#OP/USDT Ready to launch upwards#OP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.1700, and the price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.1822

First Target: 0.1893

Second Target: 0.1975

Third Target: 0.2055

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

OPUSDTPERP

#OP/USDT Ready to launch upwards#OP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.2232, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.2270

Target 1: 0.2309

Target 2: 0.2374

Target 3: 0.2449

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

#OP/USDT Ready to launch upwards#OP

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.3230. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.3300

First target: 0.3352

Second target: 0.3456

Third target: 0.3576

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

#OP/USDT – Triangle Pattern Breakout Loading?#OP

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.2660. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.2693

First target: 0.2715

Second target: 0.2757

Third target: 0.2816

Stop loss: Below the support zone in green.

Don't forget a simple thing: capital management.

For inquiries, please leave a comment.

Thank you.

#OP/USDT – Triangle Pattern Breakout Loading?#OP

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.2559. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.2624

First target: 0.2668

Second target: 0.2772

Third target: 0.2888

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

OP/USDT – On the Edge of Reversal or Final Breakdown?Optimism (OP) is standing at a critical crossroads after a long and steady downtrend that has persisted since mid-2024.

Price is now testing the major support zone between 0.405–0.476 (yellow block) — a historical demand area that once marked the beginning of a major rally in the past.

The deep wick below this area indicates a liquidity sweep, suggesting that larger players may have flushed out retail stop-losses before positioning for the next major move.

This zone is not just a number — it represents the psychological line between capitulation and accumulation.

While the macro structure still shows lower highs and lower lows, the reaction in this support range will determine whether a mid-term reversal can begin or if the macro downtrend continues.

---

Pattern & Structure Analysis

Main trend: Bearish, with continuous lower highs and lower lows.

Yellow block (0.405–0.476): Key historical demand zone that previously triggered strong accumulation.

Long wick below: Possible false breakdown or stop hunt, indicating liquidity absorption.

Potential setup: Early formation of a double-bottom pattern if price holds above 0.405 and reclaims higher resistance.

---

Bullish Scenario

If price strongly bounces from 0.405–0.476 and successfully closes above 0.6399 (5D timeframe), it could confirm the start of a mid-term reversal.

Initial target: 0.8754

Next target: 1.1797

Bullish confirmation: 5D close above 0.6399 with rising volume.

Invalidation: 5D close below 0.405.

This zone offers potential accumulation for swing traders, but confirmation from volume and structure is essential before committing.

---

Bearish Scenario

If OP fails to hold 0.405 and closes below this support zone, the bearish momentum will likely accelerate.

First target: 0.23 (previous liquidity sweep low).

Bearish confirmation: 5D close below 0.405 with strong selling volume.

Invalidation: 5D reclaim above 0.6399.

A clean breakdown would confirm a continuation of the macro downtrend, signaling a deeper capitulation phase.

---

Market Narrative

The 0.405–0.476 zone is where buyers and sellers face their final test.

This is the battlefield between smart money accumulation and bearish momentum exhaustion.

A strong bullish reaction here could indicate that smart money is stepping in, while a failure to hold could lead to the final flush before a long consolidation phase.

This is the zone that will define whether OP finds its true bottom or enters another leg down.

---

Technical Summary

Support zone: 0.405–0.476

Nearest resistance: 0.6399

Bullish targets: 0.8754 → 1.1797

Bearish target: 0.23

Main trend: Bearish

Timeframe: 5D (mid-term outlook)

---

#OP #Optimism #OPUSDT #CryptoAnalysis #TechnicalAnalysis #PriceAction #SupportAndResistance #CryptoTrading #MarketStructure #SupplyDemand #CryptoOutlook #BullishScenario #BearishScenario #AltcoinAnalysis

OP/USDT — Major Accumulation Zone: Larger Move is in the Making?

Optimism (OP) is currently consolidating within a major accumulation zone between 0.72–0.60, which has acted as a key macro support since the sharp decline from the 4.8–5.0 peak.

This range represents a crucial battleground between buyers and sellers — where selling pressure is fading and early signs of base formation are emerging.

---

Technical Structure

Current Phase: Sideways consolidation after a prolonged downtrend.

Yellow Zone (0.72–0.60): Strong demand area and macro support tested multiple times.

Key Resistance: 0.8858 — the upper boundary of the range that will define the next major direction.

Potential Pattern: Developing rectangle accumulation or rounded bottom base above demand.

Volume Behavior: Decreasing gradually, indicating quiet accumulation by long-term players (smart money phase).

---

Bullish Scenario

A confirmed breakout and close above 0.8858 would mark the end of accumulation and the start of a potential mid-term uptrend.

Projected upside targets:

1.20 → breakout validation zone

1.80 → main swing target

2.55 – 3.00 → mid-term expansion target if momentum continues

Additional confirmations:

Rising volume during breakout.

Successful retest of 0.8858 as new support.

Formation of higher lows above 0.72.

> “Reclaiming 0.8858 could transform this quiet range into the ignition point of a new bullish phase.”

---

Bearish Scenario

If the price closes below 0.60, the accumulation structure would fail and likely lead to a macro continuation to the downside.

Downside targets:

0.50 – 0.45 → minor support

0.3953 → major historical low and potential capitulation zone

Such a breakdown would confirm renewed selling dominance and a possible search for a new long-term bottom.

---

Conclusion

The 0.72–0.60 range is the critical decision zone for OP’s next major move.

As long as the price holds above this level, the bias remains neutral-to-bullish, supported by signs of accumulation.

A breakout above 0.8858 could mark the beginning of a new uptrend, while a breakdown below 0.60 would signal continuation of the broader downtrend.

> “Calm ranges like this often precede explosive moves — and OP is quietly building the foundation for one.”

---

#Optimism #OPUSDT #CryptoAnalysis #SwingTrading #TechnicalAnalysis #AccumulationZone #BreakoutSetup #Altcoins #CryptoMarket #Layer2 #PriceAction

OP/USDT Accumulation in Progress !!Currently, OP is testing the descending trendline while holding above the demand zone at 0.6860–0.6721. RSI sits near neutral (49), suggesting that the next move could determine whether the breakout occurs or further downside is seen.

Trade Plan (Long Setup):

Entry Zone: CMP (0.7050) → down to 0.6860

Stop Loss: 0.6721 (below demand zone)

Targets:

0.7240

0.7407

0.7663

0.8229

Expected Profit: ~16% to the extended target

Insights:

Break above 0.7240 confirms bullish continuation.

Losing 0.6721 invalidates the setup, opening downside risk.

RSI divergence is possible if the price retests 0.6860 and bounces strongly.

DYOR | Not Financial Advice

#OP/USDT#OP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.653.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.702

First target: 0.757

Second target: 0.805

Third target: 0.865

#OP/USDT#OP

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.600, acting as strong support from which the price can rebound.

Entry price: 0.616

First target: 0.630

Second target: 0.641

Third target: 0.658

#OP/USDT#OP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.544.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 0.564

First target: 0.581

Second target: 0.602

Third target: 0.626

OP/USDT Technical Analysis – Approaching a Major Breakout Zone!Chart Overview: The OP/USDT pair on the 1D (Daily) timeframe is currently moving within a long-term descending trendline, forming a descending triangle or falling resistance channel since November 2024. The price is now approaching a critical point near the long-term resistance trendline (yellow line), which has been tested multiple times.

---

🟢 Bullish Scenario: Breakout Potential

If the price manages to break and close above the descending trendline resistance (currently near the $0.80–$0.85 zone), it would signal a strong bullish breakout. The next key resistance levels to watch (based on yellow dotted horizontal lines) are:

1. $0.9035 – minor resistance

2. $1.0203 – psychological level

3. $1.1836 – mid-term strong resistance

4. $1.7352 and $2.1248 – extended bullish targets

A confirmed breakout would ideally be supported by increasing volume and RSI momentum above 50.

---

🔴 Bearish Scenario: Rejection at Resistance

If the price fails to break the trendline and gets rejected, a downside move is likely to follow. Key support levels to watch are:

1. $0.7200 – current support

2. $0.6000 – minor support

3. $0.4577 – strong historical support (lowest level)

This would suggest continued bearish control and could extend the downtrend that has lasted over 8 months.

---

📊 Pattern Breakdown: Descending Trendline

Consistent lower highs since the peak near $2.77

The descending trendline is the main battle zone between bulls and bears

This pattern often leads to a breakout if buyers gain momentum

---

🎯 Conclusion & Strategy:

This is a critical zone for OP/USDT.

Traders should wait for breakout confirmation before entering long positions.

For breakout traders: consider a buy-the-breakout strategy with stop-loss below the trendline.

For short sellers: look for a rejection at resistance with targets at the nearest support levels.

#OPUSDT #CryptoAnalysis #Altcoins #TechnicalAnalysis #BreakoutTrade #Optimism #CryptoSetup #BullishScenario #BearishScenario #ChartPatterns

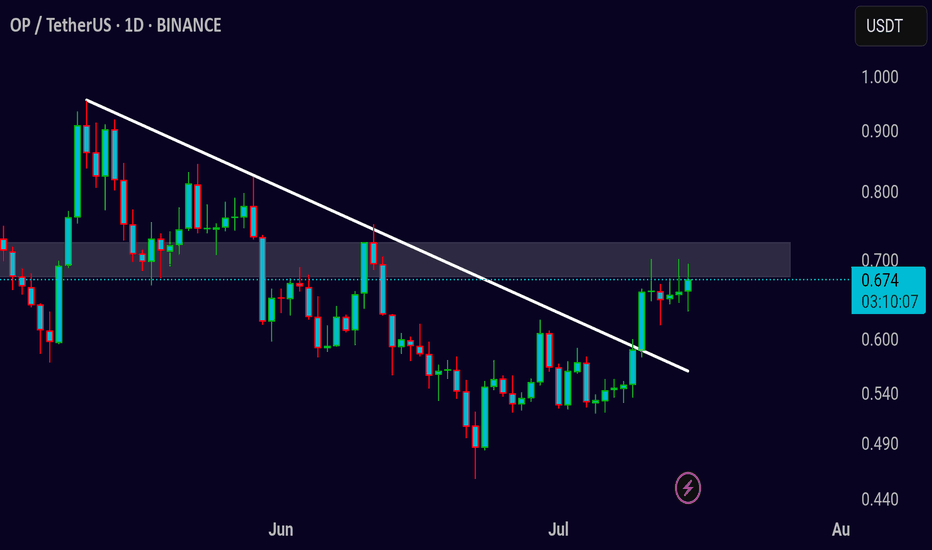

OPUSDT Update

Symbol: OP/USDT

Timeframe: Daily

Chart Analysis:

The price is currently approaching a key resistance zone at around 0.673, as seen in the chart. A descending trendline from May to June has been acting as resistance. The price has recently made a strong move towards this resistance zone, showing a potential breakout pattern.

If the price successfully breaks above the 0.673 resistance, we could see a bullish continuation towards the next resistance levels, potentially up to 0.700 or higher. The breakout would suggest a reversal of the prior downtrend.

Key Levels:

* Resistance: 0.673 (current resistance zone)

* Support: 0.600 (lower support area)

Trade Strategy:

1. Long Entry: Consider entering a long position if the price breaks above the 0.673 resistance with strong volume.

2. Target: A reasonable target could be the 0.700 region. Keep an eye on price action as it approaches this level.

3. Stop Loss: Place a stop loss below the 0.600 support to manage risk in case of a failed breakout.

Risk-Reward: A potential reward-to-risk ratio of 2:1 or better, depending on entry and exit points.

Conclusion:

Monitor the price closely for a breakout above the 0.673 level. If it breaks and sustains, a bullish move could follow. Watch for volume confirmation and market momentum to gauge the strength of the breakout.

OPUSDT Forming Descending ChannelOPUSDT is showing an impressive technical setup that has caught the attention of many crypto traders recently. The chart reflects a well-formed descending channel, which is a classic bullish reversal pattern when broken to the upside. Currently, the price action is testing the upper boundary of this channel with increasing buying pressure, signaling that a potential breakout could be on the horizon. A successful breakout here, supported by good volume, could trigger a strong rally in the coming sessions.

The volume profile for OPUSDT is encouraging, as it suggests that more investors are accumulating positions in anticipation of this move. This aligns with the optimistic sentiment in the broader crypto market, where traders are actively seeking altcoins with high potential upside. With an expected gain of around 80% to 90%+, OPUSDT offers an attractive risk-to-reward ratio, especially for those who prefer swing trades and short-term position trades in trending altcoins.

One key factor to watch is whether OPUSDT can sustain momentum above the descending channel’s resistance line. If volume remains strong and the breakout confirms on higher timeframes like the daily or weekly chart, this could attract further interest from both retail and institutional traders. Such a move often sparks a chain reaction of buying, as traders look to ride the trend to its projected target zone.

Overall, the combination of a textbook pattern, healthy volume, and increasing investor interest makes OPUSDT one to watch closely. Keep it on your radar for a possible breakout play with significant upside potential. As always, manage your risk properly and wait for a confirmed breakout before entering any position.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

OP/USDT Weekly Reversal Zone: Strong Bounce ExpectedThe OP/USDT pair is currently showing strong signs of a potential trend reversal from a major long-term demand zone.

📊 Timeframe: 1W (Weekly)

🟨 Key Support Zone: 0.396 – 0.542 USDT

The price has revisited a historically strong support area that previously served as an accumulation zone since mid-2022. The recent bounce from this level reinforces the likelihood of a bullish reversal.

📈 Upside Targets (Resistance Levels):

1. Minor Resistances:

0.699

0.844

2. Mid-Term Target:

1.190 (key breakout confirmation level)

3. Long-Term Bullish Targets:

2.168

2.400

2.700

2.991

3.725

4.020

4.538

4.865 (Previous major high)

🛡️ Critical Demand Zone:

As long as price holds above the 0.396–0.542 range, bullish structure remains intact. A breakdown below this range could invalidate the setup.

🔄 Outlook:

The chart pattern suggests the formation of a higher low and a potential breakout in stages, supported by volume and positive sentiment. Watch the 0.699 and 0.844 levels for initial confirmation of buyer strength.

📌 Note:

This setup offers an attractive risk-reward ratio for mid to long-term traders watching for a trend reversal.

24 June nifty breakout & breakdown levels 🔺 Bullish (Call Option / CE) Strategy:

✅ Buy CE (Call Option) when:

Above 24,710 → Entry for bullish trade

"Above 10m hold CE by buy level"

Above 24,870 → Stronger confirmation

"Above Opening S1 10M Hold CE By level"

Above 25,020 → Positive trade view

"Above 10M hold positive trade view"

Above 25,130 → Safer CE entry zone

"Above 10M hold CE by entry level"

Above 25,233 → Closing shot level

"Above 10M Closing Shot cover level"

🔻 Bearish (Put Option / PE) Strategy:

✅ Buy PE (Put Option) when:

Below 24,710 → Entry for bearish trade

"Below 10m hold PE By level"

Below 24,870 → Bearish confirmation

"Below Opening R1 10M Hold PE By level"

Below 25,020 → Negative trade view

"Below 10M hold nigeative trade view"

Below 25,130 → Risky PE zone

"Below 10M hold PE By Risky Zone"

Below 25,233 → Safer PE Zone

"Below 10M hold PE By Safe Zone"