NVIDIA (NVDA): Where Are We in the Cycle?Ticker: NVDA

Category: Market Structure / Elliott Wave Analysis

Author’s note: Educational analysis — not financial advice.

🧠 Market Context

NVIDIA has been one of the strongest growth stories in the last market cycle. However, after such a powerful move, many traders are now asking: Where are we in the broader structure — and what could come next?

From a structural perspective, NVDA appears to have completed its third Elliott Wave, with the fourth wave currently in progress. This phase often reflects a period of consolidation, where the market digests previous gains before potentially starting the fifth wave.

📊 Elliott Wave Structure

Through the lens of Elliott Wave theory:

Wave 3 — likely completed after the parabolic advance that marked NVIDIA’s latest all-time highs.

Wave 4 — a corrective phase, potentially forming a sideways or slightly downward structure.

Wave 5 (ahead?) — may still occur, possibly extending above the upper boundary of the current price channel.

However, once the fifth wave completes, markets typically enter a longer consolidation or corrective phase — often retracing 50–60% of the total move from the highs.

⚙️ Volatility and Price Range

Currently, NVDA is trading within a broad channel, roughly between $100 and $400+.

Volatility remains elevated — which suggests that the sideways phase could persist for several months, or even longer.

Such behavior is common in late-cycle stages when large market participants distribute part of their holdings while retail interest remains high.

📈 Key Takeaways

The main impulsive move seems to have already played out.

The market may enter a range-bound or sideways phase, with local rallies still possible.

Correction risks are gradually increasing, especially if the fifth wave develops and fails to sustain new highs.

In short, this might not be the best time to chase — but rather to observe how price behaves within the current channel.

💬 Final Thoughts

This analysis is purely educational and reflects one possible scenario based on market structure.

No one can predict the exact timing or depth of the next move — the market always decides.

👉 What do you think?

Are we already in the correction phase, or is there still one more leg up left for NVDA?

Share your view in the comments below 👇

Nvdatrading

Bullish Pullback Attack – NVIDIA Heist Plan for Escape Loot!🚨💻 NVIDIA (NVDA) Stock Heist Plan 🎭 | Swing & Day Trade Robbery 💰⚡

🌟 Hey Money Makers & Market Robbers! 🌟

Welcome back to the Thief Trading Den where we don’t trade… we steal from the market vaults! 🏦💸

🔥 Asset: NVIDIA (NVDA)

🎭 Heist Type: Swing / Day Trade

🔑 Plan: Bullish Pullback Robbery

🗝️ Entry (Breaking into the Vault)

First lockpick entry above 167.00+ 🔓

Retest & pullback = perfect robbery spot

Thief layering strategy: stack multiple buy limit orders (layered entry like robbers tunneling from multiple sides 🛠️).

Any price level? Yes, thieves adapt—grab loot wherever the window cracks open! 🏃♂️💨

🛑 Stop Loss (Escape Route 🚪)

Official Thief SL: @ 161.00 ⚠️

But dear Thief OG’s, adjust based on your risk appetite, loot bag size & startergy 🎭

Remember, no thief survives without an escape route! 🚁

🎯 Target (The Electric Fence Escape ⚡)

The High Voltage Electric Shock Fence is guarding the treasure @ 196.00 ⚡⚡

Snatch your profits before the fence fries the loot 🔥

Escape fast, spend faster, rob smarter 💸🍾

⚠️ Thief Alert 🚨

The market guards (short sellers) are patrolling heavy—don’t get caught in their traps 🕵️♂️

Use layered limit orders, scale out profits, and keep your SL tight!

A true thief never overstays at the crime scene 👀

💥 Boost this Robbery Plan 💥

Every like & comment powers the Thief Trading Family 🏆

Stay sharp, stay sneaky & let’s rob NVIDIA together! 🤑🎭

NVDA Showdown:Will Bulls Charge to $204 or Bears Drag Us to $163If NVDA falls under $179, it might quickly drop to $176.70. If it keeps falling, the next stop could be $163. But if NVDA goes up and closes above $188, we could see it reach $199 or even $204.

Why do these levels matter? Because a big move could happen soon; either a big fall or a strong jump up. What would you do if NVDA hit these prices? Have you seen this happen before?

If you’re wondering what these moves could mean for you, or if you have questions, just send me a message. Sometimes one good question leads to your best trade ever. What would you ask if you could get a clear answer?

Mindbloome Exchange/ Trade What You See

NVDA $182 Weekly CALL Setup – Cheap Premium, Big Upside?

# 🚀 NVDA Weekly Options Trade Idea (2025-09-03)

### 📊 Multi-Model Recap

* **Daily RSI**: 📉 34.3 (weak)

* **Weekly RSI**: 🔻 73.2 (falling)

* **Volume**: +1.3x → institutional distribution signs

* **Options Flow**: 🔥 C/P = 1.96 (bullish skew)

* **Gamma/Theta**: ⚡ High risk (2 DTE)

👉 Models Split:

* 🐻 Bearish: Claude, Gemini → favor \$165 PUT

* 🐂 Bullish: Llama, Grok → favor \$175 CALL

* 😶 Neutral/No Trade: Claude (low confidence)

---

### 🧭 Consensus Read

* Price & volume = bearish ⚠️

* Options flow & VIX = bullish 📈

* Net: **Mixed bias → tactical bullish bounce possible**

---

### ✅ Trade Setup (Viral Play)

```json

{

"instrument": "NVDA",

"direction": "CALL",

"strike": 175,

"expiry": "2025-09-05",

"entry_price": 0.68,

"profit_target": 1.36,

"stop_loss": 0.34,

"size": 1,

"confidence": 0.65,

"entry_timing": "market open"

}

```

---

### 🎯 Trade Details

* 📌 **Strike**: \$182 CALL

* 💵 **Entry**: 0.68 (ask, open)

* 🎯 **Target**: 1.36 (+100%)

* 🛑 **Stop**: 0.34 (-50%)

* 📅 **Expiry**: Sep 5 (2 DTE)

* 📈 **Confidence**: 65%

* ⏰ **Hold Policy**: Close by Thu EOD (don’t ride Friday gamma bomb)

---

⚠️ **Risks**:

* 2 DTE = 🔥 high gamma / fast theta decay

* Divergent signals → whipsaws possible

* Tight stop discipline required 🚨

NVDA Earnings Play | \$190C– Don’t Miss Out

# 🚀 NVDA Earnings Play | \$190C @ 2.49 | 200–400% Target 🎯

### 📝 Quick Take (TL;DR)

* **Bias:** Moderate-Bullish (78% confidence).

* **Rationale:** Fundamentals 🔥 + Options flow skewed bullish 📈 + Technicals constructive.

* **Main Risk:** China export \~\$8B headwind in guidance.

---

### 🎯 Trade Idea

* **Buy** NVDA **2025-08-29 \$190 Call**

* 📌 Entry: \$2.49 (ask) — enter **pre-earnings close** (Aug 26 AMC).

* 🛑 Stop: \$1.25 (−50%).

* 🎯 Targets:

* +200% → \$7.47

* +300% → \$9.96

* ⏳ Exit Rule: If neither stop/target hit, **close within 2h post-earnings open**.

* ⚖️ Risk: \$249 per contract (max loss).

---

### 📊 Why This Setup?

**Fundamentals (9/10)**

* Revenue growth: +69% TTM 🚀

* Margins elite (gross 70%, net 52%) 💰

* Beat history: 8/8 last quarters ✅

* Balance sheet strong (cash \~\$54B).

**Options Flow (8/10)**

* Implied move ~~5.9% (~~\$10.5).

* Call OI heavy @ \$185–\$200 (gamma cluster).

* Liquidity excellent at \$190 strike (OI >64k).

**Technicals (8/10)**

* Price \$179.83, holding above 20/50/200 MAs.

* RSI neutral (53).

* Resistance: \$184.5 / \$190 / \$200.

* Coiling under highs 🔄.

**Macro (6/10)**

* AI/data center demand = secular tailwind.

* China ban risk headline.

* VIX \~15 → complacency = bigger gap risk.

---

### ⚠️ Risks

* Guidance may highlight China hit (\$8B) → bearish gap.

* IV crush 30–50% post-print.

* Gap risk may bypass stop.

* Single-leg naked = high variance → **size small (≤2% portfolio).**

---

### 📌 Execution Checklist

✅ Confirm ask = 2.49 @ close.

✅ Expiry = 2025-08-29 (weekly).

✅ Size ≤ 2% acct.

✅ Close within 2h post-earnings if no trigger.

---

### 📊 TRADE JSON

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 190.0,

"expiry": "2025-08-29",

"confidence": 78,

"entry_price": 2.49,

"stop_loss": 1.245,

"profit_target": 7.47,

"size": 1,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-08-26",

"earnings_time": "AMC",

"expected_move": 5.9,

"iv_rank": 0.75,

"signal_publish_time": "2025-08-26 14:00:37 UTC-04:00"

}

```

---

### 🔖 Hashtags

\#NVDA #EarningsPlay #OptionsTrading #CallOptions #StockMarket #AIStocks #Futures #SwingTrade #TradingSignals #RiskReward #OptionsFlow #SP500 #TechStocks

NVDA \$200C→ Big Move Loading?

# 🚀 NVDA Weekly Options Setup | \$200 Call 🎯 (High Risk / High Reward)

📊 **TRADE SNAPSHOT**

* **Ticker**: NVDA

* **Direction**: 📈 CALL (LONG)

* **Strike**: \$200

* **Entry Price**: \$1.44

* **Profit Target**: \$2.16 (50% gain)

* **Stop Loss**: \$0.58 (40% risk)

* **Expiry**: 2025-08-29

* **Confidence**: 65%

* **Timing**: Enter at Open

* **Signal Time**: 2025-08-23 11:11 EDT

---

### 🔎 Market Analysis

✅ **Weekly RSI**: 87.2 (RISING → Strong Bullish)

⚠️ **Daily RSI**: 63.3 (FALLING → Short-term caution)

📉 **Volume**: 0.9x last week (Weak confirmation)

🔥 **Options Flow**: Calls 617k vs. Puts 383k → **1.61 ratio (Bullish Bias)**

---

### 📈 Bias & Strategy

* **Overall Sentiment**: **Moderate Bullish** 🚀

* Bullish institutions loading Calls → supports upside.

* Weak daily momentum + low volume = ⚠️ caution.

* High gamma risk → manage tight with stop loss.

🏷 **Tags**:

\#NVDA #OptionsTrading #SwingTrade #WeeklyOptions #TradingView #StockMarket #EarningsPlay #MomentumTrading #OptionsFlow #GammaRisk

Strong Bullish Flow in NVDA: $180 Calls Primed for Breakout! 🚀 NVDA Weekly Options Bullish Flow – Aug 19, 2025

**Market Sentiment:**

📈 Total calls: **632,689** | Total puts: **334,721**

💥 **Call/Put Ratio: 1.89 → Strong Weekly Bullish Flow**

⚠️ Gamma Risk: Moderate – watch volatility closely.

**Technical Indicators:**

* **Daily RSI:** 63.3 → slight pullback signs

* **Weekly RSI:** 87.2 → 🚀 strong weekly momentum

* **Weekly Volume Ratio:** 0.9x → weak institutional activity, caution advised

**Options Highlights:**

* Key strikes: **\$180** (OI: 65,649), **\$187.50** (liquid and premium-friendly)

* Expiration in **3 days** → time decay accelerating

**Risks to Monitor:**

* Weak weekly volume

* Daily RSI trending down

* Price support at **\$175.90–\$176.00**

**Consensus & Trade Setup:**

* **Overall Bias:** Moderate Bullish

* **Recommended Trade:** **Single-leg Call**

* **Strike:** \$180.00

* **Entry:** \$3.60

* **Stop Loss:** \$1.80

* **Profit Target:** \$6.00–\$7.50 (80%-100% potential)

* **Confidence:** 65%

**Trade JSON Snapshot:**

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 180.0,

"expiry": "2025-08-22",

"confidence": 0.65,

"profit_target": 6.00,

"stop_loss": 1.80,

"size": 1,

"entry_price": 3.60,

"entry_timing": "open",

"signal_publish_time": "2025-08-19 13:15:57 EDT"

}

NVDA Gamma Showdown: Will Bulls Break $185 Before Time Runs Out? 🚀 NVDA Gamma Showdown: Will Bulls Break \$185 Before Time Runs Out?

**Sentiment:** ⚖️ *Moderate Bullish, High Risk*

* **Call/Put Ratio:** 1.78 📈

* **Daily RSI:** Mixed → Losing momentum

* **Weekly RSI:** Still bullish

* **Volume:** Weak → Low institutional conviction

* **Gamma Risk:** 🔥 HIGH — expiry in 1 day

* **Time Decay:** Accelerating ⚡

---

### 📊 **Consensus Highlights**

✅ Bullish options flow supports upside potential

⚠️ Weak volume + gamma risk = cautious sizing

💡 Tight stop loss and fast profit-taking advised

---

### 🎯 **Trade Setup**

* **Type:** CALL (Naked)

* **Strike:** \$185.00

* **Expiry:** 2025-08-15

* **Entry:** \$0.62

* **Profit Target:** \$0.86 (+30%)

* **Stop Loss:** \$0.31 (–50%)

* **Confidence:** 65%

* **Entry Timing:** Market open

---

💬 *This is a high-risk, high-reward expiry play — watch it like a hawk.*

📌 *Not financial advice. DYOR.*

---

**#NVDA #OptionsTrading #GammaSqueeze #DayTrading #StocksToWatch #OptionsFlow #TradingSignals #StockMarket**

NVDA don’t Miss Out--$190 Call Target, Momentum on Fire## 🚀 NVDA Weekly Options Breakdown (Aug 11, 2025) 🚀

### 🔥 Market Sentiment: Bullish Bias Across Models

* **Grok/xAI**: Strong Bullish — rising RSI & bullish flow, but *watch weak volume*.

* **Claude/Anthropic**: Moderate Bullish but *no trade* due to policy risks & volume doubts.

* **Gemini/Google**: Moderate Bullish, recommends **\$192.5 calls** with stop loss — volume risk noted.

* **Llama/Meta**: Bullish — buy **\$190 calls**, manage volatility & premium decay.

### ✅ Consensus Trade Setup:

**Buy \$190 Calls** expiring Aug 15 @ \$0.70 premium

* 🎯 Profit Target: \$0.91

* 🛑 Stop Loss: \$0.35

* 📊 Confidence: 70%

* ⏰ Entry: Market Open Next Trading Day

### ⚠️ Key Risks:

* Policy/news impact on semiconductor sector

* Moderate gamma risk & possible volatility spikes near expiry

---

### 🔍 Model Insights Breakdown

| Model | Sentiment | Trade Idea | Confidence |

| ---------------- | ---------------- | ------------------------------ | ---------- |

| Grok/xAI | Strong Bullish | Buy \$190 Calls | 70% |

| Claude/Anthropic | Moderate Bullish | No trade (high news risk) | 45% |

| Gemini/Google | Moderate Bullish | Buy \$192.5 Calls w/ stop loss | 65% |

| Llama/Meta | Bullish | Buy \$190 Calls w/ risk mgmt | 70% |

---

### 💡 Why This Matters

* RSI and options flow point strongly bullish — calls dominate puts 1.2+ ratio

* Volume confirmation weak, so *manage risk tightly*

* Position best for aggressive traders ready to manage fast moves

---

📈 **NVDA Weekly Options Trade Summary**

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 190.0,

"expiry": "2025-08-15",

"confidence": 0.70,

"profit_target": 0.91,

"stop_loss": 0.35,

"size": 1,

"entry_price": 0.70,

"entry_timing": "open",

"signal_publish_time": "2025-08-11 10:33:48 UTC-04:00"

}

```

NVDA Don’t Miss Out## ⚡ NVDA Swing Setup (2025-08-08) ⚡

**Bias:** 📈 **Moderate Bullish** — RSI hot (67), trend up, low VIX, but volume still meh.

**🎯 Trade Plan**

* **Ticker:** \ NASDAQ:NVDA

* **Type:** CALL (LONG)

* **Strike:** \$185.00

* **Entry:** \$3.15 (near open)

* **Profit Target:** \$4.65 (+48%)

* **Stop Loss:** \$2.13 (-30%)

* **Expiry:** 2025-08-22 (14DTE)

* **Size:** 1 contract

* **Confidence:** 75%

**📊 Key Notes**

* RSI strong = momentum on your side ✅

* VIX favorable for calls ✅

* Weak volume & neutral flow = confirm before adding size ⚠️

* Watch breakout above **\$183.88** for momentum kick

**💡 Play Idea:**

Ride momentum to \$195+, take 50% profits at \$4.65, trail stops to lock gains.

NVDA Don't Miss Out !!!!

**NVDA \$185C Weekly Momentum Surge ⚡ All Models Aligned – 75% Confidence Setup 🔥**

---

### 📊 **Post Body (Optimized for TradingView):**

**NVDA Weekly Call Play — Aug 8 Expiry (3 DTE) 🔥**

📈 **Momentum Snapshot:**

* **Weekly RSI:** 🔼 Above 50 and climbing

* **Daily RSI:** 🔻 Falling — short-term caution

* **Volume:** 1.2x previous week (🟢 Institutional flow)

* **Volatility (VIX):** <22 — favorable setup

* **Gamma Risk:** 🟠 Moderate

---

🧠 **Model Scorecard Summary:**

* **Grok / xAI:** 4/5 Bullish 🟢

* **Gemini (Google):** 3/5 Bullish with 80% confidence 🟢

* **Claude (Anthropic):** 5/5 Bullish 💯

* **LLaMA (Meta):** 4/5 Bullish 💪

* **DeepSeek:** 5/5 Bullish 🚀

✅ **Consensus:** Strong Bullish 🔥

---

### 💡 **Trade Setup:**

* 🎯 **Strategy:** Long CALL

* 🟢 **Strike:** \$185

* 📅 **Expiry:** Aug 8, 2025

* 💵 **Entry Price:** \$0.96

* 📈 **Target Exit:** \$1.90 (100% gain)

* 🛑 **Stop Loss:** \$0.48 (50% risk cap)

* 📏 **Size:** 1 contract

* ⏰ **Timing:** Market Open

* 📊 **Confidence Level:** 75%

---

⚠️ **Key Risks to Watch:**

* Time decay – Only 3 DTE ⏳

* Daily RSI divergence 😬

* Gamma risk & market volatility (track \ TVC:VIX )

---

### 🧾 **Auto-Logger JSON (for tracking):**

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 185.00,

"expiry": "2025-08-08",

"confidence": 0.75,

"profit_target": 1.90,

"stop_loss": 0.48,

"size": 1,

"entry_price": 0.96,

"entry_timing": "open",

"signal_publish_time": "2025-08-05 09:43:22 UTC-04:00"

}

```

---

### 🏷️ **Suggested Hashtags (TradingView Style):**

`#NVDA #OptionsTrading #WeeklyOptions #CallOptions #MomentumStocks #AIStocks #TechLeaders #TradingSetup #RSISignal #GammaSqueeze #NVIDIA #OptionAlert #HighConviction #TradeIdeas #TechBreakout`

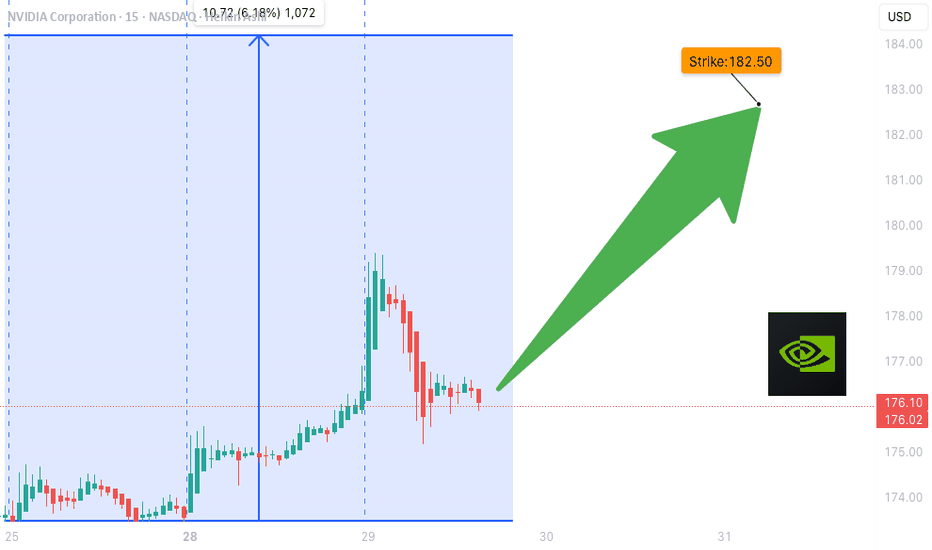

NVDA Weekly Trade Setup (2025-08-02)

### 🟢 NVDA Weekly Trade Setup (2025-08-02)

🚀 **BULLISH CONSENSUS** across 5 top-tier models

📉 Daily RSI: Weak — but weekly trend is STRONG

💼 Institutional Volume: Confirmed accumulation

📊 Options Flow: Call/Put leaning bullish

---

### 🎯 TRADE SETUP

**💥 Direction:** CALL (LONG)

**📍 Strike:** \$182.50

**📅 Expiry:** 2025-08-08

**💵 Entry:** \$0.73

**🎯 Target:** \$1.46 (100% gain)

**🛑 Stop:** \$0.36 (50% risk cap)

**✅ Confidence:** 75%

**🕒 Entry Timing:** At market open

---

### 🧠 Model Breakdown:

✅ **Grok/xAI:** Weekly bullish, 4/5 signals green

✅ **DeepSeek:** Volume confirms; cautious on daily RSI

✅ **Google/Gemini:** Bullish weekly > bearish daily

✅ **Claude:** Weekly momentum + rising options flow

✅ **Meta/Llama:** All signals aligned for \$182.50 call

---

### ⚠️ Risk Watch:

* Falling Daily RSI = short-term drag risk

* Key Support: Watch for \$178 breakdown

* Earnings/events could spike volatility

---

### 📦 TRADE JSON (for tracking):

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 182.50,

"expiry": "2025-08-08",

"confidence": 0.75,

"profit_target": 1.46,

"stop_loss": 0.36,

"size": 1,

"entry_price": 0.73,

"entry_timing": "open",

"signal_publish_time": "2025-08-03 00:54:05 UTC-04:00"

}

```

---

🔥 *“Smart money is circling. Ride the wave, not the noise.”*

💬 Drop your thoughts below. Will NVDA break \$185 next week?

NVDA Bullish Weekly Trade Setup** – 2025-07-29

📈 **NVDA Bullish Weekly Trade Setup** – 2025-07-29

🚀 *"Momentum meets money flow!"*

### 🔍 Market Snapshot:

* 💥 **Call/Put Ratio**: 2.47 → Bullish sentiment confirmed

* 🧠 **RSI**: Rising on Daily & Weekly → Momentum building

* 🔕 **Low VIX**: Favors call strategies (cheap premiums)

* ⚠️ **Caution**: Light volume = soft institutional backing

---

### 🔧 Recommended Options Trade:

**🟢 NVDA \$182.50 CALL (Exp: Aug 1)**

💰 *Entry*: \~\$0.53 (Mid)

📈 *Profit Target*: \$0.69 – \$1.06

🛑 *Stop Loss*: \$0.32

📆 *DTE*: 3 days

🔄 *Entry Timing*: Market Open

✅ *Confidence*: 75%

🔥 *Theta & Gamma Risk*: Elevated — manage position size!

---

### 💡 Why This Trade?

✅ RSI Strength across timeframes

✅ Flow favors upside

✅ Cheap premium in a low-volatility regime

🟡 Just watch that volume…

---

📊 **TRADE SNAPSHOT (JSON):**

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 182.50,

"expiry": "2025-08-01",

"confidence": 0.75,

"profit_target": 1.06,

"stop_loss": 0.32,

"size": 10,

"entry_price": 0.53,

"entry_timing": "open",

"signal_publish_time": "2025-07-29 11:59:10 UTC-04:00"

}

```

---

📣 **Taglines for Sharing:**

* "NVDA setup is 🔥—momentum + flow = GO!"

* "Gamma risk is real—but so is this profit window 💸"

* "Short-term sprint or fade? This call has range."

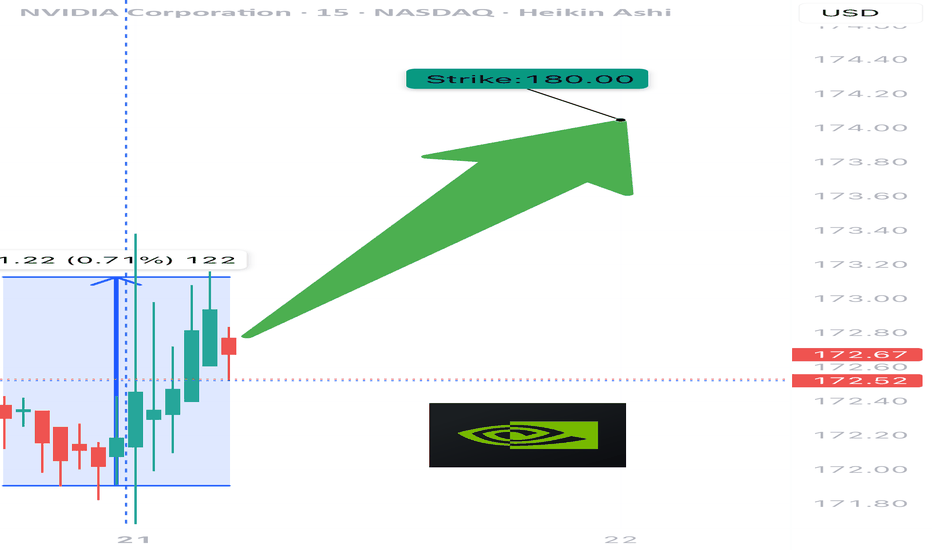

$NVDA WEEKLY TRADE IDEA – JULY 21, 2025

💥 NASDAQ:NVDA WEEKLY TRADE IDEA – JULY 21, 2025 💥

🔥 Bullish Options Flow + Weekly RSI Strength = Controlled Momentum Play

⸻

📊 Trade Details

🔹 Type: Long Call

🎯 Strike: $180.00

📆 Expiry: July 25, 2025 (4DTE)

💰 Entry: $0.51

🎯 Target: $1.02 (💯% Gain)

🛑 Stop: $0.20 (~40% Risk)

📈 Confidence: 65%

🕰️ Timing: Monday Open

📦 Size: 1 Contract (Adjust based on risk tolerance)

⸻

📈 Why This Trade?

✅ Call/Put Ratio = 1.48 → Bullish bias confirmed

📈 Weekly RSI = 77.0 → Strong momentum

🔻 Daily RSI = 80.8 (falling) → Short-term pullback risk

📉 Volume = flat (1.0x) → Weak confirmation = tighter risk mgmt

🧠 Strike Clustering: $177.50 & $180 = strong OI zones

🌬️ VIX = 16.7 → Favorable for long premium plays

⸻

⚠️ Risks & Strategy Notes

❗ Daily RSI = caution: short-term exhaustion possible

📉 Weak volume = lack of institutional chase

⏳ Exit before Friday – avoid IV crush and gamma slam

🔐 Set alerts at $178.75 and $179.80 – pre-breakout signals

⸻

🎯 Plan:

• Enter Monday open

• Scale partials if price hits +30–50%

• Full exit by Thursday unless price is breaking through $180 early with strong volume

⸻

🏁 Quick Verdict:

This is a momentum continuation setup, not a fresh breakout.

Play the trend, respect RSI signals, and cut fast if flow dries up.

NASDAQ:NVDA 180C — Risk $0.20 to Target $1.02

Let the call ride… just don’t overstay.

⸻

#NVDA #OptionsTrading #CallOption #WeeklyPlay #MomentumTrade #FlowBasedSetup #TradingViewIdeas #GammaPlay #BullishBias #NVIDIA

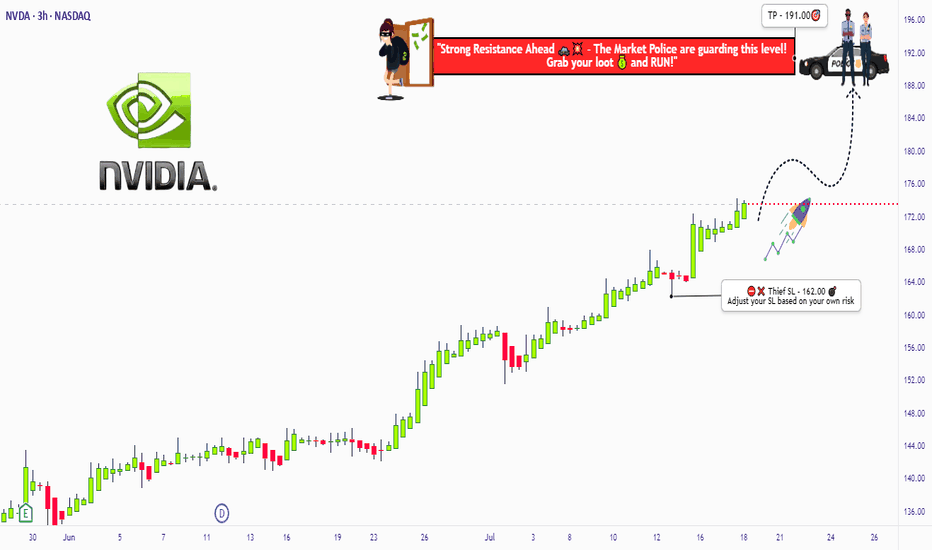

NVIDIA Robbery Plan: Bullish Swing Trade to Millions!🔥 NVIDIA (NVDA) Stock Heist Blueprint: Unlock Bullish Profits with Thief Trading Style! 🚀💰

🌟 Greetings, Wealth Warriors! 🌟

Hello, Ciao, Salaam, Bonjour, Hola, and Hallo to all you savvy traders and market masterminds! 🤑💸 Get ready to execute a high-octane trading plan with our Thief Trading Style—a bold fusion of technical precision and fundamental insights designed to crack the NVIDIA (NVDA) stock market vault! 💥📈

📝 The NVIDIA Heist Plan: Swing & Day Trading Mastery 🏆

Based on our proprietary Thief Trading Style, this plan targets NVIDIA (NVDA), currently riding a bullish wave fueled by strong fundamentals and technical setups. Follow the strategy outlined below to navigate the high-risk Red Zone—where overbought conditions, consolidation, and potential trend reversals create opportunities for sharp traders. 💪 Stay alert, as bearish players may set traps at key levels! 🕵️♂️

Entry Strategy: Crack the 🙂Vault! 🏦

Go long with confidence! The market is primed for a bullish breakout. Enter at current prices or set buy limit orders near recent swing lows/highs on the 15-minute or 30-minute timeframe. 📅

Pro Tip: Set price alerts on your chart to catch the optimal entry. Timing is everything in this heist! ⏰

Swing Traders: Look for pullbacks to key support levels for safer entries.

Scalpers: Focus on quick long-side trades with tight stops to maximize gains. 💨

Stop Loss: Protect Your Loot! 🔒

Place your stop loss (SL) below the recent swing low on the 30-minute timeframe (e.g., $162.00 for swing trades).

Adjust your SL based on your risk tolerance, position size, and number of orders. For larger accounts, consider tighter stops to lock in gains early. 🛡️

Scalpers: Use a trailing stop to secure profits while riding short-term momentum.

Take Profit Target: Cash Out Big! 💰

Aim for $191.00 as the primary target, or exit early if momentum slows.

Swing Traders: Hold for the full target if the trend remains strong.

Scalpers: Grab quick profits on smaller price spikes and re-enter on dips.

Pro Move: Use a trailing stop to let profits run while safeguarding gains. 🚀

📌Key Levels & Risk Management

Entry Zone: Market price or swing low – ideal for long positions. 📈

Stop Loss: $162.00 – based on 30m timeframe swing low. 🛑

Take Profit Target: $191.00 – primary target for swing/day trades. 🎯

Risky Red Zone: Overbought levels – watch for consolidation or reversal traps. ⚠️

💡 Why NVIDIA? The Bullish Case 📡

NVIDIA (NVDA) is powering through a bullish phase, driven by:

Fundamentals: Strong demand for AI, gaming, and data center chips. 📊

Macro Factors: Positive market sentiment and tech sector momentum. 🌍

COT Data (Latest Friday Update, UTC+1): Large speculators are increasing bullish positions, signaling confidence in NVDA’s upside (data sourced from reliable platforms). 📅

Geopolitical & News: Monitor upcoming earnings and industry developments for catalysts. 📰

Intermarket Analysis: Tech-heavy indices like the NASDAQ are trending higher, supporting NVDA’s rally. 📈

For a deeper dive, check fundamental reports, COT data, and sentiment analysis to align your trades with the bigger picture. 🔍

⚠️ Trading Alert: Navigate News & Volatility 🗞️

News releases can spark sharp price swings. To protect your capital:

Avoid new trades during major news events (e.g., earnings or Fed announcements). 🚫

Use trailing stops to lock in profits and limit downside risk. 🔐

Stay updated with real-time market developments to adjust your strategy dynamically. 📡

🚀 Boost the Heist! Support the Thief Trading Community 🤝

Love this plan? Hit the Boost Button to amplify our Thief Trading Style and empower our community to conquer the markets! 💥 Every like and share fuels our mission to make money with precision and style. 💪 Join us daily to unlock more high-profit heist plans! 🏴☠️

📌 Important Disclaimer

This analysis is for educational purposes only and not personalized investment advice. Always conduct your own research, assess your risk tolerance, and verify market conditions before trading. Markets move fast—stay sharp and adapt! ⚡

🌟 Stay tuned for the next heist plan, traders! Let’s keep stealing profits together! 🤑🐱👤🎉

Nvidia (NVDA) Share Price Surges Above $170Nvidia (NVDA) Share Price Surges Above $170

Yesterday, Nvidia’s (NVDA) share price rose by more than 4%, with the following developments:

→ It surpassed the psychological level of $170 per share;

→ Reached another all-time high;

→ Gained more than 9% since the beginning of the month.

The bullish sentiment is driven by Nvidia CEO Jensen Huang’s visit to China shortly after meeting with US President Trump. At the same time:

→ US Secretary of Commerce Howard Lutnick stated that the planned resumption of sales of Nvidia H20 AI chips in China is part of the US negotiations on rare earth metals.

→ The head of Nvidia stated that he was assured licences would be granted very quickly, and that a large number of orders for H20 chip deliveries had already been received from Chinese companies.

Market participants are viewing the situation with strong optimism, and analysts are raising their valuations for NVDA shares:

→ Morningstar analysts raised their fair value estimate for Nvidia shares from $140 to $170.

→ Oppenheimer analysts increased their target price from $170 to $200.

Technical Analysis of the NVDA Chart

The price trajectory of NVDA shares fully reflects the exceptionally strong demand:

→ The price is moving within an ascending channel with a steep growth angle;

→ Since early May, the RSI indicator on the 4-hour chart has not fallen below the 50 level;

→ Yesterday’s trading session opened with a large bullish gap.

The chart also shows the formation of a stable bullish market structure (shown with a purple broken line), expressed through a sequence of higher highs and higher lows.

Given the above, it is difficult to imagine what might cause a sharp shift from positive to negative sentiment. If a correction begins (for example, with a test of the $160 level), traders should watch for signs of its completion — this could present an opportunity to join the emerging rally.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NVIDIA(NVDA) Jackpot – Thief Trading Blueprint for Fast Profits!🚀 NVDA Stock Heist: The Ultimate AI Gold Rush (Scalping/Day Trade Plan)

🌟 Hey there, Market Pirates! 🏴☠️💰

Thieves, Traders, and Money Makers—gather around! Based on the 🔥Thief Trading Style🔥, here’s our master blueprint to loot NVIDIA’s AI-fueled rally. Follow the strategy on the chart—long entry is LIVE! Our escape? Near the high-risk Resistance Zone. Overbought? Consolidation? Reversal trap? Bears are lurking, but we’re stealing profits first! 🎯💸

🎯 Entry (The Vault is Open!)

"Swipe the AI gold at any price—the heist is ON!"

Pro Tip: Use buy limits within 15-30min near swing lows/highs for pullback entries.

🛑 Stop Loss (Thief’s Escape Route)

SL at recent swing low (4H timeframe)—adjust based on your risk & lot size.

Scalpers/Day Traders: Tighten SL if stacking multiple orders.

🏆 Target 🎯: 165.00 (The AI Jackpot!)

📈 Why NVDA?

Bullish momentum from AI dominance, earnings hype, and institutional FOMO.

Tech sector strength + chip demand = THIEF’S PARADISE.

📰 Fundamental Heist Intel

Need macro trends, sentiment, and intermarket analysis? 🔗 Check our bioo for the full robbery toolkit.

⚠️ Trading Alert: News & Position Control

Avoid new trades during earnings/news—volatility kills heists!

Trailing SLs = Locked profits. Don’t get greedy!

💥 Boost This Heist!

👊 Hit "Like" & "Boost" to fuel our next raid. Every click = More stolen profits! 🚀💰

🤑 Stay tuned—more heists coming! NVIDIA today… what’s next? 🤫🐱👤

Fundamental and technical analysis on NVDA (Chicken Nugget) soonFundamental Analysis

NVIDIA Corporation (NVDA) remains a key player in the tech sector, benefiting from the rise of artificial intelligence, data centers, and gaming. With sustained growth, constant innovation, and strong demand for its graphics chips, the company continues to deliver solid financial results.

Recent reports indicate revenue growth and expansion in key markets. Product diversification, particularly in supercomputers and embedded systems, strengthens NVDA’s position against competitors. Investor interest in the semiconductor industry helps maintain the stock’s positive momentum.

Technical Analysis

The chart analysis highlights key technical levels for investors:

- Key Resistance: $150 USD – This level must be broken to confirm a strong bullish trend. A breakout with volume could signal a gradual rise toward higher targets.

- Support Level: $131.50 USD – Strong demand and low supply are identified at this level, making it an excellent entry point for investors looking for buying opportunities before a potential rebound.

Targets & Strategy

- Short-term target (late June/early July): The target range of $170-$175 USD is possible if the bullish trend is confirmed. This level aligns with technical extensions and favorable market dynamics.

- July buyback (-5% to -10%): A moderate correction could occur, offering another buying opportunity before an upward recovery.

- Selling target (September to November): The next selling target is between $200-$240 USD, depending on market developments and investor sentiment.

Conclusion

NVDA stock presents interesting prospects, with well-defined technical levels and a strong fundamental outlook. Investors should monitor these thresholds to adjust their strategy based on market fluctuations.

If you want to refine this analysis or explore other scenarios, I'm here to dive deeper into key points! 🚀 Subscribe! TSXGanG

I hold a CCVM and MNC (Certificate of Competence to become a securities broker anywhere in Canada) and have been working as a trader for five years.

It’s a pleasure for me to help people optimize their trading strategies and make informed financial market decisions.

NVDA’s Wild Crash Alert: I’m Braced for a Heart-Stopping Drop!NVDA’s like a rocket losing altitude, and I’m on edge! It’s at $95.99, but I’m seeing it tumble to $90, maybe $88.95, then $83.59 if the bears go wild. If that breaks, whoa—$77.48 could hit hard! I’m glued to $90 for the first clue—big selling there, and it’s game on for a slide.

Kris/Mindbloome Exchange

Trade Smarter Live Better

NVDA to 151? Morning Trading Fam

Currently this is what I am seeing with NVDA, looks like we have decent support around 118 if that level holds I can see us driving up to 144 then 151 from here. However if we break through the 118 support: we could possibly see a massive breakdown down to 87-88 dollar range.

Kris/ Mindbloome Exchange

Trade Smarter Live Better

NVIDIA: last accumulation before $260 rally.NVIDIA is neutral on its 1D technical outlook (RSI = 49.723, MACD = -1.780, ADX = 32.427) as the price is accumulating in preparation for the 2025 rally. We are on a 1D MA50-100 squeeze that looks very much like November 6th 2023. The 1D RSI patterns among those two Bull Flags are also identical and what followed this squeeze was a +150% rally from the last bottom. The trade is long (TP = 260.00) aiming for a full +150% extension.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

NVDA's Next Big Moves: Targeting 190, 175, 170! NVDA's on a wild ride, and here's where we might be heading. We're eying some exciting highs with targets at 190, 175, and 170 if we can break through 147. But, keep your seatbelts on because if the market doesn't hold up, we could be looking at a drop all the way down to 110, or even 98. Let's keep our fingers crossed for the highs but prepare for any dips.

Trade Smarter/ Live Better

Kris/ Mindbloome Exchange

What’s Next for NVDA: $142 or $123?Good morning Trading Family

Here’s the game plan: if NVDA moves above $133.50, we could see it climb to $134.50, then correct back down to $123. If it breaks $129.33, it might drop to the $123 range. But if it pushes past $137, we could see it head toward $142.

This Sunday, I’m hosting a webinar on how emotions can hurt your trading and how to take control of your mindset for better results.

Send me a message or check out my profile for details. If this added value to your trading, like, comment, and share it with someone who needs it.

Kris/Mindbloome Exchange

Trade What You See