup – Dead Cat Bounce After BOS (1H, 1:3 RR)Trade Idea – NQ (Sell Setup)

* Timeframe: 1H

* Entry: 26950

* SL: 26350

* TP: 25250

* RR: 1:3

- We dropped from 26349 to 25536 after moving from the Jan2026 lows near 25000 to the Jan highs at 26349, which marked a 0.618 Fib retracement.

- From the sharp sell-off between 25536 and 26050, price has already completed another 0.618 retracement, which I consider a classic dead cat bounce.

- The break of structure (BOS) was confirmed once we closed below 26,100, so this move back to 26050 is corrective rather than impulsive.

- The decline from 26349 to 25536 formed Wave A to B. After the current 0.618 retracement up to 26050, I expect price to complete Wave C to D, targeting the 25250 area.

- The RR setup is excellent, with approximately 255 points of stop loss versus 848 points of potential profit, giving a 1:3 RR.

- There is also a strong probability of a deeper move back toward 25000, which aligns with the 0.618 Fib retracement from the Nov 2025 lows to the Jan 2026 highs.

NASDAQ $NQ US100 Major Levels And PatternsNasdaq bounced yesterday heavily and completed a W pattern. I personally have been able to capture majority of this move. You can consider yesterday's W pattern a sort of double bottom which means hat more bullishness is expected in the medium term.

On a short term, now that it has completed a W pattern and reached previous important zone which had a gap, so we can expect a correction here but this may not be a big one. In a rare case there may not be any correction here at all because NASDAQ is forming a pattern which when forms usually ignores all the smaller W and M patterns.

For that reason my Bias is bullish and I will look for buying opportunities mostly.

There are certain Higher time frame levels that I am watching closely which you will find on the chart.

Trade what you see, manage the risk.

Follow for more. Please support this analysis by liking, commenting, and sharing with friends, colleagues, traders, and trading communities. Thanks👍🙂

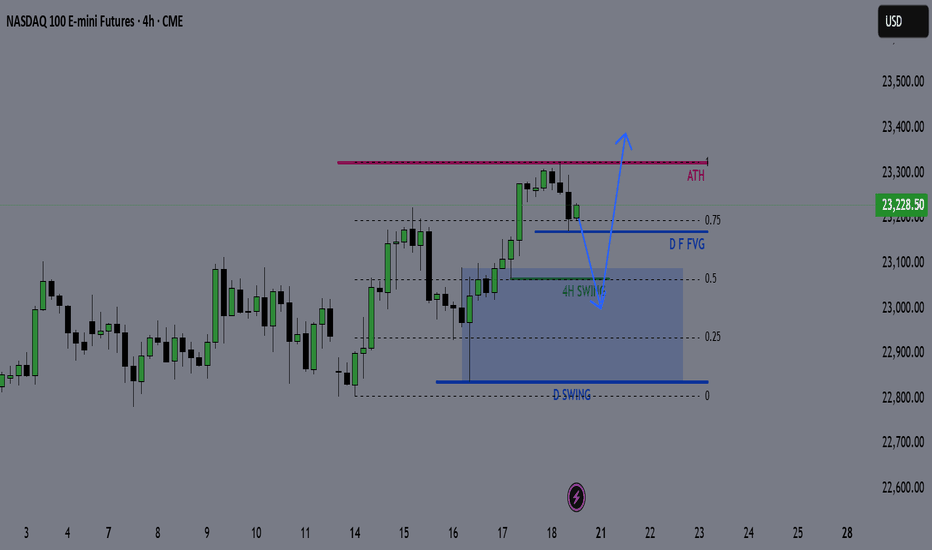

NQ Weekly Outlook & Game Plan 20/07/2025NQ Weekly Outlook & Game Plan

🧠 Fundamentals & Sentiment

Market Context:

NQ continues its bullish momentum, driven by institutional demand and a supportive U.S. policy environment.

📊 Technical Analysis:

Price is currently in price discovery, and the weekly structure remains strongly bullish — so I prefer to follow the strength.

We might see a minor retracement before pushing further above the all-time high (ATH).

🎯 Game Plan:

I'm expecting a potential retracement to the 0.5 Fibonacci level, which is the discount zone in a bullish environment.

Interestingly, the 4H liquidity zone aligns perfectly with the 0.5 Fib level — this confluence suggests price may gather enough energy from there to make new highs.

✅ Follow for weekly recaps & actionable game plans.

NASDAQ: Minor Pullback, Still on TrackOn Friday, the Nasdaq experienced a slight pullback, which was quickly absorbed at the start of the week. Currently, the index is still developing the turquoise wave B, which should top out just below resistance at 23,780 points, signaling the start of the bearish wave C. This move should lead to the low of the magenta wave (4) within our turquoise Target Zone between 17,074 and 15,867 points. Alternatively, there is a 42% probability that wave alt.(4) is already complete. In this scenario, the magenta wave alt.(5) could carry the index immediately above the mentioned resistance.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

NQ Weekly, Daily & 4 HR Chart Bullish Confirmation for Sun MonLooking for a bounce after 3 straight weeks of lower prices here starting with Sunday night's open barring any Trump/geopolitical news. Monday is a No Red Folder News Day, which also makes it look good for the longs. However, starting on Tuesday and for the rest of the week, we have red folder news every day...

Tue

Mar 11

10:00am

USD

JOLTS Job Openings

Wed

Mar 12

8:30am

USD

Core CPI m/m

Thu

Mar 13

8:30am

Core PPI m/m

PPI m/m

Unemployment Claims

226K 221K

Fri

Mar 14

10:00am

USD

Prelim UoM Consumer Sentiment

Prelim UoM Inflation Expectations

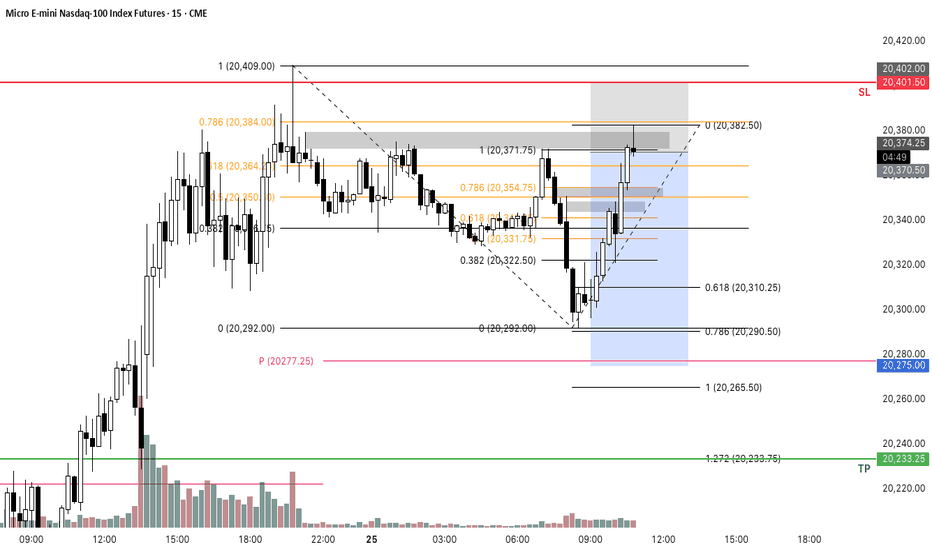

Intraday Levels for Nasdaq 100 Futures - 12/05/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

NQ Futures Daily Bullflag to $22,000After a sudden drop from ATHs and a big rebound, a daily bullflag formed into month end setting September up for a very big run.

Upside PTs are: 20150, 20300, 20450, and 22000 if a break above the previous ATH to finish out the bullflag

SL would be invalidation of the flag

NQ | QQQ | Day trading plan 7-26-2024CME_MINI:NQU2024

Bullish Scenario

Immediate Resistance Levels:

Bullish Line: : 19,115.75

Target Price 1: 19,168.75

Target Price 2: 19,278.50

Strategy:

Entry: Consider entering a long position above the immediate resistance at 19,115.75.

Stop Loss: Place a stop loss below the nearest support at 19,041.75 to minimize risk.

Targets: Set targets at the resistance levels mentioned above. Partial profit-taking can be considered at each target level.

Confirmation: Look for bullish candlestick patterns or confirmation from volume indicators before entering the trade.

Bearish Scenario

Immediate Support Levels:

Bearish Line: 19,065.00

Target Price 1: 19,041.75

Target Price 2: 18,998.75

Target Price 3: 18,932.00

Strategy:

Entry: Consider entering a short position if the price breaks below the Bearish Line at 19,065.00.

Stop Loss: Place a stop loss above the nearest resistance at 19,115.75 to minimize risk.

Targets: Set targets at the support levels mentioned above. Partial profit-taking can be considered at each target level.

Confirmation: Look for bearish candlestick patterns or confirmation from volume indicators before entering the trade.

Summary

Bullish Entry: Above 19,115.75 with targets at 19,168.75 and 19,278.50.

Bearish Entry: Below 19,065.00 with targets at 19,041.75, 18,998.75, and 18,932.00.

Stop Losses: Adjust according to the nearest support/resistance levels to manage risk.

This analysis should be used in conjunction with other indicators and market conditions for a comprehensive trading strategy.

7/10 To Soar or Not to Soar Is the Question .GREATTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTT MORNING YALLLLLLLLLLLLLLLLLLLLLLLLLLLLLLL!!!!!

😏 😏 😏

07/10/2024

**News** ON THE BLOCK TODAY!!!!

**~~Wholesale Inventories (Preliminary)~~**

10:00 AM ET

***EIA Petroleum Status Report***

10:30 AM ET

***Midnight*** **CONSENTRATED CONSOLIDATION **

*#ES 5634.25*

*#NQ 20709.50*

💰 **BUYSIDE**💰

***#ES 5646.5***.--->Above this level we look for --->....

🟢 5653.25

🟢 5676.85

🟢 5694.75

🟢 5711.25

🟢 5727.50

🟢 5738.25

***#NQ 20772.00***...---> Above this level we look for-->

🟢 20788.50

🟢 20813.00

🟢 20843.75

🟢 20878.00

🟢 20902.25

🟢 20933.25

💰 **SELLSIDE**💰

***#ES 5630***--- Below this level and we look for

🔴 5616.75

🔴 5604

🔴 5580

🔴 5564.50

🔴 5550.25

***#NQ 20696.50***---> Below this level and we look for

🔴 20685

🔴 20656

🔴 20639

🔴 20619

🔴 20594