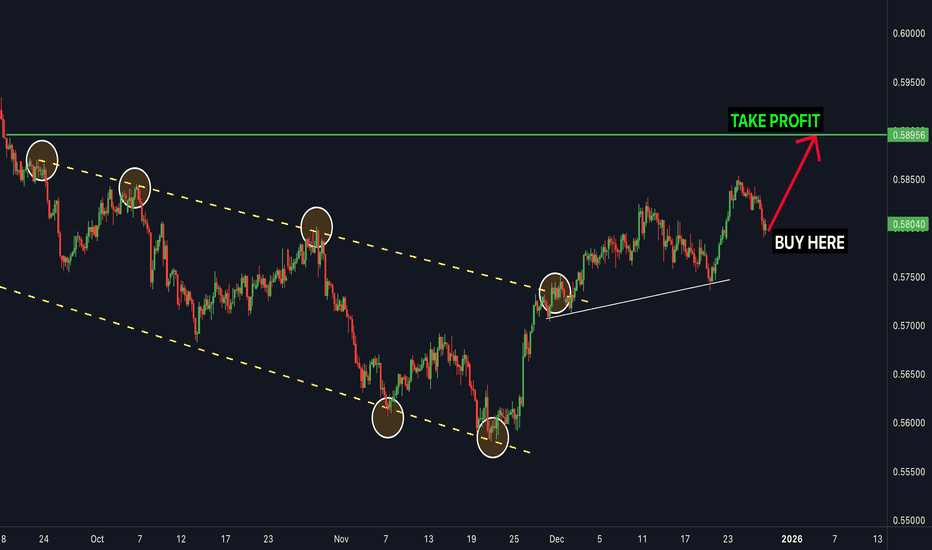

NZDUSD - TIME TO BUYNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD.

Nzdusdanalysis

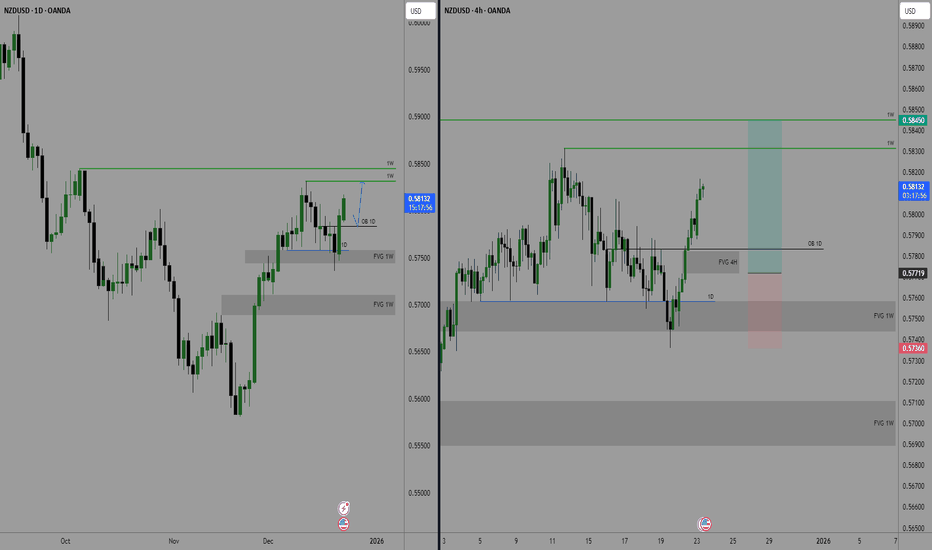

NZDUSD – 4H Descending Channel AnalysisMarket Structure:

NZDUSD is in a higher-timeframe downtrend, forming consistent lower highs and lower lows. A clear descending channel is visible on the chart, supporting bearish continuation.

Price Action:

The recent upward move appears to be a pullback. Price has shown rejection near the upper boundary of the channel, indicating selling pressure.

Trade Bias:

Sell Zone:

0.5780 – 0.5810

Stop Loss:

0.5855

Take Profit Levels:

0.5720

0.5660

0.5600

Invalidation:

4H candle close above 0.5860

TheGrove | NZDUSD buy | Idea Trading AnalysisNZDUSD is falling towards a support level which is a pullback support and could bounce from this level to our take profit.

We expect a decline in the channel after testing the current level which suggests that the price will continue to rise

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great BUY opportunity NZDUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

NZDUSD - TIME TO BUY NOW - it's going upNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD now it's going up

Market Analysis: NZD/USD CorrectsMarket Analysis: NZD/USD Corrects

NZD/USD is also rising and might aim for more gains above 0.5850.

Important Takeaways for NZD/USD Analysis Today

- NZD/USD is consolidating gains above the 0.5800 handle.

- There is a key bullish flag pattern forming with resistance at 0.5840 on the hourly chart of NZD/USD.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD, the pair started a fresh increase from 0.5735. The New Zealand Dollar broke the 0.5780 barrier to start the recent rally against the US Dollar.

The pair settled above 0.5800 and the 50-hour simple moving average. It tested 0.5850 and is currently consolidating gains. There was a minor pullback below 0.5830. The NZD/USD chart shows that the RSI is now just above 50.

On the downside, immediate support is near the 0.5795 level and the 50% Fib retracement level of the upward move from the 0.5736 swing low to the 0.5853 high.

The first key zone for the bulls sits at 0.5780 and the 61.8% Fib retracement. The next key level is 0.5760. If there is a downside break below 0.5760, the pair might slide toward 0.5735. Any more losses could lead NZD/USD into a bearish zone to 0.5700.

On the upside, the pair might struggle near 0.5840 and an upper boundary of the bullish flag pattern. The next major resistance is near the 0.5855 level. A clear move above 0.5855 might even push the pair toward 0.5880. Any more gains might clear the path for a move toward the 0.5950 zone in the coming days.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

#NZDUSD: Final Drop Before Swing Bullish ReversalThe NZDUSD has dropped significantly in recent months without any proper bullish correction. Currently, the price is approaching a key level from which we believe it could finally reverse. However, as this is a swing setup, it might take months to complete. We wish you the best in trading and stay careful tomorrow.

Good luck,

Team Setupsfx_

NZDUSD Forming Continuation StructureNZDUSD is showing a healthy bullish continuation structure after a strong impulsive move to the upside. The market previously printed a clean higher high sequence, confirming trend strength, followed by a controlled pullback inside a descending channel. This type of corrective price action typically reflects profit-taking rather than trend reversal, especially when momentum remains supported above key structure levels.

Technically, the recent breakout from the falling channel signals renewed buyer interest and continuation potential. Price respecting higher lows while compressing inside the channel indicates accumulation before expansion. As long as NZDUSD holds above the channel breakout zone, the bullish bias remains intact, with upside continuation favored toward previous highs and liquidity resting above the recent swing high.

From a fundamentals perspective, NZD strength is supported by stabilization in risk sentiment and expectations that New Zealand monetary conditions remain relatively firm compared to USD. Meanwhile, the US dollar has shown periods of weakness driven by shifting rate expectations, softer inflation components, and fluctuating risk appetite. This macro backdrop aligns well with the technical bullish structure now developing on NZDUSD.

Overall, market structure, momentum, and fundamentals are aligned for further upside continuation. Pullbacks into former resistance turned support may offer favorable risk-to-reward opportunities, while sustained price acceptance above current levels keeps the bullish scenario valid. As long as the higher low structure remains intact, NZDUSD stays positioned for continuation rather than reversal.

NZD/USD Trend Shift Confirmed | Pullback → Reversal Setup📈 NZD/USD – “THE KIWI”

Forex Market Trade Opportunity Guide (Swing / Day Trade)

🧠 Market Bias

BULLISH 🟢

Bullish plan confirmed with:

🔺 Triangular Moving Average pullback

🕯️ Heikin Ashi Doji candle → momentum pause + reversal signal

🔄 Trend structure shift indicating buyers stepping in

This combination signals controlled accumulation, not emotional chasing.

🎯 Entry Strategy

Entry: Any price level

➡️ PLEASE NOTE: Thief Using Layer (or) Any Price Level Entry

🔹 Layering Strategy (Multiple Buy Limits):

📍 0.57400

📍 0.57500

📍 0.57600

📍 0.57700

➡️ You may increase or adjust layers based on your own risk management.

📌 Why layering?

It reduces emotional entries, improves average price, and aligns with institutional-style execution.

🛑 Stop Loss

Thief SL: 0.57300

⚠️ Dear Ladies & Gentlemen (Thief OG’s),

Adjust your SL according to your own strategy, capital, and risk profile.

📎 This SL is a reference, not a recommendation.

🎯 Target / Exit Logic

Target: 0.58500

🚔 Moving Average acts as a “Police Barricade”

Strong dynamic resistance

Overbought conditions likely

Potential bull trap + corrective reaction

➡️ Kindly escape with profits near resistance zones.

⚠️ Dear Ladies & Gentlemen (Thief OG’s),

I am not recommending using only my TP.

Profit-taking is your responsibility.

🔗 RELATED PAIRS TO WATCH (Correlation Insight)

💵 USD-Related

TVC:DXY (US Dollar Index):

⬇️ Weak DXY = ⬆️ NZD/USD bullish continuation

$EUR/USD:

Strength here often confirms USD weakness

$AUD/USD:

Strong positive correlation with NZD (commodity-linked currencies)

🧾 Commodity Link

$XAU/USD (Gold):

Risk-on flows into commodities often support NZD strength

📌 If AUD/USD and EUR/USD stay bid while DXY weakens, NZD/USD bullish bias strengthens.

🌍 ECONOMIC FACTORS TO CONSIDER BEFORE ENTRY

🇳🇿 New Zealand (NZD Drivers)

📊 RBNZ Interest Rate Decisions

📉 Inflation (CPI) trends

🥛 Dairy prices & export demand

🇨🇳 China growth data (key NZ trade partner)

🇺🇸 United States (USD Drivers)

🏦 Federal Reserve policy outlook

📈 CPI / Core PCE inflation data

👷 NFP & unemployment data

📉 Bond yields & risk sentiment

🌐 Macro Environment

Risk-ON → NZD strengthens

Risk-OFF → USD demand increases

📌 Always align technical bias with macro flow.

✅ Final Notes

✔️ Technical confirmation present

✔️ Structured risk via layering

✔️ Macro alignment improves probability

❌ No emotional entries

❌ No blind TP/SL copying

💬 If this setup aligns with your view, support with a LIKE ❤️ and SHARE your thoughts below.

📌 Trade smart. Trade disciplined. Let price do the talking.

NZDUSD - TIME TO BUY NOWNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD now

NZDUSD: Bullish Momentum For 2 Weeks! Buy The Dip!Welcome back to the Weekly Forex Forecast for the week of Dec. 15 -19th.

In this video, we will analyze the following FX market: NZDUSD

NZDUSD is bearish on the HTFs, but it has started moving higher against a weakened USD.

The Daily shows the order flow is bullish, so there is no reason to sell this market in the short term.

Wait for the pullback, and by the dip.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

NZDUSD - buy nowNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY NZDUSD now

Market Analysis: NZD/USD Test Support, Break or Bounce Next?Market Analysis: NZD/USD Test Support, Break or Bounce Next?

NZD/USD is consolidating and could aim for a move above 0.5800 in the short term.

Important Takeaways for NZD/USD Analysis Today

- NZD/USD is consolidating above 0.5765 and 0.5755.

- There is a major bullish trend line forming with support at 0.5765 on the hourly chart of NZD/USD.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD, the pair also followed AUD/USD. The New Zealand Dollar failed to stay above 0.5800 and corrected gains against the US Dollar.

The pair dipped below 0.5790 and the 50-hour simple moving average and 0.5830. A low was formed at 0.5765, and the pair is now consolidating below the 23.6% Fib retracement level of the downward move from the 0.5831 swing high to the 0.5765 low.

The NZD/USD chart suggests that the RSI is below 40, signaling a short-term negative bias. On the upside, the pair is facing resistance near the 50% Fib retracement level at 0.5800.

The next major hurdle for buyers could be 0.5815. A clear move above 0.5815 might even push the pair toward 0.5830. Any more gains might clear the path for a move toward the 0.5880 pivot zone in the coming sessions.

On the downside, there is support forming near the 0.5765 zone and a bullish trend line. If there is a downside break below 0.5765, the pair might slide toward 0.5740. Any more losses could lead NZD/USD into a bearish zone to 0.5710.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NZDUSD - Time to buy nowNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD Now

Growth is gaining momentum: an upward wave in developmentIn its current phase, USDJPY is showing signs of gradual strengthening. After a period of consolidation, the upward movement is becoming more pronounced, and the wave structure points to the formation of a bullish scenario. Buyers maintain the initiative, limiting the depth of pullbacks.

The chart shows that the price is consolidating above local support zones, while the sequence of waves is taking on a clearer upward character. This dynamic creates the foundation for a new impulse and confirms interest in continued growth.

The fundamental backdrop also favors strengthening: demand for the dollar remains supported by expectations of a dovish Bank of Japan policy, which reinforces buyer positions and sustains upward movement.

As a result, the pair remains in a recovery phase, where the market’s next steps may confirm the formation of a sustainable bullish trend.

NZDUSD: Bullish Order Flow For Two weeks Now! Buy It!Welcome back to the Weekly Forex Forecast for the week of Dec. 8 - 15th.

In this video, we will analyze the following FX market: NZDUSD

NZDUSD is bearish on the HTFs, but has been bullish the last two weeks. Bullish enough to form a change in the state of delivery! The move indicates bullish order flow entering the market!

Wait for the market to confirm its bullish intent with the +FVG it is currently sitting in, and buy it.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Is NZD/USD Ready for a Bullish Drive? WMA Breakout Validated🎯 EUR/USD "THE FIBRE" BREAKOUT SETUP | Multi-Layer Entry Strategy 📊

📈 MARKET ANALYSIS | EUR/USD SWING/DAY TRADE

Asset: EUR/USD (The Fibre)

Bias: BULLISH ✅

Setup: Triangular Moving Average Breakout + Retest Confirmed

Strategy Type: Swing/Day Trade | Multi-Layer Entry (Thief Method)

🎯 TRADE PLAN BREAKDOWN

Entry Strategy: "THIEF LAYERING METHOD" 💰

This strategy uses multiple limit orders to scale into position:

📍 Multi-Layer Buy Limit Entries:

Layer 1: 1.16400

Layer 2: 1.16600

Layer 3: 1.16800

Note: You can add more layers based on your capital allocation and risk tolerance

🛑 Stop Loss:

Thief SL: 1.16200

⚠️ Adjust based on YOUR strategy and risk management plan

🎯 Take Profit Target:

Primary TP: 1.17600 (Strong resistance + potential overbought zone)

💡 Exit Strategy: Watch for trap patterns near resistance—secure profits wisely!

⚡ KEY TECHNICAL LEVELS

Entry Zone: 1.16400-1.16800 (Multi-layer accumulation)

Stop Loss: 1.16200 (Risk management level)

Target: 1.17600 (Resistance + overbought zone)

🔗 RELATED PAIRS TO WATCH (USD CORRELATION)

Monitor these pairs for confirmation and correlation analysis:

Direct USD Pairs:

GBP/USD (Cable) 📉 - Positive correlation with EUR/USD approximately 70-80%. When Cable moves higher, it typically confirms USD weakness across the board and supports EUR/USD bullish momentum.

USD/JPY 📊 - Inverse correlation, acts as a USD strength indicator. If USD/JPY drops below 150.00, it signals USD selling pressure which benefits EUR/USD longs.

USD/CHF 🇨🇭 - Inverse correlation, serves as a risk-off sentiment gauge. When USD/CHF falls, it indicates USD weakness and supports EUR/USD upside.

EUR Cross Pairs:

EUR/GBP 🇪🇺🇬🇧 - Measures EUR strength versus GBP. Rising EUR/GBP shows Euro outperformance and confirms EUR/USD bullish bias.

EUR/JPY 📈 - Risk appetite indicator. When EUR/JPY climbs, it signals risk-on sentiment which typically supports EUR/USD gains.

EUR/CHF - Euro zone stability measure. Stable or rising EUR/CHF indicates confidence in the Eurozone economy.

💡 Correlation Key Points:

USD Index (DXY) - Watch for weakness below 106.00 for EUR/USD bullish continuation. A breaking DXY confirms broad USD selling.

GBP/USD alignment - If Cable breaks higher simultaneously, this confirms USD weakness is widespread, not just EUR strength.

USD/JPY divergence - A drop below 150.00 signals significant USD selling pressure across all pairs.

Risk Sentiment - EUR/JPY rising equals risk-on environment which generally supports EUR/USD bullish moves.

⚠️ RISK DISCLAIMER

Dear Traders (OG Thief Gang),

This is NOT financial advice—educational analysis only

ADJUST YOUR SL/TP based on YOUR risk tolerance

Money management is YOUR responsibility

Take profits at YOUR comfort zone

Never risk more than you can afford to lose

Markets can be unpredictable—trade smart! 🧠

📊 WHY THIS SETUP WORKS

✅ Triangular MA breakout confirmed

✅ Retest of breakout level completed

✅ Multi-layer entry reduces timing risk

✅ Clear risk/reward ratio defined

✅ Correlation analysis supports directional bias

📌 Remember: The market rewards patience and discipline. Trade your plan, not your emotions! 🎯💪

NZDUSD: Bullish Push to 0.593?FX:NZDUSD is eyeing a bullish rebound on the daily chart , with price approaching a key support zone near cumulative sell liquidation, converging with downward short-term and long-term trendlines that could spark upside momentum if buyers defend the level amid recent consolidation. This setup hints at a reversal opportunity after the downtrend, targeting higher levels with strong risk-reward.🔥

Entry between 0.56060–0.56780 for a long position (entry at current levels with proper risk management is recommended). Target at 0.59300 . Set a stop loss at a close below 0.55680 , yielding a risk-reward ratio of approximately 1:2.5 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging the pair's potential recovery post-pullback.🌟

Fundamentally , NZDUSD is holding near 0.5723 as of November 28, 2025, after surging to 0.5715 following the RBNZ's 25 bps rate cut to 2.25% on November 27, with signals of no further easing ahead amid resilient labor markets and inflation concerns. The pair has risen about 2.65% since late last week from a low of 0.55910 on November 20, driven by renewed NZD strength and rising US rate cut bets that could weaken the USD further, though forecasts suggest testing support near 0.5675 with volatility persisting due to diverging central bank policies. 💡

📝 Trade Setup

🎯 Entry (Long):

0.56060 – 0.56780

🎯 Target:

• 0.59300

❌ Stop Loss:

• Daily close below 0.55680

⚖️ Risk-to-Reward:

• ~1:2.5 overall

👇 Share your thoughts below! 👇

NZDUSD - buy nowNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY NZDUSD Now

Sell Zone Ahead for NZDUSDAfter reaching a low just under the 0.56 figure — just above the 2025 lows — OANDA:NZDUSD finally found support and began reversing to the upside. The pair then broke above the falling-wedge resistance, confirming short-term bullish momentum.

At the time of writing the price is 0.5782, and is approaching the 0.5850 major resistance zone.

Given:

- the significance of this resistance level,

- the prevailing long-term bearish trend,

- and the broader fundamental landscape,

I believe 0.5850 offers an attractive sell zone for a longer-term swing trade.

A rejection from this area could send the pair back toward the lows.