NZDCHF Losing Strength | Sellers Target Lower Levels🔻🧊 NZDCHF Losing Strength | Sellers Target Lower Levels 🎯

Overview:

NZDCHF is showing bearish continuation signs, with price reacting near a key supply area, opening the door for further downside movement.

Sell Zone (Focus Area):

🔴 0.4600 – 0.4595

This zone acts as a resistance area where selling pressure is expected to remain active.

Downside Targets:

🎯 Target 1: 0.4570 – Initial downside reaction

🎯 Target 2: 0.4560 – Continuation target

🎯 Target 3: 0.4550 – Deeper downside objective

Why This Setup Works:

✔ Price respecting a clear resistance zone

✔ Bearish structure remains intact

✔ Smooth downside path with defined targets

Trade Management Insight:

Scaling out at each target helps secure profits while maintaining exposure for further downside continuation.

Execution Guidance:

Allow price to confirm rejection or acceptance near the sell zone before entry. Precision improves outcomes.

Final Note:

As long as price remains below the resistance zone, the probability favors a move toward lower targets.

⸻

✨ Special Note for Serious Traders

If you value clean setups, precise targets, and disciplined execution over emotional trading, feel free to connect. I work with traders who focus on structure, patience, and long-term consistency.

Nzdchfanalysis

NZDCHF: Bullish Push to 0.467?FX:NZDCHF is eyeing a bullish breakout on the 4-hour chart , with price rebounding from support after a downward trendline break and breakout candle, converging with a potential entry zone that could fuel upside momentum if buyers hold amid recent volatility. This setup suggests a continuation opportunity in the uptrend, targeting higher resistance levels with risk-reward exceeding 1:2.🔥

Entry between 0.4516–0.4544 for a long position. Target at 0.4670 . Set a stop loss at a daily close below 0.4585 , yielding a risk-reward ratio of more than 1:2 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging the pair's momentum post-breakout.🌟

Fundamentally , NZDCHF is trading around 0.458 in late December 2025, with limited high-impact events for NZD this week, shifting focus to CHF catalysts that could influence the pair. For the Swiss Franc, key releases include Current Account Q3 on December 19 at 08:00 AM (forecast CHF 14.5B), where a weaker surplus might pressure CHF; Economic Sentiment Index DEC on December 23 at 09:00 AM (forecast 10), potentially weakening CHF if sentiment dips; and KOF Leading Indicators DEC on December 30 at 08:00 AM (forecast 102.5), with softer readings signaling economic slowdown and CHF vulnerability. No major NZD events until January, leaving the pair sensitive to CHF data and broader USD sentiment. 💡

📝 Trade Setup

🎯 Entry (Long):

0.4516 – 0.4544

🎯 Target:

• 0.4670

❌ Stop Loss:

• Daily close below 0.4585

⚖️ Risk-to-Reward:

• > 1:2

💡 Your view?

Will NZDCHF defend this breakout zone and push toward 0.4670 — or does momentum fade into consolidation? 👇

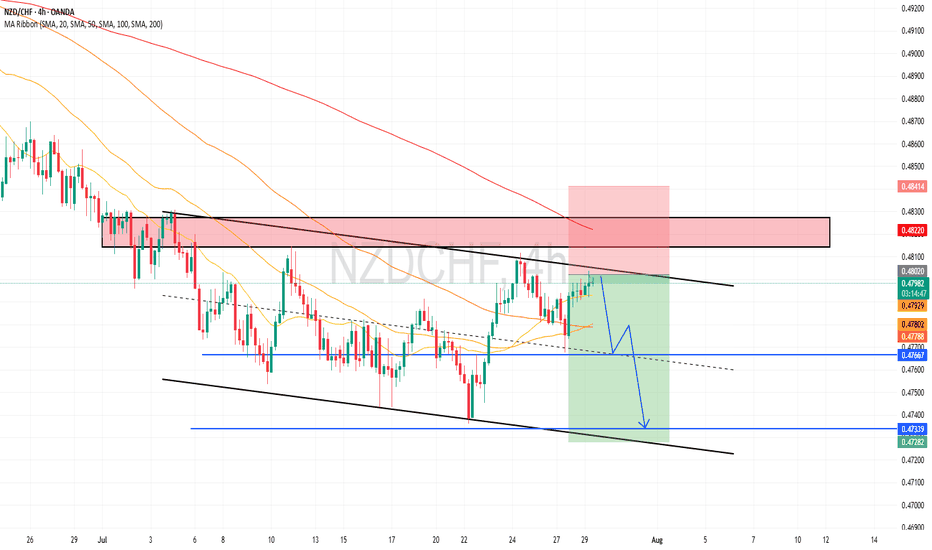

NZDCHF: Bullish Push to 0.473?OANDA:NZDCHF is eyeing a bullish breakout on the 4-hour chart , with price forming higher lows after rebounding from support, converging with a downward trendline touch that could ignite upside momentum if buyers break through amid recent consolidation. This setup suggests a reversal opportunity post-downtrend, targeting higher resistance levels with near 1:3 risk-reward .🔥

Entry between 0.4497–0.4543 for a long position. Target at 0.4730 . Set a stop loss at a daily close below 0.4470 , yielding a risk-reward ratio of near 1:3 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging the pair's potential recovery near lows.🌟

Fundamentally , NZDCHF is trading around 0.453 in early January 2026, with limited high-impact events this week due to the New Year holiday period, but key releases next week could influence direction. For the New Zealand Dollar, the RBNZ will resume regular data releases starting January 5, with notable events including National Accounts (income, saving, assets, and liabilities) for September 2025 quarter on January 15 at 10:45 AM NZT, potentially impacting NZD if showing economic strength. For the Swiss Franc, the KOF Leading Indicator for December on January 27 at 8:00 AM CET (forecast 102.5) is a major forward-looking metric that could weaken CHF if below expectations, signaling slowdown. Overall, softer Swiss data could favor NZD upside in thin post-holiday markets. 💡

📝 Trade Setup

🎯 Entry (Long):

0.4497 – 0.4543

(Entry within this zone is valid with proper risk & capital management.)

🎯 Target:

• 0.4730

❌ Stop Loss:

• Daily close below 0.4470

⚖️ Risk-to-Reward:

• ~ 1:3

💡 Your view?

Does NZDCHF finally break the descending trendline and push toward 0.4730 — or will resistance cap the move and force another range? 👇

NZDCHF is in the Bearish DirectionHello Traders

In This Chart NZDCHF HOURLY Forex Forecast By FOREX PLANET

today NZDCHF analysis 👆

🟢This Chart includes_ (NZDCHF market update)

🟢What is The Next Opportunity on NZDCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

NZD/CHF Price Action Supports Upside Continuation Scenario🔥 NZD/CHF Bullish Breakout After Kijun Retest — Upside in Play? 🔥

📊 Asset

NZD/CHF – “KIWI DOLLAR vs SWISSY”

Forex Market Trade Opportunity Guide (Swing / Day Trade)

🧭 Market Bias

🟢 Bullish Structure Confirmed

Price has successfully broken above the KIJUN Moving Average and completed a clean breakout + retest, signaling a shift in momentum from sellers to buyers. This type of Kijun behavior often acts as a trend continuation trigger when aligned with broader risk sentiment.

🎯 Trade Plan

📈 Bullish Plan – Active

✅ Confirmation: Kijun MA Breakout & Retest

🔓 Entry: You can enter at ANY price level

(Position sizing and timing should match your own execution model)

🛑 Stop Loss

🚫 Thief SL: 0.45600

Dear Ladies & Gentlemen (Thief OG’s),

Adjust your stop-loss based on your own risk management, volatility tolerance, and account size. This SL is not mandatory—it’s a reference level only.

⚠️ Note: I do not recommend blindly following my SL. You make money, you manage risk — your responsibility, your choice.

🎯 Target Zone

🎯 Primary Target: 0.46700

🚧 Police Barricade Resistance Zone

📊 Overbought conditions building

Potential liquidity trap near highs

Kindly escape with profits as price approaches this zone. Momentum may stall or reverse once supply steps in.

⚠️ Note: I do not recommend blindly following my TP. Scale out or exit based on your own system.

👀 Related Pairs to Watch (Correlation & Confirmation)

💱 NZD-Related (Risk Currency)

$NZD/USD 💵

🔹 Strong positive correlation with NZD/CHF

🔹 Kiwi strength vs USD supports upside continuation in NZD crosses

$AUD/NZD 💵

🔹 Acts as a regional sentiment gauge

🔹 AUD weakness vs NZD adds confidence to NZD bullish flows

💱 CHF-Related (Safe Haven)

OANDA:USDCHF 💵

🔹 CHF weakness vs USD often aligns with CHF weakness across the board

🔹 Rising USD/CHF = supportive for NZD/CHF upside

OANDA:EURCHF 💵

🔹 CHF selling pressure here confirms broader Swiss franc softness

🔹 Sustained EUR/CHF bids favor NZD/CHF bullish continuation

📌 Key Correlation Insight

📈 Risk-ON environment = NZD strength

📉 Risk-OFF environment = CHF strength

If equities and risk assets remain supported, NZD/CHF bullish structure stays valid.

🧠 Final Thought

This setup favors trend continuation traders following Ichimoku Kijun dynamics. Manage risk smartly, respect resistance zones, and don’t marry the trade.

💬 If this breakdown helps you, drop a LIKE ❤️, COMMENT 🗨️, and FOLLOW 🔔 for more clean market structures.

Trade safe. Trade disciplined. 💼📊

Will the Kiwi Fall Against the Swissy? Bearish Trend in MotionNZD/CHF Swing Trade Setup 🐻 | HULL MA Reversal & Support Breakout Confirmation! 🚨

🎯 Welcome, Traders! 🎯

Get ready for a high-probability swing trade opportunity on the NZD/CHF (Kiwi vs. Swissy)! This bearish plan is confirmed by a powerful technical confluence. Let's dive in! 👇

⚡ Trade Thesis: BEARISH ⚡

The pair is showing a classic trend reversal signature. We have a confirmed breakdown of a strong support level, coupled with a decisive pullback from the HULL Moving Average, signaling a shift in momentum to the downside.

📊 The Technical Edge (Why This Works):

HULL MA Rejection: Price has been rejected at the dynamic resistance of the HULL Moving Average, confirming the loss of bullish momentum. 📉

Support Turned Resistance: The previous strong support zone has now broken, and we expect it to act as a new resistance barrier.

Market Trap Identification: The structure suggests an overbought trap, where late bulls are likely getting squeezed. It's time to escape with the bears! 🐻➡️💰

🎯 Detailed Trading Plan (The "Thief" Strategy)

This plan uses a layered entry method to optimize your average entry price and manage risk effectively.

📍 Asset: NZDCHF | #Forex | #SwingTrade

🛑 Entry Strategy (Layer Method):

We are deploying multiple SELL LIMIT orders at the following key levels:

Layer 1: 0.45500

Layer 2: 0.45400

Layer 3: 0.45300

Layer 4: 0.45200

💡 Pro Tip: You can increase or decrease the number of layers based on your capital and risk appetite. The goal is to scale into the position.

🚨 Stop Loss (RISK MANAGEMENT):

A collective Stop Loss can be placed above the last layer and the recent swing high at 0.45600.

⚠️ Disclaimer: This is MY strategy. You MUST adjust your SL based on your personal risk tolerance and trading rules. Protect your capital first! 🙏

🎯 Take Profit Target:

Our primary profit target is set at 0.44400, a key support zone where we anticipate the next significant pullback or consolidation.

💰 Reminder: You are free to take partial profits along the way! Trail your stop or secure gains at your own discretion. The market is yours to conquer!

🔍 Related Pairs & Market Context

To strengthen your market view, keep an eye on these correlated assets:

OANDA:AUDCHF : The Australian Dollar often moves in correlation with the NZD (both are risk-sensitive, commodity-linked currencies). A bearish NZD/CHF is often confirmed by a weak AUD/CHF.

OANDA:NZDUSD & OANDA:AUDUSD : Watch the broader "Kiwi" and "Aussie" strength against the USD. If they are also showing weakness, it confirms a broader risk-off sentiment, strengthening our bearish NZD/CHF thesis.

OANDA:USDCHF : The Swiss Franc (CHF) is a traditional safe-haven. A strengthening CHF (weak NZD/CHF) might coincide with a weaker USD/CHF if the USD is also weak, or it could show pure CHF strength. Monitor this for clues on CHF flows.

Key Correlation Point: A strong bearish move in NZDUSD often amplifies the bearish move in NZDCHF.

💬 Let's Engage!

What do you think of this setup? 💭

Like & Follow if you found this analysis valuable!

Share your chart in the comments below!

🔔 Don't forget to follow my profile for more high-quality trade ideas and educational content!

#TradingView #ForexTrade #NZDCHF #SwingTrading #TechnicalAnalysis #Bearish #HULLMA #TradingStrategy #RiskManagement

NZD/CHF Turning Point — Are We Seeing a Breakout or Fakeout?🥝💶 NZD/CHF "KIWI DOLLAR VS SWISS" – Market Capital Flow Blueprint (Swing/Day Trade)

🧭 Plan:

A Bullish structure is confirmed with an LSMA (Least Squares Moving Average) breakout, signaling early momentum flow in favor of the Kiwi Dollar.

Market shows potential continuation after a breakout retest phase, supported by a constructive bullish bias in the CHF cross pairs.

Thief Trader’s Strategy:

I’m using a layering-style entry system — stacking multiple limit orders for optimal positioning.

Buy Limit Layers:

🧱 0.45500

🧱 0.45600

🧱 0.45700

🧱 0.45800

💡 You can customize or increase the layer levels based on your own style and risk comfort.

🎯 Target Zone:

Police barricade (resistance) spotted near 0.46400, where overbought conditions + liquidity trap potential = time to secure profits and vanish like a pro! 🕶️💰

⚠️ Note:

Dear Ladies & Gentlemen (Thief OGs) — this target is for illustration only. You can take profits, scale out, or hold based on your own plan. Trade safe, not greedy!

🛑 Stop-Loss Plan:

📍 Thief SL @ 0.45300

Remember: I’m not recommending everyone to use the same SL. It’s your trade, your risk. Adjust smartly according to your setup and psychology.

💬 Market Correlation Watchlist:

Keep an eye on related pairs to confirm flow direction and sentiment:

OANDA:NZDUSD → Correlates positively with NZD/CHF. A strong Kiwi vs. USD often strengthens NZD/CHF.

OANDA:USDCHF → Inverse correlation. When USDCHF falls, NZDCHF tends to rise.

OANDA:AUDCHF → Moves similarly with NZDCHF. Confirm trend strength across both pairs.

OANDA:EURCHF → Useful for identifying CHF-specific strength or weakness.

⚙️ Key Technical Points:

LSMA Breakout confirming trend shift 📈

Strong accumulation base below 0.45500

Momentum picking up on higher timeframes

RSI rising above neutral zone (momentum confirmation)

Risk-to-reward ratio aligns well for swing/day style setups

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NZDCHF #ForexAnalysis #SwingTrade #DayTrading #KiwiDollar #ThiefTrader #CHF #ForexStrategy #LSMA #MarketFlow #SmartMoney #ForexEducation

#NZDCHF: Will Price Continue The Bearish Trend? If we analyse the trading history of NZDCHF, the overall trend has been bearish. The CHF has consistently dominated the NZD, and this trend is expected to continue. The price has dropped significantly, and since the last two weeks, it has filled the gap area. In the future, we anticipate the price moving towards 0.40.

Wishing you good luck and safe trading!

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

Swiss Franc Pullback! NZD/CHF Long Opportunity Emerging🥝💰 KIWI DOLLAR VS SWISS FRANC | The Thief's Layered Entry Playbook

📊 Asset: NZD/CHF (New Zealand Dollar / Swiss Franc)

Market Context (Live Data - Oct 10, 2025):

Current Price: ~0.4628-0.4655 CHF

30-Day Range: 0.4606 - 0.4758

Monthly Performance: -1.42%

Yearly Performance: -12.35%

Currency Strength Analysis:

🇳🇿 NZD Strength: Moderately weak - NZD has declined 5.09% over the past 12 months and down 2.81% over the last month, showing underlying weakness against major currencies

🇨🇭 CHF Strength: Relatively strong - Swiss Franc gained 5.83% over 12 months but weakened slightly by 1.00% in the past month, indicating recent profit-taking but maintaining safe-haven status

🎯 THE SETUP

Bias: 🟢 BULLISH

Confirmation Signal: LSMA (Least Squares Moving Average) breakout above 0.46400 — this is our green light to enter the market!

🔧 THE "THIEF STYLE" LAYERED ENTRY STRATEGY

Instead of going all-in at one price (boring! 😴), we're using multiple limit orders to scale into position like a professional thief sneaking into a vault — quietly, strategically, and with multiple entry points!

💼 Entry Zones:

Option A: Market Entry (Aggressive)

Any price level after LSMA breakout confirmation @ 0.46400

Option B: The Thief's Ladder (Conservative - Recommended)

Multiple buy limit layers:

Layer 1: 0.46300

Layer 2: 0.46200

Layer 3: 0.46100

Pro Tip: You can add more layers based on your risk appetite and account size!

🛡️ RISK MANAGEMENT

Stop Loss: 0.45900 (200 pips breathing room)

⚠️ Disclaimer: Dear Ladies & Gentlemen (Thief OG's), I'm NOT recommending you use only my stop loss. This is YOUR money on the line — set your risk parameters based on YOUR risk tolerance and account size. Trade at your own risk! This is just my play, not financial advice.

🎯 PROFIT TARGET

Take Profit Zone: 0.47100

Technical Reasoning:

LSMA moving average acting as strong dynamic resistance

Overbought conditions expected in this zone

Potential bull trap area — take profits and escape with the loot! 💰

⚠️ Disclaimer: Dear Ladies & Gentlemen (Thief OG's), I'm NOT recommending you hold until my TP. If you're in profit and happy, TAKE IT! Nobody ever went broke taking profits. Your money, your rules, your risk.

🔗 RELATED PAIRS TO WATCH

Positive Correlation (Move Together):

OANDA:NZDUSD 📊 - Kiwi's health check against the dollar

OANDA:AUDCHF 🦘 - Commodity currency neighbor correlation

Inverse Correlation (Move Opposite):

OANDA:CHFJPY 🏦 - Safe-haven flow indicator

FX:EURCHF 🇪🇺 - Swiss franc strength gauge

Key USD Pairs for Context:

OANDA:USDCHF 💵 - Currently trading around 0.8067, Swiss franc showing slight weakness

OANDA:NZDUSD 💵 - Trading near 0.5759, down 0.78% showing NZD weakness

Correlation Logic: When risk sentiment improves, commodity currencies (NZD, AUD) strengthen while safe havens (CHF, JPY) weaken. Watch USD/CHF for Swiss franc momentum shifts and NZD/USD for kiwi dollar strength trends.

⚙️ TECHNICAL SETUP SUMMARY

✅ LSMA Breakout Strategy

✅ Layered Entry Approach

✅ Risk-Reward Ratio: ~6:1 (600 pips reward / 100-300 pips risk per layer)

✅ Swing/Day Trading Timeframe

✅ Multiple Entry Opportunities

💡 THE THIEF'S WISDOM

Remember: Markets don't move in straight lines. The layered entry approach allows you to:

Average your entry if price dips lower

Reduce FOMO — you're not chasing, you're waiting

Manage risk better — smaller positions at multiple levels

Stay calm — even if one layer doesn't fill, others might

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

⚖️ LEGAL DISCLAIMER:

This is the "Thief Style" trading strategy — presented for educational and entertainment purposes only. This is NOT financial advice. I am not a licensed financial advisor. Trading forex carries substantial risk of loss. Only trade with money you can afford to lose. Past performance does not guarantee future results. Always conduct your own research and consider consulting with a licensed financial professional before making investment decisions. Trade at your own risk! 🎲

#NZDCHF #ForexTrading #SwingTrading #DayTrading #TradingStrategy #ForexSignals #TechnicalAnalysis #LSMA #LayeredEntry #RiskManagement #KiwiDollar #SwissFranc #ForexSetup #TradingIdea #ForexCommunity #PriceAction #ThiefStyle #ForexLife #TradeSmart

Bearish Pressure Intensifies in NZD/CHF – Plan Your Entry!🎯 NZDCHF: The "Kiwi Heist" Setup | Bears Running Wild on the Swiss Alps 🏔️💰

📊 Market Overview: NZD/CHF (Kiwi Dollar vs Swiss Franc)

The Kiwi is looking heavy against the Swiss, and the charts are screaming re-distribution phase. This Forex pair is setting up for a potential downside move, and we're positioning for a bearish swing/day trade opportunity using the legendary "Thief Strategy" – layered limit orders to maximize entry efficiency.

🔍 Technical Analysis & Bias

Directional Bias: 🐻 BEARISH CONFIRMED

The price action suggests we're in a re-distribution zone with sellers taking control. Key technical confluence points toward a continuation to the downside:

Resistance overhead acting as a ceiling

Bearish market structure intact

Distribution pattern confirmed on lower timeframes

Target zone shows strong support + oversold conditions + potential trap zone

🎲 The "Thief Strategy" Entry Plan (Layered Limit Orders)

Instead of chasing price or entering at "any level," we're using multiple sell limit orders to scale into this position like pros. Think of it as setting traps at different price levels – the market comes to us!

🎯 Sell Limit Layer Entries:

Layer 1: 0.46000

Layer 2: 0.45900

Layer 3: 0.45800

Note: You can increase the number of layers based on your risk appetite and position sizing. The beauty of layering? You get better average entries and reduce FOMO!

🛑 Risk Management (The Boring Stuff That Saves Accounts)

Stop Loss Reference: 0.46100

⚠️ Disclaimer: This is MY stop loss level based on my risk tolerance. You're the captain of your own ship! Adjust your SL based on YOUR account size, risk per trade, and trading plan. No one-size-fits-all here, OG Thieves!

Target Zone: 0.45300

🎯 This is where strong support + oversold conditions + potential bull trap zone converge. It's the sweet spot to bank profits and escape before the crowd realizes what's happening.

⚠️ Target Disclaimer: Again, this is MY target. You're free to take partial profits along the way or let it ride based on your strategy. Secure the bag at YOUR comfort level!

🌍 Related Pairs to Watch & Correlation Analysis

Keep your eyes on these correlated pairs for confirmation and additional opportunities:

💵 USD Pairs:

OANDA:NZDUSD – If the Kiwi weakens broadly, you'll see weakness here too

OANDA:USDCHF – Inverse correlation; Swiss strength appears here

OANDA:AUDNZD – Cross-check Kiwi strength against its Aussie cousin

OANDA:EURCHF – Swiss Franc strength gauge against the Euro

📈 Key Correlation Points:

NZD is a commodity currency (sensitive to risk sentiment and dairy prices)

CHF is a safe-haven currency (strengthens during risk-off moves)

Watch S&P 500 and global risk sentiment – when markets dump, CHF typically rallies

RBNZ (Reserve Bank of New Zealand) dovish stance vs SNB (Swiss National Bank) stability = bearish pressure on NZD/CHF

⚡ Key Takeaways for This Setup

✅ Bearish bias confirmed with re-distribution pattern

✅ Layered entry strategy reduces risk and improves average price

✅ Clear stop loss and target zones defined

✅ Correlated pairs support the directional thesis

✅ Risk-off sentiment favors CHF strength over NZD

🎉 Final Words from Your Friendly Neighborhood Chart Thief

Remember, trading is a marathon, not a sprint. The Thief Strategy is about patience, precision, and pocketing profits when the setup is right. Whether you're a swing trader or day trader, let the market come to your levels – don't chase!

Stay sharp, stay disciplined, and may the pips be ever in your favor! 🎩💸

✨ "If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!"

⚠️ Disclaimer: This is a "Thief Style" trading strategy presented for educational and entertainment purposes only. All trading involves risk. This is not financial advice – trade responsibly and always do your own due diligence!

#NZDCHF #ForexTrading #SwingTrading #DayTrading #ThiefStrategy #BearishSetup #ForexSignals #TechnicalAnalysis #PriceAction #RiskManagement #ForexCommunity #TradingIdeas #ChartAnalysis #ForexStrategy #LayeredEntry #ForexLife #TradingPlan #MarketAnalysis #ForexEducation #SwissFranc #KiwiDollar

NZDCHF is in the Bearish DirectionHello Traders

In This Chart NZDCHF HOURLY Forex Forecast By FOREX PLANET

today NZDCHF analysis 👆

🟢This Chart includes_ (NZDCHF market update)

🟢What is The Next Opportunity on NZDCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

Time To Steal Pips? NZD/CHF Bullish Layer StrategyNZD/CHF "Kiwi vs Swiss" Bank Heist Plan 🏦💰 - Bullish Swing Play (Layer Entry Strategy)

🎯 The Heist Plan (Trade Setup)

Asset: OANDA:NZDCHF (Kiwi vs Swiss Franc)

Bias: Bullish 🐂

Strategy: "The Thief's Layer" 🎭 - Using multiple limit orders to scale into the position and optimize entry.

🛠️ Entry (The Layered Approach):

"A thief doesn't knock on the front door! 🚪 Use layered limit orders for a better average entry."

Consider layering buy limits at: 0.47400 📈, 0.47300 📈, 0.47200 📈, 0.47100 📈.

You can adjust the number of layers and levels based on your own capital and risk appetite!

🚨 Stop Loss (Your Escape Route):

Thief's Suggested SL: 0.46800 ❌

⚠️ Important Note: Dear Thief OGs (Ladies & Gents), this is MY plan. You MUST adjust your SL based on your own risk management and strategy. Protect your capital! 🛡️

🎯 Take Profit (Escape With The Loot):

Target: 0.48200 ✅

Why Here? This area acts as a key police barricade 🚧 (resistance), confluence with ATR, overbought signals, and potential bull traps. Secure your stolen profits before then! 💰💨

⚠️ Important Note: Take money at your own risk! You are free to take partial profits earlier or trail your stop. This is a suggested target, not financial advice.

🔍 Why This Heist? The Fundamental Blueprint

This isn't a random trade; it's a planned operation based on current data.

📊 Real-Time Data (As of Sep 10, 2025)

Current Rate: 0.4972 (+0.32% today) 💹

🧠 Trader Sentiment

Retail: 🟢 58% Long | 🔴 42% Short (Bullish Bias)

Institutional: 🟢 52% Long | 🔴 48% Short (Neutral-Leaning Bullish)

Overall Mood: Moderately Optimistic 😊

📈 Fear & Greed Index

Level: 55/100 (Greed Zone) - Indicates market optimism is present, supporting risk-on plays like NZD.

📋 Fundamental Score: 62/100 ✅

🟢 NZD Strength: Strong Asian export demand supports the Kiwi.

🔴 CHF Strength: Its safe-haven status due to global uncertainties provides a floor.

⚪ Neutral: Both RBNZ and SNB are on hold with rates; no major shocks expected.

🌍 Macro Score: 58/100 ✅

🟢 Pro-NZD: Global risk-on mood benefits commodity currencies (NZD).

🔴 Pro-CHF: Any US rate cut speculation can briefly strengthen the Swissy.

⚪ Neutral: Stable economic data from both nations.

🐂 Overall Outlook: Neutral to Slightly Bullish

A favourable mix for a potential NZD grind higher, though CHF's safe-haven status will likely prevent a moonshot. This setup aims to steal a chunk of that predicted move.

👮♂️ Risk Management (The Most Important Part)

This is a SWING/DAY TRADE idea, not investment advice.

MANAGE YOUR RISK. Use proper position sizing. Only risk what you can afford to lose.

The "Layer" strategy helps your average entry but requires disciplined capital allocation.

Related Pairs to Watch: OANDA:AUDCHF , OANDA:NZDUSD , OANDA:USDCHF , OANDA:AUDNZD

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NZDCHF #Forex #Trading #SwingTrading #DayTrading #Kiwi #ForexAnalysis #FX #TechnicalAnalysis #ThiefStrategy

Technical analysis for NZD/CHF (4H chart)Market recently bounced from below 0.4600, showing short-term recovery.

However, price is still trading below the 50, 100, and 200 SMAs, meaning the overall trend remains bearish.

🔹 Moving Averages (SMA Ribbon)

Price is testing the 20 SMA (yellow line).

The 50 SMA (orange) and 100 SMA (brown) above are acting as strong resistance.

The 200 SMA (red) is far above – unless price breaks 0.4700–0.4720, the downtrend is intact.

🔹 RSI (Relative Strength Index)

RSI is around 60.

Indicates some short-term bullish momentum.

If RSI pushes above 70, it enters overbought zone.

A bullish divergence had formed earlier, which explains the recent bounce.

🔹 Key Levels

Resistance: 0.4660 – 0.4680 (50 & 100 SMA zone), then 0.4720 – 0.4740

Support: 0.4620 – 0.4600 (recent swing low), then 0.4560

🔹 Possible Scenarios

1. Bullish Case (Short-term bounce)

If price sustains above 0.4660, next upside targets are 0.4680–0.4720.

2. Bearish Case (Trend continuation)

If price closes below 0.4620, decline towards 0.4600 and 0.4560 is likely.

📌 Summary:

Short-term: Some bullish recovery.

Medium-term: Still in a bearish trend unless it breaks above 0.4720.

Best approach: Intraday traders can look for selling opportunities near 0.4660–0.4680. If a breakout above 0.4720 happens, then buyers may step in.

NZDCHF is in the Bearish SidedHello Traders

In This Chart NZDCHF HOURLY Forex Forecast By FOREX PLANET

today NZDCHF analysis 👆

🟢This Chart includes_ (NZDCHF market update)

🟢What is The Next Opportunity on NZDCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

Loot the Forex Vault: NZD/CHF Bearish Layer Entry Plan🔥 NZD/CHF "Kiwi vs Swissy" Forex Bank Heist Plan (Swing/Scalping Trade) 🤑💰

🌟 Dear Thief Traders & Money Bandits 🌟Get ready to pull off the ultimate heist on the NZD/CHF market! 📉 Our Thief Trading Style is locked and loaded with a bearish plan to swipe profits. Follow the strategy below, execute with precision, and escape before the market cops catch up! 🚨💸

📝 Heist Plan Overview

Asset: NZD/CHF (Kiwi vs Swissy) 🥝🇨🇭

Direction: Bearish 📉

Style: Swing/Scalping Trade 🕒

Strategy: Thief Layering (Multiple Limit Orders) 🎯

🚪 Entry: Crack the Vault Wide Open!

Entry Levels: Place sell limit orders at these key levels to layer your entries like a pro thief:

📍 0.47400

📍 0.47200

📍 0.47100

Flexibility: Add more layers based on your risk appetite and market conditions. Stack those orders to maximize your loot! 💰

Thief Tip: Enter at any price level if you spot a swing high or pullback on a 15M/30M timeframe. The vault is open—strike fast! ⚡

🛑 Stop Loss: Secure Your Getaway Car

Thief SL: Set at 0.48000 on the 4H timeframe for swing/scalping trades. 🚗

Risk Management: Adjust SL based on your strategy, lot size, and number of layered orders. Stay sharp, OG Thieves! 🕵️♂️

🎯 Target: Grab the Loot & Escape!

Police Barricade: Market resistance at 0.45500—watch out for the cops! 🚔

Thief Target: Take profits at 0.45700 to slip away with the cash before the barricade closes in. 💵

📰 Market Intel: Know Before You Steal

Fundamental Analysis: Check COT reports, macroeconomic data, and sentiment outlook for NZD/CHF. 📊

Intermarket Analysis: Monitor correlated pairs and global market trends. 🗺️

News Alert: Avoid trading during high-impact news releases to dodge volatility traps. Use trailing stops to lock in profits on open positions. 🚫

💡 Thief Trading Tips

Layering Strategy: Use multiple sell limit orders to average into the trade (DCA style). Spread your entries to reduce risk and increase reward. 📈

Stay Updated: Market conditions shift fast. Keep an eye on real-time data and adjust your plan. 🕵️

Boost the Heist: Smash the Boost Button to power up our robbery squad and make stealing profits easier! 💪🚀

🏆 Why Thief Trading Style?

Precise, calculated entries with layered orders. 🎯

Risk-managed SL to protect your stash. 🛡️

Clear profit targets to escape with max loot. 💰

Backed by technical and fundamental analysis for a clean getaway. 📉

💥 Join the Heist! 💥 Hit the Boost Button, share the plan, and let’s rob the NZD/CHF market together! Stay tuned for the next heist, Money Bandits! 🤑🐱👤🎉

NZDCHF is in the Bearish Side due to Bearish TrendHello Traders

In This Chart NZDCHF HOURLY Forex Forecast By FOREX PLANET

today NZDCHF analysis 👆

🟢This Chart includes_ (NZDCHF market update)

🟢What is The Next Opportunity on NZDCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

NZDCHF; Heikin Ashi Trade Idea📈 Hey Traders!

Here’s a fresh outlook from my trading desk. If you’ve been following me for a while, you already know my approach:

🧩 I trade Supply & Demand zones using Heikin Ashi chart on the 4H timeframe.

🧠 I keep it mechanical and clean — no messy charts, no guessing games.

❌ No trendlines, no fixed sessions, no patterns, no indicator overload.

❌ No overanalyzing market structure or imbalances.

❌ No scalping, and no need to be glued to the screen.

✅ I trade exclusively with limit orders, so it’s more of a set-and-forget style.

✅ This means more freedom, less screen time, and a focus on quality setups.

✅ Just a simplified, structured plan and a calm mindset.

💬 Let’s Talk:

💡 Do you trade supply & demand too ?

💡What’s your go-to timeframe ?

💡Ever tried Heikin Ashi ?

📩 Got questions about my strategy or setup? Drop them below — ask me anything, I’m here to share.

Let’s grow together and keep it simple. 👊

NZDCHF is in the Bearish Side due to Bearish TrendHello Traders

In This Chart NZDCHF HOURLY Forex Forecast By FOREX PLANET

today NZDCHF analysis 👆

🟢This Chart includes_ (NZDCHF market update)

🟢What is The Next Opportunity on NZDCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

NZDCHF is in the Bearish Side due to Bearish TrendHello Traders

In This Chart NZDCHF HOURLY Forex Forecast By FOREX PLANET

today NZDCHF analysis 👆

🟢This Chart includes_ (NZDCHF market update)

🟢What is The Next Opportunity on NZDCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

NZDCHF – Waiting for a Reaction at Key LevelWe’re waiting for price to reach our marked zone.

✅ Short is the primary scenario — but only with a valid bearish signal.

❗️If the zone breaks and price confirms above, we’ll look to buy after a proper pullback and signal.

We don’t predict — we prepare.

The market decides, we just follow with structure and discipline.

NZD/CHF Heist Blueprint: Snag the Kiwi vs. Franc Profits!Ultimate NZD/CHF Heist Plan: Snag the Kiwi vs. Franc Loot! 🚀💰

🌍 Greetings, Wealth Raiders! Hola! Ciao! Bonjour! 🌟

Fellow money chasers and market bandits, 🤑💸 let’s dive into the NZD/CHF "Kiwi vs. Franc" Forex heist with our 🔥Thief Trading Style🔥, blending sharp technicals and solid fundamentals. Follow the charted strategy for a long entry, aiming to cash out near the high-risk ATR zone. Watch out for overbought signals, consolidation, or a trend reversal trap where bearish robbers lurk. 🏴☠️💪 Seize your profits and treat yourself—you’ve earned it! 🎉

Entry 📈

The vault’s open wide! 🏦 Grab the bullish loot at the current price—the heist is live! For precision, set Buy Limit orders on a 15 or 30-minute timeframe, targeting a retest of the nearest high or low.

Stop Loss 🛑

📍 Place your Thief SL at the recent swing low on a 4H timeframe for day trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of orders.

Target 🎯

Aim for 0.50400 or slip out early to secure your loot! 💰

Scalpers, Listen Up! 👀

Stick to long-side scalps. Got big capital? Jump in now! Smaller stacks? Join swing traders for the robbery. Use a trailing SL to lock in your gains. 🧲💵

NZD/CHF Market Intel 📊

The Kiwi vs. Franc is riding a bullish wave, fueled by key drivers. Dig into the fundamentals, macro trends, COT reports, sentiment, intermarket analysis, and future targets for the full scoop. 🔗👇

⚠️ Trading Alert: News & Position Safety 📰

News drops can shake the market! To protect your loot:

Skip new trades during news releases.

Use trailing stops to secure profits and limit losses. 🚫

Join the Heist! 💥

Support our robbery plan—hit the Boost Button! 🚀 Let’s stack cash with ease using the Thief Trading Style. 💪🤝 Stay sharp for the next heist plan, bandits! 🤑🐱👤🎉

NZD/CHF Potential Bullish Reversal SetupNZD/CHF Potential Bullish Reversal Setup 🔄📈

📊 Chart Analysis:

The chart shows a potential bullish reversal for NZD/CHF, supported by technical patterns and key levels:

🧠 Key Technical Highlights:

🔹 Double Bottom Formation (🟠 Circles)

A clear double bottom pattern can be seen around the 0.48300 support zone, signaling potential reversal from the downtrend.

🔹 Strong Support Zone 📉

Price bounced from a historically respected support zone (~0.48200–0.48400), which held several times in the past (marked with green arrows).

🔹 Downtrend Breakout 🔺

A short-term bearish channel has been broken to the upside, indicating potential bullish pressure.

🔹 Target Zone 🎯

Immediate bullish target is around 0.49265, aligning with previous resistance.

🔹 Resistance Area (🔵 Boxes)

Next significant resistance lies at 0.49400–0.49800, which may act as the next hurdle if price breaks the 0.49265 level.

✅ Conclusion:

As long as price holds above 0.48400, bulls may aim for the 0.49265 🎯 target. A breakout above that level can open the path to higher resistances.

📌 Bullish Bias maintained above support zone — monitor for volume confirmation and retest strength.